Professional Documents

Culture Documents

Us Benefits Summary Ees 2

Uploaded by

Joel PanganibanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Us Benefits Summary Ees 2

Uploaded by

Joel PanganibanCopyright:

Available Formats

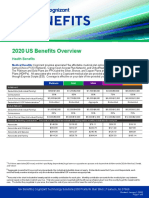

2021 BENEFITS

BENEFITS WEBSITE:

wellness.celanese.com

Celanese offers a competitive benefits package. Coverage will begin on the date of hire for all regular, full-time

employees and part-time employees scheduled to work 20 or more hours per week.

Our health plan strategy is to offer a High Deductible Health Plan (HDHP) combined with a Health Savings Account

(HSA). This combination promotes employees' active engagement in managing their healthcare expenses, rewards

good health and offers the flexibility to efficiently fund anticipated expenses and grow an HSA account balance year-

over-year. Our goal with other health and welfare benefits is to provide employees the opportunity to have the

protection they want with the employee and Celanese sharing in the cost of that protection.

Our retirement benefit offering features both a 5% company Retirement Contribution and 401(k) savings account with

a $1-for-$1 company match up to 6%. With this approach, Celanese combines a basis for retirement income with an

opportunity for employee participation in reaching their own retirement goals.

Medical Plan (Administered by UnitedHealthcare – www.myuhc.com/Choice Plus Plan)

HDHP90

In Network: EE Only Other Tiers

Annual Deductible $2,500 $5,000

Annual Out-of-Pocket Maximum $3,500 $7,000

Coinsurance & Copays Deductible must be met before plan pays 90% and employee pays 10% of costs.

Out-of-Pocket Maximum must be met before the plan pays 100% for services

and prescriptions; copays not applicable

Preventive Care Covered at 100% in-network

Prescription Drugs 100% for many preventive drugs; others subject to deductible

Out-of-network Services Not Covered

Health Savings Account Employee Biweekly Medical Plan Rates (pre-tax)

Annual base pay under $70,000 $70,000 - $150,000 over $150,000

The HSA is a tax-advantaged account that EE only $29.40 $37.60 $41.40

can be used to pay for eligible healthcare

expenses. Unused amounts roll over from EE + Spouse $58.80 $75.20 $82.70

year to year. Employees can contribute to

their HSA up to IRS limits, but Celanese

also makes a contribution to employee EE + Child(ren) $52.90 $67.70 $74.40

accounts. Celanese HSA contributions for

new hires during the year will be prorated EE + Family $93.90 $120.40 $132.30

biweekly.

Biweekly rates shown do not include the working spouse/partner surcharge of

EE only: Other Tiers: $35/pp, the health screening surcharge of $40/pp for failure to get a physical prior

to the annual deadline, or the tobacco surcharge of $50/pp (if applicable)

$1,000 $2,000

Dental Plan (Administered by Delta Dental)

You can use any provider for dental care or stay within the Delta Dental networks for discounts and easy claim filing.

High Plan Low Plan Biweekly Dental Plan Rates (pre-tax)

Deductibles $25 ind/$50 family $50 ind/$100 family High Low

Preventive Care 100% no deductible 100% no deductible EE only $5.90 $3.50

Basic & Major Services 80% after deductible 50% after deductible EE + Spouse $11.80 $7.00

Orthodontia* 80% after deductible 50% after deductible EE + Child(ren) $10.60 $6.30

Annual Maximum $1,500 $1,000 EE + Family $18.90 $11.20

*Orthodontia coverage only for dependent children; lifetime max of $1,500 under both plans

Vision Plan (Offered through EyeMed)

Offers annual eye exam, frames and lenses with copays, and contact lens allowances with in-network provider discounts.

Biweekly Vision Rates (pre-tax)

EE only $4.07 EE+Sp $7.74 EE+Ch $8.16 EE+Fam $11.99

Life and AD&D Insurance Benefits (Offered through Sun Life)

Celanese offers both company-paid and voluntary employee-paid insurance coverage.

Company-Paid Coverage

Basic Life: Celanese provides and pays for 1x your annual base pay

Basic AD&D: Celanese provides and pays for 1x your annual base pay in accidental death & dismemberment coverage

Employee-Paid Coverage

Voluntary Life: Employees can elect from 1x-6x of annual base pay; the lesser of 4x voluntary life or $1 million total life

coverage is available without evidence of insurability (EOI)

Spouse Life: Coverage for a spouse is available at three levels - $10,000; $25,000; or $50,000

Child Life: Coverage for children is available at two levels - $5,000 or $10,000 for each child

Voluntary AD&D: Employees can elect from 1x-6x annual base pay up to a maximum of $1 million

Spouse AD&D: Coverage for a spouse is available at three levels - $10,000; $25,000; or $50,000

Child AD&D: Coverage for children is available at two levels - $5,000 or $10,000 for each child

Long-Term Disability (Offered through Sun Life)

Celanese provides and pays for long-term disability (LTD) coverage that pays 50% of pre-disability base pay if you

become disabled based on the terms of the plan. Employees can elect and pay for enhanced LTD that increases the

benefit to 66-2/3% of pre-disability base pay. Benefits under either option can begin after 26 weeks of disability if

approved and will be offset by other sources of income.

Retirement Savings Plan (Administered by Fidelity Retirement)

Eligible employees can make contributions to their 401(k) from 0-50% of eligible pay (base salary + overtime/shift

premiums) on a pre-tax, after-tax or Roth basis up to IRS limits. Employee contributions are matched $1 for $1 by

company contributions up to 6% each pay period. Company match contributions are immediately 100% vested. A range

of investment options are available. Rollovers from certain other qualified plans are permitted.

In addition, Celanese will make an annual retirement contribution of 5% of eligible pay to an employee's account while

they are employed with Celanese. Employees are eligible for this contribution regardless of whether or not they contribute

to the 401(k) plan, but must be employed on 12/31 to receive that year's contribution. Retirement contributions vest after 3

years of service.

Newly eligible employees are automatically enrolled at a 6% pre-tax contribution rate 45 days after hire unless they

actively enroll or opt out of the plan. The default investment option is a target date fund that corresponds to an expected

retirement date. Automatic enrollment includes an annual automatic increase of 1% in the contribution rate up to 12%, but

employees can opt-out of this feature and change contribution percentages at any time.

Additional Benefits

Vacation & Holidays Employee Stock Purchase Plan Group Legal Assistance Program

Livongo, Hinge Health, 2nd MD Employee Assistance Program (EAP) Dependent Care Flexible Spending Account

Voluntary Quit-4-Life (tobacco cessation) Voluntary Auto, Homeowners, Renters Insurance

Accident/Hospital/Critical Illness

Important Note

The information contained in this summary is intended to provide basic descriptions of the benefits that are generally available to eligible participants of Celanese-sponsored

plans. In the event of a conflict between this information and plan documents, service agreements, or insurance contracts, the official documents will govern or control.

Celanese reserves the right to amend, modify, revoke or terminate these benefits and plans in whole or in part at any time. Neither this summary nor participation in the

benefit plans described herein constitutes a promise of employment or continuation of employment with Celanese.

You might also like

- Us Benefits Summary Ees 2Document2 pagesUs Benefits Summary Ees 2Joel PanganibanNo ratings yet

- Habasit 2017 Benefits GuideDocument2 pagesHabasit 2017 Benefits GuideBlackBunny103No ratings yet

- 2021 - Life, Dental, Vision PacketDocument12 pages2021 - Life, Dental, Vision PacketEberNo ratings yet

- Benefit Plan: Manulife Benefits BasicsDocument1 pageBenefit Plan: Manulife Benefits BasicsMuneeb ArshadNo ratings yet

- 2024 - US Healthcare One PagerDocument14 pages2024 - US Healthcare One PagerAsad AllibhoyNo ratings yet

- 2011-12 Benefits BrochureDocument4 pages2011-12 Benefits BrochureKevin MarshallNo ratings yet

- SeKON Employee Benefits Summary 2016Document3 pagesSeKON Employee Benefits Summary 2016Ali HajassdolahNo ratings yet

- New Hire Benefits Summary: Medical, PTO, Life Ins & MoreDocument3 pagesNew Hire Benefits Summary: Medical, PTO, Life Ins & MoreRavi Prakash MayreddyNo ratings yet

- Your Customized Benefits Plan at HCL America IncDocument2 pagesYour Customized Benefits Plan at HCL America IncShiv RanjanNo ratings yet

- Wilo BenefitsDocument25 pagesWilo BenefitsscottjsterlingNo ratings yet

- Medical Education Bariatric Fellowship BenefitsDocument6 pagesMedical Education Bariatric Fellowship BenefitsOmer FarooqNo ratings yet

- OE Powerpoint PresentationDocument35 pagesOE Powerpoint PresentationAnonymous ibpKT07GNo ratings yet

- CFG Reference GuideDocument38 pagesCFG Reference GuideStefan IonescuNo ratings yet

- Yeu Benefit Update May 2011Document3 pagesYeu Benefit Update May 2011Jordan EbareNo ratings yet

- Benefits Summary YahDocument3 pagesBenefits Summary YahJohn NixonNo ratings yet

- AST Benefits SummaryDocument4 pagesAST Benefits SummarySam GobNo ratings yet

- 2014 Benefits Summary FINALDocument5 pages2014 Benefits Summary FINALoljayseeNo ratings yet

- 2013 Benefits SummaryDocument0 pages2013 Benefits SummarybalajisaireddyNo ratings yet

- 2016 Benefit Changes (Non-Barganing Unit)Document18 pages2016 Benefit Changes (Non-Barganing Unit)Blaine RiceNo ratings yet

- Calculating Your Per Pay Period Costs: Monthly Rates and Health Care Comparison 2014Document2 pagesCalculating Your Per Pay Period Costs: Monthly Rates and Health Care Comparison 2014frabziNo ratings yet

- 8Z9N0K0001V0Document3 pages8Z9N0K0001V0Vanessa Graves FosterNo ratings yet

- 2022 Grad Benefits SummaryDocument13 pages2022 Grad Benefits SummaryZeeshan Khalid ChaudheryNo ratings yet

- 2014-15 Ag-Pro Final New Hire Benefit BookletDocument20 pages2014-15 Ag-Pro Final New Hire Benefit BookletkellifitzgeraldNo ratings yet

- Employer'S Health Insurance Information: State of Utah Department of HealthDocument2 pagesEmployer'S Health Insurance Information: State of Utah Department of HealthJon SmithNo ratings yet

- Upcoming HR Program Changes - Part Time Employees - EN PDFDocument4 pagesUpcoming HR Program Changes - Part Time Employees - EN PDFjsource2007No ratings yet

- Ternian HCIS InteractiveDocument10 pagesTernian HCIS InteractivetrninsgrpNo ratings yet

- Mercy Ships Benefits SummaryDocument4 pagesMercy Ships Benefits SummaryRitishNo ratings yet

- APRIL 1, 2011: Preferred Blue PPO Plan Blue Care Elect PPODocument19 pagesAPRIL 1, 2011: Preferred Blue PPO Plan Blue Care Elect PPOIan S. SandovalNo ratings yet

- Summary of 2022 Benefit Changes: MedicalDocument5 pagesSummary of 2022 Benefit Changes: MedicalChinnu SalimathNo ratings yet

- Final Draft Gig Harbor Enrollment Guide 2024Document24 pagesFinal Draft Gig Harbor Enrollment Guide 2024api-307235383No ratings yet

- Benefits HighlightsDocument1 pageBenefits HighlightsRobert AvramescuNo ratings yet

- 2021 Part-Time Apple Dental Plan Overview: Carrier MetlifeDocument1 page2021 Part-Time Apple Dental Plan Overview: Carrier MetlifeCT NguonNo ratings yet

- 2021 Sweet Express Benefit GuideDocument20 pages2021 Sweet Express Benefit GuideCameron WolfNo ratings yet

- FTUUPbenefitsummary June 2019Document2 pagesFTUUPbenefitsummary June 2019mian sudaisNo ratings yet

- Voya Compass Hospital Confinement Indemnity InsuranceDocument4 pagesVoya Compass Hospital Confinement Indemnity InsuranceDavid BriggsNo ratings yet

- Benefits at A Glance 2018Document2 pagesBenefits at A Glance 2018JeffNo ratings yet

- 2016 Employee Benefit Summary For Graduate Assistants, Post-Doctoral Appointees and Short-Term Academic AppointmentsDocument10 pages2016 Employee Benefit Summary For Graduate Assistants, Post-Doctoral Appointees and Short-Term Academic Appointmentszazoo17No ratings yet

- Costco 2021 BENEFIT PLAN CHANGESDocument16 pagesCostco 2021 BENEFIT PLAN CHANGESbrianNo ratings yet

- Jasmine F Slaughter - Day&Zimmerman - Fall2011Document22 pagesJasmine F Slaughter - Day&Zimmerman - Fall2011studentATtempleNo ratings yet

- So Cal Kaiser GuideDocument13 pagesSo Cal Kaiser GuideWai DaiNo ratings yet

- Onboarding Process: Accept The OfferDocument9 pagesOnboarding Process: Accept The Offerrnj1230No ratings yet

- FSA Introduction PPTDocument15 pagesFSA Introduction PPTSarah VillanuevaNo ratings yet

- Blue-Cross-Premier-Platinum-Extra-Dental-Vision CareerDocument8 pagesBlue-Cross-Premier-Platinum-Extra-Dental-Vision Careerapi-248930594No ratings yet

- Benefit Summary - Regular Employees in Flex Plan (Classes 6 and 7)Document25 pagesBenefit Summary - Regular Employees in Flex Plan (Classes 6 and 7)suchit.singhNo ratings yet

- And There Are Plenty of Benefits To Joining Our Team..Document2 pagesAnd There Are Plenty of Benefits To Joining Our Team..venkata_gurramNo ratings yet

- PayAssure InfomationDocument2 pagesPayAssure InfomationMun Kit100% (1)

- 2020 US Benefits OverviewDocument5 pages2020 US Benefits OverviewrdmNo ratings yet

- JUSTIN M KEMP - ExecutiveHealthResources - Fall2011Document27 pagesJUSTIN M KEMP - ExecutiveHealthResources - Fall2011studentATtempleNo ratings yet

- ACDocument4 pagesACNrc A.No ratings yet

- 2020 Ankura Benefits GuideDocument20 pages2020 Ankura Benefits GuidegpperkNo ratings yet

- Understanding My Benefits: Pre - Auth@Document2 pagesUnderstanding My Benefits: Pre - Auth@Jonelle Morris-DawkinsNo ratings yet

- Important Questions Answers Why This MattersDocument10 pagesImportant Questions Answers Why This MattersJunior GatbuntonNo ratings yet

- Candidate Facing Benefits Sheet 2Document4 pagesCandidate Facing Benefits Sheet 2brendaNo ratings yet

- Your SFSS Enhanced Student Health & Dental PlanDocument2 pagesYour SFSS Enhanced Student Health & Dental PlanJiho KimNo ratings yet

- 2021 Benefits Summary - ReadDocument12 pages2021 Benefits Summary - Readapi-544195419No ratings yet

- Tracy Buckler ContractDocument11 pagesTracy Buckler ContractcbcSudburyNo ratings yet

- United Healthcare UHC Premier 1500 CEFP GoldDocument14 pagesUnited Healthcare UHC Premier 1500 CEFP GoldSteveNo ratings yet

- Secure Access 2015Document16 pagesSecure Access 2015api-288656991No ratings yet

- Liturgical Calendar: United States of AmericaDocument52 pagesLiturgical Calendar: United States of AmericaJoel PanganibanNo ratings yet

- PCO Accreditation Application FormDocument3 pagesPCO Accreditation Application FormDennie Vieve IdeaNo ratings yet

- General Application Form ScholarshipDocument6 pagesGeneral Application Form ScholarshipJoel PanganibanNo ratings yet

- CIA Exam Application GuideDocument2 pagesCIA Exam Application GuideJoel PanganibanNo ratings yet

- Application Form Scholarship For Which You Are Applying: Youth CommunityDocument1 pageApplication Form Scholarship For Which You Are Applying: Youth CommunityJoel PanganibanNo ratings yet

- Apply for Chatman/Fairchild Book ScholarshipDocument1 pageApply for Chatman/Fairchild Book ScholarshipJoel PanganibanNo ratings yet

- 820 105 K12Schools2021 2022Document24 pages820 105 K12Schools2021 2022Joel PanganibanNo ratings yet

- 2022 CalDocument52 pages2022 CalKaemi CaiñaNo ratings yet

- Application Form For HS Grads 21 22 Final FillableDocument9 pagesApplication Form For HS Grads 21 22 Final FillableJoel PanganibanNo ratings yet

- 820 105 K12Schools2021 2022Document24 pages820 105 K12Schools2021 2022Joel PanganibanNo ratings yet

- CIA Exam Application GuideDocument2 pagesCIA Exam Application GuideJoel PanganibanNo ratings yet

- (Circular E), Employer's Tax Guide: Future DevelopmentsDocument49 pages(Circular E), Employer's Tax Guide: Future DevelopmentsJoel PanganibanNo ratings yet

- PCO Accreditation Application FormDocument3 pagesPCO Accreditation Application FormDennie Vieve IdeaNo ratings yet

- Apply Work Permit OnlineDocument18 pagesApply Work Permit OnlineSuresh Thevanindrian100% (1)

- Application Form: Personal InformationDocument4 pagesApplication Form: Personal InformationJoel PanganibanNo ratings yet

- UNICEF Lego Foundation Learning Through Play PDFDocument36 pagesUNICEF Lego Foundation Learning Through Play PDFsamaNo ratings yet

- PDF501 BLANK v022020Document2 pagesPDF501 BLANK v022020Joel PanganibanNo ratings yet

- Application FormatDocument3 pagesApplication Formatjhabak1No ratings yet

- Reading For Pleasure PDFDocument33 pagesReading For Pleasure PDFGretchen Barrera PatenioNo ratings yet

- PDF501 BLANK v022020Document2 pagesPDF501 BLANK v022020Joel PanganibanNo ratings yet

- WEF The Global Risks Report 2022Document117 pagesWEF The Global Risks Report 2022Jamie WhiteNo ratings yet

- IRS Publication 15-B guide to tax-free fringe benefitsDocument34 pagesIRS Publication 15-B guide to tax-free fringe benefitsJoel PanganibanNo ratings yet

- Reading For Pleasure PDFDocument33 pagesReading For Pleasure PDFGretchen Barrera PatenioNo ratings yet

- PDF501 BLANK v022020Document2 pagesPDF501 BLANK v022020Joel PanganibanNo ratings yet

- IRS Publication 15-B guide to tax-free fringe benefitsDocument34 pagesIRS Publication 15-B guide to tax-free fringe benefitsJoel PanganibanNo ratings yet

- IRS Publication 15-B guide to tax-free fringe benefitsDocument34 pagesIRS Publication 15-B guide to tax-free fringe benefitsJoel PanganibanNo ratings yet

- Strength Training For Older AdultsDocument126 pagesStrength Training For Older AdultsMedic3100% (1)

- Benefits For Children: What You Will Need When You Apply For Child's BenefitsDocument2 pagesBenefits For Children: What You Will Need When You Apply For Child's BenefitsJoel PanganibanNo ratings yet

- Employer costs for employee compensation in September 2021Document19 pagesEmployer costs for employee compensation in September 2021Joel PanganibanNo ratings yet

- Benefits For Children: What You Will Need When You Apply For Child's BenefitsDocument2 pagesBenefits For Children: What You Will Need When You Apply For Child's BenefitsJoel PanganibanNo ratings yet

- Genetic Counselling For Haemophilia: Katherine Rose Genetic Counsellor Genetic Health Services VictoriaDocument20 pagesGenetic Counselling For Haemophilia: Katherine Rose Genetic Counsellor Genetic Health Services VictoriadrusmanjamilhcmdNo ratings yet

- Studi Kasus: Kehamilan Dengan: Dengan Katub Jantung Prostetik Mekanik Dan Penggunaan AntikoagulanDocument10 pagesStudi Kasus: Kehamilan Dengan: Dengan Katub Jantung Prostetik Mekanik Dan Penggunaan AntikoagulanMonyet...No ratings yet

- 3 Transcripts From The Adrenal Solutions SummitDocument39 pages3 Transcripts From The Adrenal Solutions SummitPatriciaPedroGomesNo ratings yet

- Overview of Public Health Nursing in The PhilippinesDocument26 pagesOverview of Public Health Nursing in The PhilippinesZarlyn MirafloresNo ratings yet

- Strategies of PHCDocument39 pagesStrategies of PHCYosi Dwi Saputro Part II100% (2)

- Nursing Care Plan for Seizure DisorderDocument2 pagesNursing Care Plan for Seizure Disorderseeker009No ratings yet

- Advanced English Vocabulary List for Socio-Economic TopicsDocument3 pagesAdvanced English Vocabulary List for Socio-Economic TopicsNgọc MinhNo ratings yet

- Understanding the EMS DNR Order ActDocument2 pagesUnderstanding the EMS DNR Order ActSteven EtheredgeNo ratings yet

- Vitapex. A Case Report PDFDocument4 pagesVitapex. A Case Report PDFPamela GuzmánNo ratings yet

- Revanggi Ujian OfkomDocument8 pagesRevanggi Ujian OfkomRadit FauzieNo ratings yet

- B.well SwissDocument1 pageB.well SwissZumrud QafarliNo ratings yet

- ParacentesisDocument3 pagesParacentesisVenus April LimonNo ratings yet

- CHN Essay HamoyDocument13 pagesCHN Essay HamoybabyboyNo ratings yet

- Obstetrics case proforma physical examDocument1 pageObstetrics case proforma physical examHeroNo ratings yet

- Issuance of Sick Leave Certificate Policy Final - UAEDocument12 pagesIssuance of Sick Leave Certificate Policy Final - UAEmarks2much100% (2)

- Breast Cancer TreatmentDocument13 pagesBreast Cancer TreatmentRissa AlmiraNo ratings yet

- 1.1.PCOS QuestionnaireDocument5 pages1.1.PCOS QuestionnaireJoe-Liane AntonioNo ratings yet

- 50 Facts Global Health Situation and Trends 1955-2025Document4 pages50 Facts Global Health Situation and Trends 1955-2025ClydeNo ratings yet

- MSQH 5th Edition Standard 06 - Patient and Family Rights-Jan 2017 PDFDocument31 pagesMSQH 5th Edition Standard 06 - Patient and Family Rights-Jan 2017 PDFGarFieLd macHeLoNo ratings yet

- Introduction To PharmacotherapeuticsDocument49 pagesIntroduction To PharmacotherapeuticsChandraprakash JadhavNo ratings yet

- Learning Disabilities Scenario 2 Shanaya Profound LD 2018 2019 1-1-02-2Document2 pagesLearning Disabilities Scenario 2 Shanaya Profound LD 2018 2019 1-1-02-2Mark OngaroNo ratings yet

- Amniotic Fluid Embolism (AFE)Document27 pagesAmniotic Fluid Embolism (AFE)ThenewaaSitumorangNo ratings yet

- Pediatric Nutrition GuideDocument6 pagesPediatric Nutrition GuideJoher Bolante Mendez Jr.No ratings yet

- Pattern Identification According To Qi and BloodDocument7 pagesPattern Identification According To Qi and BloodCarleta StanNo ratings yet

- PeritonitissDocument46 pagesPeritonitissNinaNo ratings yet

- Inpatient Psychiatric Unit Patient HandbookDocument7 pagesInpatient Psychiatric Unit Patient HandbookJuanCarlos Yogi0% (1)

- ISSA Online Coaching Certification Fat Loss WorkshopDocument13 pagesISSA Online Coaching Certification Fat Loss WorkshopSven PhamNo ratings yet

- Homeopathy Catalogue 2014Document32 pagesHomeopathy Catalogue 2014shivuz20No ratings yet

- Nursing Care Plan: Assessment Diagnosis Planning Intervention Rationale Evaluation Subjective: Risk For ConstipationDocument4 pagesNursing Care Plan: Assessment Diagnosis Planning Intervention Rationale Evaluation Subjective: Risk For Constipationkenneth_bambaNo ratings yet