Professional Documents

Culture Documents

General Readings in Economics PDF

General Readings in Economics PDF

Uploaded by

Varkalesh0 ratings0% found this document useful (0 votes)

7 views12 pagesOriginal Title

General Readings in Economics.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views12 pagesGeneral Readings in Economics PDF

General Readings in Economics PDF

Uploaded by

VarkaleshCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 12

i year passed by was an

eventful one. Circumstances

produce events and the latter leave

behind their imprints that design the

future. The world saw defining

stuctural changes since the.

beginning of 20th century which

moved the world on to new shythms.

in technology, politics, economic

gowth and management. The impact

of the US financial crisis of 2008-09

has let its scar all over. However, in

2014 a new optimism ushered in

parts of the world with employment

and wages rising demand is,

Increasing and households incomes

moving northwards, This has been

ontibuted by the declining fuel oil

pice and the quantitative easing

(hough the central banks buying

bonds). Hopefully, GDP will grow

over 3% growth in 2018.

Crude oil price decline

Ctude oil prices plunged nearly

50%, sequel to the Saudi Arabia and

the UAEed Organization of

Petroleum Exporting Countries

(OPEC) refusing to cut production,

despite fall in global domand, They

‘id not want to lose market share to

US-Canadian shale gas producers,

This trend helped oll importing

countries cut their import bills. With

the emergence of shale gas and oil

in the USA, the energy landscape

has undergone a major change. The

fuel ol price now hovers around $60.

* Di KU. Mada, Economist & Former

Development Banker, #24, New Siver

Home, 15, Kantwadi Road, Bandra West

Murbai-400 050,

February 1, 2015

By K. U. Mada

Many US and Canadian producers of

shale oil, says Mr. Claude Smadia,

find their production unprofitable,

Hence, the oil price may not climb up

to $ 80 oF $ 90, at least for a yoar

hhence. The OPEC monopoly fixing cil

price at $ 100 or above may not

bounce back in the near-term. The oil

scene is. uncertain with the

developments. taking place in non-

fossil energies. On global monetary

and financial fronts, the actions of the

major governmentsicentral banks in

2014 proved that the globalized

world will have to keep adjusting

themselves to changing scenarios.

Developed economies

The USA is on the path of

recovery and its economy grew at

5% in June-September Quarter,

2014, There are rising stock markets

with Dow breaching 18,000. The US

government has been pushing

growth. The US Fed, as employment

improves, is expected to raise its

signal interest rates from the middle

of 2015,

Europe which had a great

promise after the fall of Bertin wall is

faced with economic threat. The euro

area is on the verge of recession.

‘And, the European Central Bank

wants to do “whatever it takes” to

save the Euro single currency, The

French and the Italians have been

dodging structural reforms. Germany

has been insisting on austerity in

European countries. The Eurozono

inflation is down to 0.3% revealing

tronds of stagnation and deflation.

When there is falling prices,

‘consumers stop spending leading to

—_ (88! Year of Publication} A_____________

Global Economic Trends — 2015

declined demand and rising loan

defaults. In the rich OECD countries,

roughly 45 million workers are

jobless, according to The Economist,

London. italy and Spain have youth

unemployment of over 40%. Short-

term interest rates are close to zero

in many economies.

The central banks had to increase

liquidity. Europe's. weaknesses

Include ageing demography, heavy

indebtedness and sticky labour

markets. Europe has to spend on

infrastructure; the financial institutions

should launch expansion in

investment on Europe-wide ail links

and electricity grids, Deficit spending

could shake off deflation. There has

been no cohesion in the European

Union. Crisis in Ukraine too hurt the

Euro zone. Germany expects the

pproblem-ridden countries like Greece

to adopt zero deficit budgets and

austerity measures. The degraded

the infrastructure and educational

system on the other hand require

investments. Unless there are

appropriate fiscal and monetary

measures, Europe cannot return to

‘growth path in the near-term.

In Japan, PM Shinzo Abe's

Abenomics had a setback after the

hike of consumer tax from 5% to 8%

in April 2014 leading to reduced

demand. Another scheduled hike in

the levy has been deferred. There

have been two consecutive negative

growth quarters recently. The “3

arrows" of Abenomics viz. monetary

policy to restore inflation, supportive

fiscal policy and structural reforms for

long-term growth are yet to make

5

Southern Economist

their impact on the economy though

the Bank of Japan started making its

contribution, Also, there are no

‘supply side reforms of increasing

labour force, say, by encouraging

more women to work, enticing older

Japanese to remain in the labour

force, developing more friendly

labour policies, and importantly, by

weleoming immigrants,

For Olympic (2020) construc-tion

workers were allowed but there has

been no bureaucratic and political

support for allowing nurses and

hospice workers. Bureaucracy

continues to be an important power

centre. Abenomics has, as Kenneth

Rogoff says, falled to tum around

doflationary mindset. Problems of

outsize government debt and

undersize pension assets continue,

Emerging market economies

Inthe emerging market

economies, the BRIC countries, as

emerging block comprising Brazil,

Russia, India and China, have been

showing mixed growth prospects.

Poltics played a crucial role in

changing the course of | BRIC

economies in 2014, A snap shot

here.

Brazil's economy continues to

falter. The economy is faced with

height tax burden and rising inflation,

The red tape in administration and

poor infrastructure hold back the

growth prospects. President Dilma

Rousseff, reflected in a tough poll, is

faced with its sagging economy. The’

IMF estimated GDP growth of 0.3% in

2014 and forecast GDP at 1.3% in

2015.

The developments in Russie

hhave taken a dramatic turn in 2014,

Russia was annoyed with the US

and Europe allegedly for pushing

NATO's boundaries close to Russia's

6 Southern Economist

borders, thereby encroaching on its

sphere of influence. President

Vladimir Putin's annexation of.

Crimea and support to Ukraine

rebels led to economic sanctions by

the US and Europe, shutting out

Russia's banks from global finance,

Ruble tumbled 40%, Crude oll prices

plunged adding to Russia's troubles

since oil and gas account for over

90% of its exports. AS against

estimated GDP growth of 0.2% in

2014, IMF forecasts 0.5% growth in

2015.

In India, with BJP's success. in

May elections and Mr. Narendra

Modi assuming the prime minister

ship coupled with his. image-building

efforts with international leaders, it is

expected to become an important

investment destination for global

Westors. Given the PM's pro-growth

image, investors expect the

government to Introduce _long-

awaited reforms in ensuring the ease

‘of doing business, insurance, and

‘coal, land acquisition for industrial,

infrastructure and development

purposes, mining, arbitration and in

such other related areas. The current

falling oll and commodity prices and

surging stock markets have given

boost to the new government. Also, if

the inflationary trends continue to

slide downwards the RBI may cut its

signal rates in the near future. IMF

expects a growth of 5.6% in 2014-15

and 6.4% in 2015-16.

China, despite being the fasted

‘growing economy, is faced with a

recent slow-down in the pace of

expansion. While slowing export has

hurt manufacturing, the challenge for

President Xi Jinping is. to transform

the economy towards domestic.

consumption rather than depending

heavily on global demand for

manufactured goods. IMF estimated

growth at 7.4% in 2014 and forecast

at 7.1% Jn 2015, the central bank

‘may cut its rates. There has beon a

shift from collective leadership to

‘one-man leadership. China is the

fising economic and geopolitical

player in the region. The new

development model based more on

domestic consumption meant quality

growth,

Conclusion

All the trends point to a world

where fiscal or monetary actions by

the two major world economies, the

USA and China, will matter a groat

deal, The US hegemony is replaced

by new centres of power, namely, the

US, Europe, Japan and BRIC

countries. Developments in these

countries have assumed importance

in world affairs. Also, in additions to

the earlior conclaves of the world

leaders, the formation of G-20 since

the 2008-09 financial crisis and the

‘emergence of emerging economies,

especially the BRICS (including

South Arica) the frequent.

Interactions through the = G-20

meetings offer scope for deliberating

‘on the emerging challenges,

BRICS established the New

Development Bank; China's Invest-

ment Bank has come into existence.

Also, a new set of transformational

political relations got established in

2014 among the US, China, India,

Japan, Europe and the rest of the

world. In Asia, China, India and

Japan are active in their role-playing

land the US continues with its role in

‘Asia, Europe and the Middle East

With the new economic and political

re-balancing in place, the world is in

the process of establishing its new

architecture of relationships, poltcal

equations and economic equilibrium.

In this scenario, 2018 will be soving

many theatres of diverse actions,

February 1, 2015

Gard Year of Publication

Make in India, Largely for India

1@ global economy is still weak,

despite a strengthening recovery

in the United States. The Euro area

is veering close to recession, Japan

has already experienced two

quarters of negative growth after a

tax hike, and many emerging markets

‘are rethinking their export-led growth

models as the industrial world

stagnates. In the last couple of years,

the IMF has repeatedly reduced its

‘growth forecasts. After 6 years of a

tepid post-crisis recovery, the IMF

titled its most recent World Economic

Outlook ‘Legacies, Clouds, Uncer-

taintios

The conventional diagnosis and

remedy

Why is the world finding it so hard

fo resume pre-Great Recession

growth rates, let alone restore the

levels of GDP that would have been

attained if the Great Recession had

nnot happened? The obvious answer

|g that the legacy of the financial

boom that preceded the Great

Recession is debt, and the overhang

of debt, whether on govemments,

households, or banks, is “holding

back growth. In the colourful words of

the IMF's Managing Director, we are

experiencing ‘the New Mediocre’.

‘The implication is that growth is

unacceptably low relative to

+ Excerpts from the Address of

Dr. Raghuram Rajan, Governor, Reserve

Bank of India atthe Bharat Ram

Memorial Lecture at FICC! on December

12, 2014 in New Debi

32 Southern Economist

By Raghuram Rajan*

potential, and more can be done to

lit it, especially given that a. number

of economies are flirting with

deflation. Hence the conventional

policy advice urges yet more

Innovative monetary interventions

with an ever expanding set of

‘acronyms, even while governments

fare urged to spend on ‘obvious’

needs such as infrastructure. While

the need for structural reforms is

acknowledged, they are typically

deemed painful, and possibly growth-

reducing In the short run. Hence the

accent is on monetary and fiscal

stimulus, and as much of it as

possible given the deadening effects

‘of debt overang.

The efficacy of such policy advice

remains 0 be seen. But the

Japanese checked each of these

boxes over the last two decades,

including interest rates held low for

long, quantitative easing, and

massive debtfinanced spending on

infrastructure, Few would argue that

Japan has shed its seeming malaise.

A different diagnosis,

AA different narrative of the pre-

crisis period is now emerging that

may explain why the efforts at

stimulating economies back to the

pre-crisis growth paths have not

been successful, even six years after

the crisis. The term ‘secular

stagnation’ used by Larry Summers

to describe the current persistent

economic malaise, echoing Alvin

Hansen's speech in 1938 in the

midst of the Great Depression, has

caught on. But different economists

focus on different aspects and

causes of the stagnation. Summers

‘emphasises the inadequacy of

aggregate demand, and the fact that

the zero lower bound as well as the

potential for financial instability

prevents monetary policy from being

more active. The reasons for weak

aggregate demand include ageing

populations that want to consume

less and the increasing income share

of the very rich, whose marginal

propensity to consume is small.

Tyler Cowen and Robert Gordon

fon the other hand, emphasise @

weak supply potential. They argue

that the post-World War Il years were

fan aberration because growth was

helped in industrial countries by

reconstruction, the spread of

technologies such as electricity,

telephones, and automobiles, ising

educational attainment, higher labour

participation rates as women entered

the work force, a restoration of global

trade, and increasing investments of

capital.

However, postwar total factor

productivity growth — the part of

‘growth stemming from new ideas and

methods of production — fell from its

1920-50 high. More recent, not only

has productivity growth fallen further,

but growth has been held back by

the headwinds of _plateauing

‘education levels. and labour

participation rates, as well as a

shrinking labour force in some

countries because of population

ageing,

February 1, 2015

53rd Year of Publication

It is obvious from these lists of

factors that it is hard to disentangle

the elfects of weak aggregate

demand from slow growth in potential

supply. Population ageing contributes

to both. Indeed, one may cause the

other. For example, anticipating

@ slowdown in growth potential

households, worried about impen-

fing retirement in the face of

promised social security entitlements,

that are unlikely to be dolivered

upon, may try and build savings. This

will depress demand further.

Conversely, anticipated weak demand

may reduce incentives. for

‘omporations to invest, causing

supply potential to grow moro slowly.

Whatever the reasons for siow

underlying growth starting in tho

1970s, the traditional adverse

consequences such as the growing

unemployment of the system's,

putsiders such as immigrants and the

youth was compounded by the

‘rowing realisation that economies

‘ould also not deliver on social

security promises without growth.

These promises, as sociologist

Wolfgang Streeck writes, were made

to the wider public during the growth

years of the 1960s when visions of a

‘Great Society’ seemed attainable 4

Promises have been augmented

since then by increases in pension

and old age healthcare commitments

to public sector workers. These have

been made to avert budget-breaking

wage increases, but they have

created huge liabilities for the future,

hich is approaching fast.

Growth therefore became an

imperative, and with underlying

growth slow from the 1970s on,

governments began to spend more to

stimulate the economy. With supply

potential also stagnant, the spending

translated into inflation, which

spiraled upwards. Stroeck arguesthat

industrial country suocesses in

cutbing inflation in the 1980s meant

February 1, 2015

else had to take the place

inflation tax. in financing

of the

spending. And that was debt, first

public debt, then as governments

narrowed fiscal deficits, an

encouragement to the private sector

to take on debt. Growing leverage of

all kinds, whether on banks,

corporates, households, or govern-

ments, led to the financial crisis of

2008-11. Some of the private debt

has morphed into._government

liabilities, but the overall level of debt

in industrial countries as a fraction of

GOP is stil growing.

Governments that are not forced

by market prossures to undertake

productivity-enhancing reforms. prefer

to delay them. As a result, overall

debt is still growing because the

policies of ‘reaching for growth’

through monetary and fiscal stimulus

have not abated. Further

complicating all this is a growing

sense amongst the middie class that

they need quality higher education

and training to not slip back into the

ranks of the poor, but the poor

quality early education they have

received, as well as the prohibitive

ccost of quality higher education, puts

better livelihoods out of reach

Populist middie class movements, as

epitomised by the Tea Party in the

United States or UKIP in the United

Kingdom, reflect these worries. The

possibilty of a backlash against

technology, global finance, and

foreign immigration and trade, which

the middle class is ted to believe are

responsible for its plight, is very real

The mediocre economic outlook

might change. Strong US growth

could pull the world out its funk,

while low oll pricas could also give a

‘substantial boost to aggregate

demand, The industial world may

well muddle through for awhile

before it figures how to hamess and

monetize (as well as measure)

new techriologies. New well-paying

middle class jobs that we cannot

imagine today may emerge once

again, as they ahvays have. But

overall, there is a palpable sense of

gloom in the industrial world, a boliof

that growth is unlikely to te strong

enough to satisty for the foreseeable

future,

If secular stagnation persists,

Industrial countries will have to figure

out how to restructure their promises,

whether debt, social security, or low

taxes, and how to distribute the

burden. After fing for bankruptcy, the

city of Detroit in the United States

has alteady had to make tough

choices, between servicing its

pensioners or its dobt, keeping its

museums open or its police force

intact. More such difficult decisions

will have to be made.

What about emerging markets?

Slow industrial country growth

has made more difficult a traditional

development path for emerging

markets — exported growth. Indeed,

in the last decade, even as China

developed on the back of its exports

to industial countries, other

emerging markets flourished as they

exported to China. Emerging markets,

now have to rely once again on

domestic demand, always a difficult

task because of the temptation to

overstimulate. That task has become

more difficult because of the

abundance of liquidity sloshing

around the world as a result of ultra

accommodative monetary policies in

industrial countries. Any signs of

growth can attract foreign capital,

land If not properly managed, these

flows can precipitate a credit and

asset price boom and exchange

rate overvaluation. When industrial

country monetary policies are

‘eventually tightened, some of the

capital is likely to depart emerging

market shores. Emerging markets

have to take extreme care to ensure

they are not vulnerable at that point

Southern Economist 33

53rd Year of Publication

What implications should - an

emerging economy like India, which

has weathered the initial squalls of

the ‘taper tantrums’ of the summer of

2013, take away for its policies over

the medium term? | would focus on

four: 1) Make in India; 2) Make for

Inia; 3) Ensure transparency and

stability of the economy; and 4) Work

towards a more open and fair global

system.

Lessons for India

1, Make in India: The government

has the commendable aim of making

more in India. This means improving

theefficiency of producing in India,

whether of agricultural commodities,

mining, manufacturing, or services.

To achieve this goal, it has to

implement its ambitious plans on

building out infrastructure. This

includes

Physically linking every comer of

the country to domestic and

international markets through roads,

railways, ports and airports. The kind

‘of economic activity that is generated

when a pukka all-weather road is

built into a village the explosion of

horticulture, poultry, and dairy

farming, the opening of clothing and

assorted goods shops, the increasing

use of powered vehicles — is

extraordinary, as is the kind of

activity that emerges around national

highways,

+ Ensuring the availabilty of

inputs such as power, minerals, and

water at competitive prices.

+ Linking everyone electronically

and financially to the broader system

through mobiles, broadband, and

intermediaries such as business

correspondents.

+ Encouraging the development

of public institutions such as markets,

warehouses, regulators, information

aggregators and disseminators, etc.

34 Southern Economist

* Making possible affordable

‘and safe homes and workplaces.

A second necessity for increasing

productivity in India is to improve

human capital. This requires

enhancing the quality and spread of

health care, nutrition, and sanitation

to start with so that people are

healthy and able People also need

better and more appropriate

education, skills that are valued i

the labour markets, and jobs where

firms have the incentive to invest

more in their learning,

The government Is examining the

cost of doing business in india with a

view to bring it down. The woes of

the small entrepreneur, as she

confronts themyriad mysterious

Fegulations that gover her, and the

humerous inspectors who have the

ower of closing her down, are well

known. The petty bureaucrat,

empowered by these regulations, can

become a tyrant. It is appropriate that

the government intends to make him

help business rather than hinder it.

As regulators, we too have to

continuously examine the costs and

benefits of the regulations we

impose.

Finally, we need to make access

to finance easier. | have spoken

about that in other contexts, and will

not dwell on it here. Before | move

fon, let me add some caveats.

There is @ danger when we

discuss ‘Make in India’ of assuming it

means a focus on manufacturing, an

attempt to follow the export-led

growth path that China followed. |

don't think such a specific focus is

intended.

First, slow growing industrial

countries will be much less likely to

be able to absorb a substantial

additional amount of imports in. the

foreseeable future. Other emerging

markets certainly could absorb more,

‘and a regional focus for exports will

pay off, But the world as a whole is

Unlikely to be able to accommodate

another export-led China.

‘Second, industrial countries

themselves have been improving

capitalintensive flexible manu-

facturing, so much so that some

manufacturing activity is being ‘re-

shored’. Any emerging market

wanting to export manufacturing

{goods will have to contend with this

ew phenomenon. Third, when India

pushes into manufacturing exports, it

will have China, which stil has some

‘surplus agricultural labour to draw

fon, to contend with. Exportled

‘growth will not be as easy as it was

for the Asian economics who took

that path before us.

India hasbeen —_ extremely

successful at carving out its own

areas of comparative advantage, and

will continue to do so. instead,

counselling against an export led

strategy that involves _subsidising

exporters with cheap, inputs as. well

aS an undervalued exchange rate,

simply because it is unlikely to be as

effective at this juncture

Cautioning against picking a

Particular sector. = suchas

manufacturing for encouragement,

simply because it has worked wall for

China. India is different, and

developing at a different time, and

we should be agnostic about what

will work

Mote broadly, such agnosticism

means creating an _ environment

where all sons of enterprise

can flourish, and then leaving

entrepreneurs, of whom we have

plenty, to choose what they want to

do. Instead of subsidising inputs to

specific industries because thoy are

deemed important or labour

intensive, a strategy that has not

really paid off for us over the years,

let us figure out the public goods

each sector needs, and strive to

February 1, 2015

provide them. For instance, SMEs

might benefit much more from an

agency that can cortiy product

quality, or a platform to help them

sell receivables, or a state portal that

will create marketing web sites for

them, than from subsidised credit

The tourist industry will probably

benefit more from visa on arrival and

2 strong transportation network than

from the tax sops they usually

demand,

‘A second possible misunde!

standing is to see “Make in India’ as

a strategy of import substitution

through tariff barriers. This strategy

has been tried and it has not worked

because it ended up reducing

domestic competition, making pro-

ducers inefficient, and increasing

costs to consumers. Instead, ‘Make in

India’ will typically mean more

openness, as we create an

environment that makes our firms

able to compete with the rest of the

world, and encourages foreign

producers to come take advantage of

‘ur environment to create jobs in

India

2. Make for India

extemal demand growth is tkely

to be muted, we have to produce for

the intemal market, This means we

have 10 work on creating the

strongest sustainable unified market

we can, which requires a reduction in

the transactions costs of buying and

seling throughout the country.

Improvements inthe physical

transportation network | discussed

eatior wil help, but so will fewer, but

more efficient and competitive

intermediaries in the supply chain

from producer to the consumer, A

well designed GST bill, by reducing

slate border taxes, will have the

important consequence of creating a

truly national market for goods and

services, which will be critical for our

growth in years to come,

February 1, 2015

53rd Year of Publication

Domestic demand has to be

financed responsibly, as far as

possible through domestic savings.

Our banking system is undergoing

some stress. Our banks have to learn

from past mistakes in project

‘evaluation and structuring as they

finance the immense needs of the

economy, They will also have to

Improve their efficiency as they

compete with new players such as

the recently licensed universal banks

as well as the soon-lo-be licensed

payment banks and small finance

banks. At the same time, we should

not make their task harder by

creating impediments in the process

‘of fuming around, or recovering,

stressed assets. The RBI, the

government, as well as the courts

hhave considerable work to do here,

We also have to work on

spreading financial services to the

excluded, for once they learn how to

manage finances and save they can

bbe relied on to borrow responsibly,

Now institutions and new products to

‘Sook out financial savings in every

comer of the country will also help

halt the erosion in household savings

rates, as will a low and stable

Inflation rate. The income tax benefits

for an individual to save have been

largely fixed in nominal terms til the

recent budget, which means the real

value of the benefits have eroded,

Some budgetary incentives for

household savings could help ensure

that the country’s investment is

largely financed from domestic

savings.

3. Ensure transparency and stability

of the economy

Even developed countries lke

Portugal and Spain have been

singularly unable to manage

domestic demand. Countries tend to

overstimulato, with large ‘fiscal

deficits, large current account deficits,

high credit and asset price growth,

only to see growth collapse as

money gets tight. The fow countries

that have avoided such booms and

busts typically have done so with

sound policy frameworks.

‘As a country that does not belong

to any powor blocks, we do not ever

want to be in a position where we

need multilateral support, It wil be all

the more important to get our policy

frameworks ight.

Clearly, a sound fiscal framework

‘around a clear fiscal consoldation

path is critical, The Dr. Bimal Jalan

Committee's report will provide a

game plan for the former, while the

government has clearly indicated its

intent to. stick to the fiscal

‘consolidation path that has been laid

out. Whether we need more

institutions to ensure deficits stay

within control and the quality of

budgets is high, is something worth

debating. A number of countries

have independent budget offices!

committees that opine on budgets.

These offices are especially

Important in scoring budgetary

estimates, including unfunded long

term liabilities that the industrial

countries have shown are so easy to

contract in times of growth and so

hard to actually deliver.

(On the monetary side, a central

bank focused primarily on keeping

inflation low and stable will ensure

the best conditions for growth. In

reacting to developments, however,

the contral bank has to recognise

that emerging markets are not as

resilient as industrial economies. So

the path of disinflation cannot be as

steep as in an industrial economy

because an emerging market is more

fragile, and people's butters and

safety nets are thinner. A ‘Volker’ like

disinflation was never on the cards in

Southern Economist 35

India, but an Urjt Patel glide path fits

us very woll, ensuring moderate

growth even while we disinflat.

Going forward, wo will discuss an

appropriate timeline withthe

‘government in which the economy

should move to the centre of the

medium term inflation band of 2-6

per cent

In addition to inflation, however, @

central bank has to pay attention to

financial stability. This is a secondary

objective, but it may become central

If the economy enters a low-inflation

credit and asset price boom.

Financial stability sometimes means

regulators, including the central

bank, have to go against popular

sentiment, The role of regulators is

‘not to boost the Sonsox but to ensure

that the underlying fundamentals of

the economy and its financial system

‘are sound enough for sustainable

growth. Any postive consequences

to the Sensex are welcome: but are

only a collateral benefit, not the

objective.

Finally, India will, for the

foreseeable future, run a current

account deficit, which means we will

need net foreign financing. The best

form of financing is long term equity,

that is, Foreign Direct Investment

(FD), which has the additional

benefit of bringing in now

technologies and methods. While we

should not be railroaded into

compromising India's interest to

attract FDI ~ for example, the

requirements to patent a medicine in

India are perfectly reasonable, no

matter what the International drug

‘companies say ~ we should ensure

policies are transparent and redress

Quick. If we make it easier for young

Indian companies to do business, we

will also make it easier for foreign

‘companies to invest, for after all both

‘are outsiders to the system. This

36 Southern Economist

means a transparent and quick legal

process 0 deal with contractual

disputes, and a proper system of

bankruptcy to deal with distress. Both

are issues the govemment has taken

4. Work towards:

fair global system

‘As a’ country that does not belong

to any power block, and that does

‘not export vital natural resources but

is dependent on substantial

‘commodity imports, India needs an

‘open, competitive and vibrant system

of international trade and finance.

Our energy security, for example, lies

‘not in owning oll assets in remote

fragile countries but in ensuring the

global oll market works well and is

not distupted. We need strong

independent multiateral institutions

that can play the role of impartial

arbiter in facilitating Intemational

economic transactions.

more open and

Unfortunately, the Intemational

‘monetary system is stil dominated by

the frameworks put in place in the

past by industrial countries, and its

governance is stil dominated by their

citizens. To be fair, it is changing,

albeit slowly. But there is a more

Immediate reason for faster change.

With slow growth, as well as the

need to finance large debt loads, the

interest of industrial countries in an

‘open global systom cannot be taken

for granted. For instance, regulations

that have the appearance of shoring

up safely and soundness of the

industrial country financial system

may have the collateral effect of

discouraging investment in emerging

market assets. We have to recognise

that slow growth may direet industrial

‘economy policymakers’ attention

inwards, even while politics tums

protectionist. The multilateral

governance system, silly dominated

by industrial countries, may not

provide a sufficient defence of

openness.

Emerging markets may therefore

have the responsibilty of keeping the

Global economy open. For this, not

‘only do emerging markets have to

work on quota and management

reforms in the multilateral institutions,

but they also have to work on

injecting new agendas, new ideas,

‘and new thinking into the global

arena. No longer will it sutice for

India to simply object to industrial

country proposals, it will have to put

some of its own on the table. And

this means that our research

departments, universities, and think

tanks have to develop ideas that they

can feed to India's representatives in

international meetings.

Conclusion

We are more dependent on the

global economy than we think. That it

is growing more slowly, and is more

inward looking, than in the past

means that we have to look to

regional and domestic demand for

our growth - to make in India

primarily for India. Domestic-demand-

led growth is notoriously difficult to

manage, and typically leads to

excess. This is why we need to

strengthen domestic macroeconomic

institutions, so that we can foster

sustainable and stable growth. At the

same time, we cannot let foreign

‘markets shrink further, and we have

to take up the fight for an open

global system. Rather than being

reactive, we have to be active in

setting the agenda. That requires

investment in our idea-producing

institutions ~ research departments of

official bodies, think tanks, as well as

Universities. In sum, the diminishad

expectations in the world at large

should not be a reason for us to

lower our sights.

February 1, 2015

53rd Year of Publication

Development versus Environment — A Case of India

ae question of economic

development versus environment

is @ widely debated issue among the

nations. Post industrialization

scenario points out the strong

linkage between environment and

development. Development without a

negative extemality on the environ-

ment is considered as untenable,

The environmental pollution and. indi=

scriminate use of natural resources

poses danger to the environment and

health of the people in the country.

Serious environmental problems.

such as disturbance inthe

ecosystem, climate change, water

and air pollution, rising sea levels,

global warming and ‘so on can be

seen as the unintended conse-

‘quences of the development process,

India has resorted to planned

‘economic development since inde-

pendence. For attaining rapid

economic progress and for improving

the life of its poople, India has given

due stress on development of its

agrarian and industrial sectors

through its Five Year Plans. India's

First Five Year Plan aimed at

economic stabilization and for

altaining self sufficiency in the

agrarian sector. The Second Five

Year Plan initiated structural

transformation with an emphasis on

heavy industialization. The first two

plans laid the foundation for

dovelopment planning in India. Other

Sr Julie P. Lazar, Assistant

Professor, Department of Economies,

St, Marys College, Thrissur, Kerala

44 Southern Economist

By Julie. P. Lazar*

plans were devised so as to develop

agriculture, industry, service sectors,

‘overcome the issues of poverty and

unemployment and to attain inclusive

growth. Environmental issues were

completely overlooked during the first

two decades of economic develop-

‘ment. In early 1970s the Government

realized the need for economic

protection as an integral part of

Environmental resources like clean

alr, fresh water, forests, land and

biodiversity are valuable not just

ecologically but also economically.

India should consider economic

development and environmental

Protection as complementary aims

‘not as conflicting goals. India

should aim at green growth to

achieve a harmony between

‘economic growth and

environmental sustainability in the

long-term and for all round human

evelopment

economic policy. The Planning

Commission in its Approach Paper to

the 12h Five year Plan points out

‘that economic development will be

sustainable only if it is pursued in a

manner which protects the environ-

ment. Managing the Environment and

Ecology with the following five

components is one of the 12 strategy

challenges of the plan — land,

mining, and forest rights, mitigation

and adaptation strategy for climate

change, waste management and

pollution abatement, degradation of

forests and loss of biodiversity and

Issues of environment sustainability

The economic development of

India particularly in the post

globalization period hasbeen

instrumental in environmental degra:

dation. The increasing industria

lization, urbanization, intensive agr

culture, transportation advance:

ments, consumerism and unplanned

development are the factors’ which

threaten and cause adverse Impact

fon the environment of the country

Compared to developed nations,

India is much more vulnerable to the

effects of climate chango due to theit

low capacity to adapt and their

disproportionate dependency on

natural resources for welfare

Objective

The paper examines the influence

fof development on environment in

India,

India’s Growth Performance

India's GNI at Factor Cost (current

prices) has marked an increase from

Rs 9995 crore in 1950-51 to As

7185159 crore in 2010-11. The NNI

at Factor Cost has increased to Rs

6422359 crore in 2010-11, The per

capita NNI has increased from Rs

264 in 1950-51 to Rs 54151 in 2010-

11. The share of agriculture in India's

GDP has declined and there is @

significant increase in the shares of

Industrial and service sectors, The

intensive agriculture and the use ot

chemicals and fertilizers and

adoption of advanced technology

hhad made rapid strides in agricultural

scenario of the country. Industral

Performance has made considerable

progress with the second five year

February 1, 2015

Gi Year of Pabtieation )

plan and the progress has been

accelerated with the new industrial

policy of 1991.The service sector is

the largest contributor to India's GDP

with a share of around 55 percent.

The green revolution, _industria-

lization and the service sector

advancement have often a negative

Impact on the environment.

Demographic Trends in Indi

India with a population of 1210.2

milion (census 2011) is almost equal

to the combined population of U.S.A.

Indonesia, Brazil, Pakistan,

Bangladesh and Japan put together.

India with only 2.4 percent of world's

surface area accounts for world’s

47.5 per cent population The

population of most populous state

Uttar Pradesh is larger than

population of Brazil. The decadal

population growth rate increased

from 13.31 percent in 1951 to 24.66,

percent in 1981. Thereafter there is a

decline. Since independence the

decline in decadal population growth

rate is highest in India during 2001-

2011.The density of population in

India is 382, with Bihar having the

highest density of 1102 people per

‘Sq kilometer and Arunachal Pradesh

with lowest density. The Birth rate in

2011 is 21.8 and death rate is 7.1

Urbanisation

There is an increasing trend

towards urbanization in the country.

The rural urban demographic divide

has been narrowing down during the

period of planned economic

development, The rural population

increased at an average growth rate

of 2.65 percent, an increase of 4

times from 1901 to 2017.The growth

‘of urban population during the period

was at average growth rate of 12.33

percent, an increase of 15 times

during the same period. First time

since independence the absolute

increase in population has been

more in urban than rural areas. The

February 1, 2015

Increase in urban population is

attributed to migration from rural to

urban areas, inclusion of new areas

under urban and natural increase in

urban areas.

Vehicle traffic

Tho increasing vehicles in tho

country, enhances air pollution, fuel

consumption , traffic jams and

demands for road construction- often

at the cost of agricultural land. Tho

number of registered motor vehicles

has increased at a CAGR of 10.8

percent during the period 2011/1951

Changes in consumption pattern

Human wants are never ending

Population growth increases the

need to produce consumer products

land this in tum, intensifies the trend

to over-exploit. and misuse

‘environmental resources, The share

‘of income on food consumption is on

the decline in India, The young

population with increased income

and easy financial options are the

major drivers of India's consumer

industry. The intense competition

emergence of new companies, state

of art models, price discounts,

exchange schemes have increased

consumption and replacement of

consumer durables classified as

white goods, brown goods and

‘consumer electronics. The generation

of @ waste in form CDs, mobile

phones and other _ electronic

accessories is a matter of concern to

all the nations of the word

Energy generation and consumption

The growth in population,

industriazation and increased

roliance on technology in agriculture

has resulted in accelerating the

‘energy production and consumption

in the country. This increase is

expected to continue in the future

India mainly relies on conventional

sources of | energy and its

indiscriminate use polltes the

environment. Burning of fossil fuels,

adds a large amount of carbon-di-

oxide into the atmosphere and

increases. air pollution. Two thirds of

Indian population use firewood, crop

residue, cow dung or coal as fuel

‘The coal production in milion tonnes

increased from 72.95 in 1970-71 to

532,69 in 2010-11 an increase of

CAGR of 497 percent. The crude

petroleum production increased at a

CAGR of 4.26 percent in 2011/1971

CAGR of natural gas production and

clecticity is 9.14 percent and 4.04

percent respectively during "the

period. Per capita nergy consum.

ption (KWH) increased from 1204.99

in 1970-71 to 4816.44 in 2010-11, an

increase of CAGR of 3.44 percent. Of

the electricity generation of 844,846

gigawathour in 2010-11.704323 is

contributed by Thermal power,

114,257 is contributed by Hydro

power and 26,266 is contributed by

nuclear power. The buk of

commercial energy comes trom the

‘burning of fossil fuels viz. coal and

lignite in solid form, petroleum in

liquid form and natural gas in

gaseous form.

Degradation of environment

Along with the rapid development,

the Indian Economy faces certain key

‘environmental challenges climate

change, land degradation, air

pollution and water security. World

Bank in the report, “Diagnostic

Assessment of Select Environmental

Challenges in India" has pointed out

that environmental degradation

costs India about Rs.3.75 trillion

($80 billion) annually equivalent to

5.7 percent of the India's GDP - with

air pollution being a major

contributor.

Land degradation

India supports approximately 17.5,

percent of the world's human beings

and 20 percent of _ livestock

population on a mere 2.4 percent of

Southern Economist 45

53rd Year of Publication

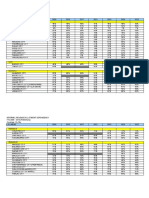

Table-1 ~ GNI and NNI at Current Prices India

the world’s geographical area. The

pressure. on’ the county's land

Year CGN at Factor Cost NNIat Factor Gost Por Gapta Pressure. on, the, countrys and

(Risin erres) (Fs in crores) __NNI (RS) gen of land for foresty, agree

e501 9908 464 264 pastes, human sateen an

Industries "exo an enormous

1970-71 44098 41204 763 pressure on the country’s finite land

1980-61 37189 125761 10712 Fesoutees. Ths is mainly duo tothe

1990-91 524268 471618 5621 pict a couitry oe ail been

implementing a. welldotned io

2000401 1969249 zo7sese 17205 implementing: @ weltdofined no,

or04t1 7195159 0422059 54151 managoment ‘has’ largely been

Source: Government of India, Economic Sur 2012-13 (eelenite end: ecbirery both: of

soit which have resulted in the current

Table-3 ~ Demographie Trends in n phase of degradation

Year Pepueion Dead rh Densye? Sex ato Uiowsy Tho drect and indirect causes of

=: a perdsin (ondesper Psa ‘land ogradation aro. Inked ited

(ooo perSein) _'owDmabs) _ponan) ‘land resources and an increase n

population. They combine to produce

1901 2583 ; 7 Te land shortages, resulting in smal

1951 26.10 aa 117 946 18,99 farms, low production per person and

1961 49.92 21.68 fae mae zea Raigenka. lleomeon.. shang

1971 sae 24.00 177 930 34.45Land"bhowaye "and "poverty" takes

1981 03 24.66 216 9344357 together, lead to non-sutanade

land.""managemont_practoos, the

1991 esa 73.06 Be eat ona Ga lemme weactoon,

2001 1027 21.56 S24 833. 64.8382 por cont of Indias toll land ea

zor1___121.02 1764 362 940_74.08 is aflected by land dogradaon , and

25. porcont of tho. county's "goo

Table-4 ~ Rural and Urban Population in india Fr Reeean by piegone. caer

Year Rurar Urban Tat "rrr rban eter Degradation | hae srvere

{r_ tions) ¢r_miions)_— (hn ions)_In%6_In 3% Soturtyfor mins oF eons thng

7901 2125-258 a4 697109 in those. ‘heaviy populated areas

ia ae oid 88811. Degradaton “of land fe atnbuted to

unsustainable agrcutual practice,

1951 207 ea S611 827 173 version of land. 10. development

1991 628.7 217.2 846.3 743 25.7 programmes, industrial _effiuents,

Mining and’ deforestation, Inensve

007 72 7

ae ei ee "og é 27.8 agriculture and irrigation contribute to

2011 ooo) amt 2102 ose an

Table-2 ~ GDP at FACTOR COST by Industry of Origin (at Current Prices: Rs in erves)

ead 195061 197071 1900-91 7000-01 2010.1

Aarcutur, foresty, fishing, mining 527419086 198166 505476 1503000

Manufacturing, constuction, elec gas and water supply 13488622 127079 474a29. 1a07212

Trade Hotels, Transport and Communication 968 5627 100918 4817851774708

Financing, insurance eal estate and business service 1254 5579 64598 274040 1165001

Community socal personal sevice 1115 591570019 _204450_1016112

‘Source: Government of India, Economic Survey 2012-13

46 Southern Economist

February 1, 2015

‘Table-5 — Total number of registered Motor vehicles In India

"Al woes _@ Whose _Careleeps Bus owls weeks _Othors

1951 306 ar 159 34 4

1961 665 88 31087 16842

1971 1805 576 68292 mee 113

931 5301 2618 = 1160162 554897

1991 21a74 14200 «2954331 19502593

2001 54991 985567058 634 20485795

2005 s1499 58799 10320 892 4017487

2006 sogte 6474s 11528 992 44387921

2007 96707 6912912649 1350 5119 8460

2008 10535375538 © 19950 1427, 5601 9039

2009 114951 s2402 18813 1486 56019710

2010 12746 9159817109 1527, 6432 11080

2011 141866 101865 19281 1604 7064 12102

SO] crannies: 108147 a3 66 fa. 143

. CAGR 2011/2005 97 96 40.9 10.2 98 84

land dogradation particularly sali

nation, alkalization and water logging

‘According tothe National

Commission on Floods, the area

prone to floods in the country was

about 40 million hectares, out of

which 80 percent, i.e., estimated 32

million hectares could be provided a

feasonable degree of protection

‘Around 68 porcent of the country is,

prone to drought in varying degrees.

India witnessed a severe drought

hich affected 300 million people,

150 milion cattle and reduced food

grain production by 29 millon tons.

The entire country was declared

drought-hit in the years 1966, 1972,

1979, 1987 and 2002. India is well

known as one of the 12 mega

diversity zones of the world with 7

percent of total biodiversity. On

account of soil degradation and

erosion nearly half of country's lands

are degraded

Air pollution

Air pollution is a complex issue,

fuolled by multiple sources ranging

from ~ vehicle exhaust, re suspended

February 1, 2015

Source: Government of India, Road Transport Year Book relevant Volumes

dust on the roads due to vehicle

movernents, industrial fumes, con:

struction debris, garbage burning,

domestic cooking and heating, and

some seasonal sourees such as

agricultural field residue burning,

dust storms and sea salt. The

increased movement of vehicles has

emissions of carbon monoxide

beyond the permissible levels. The

increased nitrogen oxide emissions

fon account of increased diesel

vehicles causes air polution and

health problems,

Studies point out that vehicles

running on CNG in India are

eadapted and cause high rates of

potentially hazardous methane

carbonyl emissions. Air pollution is

responsible for increasing the

mortality and morbidity cases in the

Indian cities. Studies point out that in

terms of air pollution, Bangalore is

worse than Shanghai and Beijing is

better than Mumbai and air pollution

in Ludhiana, Is higher than Los

Angeles. A recent study by Central

Pollution Control Board (Delhi, India)

has declared Delhi as the “Asthma

53rd Year of Publication

Capital” of India. it is noted that

Delhi's air pollution is up by 5 times

since 2004. Accelerating growth in

the transport sector, a booming

construction industry, and a growing

industrial sector are responsible for

worsening air pollution in Indian

cities. Air quality levels have

deteriorated in most large cities in

India, with Respiratory suspended

particulate matter. (RSPM) and

suspended particulate matter (SPM)

standing out as major pollutants,

Almost 83 per cent cities showed

Violation of ASPM standards in 2009-

10. And the capital is among the

worst performers. A US research has

revealed that India has the most

polluted air ahead of | China

Environment Performance Index (EPI

2014) has put India in 155th place

with score $1.23 out of maximum 100

points, India is behind neighbours,

Pakistan and Nepal. According to a

recent WHO survey, across the G-20

economies it is pointed out that 13 of

the 20 most polluted cities are in

India, TERI Environmental Survey

2018 conducted with a sample size

‘of 4,039 respondents in six major

cities, Bangalore, Chennai, Delhi

Hyderabad, Kolkata and Mumbai has

ted that transport sector is a major

contributor of air pollution in

Chennai, Delhi, Kolkata and Mumbai

Factories and Construction activities

occupied the first. place among the

respondents of Bangalore and

Hyderabad.

Water Scarcity and Water Pollution

Access to safe drinking water is

an essential prerequisite of the

individuals. Water is mainly used by

agriculture followed by domestic use

and by industries. Census 2011

points out only 46.6 percent of the

households in India have drinking

water in their premises, 95.8 percent

near their homes and 17.6 percent

have water only about 500m to 1000

m away from their homes. With the

increase in population, water scarcity

Js not far away. It is pointed out that

by 2050, 22 percent of the

geographical area of the country and

Southern Economist. 47

Gani ear of Fatication }

17 percent of the population will face

scarcity of water. The per capita

water availability in the country has

declined from 1816 cubic meters. in

2001 to 1545 cubic meters in 2011

land is expected to decline 101295

cubic meters in 2050.

Quality of available water is @

matter of concern. An UN. study

feport points out that contaminated

and polluted water kills more people

than all forms of violence: including

war. In India, almost all surface water

resources are contaminated and unfit

for human consumption. The growing

Population andthe increased.

demand for food and. shortage of

agricutural land have intensified the

cropping pattern. The intensive use

of land, with increased. use. of

fertiizers and pesticides to. enhance

productivity and production has

deteriorating affect on the land and.

water resources. The pesticides and

fertiizers flow into the water bodies,

and cause serious damago to

humans, aquatic animals and plants.

The discharge of untreated wastes

from various quarters, industrial

intoxicants and so on poses grave

threat to the surface water.

‘The ground water is affected by

arsenic, fluoride and other chemical

fertilizers and pesticides. 90 percent

‘of water discharge in. developing

Countries is untreated contributing, 10

2.2 milion deaths due to diarrheal

disoases. The increasing pollution of

rivers, lakes and other water bodies

has. ‘deteriorating effects on the.

health of the community and spreads

infectious diseases. Eighty percent of

country’s urban waste ends up in

rivers. The holy river Ganges is dying,

due to increased pollution. In India

fecal coliform — a bacteria causes

increased pollution due to lack of

proper sanitation facilities. It is

pointed out that 49.2 percent of the

people of India defecate in open.

Diseases like hepatitis, cholera,

diarrhea, typhoid, amoebic dysentery,

skin infections, are some of the

diseases associated with poor water

quality. The impact of polluted

drinking water has adverse effect on

the poor.

48 Southern Economist

Global warming

Global watming is likely to cause

Widespread economic, social and

environmental destruction over the

next century. A recent study predicts

that harvest will decline by more than

30 percent in India and Pakistan

Rising seas may threaten the lives of

millions in developing countries. The

impact of global warming is

immeasurable and uncedain. The

increasing use of air conditioners,

refrigerators depletes the ozone layer

which in tum leads to climate

changes and health issues like

cancer. The mobile towers pose the

fick of increased radiation in the

‘atmosphere.

‘An important feature of global

warming is climate change resulting

in change in rainfall pattern,

precipitation levels, water availabilty,

melting of ice, and depletion of

‘ozone. The climate change, rising

heat has increased the health

problems of the people. Researches

point out that Indian summer-

monsoon rainfall is likely to fail much

more frequently under global

warming in the coming two centuries.

The effects of these unprecedented

changes would be extremely

detrimental to India's economy which

relies heavily on the monsoon

season to bring fresh water to the

farms. India has become highly

vwulliorable to climate-related disa-

stors. The Natural Hazards Risk Atlas

2011 compiled by tho World Bank

and other international agencies

ranks points out that India in the

highest risk category along with six

other countries (Mexico, Philippines,

Turkey, Indonesia,.ttaly, and Canada),

Suggestions

1 Give stress on 3 F's - Reduce,

Rouse, Recycle

2 Impose taxes to yield postive

nvironmental benefits and to reduce

negative impact

4 Green growth aiming to achieve

‘a harmony between economic. growth

and environmental sustainability

5 Increase the dependence on

renewable energy sources.

6 Increased research on

measures to dispose e-waste in an

officiont manner.

7 Coordination between different

levels of government, institutions,

NGOs and the public fo reduce the

harm to the environment.

Conelusion

Environmental resources ike clean

air, fresh water, forests, land and

biodiversity are’ valuable not just

ecologically but also economically

India” should consider economic

development and environmental pro-

tection as complementary aims not

as conflicting goals. India should aim

at green growth to achieve a

harmony between economic growth

‘and environmental. sustainabilty in

the long-term and for all round

human development. Economic deve

lopment can provide a solid

foundation for environmental prote-

ction efforts, enabling Indian

government to take a better care of

their ecosystems, and equip them

financially and technologically for the

fight against environment degra-

dation. "Indian economic policy

should ensure faster and greener

growth,

Referenc

1. Sarbapria Ray, Ishita Adiya Ray,

(2011) Impact’ of Population Growth on

Environmental Degradation: Case of

India, Journal of "Economics and

Sustainable Development 2 Vol2, No8

2.tndia Census Report 2011

3. Central Statistical Organization,

(2012), Energy Statistics, Government of

Inca,

4,Haemanti Bhattacharya, Robert

Innes. (2011) Income and tha

Environment in Rural india : 1s There a

Poverty Trap wirw.uce®borkoey.odu

‘5. Purushitam Nayak, (2004) Povery

land Environment Degradation in ral

India -A Nexus,

SyoPalicies and measures. to 6. Steve Baker, (2003) Environmental

reduce particulate matter to control Economics, Doman Pubishers New

air pollution, s Deh.

February 1, 2015

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Practice For Chapter 7 and 8 Standard CostingDocument12 pagesPractice For Chapter 7 and 8 Standard CostingNCT33% (3)

- NXP Semiconductor 0078056 16949 Engus Iatf Atkh KaohsiungDocument5 pagesNXP Semiconductor 0078056 16949 Engus Iatf Atkh KaohsiungPr RabariNo ratings yet

- ......... May 22 QPDocument32 pages......... May 22 QPYuvipro gidwaniNo ratings yet

- SOVEM20-00068 - MY DUNGEON Sales Terms and ConditionsDocument7 pagesSOVEM20-00068 - MY DUNGEON Sales Terms and ConditionsC J Moscoso MadronaNo ratings yet

- 04 04Rpt Funding Request SummaryDocument8 pages04 04Rpt Funding Request SummarySri Maharani AndaNo ratings yet

- Theory of Urban DesignDocument27 pagesTheory of Urban DesignLawrence Babatunde OgunsanyaNo ratings yet

- Cutting Table DIY Plan - by Closet Core PatternsDocument11 pagesCutting Table DIY Plan - by Closet Core PatternsWestwickateNo ratings yet

- Advanced Accounting 2 BDocument3 pagesAdvanced Accounting 2 BMila AgaNo ratings yet

- AMITA, Gilliane C. - PURPO-EA3 FINAL PAPER (PROBLEM - SOLUTION ESSAY)Document6 pagesAMITA, Gilliane C. - PURPO-EA3 FINAL PAPER (PROBLEM - SOLUTION ESSAY)Gilliane AmitaNo ratings yet

- Coconut Processing PDFDocument21 pagesCoconut Processing PDFDewi Apriyani0% (1)

- Asco Series 290 Angle Body Full CatalogDocument12 pagesAsco Series 290 Angle Body Full CatalogJuan Sebastián BustosNo ratings yet

- Construction Management Chapter 2Document92 pagesConstruction Management Chapter 2thapitcherNo ratings yet

- ACER Market Monitoring Report 2015 - KEY INSIGHTS AND RECOMMENDATIONS - PresentationDocument56 pagesACER Market Monitoring Report 2015 - KEY INSIGHTS AND RECOMMENDATIONS - PresentationŽeljkoMarkovićNo ratings yet

- Regression Statistics: Output of Rocinante 36Document5 pagesRegression Statistics: Output of Rocinante 36prakhar jainNo ratings yet

- Development of A Mold Trial Procedure For Establishing A Robust PDocument221 pagesDevelopment of A Mold Trial Procedure For Establishing A Robust PMoez BellamineNo ratings yet

- Internal Revenue Allotment DependencyDocument16 pagesInternal Revenue Allotment DependencyKim SisonNo ratings yet

- Organization&Management CPMDocument23 pagesOrganization&Management CPMZ JanieNo ratings yet

- Undertaking For Gurantee (Shariah Vettd)Document2 pagesUndertaking For Gurantee (Shariah Vettd)muhammad ihtishamNo ratings yet

- MODULE in MICROECONOMICSDocument39 pagesMODULE in MICROECONOMICSJerizNo ratings yet

- ARMAN KHAN Obf 8834Document1 pageARMAN KHAN Obf 8834Arman KhanNo ratings yet

- Read On.: Excavator Operating Weight Class 120 TonnesDocument4 pagesRead On.: Excavator Operating Weight Class 120 Tonnesedgar lopezNo ratings yet

- A Horse and Two GoatsDocument16 pagesA Horse and Two Goatsgatikalmal3No ratings yet

- Rental Apartment Brochure TrifoldDocument2 pagesRental Apartment Brochure TrifoldNazir AhmedNo ratings yet

- Briefer - PS Depot - Revised - 3Document49 pagesBriefer - PS Depot - Revised - 3EarthAngel OrganicsNo ratings yet

- MCQ On Marketing ManagementDocument2 pagesMCQ On Marketing ManagementCharu Modi75% (4)

- Journal EntryDocument15 pagesJournal EntryNajOh Marie D ENo ratings yet

- Reinforced Concrete Building Design and Analysis: Project: Proposed Two-Storey Residential HouseDocument106 pagesReinforced Concrete Building Design and Analysis: Project: Proposed Two-Storey Residential HouseRonaldo BatlaganNo ratings yet

- History of Tawara Mining: Report Produced By: Leul TeweldeDocument3 pagesHistory of Tawara Mining: Report Produced By: Leul TeweldeKedus Leji YaredNo ratings yet

- Applied Economics: Market Demand, Market Supply and Market EquilibriumDocument7 pagesApplied Economics: Market Demand, Market Supply and Market Equilibriumma. donna v. detablanNo ratings yet

- CRR (May)Document1 pageCRR (May)Jason AvilesNo ratings yet