Professional Documents

Culture Documents

Transmission Corporation of Andhra Pradesh Limited Income Tax Statement For The Year 2014-15

Uploaded by

Rama Krishna0 ratings0% found this document useful (0 votes)

17 views2 pagesbbbb

Original Title

Ade

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbbbb

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views2 pagesTransmission Corporation of Andhra Pradesh Limited Income Tax Statement For The Year 2014-15

Uploaded by

Rama Krishnabbbb

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

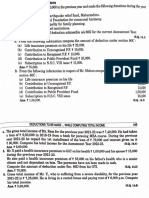

TRANSMISSION CORPORATION OF ANDHRA PRADESH LIMITED

INCOME TAX STATEMENT FOR THE YEAR 2014-15

1.Name of the Officer & Designation

P.Srinivasa Rao

ADE/M/220KVSS/Bhimadole

2. a)Residential Address

b)Permanent I.T.A/c No.(Compulsory)

3. a) Total salary from 03/2013 to 02/2014

(+)Family Pension

:

:

:

Bhimadole

12,63,555-00

b) Withdrawal from NSS if any

c) Total (a+b)

: Rs 12,63,555-00

d) LESS

Prof.Tax

Conveyance & Kit allowance

Total (d)

Total Salary (3c-3d)

NOTE:Med.All.not elegible for deduction

4. i) H.R.A Received

: Rs 2,400-00

:

: Rs 2,400-00

: Rs 1261155-00

ii) a) House Rent paid (enclose receipts)

b) 10% of Salary (Pay )

c) Balance eligible for Deduction

iii) Deduct whichever is less (i or ii)

5. Balance Income (Col.3-4)

6.ADD:I) i) Int.paid on H.B.A. Loan

ii) a)Income received from house

b) Less Municipal Tax paid

c) Net annual value (ii(a-b)

d) Less:Repairs (30% of above)

Net Income from Hose (c-d)

iii) Net int.allowed for exemtion (i-ii)

II) Any other income

7. Net Income (5-6)

8.SAVINGS FOR TAX REBATE (U/S 80C)

I) a) i) GPF (A/c.No.22463 )Contributions

:

:

:

:

: Rs 1261155-00

ii) DA credited to GPF A/c.

b) LIC Premium paid during the year

Policy No.

Amount.

1.

: Rs 94669.00

:

:

:

:

:

:

:

:

: Rs 1261155-00

:

: Rs 34,200-00

:

: Rs 38,624-00

: Rs 15,000-00

(Certified that the above policies are alive)

c) GIS

:

: Rs 1440-00

d) APLI / PLI / GSLIS

e) 10 / 15 years postal CTD No.

:

:

f) PPF Deposited (A/c. No.

:

g) ULIP

:

h) NSC VIII Series

:

i) Int.on NSC VI,VII & VIII issues

:

j) Repayment to HBA Loans

:

k) Tution Fee for Children:

for the financial year upto Max.2Nos.

: Rs 60,000.00

children

:

l) Infrastructure bonds

:

m) Contribution to Pension Funds

:

Total Savings (a to m) limited to Rs.1Lakh : Rs 1,49,264-00

Limited to Rs 1,49,264-00

II) 1) Handicapped Exp.(Under section 80 DD) :

2) Medical Insurance Premium (U/s.80D)

:

(Max.10,000)

3) Flag Day Fund (U/s.80G)

: Rs 50.00+3570.00

= Rs 3620.00

4)CMRF

:

9. a) Taxable Income (7-8)

: Rs 11,08,271.00

b) Rounded off to Rs.10/: Rs 11,08,271.00

10. Income Tax

:

a) i) Rs.2,50,000/- NIL

:

ii) Rs.2,50,001/- to 5,00,000/- 10% excess

over Rs 2,00,000/: Rs 25000.00

iii) Rs5,00,001/- to Rs.10,00,000/- Rs.30,000/+20% excess over Rs.5,00,000/: Rs 100000.00

iv) Rs.10,00,001/- and above Rs.94,000/: Rs 32481.30

+30% excess over Rs.10,00,000/Total Tax

: Rs 157481.30

c) TOTAL TAX LIABILITY

: Rs

4724.44

( + 3% Education Cess)

Rs 162205.74

11. Tax paid upto 12/2013

: Rs 126455.00

12. Tax to be collected from 01/2014

:

02/2014

:

TOTAL 11+12 same as Col.10(c)

: Rs

Encls:For evidence of proof

:

1. Gross Pay Statement

: Enclosed

2. House Rent Receipts

: .

3. All other proofs relating to savings other

:

than recovered from salary

SIGNATURE OF THE EMPLOYEE

You might also like

- Transmission Line: Ravi Shankar Singh (E6S304)Document44 pagesTransmission Line: Ravi Shankar Singh (E6S304)amit143263No ratings yet

- 50 Greatest Mysteries in The Universe 2012 PDFDocument100 pages50 Greatest Mysteries in The Universe 2012 PDFkonohateo100% (6)

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- Retirement Planning (Finally Done)Document47 pagesRetirement Planning (Finally Done)api-3814557100% (5)

- Income Tax Calculation: Name: S. Ram Mohan ReddyDocument6 pagesIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvNo ratings yet

- IT Calculation for FY 2020-2021Document3 pagesIT Calculation for FY 2020-2021Sampath SanguNo ratings yet

- Statement Showing Pay, Allowances, Deductions and Tax Details for xyzDocument4 pagesStatement Showing Pay, Allowances, Deductions and Tax Details for xyzreamer27No ratings yet

- M4 Tax Planning Practice QuestionsDocument32 pagesM4 Tax Planning Practice Questionsapi-3814557No ratings yet

- DR AlliDocument20 pagesDR AlliDr K. Mamatha Prof & Hod FMTNo ratings yet

- Computation of Income TaxDocument2 pagesComputation of Income TaxKishor PaulNo ratings yet

- Income Tax FormatDocument2 pagesIncome Tax FormatmanmohanibcsNo ratings yet

- Income Tax Calculation GuideDocument17 pagesIncome Tax Calculation Guidesaravanand1983No ratings yet

- IT Calculator, Mohandas 2013Document36 pagesIT Calculator, Mohandas 2013DEEPTHISAINo ratings yet

- Employee salary and tax detailsDocument13 pagesEmployee salary and tax detailsseeyem2000No ratings yet

- 1 Form 16 16a LatestDocument25 pages1 Form 16 16a LatestNishant GhaseNo ratings yet

- Tax AnswerDocument22 pagesTax Answer336-Hardik JoisarNo ratings yet

- Form16Document10 pagesForm16anon-263698No ratings yet

- Statement of Income and Tax CalculationDocument4 pagesStatement of Income and Tax Calculationanirbanpwd76No ratings yet

- Investment Declaration (Form-12BB) For FY 2020-21 (Old Regime)Document2 pagesInvestment Declaration (Form-12BB) For FY 2020-21 (Old Regime)Ranga.SathyaNo ratings yet

- Money SavingDocument2 pagesMoney SavingRanga.SathyaNo ratings yet

- VRS NotesDocument82 pagesVRS NotesrisingiocmNo ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- Form 12 BBSampleDocument2 pagesForm 12 BBSampleAbhishekChauhanNo ratings yet

- Accounts Test Higher - 001Document20 pagesAccounts Test Higher - 001SR CapitalsNo ratings yet

- Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)Document1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)ikbalbahar1992No ratings yet

- Form 16Document3 pagesForm 16tid_scribdNo ratings yet

- Rebate Details W.R.T. Inspector Manoj Kumar (Pis NO. 16960170) FOR THE FINANCIAL YEAR 2015-16Document3 pagesRebate Details W.R.T. Inspector Manoj Kumar (Pis NO. 16960170) FOR THE FINANCIAL YEAR 2015-16Vinay PrabhakarNo ratings yet

- Cps Tax Form Format For 23-24Document11 pagesCps Tax Form Format For 23-24sr91919No ratings yet

- Tax Calculation Statement: IncomeDocument4 pagesTax Calculation Statement: IncomeDrAnjani K KumarNo ratings yet

- MCQ On Income TaxDocument76 pagesMCQ On Income Taxnavya sreeNo ratings yet

- Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CDocument2 pagesSchedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CJeevabinding xeroxNo ratings yet

- Income Tax Details for Assistant Engineer in 2015-16Document5 pagesIncome Tax Details for Assistant Engineer in 2015-16Phani PitchikaNo ratings yet

- 6-3-569/1, Surana House Somajiguda, Hyderabad-83Document2 pages6-3-569/1, Surana House Somajiguda, Hyderabad-83seshu18098951No ratings yet

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaNo ratings yet

- MCQ'S Practies: Direct TaxDocument12 pagesMCQ'S Practies: Direct TaxTina AggarwalNo ratings yet

- Form 16Document6 pagesForm 16Ravi DesaiNo ratings yet

- Paper 16Document5 pagesPaper 16VijayaNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)bhagesh sharmaNo ratings yet

- Introduction To Income Tax: Multiple Choice QuestionsDocument6 pagesIntroduction To Income Tax: Multiple Choice QuestionsNidhi LathNo ratings yet

- Income Tax Calculation StatementDocument106 pagesIncome Tax Calculation Statementnarayanan630% (1)

- Income Tax Projection Statement As On Mar 14, 2014Document2 pagesIncome Tax Projection Statement As On Mar 14, 2014manotiwaNo ratings yet

- Income Tax 2023-24 Statement - Mahesh R1Document2 pagesIncome Tax 2023-24 Statement - Mahesh R1akhilhed100% (1)

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- 120 Income Tax - IIDocument21 pages120 Income Tax - IIPriya Dharshini PdNo ratings yet

- Calculate Salary Income for Tax PurposesDocument11 pagesCalculate Salary Income for Tax PurposesSk Salim JanNo ratings yet

- CS EXECUTIVE TAX LAW AND PRACTICE MCQ TEST PAPERSDocument43 pagesCS EXECUTIVE TAX LAW AND PRACTICE MCQ TEST PAPERSSuman MehtaNo ratings yet

- Deductions - Practical 2Document2 pagesDeductions - Practical 2ishaankundaliya28No ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- De Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Document5 pagesDe Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Lakshmanan SNo ratings yet

- (I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)Document4 pages(I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)dpfsopfopsfhopNo ratings yet

- St. Anne'S Girls High School. Halasuru, Bangalore-560 008 Calculation of Income Tax For The Year 2015-16 Assessment Year 2016-17Document2 pagesSt. Anne'S Girls High School. Halasuru, Bangalore-560 008 Calculation of Income Tax For The Year 2015-16 Assessment Year 2016-17Rama KurubaNo ratings yet

- Time Allowed: 3 Hours Maximum Mark: 100: Executive ProgrammeDocument18 pagesTime Allowed: 3 Hours Maximum Mark: 100: Executive ProgrammeDevendra AryaNo ratings yet

- JSK It Returns 2011 12 AuttDocument3 pagesJSK It Returns 2011 12 AuttGobi S Gobi SNo ratings yet

- 2017 Accoutns Paper PracticalDocument4 pages2017 Accoutns Paper PracticalHmingsangliana HauhnarNo ratings yet

- Solution CA Inter TaxationDocument17 pagesSolution CA Inter TaxationBhola Shankar PrasadNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Fileupload 210412 8429Document5 pagesFileupload 210412 8429Rama KrishnaNo ratings yet

- 132kv KURNOOLDocument2 pages132kv KURNOOLRama KrishnaNo ratings yet

- SandorderbillDocument1 pageSandorderbillRama KrishnaNo ratings yet

- 132kv KURNOOLDocument2 pages132kv KURNOOLRama KrishnaNo ratings yet

- Maps/Excel Sheets/Kadapa/Kadapa/220 KV KADAPADocument2 pagesMaps/Excel Sheets/Kadapa/Kadapa/220 KV KADAPARama KrishnaNo ratings yet

- Maps/Excel Sheets/Kadapa/Anantapur/132kv SS ANTPDocument2 pagesMaps/Excel Sheets/Kadapa/Anantapur/132kv SS ANTPRama KrishnaNo ratings yet

- Maps/Excel Sheets/Kadapa/Chttoor/132kV CHITOORDocument2 pagesMaps/Excel Sheets/Kadapa/Chttoor/132kV CHITOORRama KrishnaNo ratings yet

- CERC Draft Model Guidelines by ForDocument9 pagesCERC Draft Model Guidelines by ForpradeepNo ratings yet

- Kwon 2015Document8 pagesKwon 2015Rama KrishnaNo ratings yet

- CERC Staff PaperDocument18 pagesCERC Staff Papershashank_mehta_7No ratings yet

- $6WXG/RQ+9'&8VHU'HILQHG0RGHOLQJLQ366 (: 'RQJKXL KDQJ Ldrplqj-Lq%Drurqj KRX +Dlolq6X XFKXDQ&KHQ/LQ KXDocument6 pages$6WXG/RQ+9'&8VHU'HILQHG0RGHOLQJLQ366 (: 'RQJKXL KDQJ Ldrplqj-Lq%Drurqj KRX +Dlolq6X XFKXDQ&KHQ/LQ KXRama KrishnaNo ratings yet

- Fundamentals of Power Electronics - Unit 3 - Week 1Document5 pagesFundamentals of Power Electronics - Unit 3 - Week 1Rama KrishnaNo ratings yet

- Details of 400kV Sub-Stations in APTRANSCODocument1 pageDetails of 400kV Sub-Stations in APTRANSCORama KrishnaNo ratings yet

- General Consumer: Sand Transaction ReceiptDocument1 pageGeneral Consumer: Sand Transaction ReceiptRama KrishnaNo ratings yet

- Research ArticlesDocument3 pagesResearch ArticlesRama KrishnaNo ratings yet

- Amma Neeti KathaluDocument39 pagesAmma Neeti KathaluSrinivas KankanampatiNo ratings yet

- Kerala Industries Budget Estimate Additional FundsDocument1 pageKerala Industries Budget Estimate Additional FundsRama KrishnaNo ratings yet

- 5 6289733988697243708 PDFDocument42 pages5 6289733988697243708 PDFRama KrishnaNo ratings yet

- Chapter - 3 Multi Level Inverters 3.1 InverterDocument8 pagesChapter - 3 Multi Level Inverters 3.1 InverterRama KrishnaNo ratings yet

- 4 5818828671942656387 PDFDocument3 pages4 5818828671942656387 PDFRama KrishnaNo ratings yet

- Chapters 2Document21 pagesChapters 2Rama KrishnaNo ratings yet

- Name of The Former RS - No Location Number Name of The Tree Girth Hight 1 Chelikani Kishore Kumar 217-1A-2 117/0 TeakDocument9 pagesName of The Former RS - No Location Number Name of The Tree Girth Hight 1 Chelikani Kishore Kumar 217-1A-2 117/0 TeakRama KrishnaNo ratings yet

- Spouse Certificate: Declaration by The Teacher Applying Under SpouseDocument7 pagesSpouse Certificate: Declaration by The Teacher Applying Under SpouseRama KrishnaNo ratings yet

- M.tech ThesisDocument59 pagesM.tech ThesisRama Krishna100% (1)

- RK ContractorsDocument1 pageRK ContractorsRama KrishnaNo ratings yet

- GPS LOcations of The LineDocument1 pageGPS LOcations of The LineRama KrishnaNo ratings yet

- Kidney Book in TeluguDocument215 pagesKidney Book in TeluguRama KrishnaNo ratings yet

- Outlook Traveller May 2017Document126 pagesOutlook Traveller May 2017Rama KrishnaNo ratings yet