Professional Documents

Culture Documents

Asset Exchanged at A Loss: Cost of New Asset Acquired: Loss On Exchange of Old Asset

Asset Exchanged at A Loss: Cost of New Asset Acquired: Loss On Exchange of Old Asset

Uploaded by

Steven Sanderson0 ratings0% found this document useful (0 votes)

8 views1 pageThe document discusses an example of an asset exchange where an old asset with a book value of $5,000 and fair market value of $4,000 was exchanged for a new similar asset plus $10,000 cash. This resulted in a $1,000 loss on disposal that was recorded by debiting loss on disposal and crediting the old asset and cash received accounts. The cost of the new asset was determined to be $14,000.

Original Description:

Original Title

TT 10-K5

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses an example of an asset exchange where an old asset with a book value of $5,000 and fair market value of $4,000 was exchanged for a new similar asset plus $10,000 cash. This resulted in a $1,000 loss on disposal that was recorded by debiting loss on disposal and crediting the old asset and cash received accounts. The cost of the new asset was determined to be $14,000.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageAsset Exchanged at A Loss: Cost of New Asset Acquired: Loss On Exchange of Old Asset

Asset Exchanged at A Loss: Cost of New Asset Acquired: Loss On Exchange of Old Asset

Uploaded by

Steven SandersonThe document discusses an example of an asset exchange where an old asset with a book value of $5,000 and fair market value of $4,000 was exchanged for a new similar asset plus $10,000 cash. This resulted in a $1,000 loss on disposal that was recorded by debiting loss on disposal and crediting the old asset and cash received accounts. The cost of the new asset was determined to be $14,000.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

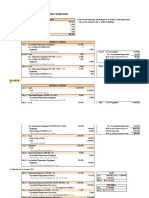

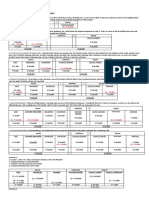

PLANT ASSET DISPOSALS — EXCHANGE OF SIMILAR ASSETS

Asset Exchanged at a Loss

Asset originally purchased on 1/1/96 is exchanged for a similar asset on 1/1/99. Cash of

$10,000 is also paid and the old asset has fair market value of $4,000 on the date of

exchange.

Equipment Accumulated Depreciation-Equipment

20,000 12/31/96 5,000

12/31/97 5,000

12/31/98 5,000

Bal. 15,000

Book Value = $5,000

Entry:

Equipment (new) 14,000

Accumulated Depreciation-Equipment 15,000

Loss on Disposal 1,000

Equipment (old) 20,000

Cash 10,000

Cost of new asset acquired: Loss on exchange of old asset:

Fair value of old asset $ 4,000 Fair value of old asset $ 4,000

Cash paid 10,000 Book value of old asset 5,000

Cost of new asset $14,000 Loss on disposal ($1,000)

Copyright 1999 John Wiley & Sons, Inc. Weygandt/Principles 5e T T 10–K

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Alya Sufi Ikrima0% (1)

- Business Combination ExercisesDocument5 pagesBusiness Combination ExercisesmmNo ratings yet

- Journal TransactionsDocument3 pagesJournal TransactionsFaye Garlitos100% (1)

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Advance AccountingDocument7 pagesAdvance AccountingPutri anjjarwatiNo ratings yet

- Asset Exchanged at A Gain: Cost of New Asset Acquired: Gain On Exchange of Old AssetDocument1 pageAsset Exchanged at A Gain: Cost of New Asset Acquired: Gain On Exchange of Old AssetSteven SandersonNo ratings yet

- Asset Sold at A Gain: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageAsset Sold at A Gain: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven SandersonNo ratings yet

- Asset Is Not Fully Depreciated: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageAsset Is Not Fully Depreciated: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven SandersonNo ratings yet

- Asset Sold at A Loss: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageAsset Sold at A Loss: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven SandersonNo ratings yet

- 8 - Nonmonetary Transactions Problems With SolutionsDocument9 pages8 - Nonmonetary Transactions Problems With Solutionsbusiness docNo ratings yet

- ParCor AccountingDocument2 pagesParCor AccountinggirlieNo ratings yet

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNo ratings yet

- Accounting Chap 9 - Sheet1Document4 pagesAccounting Chap 9 - Sheet1Nguyễn Ngọc MaiNo ratings yet

- (IFA 12) - Rendy Filiang - 1402210324Document6 pages(IFA 12) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Home Assignment Ch.1Document6 pagesHome Assignment Ch.1Sausan SaniaNo ratings yet

- 2nd Training Session 2022 03 14 18 41 46Document24 pages2nd Training Session 2022 03 14 18 41 46Sara PiccioliNo ratings yet

- Tugas Asdos AklDocument6 pagesTugas Asdos AklNicholas AlexanderNo ratings yet

- Fully Depreciated Asset: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eDocument1 pageFully Depreciated Asset: 1999 John Wiley & Sons, Inc. Weygandt/Principles 5eSteven Sanderson100% (1)

- Used Assets Management: by DR ZahirDocument32 pagesUsed Assets Management: by DR Zahirshabbar aliNo ratings yet

- Soal Jawaban AKL CHP 1Document5 pagesSoal Jawaban AKL CHP 1Allpacino DesellaNo ratings yet

- Cash Flow Statement Assignment No. 1 SOLDocument1 pageCash Flow Statement Assignment No. 1 SOLMahmoud IbrahimNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - Partnership FormationDocument3 pagesNUDJPIA FAR AND AFAR SOLUTIONS - Partnership FormationKyla Artuz Dela CruzNo ratings yet

- BusCom Exercises AnswerDocument4 pagesBusCom Exercises AnswerVidgezxc LoriaNo ratings yet

- Training Financial AccountingDocument23 pagesTraining Financial AccountingSara PiccioliNo ratings yet

- Week 4 Managerial AccountingDocument7 pagesWeek 4 Managerial AccountingMari SylvesterNo ratings yet

- Advacc Buscom Prob IIIDocument3 pagesAdvacc Buscom Prob IIIEdward James SantiagoNo ratings yet

- I-11.03 StudentDocument4 pagesI-11.03 StudentDavid GuerraNo ratings yet

- Sherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingDocument7 pagesSherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingSTEFANI NUGRAHANo ratings yet

- Advanced Financial Accounting QuizDocument53 pagesAdvanced Financial Accounting Quizanon nimusNo ratings yet

- Audit of Owner's EquityDocument9 pagesAudit of Owner's EquityHira IdaceiNo ratings yet

- Module 7.2Document9 pagesModule 7.2Althea mary kate MorenoNo ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- IA3 Chapter 14 Problem 31Document3 pagesIA3 Chapter 14 Problem 31Bea TumulakNo ratings yet

- 2 Primary Sources of Equity (Assets - Liabilities Equity) : The Components of CapitalDocument3 pages2 Primary Sources of Equity (Assets - Liabilities Equity) : The Components of Capitalramirezp3No ratings yet

- Andrew's Sa... Service - SARAY 2Document2 pagesAndrew's Sa... Service - SARAY 2Laiza Cristella SarayNo ratings yet

- Reporting & Interpreting Investments in Other CorporationsDocument12 pagesReporting & Interpreting Investments in Other CorporationslelydiNo ratings yet

- PPE Acquisition and Borrowing CostDocument3 pagesPPE Acquisition and Borrowing Cost夜晨曦No ratings yet

- BA 118.3 (D. Salazar/R. Placido/K. Dela Cruz)Document6 pagesBA 118.3 (D. Salazar/R. Placido/K. Dela Cruz)Ian De Dios100% (1)

- 580621Document5 pages580621mohitgaba19No ratings yet

- Remi DadaDocument1 pageRemi DadaaderemidadaNo ratings yet

- Case 5-1Document4 pagesCase 5-1fitriNo ratings yet

- ACCOUNTINGDocument7 pagesACCOUNTINGphiateves.21No ratings yet

- Depletion IFRS Vs ASPE Simple DemoDocument4 pagesDepletion IFRS Vs ASPE Simple DemonishitNo ratings yet

- 9 1Document2 pages9 1laale dijaanNo ratings yet

- Chapter9 MaDocument2 pagesChapter9 MaLele MaNo ratings yet

- Tugas 4 - ELRISKA TIFFANI - 142200111Document6 pagesTugas 4 - ELRISKA TIFFANI - 142200111Elriska Tiffani75% (4)

- Soal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)Document2 pagesSoal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)SECRET MENUNo ratings yet

- E Chapter 10Document8 pagesE Chapter 10Sarah QuinnNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- Chapter 10 in Class Problems DAY 2 SolutionsDocument2 pagesChapter 10 in Class Problems DAY 2 SolutionsAbdullah alhamaadNo ratings yet

- ค ำตอบบทฝึกหัดที่ 11 ที่ดิน อำคำรและอุปกรณ์ ทรัพยำกรธรรมชำติและสินทรัพย์ที่ไม่มีตัวตน ข้อ 1. General JournalDocument4 pagesค ำตอบบทฝึกหัดที่ 11 ที่ดิน อำคำรและอุปกรณ์ ทรัพยำกรธรรมชำติและสินทรัพย์ที่ไม่มีตัวตน ข้อ 1. General Journaltoon095105No ratings yet

- Accounting Chap 11Document3 pagesAccounting Chap 11Khanh KimNo ratings yet

- Chapter 02 - Consolidation of Financial Information: PROBLEMS 2-20, 2-21, 2-27, 2-22Document33 pagesChapter 02 - Consolidation of Financial Information: PROBLEMS 2-20, 2-21, 2-27, 2-22Su Ed100% (1)

- Assignment On ACT in Primeasia UniversityDocument8 pagesAssignment On ACT in Primeasia UniversityMaria khanNo ratings yet

- AsasassaDocument3 pagesAsasassaIden PratamaNo ratings yet

- Stafford Press QuestionDocument4 pagesStafford Press QuestionVishal ShuklaNo ratings yet

- Notes Accounting Equation ExamplesDocument2 pagesNotes Accounting Equation ExamplesKaren Grace AntolijaoNo ratings yet

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Chapters 3,4,5 and 6 Assesment QuestionsDocument10 pagesChapters 3,4,5 and 6 Assesment QuestionsSteven Sanderson100% (4)

- Reaction Paper To Chapter 6Document3 pagesReaction Paper To Chapter 6Steven Sanderson100% (1)

- Chapters 10,11 and 12 Assessment QuestionsDocument10 pagesChapters 10,11 and 12 Assessment QuestionsSteven Sanderson100% (1)

- Chapters 13, 14, 15, 16 Assessment QuestionsDocument11 pagesChapters 13, 14, 15, 16 Assessment QuestionsSteven Sanderson100% (5)

- Reaction Paper To Chater 13Document2 pagesReaction Paper To Chater 13Steven Sanderson100% (5)

- Reaction Report To Student OrientationDocument1 pageReaction Report To Student OrientationSteven SandersonNo ratings yet

- Chapters 7,8,9 Assesment QuestionsDocument9 pagesChapters 7,8,9 Assesment QuestionsSteven Sanderson100% (3)

- Chapter 21 Reaction PaperDocument4 pagesChapter 21 Reaction PaperSteven Sanderson100% (1)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Chapter One and 2 Assessment QuestionsDocument6 pagesChapter One and 2 Assessment QuestionsSteven Sanderson100% (3)

- Acct II - Chapter 15 Lecture NotesDocument4 pagesAcct II - Chapter 15 Lecture NotesSteven Sanderson100% (1)

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- Cost BehaviorDocument10 pagesCost BehaviorSteven Sanderson100% (5)

- Statement of Cash Flows - Lecture NotesDocument6 pagesStatement of Cash Flows - Lecture NotesSteven Sanderson100% (8)