Professional Documents

Culture Documents

Monday, December 15, 2008

Uploaded by

Vanessa HaliliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monday, December 15, 2008

Uploaded by

Vanessa HaliliCopyright:

Available Formats

E. P.

S

M O N D A Y , D E C E M B E R 1 5 , 2 0 0 8

MULTIPLE CHOICEConceptual

1. With respect to the calculation of earnings per share, which of the following would

be most indicative of a simple capital structure?

c. Ownership interest consisting solely of common shares

2. In calculating earnings per share for a simple capital structure, if the preferred

shares are cumulative, the amount that should be deducted as an adjustment to the

numerator (earnings) is the

d. none of these.

3. In calculations of weighted average of shares outstanding, when a stock dividend or

stock split occurs, the additional shares are

d. considered outstanding at the beginning of the earliest year reported.

4. What effect will the acquisition of treasury shares have on shareholders' equity and

earnings per share, respectively?

c. Decrease and increase

5. When calculating diluted earnings per share, convertible bonds are

d. assumed converted only if they are dilutive.

6. Dilutive convertible securities must be used in the calculation of

b. diluted earnings per share only.

7. In calculating earnings per share, the equivalent number of convertible preferred

shares are added as an adjustment to the denominator (number of shares

outstanding). If the preferred shares are cumulative, which amount should then be

added as an adjustment to the numerator (net earnings)?

a. Annual preferred dividend

8. In the diluted earnings per share calculation, the treasury shares method is used

for options and warrants to reflect assumed reacquisition of common shares at the

average market price during the period. If the exercise price of the options or

warrants exceeds the average market price, the calculation would

d. be antidilutive.

9. In applying the treasury shares method to determine the dilutive effect of shares

options and warrants, the proceeds assumed to be received upon exercise of the

options and warrants

a. are used to calculate the number of common shares repurchased at the average

market price, when calculating diluted earnings per share.

10. When applying the treasury shares method for diluted earnings per share, the

market price of the common shares used for the repurchase is the

b. average market price.

11. Antidilutive securities

d. should be ignored in all earnings per share calculations.

12. Assume there are two dilutive convertible securities. The one that should be used

first to recalculate earnings per share is the security with the

d. smaller earnings per share adjustment.

MULTIPLE CHOICEComputational

13. Aba Corp. had 600,000 common shares outstanding on January 1, issued 900,000

shares on July 1, and had income applicable to common shares of $630,000 for the

year ending December 31, 2006. Earnings per share for 2006 would be

c. $.60.

14. At December 31, 2006, Meyer Company had 500,000 common shares issued and

outstanding, 400,000 of which had been issued and outstanding throughout the year

and 100,000 of which were issued on October 1, 2006. Net income for the year ended

December 31, 2006, was $510,000. What should be Meyer's 2006 earnings per common

share, rounded to the nearest penny?

c. $1.20

15. Ava Co. had 600,000 common shares outstanding on January 1, issued 84,000

shares on May 1, purchased 42,000 treasury shares on September 1, and issued 36,000

shares on November 1. The weighted average shares outstanding for the year is

b. 648,000.

16. On January 2, 2006, Starr Co. issued at par $10,000 of 6% bonds convertible in

total into 1,000 of Starr's common shares. No bonds were converted during 2006.

Throughout 2006, Starr had 1,000 shares of common shares outstanding. Starr's 2006

net income was $6,000. Starr's income tax rate is 30%.

No potentially dilutive securities other than the convertible bonds were outstanding

during 2006. Starr's diluted earnings per share for 2006 would be (rounded to the

nearest penny)

b. $3.21.

17. At December 31, 2005, Collins Company had 500,000 common shares outstanding.

On October 1, 2006, an additional 100,000 common shares were issued. In addition,

Collins had $5,000,000 of 6% convertible bonds outstanding at December 31, 2005,

which are convertible into 225,000 common shares. No bonds were converted into

common shares in 2006. The net income for the year ended December 31, 2006, was

$1,500,000. Assuming the income tax rate was 30%, the diluted earnings per share for

the year ended December 31, 2006, should be (rounded to the nearest penny)

c. $2.28.

18. On January 2, 2006, Dane Co. issued at par $300,000 of 9% convertible bonds.

Each $1,000 bond is convertible into 30 shares. No bonds were converted during 2006.

Dane had 50,000 common shares outstanding during 2006. Dane's 2006 net income was

$160,000 and the income tax rate was 30%. Dane's diluted earnings per share for 2006

would be (rounded to the nearest penny)

b. $3.03.

19. At December 31, 2005, Marris Co. had 800,000 common shares outstanding. In

addition, Marris had 300,000 preferred shares which were convertible into 500,000

common shares. During 2006, Mraris paid $300,000 in cash dividends on the common

shares and $200,000 in cash dividends on the preferred shares. Net income for 2006

was $1,700,000 and the income tax rate was 40%. The diluted earnings per share for

2006 is (rounded to the nearest penny)

b. $1.31.

Use the following information for questions 20 and 21.

Edwards Co. had 200,000 common shares, 30,000 convertible preferred shares, and

$1,500,000 of 10% convertible bonds outstanding during 2006. The preferred shares

are convertible into 40,000 common shares. During 2006, Edwards paid dividends of

$1.20 per share on the common shares and $3.00 per share on the preferred shares.

Each $1,000 bond is convertible into 45 common shares. The net income for 2006 was

$900,000 and the income tax rate was 30%.

20. Basic earnings per share for 2006 is (rounded to the nearest penny)

b. $4.05.

21. Diluted earnings per share for 2006 is (rounded to the nearest penny)

c. $3.27.

22. Sultan, Incorporated, has 6,000,000 common shares outstanding on December 31,

2005. An additional 1,000,000 common shares were issued on April 1, 2006, and

500,000 more on July 1, 2006. On October 1, 2006, Sultan issued 25,000, $1,000 face

value, 8% convertible bonds. Each bond is convertible into 20 common shares. No

bonds were converted in 2006. What is the number of shares to be used in calculating

basic earnings per share and diluted earnings per share, respectively?

b. 7,000,000 and 7,125,000

23. Gregg Co. has 1,000,000 common shares outstanding on December 31, 2005. An

additional 100,000 shares are issued on April 1, 2006, and 240,000 more on September

1. On October 1, Gregg issued $3,000,000 of 9% convertible bonds. Each $1,000 bond

is convertible into 40 common shares. No bonds have been converted. The number of

shares to be used in calculating basic earnings per share and diluted earnings per

share on December 31, 2006 is

b. 1,155,000 and 1,185,000.

24. At December 31, 2005, Bowen Company had 2,000,000 common shares

outstanding. On January 1, 2006, Bowen issued 500,000 preferred shares which were

convertible into 1,000,000 common shares. During 2006, Bowen declared and paid

$900,000 cash dividends on the common shares and $300,000 cash dividends on the

preferred shares. Net income for the year ended December 31, 2006, was $3,000,000.

Assuming an income tax rate of 30%, what should be diluted earnings per share for the

year ended December 31, 2006? (Round to the nearest penny.)

b. $1.00

25. Cisco Company had 300,000 common shares issued and outstanding at December

31, 2005. During 2006, no additional common shares were issued. On January 1, 2006,

Cisco issued 400,000 nonconvertible preferred shares. During 2006, Cisco declared and

paid $180,000 cash dividends on the common shares and $150,000 on the preferred

shares. Net income for the year ended December 31, 2006, was $960,000. What

should be Cisco's 2006 earnings per common share, rounded to the nearest penny?

c. $2.70

26. At December 31, 2005, Keynes Company had 900,000 common shares outstanding.

On September 1, 2006, an additional 300,000 common shares were issued. In addition,

Keynes had $10,000,000 of 6% convertible bonds outstanding at December 31, 2005,

which are convertible into 600,000 common shares. No bonds were converted in 2006.

The net income for the year ended December 31, 2006, was $3,750,000. Assuming the

income tax rate was 30%, what should be the diluted earnings per share for the year

ended December 31, 2006, rounded to the nearest penny?

c. $2.61

27. Hart Company has 4,000,000 common shares outstanding on December 31, 2005.

An additional 250,000 common shares were issued on July 1, 2006, and 500,000 more

on October 1, 2006. On April 1, 2006, Hart issued 10,000, $1,000 face value, 8%

convertible bonds. Each bond is convertible into 40 common shares. No bonds were

converted in 2006. What is the number of shares to be used in calculating basic

earnings per share and diluted earnings per share, respectively, for the year ended

December 31, 2006?

a. 4,250,000 and 4,550,000

Use the following information for questions 28 and 29.

Information concerning the capital structure of Sen Corporation is as follows:

December 31,

2006 2005

Common shares 100,000 shares 100,000 shares

Convertible preferred shares 10,000 shares 10,000 shares

9% convertible bonds $2,000,000 $2,000,000

During 2006, Sen paid dividends of $1.00 per share on its common shares and $2.50

per share on its preferred shares. The preferred shares are convertible into 20,000

common shares. The 9% convertible bonds are convertible into 50,000 common

shares. The net income for the year ended December 31, 2006, was $500,000. Assume

that the income tax rate was 30%.

28. What should be the basic earnings per share for the year ended December 31,

2006, rounded to the nearest penny?

c. $4.75

29. What should be the diluted earnings per share for the year ended December 31,

2006, rounded to the nearest penny?

b. $3.68

30. Warrants exercisable at $20 each to obtain 50,000 common shares were

outstanding during a period when the average market price of the common shares was

$25. Application of the treasury shares method for the assumed exercise of these

warrants in calculating diluted earnings per share will increase the weighted average

number of outstanding shares by

c. 10,000.

31. Dextar Corporation had 300,000 common shares outstanding at December 31,

2006. In addition, it had 90,000 stock options outstanding, which had been granted to

certain executives, and which gave them the right to purchase Dextar's shares at an

option price of $37 per share. The average market price of Dextar's common shares

for 2006 was $50. What is the number of shares that should be used in calculating

diluted earnings per share for the year ended December 31, 2006?

d. 323,400

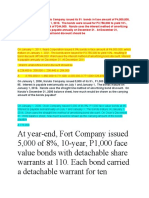

DERIVATIONS Computational

No. Answer Derivation

13. c = $.60.

14. c = $1.20.

15. b 600,000 + (84,000 8/12) (42,000 4/12) + (36,000 2/12) = 648,000.

16. b = $3.21.

17. c = $2.28.

18. b = $3.03.

19. b = $1.31.

20. b = $4.05.

21. c = $3.27.

22. b 6,000,000 + (1,000,000 9/12) + (500,000 6/12) = 7,000,000 (BEPS)

7,000,000 + (25,000 20 3/12) = 7,125,000 (DEPS).

23. b 1,000,000 + (100,000 9/12) + (240,000 4/12) = 1,155,000.

1,155,000 + = 1,185,000.

No. Answer Derivation

24. b = $1.00.

25. c = $2.70.

26. c = $2.61.

27. a 4,000,000 + (250,000 6/12) + (500,000 3/12) = 4,250,000

4,250,000 + (10,000 40 9/12) = 4,550,000.

28. c = $4.75.

29. b = $3.68.

30. c 50,000 $20 $25 = 40,000

50,000 40,000 = 10,000.

31. d 90,000 (90,000 $37 $50) = 23,400

300,000 + 23,400 = 323,400.

POS TED BY B AT 1 1 : 1 6 AM NO COMMENTS :

Home

Subscribe to: Posts (Atom)

You might also like

- TEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Document5 pagesTEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Mike HerreraNo ratings yet

- Ak 2Document2 pagesAk 2Suryo SasonoNo ratings yet

- Ch07 Beams10e TBDocument29 pagesCh07 Beams10e TBjeankoplerNo ratings yet

- Reading 18 Understanding Income StatementsDocument109 pagesReading 18 Understanding Income StatementsNeerajNo ratings yet

- Kuis UTS Genap Lab AKM II DoskoDocument4 pagesKuis UTS Genap Lab AKM II DoskoYokka FebriolaNo ratings yet

- 2010-08-12 103926 Mcqs For Artick LightDocument3 pages2010-08-12 103926 Mcqs For Artick LightCarl Adrian ValdezNo ratings yet

- 6Document5 pages6Carlo ParasNo ratings yet

- Tutorial - Corporate Dividends - For StudentsDocument3 pagesTutorial - Corporate Dividends - For StudentsBerwyn GazaliNo ratings yet

- 1 Cash Dividends On The 10 Par Value Common Stock PDFDocument2 pages1 Cash Dividends On The 10 Par Value Common Stock PDFHassan JanNo ratings yet

- Assignment 4 FA 03062021 102154pmDocument3 pagesAssignment 4 FA 03062021 102154pmMuhammad ArhamNo ratings yet

- Chapter-05-Earnings Per ShareDocument9 pagesChapter-05-Earnings Per ShareSafeen LabibNo ratings yet

- Chapter 15 in ClassDocument4 pagesChapter 15 in ClassTati AnaNo ratings yet

- CH 16Document3 pagesCH 16vivienNo ratings yet

- Accounting HW Chapter 15Document4 pagesAccounting HW Chapter 15chiaraar88No ratings yet

- Exercise Problem 3 - Shareholder's EquityDocument5 pagesExercise Problem 3 - Shareholder's EquityLLYOD FRANCIS LAYLAYNo ratings yet

- Working 7Document5 pagesWorking 7Hà Lê DuyNo ratings yet

- Kuis AK 2Document4 pagesKuis AK 2Jhon F SinagaNo ratings yet

- Pryor Company Receives Net Proceeds ofDocument4 pagesPryor Company Receives Net Proceeds ofAulia HidayatiNo ratings yet

- ACC 291 Week 4 ProblemsDocument8 pagesACC 291 Week 4 ProblemsGrace N Demara BooneNo ratings yet

- Bab 3 - Soal-Soal No. 4 SD 10Document4 pagesBab 3 - Soal-Soal No. 4 SD 10Vanni LimNo ratings yet

- Accounting II Chapters 12, 13, 14 ReviewDocument10 pagesAccounting II Chapters 12, 13, 14 ReviewJacKFrost1889No ratings yet

- ACC 3003- Final Exam RevisionDocument19 pagesACC 3003- Final Exam Revisionfalnuaimi001No ratings yet

- H1 ReviewFinancialStatementsDocument2 pagesH1 ReviewFinancialStatementsLim Kuan YiouNo ratings yet

- Credit Sales AR and Equity Chapters QuestionsDocument4 pagesCredit Sales AR and Equity Chapters QuestionsSakhawat HossainNo ratings yet

- AC 551 Final ExamDocument2 pagesAC 551 Final ExamNatasha Declan100% (2)

- Acct Exam 1 AnswerDocument10 pagesAcct Exam 1 Answermiranda100789100% (2)

- Review Sw4tgession 5 TEXTDocument9 pagesReview Sw4tgession 5 TEXTMelissa WhiteNo ratings yet

- Dilutive Dan EpsDocument18 pagesDilutive Dan EpsCepi Juniar PrayogaNo ratings yet

- Market Ratios - Practice QuestionsDocument16 pagesMarket Ratios - Practice QuestionsOsama Saleem0% (1)

- ACC 423 Final Exam GuideDocument11 pagesACC 423 Final Exam Guideapjk510No ratings yet

- Intacc Questions To AnswerDocument12 pagesIntacc Questions To AnswerMichelle Esternon0% (2)

- EpsDocument10 pagesEpsDanica Austria DimalibotNo ratings yet

- Calculating bond interest expense and amortizationDocument8 pagesCalculating bond interest expense and amortizationLalaina EnriquezNo ratings yet

- ACC 423 Final Exam GuideDocument6 pagesACC 423 Final Exam Guideapjk510No ratings yet

- 7Document4 pages7Carlo ParasNo ratings yet

- Chapter 10 and 11 HWDocument4 pagesChapter 10 and 11 HWkanielafinNo ratings yet

- Solutions Guide: Please Do Not Present As Your Own. This Is Only Meant As A Solutions Guide For You To Answer The Problem On Your OwnDocument5 pagesSolutions Guide: Please Do Not Present As Your Own. This Is Only Meant As A Solutions Guide For You To Answer The Problem On Your OwnLai YanyanNo ratings yet

- Intermediate Accounting 2.0 InvestmentsDocument6 pagesIntermediate Accounting 2.0 InvestmentsKaren Joy Jacinto ElloNo ratings yet

- Preparing Financial StatementsDocument15 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Quiz - Inter 2 UTS - Wo AnsDocument3 pagesQuiz - Inter 2 UTS - Wo AnsNike HannaNo ratings yet

- Diluted Earnings Per Share QDocument2 pagesDiluted Earnings Per Share Qjano_art210% (4)

- CPA Questions in Word Ch 19Document4 pagesCPA Questions in Word Ch 19rohaanali222No ratings yet

- Solutiondone 77Document1 pageSolutiondone 77trilocksp SinghNo ratings yet

- Test 1 W AnswersDocument8 pagesTest 1 W AnswersVaniamarie VasquezNo ratings yet

- Audit 2 - Topic4Document18 pagesAudit 2 - Topic4YUSUF0% (1)

- 12 Altprob 8eDocument4 pages12 Altprob 8eRama DulceNo ratings yet

- Final Exam: Cpa Exam Questions & Additional ExercisesDocument24 pagesFinal Exam: Cpa Exam Questions & Additional Exercisessino akoNo ratings yet

- Chapter 17 HomeworkDocument3 pagesChapter 17 HomeworkTracy LeeNo ratings yet

- Act Part5Document1 pageAct Part5Moe ChannelNo ratings yet

- Chapter 13 14 Review QuestionsDocument6 pagesChapter 13 14 Review QuestionsHERSINo ratings yet

- CHAPTERS 15-18 PRACTICE PROBLEMSDocument16 pagesCHAPTERS 15-18 PRACTICE PROBLEMSchloekim03No ratings yet

- Problem A:: Midterm Homework-EPS Write A Summary of Your Final Answer and Provide Solution in Any FormDocument2 pagesProblem A:: Midterm Homework-EPS Write A Summary of Your Final Answer and Provide Solution in Any FormDynNo ratings yet

- Sample Final Exam QuestionsDocument28 pagesSample Final Exam QuestionsHuyNo ratings yet

- 3 6int 2006 Dec QDocument9 pages3 6int 2006 Dec QHannan SalimNo ratings yet

- Chapter 16 Day 1 EPS - ComplexDocument5 pagesChapter 16 Day 1 EPS - Complexgilli1trNo ratings yet

- Exercise Chapter 16Document4 pagesExercise Chapter 16hangbg2k3No ratings yet

- The Post Closing Trial Balance of Storey Corporation at December 31Document1 pageThe Post Closing Trial Balance of Storey Corporation at December 31trilocksp SinghNo ratings yet

- Chapter 17 HomeworkDocument70 pagesChapter 17 HomeworkCarl Agape DavisNo ratings yet

- Acc 308 - Week4-4-2 Homework - Chapter 13Document6 pagesAcc 308 - Week4-4-2 Homework - Chapter 13Lilian L100% (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Hyde Greek PreviewDocument73 pagesHyde Greek PreviewVanessa HaliliNo ratings yet

- Sheryl LDocument2 pagesSheryl LVanessa HaliliNo ratings yet

- Vanessa P. Halili: Kelly AndersonDocument1 pageVanessa P. Halili: Kelly AndersonVanessa HaliliNo ratings yet

- ApprovalDocument13 pagesApprovalVanessa HaliliNo ratings yet

- Tomato Sauce Recipe IngredientsDocument1 pageTomato Sauce Recipe IngredientsVanessa HaliliNo ratings yet

- Huánlǐ - : RequitalDocument7 pagesHuánlǐ - : RequitalVanessa HaliliNo ratings yet

- Edited MarketingDocument13 pagesEdited MarketingVanessa HaliliNo ratings yet

- English 2 Chapter 5Document2 pagesEnglish 2 Chapter 5Vanessa HaliliNo ratings yet

- LawDocument31 pagesLawVanessa HaliliNo ratings yet

- Stocks, Sauces and SoupsDocument15 pagesStocks, Sauces and SoupsVanessa Halili100% (2)

- Market Survey QuestionnaireDocument1 pageMarket Survey QuestionnaireVanessa HaliliNo ratings yet

- Cost Accounting-Job Order Costing1 (Q)Document2 pagesCost Accounting-Job Order Costing1 (Q)Vanessa HaliliNo ratings yet

- CHapter 3Document32 pagesCHapter 3Vanessa HaliliNo ratings yet

- Sol Ass3Document3 pagesSol Ass3Vanessa HaliliNo ratings yet

- Chapter 4-Differential Analysis (Q)Document10 pagesChapter 4-Differential Analysis (Q)Vanessa HaliliNo ratings yet

- Cost Accounting - Chapter 12Document7 pagesCost Accounting - Chapter 12xxxxxxxxx33% (3)

- Chapter 4-Differential AnalysisDocument16 pagesChapter 4-Differential AnalysisVanessa HaliliNo ratings yet

- Preliminary Examination MC (Q)Document9 pagesPreliminary Examination MC (Q)Vanessa HaliliNo ratings yet

- FinanceSolutions Manual of FMDocument170 pagesFinanceSolutions Manual of FMRahman Ullah Khan100% (2)

- 20 Winter 2014 - FinalDocument21 pages20 Winter 2014 - FinalVanessa HaliliNo ratings yet

- Chapter 4-Differential AnalysisDocument16 pagesChapter 4-Differential AnalysisVanessa HaliliNo ratings yet

- Project in Marketing 1: (SWOT Analysis)Document2 pagesProject in Marketing 1: (SWOT Analysis)Vanessa HaliliNo ratings yet

- Activity-Based Costing and Management Systems Chapter ReviewDocument63 pagesActivity-Based Costing and Management Systems Chapter ReviewVanessa HaliliNo ratings yet

- Cost Accounting Answer Chapter 2 PDFDocument5 pagesCost Accounting Answer Chapter 2 PDFangel cruz0% (1)

- Fifo Method of Process CostingDocument17 pagesFifo Method of Process CostingPrateek DubeyNo ratings yet

- Management 2Document2 pagesManagement 2Vanessa HaliliNo ratings yet

- Ch08 Teamwork and Team PerformanceDocument40 pagesCh08 Teamwork and Team PerformanceThezenwayNo ratings yet

- Chapter 3Document29 pagesChapter 3Vanessa HaliliNo ratings yet

- Call Center Industry: AOL Member Services Philippines, Inc. (America On-Line)Document2 pagesCall Center Industry: AOL Member Services Philippines, Inc. (America On-Line)Vanessa HaliliNo ratings yet

- Preliminary Examination MC (Q)Document9 pagesPreliminary Examination MC (Q)Vanessa HaliliNo ratings yet