Professional Documents

Culture Documents

Fully Depreciated Asset: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5e

Fully Depreciated Asset: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5e

Uploaded by

Steven Sanderson100%(1)100% found this document useful (1 vote)

16 views1 pageAn asset that was originally purchased for $20,000 on 1/1/96 was fully depreciated and discarded on 1/1/00 with no salvage value. When recording the disposal of a fully depreciated asset, the accumulated depreciation account is debited for the total amount of depreciation taken over the life of the asset ($20,000) and the equipment asset account is credited to remove the asset from the books at its book value of $0.

Original Description:

Original Title

TT 10-G5

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAn asset that was originally purchased for $20,000 on 1/1/96 was fully depreciated and discarded on 1/1/00 with no salvage value. When recording the disposal of a fully depreciated asset, the accumulated depreciation account is debited for the total amount of depreciation taken over the life of the asset ($20,000) and the equipment asset account is credited to remove the asset from the books at its book value of $0.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

16 views1 pageFully Depreciated Asset: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5e

Fully Depreciated Asset: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5e

Uploaded by

Steven SandersonAn asset that was originally purchased for $20,000 on 1/1/96 was fully depreciated and discarded on 1/1/00 with no salvage value. When recording the disposal of a fully depreciated asset, the accumulated depreciation account is debited for the total amount of depreciation taken over the life of the asset ($20,000) and the equipment asset account is credited to remove the asset from the books at its book value of $0.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

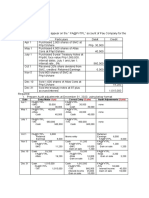

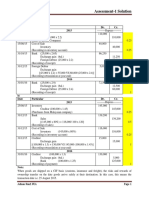

PLANT ASSET DISPOSALS —RETIREMENTS

Fully Depreciated Asset

Asset originally purchased on 1/1/96 is discarded on 1/1/00 and

there is no salvage value.

Equipment Accumulated Depreciation-Equipment

20,000 12/31/96 5,000

12/31/97 5,000

12/31/98 5,000

12/31/99 5,000

Bal. 20,000

Book Value = $0

Entry:

Accumulated Depreciation-Equipment 20,000

Equipment 20,000

Note: When recording a plant asset disposal, the plant asset account

is always credited and the related accumulated depreciation

account is always debited to remove them from the books.

Copyright 1999 John Wiley & Sons, Inc. Weygandt/Principles 5e T T 10–G

You might also like

- Test Bank 2 - Ia 3Document31 pagesTest Bank 2 - Ia 3Xiena100% (6)

- Problem SolvingDocument10 pagesProblem SolvingRegina De LunaNo ratings yet

- You Are Presented With The Following Trial Balance of Arbalrest, A Limited Liability Company at Account DR $ CR $Document4 pagesYou Are Presented With The Following Trial Balance of Arbalrest, A Limited Liability Company at Account DR $ CR $Nguyễn GiangNo ratings yet

- Quiz Chapter-10 She-Part-1 2021Document4 pagesQuiz Chapter-10 She-Part-1 2021Hafsah Amod DisomangcopNo ratings yet

- Quizzes - Chapter 15 - Accounting For CorporationsDocument6 pagesQuizzes - Chapter 15 - Accounting For CorporationsAmie Jane Miranda100% (3)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Inventory Estimation: QuizDocument2 pagesInventory Estimation: QuizAngela Ricaplaza ReveralNo ratings yet

- P16-3A Journalize Transactions and Adjusting Entry For Stock InvestmentsDocument3 pagesP16-3A Journalize Transactions and Adjusting Entry For Stock InvestmentsRisky FernandoNo ratings yet

- Exercise5 With SolutionDocument5 pagesExercise5 With SolutionRexmar Christian Bernardo71% (7)

- Asset Is Not Fully Depreciated: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageAsset Is Not Fully Depreciated: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven SandersonNo ratings yet

- Asset Sold at A Loss: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageAsset Sold at A Loss: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven SandersonNo ratings yet

- Asset Sold at A Gain: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageAsset Sold at A Gain: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven SandersonNo ratings yet

- Asset Exchanged at A Gain: Cost of New Asset Acquired: Gain On Exchange of Old AssetDocument1 pageAsset Exchanged at A Gain: Cost of New Asset Acquired: Gain On Exchange of Old AssetSteven SandersonNo ratings yet

- Accounting Chap 9 - Sheet1Document4 pagesAccounting Chap 9 - Sheet1Nguyễn Ngọc MaiNo ratings yet

- Asset Exchanged at A Loss: Cost of New Asset Acquired: Loss On Exchange of Old AssetDocument1 pageAsset Exchanged at A Loss: Cost of New Asset Acquired: Loss On Exchange of Old AssetSteven SandersonNo ratings yet

- Inventory 1Document8 pagesInventory 1Ren AikawaNo ratings yet

- Fabm Unit 8: Assignment: Mark Kenneth V Adonis Grade 11-GalatiansDocument2 pagesFabm Unit 8: Assignment: Mark Kenneth V Adonis Grade 11-GalatiansKenCy CUTENo ratings yet

- Homework Chapter 9Document5 pagesHomework Chapter 9Linh TranNo ratings yet

- Chap 11Document6 pagesChap 11Shiela DimaculanganNo ratings yet

- F7 - C5 (IAS36), C6 (IAS 2 & 41) FullDocument69 pagesF7 - C5 (IAS36), C6 (IAS 2 & 41) FullK59 Vo Doan Hoang AnhNo ratings yet

- The Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyDocument5 pagesThe Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyJel SanNo ratings yet

- Case 3 4Document7 pagesCase 3 4Jude Español JorsaNo ratings yet

- Part 3 - AnswersDocument4 pagesPart 3 - AnswersFenladen AmbayNo ratings yet

- Chapter 3 ExampleDocument3 pagesChapter 3 Exampleasistensi varaNo ratings yet

- Accounts Paper 1 November 1996Document8 pagesAccounts Paper 1 November 1996xk dreamerNo ratings yet

- Intermediate Accounting Unit4 - Topic5Document7 pagesIntermediate Accounting Unit4 - Topic5Lea PolinarNo ratings yet

- Rand Inc. Journal EntriesDocument1 pageRand Inc. Journal EntriesKri BanayNo ratings yet

- Activity 10Document2 pagesActivity 10Randelle James FiestaNo ratings yet

- 04 Case Problem - SheDocument13 pages04 Case Problem - SheJen DeloyNo ratings yet

- SHE Problems PDFDocument12 pagesSHE Problems PDFMinie KimNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- InventoryDocument3 pagesInventoryLam GraceNo ratings yet

- Most Common Business TransactionsDocument6 pagesMost Common Business TransactionsADRIAN LASA MEDIAVILLANo ratings yet

- P10-5A Journalize A Series of Equipment Transactions Related To Purchase, Sale, Retirement, and DepreciationDocument4 pagesP10-5A Journalize A Series of Equipment Transactions Related To Purchase, Sale, Retirement, and DepreciationRisky FernandoNo ratings yet

- Quiz Chapter-11 She-Part-2 2021Document5 pagesQuiz Chapter-11 She-Part-2 2021Salma B. AbdullahNo ratings yet

- Accounting Cycle of A Merchandising BusinessDocument31 pagesAccounting Cycle of A Merchandising BusinessAresta, Novie Mae100% (1)

- Disposal of Fixed Assets and DepreciationDocument4 pagesDisposal of Fixed Assets and Depreciationruv.asn17No ratings yet

- Class Exercise 4Document3 pagesClass Exercise 4NUR FARRAH SYAKIRAH AMRANNo ratings yet

- Accounting Cycle of A Merchandising BusinessDocument34 pagesAccounting Cycle of A Merchandising BusinessTariga, Dharen Joy J.No ratings yet

- Cost Acctg-Ch1&2Document5 pagesCost Acctg-Ch1&2JACQUELYN PABLITONo ratings yet

- P13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Document3 pagesP13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Friska AvriliaNo ratings yet

- Past ExamDocument9 pagesPast ExamHaziNo ratings yet

- 3 9 PDFDocument4 pages3 9 PDFHassan TariqNo ratings yet

- Audit of Owner's EquityDocument9 pagesAudit of Owner's EquityHira IdaceiNo ratings yet

- Module 3 - Solutions #2 (2022)Document11 pagesModule 3 - Solutions #2 (2022)Mergierose DalgoNo ratings yet

- Activity Chapter 5: Effect On December 31, 20X1: Using Straight Line MethodDocument2 pagesActivity Chapter 5: Effect On December 31, 20X1: Using Straight Line MethodRandelle James FiestaNo ratings yet

- Chapter 16 Problem2 New PDFDocument5 pagesChapter 16 Problem2 New PDFBernadette Joyce ManjaresNo ratings yet

- Auditing - Midterms Investment QuizDocument6 pagesAuditing - Midterms Investment QuizmoNo ratings yet

- Bài tập buổi 12Document7 pagesBài tập buổi 12Huế ThùyNo ratings yet

- Cash Generated From Operations Net Cash From Operating ActivitiesDocument8 pagesCash Generated From Operations Net Cash From Operating ActivitiesnickolocoNo ratings yet

- General Accounting 2Document5 pagesGeneral Accounting 2Rheu ReyesNo ratings yet

- Accounting For Price Level Changes 2Document9 pagesAccounting For Price Level Changes 2lil telNo ratings yet

- DDDocument4 pagesDDAmelia Salini100% (1)

- Acc108 Gen 008 p3 Questions and AnswersDocument26 pagesAcc108 Gen 008 p3 Questions and AnswersdgdeguzmanNo ratings yet

- Bruno PPE Note - SolutionDocument4 pagesBruno PPE Note - SolutionizzyhowoNo ratings yet

- Lect 11c Depreciation-Disposals (Part 3)Document17 pagesLect 11c Depreciation-Disposals (Part 3)11Co sarahNo ratings yet

- CAF-07 Assessment-1 Solution: Answer-1 A) Date Particular Dr. Cr. 2015Document5 pagesCAF-07 Assessment-1 Solution: Answer-1 A) Date Particular Dr. Cr. 2015Ali OptimisticNo ratings yet

- Answer-Key Chapter-6 RevisedDocument5 pagesAnswer-Key Chapter-6 RevisedMcy CaniedoNo ratings yet

- Chapter One and 2 Assessment QuestionsDocument6 pagesChapter One and 2 Assessment QuestionsSteven Sanderson100% (3)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Reaction Paper To Chapter 6Document3 pagesReaction Paper To Chapter 6Steven Sanderson100% (1)

- Reaction Report To Student OrientationDocument1 pageReaction Report To Student OrientationSteven SandersonNo ratings yet

- Reaction Paper To Chater 13Document2 pagesReaction Paper To Chater 13Steven Sanderson100% (5)

- Chapters 13, 14, 15, 16 Assessment QuestionsDocument11 pagesChapters 13, 14, 15, 16 Assessment QuestionsSteven Sanderson100% (5)

- Chapters 10,11 and 12 Assessment QuestionsDocument10 pagesChapters 10,11 and 12 Assessment QuestionsSteven Sanderson100% (1)

- Chapters 3,4,5 and 6 Assesment QuestionsDocument10 pagesChapters 3,4,5 and 6 Assesment QuestionsSteven Sanderson100% (4)

- Chapters 7,8,9 Assesment QuestionsDocument9 pagesChapters 7,8,9 Assesment QuestionsSteven Sanderson100% (3)

- Chapter 21 Reaction PaperDocument4 pagesChapter 21 Reaction PaperSteven Sanderson100% (1)

- Acct II - Chapter 15 Lecture NotesDocument4 pagesAcct II - Chapter 15 Lecture NotesSteven Sanderson100% (1)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- Cost BehaviorDocument10 pagesCost BehaviorSteven Sanderson100% (5)

- Statement of Cash Flows - Lecture NotesDocument6 pagesStatement of Cash Flows - Lecture NotesSteven Sanderson100% (8)