Professional Documents

Culture Documents

Asianpaintsppt 120127000947 Phpapp02

Asianpaintsppt 120127000947 Phpapp02

Uploaded by

Muhammed Rafique0 ratings0% found this document useful (0 votes)

4 views32 pagesabout asian paints

Original Title

asianpaintsppt-120127000947-phpapp02

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentabout asian paints

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views32 pagesAsianpaintsppt 120127000947 Phpapp02

Asianpaintsppt 120127000947 Phpapp02

Uploaded by

Muhammed Rafiqueabout asian paints

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 32

Paint Industry

Paint industry estimated at INR 135bn.

Unorganized sector accounts to 35% of paint market.

Volume growth estimated at 15%.

Indias share in the world paint market is 1.6%.

Per capita consumption of paint in India is 1.2kg/annum.

Introduction to Asian Paints

Started in 1942 by four entrepreneurs:

Choksey Bros,

ASIAN OIL & PAINTS COMPANY.

In 1967, Asian paints became the 10

th

largest paint company in

the world.

In 1973, AP became a public ltd company.

In 2002. AP was a market leader of Indian Decorative Paints

Introduction to Asian Paints

Turnover of INR 7750 crore ($1.73 Bn)

Asian Paints along with its subsidiaries have operations in 17

countries across the world

Consist of 23 paint manufacturing facilities

Asian Paints has two alliances, one with PPG Industries USA &

other with Protech Chemicals, Canada.

6

Competitors

Market Share in India

Segments

s

e

g

m

e

n

t

s

Paint

Decorative

Paints

Industrial Paints

Chemicals

Phthatic

Anhydried

Penraerythritol

Interior Paints

Exterior Paints

Wood Furnishes

Wood & Metal Furnishes

Product Profile

Group subsidiaries

Company in South pacific island.

AP operates in Australia, Fiji,

Tonga,Soloman Island under brand

name APCO.

England based Company. In 2002,

became part of AP

Egypt company which became

part of AP in August 2002

US Company with 50:50 equity sharing

with AP in 1997. Pittsburgh Paints and

Glass Industries (PPG), USA

Fiji company became a part of AP in

September 2003.

Continued

Indian Manufacturing Plants

Asian Plants

Bhandup (Maharashtra) in India

Asian Plants

Kasna (Uttar Pradesh) in India

Asian Plants

Sriperumbudur in India

Asian Plants

(Rohtak, Haryana)

Overseas

Berger International Plants

Barbados

Berger International Plants

Bahrain

Berger International Plants

Jamaica

Berger International Plants

Singapore

Berger International Plants

Trinidad

RETAIL INITIATIVES

Asian Paints has fostered a customer-centric

approach to business

Asian Paints Home Solutions

Offers a painted surface vs. just paint

Aimed at controlling the quality of end

product

Brand Mascot

Growth Strategies

Growth Strategy: To increase sales growth rate of the group

beyond past levels using a two-pronged approach:

Market Share

Gain

Market

Expansion

Organic

Growth

International

M & As

Domestic

M & As

Inorganic

Growth

Buys Taubmans Paints (Fiji) In September 2003.

Acquires ICI Indias Unit (February 2007).

Sells stake in Australian Unit (June 2007).

Marketing Strategies

Rural Marketing Initiatives since 1970.

Distribution is one of the main focus strategy of Asian Paints.

Advertising & Promotional Expenditure started in 1980s.

Advertising Methods- Radio, TVCs, Print, Internet,

OOH, POP, Retail Outlets, Seminars, Workshops.

Marketing Strategies

Company is using different techniques such as advertising

Campaign, sales promotion, personal selling, direct

marketing and public relation to increase sales

A total amount of 85 crore is spent on the ad campaign by asian

paint. Their particular ad campaign Mera Walla Blue har ghar

kuch kehta hai

Online marketing for urban customer as well as Asian paints has

started cutomer helpline service(24x7)

Promotional Expenditure grew

from 15% in 2003 to 22% in 2010.

Diagrammatic Representation of Management

Majority of employees are hired from premium

management institutes.

Recreational facilities are provided to the employees.

Water Conservation-Total

Water Management Center

Age Care

Education

Other Initiatives

SWOT ANALYSIS

STRENGTH

Market leaders with 35%+ market shares.

Strong in inventory control.

The pricing strategy is oriented to middle and lower end

consumers.

Widest product range in terms of products, shades, pack sizes.

Comprehensive nation wide coverage of the market.

SWOT ANALYSIS

WEAKNESSES

Seasonal demand and hence in off seasons it can

lead to cash flow problems.

Innovation in developing new product is inadequate.

Weakness on the technology front in industrial

paints.

SWOT ANALYSIS

Opportunities

The automobile industry accounted for 50% of the

industrial markets.

Can increase investment in IT

Rural Market

SWOT ANALYSIS

Threats

Competitors have gone in for hi-tech instacolour spot

mixing.

Domination of few foreign companies.

Competition is catching up fast, hi-tech facilities

gives abundant choices.

Rural markets have considerable potential. Companies that can

establish a dealer network in these markets are likely to get the

edge in positing above par growth rates over the next few years.

As setting up distribution infrastructure is expensive, it would

mean that the competition is limited to the top players.

Due to substantial hike in raw material prices, Asian Paints has

raised the prices of solvent based paints, thus demand would be

affected to some extent.

Prepared by:

Yuvraj Zala

Shivani Singh

You might also like

- Servicewide Specialists v. CADocument2 pagesServicewide Specialists v. CAd2015memberNo ratings yet

- Dyson - Presentation About Company and Case StudyDocument17 pagesDyson - Presentation About Company and Case StudyPiotr Bartenbach67% (6)

- Marketing Strategy of Asian PaintsDocument35 pagesMarketing Strategy of Asian PaintsGunjan Chakraborty40% (5)

- Swing DanceDocument7 pagesSwing DanceRodel MirandillaNo ratings yet

- Death Is Not The End of Our StoryDocument12 pagesDeath Is Not The End of Our StoryGabriel DincaNo ratings yet

- Section 013300 Submit Tal ProceduresDocument5 pagesSection 013300 Submit Tal ProceduresAnonymous NUn6MESxNo ratings yet

- Asian PaintsDocument28 pagesAsian PaintsBhavani Kanth100% (1)

- Menu Design: Class: CLN2400 Lecturer: Bruno Baumann Project By: Caroline, Debby, GlebDocument9 pagesMenu Design: Class: CLN2400 Lecturer: Bruno Baumann Project By: Caroline, Debby, GlebCaroline Elia0% (1)

- Asian PaintsDocument26 pagesAsian Paintsshivakumar devopsNo ratings yet

- My Last FarewellDocument2 pagesMy Last FarewellLiz CNo ratings yet

- BR Kapoor V State of Tamil NaduDocument13 pagesBR Kapoor V State of Tamil Naduagrawalabinas83% (6)

- Swot AnalysisDocument6 pagesSwot AnalysisPragati1711No ratings yet

- Asian Paint Strategic ManagementDocument27 pagesAsian Paint Strategic Managementarushpratyush100% (2)

- Financial Project Report On Asian PaintsDocument36 pagesFinancial Project Report On Asian Paintsdhartip_169% (13)

- Asian Paints ProjectDocument23 pagesAsian Paints ProjectAbhishek Jagwani83% (6)

- Marketing Management Project - Asian PaintsDocument40 pagesMarketing Management Project - Asian Paintsjhunababu100% (12)

- Motion For Re-Raffle SampleDocument2 pagesMotion For Re-Raffle SampleJerome Carlos MacatangayNo ratings yet

- 01 - Asian Paints Case StudyDocument11 pages01 - Asian Paints Case Studyrahil .pgpm17gNo ratings yet

- Asian Paint PPT Presentation - PPTX Recovered)Document38 pagesAsian Paint PPT Presentation - PPTX Recovered)Akash SalveNo ratings yet

- Asian PaintsDocument31 pagesAsian PaintsAman Kumar100% (1)

- Free Project Report On Asian Paints LTD 1Document54 pagesFree Project Report On Asian Paints LTD 1Shreyansh Kothari50% (2)

- Asian PaintsDocument30 pagesAsian PaintsJason MintNo ratings yet

- Project On Marketing Strategy of Asian PaintsDocument52 pagesProject On Marketing Strategy of Asian Paintsneenadmba100% (7)

- Estate of Rodriguez v. Republic, G.R. No. 214590, (April 27, 2022) )Document22 pagesEstate of Rodriguez v. Republic, G.R. No. 214590, (April 27, 2022) )Gerald MesinaNo ratings yet

- How to Apply Marketing Theories for "The Marketing Audit": 27 Theories Practical Example insideFrom EverandHow to Apply Marketing Theories for "The Marketing Audit": 27 Theories Practical Example insideNo ratings yet

- Innovate Indonesia: Unlocking Growth Through Technological TransformationFrom EverandInnovate Indonesia: Unlocking Growth Through Technological TransformationNo ratings yet

- Asain PaintsDocument118 pagesAsain PaintsMagesh GurunathanNo ratings yet

- Asian PaintsDocument10 pagesAsian Paintsprahaladhan-knight-940100% (3)

- Asian Paints Strategic AnalysisDocument3 pagesAsian Paints Strategic AnalysisTarunvir KukrejaNo ratings yet

- Asian Paints Supply Chain ManagementDocument11 pagesAsian Paints Supply Chain ManagementPraveen Sharma100% (11)

- Dissertation ReportDocument61 pagesDissertation ReportGeetanshi AgarwalNo ratings yet

- The Product Management for AI & Data Science: Becoming a Successful Product Manager in the Field of AI & Data ScienceFrom EverandThe Product Management for AI & Data Science: Becoming a Successful Product Manager in the Field of AI & Data ScienceNo ratings yet

- By: Loy Lobo Aapa Angchekar Priyanka BendaleDocument45 pagesBy: Loy Lobo Aapa Angchekar Priyanka BendaleLoy LoboNo ratings yet

- Imarketing Strategy of Asian Paints Jatin Roll No 32Document37 pagesImarketing Strategy of Asian Paints Jatin Roll No 32Defaultr 0007No ratings yet

- Asian Paints ProjectDocument23 pagesAsian Paints ProjectBheeshm Singh100% (1)

- Asian PaintsDocument20 pagesAsian PaintsDarshan Somashankara100% (1)

- Company Report On Asian Paints LTDDocument13 pagesCompany Report On Asian Paints LTDAkash Singh RajputNo ratings yet

- Project On Marketing Strategy of Asian Paints - 194513673Document50 pagesProject On Marketing Strategy of Asian Paints - 194513673Aman Singh100% (1)

- A Report Submitted in Partial Fulfillment of The Reequirements For The Degree of Master of Business AdministrationDocument24 pagesA Report Submitted in Partial Fulfillment of The Reequirements For The Degree of Master of Business AdministrationRahul YaduwanciNo ratings yet

- Asian PaintsDocument35 pagesAsian Paintsmerchantraza14No ratings yet

- Asian PaintsDocument23 pagesAsian PaintsAnkit Thatai100% (1)

- Asian PaintDocument33 pagesAsian PaintSunil ChitragarNo ratings yet

- The Indian Paint IndustryDocument57 pagesThe Indian Paint IndustryMumthaz AhmedNo ratings yet

- Asian PaintsDocument35 pagesAsian Paintsmerchantraza14No ratings yet

- Asian PaintsDocument26 pagesAsian PaintsAjinkya Nikam100% (1)

- Asian PaintsDocument16 pagesAsian PaintsChithralekha S KumarNo ratings yet

- Document On Berger Paints SlideDocument48 pagesDocument On Berger Paints SlideSammy BossNo ratings yet

- Painters:: Rohit Girdhar Shivam Kundra Ridhi Dhawan Nupur Bhalla Parul GuptaDocument19 pagesPainters:: Rohit Girdhar Shivam Kundra Ridhi Dhawan Nupur Bhalla Parul GuptaShivam KundraNo ratings yet

- Asian Paints LimitedDocument3 pagesAsian Paints LimitedSagar ViraniNo ratings yet

- Introducing The Asian Paints GroupDocument15 pagesIntroducing The Asian Paints GroupBetterstoriesNo ratings yet

- Asian PaintDocument34 pagesAsian PaintSantosh MirjeNo ratings yet

- Asian Paint SlideDocument47 pagesAsian Paint SlideIt's SammyNo ratings yet

- Marketing Strategies and S.W.O.T Analysis of AsianDocument7 pagesMarketing Strategies and S.W.O.T Analysis of AsianLevin OliverNo ratings yet

- Financial Project Report On Asian PaintsDocument37 pagesFinancial Project Report On Asian PaintsChe Tanifor Banks80% (5)

- Asian Paints - Chapter4Document6 pagesAsian Paints - Chapter4Chithralekha S KumarNo ratings yet

- Good MorningDocument17 pagesGood Morningpayal65No ratings yet

- Pestel Analysis IndiaDocument51 pagesPestel Analysis IndiaRishabh JainNo ratings yet

- Asian PaitsDocument12 pagesAsian PaitschaithrapatelNo ratings yet

- Relationship Marketing in Asian Paints (India) Limited and Kansai Nerolac Paints LimitedDocument29 pagesRelationship Marketing in Asian Paints (India) Limited and Kansai Nerolac Paints LimitedShiksha AgarwalNo ratings yet

- Asian PaintsDocument3 pagesAsian PaintsAditya PrakashNo ratings yet

- Chauhan Project On Marketing StrategiesDocument39 pagesChauhan Project On Marketing StrategiesSandiep SinghNo ratings yet

- Entrepreneurship: Model Assignment answer with theory and practicalityFrom EverandEntrepreneurship: Model Assignment answer with theory and practicalityNo ratings yet

- Model Answer: E-Commerce store launch by Unilever in Sri LankaFrom EverandModel Answer: E-Commerce store launch by Unilever in Sri LankaNo ratings yet

- Model Answer: Launch of a laundry liquid detergent in Sri LankaFrom EverandModel Answer: Launch of a laundry liquid detergent in Sri LankaNo ratings yet

- Sustainable Growth in Global Markets: Strategic Choices and Managerial ImplicationsFrom EverandSustainable Growth in Global Markets: Strategic Choices and Managerial ImplicationsNo ratings yet

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- Kerala Case Jto Pay ScaleDocument33 pagesKerala Case Jto Pay ScaleVijaya Raghava Rao TakkellapatiNo ratings yet

- Grant Neal v. CSU Pueblo Et. Al.Document90 pagesGrant Neal v. CSU Pueblo Et. Al.Michael_Lee_RobertsNo ratings yet

- Chapter 4 The Mughal DynastyDocument4 pagesChapter 4 The Mughal Dynastydeep_72No ratings yet

- Cpi201t 9 2013 FTDocument66 pagesCpi201t 9 2013 FTPortia ShilengeNo ratings yet

- Worksheet 1Document3 pagesWorksheet 1Hend HamedNo ratings yet

- DigestDocument30 pagesDigestyguhbnijmokp32No ratings yet

- ILO JudgementsDocument28 pagesILO JudgementsArshima RNo ratings yet

- Heuristics and Biases: The Psychology of Intuitive JudgmentDocument6 pagesHeuristics and Biases: The Psychology of Intuitive JudgmentJulia TartagliaNo ratings yet

- Objective General English - DjvuDocument2,637 pagesObjective General English - DjvuBala Mech SBNo ratings yet

- ĐỀ ĐỌC ĐIỀN 4Document6 pagesĐỀ ĐỌC ĐIỀN 4Mai LeNo ratings yet

- ISDN - Partnership Agreement SampleDocument9 pagesISDN - Partnership Agreement SampleMaxine Nicole BacarezaNo ratings yet

- Letter To SponsorDocument11 pagesLetter To SponsorJeremiah Miko LepasanaNo ratings yet

- 10 - How Liberia Keeps Bloodily Faking and Mocking Independence andDocument28 pages10 - How Liberia Keeps Bloodily Faking and Mocking Independence andMoinma KarteeNo ratings yet

- Ethics Question BankDocument3 pagesEthics Question BankNishant IrudayadasonNo ratings yet

- ND Di+ Tf-Thi U Bu: E Lalefivibaitri (HeDocument1 pageND Di+ Tf-Thi U Bu: E Lalefivibaitri (HeMohammad Iqbal HossainNo ratings yet

- Assignment - Hero Motocorp LTD - SHRM - Debasis RoutDocument2 pagesAssignment - Hero Motocorp LTD - SHRM - Debasis RoutAvishek BhattacharjeeNo ratings yet

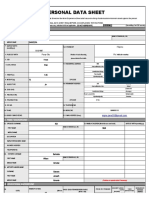

- Cs Form No. 212 Revised Personal Data Sheet - NewDocument8 pagesCs Form No. 212 Revised Personal Data Sheet - NewRose Anne Jane BartolataNo ratings yet

- JEAN-PAUL SARTRE Power Point! Abbbbbbbbbbbs!Document15 pagesJEAN-PAUL SARTRE Power Point! Abbbbbbbbbbbs!Gabrelle OgayonNo ratings yet

- DMMMSU Open University Accomplishment 2019Document5 pagesDMMMSU Open University Accomplishment 2019Joanne Camus RiveraNo ratings yet

- The Pedagogical Model: Eva LuaDocument28 pagesThe Pedagogical Model: Eva LuaEdison ChandraseelanNo ratings yet