Professional Documents

Culture Documents

Resenting Arned Alue: Successfully

Resenting Arned Alue: Successfully

Uploaded by

Eyob YimerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Resenting Arned Alue: Successfully

Resenting Arned Alue: Successfully

Uploaded by

Eyob YimerCopyright:

Available Formats

Contra

Earned ct Review

Value

Report

Projec

t/

Tasks

Totals

Successfully

for Pro

ject

Oct obe

Summa

ry

2002

Nov em

ber

Task 1

Decem

Task 1-A

Presenting

Earned Value

Progra

m Revie

w

ber

Budget

Task 1-B

Task 2

Budget

Spendin

$4,000.0

0

$3,000.0

0

$2,000.0

0

$1,000.0

0

$0.00

$321.74

$200.00

$483.33

t/

Projec

Tasks

March

Ap

May

$109.29

Bu

BCWP

ACWP

Value

ing E

BCWS Spend

dge t

$300

.00

$2, 500

.00

$2, 000

Task 2

Task 3

Task 4

BCWP

.00

$1, 500

BCWS

ACWP

$400

.00

$1, 000

$350

0

$500.0

Task 5

$456

$725

$550

$189

$159

$107

$0. 00

BCWS

BCWP

t

Budge

ACWP

Sum mar

$140

$175

$128

$250

$200

$100

$200

$564

$211

$223

$168

$150

Incomple

Earned Value Management (EVM) is a project management system that combines

schedule performance and cost performance to answer the question, What did we get for

the money we spent?

Basic concepts of EVM:

All project steps earn value as work is completed.

The Earned Value (EV) can then be compared to actual costs and planned costs to

determine project performance and predict future performance trends.

Physical progress is measured in dollars, so schedule performance and cost

performance can be analyzed in the same terms.

Earned Value has been used since the 1960s by the Department of Defense as a central

part of the C/SCSC (Cost/Schedule Control Systems Criteria). Recently, the DOD

revised the 35 criteria contained in the C/SCSC and produced the 32 criteria for EVMS

(Earned Value Management Systems).

$61

30. 6%

Review

CPI abo

te Task

d Task

These criteria have since been accepted by the American National Standards Institute/

Electronic Industry Association as a new standard, called ANSI/EIA 748. Now, EVM

is being used in a wider variety of government contracts, and is spreading through the

private sector as a valuable tool for project managers.

63. 6%

$64

ve 1.3

1.24

2.82

$364

$22

Program

Stat us

Com plete

52. 6%

1.09

0.80

($35)

$108

77. 8%

1.00

1.00

$0

$12

55. 8%

1.00

0.86

($50)

$0

100.0%

$400

$400

$400

$400

Task 1

$350

$300

1.15

1.27

$431

$0

100.0%

$300

SPI

CPI

CV

$267

67. 4%

What is Earned Value

Management?

48.6%

69.7%

CMPLT

$2, 005

$1, 575

$1, 740

$2, 975

.00

$3, 000

ABC

Project

Task 7

66.7%

$100.00

Contrac

ts review:

11-30-02

Sign Off:

______

______ SV

_____

PRCNT

Total

t

Budge

74.4%

64.4%

$200.00

$243.94

Review

mance

2002

Perfor

ril

80.4%

$186.05

$836.56

$225.00

$350.00

78.6%

$500.00

$725.00

Task 6

Your guide to Earned Value Management

$235.71

$175.00

$1,300.0

0

Value

78.3%

$200.00

$350.00

$250.00

Task 2-B

64.2%

$743.50

$400.00

Task 2-C

PRCNT

CMPLT

$2,585.6

2

$725.00

$300.00

Task 2-A

Status

BCW

Ear ned P

Value

$1,375.0

0

$950.00

Task 1-C

Ear ned

ACWP

Spe ndi

ng

$4,025.0

0

$111

$23

$18

1.12

2.11

1.12

1.12

1.40

1.57

CPI from

1 to 1.3

w1

CPI belo

Successfully

Presenting Earned Value

page 2

What are the benets of using

Earned Value Management?

In a typical spend plan analysis, physical progress is not taken into account when

analyzing cost performance. Instead, a projects actual costs to date are simply compared

to planned costs, often with misleading results.

March

Example:

April

May

$3,000.00

Budget-at-Completion

A task has a planned value (PV) of $1000,

and actual costs (AC) of $1000. It appears

this task has perfect cost performance, and is

in good shape to nish on-budget (Figure 1).

However, if physical progress is taken into

account, the results may differ.

$2,500.00

$2,000.00

$1,500.00

Planned

Value = $1000

$1,000.00

Actual

Costs = $1000

$500.00

2002

March

April

May

$0.00

$3,000.00

Budget

AC

$2,500.00

Actual

Costs = $1000

Planned

Value = $1000

$2,000.00

Figure 1

$1,500.00

$1,000.00

Earned

Value = $750

$500.00

$0.00

EV

Budget

AC

In Figure 2, the project has spent $1000

in actual costs but has only achieved $750

of Earned Value.

This is called a cost overrun, and this

project would have a Cost Variance (CV)

of -$250.

Figure 2

From this example, we can see that EVM expands on the two-dimensional analysis

Has this project spent more or less money than planned? by adding the third

dimension What did we get for the money we spent?

Successfully

Presenting Earned Value

page 3

Building Blocks of

Earned Value Analysis

In addition to more accurate project status assessment, EVM makes it easy for a project

manager to analyze both schedule and cost performance in a variety of ways. Using a

limited set of basic task information, it is possible not only to determine how a project

has been performing, but to predict future performance trends as well.

Basis for Earned Value Analysis:

Budget at Completion (BAC) = Overall approved budget for a task.

Actual Costs (AC) = Total amount spent on a task up to the current date.

Percent Complete = Task progress, related as either EV/BAC, or simply physical

progress shown by the ll of the task bar.

Contract Review

Earned Value Report

Project /

Tasks

Totals for Project

2002

October

November

BAC

AC

December

%

Complete

$4,025.0

$1,375.00

63.7%

$950.0

$725.00

78.3%

Task 1-A

$300.0

$200.00

78.6%

Task 1-B

$400.0

$350.00

80.4%

Task 1-C

$250.0

$175.00

74.4%

Task 1

$4,000.00

Once these three measurements have been established, the following calculations can be

performed:

Earned Value (EV) = BAC x Percent Complete. The budgeted cost of completed

work as of the current date.

Planned Value (PV) = The point along the time-phased budget that crosses the

current date. Shows the budgeted cost of scheduled work as of the current date.

Presenting Earned Value

Successfully

page 4

Building Blocks of

Earned Value Analysis

Project /

Tasks

October

November

December

Actual Earned Planned

Value

Costs Value

BAC

64%

$4,025

$1,375

$2,564

$2,780

78%

$950

$725

$743

$783

Task 1-A

79%

$300

$200

$236

$246

Task 1-B

80%

$400

$350

$322

$339

Task 1-C

74%

$250

$175

$186

$198

10

Totals for Project

Task 1

11

12

13

14

View detailed EVM data in

actual dollars as part of a

presentation schedule...

October

November

December

$4,000.00

BAC

DATE

LINE

$3,500.00

$3,000.00

PV

$2,500.00

EV

$2,000.00

$1,500.00

$1,000.00

AC

$500.00

$0.00

Earned Value

Budget

Actual Costs

Planned Value

Summary

Program Review

Status

...or use an easy-to-read

DataGraph for at-a-glance

visual analysis of project

trends.

Successfully

Presenting Earned Value

page 5

Performance Indices

and Variance

Once Earned Value and Planned Value are known, they can then be used to determine

schedule and cost variance, and calculate performance efciency.

October

Schedule Variance (SV) = Earned Value Planned Value. The difference

between what was planned to be completed and what has actually been completed

as of the current date.

Cost Variance (CV) = Earned Value Actual Costs. The difference between

the work that has been accomplished (in dollars) and how much was spent to

accomplish it.

November

December

January

$3,500.00

$3,000.00

Schedule

Variance (SV)

$2,500.00

$2,000.00

Cost

Variance (CV)

$1,500.00

$1,000.00

$500.00

$0.00

Planned Value

Earned Value

BAC

Actual Costs

Figure 6

In Figure 6, the project shown

has a negative SV, because it

has earned less value than was

planned, as of the current date.

However, it has a positive CV,

because the Earned Value is greater

than the Actual Costs accrued.

Successfully

Presenting Earned Value

page 6

Performance Indices

and Variance

Schedule Performance Index (SPI) = Earned Value / Planned Value. Schedule

variance related as a ratio instead of a dollar amount. A ratio less than 1 indicates

that work is being completed slower than planned.

Cost Performance Index (CPI) = Earned Value / Actual Costs. Cost variance

related as a ratio instead of a dollar amount. A ratio less than 1 indicates that the

value of the work that has been accomplished is less than the amount of money

spent.

Performance Review

Tasks

2004

BAC

March

April

May

Earned Planned Actual

Value

Value Costs

CPI

SPI

Project A

$850

$270

$335

$250

1.08

0.81

Task 1

$350

$195

$260

$150

1.30

0.75

Task 2

$500

$75

$75

$100

0.75

1.00

Figure 7

In Figure 7, Project A has a CPI greater than 1.00. This shows

us that the project has been earning value faster than it has been

accruing costs.

However, Project A also has a SPI value that is less than 1.00.

Although Actual Costs are low, Task 1 is behind schedule,

so the project has not earned as much value as was planned.

Successfully

Presenting Earned Value

page 7

Forecasting Future

Performance Trends

The Schedule Performance and Cost Performance Indices not only monitor current

project performance, they can also be used to predict future performance trends.

To-Complete Performance Index (TCPI) = (BAC-EV) / (BAC-AC).

Indicates the CPI required throughout the remainder of the project to stay within

the stated budget.

Estimate at Completion (EAC) = AC + ((BAC-EV)/CPI). A forecast of total

costs that will be accrued by project completion based on past cost performance

trends.

Variance at Completion (VAC) = EAC BAC. The difference between the new

Estimate at Completion and the original Budget at Completion.

Performance Review

Tasks

BAC

EAC

2004

VAC

March

Project A

$2,975.0

2,355.70

-619.30

Task 1

$300.0

350.00

50.00

Task 2

$400.0

440.00

40.00

April

AC

EV

TCPI

CPI

May

$3,000.00

$1,615.00

$2,004.73

0.71

1.24

$350.00

$300.00

0.00

0.86

$440.00

$400.00

0.00

0.91

$175.00

$139.53

1.47

0.80

$200.00

$563.89

0.31

2.82

$1,000.00

$100.00

$210.53

0.63

2.11

$500.00

$200.00

$222.73

0.85

1.11

$150.00

$168.06

0.95

1.12

$2,500.00

$2,000.00

Task 3

$250.0

313.09

63.09

$1,500.00

Task 4

$725.0

257.13

-467.87

Task 5

$400.0

189.80

-210.20

Task 6

$350.0

314.66

-35.34

Task 7

$550.0

491.02

-58.98

$0.00

Planned Value

Earned Value

Budget

Actual Costs

Successfully

Presenting Earned Value

page 8

How do I get started using

Earned Value Management?

Identify and Organize all Project Steps

First, identify all tasks that need to be accomplished and organize the tasks into subgroups (1). Breaking down activities into the smallest possible steps makes it easier to

pinpoint schedule and cost performance problems.

2004

Tasks

March

Project A

April

May

3/10

5/8

Total

Budget

$2,975.0

Task 1

$300.0

Task 2

$400.0

Task 3

(2)

(1)

$250.0

Task 4

$725.0

Task 5

$400.0

(3)

Task 6

Task 7

$350.0

$550.0

Status

Incomplete Task

Completed Task

Started Task

Allocate the Budget and Schedule the Tasks

Each activity in the project should have a planned Budget-at-Completion (BAC). All

subsequent earned value calculations will be based on this amount (2). In addition to

the BAC, each task should also have a specic duration (3), which provides the basis for

monitoring actual costs and physical progress.

Successfully

Presenting Earned Value

page 9

How do I get started using

Earned Value Management?

Update Task Status and Enter Actual Costs

As the project progresses, the percent complete for unnished tasks should be updated

and monitored (4). Earned Value (EV) is determined by relating this physical progress

to the BAC. Along with task status and budget, it is necessary to maintain actual costs

accrued for each task in order to calculate cost performance (5).

Tasks

Project A

%

Comp.

2004

March

April

59% 3/10

May

5/8

Total

Budget

AC

$2,975.00

$1,575.00

(5)

Task 1

100%

$300.00

$350.00

Task 2

100%

$400.00

$400.00

Task 3

51%

$250.00

$175.00

Task 4

78%

$725.00

$200.00

Task 5

47%

$400.00

$100.00

Task 6

73%

$350.00

$200.00

Task 7

14%

$550.00

$150.00

(4)

Status

Incomplete Task

Completed Task

Started Task

Successfully

Presenting Earned Value

page 10

How do I get started using

Earned Value Management?

Use the Data to Make Informed Decisions

Now that all tasks have been scheduled, and the BAC, EV, Percent Complete, and AC

are known, further analysis can be performed, including schedule and cost variances,

performance efciency, and estimates-at-completion.

Earned Value Report

Project /

Tasks

2004

October

Totals for Project

Task 1

Task 1-A

Task 1-B

Task 1-C

Task 2

2002

Task 2-A

Task 2-B

April

May

Task 2-C

5/9

Task 3

Task 3-A

Task 3-B

Task 3-C

December

Earned Value and Performance Review

Project/

Tasks

March

Project ABC

3/11

Task 1

Total

Budget

$2,975.0

$300.0

ACWP

Spending

BCWS

$1,739.90

$300.00

Contract Review

Task 2

Earned Value

Task 3

Budget

Task 4

Spending

$400.0

$350.00

$400.00

$400.00

$127.91

$175.00

October

BCWP

E Value

$4,025.0

$2,585.62

$950.0

$300.0

$743.50

$235.71

$400.0

$321.74

$250.0

$1,300.0

$186.05

$836.56

$725.0

SV

$225.0

PRCNT

CMPLT

$483.33

CV

CPI

$109.29

$350.0

67.4%$1,775.0

$264.85

$243.94

$429.74

$1,005.56 1.27

$550.0

$300.00 Final 100.0%

$0.00

$800.0

Review

$425.0

$400.00

100.0%

$0.00

$358.14

($50.00)

0.86

$480.00

$167.42

$0.00

1.00

$2,004.73

Project /

$3,000.00

$250.0

Tasks

$139.53

SPI

1.15

1.00

1.00

2004

55.8%

$11.62 ($35.47)

0.80

November

December

$1,500.00

Totals for Project

$725.0

1.09

$4,000.00

$456.48

$200.00

$563.89

77.8%

$107.41

$363.89

2.82

$189.47

$100.00

$210.53

52.6%

$21.06

$110.53

2.11 $3,500.00

1.11

1.24

$400.0

Summary

Task 1-A

Task 6

Program Review

$350.0

$159.09

$200.00

$222.73

Status

63.6%

$63.64

$22.73

1.11

Task 1-B

Task 7

$3,000.00

$550.0

$3,000.00

$2,000.00

$1,000.00

$0.00

Schedule Variance $500.00

Cost Variance

$350.00

$200.00

$50.00

($100.00)

AC

EV

$4,025.0

$1,375.00

$2,563.59

63.7%

$950.0

$725.00

$743.50

78.3%

$300.0

$200.00

$235.71

78.6%

$400.0

$350.00

$321.74

80.4%

74.4%

1.40

$106.94

$150.00

$168.06

30.6%

$61.12

$18.06

1.12

1.57

Task 1-C

PV

EV

BAC

AC

BAC

$0.00

Task 1

Task 5

$1,575.00

Earned

Value

Budget

November

$250.0

$175.00

$186.05

$1,300.0

$500.00

$836.56

64.4%

$725.0

$200.00

$483.33

66.7%

$225.0

$100.00

$109.29

48.6%

$350.0

$200.00

$243.94

69.7%

$1,775.0

$150.00

$983.53

55.4%

$550.0

$150.00

$358.14

65.1%

$800.0

$0.00

$480.00

60.0%

$0.00

$145.39

34.2%

$2,500.00

Task 2

Summary

Status

Task 2-A

Task 2-B

$2,000.00

Completed Task

CPI above 1.3

$1,500.00

Task 2-C

Incomplete Task

CPI from 1 to 1.3

Program Review

CPI below 1

Task 3

Task 3-A

$1,000.00

$500.00

Task 3-B

Final

Review

Task 3-C

Earned Value

Budget

Spending

$0.00

$425.0

Contracts review: 11-30-01

Summary

Program Review

Status

Sign Off: _________________

Successfully

Presenting Earned Value

page 11

Example Reports and

Resources

On the following pages, several example Earned Value reports are shown. These

examples, as well as the charts on the previous pages, were created in Milestones

Professional 2004. Visit KIDASA.com to view these examples and more, or to

download a trial version of Milestones Professional.

Earned Value = Budget x % Complete

Planned Value = Total Budget x % duration to the current date

Earned Value Calculations

Project/

Tasks

2005

March

Project ABC

BAC

April

May

PRCNT

CMPLT

$1,809

$1,575.0

$2,005

67.4%

Budget $2,500.00

$300

$300

$350.0

$300

100.0%

$2,000.00

$400

$400

$400.0

$400

100.0%

$1,500.00

$250

$134

$175.0

$140

55.8%

$1,000.00

$725

$483

$200.0

$564

77.8%

$400

$200

$100.0

$211

52.6%

$350

$170

$200.0

$223

63.6%

PV

Task 3

AC

Spending

Task 4

Earned

Value

$2,975

Task 2

Earned Value

Actual

Costs

5/8 $3,000.00

3/10

Task 1

Planned

Value

Task 5

$500.00

Task 6

$0.00

PV

EV

BAC

AC

Status

Incomplete Task

Completed Task

Started Task

Successfully

Presenting Earned Value

Earned Value and Performance Review

Project/

Tasks

2005

Schedule Variance = EV - PV

Cost Performance Index = EV / AC

May

Total

Budget

5/8

$2,975.00

Task 1

Task 2

Cost Variance = EV - AC

Schedule Performance Index = EV / PV

Actual

Costs

Earned

Value

$1,808.97

$1,575.00

$2,004.73

67.4%

$195.77

$429.74

1.27

1.11

$300.00

$300.00

$350.00

$300.00

100.0%

$0.00

($50.00)

0.86

1.00

$400.00

$400.00

$400.00

$400.00

100.0%

$0.00

$0.00

1.00

1.00

Task 3

$250.00

$133.72

$175.00

$139.53

55.8%

$5.81

($35.47)

0.80

1.04

Task 4

$725.00

$483.33

$200.00

$563.89

77.8%

$80.56

$363.89

2.82

1.17

Task 5

$400.00

$200.00

$100.00

$210.53

52.6%

$10.53

$110.53

2.11

1.05

Task 6

$350.00

$169.70

$200.00

$222.73

63.6%

$53.03

$22.73

1.11

1.31

$550.00

$122.22

$150.00

$168.06

30.6%

$45.84

$18.06

1.12

1.38

March

Project ABC

April

3/10

Task 7

PV

EV

BAC

AC

Planned

Value

page 12

PRCNT

CMPLT

SV

CV

CPI

SPI

$3,000.00

Summary

Status

Completed Task

CPI above 1.3

Incomplete Task

CPI from 1 to 1.3

Program Review

CPI below 1

$2,000.00

$1,000.00

$0.00

SV

CV

$500.00

$350.00

$200.00

$50.00

($100.00)

Contract Review

Summary

Earned Value Report

Project /

Tasks

Program Review

2005

October

November

Budget

December

Totals for Project

Actual

Costs

Status

Earned

Value

PRCNT

CMPLT

$4,025.00

$1,375.00

$2,585.62

64.2%

$950.00

$725.00

$743.50

78.3%

Task 1-A

$300.00

$200.00

$235.71

78.6%

Task 1-B

$400.00

$350.00

$321.74

80.4%

Task 1-C

$250.00

$175.00

$186.05

74.4%

$1,300.00

$500.00

$836.56

64.4%

Task 2-A

$725.00

$200.00

$483.33

66.7%

Task 2-B

$225.00

$100.00

$109.29

48.6%

Task 2-C

$350.00

$200.00

$243.94

69.7%

$1,775.00

$150.00

$1,005.56

56.7%

$550.00

$150.00

$358.14

65.1%

$800.00

$0.00

$480.00

60.0%

$425.00

$0.00

$167.42

39.4%

Task 1

Task 2

Task 3

Task 3-A

Task 3-B

Final

Review

Task 3-C

Earned Value

Budget

Spending

$4,000.00

$3,000.00

$2,000.00

$1,000.00

$0.00

Contracts review: 11-30-02

Sign Off: _________________

Successfully

Presenting Earned Value

Schedule Variance = EV - PV

Cost Performance Index = EV / AC

Performance Review

Project/

Tasks

2005

March

April

Total

Budget

May

$3,000.00

Project ABC

Budget

$2,500.00

Task 1

Task 2

Planned

Value

page 13

Cost Variance = EV - AC

Schedule Performance Index = EV / PV

Actual

Costs

Earned

Value

PRCNT

CMPLT

SV

CV

CPI

SPI

$2,975.0

$1,808.97

$1,575.00

$2,004.73

67.4%

$195.77

$429.74

1.27

1.11

$300.0

$300.00

$350.00

$300.00

100.0%

$0.00

($50.00)

0.86

1.00

$400.0

$400.00

$400.00

$400.00

100.0%

$0.00

$0.00

1.00

1.00

$250.0

$133.72

$175.00

$139.53

55.8%

$5.81

($35.47)

0.80

1.04

$725.0

$483.33

$200.00

$563.89

77.8%

$80.56

$363.89

2.82

1.17

$400.0

$200.00

$100.00

$210.53

52.6%

$10.53

$110.53

2.11

1.05

$350.0

$169.70

$200.00

$222.73

63.6%

$53.03

$22.73

1.11

1.31

$550.0

$122.22

$150.00

$168.06

30.6%

$45.84

$18.06

1.12

1.38

$2,000.00

Earned Value

Task 3

Planned Value

$1,500.00

Task 4

Actual Cost

$1,000.00

Task 5

Task 6

$500.00

Task 7

$0.00

PV

EV

BAC

AC

Summary

Status

Program Review

CPI from 1 to 1.3

Completed Task

Incomplete Task

CPI above 1.3

CPI below 1

Materials for further Earned Value Management research:

Fleming, Q., & Koppelman, J. (2000). Earned Value Project Management. 2nd Ed.

Pennsylvania: Project Management Institute.

Lewis, J. (2000). The Project Managers Desk Reference. New York: McGraw-Hill.

Portny, S. (2001). Project Management for Dummies. New York: Hungry Minds, Inc.

KIDASA.com - Home of KIDASA Software, Inc., makers of Milestones Professional.

EarnedValueManagement.com - All about Earned Value. Denitions, examples, and more.

PMI.org - Home of the Project Management Institute, and a variety of PM resources.

Copyright 2005 KIDASA Software, Inc. All rights reserved. www.kidasa.com. This publication may be distributed freely, as long as it is distributed in its entirety.

You might also like

- Schecter C1 Exotic PDFDocument1 pageSchecter C1 Exotic PDFMoshi MoshiNo ratings yet

- Electronic Service ToolDocument199 pagesElectronic Service ToolEzequiel ZetaNo ratings yet

- Introduction To Business Process ManagementDocument27 pagesIntroduction To Business Process ManagementMohiniRoyChowdhuryNo ratings yet

- Schecter C1 CLASSIC OldspecDocument1 pageSchecter C1 CLASSIC OldspecThomas EnglishNo ratings yet

- Cash Rules Learn and Manage The 7 Cash Flow Drivers For Your Company SuccessDocument218 pagesCash Rules Learn and Manage The 7 Cash Flow Drivers For Your Company SuccessmonicaescobarroaNo ratings yet

- Strategy, Organization Design, and EffectivenessDocument20 pagesStrategy, Organization Design, and Effectivenessapi-3719504100% (2)

- Document 216109.1Document9 pagesDocument 216109.1achrefNo ratings yet

- 11-HUMSS: SUMMARY OF GRADES (2nd Quarter, 1st Semester 2020-2021)Document3 pages11-HUMSS: SUMMARY OF GRADES (2nd Quarter, 1st Semester 2020-2021)Giancarla Maria Lorenzo DingleNo ratings yet

- ROB DATA To CBE KANWAR PH-30 Work As On 17.07.2020Document21 pagesROB DATA To CBE KANWAR PH-30 Work As On 17.07.2020mchkppNo ratings yet

- Week 4 - Column Interaction DiagramDocument8 pagesWeek 4 - Column Interaction DiagramMAYHAY, ADRIAN PAULNo ratings yet

- Azizan Baba, Dahna-e-Ghori Structural Mitigation ProjectDocument4 pagesAzizan Baba, Dahna-e-Ghori Structural Mitigation ProjectmansorsaalemiNo ratings yet

- 2059 w08 QP 02 PDFDocument8 pages2059 w08 QP 02 PDFSara KhanNo ratings yet

- Accounting: International General Certificate of Secondary EducationDocument1 pageAccounting: International General Certificate of Secondary EducationSidumo DlaloseNo ratings yet

- Accounting: International General Certificate of Secondary EducationDocument1 pageAccounting: International General Certificate of Secondary EducationItai Nigel ZembeNo ratings yet

- Adobe Scan 29-Dec-2020Document1 pageAdobe Scan 29-Dec-2020hemanthNo ratings yet

- Project Connect Vision Plan 092618 v7Document1 pageProject Connect Vision Plan 092618 v7Anonymous Pb39klJNo ratings yet

- DSD SR2019 20 Full ReportDocument97 pagesDSD SR2019 20 Full ReportCheung Hing TaiNo ratings yet

- Intac 2Document1 pageIntac 22022301307No ratings yet

- Net Work Planning: Pekerjaan: Pembangunan Balai Nikah Dan Manasik Haji Kua SambirejoDocument1 pageNet Work Planning: Pekerjaan: Pembangunan Balai Nikah Dan Manasik Haji Kua SambirejoyunuspwNo ratings yet

- Ellicott Trail Map PDFDocument1 pageEllicott Trail Map PDFThe Livingston County NewsNo ratings yet

- Quick Installation Guide: Hardware ConnectionDocument1 pageQuick Installation Guide: Hardware ConnectionI Dewa Gede AdiwiranataNo ratings yet

- Revenues and Costs Plus Sources of FinanceDocument3 pagesRevenues and Costs Plus Sources of FinancesabinaNo ratings yet

- Communication Workflow ProcessDocument1 pageCommunication Workflow ProcessNylocNo ratings yet

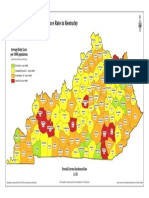

- KY Incident MapDocument1 pageKY Incident MapDebbie HarbsmeierNo ratings yet

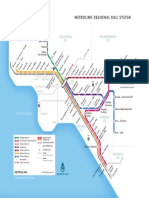

- Metrolink Map - System MapDocument1 pageMetrolink Map - System MapDeepak PandeNo ratings yet

- First Load Procedure: Enter DocumentDocument19 pagesFirst Load Procedure: Enter DocumentAlok BishnoiNo ratings yet

- Workflow Process Inside PODDocument1 pageWorkflow Process Inside PODA SNo ratings yet

- RT10 WebDocument2 pagesRT10 Websofia riveraNo ratings yet

- Power Factor Correction Maintenance: Call Us On: 01799 530728 Fax Us On: 01799 530235Document2 pagesPower Factor Correction Maintenance: Call Us On: 01799 530728 Fax Us On: 01799 530235Slick72No ratings yet

- Incidence Map 07082021Document1 pageIncidence Map 07082021Debbie HarbsmeierNo ratings yet

- CR NotesDocument1 pageCR Notesvivekanantha velappanNo ratings yet

- Princeton Fire MapDocument1 pagePrinceton Fire MapCarmen WeldNo ratings yet

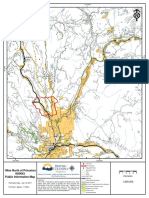

- OP Schedule G - Part of Jackson Creek Plan PDFDocument1 pageOP Schedule G - Part of Jackson Creek Plan PDFPeterborough ExaminerNo ratings yet

- Ae687 Assignment1Document4 pagesAe687 Assignment1Shrutikirti SinghNo ratings yet

- NIS2 Security Solution InfographicDocument1 pageNIS2 Security Solution InfographicPaolo ZampieriNo ratings yet

- Pad530 220Document1 pagePad530 220oliviogmNo ratings yet

- Ims Policy - Integrated Management System: Ergy For The WDocument4 pagesIms Policy - Integrated Management System: Ergy For The WJulius MuhimboNo ratings yet

- NR'S MVDC Solution: 10Kv Jiangdong MVDC For Optimizing Distribution NetworkDocument2 pagesNR'S MVDC Solution: 10Kv Jiangdong MVDC For Optimizing Distribution NetworkMoshNo ratings yet

- Rail Sys Aug2022Document1 pageRail Sys Aug2022jazminNo ratings yet

- Incidence Map 02282022Document1 pageIncidence Map 02282022Debbie HarbsmeierNo ratings yet

- LeasingDocument42 pagesLeasingMokhtarMCINo ratings yet

- Incidence Map 07202021Document1 pageIncidence Map 07202021Debbie HarbsmeierNo ratings yet

- Overall Plan vs. ProductionDocument24 pagesOverall Plan vs. Productionsoyeb60No ratings yet

- PKS PresentationDocument27 pagesPKS PresentationvarshaNo ratings yet

- TABLE 1 Enclosure Symbols TABLE 3 Signal Processing Symbols: NotesDocument1 pageTABLE 1 Enclosure Symbols TABLE 3 Signal Processing Symbols: NotesRudi HermawanNo ratings yet

- 03 Fish Bone DiagramDocument1 page03 Fish Bone DiagramShannon MacDonaldNo ratings yet

- Final Merit List of Ot AssistantDocument2 pagesFinal Merit List of Ot AssistantKottapalli Sundar mahesh (RA1811034010048)No ratings yet

- Oktnp 2018 08 23 A 001 PDFDocument1 pageOktnp 2018 08 23 A 001 PDFNewcastle NewsNo ratings yet

- Incidence Map 09202021Document1 pageIncidence Map 09202021haeli spearsNo ratings yet

- Tugas Etap-6 Garut - SummaryDocument3 pagesTugas Etap-6 Garut - SummaryHasnan HabibiNo ratings yet

- Incidence Map 08162021Document1 pageIncidence Map 08162021Debbie HarbsmeierNo ratings yet

- SupplyMgmt TOC 0912 v3 FNLDocument1 pageSupplyMgmt TOC 0912 v3 FNLMAG1992No ratings yet

- Incidence Map 05292021Document1 pageIncidence Map 05292021Debbie HarbsmeierNo ratings yet

- Chapter 1, Unit 2, Biostatistics and Research Methodology, B Pharmacy 8th Sem, Carewell PharmaDocument8 pagesChapter 1, Unit 2, Biostatistics and Research Methodology, B Pharmacy 8th Sem, Carewell PharmaIntresting FactsNo ratings yet

- Chapter 1, Unit 2, Biostatistics and Research Methodology, B Pharmacy 8th Sem, Carewell PharmaDocument8 pagesChapter 1, Unit 2, Biostatistics and Research Methodology, B Pharmacy 8th Sem, Carewell Pharma60 Shriniwas RaipatwarNo ratings yet

- Incidence Map 100421Document1 pageIncidence Map 100421haeli spearsNo ratings yet

- Tugas Etap-6 Garut - SummaryDocument3 pagesTugas Etap-6 Garut - SummaryHasnan HabibiNo ratings yet

- Tugas Etap-6 Garut - SummaryDocument3 pagesTugas Etap-6 Garut - SummaryHasnan HabibiNo ratings yet

- Service - Flow Chart: N Ee R Gi N Ee R Ad Er e A D M in Ly C Ha in ST Ic & ST o Re ElDocument1 pageService - Flow Chart: N Ee R Gi N Ee R Ad Er e A D M in Ly C Ha in ST Ic & ST o Re ElNyomanIdabagusNo ratings yet

- Eurasian Cities: New Realities along the Silk RoadFrom EverandEurasian Cities: New Realities along the Silk RoadRating: 3.5 out of 5 stars3.5/5 (1)

- Value Engineering Program Guide For Design and Construction Vol 1 PDFDocument157 pagesValue Engineering Program Guide For Design and Construction Vol 1 PDFMukeshwaranNo ratings yet

- Organizational Structure & TheoryDocument13 pagesOrganizational Structure & Theoryapi-3719504100% (1)

- m770 chp10&11Document20 pagesm770 chp10&11api-3719504No ratings yet