Professional Documents

Culture Documents

Form Dealer Review

Uploaded by

RijalulGhaibCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form Dealer Review

Uploaded by

RijalulGhaibCopyright:

Available Formats

1.

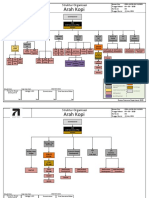

Struktur Organisasi

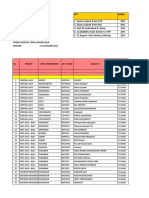

2. Manpower

2009 2010 YTD 2011 2012

Person Person Person Person

1 PIC Manager 1 1 1 1

2 Supervisor

3 Salesman 10 23 35 15

4 Sales Counter 1 1 2 3

5 ADH 1 1 1 1

6 Kasir 1 1 1 1

PT DAYA ANUGRAH MANDIRI - BELITUNG

No Position

KASIR

MEKANIK PDI

ADMIN H1 ADMIN H23

ADH

OFFICE BOY

DRIVER

7 Administration 1 1 1 1

8 Kepala Bengkel 1 1 1 1

9 Service Advisor 1 1 1 1

10 Kepala Regu 1 1 1 1

11 Mechanics 4 4 4 4

12 Front Desk 1 1 1 1

13 Spare Part 1 1 1 1

Total 24 37 50 31

3. Area Information

Luas Wilayah 4,547 km2

Jumlah Penduduk 85,974 jiwa Utara

Kecamatan Timur

Kelurahan Selatan

Barat

Honda

Yamaha

Suzuki

Other

4. Coverage Area (Peta Belitung)

ASP, TDM, NSS

Sumber Jadi 1, Sumber jadi 2, Cahaya Motor, Taurus Motor

Viar,KTM,Kawasaki,Bajai

Dealer Motor Terdekat

Tanjung Pandan

Kota

Langgeng Sewu

5. Mapping Pos Penjualan Dealer Ema Mtr

Perbulan maret 2012 POS Tanjung kelayang,Pos Manggar stop operasional

Tanjung Kelayang

PT DAYA ANUGRAH MANDIRI - BELITUNG

KEPALA CABANG

COUNTER SALES SERVICE ADVISOR

MARKETING

EXCEKUTIF

SPV MARKETING

MARKETING TRAINEE

FRONTDESK PART INVENTORY

Batas Wilayah Potensi Market

Kecamatan Sijuk Perumahan

Kecamatan Badau Perumahan, Perkebunan dan pasar

Kecamatan Membalong Perumahan, Perkebunan dan pasar

Kecamatan Selat Nasik Perumahan, Perkebunan

ASP, TDM, NSS

Sumber Jadi 1, Sumber jadi 2, Cahaya Motor, Taurus Motor

Viar,KTM,Kawasaki,Bajai

Dealer Motor Terdekat

Langgeng Sewu

Perbulan maret 2012 POS Tanjung kelayang,Pos Manggar stop operasional

Kelapa Kampit

Manggar

Simpang Pesak

PT DAYA ANUGRAH MANDIRI - BELITUNG

KEPALA REGU SERVICE ADVISOR

KEPALA BENGKEL

MEKANIK PART INVENTORY

Mapping By Type

Matic, Revo,Blade

Matic, Revo,Blade

Matic, Cub, Sport

Matic, Revo,Blade

Tanjung Pandan

Luas wilayah 4.547 km

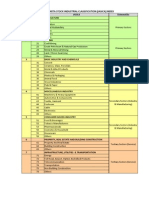

6. a. Sales By Type YTD

Average Sales

Per Month

% Contribution

Abs.Revo Fit 1 2%

Abs.Revo Sp 10 20%

Abs.Revo CW 14 29%

Revo Techno 0 0%

Blade 5 10%

Blade (Repsol) 0 0%

Cub > 125 cc Supra X 125 Sp 1 2%

Supra X 125 CW 2 4%

Supra X 125 CW Hi 0 0%

Supra X 125 CW Hi

Fi

0 0%

City Sport CS 1 2 4%

BeAT Sp 0 0%

BeAT CW 5 10%

Spacy Sp Hi 0 0%

Spacy CW Hi 0 0%

Spacy CW Hi Fi 0 0%

Scoopy 0 0%

Vario CW 5 10%

Vario Techno 1 2%

Vario CBS 0 0%

Vario PGM Fi 0 0%

Megapro Sp 1 2%

Megapro CW 1 2%

Tiger 0 0%

Tiger Single L 1 2%

Total All type 49 100%

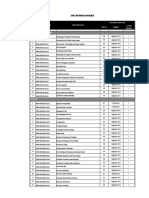

6. b. Sales By Type Per Month

120 141

Jan-12 Feb-12

Abs.Revo Fit 13 15

Abs.Revo Sp 1 0

Abs.Revo CW 1 2

Total 15 17

Revo Techno 0 0

Blade 7 6

Blade (Repsol) 4 8

Supra X 125 D 0 0

Total 11 14

Supra X 125 Sp 0 0

Supra X 125 CW 0 0

Type

2009

Type Category

Category

CUB

Cub High

Cub Low

Cub Mid

SubCategory

Sport

A/T Scooter

Cub < 125 cc

Supra X 125 CW

Helm In

0 3

Supra X 125 CW

Helm In Fi

1 1

Total 1 4

Total Cub 27 35

BeAT Sp 0 0

BeAT CW 14 25

Spacy Sp Hi 0 0

Spacy CW Hi 5 13

Spacy CW Hi Fi 4 0

Total 23 38

AT Mid Scoopy 20 11

Total 20 11

Vario CW 1 0

Vario Techno 7 8

Vario CBS 1 4

Vario 125 PGM Fi

0 0

Vario 125 PGM Fi

CBS

0 0

Total 9 12

Total AT 52 61

Sport Low CS 1 0 0

Total 0 0

Megapro Sp 0 0

Megapro CW 1 2

Total 1 2

Sport High Tiger 1 1

Total 1 1

Total sport 2 3

Total All type 81 99

6. c. Grafik Sales By Type YTD

Sport Sport Mid

CUB

Cub High

AT Low

AT High

AT

0%

10%

20%

12%

1%

19%

1%

8%

1%

1%

1%

0% 0%

1%

0%

16%

0%

10%

0%

17%

1%

% Contribution

6. d. Grafik Sales By Type Per Month

Jan-12 Feb-12 Mar-12

Cub Cub Low 15 17

Cub Mid 11 14

Cub High 1 4

cub 27 35 0

AT AT Low 23 38

AT Mid 20 11

AT High 9 12

AT 52 61 0

Sport Sport Low 0 0

Sport Mid 1 2

Sport High 1 1

Sport 2 3 0

15

17

11

14

1

4

23

38

20

11

9

12

1 1

0

5

10

15

20

25

30

35

40

Jan-12 Feb-12

Average Sales

Per Month

% Contribution

Average Sales

Per Month

% Contribution

Average Sales

Per Month

1 7% 18 12% 1700% 8

12 11% 2 1% -83% 1

35 33% 30 19% -14% 1

0 0% 1 1% #DIV/0! 0

3 3% 13 8% 333% 3

2 2% 2 1% 0% 4

1 1% 1 1% 0% 0

5 5% 2 1% -60% 0

0 0% 0 0% #DIV/0! 2

0 0% 0 0% #DIV/0! 1

1 1% 1 1% 0% 0

0 0% 0 0% #DIV/0! 0

24 23% 25 16% 4% 13

0 0% 0 0% #DIV/0! 0

0 0% 16 10% #DIV/0! 7

0 0% 0 0% #DIV/0! 1

3 3% 26 17% 767% 5

7 7% 2 1% -71% 1

6 6% 11 7% 83% 4

1 1% 2 1% 100% 2

0 0% 0 0% #DIV/0! 0

1 1% 1 1% 0% 0

1 1% 2 1% 100% 1

0 0% 0 0% #DIV/0! 0

2 2% 1 1% -50% 1

105 100% 156 100% 49% 181

160 171 185 219 239 163

Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12

0 0 0 0 0 0

0 0 0 0 0 0

CLY

2010 2011 2012

0 0 0 0 0 0

0 0 0 0 0 0

0 0 0 0 0 0

0 0 0 0 0 0

0 0 0 0 0 0

0 0 0 0 0 0

0 0 0 0 0 0

0 0 0 0 0 0

0 0 0 0 0 0

0 0 0 0 0 0

0 0 0 0 0 0

Ser

ies

1

1%

7%

1%

0%

1%

1%

0%

1%

Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12

0 0 0 0 0 0

0 0 0 0 0 0

0 0 0 0 0 0

2

1

Cub Low

Cub Mid

Cub High

AT Low

AT Mid

AT High

Sport Low

Sport Mid

Sport High

27

52

2

0

10

20

30

40

50

60

70

% Contribution

4% -56%

1% -50%

1% -97%

0% -100%

2% -77%

2% 100%

0% -100%

0% -100%

1% #DIV/0!

1% #DIV/0!

0% -100%

0% #DIV/0!

7% -48%

0% #DIV/0!

4% -56%

1% #DIV/0!

3% -81%

1% -50%

2% -64%

1% 0%

0% #DIV/0!

0% -100%

1% -50%

0% #DIV/0!

1% 0%

100% 16%

186 188 197 204 2173

Sep-12 Oct-12 Nov-12 Dec-12 Average 2012

28

1

3

0 0 0 0 32

0

13

12

0

0 0 0 0 25

0

0

CLY

2012

3

2

0 0 0 0 5

0 0 0 0 62

0

39

0

18

4

0 0 0 0 61

31

0 0 0 0 31

1

15

5

0

0

0 0 0 0 21

0 0 0 0 113

0

0 0 0 0 0

0

3

0 0 0 0 3

2

0 0 0 0 2

0 0 0 0 5

0 0 0 0 180

Oct-12 Nov-12 Dec-12

0 0 0

0 0 0

0 0 0

35

61

3

cub

AT

Sport

7. Sales Target Achievement By Type Per Month

Target

Achievem

ent

Target

Achievem

ent

Target

Achievem

ent

Revo Fit

Revo Spoke

Revo CW

Revo Deluxe

Revo Matic

Blade

Supra X 125

Spoke

Supra X 125 CW

Supra X 125

PGM-FI

New Beat CW

Spacy CW

Spacy FI

Scoopy

New Vario

V Techno Non

CBS

Vario CBS

Vario PGM Fi

PCX

CS ONE

Mega Pro Spoke

Mega Pro CW

Tiger

Tiger Single L

TOTAL 0 0 0 0 0 0 0

8. Target vs Achievement All Type

Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12

Target

Achievement

TYPE

Jan-12 Feb-12 Mar-12

-

0

0

1

1

1

1

Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12

Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12

Target

Achievement

Target vs Achievement

0 0 0 0 0 0 0 0 0

Aug-12 Sep-12 Oct-12 Nov-12 Dec-12

Aug-12 Sep-12 Oct-12 Nov-12 Dec-12

Aug-12 Sep-12 Oct-12 Nov-12 Dec-12

Target vs Achievement

Target

Achievement

0 0 0 0 0 0 0 0

9. Sales Structure

2009 2010 2011 2009

Cash 9% 4% 5% Cash 55

Credit 91% 96% 95% Credit 553

608

Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12

Cash 9% 9%

Credit 91% 91%

10. Finance Company Share

2009 2010 2011 ytd 2012 2009

FIF 96% 89% 86% 82% FIF 517

Adira 4% 6% 8% 9% Adira 24

SOF 0% 0% 0% 0% SOF 0

Others 0% 5% 6% 9% Others 0

541

Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12

FIF 84% 80%

Adira 8% 10%

SOF 0% 0%

Others 8% 10%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2009 2010 2011

9%

4%

5%

91%

96%

95%

Cash

Credit

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

11. Sales Structure By DP

2011 DP <1,5JT

DP 1,6-

2,5JT

DP >2,55 2011 DP <1,5JT DP 1,6-2,5JT

LEASING DP 10 % DP 20% DP 30% LEASING DP 10 % DP 20%

FIF 58% 17% 25% FIF 35 10

OTO #DIV/0! #DIV/0! #DIV/0! OTO 0 0

ADIRA 38% 38% 23% ADIRA 10 10

OTHER 63% 19% 19% OTHER 200 60

96%

89%

86%

82%

4%

6%

8%

9%

0% 0% 0% 0% 0%

5%

6%

9%

0%

20%

40%

60%

80%

100%

120%

2009 2010 2011 ytd 2012

2010 2011

44 99

1176 1732

1220 1831

Aug-12 Sep-12 Oct-12 Nov-12 Dec-12

2010 2011

1050 1490

72 139

0 0

54 103

1176 1732

Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 ytd 2012

82%

9%

0%

9%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Jan-12 Feb-12

9% 9%

91% 91%

Cash

Credit

DP >2,55

DP 30%

15 60

0 0

6 26

60 320

406

9%

FIF

Adira

SOF

Others

12. Jumlah Activity BTL Dealer

DEALER : PT DAYA ANUGRAH MANDIRI - BELITUNG

BULAN & TAHUN :

TARGET RETAIL SALES : unit

% Cont. Counter Sls : 70 33.2%

% Cont. Slsman : 141 66.8%

% Cont. Others : 0 0.0%

TOTAL : 211 100.0%

FORECAST SALES :

Counter Sales & Others : 23

GAP Forecast Sls vs Tgt : -30

% Achv : #DIV/0!

Salesman/girl Sales & POS : 107

GAP Forecast Sls vs Tgt : -31

% Achv : #DIV/0!

TARGET & FORECAST RETAIL SALES DEALERS

TOTAL FORECAST SALES : 130

GAP FORECAST SLS VS TGT : 130

% ACHIEVEMENT : #DIV/0!

40

110

unit ----> * Showroom Event : 0 x / bln

- Soft Opening 0 x / bln

unit - Gathering Cust 0 x / bln

- Service & Parts Discount 1 x / bln

- Lomba (masak, gambar) 1 x / bln

* Regular Sales : 24 hari kerja*

- Flyering - everyday

* Others Sales :

- Mediator + Non Chnl

(note : * diluar event, sabtu & minggu buka)

unit ----> * BTL Event : 2 x / bln

- Roadshow 3 x / bln

unit - Gerebek Pasar 2 x / bln

- Gerebek Rmh Makan 0 x / bln

- Gerebek Perum 4 x / bln

- Exhibition 0 x / bln

- Canvasing 10 x / bln

* POS : 2 location

- Flyering - everyday

TARGET & FORECAST RETAIL SALES DEALERS

unit

unit

----> Tot Sls per event : 0 unit ----> Sls Total Showroom Event :

----> Sls per event : 0 unit ----> Sls Total Event :

----> Sls per event : 0 unit ----> Sls Total Event :

----> Sls per event : 0 unit ----> Sls Total Event :

----> Sls per event : 5 unit ----> Sls Total Event :

----> Sls per hari* : ----> Sls Total Regular :

(rata-rata)

----> Sls Total Others :

Total Sales vs Counter :

----> Tot Sls per event : 26 unit ----> Sls Total BTL Event :

Sls per event : 10 unit ----> Sls Total Event :

Sls per event : 8 unit ----> Sls Total Event :

Sls per event : 0 unit ----> Sls Total Event :

Sls per event : 3 unit ----> Sls Total Event :

Sls per event : 0 unit ----> Sls Total Event :

Sls per event : 5 unit ----> Sls Total Event :

----> Sls per POS : 15 unit ----> Sls Total POS :

(rata-rata)

TARGET & FORECAST RETAIL SALES DEALERS

Total Sales by Slsman :

0 unit

0 unit

0 unit

0 unit

5 unit

13 unit

0 unit

18 unit

52 unit

30 unit

16 unit

0 unit

12 unit

0 unit

50 unit

30 unit

TARGET & FORECAST RETAIL SALES DEALERS

160 unit

13.Main Issue

Aspek Problem Identification

People Turn over Marketing tinggi

produk revo kalah image dari kompetitor (vega zr) di kalangan anak muda

price(sales program) bunga dari fincoy lebih tinggi

place(mapping)

Promotion

brosur di dealer kurang memadai

kurang tenda untuk mengadakan event

mapping area belum maksimal

Corrective Action

Recrutment Marketing setiap hari dengan menggunakan media

koran,spanduk, brosur

melakukan program BTL activity khusus revo

koordinasi dengan pihak main dealer untuk memberikan suku bunga yang

kompetitif

rencana akan membuka pos/chanell

koordinasi dengan main dealer untuk pengadaan material promosi

You might also like

- Business and Market DevelopmentDocument17 pagesBusiness and Market DevelopmentAvnish NarulaNo ratings yet

- 20 Jan Marketing ReportDocument3 pages20 Jan Marketing ReportYansyah RiansyahNo ratings yet

- 1 Marketing Mix - MMTDocument29 pages1 Marketing Mix - MMTArnab DeyNo ratings yet

- Dealer Daikin SemarangDocument1 pageDealer Daikin SemarangWicara PutraNo ratings yet

- List Toko CNY Pay1Get2Document6 pagesList Toko CNY Pay1Get2Setiawan PrasetyaNo ratings yet

- TQC Action Plan g10 2017Document2 pagesTQC Action Plan g10 2017Albert Ian CasugaNo ratings yet

- Analisa Revenue Cabang & Depo SBY - Ytd 2021Document52 pagesAnalisa Revenue Cabang & Depo SBY - Ytd 2021sholehudinNo ratings yet

- KPI Admin MonitoringDocument364 pagesKPI Admin MonitoringrizaNo ratings yet

- KPI DesignerDocument2 pagesKPI DesignerAshraf HamdanNo ratings yet

- Daftar PesertaDocument15 pagesDaftar PesertaGifari ArdiansyahNo ratings yet

- Recruitment Report (Jan - Juni 2016)Document3 pagesRecruitment Report (Jan - Juni 2016)ElwansyahRismanNo ratings yet

- BR Fundamental System D2Document13 pagesBR Fundamental System D2TheCuriousMindNo ratings yet

- Database SiteList MS TERUPDATE - ReStructure & ReClusteringDocument698 pagesDatabase SiteList MS TERUPDATE - ReStructure & ReClusteringstreet jobNo ratings yet

- Daftar Gaji Karyawan PT SASAKADocument4 pagesDaftar Gaji Karyawan PT SASAKAMARKAS GANN DPPNo ratings yet

- Vendor registration formDocument3 pagesVendor registration formMuhammad AlisyabanaNo ratings yet

- Fullset Drawing E686 - Mb. Erafone Tarailu Mamuju UpdateDocument27 pagesFullset Drawing E686 - Mb. Erafone Tarailu Mamuju UpdateSAHRIL GUNAWAN 521192034No ratings yet

- Incentive Elina PSP & MS Jan 2019Document125 pagesIncentive Elina PSP & MS Jan 2019Admin FinanceNo ratings yet

- Sales Module Flow ChartDocument1 pageSales Module Flow Chartezhumalai05No ratings yet

- Fullset Erafone 2.5 Palembang Indah Mall - 1Document26 pagesFullset Erafone 2.5 Palembang Indah Mall - 1Puji SuminoNo ratings yet

- TMMIN Internship Report on CSR Projects and Personal DevelopmentDocument11 pagesTMMIN Internship Report on CSR Projects and Personal DevelopmentFauzan YRNo ratings yet

- Contoh Pengisian Form KPIDocument1 pageContoh Pengisian Form KPItri narwantoNo ratings yet

- Nota Hypermart 2016Document210 pagesNota Hypermart 2016Arman STNo ratings yet

- Jobdesk Sales & Marketing Dept - Content CreatorDocument2 pagesJobdesk Sales & Marketing Dept - Content Creatorpram monossNo ratings yet

- Logistics Operation PlanningDocument24 pagesLogistics Operation PlanningDani Leonidas S100% (1)

- Strategic Plan 2022Document3 pagesStrategic Plan 2022Energy Trading QUEZELCO 1No ratings yet

- Mitra 10 CibuburDocument62 pagesMitra 10 CibubursuarditayasaNo ratings yet

- SKBBBDocument42 pagesSKBBBKazuyano DoniNo ratings yet

- Rakor HRD 19022Document58 pagesRakor HRD 19022sarNo ratings yet

- Supply Chain Management Assignment-1Document2 pagesSupply Chain Management Assignment-1Z Babar KhanNo ratings yet

- City 8 Budget Estimation CALCULATIONDocument47 pagesCity 8 Budget Estimation CALCULATIONGreat Universe100% (1)

- Gambar Kerja Furniture Erafone 2.5 VOL.5Document67 pagesGambar Kerja Furniture Erafone 2.5 VOL.5Puji SuminoNo ratings yet

- Budgeting Section Head Job Role DesignDocument5 pagesBudgeting Section Head Job Role DesignImam Kesuma DilagaNo ratings yet

- Fullset Erafone MB JL - Karya MedanDocument30 pagesFullset Erafone MB JL - Karya MedanXlabs MedanNo ratings yet

- Matrix Agustus No Rumus 2023Document44 pagesMatrix Agustus No Rumus 2023ananda putralfaNo ratings yet

- Sales Management Strategies for Achieving Goals EffectivelyDocument17 pagesSales Management Strategies for Achieving Goals EffectivelyShoaibNo ratings yet

- No Description Action Why It Needed Deadline ResponsiblitiesDocument23 pagesNo Description Action Why It Needed Deadline ResponsiblitiesHakim Arahman100% (1)

- Struktur Org. Arah Kopi 210721Document3 pagesStruktur Org. Arah Kopi 210721Ardev PrimaNo ratings yet

- MD Minis - Form Check List - SAT-Midi - November 2018 (301118)Document47 pagesMD Minis - Form Check List - SAT-Midi - November 2018 (301118)Anonymous x5UlJrYMaNo ratings yet

- OVERCOMING CHALLENGES MAINTAINING STRONG POSITIONDocument249 pagesOVERCOMING CHALLENGES MAINTAINING STRONG POSITIONNadia IndrianiNo ratings yet

- Pelatihan Smart Parenting: Menjadikan Orang Tua Dan Anak Lebih Hebat, Cerdas Dan KreatifDocument9 pagesPelatihan Smart Parenting: Menjadikan Orang Tua Dan Anak Lebih Hebat, Cerdas Dan KreatifSurabaya School of Public SpeakingNo ratings yet

- Daftar Emiten BEIDocument23 pagesDaftar Emiten BEIisnaini latifah0% (1)

- Skill Matrix BoardDocument1 pageSkill Matrix BoardAmit SinghNo ratings yet

- Six Sigma Overview Origins of Six Sigma: What Is Six Sigma? What Is Six Sigma?Document4 pagesSix Sigma Overview Origins of Six Sigma: What Is Six Sigma? What Is Six Sigma?Rohan PaunikarNo ratings yet

- Distributor Enrolment Form: Copy of PAN CARD To Be Attached (Mandatory For All Organisations)Document2 pagesDistributor Enrolment Form: Copy of PAN CARD To Be Attached (Mandatory For All Organisations)neh SinghNo ratings yet

- Master PromoDocument80 pagesMaster Promostevie baraNo ratings yet

- ISO Management Process OverviewDocument1 pageISO Management Process OverviewAsryan Abrar RamadhianNo ratings yet

- Sales and Operation Planning 2021Document10 pagesSales and Operation Planning 2021areta nabillarisaNo ratings yet

- Form Induk Dokumen Perubahan DokumenDocument5 pagesForm Induk Dokumen Perubahan DokumenYudha MaretaNo ratings yet

- Trading TermDocument3 pagesTrading Termanrea100% (1)

- Sop Refreshment TrainingDocument4 pagesSop Refreshment TrainingDewi Hijriani Sekar NingtyasNo ratings yet

- Retail Manager Fresh Food CVDocument2 pagesRetail Manager Fresh Food CVMike Kelley0% (1)

- Training Need AnalysisDocument21 pagesTraining Need AnalysisWana PurnaNo ratings yet

- MappingDocument11 pagesMappingbusiness analystNo ratings yet

- Item specification table for scientific knowledge elementsDocument4 pagesItem specification table for scientific knowledge elementsNur SyahidaNo ratings yet

- SPPD UserDocument32 pagesSPPD UserswelagiriNo ratings yet

- From:-Mis Deptt - No Employee Code Name Month Branch: - Indore Sales Details: - Products Mix - % To Total Sale Value (Without Refill) Documented SaleDocument3 pagesFrom:-Mis Deptt - No Employee Code Name Month Branch: - Indore Sales Details: - Products Mix - % To Total Sale Value (Without Refill) Documented SaleJoseph DavisNo ratings yet

- Siraj Weekly Report m3 w4Document1 pageSiraj Weekly Report m3 w4Daniel Anoop RajNo ratings yet

- Manpower ReportDocument3 pagesManpower Report243021No ratings yet

- Reliance Trends Chennai tax invoiceDocument3 pagesReliance Trends Chennai tax invoiceKarthik sankarNo ratings yet

- Rudra PDFDocument12 pagesRudra PDFRaNo ratings yet

- Tes 5Document1 pageTes 5RijalulGhaibNo ratings yet

- Tes 3Document1 pageTes 3RijalulGhaibNo ratings yet

- Tes 4Document1 pageTes 4RijalulGhaibNo ratings yet

- Tes 3Document1 pageTes 3RijalulGhaibNo ratings yet

- Tes 2Document1 pageTes 2RijalulGhaibNo ratings yet

- Testing Mau Download OkDocument1 pageTesting Mau Download OkRijalulGhaibNo ratings yet

- Insentif Selisih Nov'12 s1Document5 pagesInsentif Selisih Nov'12 s1RijalulGhaibNo ratings yet

- Undangan Training Honda New Product Desember 12Document1 pageUndangan Training Honda New Product Desember 12RijalulGhaibNo ratings yet

- Aktual+Plan Data Asset Kode Cabang/CabangDocument24 pagesAktual+Plan Data Asset Kode Cabang/CabangRijalulGhaibNo ratings yet