Professional Documents

Culture Documents

Asset Exchanged at A Gain: Cost of New Asset Acquired: Gain On Exchange of Old Asset

Asset Exchanged at A Gain: Cost of New Asset Acquired: Gain On Exchange of Old Asset

Uploaded by

Steven SandersonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asset Exchanged at A Gain: Cost of New Asset Acquired: Gain On Exchange of Old Asset

Asset Exchanged at A Gain: Cost of New Asset Acquired: Gain On Exchange of Old Asset

Uploaded by

Steven SandersonCopyright:

Available Formats

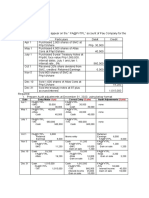

PLANT ASSET DISPOSALS — EXCHANGE OF SIMILAR ASSETS

Asset Exchanged at a Gain

Asset originally purchased on 1/1/96 is exchanged for a similar asset on 1/1/99. Cash of

$10,000 is also paid and the old asset has fair market value of $8,000 on the date of

exchange.

Equipment Accumulated Depreciation-Equipment

20,000 12/31/96 5,000

12/31/97 5,000

12/31/98 5,000

Bal. 15,000

Book Value = $5,000

Entry:

Equipment (new) 15,000

Accumulated Depreciation-Equipment 15,000

Equipment (old) 20,000

Cash 10,000

Cost of new asset acquired: Gain on exchange of old asset:

Fair value of old asset $ 8,000 Fair value of old asset $8,000

Cash paid 10,000 Book value of old asset 5,000

18,000 Gain on disposal $3,000

Less: Gain on disposal 3,000

$15,000

Copyright 1999 John Wiley & Sons, Inc. Weygandt/Principles 5e T T 10–L

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2017 Vol 2 CH 3 AnsDocument17 pages2017 Vol 2 CH 3 AnsJohn Lloyd YastoNo ratings yet

- Adv. Accounting. Business Comb. MCQDocument13 pagesAdv. Accounting. Business Comb. MCQalmira garciaNo ratings yet

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Tugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Alya Sufi Ikrima0% (1)

- Auditing - Midterms Investment QuizDocument6 pagesAuditing - Midterms Investment QuizmoNo ratings yet

- Business Combination ExercisesDocument5 pagesBusiness Combination ExercisesmmNo ratings yet

- Latihan Kasus - Application of Perpetual Vs Periodic System 2110111041 - Frisca AprilliaDocument8 pagesLatihan Kasus - Application of Perpetual Vs Periodic System 2110111041 - Frisca AprilliawibuNo ratings yet

- Journal TransactionsDocument3 pagesJournal TransactionsFaye Garlitos100% (1)

- Asset Exchanged at A Loss: Cost of New Asset Acquired: Loss On Exchange of Old AssetDocument1 pageAsset Exchanged at A Loss: Cost of New Asset Acquired: Loss On Exchange of Old AssetSteven SandersonNo ratings yet

- Asset Sold at A Gain: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageAsset Sold at A Gain: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven SandersonNo ratings yet

- Asset Sold at A Loss: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageAsset Sold at A Loss: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven SandersonNo ratings yet

- Asset Is Not Fully Depreciated: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageAsset Is Not Fully Depreciated: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven SandersonNo ratings yet

- 8 - Nonmonetary Transactions Problems With SolutionsDocument9 pages8 - Nonmonetary Transactions Problems With Solutionsbusiness docNo ratings yet

- ParCor AccountingDocument2 pagesParCor AccountinggirlieNo ratings yet

- Accounting Chap 9 - Sheet1Document4 pagesAccounting Chap 9 - Sheet1Nguyễn Ngọc MaiNo ratings yet

- 2nd Training Session 2022 03 14 18 41 46Document24 pages2nd Training Session 2022 03 14 18 41 46Sara PiccioliNo ratings yet

- Fully Depreciated Asset: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageFully Depreciated Asset: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven Sanderson100% (1)

- Chapter 8 In-Class Problems SOLUTIONSDocument4 pagesChapter 8 In-Class Problems SOLUTIONSAbdullah alhamaadNo ratings yet

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNo ratings yet

- (IFA 12) - Rendy Filiang - 1402210324Document6 pages(IFA 12) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Cash Flow Statement Assignment No. 1 SOLDocument1 pageCash Flow Statement Assignment No. 1 SOLMahmoud IbrahimNo ratings yet

- Module 7.2Document9 pagesModule 7.2Althea mary kate MorenoNo ratings yet

- I-11.03 StudentDocument4 pagesI-11.03 StudentDavid GuerraNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - Partnership FormationDocument3 pagesNUDJPIA FAR AND AFAR SOLUTIONS - Partnership FormationKyla Artuz Dela CruzNo ratings yet

- Chapter 10 in Class Problems DAY 2 SolutionsDocument2 pagesChapter 10 in Class Problems DAY 2 SolutionsAbdullah alhamaadNo ratings yet

- A. B. C. D.: ExplanationDocument2 pagesA. B. C. D.: ExplanationMahmoud Hamouda (Mahmoud Hamouda 's Blog)No ratings yet

- Used Assets Management: by DR ZahirDocument32 pagesUsed Assets Management: by DR Zahirshabbar aliNo ratings yet

- Home Assignment Ch.1Document6 pagesHome Assignment Ch.1Sausan SaniaNo ratings yet

- Soal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)Document2 pagesSoal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)SECRET MENUNo ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Audit of Owner's EquityDocument9 pagesAudit of Owner's EquityHira IdaceiNo ratings yet

- Tugas Asdos AklDocument6 pagesTugas Asdos AklNicholas AlexanderNo ratings yet

- Training Financial AccountingDocument23 pagesTraining Financial AccountingSara PiccioliNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- Soal Jawaban AKL CHP 1Document5 pagesSoal Jawaban AKL CHP 1Allpacino DesellaNo ratings yet

- Accountancy Project Roll No. 19-24Document25 pagesAccountancy Project Roll No. 19-24Diya DileepNo ratings yet

- Solution Ram TradersDocument12 pagesSolution Ram TradersNikunj DudharaNo ratings yet

- BA 118.3 (D. Salazar/R. Placido/K. Dela Cruz)Document6 pagesBA 118.3 (D. Salazar/R. Placido/K. Dela Cruz)Ian De Dios100% (1)

- Angelo Fernando - 01012190021 - Tugas Akuntansi Menengah 2 - Pertemuan 5Document4 pagesAngelo Fernando - 01012190021 - Tugas Akuntansi Menengah 2 - Pertemuan 5ANGELOXAK202No ratings yet

- Week 4 Managerial AccountingDocument7 pagesWeek 4 Managerial AccountingMari SylvesterNo ratings yet

- IA3 Chapter 14 Problem 31Document3 pagesIA3 Chapter 14 Problem 31Bea TumulakNo ratings yet

- Audit ProblemDocument4 pagesAudit ProblemKaren Joy Jacinto ElloNo ratings yet

- Audit ProblemDocument4 pagesAudit ProblemKaren Joy Jacinto ElloNo ratings yet

- Reporting & Interpreting Investments in Other CorporationsDocument12 pagesReporting & Interpreting Investments in Other CorporationslelydiNo ratings yet

- CH9 SolutionsDocument11 pagesCH9 SolutionsGhadeer MohammedNo ratings yet

- BusCom Exercises AnswerDocument4 pagesBusCom Exercises AnswerVidgezxc LoriaNo ratings yet

- ACCG308 Tutorial AnswersDocument8 pagesACCG308 Tutorial AnswersLi0% (2)

- Acctg. Equation Puring CompanyDocument8 pagesAcctg. Equation Puring CompanyAngelNo ratings yet

- Balance de Gobal FestibalDocument3 pagesBalance de Gobal Festibalvanessa briñezNo ratings yet

- Accounting Chap 11Document3 pagesAccounting Chap 11Khanh KimNo ratings yet

- ACCT 210-Fall 21-22-Revision Sheet - FinalDocument3 pagesACCT 210-Fall 21-22-Revision Sheet - FinalAndrew PhilipsNo ratings yet

- Assignment On ACT in Primeasia UniversityDocument8 pagesAssignment On ACT in Primeasia UniversityMaria khanNo ratings yet

- ACCDocument11 pagesACCVo Hoang Mai Tuyet (K17 HCM)No ratings yet

- PPE Acquisition and Borrowing CostDocument3 pagesPPE Acquisition and Borrowing Cost夜晨曦No ratings yet

- Cost of TicketsDocument12 pagesCost of TicketsLester PioquintoNo ratings yet

- Chapter One and 2 Assessment QuestionsDocument6 pagesChapter One and 2 Assessment QuestionsSteven Sanderson100% (3)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Reaction Paper To Chapter 6Document3 pagesReaction Paper To Chapter 6Steven Sanderson100% (1)

- Reaction Report To Student OrientationDocument1 pageReaction Report To Student OrientationSteven SandersonNo ratings yet

- Reaction Paper To Chater 13Document2 pagesReaction Paper To Chater 13Steven Sanderson100% (5)

- Chapters 13, 14, 15, 16 Assessment QuestionsDocument11 pagesChapters 13, 14, 15, 16 Assessment QuestionsSteven Sanderson100% (5)

- Chapters 10,11 and 12 Assessment QuestionsDocument10 pagesChapters 10,11 and 12 Assessment QuestionsSteven Sanderson100% (1)

- Chapters 3,4,5 and 6 Assesment QuestionsDocument10 pagesChapters 3,4,5 and 6 Assesment QuestionsSteven Sanderson100% (4)

- Chapters 7,8,9 Assesment QuestionsDocument9 pagesChapters 7,8,9 Assesment QuestionsSteven Sanderson100% (3)

- Chapter 21 Reaction PaperDocument4 pagesChapter 21 Reaction PaperSteven Sanderson100% (1)

- Acct II - Chapter 15 Lecture NotesDocument4 pagesAcct II - Chapter 15 Lecture NotesSteven Sanderson100% (1)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- Cost BehaviorDocument10 pagesCost BehaviorSteven Sanderson100% (5)

- Statement of Cash Flows - Lecture NotesDocument6 pagesStatement of Cash Flows - Lecture NotesSteven Sanderson100% (8)