Professional Documents

Culture Documents

Pathways - Long Term Care

Uploaded by

arsenic210Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pathways - Long Term Care

Uploaded by

arsenic210Copyright:

Available Formats

Pathways

Protect Your Future,

Today

Not many of us want to think about it, much less talk about it, but the reality is that if we live long enough,

there’s a good chance we’ll eventually need long term care.

What is long term care?

It’s the help you need when you can no longer take care of yourself and become dependent on others – possibly

your family.

Aside from the physical and emotional toll that long term care can take, most people are surprised to hear how

much that care costs. Whether delivered at home or in a facility, paying for long term care could completely

deplete your assets and retirement savings.

Public Long Term Facility Private Long Term Facility

Daily Monthly Annually Daily Monthly Annually

Basic $50.00 $1,480.71 $18,250.00 Least Expensive $117.00 $3,500.00 $42,000.00

Semi-Private $57.47 $1,724.32 $20,976.55 Average $185.00 $5,500.00 $66,600.00

Private $66.61 $2,048.49 $24,312.65 Most Expensive $334.00 $10,000.00 $120,000.00

Home Care - by paramed home health services Government Role In Home Care Services

Registered Nurse $45.75/hr One hour per day of a Personal Support Worker

A care manager from the Community Care Access Center (CCAC)

Licensed Practical Nurse $28.03/hr

assesses each case on an individual basis

Personal Support Worker $26.00/hr If termed ‘Palliative’ the government will offer more care

Home Support Worker $21.90/hr The waiting list for home care is between six and nine months

Companion $17.84/hr The care provided may be a bath or supervision

Average Spent Annually $65,000 The individual must cover all remaining expenses out of pocket

There is a solution. It’s called long term care insurance. It can help you: protect your retirement assets;

plan and control care decisions and lighten the care burden for your loved ones.

You’ll have the financial resources to make choices:

Select care in a setting that is convenient and suitable to your needs or professional attention in your home

Payment of medical expenses that may be only partially subsidized by provincial health plans

Benefits paid directly to you, so you can choose how to use them

Some plans only require payments for a limited time and are guaranteed not to increase for 5 years

For more information on Long Term Care Insurance, contact your advisor

John Sabourin, BA, B.Comm, FLMI, CFP

Telephone: (519) 675-1177 1-888-327-5777

Facsimile: (519) 675-1331

www.selectpath.ca

John@selectpath.ca

You might also like

- Ideas For Implementing The Seven Dimensions of Wellness: Presented by Donna Martz & Annika CollinsDocument34 pagesIdeas For Implementing The Seven Dimensions of Wellness: Presented by Donna Martz & Annika CollinsMillerJamesDNo ratings yet

- Use Your Home To Stay at Home: A Planning Guide For Older ConsumersDocument20 pagesUse Your Home To Stay at Home: A Planning Guide For Older ConsumersValerie VanBooven RN BSNNo ratings yet

- Scania DC12 Operator's ManualDocument65 pagesScania DC12 Operator's ManualAlex Renne Chambi100% (3)

- B737 AutothrottleDocument103 pagesB737 AutothrottleZaw100% (1)

- 1250kva DG SetDocument61 pages1250kva DG SetAnagha Deb100% (1)

- CaregiverHiringGuide 176399 7Document26 pagesCaregiverHiringGuide 176399 7dtrobisNo ratings yet

- Advanced Calculus For Applications - Francis B Hilderand 1962Document657 pagesAdvanced Calculus For Applications - Francis B Hilderand 1962prabu201No ratings yet

- Language - Introduction To The Integrated Language Arts CompetenciesDocument7 pagesLanguage - Introduction To The Integrated Language Arts CompetenciesHari Ng Sablay100% (1)

- Qatar OM PART C PDFDocument796 pagesQatar OM PART C PDFBobi Guau100% (3)

- A Narrative Comprehensive Report of Student Teaching ExperiencesDocument82 pagesA Narrative Comprehensive Report of Student Teaching ExperiencesEpal Carlo74% (23)

- Elder Care BenefitsDocument27 pagesElder Care Benefitssidrah_farooq2878No ratings yet

- Five Questions About Long Term CareDocument2 pagesFive Questions About Long Term CareLindsey HarrisNo ratings yet

- 5-Benefits at A GlanceDocument2 pages5-Benefits at A GlanceBlackBunny103No ratings yet

- AARP Long-Term Care Guide 15027 Compact Icc18-1737276Document9 pagesAARP Long-Term Care Guide 15027 Compact Icc18-1737276Ardal Powell MA PhD CLTC FSCPNo ratings yet

- Benefit Highlights: Health Plan Is Through BCBSNC Health AdvocateDocument4 pagesBenefit Highlights: Health Plan Is Through BCBSNC Health AdvocateMaríaMadridNo ratings yet

- Your Guide To Short Term Restorative CareDocument28 pagesYour Guide To Short Term Restorative CareSimran SekhonNo ratings yet

- Benefit Plan: Manulife Benefits BasicsDocument1 pageBenefit Plan: Manulife Benefits BasicsMuneeb ArshadNo ratings yet

- Cozy Cloister HotelDocument4 pagesCozy Cloister HotelArcaplumNo ratings yet

- OE Powerpoint PresentationDocument35 pagesOE Powerpoint PresentationAnonymous ibpKT07GNo ratings yet

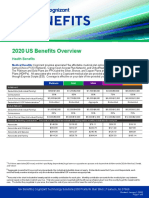

- 2020 US Benefits OverviewDocument5 pages2020 US Benefits OverviewrdmNo ratings yet

- Aged Care: What You Need To KnowDocument4 pagesAged Care: What You Need To KnowroykelumendekNo ratings yet

- 2011-12 Benefits BrochureDocument4 pages2011-12 Benefits BrochureKevin MarshallNo ratings yet

- Long-Term Care For AICPA MembersDocument9 pagesLong-Term Care For AICPA MembersMusic Word Media GroupNo ratings yet

- Lesson 1 DebtDocument21 pagesLesson 1 DebtAlf ChingNo ratings yet

- GHS General Presentation #1Document20 pagesGHS General Presentation #1Caleb HollowayNo ratings yet

- Critical Illness STDDocument4 pagesCritical Illness STDEmilyNo ratings yet

- Pathways - DisabilityDocument1 pagePathways - Disabilityarsenic210No ratings yet

- Molina Enhanced Benefits July 2021Document2 pagesMolina Enhanced Benefits July 2021Michelle HuynhNo ratings yet

- 2021 - Life, Dental, Vision PacketDocument12 pages2021 - Life, Dental, Vision PacketEberNo ratings yet

- Topic: Pet Insurance Why Pet Insurance Is Not Worth ItDocument6 pagesTopic: Pet Insurance Why Pet Insurance Is Not Worth ItOdumogu ChristianNo ratings yet

- A Long Term Care InsuaranceDocument17 pagesA Long Term Care InsuaranceTECHNICAL SAMIULLAHNo ratings yet

- The Middle Class Guide To Medicaid PlanningDocument9 pagesThe Middle Class Guide To Medicaid PlanningDoug ShannonNo ratings yet

- ANS Benefits Brochure - NewDocument29 pagesANS Benefits Brochure - NewsasdadNo ratings yet

- 2022 Steven Charles BAG - CODocument4 pages2022 Steven Charles BAG - COAlejuanchis Kamacho GarciaNo ratings yet

- Summary of Benefits PDFDocument4 pagesSummary of Benefits PDFRitishNo ratings yet

- M2A1 US Census Data SearchDocument6 pagesM2A1 US Census Data SearchragcajunNo ratings yet

- Long Term Care Insurance GuideDocument8 pagesLong Term Care Insurance Guidelongtermcare101No ratings yet

- Discussion 5 Health Insurance Long Term CareDocument2 pagesDiscussion 5 Health Insurance Long Term CareAyat fatimaNo ratings yet

- Wiser Financial Guide For CaregiversDocument32 pagesWiser Financial Guide For CaregiversCintia UmañaNo ratings yet

- Funding Senior Care & Housing: A Family Guide ToDocument12 pagesFunding Senior Care & Housing: A Family Guide ToCarepro AsiaNo ratings yet

- Us Benefits Summary Ees 2Document2 pagesUs Benefits Summary Ees 2Joel PanganibanNo ratings yet

- Us Benefits Summary Ees 2Document2 pagesUs Benefits Summary Ees 2Joel PanganibanNo ratings yet

- Statement of AdviceDocument11 pagesStatement of Advicepatrick wafulaNo ratings yet

- Entrepreneurship: Managing Your Personal FinancesDocument38 pagesEntrepreneurship: Managing Your Personal FinancesRamon BrionesNo ratings yet

- Personal Finance Final Project ExampleDocument19 pagesPersonal Finance Final Project ExampleAnonymous klPpfg7pNo ratings yet

- Desjardin Group Coverage Policy DocumentDocument2 pagesDesjardin Group Coverage Policy DocumentSouptik BanerjeeNo ratings yet

- Office Policy UpdatedDocument7 pagesOffice Policy Updatedapi-362969960No ratings yet

- Income Protection Organized Language - 09.2019Document8 pagesIncome Protection Organized Language - 09.2019Euneel EscalaNo ratings yet

- Home Care Services: Your Guide ToDocument10 pagesHome Care Services: Your Guide ToelenaNo ratings yet

- Black 70 Boost ExtrasDocument6 pagesBlack 70 Boost ExtrasSaifuddin SidikiNo ratings yet

- BF ProjectDocument4 pagesBF ProjectKartikSarupariaNo ratings yet

- Hsci 360 Long Term Care PPT Revised 9Document23 pagesHsci 360 Long Term Care PPT Revised 9api-249502229No ratings yet

- Health Microinsurance - : A Case Study in KenyaDocument18 pagesHealth Microinsurance - : A Case Study in KenyaWilliam KinaiNo ratings yet

- Roadmap To Financial PlanningDocument7 pagesRoadmap To Financial PlanningMuskan SadhwaniNo ratings yet

- Wilo BenefitsDocument25 pagesWilo BenefitsscottjsterlingNo ratings yet

- Do You Have Disaster Insurance?: Lifetime IncomeDocument14 pagesDo You Have Disaster Insurance?: Lifetime IncomeFinancial SenseNo ratings yet

- Long-Term Care Insurance ExplainedDocument23 pagesLong-Term Care Insurance Explainedswaminathan1No ratings yet

- Your Customized Benefits Plan at HCL America IncDocument2 pagesYour Customized Benefits Plan at HCL America IncShiv RanjanNo ratings yet

- Medical Education Bariatric Fellowship BenefitsDocument6 pagesMedical Education Bariatric Fellowship BenefitsOmer FarooqNo ratings yet

- Day Care CentreDocument5 pagesDay Care Centrefisherman6378No ratings yet

- Draft Questions EBU1063Document3 pagesDraft Questions EBU1063Russell FloydNo ratings yet

- Blue-Cross-Premier-Platinum-Extra-Dental-Vision CareerDocument8 pagesBlue-Cross-Premier-Platinum-Extra-Dental-Vision Careerapi-248930594No ratings yet

- Maine Resiliency Package GraphicDocument4 pagesMaine Resiliency Package GraphicNEWS CENTER MaineNo ratings yet

- Benefits Enrollment InformationDocument7 pagesBenefits Enrollment Informationjaiden woodNo ratings yet

- Important Questions Answers Why This MattersDocument10 pagesImportant Questions Answers Why This MattersJunior GatbuntonNo ratings yet

- Pathways - Tax Exempt LifeDocument1 pagePathways - Tax Exempt Lifearsenic210No ratings yet

- Pathways - IPPDocument1 pagePathways - IPParsenic210No ratings yet

- Pathways - Online BankingDocument1 pagePathways - Online Bankingarsenic210No ratings yet

- Pathways - Safe Withdrawal RatesDocument1 pagePathways - Safe Withdrawal Ratesarsenic210No ratings yet

- Pathways - Investing CertaintyDocument2 pagesPathways - Investing Certaintyarsenic210No ratings yet

- Pathways - Insurance GICDocument1 pagePathways - Insurance GICarsenic210No ratings yet

- Pathways - High Yield Bond FundDocument1 pagePathways - High Yield Bond Fundarsenic210No ratings yet

- Pathways - DisabilityDocument1 pagePathways - Disabilityarsenic210No ratings yet

- Pathways - Fair Vs ShareDocument1 pagePathways - Fair Vs Sharearsenic210No ratings yet

- Pathways - Dynamic Strategic YieldDocument1 pagePathways - Dynamic Strategic Yieldarsenic210No ratings yet

- Pathways - Corporate ClassDocument1 pagePathways - Corporate Classarsenic210No ratings yet

- Pathways - CPP ChangesDocument2 pagesPathways - CPP Changesarsenic210No ratings yet

- Pathways - 60 Second Check UpDocument1 pagePathways - 60 Second Check Uparsenic210No ratings yet

- Pathways - 60 Second Check UpDocument1 pagePathways - 60 Second Check Uparsenic210No ratings yet

- Pathways - Tax Exempt LifeDocument1 pagePathways - Tax Exempt Lifearsenic210No ratings yet

- Pathways - HSTDocument2 pagesPathways - HSTarsenic210No ratings yet

- Pathways - Safe Withdrawal RatesDocument1 pagePathways - Safe Withdrawal Ratesarsenic210No ratings yet

- Assignment-3: Marketing Management (MGT201)Document6 pagesAssignment-3: Marketing Management (MGT201)Rizza L. MacarandanNo ratings yet

- Emmanuel John MangahisDocument15 pagesEmmanuel John MangahisEmmanuel MangahisNo ratings yet

- CanagliflozinDocument7 pagesCanagliflozin13201940No ratings yet

- Walkie Talkie - 10 Codes - CommUSADocument1 pageWalkie Talkie - 10 Codes - CommUSASakthi VasuNo ratings yet

- Cebex 305: Constructive SolutionsDocument4 pagesCebex 305: Constructive SolutionsBalasubramanian AnanthNo ratings yet

- NS2-DVN-2540.Rev4 - Profomal Packing List BLR Piping Hanger Support Beam-Unit 2 - 20200710Document27 pagesNS2-DVN-2540.Rev4 - Profomal Packing List BLR Piping Hanger Support Beam-Unit 2 - 20200710PHAM PHI HUNGNo ratings yet

- TP PortalDocument25 pagesTP PortalSurendranNo ratings yet

- IBEF Cement-February-2023Document26 pagesIBEF Cement-February-2023Gurnam SinghNo ratings yet

- RLA-Grade 6 2023Document4 pagesRLA-Grade 6 2023Catherine Mabini BeatoNo ratings yet

- Aurora National High School: Report On AttendanceDocument2 pagesAurora National High School: Report On AttendanceLimuel CaringalNo ratings yet

- Leave Management System: Software Requirements Specification DocumentDocument6 pagesLeave Management System: Software Requirements Specification Documentk767No ratings yet

- Presentation 1Document11 pagesPresentation 1CJ CastroNo ratings yet

- MaekawaDocument2 pagesMaekawabhaskar_chintakindiNo ratings yet

- Kuka Interbus InterfaceDocument11 pagesKuka Interbus InterfaceAnonymous Zh6p3ENo ratings yet

- Sociology Internal AssessmentDocument21 pagesSociology Internal AssessmentjavoughnNo ratings yet

- Antai Solar Mounting Systems: Components List 2016Document12 pagesAntai Solar Mounting Systems: Components List 2016fedegarinNo ratings yet

- Chords, Arcs, and Central and Inscribed AngleDocument14 pagesChords, Arcs, and Central and Inscribed AngleAlice KrodeNo ratings yet

- Philips Cdr775Document50 pagesPhilips Cdr775Tomasz SkrzypińskiNo ratings yet

- IQX Controller & I/O ModulesDocument12 pagesIQX Controller & I/O ModulesAnonymous XYAPaxjbYNo ratings yet

- Patchu Time Management and Its Relation To The Working StudentsDocument17 pagesPatchu Time Management and Its Relation To The Working StudentsGui De OcampoNo ratings yet

- GW1101-1DI (3IN1) DatasheetDocument6 pagesGW1101-1DI (3IN1) DatasheetGina HuachoNo ratings yet

- Alup Allegro 37 AC IE3 400V 4-13bar 50Hz Metric Technical Data ENDocument2 pagesAlup Allegro 37 AC IE3 400V 4-13bar 50Hz Metric Technical Data ENBosznay ZoltánNo ratings yet

- Initial 2Document6 pagesInitial 2Asad HoseinyNo ratings yet