Professional Documents

Culture Documents

ROO Comparative Table - Working Draft

Uploaded by

diwalikhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ROO Comparative Table - Working Draft

Uploaded by

diwalikhaCopyright:

Available Formats

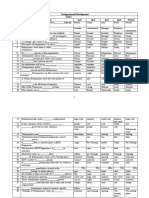

ASEAN – Australia/ ASEAN Trade in Goods Japan-Philippines Economic Partnership

New Zealand Agreement (ATIGA) Agreement (JPEPA)

(AANZFTA)

Basic rules of origin RVC (40) RVC (40) -RVC

CTC (4-digit) CTC (4-digit) -change in tariff classification

Co-equal Co-equal -specific manufacturing /processing operation

Cumulation approach Regional Cumulation permitted Full cumulation permitted across ATIGA Bilateral cumulation permitted

across AANZFTA Provided inputs each satisfy RVC or CTC rule

provided inputs each

satisfy RVC or CTC rule Partial cumulation

permitted in RVC calculation on pro rata

basis where RVC is at least 20%

RVC Calculation Direct formula (build-up method) or Direct formula (build-up method) or Direct formula (build-up method)

Indirect formula (build-down method) Indirect formula (build-down method)

De Minimis Rule 2 Rules: 1 Rule de minimis- product specific

(1) For goods other than Non-CTC qualified

textiles and apparel in inputs allowed up to 10

HS 50-63, non-CTC percent of FOB value of

qualified inputs up to 10 final good

percent of FOB value of

final product allowed

(2) For textiles and

apparel in HS 50-63,

non-CTC qualified up to

(a) 10 percent of value

or (b) 10 percent of total

weight allowed.

Pre-export Examination Yes – Exporter to request as basis for Yes – Exporter to request as basis for Yes – Exporter to request as basis for

supporting evidence of origin supporting evidence of origin supporting evidence of origin

Exporter Application Written application to Written application to Written application to

issuing authorities with issuing authorities with issuing authorities with

prescribed minimum data prescribed minimum data prescribed minimum data

Certificate of Origin Unique Certificate number Unique Certificate number Unique Certificate number

Original plus two copies Original plus two copies Original plus two copies

Official seal / signature of issuing body Official seal / signature of issuing body Official seal / signature of issuing body

Specified minimum data requirements Specified minimum data requirements Specified minimum data requirements

Issued within 3 days of export Issued within 3 days of export

Period of Validity 12 months 12 months 12 months

Retroactive Issuance Yes – Up to 12 months Yes – Up to 12 months Yes – Up to 12 months

Action by Importer Submit original copy of Certificate Submit original copy of Certificate -Submit original copy of Certificate plus triplicate

at time of import declaration at time of import declaration copy at time of import declaration.

-Triplicate copy sent back to issuing authority in

exporting country

No Certificate Required No certificate required for goods valued at less No certificate required for goods valued at less No exemption specified in

than US$ 200 FOB than US$ 200 FOB OCPs for the JPEPA

Back-to-Back Certificates Yes – required in transhipment cases Yes – required in transhipment cases no back-toback CO

Verification Procedure Yes – after the fact Yes – after the fact verification where Yes – after the fact verification

verification where considered necessary considered necessary where considered necessary

Record Keeping Issuing body, exporter and importer to keep Issuing body, exporter and -Issuing body to keep records for at least 2 years.

relevant records for 3 years importer to keep relevant -Exporter to retain “Quadruplicate” copy for 12

records for 3 years months.

-have the simplest rule

-generally liberal most complicated and restrictive, less lenient

-characterized by generality in application

ASEAN – Japan ASEAN – Korea ASEAN – India ASEAN – China

Comprehensive Economic Trade in Goods Trade in Goods Trade in Goods

Partnership Agreement Agreement Agreement

Basic rules of origin RVC (40) RVC (40) RVC (35) Plus CTSH RVC (40)

CTC (4-digit) CTC (4-digit)

Co-equal Co-equal

Cumulation approach Diagonal Cumulation permitted across Diagonal Cumulation permitted across Diagonal Cumulation permitted Diagonal Cumulation permitted

participating countries participating countries across all RTA Parties across all RTA Parties provided inputs

provided inputs each satisfy Provided inputs each satisfy provided inputs each each satisfy RVC (40)

RVC or CTC rule RVC or CTC rule satisfy RVC(35)+CTSH rule rule

RVC Calculation Indirect formula (build-down Direct formula (buildup method) or Direct formula (build-up Modified Indirect formula designed to

method) only Indirect formula (build-down method) method) or show non-originating content of

≤ 60 percent.

Modified Indirect formula

designed to show non-originating In practice, direct method of

content of <65 percent calculation is also allowed.

De Minimis Rule 3 Rules: 2 Rules: Not applicable. Not applicable.

(1) For goods in HS (1) For goods other No CTC ROO. No CTC ROO.

16,19,20,22,23,28 through 49 than textiles and

and 64 through 97, non-CTC apparel in HS 50-63,

qualified inputs up to 10 non-CTC qualified up

percent of FOB value of final to 10 percent of value

product allowed allowed

(2) For goods in HS 18 and (2) For textiles and

21, non-CTC qualified inputs apparel in HS 50-63,

allowed up to 10 % or 7% of non-CTC qualified up

FOB value as per annex 2 to 10 percent of total

(3) For textiles and apparel in weight allowed.

HS 50-63, non-CTC qualified

up to 10 percent of total

weight allowed.

Pre-export Examination Yes as provided in the Yes – Exporter to request Yes – Exporter to request as Yes – Exporter to request as

Implementing Regulations as basis for supporting basis for supporting evidence basis for supporting evidence

evidence of origin of origin of origin

Exporter Application Written application to Written application to Written application to issuing Written application to issuing

issuing authorities with issuing authorities with authorities with prescribed authorities with prescribed

prescribed minimum data prescribed minimum data minimum data minimum data

and proof of origin of goods

Certificate of Origin Unique Certificate number Unique Certificate number Unique Certificate number Unique Certificate number

Original plus two copies Original plus two copies Original plus three copies Original plus three copies

Official seal / signature of issuing body Official seal / signature of issuing body Official seal/sign.of issuing body Official seal/signature of issuing body

Specified minimum data requirements Specified minimum data requirements Dedicated form / data requirements Dedicated form / data requirements

Issued within 3 days of export Issued within 3 days of export

Period of Validity 12 months 6 months 12 months Normally 4 months

6 months when transhipped

through a non-Party

Retroactive Issuance Yes – Up to 12 months Yes – Up to 12 months Yes – Up to 12 months Yes – Up to 12 months

Action by Importer Submit original copy of Submit original copy -Submit original copy of -Submit original copy of

Certificate at time of import of Certificate at time of Certificate plus triplicate copy Certificate plus triplicate copy

declaration import declaration at time of import declaration. at time of import declaration.

-Triplicate copy sent back to -Triplicate copy sent back to

issuing authority in exporting issuing authority in exporting

country country

No Certificate Required No certificate required for No certificate required for No exemption specified in No Certificate is required for

goods valued a goods valued at less than OCPs for the AIFTA goods valued at less than

US$ 200 FOB US$ 200 FOB

Back-to-Back Certificates Yes – required in Yes – required in Yes – required in No provision

transhipment cases transhipment cases transhipment cases

Verification Procedure Yes – after the fact Yes – after the fact Yes – after the fact verification Yes – after the fact verification

verification where verification where where considered necessary where considered necessary

considered necessary considered necessary

Record Keeping Issuing body, exporter and Issuing body, exporter Issuing body to keep records Issuing body to keep records

importer to keep relevant and importer to keep for at least 2 years. Exporter for at least 2 years. Exporter

records for 3 years relevant records for 3 to retain “Quadruplicate” to retain “Quadruplicate”

years copy for 12 months. copy for 12 months.

ess symmetric than ACFTA but more Most simple and most symmetric,

flexible; however, the lack of alternative rule

could be constraining

You might also like

- Issuance of Import Permit (Ip), Special Permit (SP), and Export Permit (Ep)Document2 pagesIssuance of Import Permit (Ip), Special Permit (SP), and Export Permit (Ep)shirley sanchezNo ratings yet

- Share FileDocument3 pagesShare File张正No ratings yet

- Form VN-CUDocument2 pagesForm VN-CUkatacumiNo ratings yet

- Adittional Info:-: in Short:-In Above Both Payment Term, Bank Intervention Requires in Documents ProcessDocument2 pagesAdittional Info:-: in Short:-In Above Both Payment Term, Bank Intervention Requires in Documents Processsanraaj66No ratings yet

- Tax NotesDocument13 pagesTax NotesJotham Delfin FunclaraNo ratings yet

- (ADDENDUM) Procurement Checklist v1.2Document2 pages(ADDENDUM) Procurement Checklist v1.2FLORES CHARLESNo ratings yet

- Lumbera NotesDocument7 pagesLumbera NotesElizabeth LotillaNo ratings yet

- For Importer and ExporterDocument4 pagesFor Importer and ExporterShivaniNo ratings yet

- LOI-Brazil Chic PawsDocument3 pagesLOI-Brazil Chic PawsMalcolm OngNo ratings yet

- SR - No - Particulars Details: Form IDocument3 pagesSR - No - Particulars Details: Form IHannah Olivar100% (1)

- Valuation of An Acquisition: Oggy and The CockroachesDocument36 pagesValuation of An Acquisition: Oggy and The CockroachescristianoNo ratings yet

- Sop - Pibo'S: ULB Endorsement Agreement of WMA With PWPFDocument2 pagesSop - Pibo'S: ULB Endorsement Agreement of WMA With PWPFPriyankaNo ratings yet

- ROO Slides - Outreach Session On CPTPP and RCEPDocument30 pagesROO Slides - Outreach Session On CPTPP and RCEPWinson Chong Wen ShanNo ratings yet

- Annex C - TCVC (Individual)Document3 pagesAnnex C - TCVC (Individual)cbsacctg0920No ratings yet

- Documentary Requirements-1 OkDocument74 pagesDocumentary Requirements-1 OkAngierose Simon GarnaceNo ratings yet

- 1.3 Libya Customs Information: Duties and Tax ExemptionDocument3 pages1.3 Libya Customs Information: Duties and Tax ExemptionMohamed SulimanNo ratings yet

- CHECKLIST 1st 2nd Succeeding Month Salary ClaimsDocument2 pagesCHECKLIST 1st 2nd Succeeding Month Salary ClaimsrizaNo ratings yet

- Presentation of GeneratorDocument18 pagesPresentation of Generatorapi-3834081100% (1)

- Checklist of Requirements For The Registration of An in Vitro Diagnostic DeviceDocument1 pageChecklist of Requirements For The Registration of An in Vitro Diagnostic DeviceRosenda MonetteNo ratings yet

- Mera Pakistan, Mera Ghar: (NAPHDA Projects) (Non-NAPHDA) (Non-NAPHDA)Document2 pagesMera Pakistan, Mera Ghar: (NAPHDA Projects) (Non-NAPHDA) (Non-NAPHDA)Hur Hussain SyedNo ratings yet

- SCR Proc Process OS LIDocument1 pageSCR Proc Process OS LISinzianaNo ratings yet

- Qualification. Ffre Technicui - Iit"ri, Is To or of in Oiln A Oi, Ru - "LuntDocument4 pagesQualification. Ffre Technicui - Iit"ri, Is To or of in Oiln A Oi, Ru - "LuntmoonimaNo ratings yet

- Chapter 1Document30 pagesChapter 1Christine ChuaNo ratings yet

- Procurement Checklist v1.2Document18 pagesProcurement Checklist v1.2FLORES CHARLES100% (1)

- Ae 28 Worksheet 3Document4 pagesAe 28 Worksheet 3Jomar PorterosNo ratings yet

- Evolution of TP in Sri LankaDocument13 pagesEvolution of TP in Sri Lankahiran meneripitiyaNo ratings yet

- Check List For New ConnectionDocument5 pagesCheck List For New Connectionmuhammad.wajahat194No ratings yet

- PRPA ChecklistDocument1 pagePRPA ChecklistJaydison AniwerNo ratings yet

- Csa 23 9078sup 00010720230208Document4 pagesCsa 23 9078sup 00010720230208Vijay PandeyNo ratings yet

- E & J Oil & Gas LLC Sco Sept 2023Document3 pagesE & J Oil & Gas LLC Sco Sept 2023hendrick villegas100% (1)

- Corp Control Project Reporte Renzo 11 22Document51 pagesCorp Control Project Reporte Renzo 11 22Rubi Jara HidalgoNo ratings yet

- 4.2 Documents Under GST, Books & RecordsDocument45 pages4.2 Documents Under GST, Books & Recordsvenkatesh grietNo ratings yet

- Minister of Trade Regulation Number 36 of 2023 For Electronic ProductDocument34 pagesMinister of Trade Regulation Number 36 of 2023 For Electronic ProductSalmon JosefianoNo ratings yet

- Stock Transfer OrderDocument15 pagesStock Transfer OrderAman SiddiquiNo ratings yet

- (The Bidder Shall Fill in This Form in Accordance With The Instructions Indicated No Alterations ToDocument5 pages(The Bidder Shall Fill in This Form in Accordance With The Instructions Indicated No Alterations Toa769No ratings yet

- Schedule of Charges BandhanDocument3 pagesSchedule of Charges BandhanSoumya ChatterjeeNo ratings yet

- Functional Template E-Invoice Template - 1june2021Document490 pagesFunctional Template E-Invoice Template - 1june2021AkshayNo ratings yet

- Custom Tax l5v1 (Autosaved)Document78 pagesCustom Tax l5v1 (Autosaved)MadhuNo ratings yet

- ASEAN India OCP PDFDocument2 pagesASEAN India OCP PDFCha CahNo ratings yet

- Advance License 5Document26 pagesAdvance License 5Rachit GoelNo ratings yet

- Bandhan MF - STP FormDocument2 pagesBandhan MF - STP FormserviceNo ratings yet

- RA Document RA DetailsDocument7 pagesRA Document RA DetailsBrij TradelinkNo ratings yet

- Checklist For Partnership ConcernDocument9 pagesChecklist For Partnership Concernm3788999No ratings yet

- Road Permits State WiseDocument16 pagesRoad Permits State WiseSanjay MehtaNo ratings yet

- FlowchartDocument2 pagesFlowchartSunil Kumar Dadwal RuhelaNo ratings yet

- Oracle Applications EBS - Accounting EntriesDocument31 pagesOracle Applications EBS - Accounting EntriesBeverly Baker-Harris100% (1)

- LIBF Level 4 Certificate For Documentary Credit Specialists (CDCS)Document10 pagesLIBF Level 4 Certificate For Documentary Credit Specialists (CDCS)Abhinav GuptaNo ratings yet

- Guerrero, Luis V PDFDocument3 pagesGuerrero, Luis V PDFAlbert MosesNo ratings yet

- Tendernotice 1Document7 pagesTendernotice 1Hari Krishna RajuNo ratings yet

- Are 3Document3 pagesAre 3vikalpnNo ratings yet

- China FJ fj3 enDocument7 pagesChina FJ fj3 enjverdugo272015No ratings yet

- All About Logistics CostDocument10 pagesAll About Logistics Costyesilda periabrasNo ratings yet

- Charts DTDocument57 pagesCharts DTAayushi AayushiNo ratings yet

- 1100 Hours 204Document27 pages1100 Hours 204UmairNo ratings yet

- TAX ExciseDocument30 pagesTAX ExcisefharooksNo ratings yet

- Compliance Calendar - 0Document37 pagesCompliance Calendar - 0Mohit DudheriaNo ratings yet

- Standard Schedule of Charges For SB-CA-NRI-July 1 2016Document4 pagesStandard Schedule of Charges For SB-CA-NRI-July 1 2016Vasundhara GuptaNo ratings yet

- Sample 2023 Export Pricing Incoterms (En)Document4 pagesSample 2023 Export Pricing Incoterms (En)Phạm Hoài ThươngNo ratings yet

- Reg 43 Inspection Fees Reg 43 Inspection Fees Reg 43 Inspection FeesDocument1 pageReg 43 Inspection Fees Reg 43 Inspection Fees Reg 43 Inspection FeesAyyasamy PeriyathambiNo ratings yet

- CSC Resolutions - Thematic DoctrinesDocument6 pagesCSC Resolutions - Thematic DoctrinesdiwalikhaNo ratings yet

- Taxation 1 Carag SyllabusDocument4 pagesTaxation 1 Carag SyllabusdiwalikhaNo ratings yet

- UP College of Law Curriculum PDFDocument1 pageUP College of Law Curriculum PDFFroilan Richard RamosNo ratings yet

- ROO Comparative Table - Working DraftDocument4 pagesROO Comparative Table - Working DraftdiwalikhaNo ratings yet

- Jpepa Main TextDocument121 pagesJpepa Main TextNO DEAL! MovementNo ratings yet

- 2010 NIHL Moot ProblemDocument10 pages2010 NIHL Moot ProblemdiwalikhaNo ratings yet

- Chapter XI - Financing The Corporation Capital StructureDocument14 pagesChapter XI - Financing The Corporation Capital StructurediwalikhaNo ratings yet

- Philippine Laws On WomenDocument56 pagesPhilippine Laws On WomenElle BanigoosNo ratings yet

- Adv Accounts RTP M19Document35 pagesAdv Accounts RTP M19Harshwardhan PatilNo ratings yet

- Statement by Bob Rae On The Death of Don SmithDocument1 pageStatement by Bob Rae On The Death of Don Smithbob_rae_a4No ratings yet

- Calalang Vs WilliamsDocument2 pagesCalalang Vs Williamsczabina fatima delicaNo ratings yet

- Ultra 3000 Drive (2098-In003 - En-P)Document180 pagesUltra 3000 Drive (2098-In003 - En-P)Robert BarnetteNo ratings yet

- Adverb18 Adjective To Adverb SentencesDocument2 pagesAdverb18 Adjective To Adverb SentencesjayedosNo ratings yet

- Unit - I - MCQDocument3 pagesUnit - I - MCQDrSankar CNo ratings yet

- Experience Rafting and Camping at Rishikesh-1 Night-2 Days PDFDocument4 pagesExperience Rafting and Camping at Rishikesh-1 Night-2 Days PDFAMAN KUMARNo ratings yet

- ManeDocument2 pagesManeMukesh Manwani100% (2)

- Loss or CRDocument4 pagesLoss or CRJRMSU Finance OfficeNo ratings yet

- Sum09 Siena NewsDocument8 pagesSum09 Siena NewsSiena CollegeNo ratings yet

- Position Paper in Purposive CommunicationDocument2 pagesPosition Paper in Purposive CommunicationKhynjoan AlfilerNo ratings yet

- Short Term Financial Management 3rd Edition Maness Test BankDocument5 pagesShort Term Financial Management 3rd Edition Maness Test Bankjuanlucerofdqegwntai100% (16)

- Circular Motion & Centripetal Force: StarterDocument12 pagesCircular Motion & Centripetal Force: StarterJhezreel MontefalcoNo ratings yet

- Ang vs. TeodoroDocument2 pagesAng vs. TeodoroDonna DumaliangNo ratings yet

- Yanmar 3TNV88XMS 3TNV88XMS2 4TNV88XMS 4TNV88XMS2 Engines: Engine Parts ManualDocument52 pagesYanmar 3TNV88XMS 3TNV88XMS2 4TNV88XMS 4TNV88XMS2 Engines: Engine Parts Manualshajesh100% (1)

- Energy Investor's Guidebook 2013 (Philippines)Document149 pagesEnergy Investor's Guidebook 2013 (Philippines)idoru_m015No ratings yet

- Introduction To The Study of RizalDocument2 pagesIntroduction To The Study of RizalCherry Mae Luchavez FloresNo ratings yet

- Music Scrap BookDocument38 pagesMusic Scrap BookKaanthi PendemNo ratings yet

- El Kanah-The Jealous GodDocument12 pagesEl Kanah-The Jealous GodspeliopoulosNo ratings yet

- SPF 5189zdsDocument10 pagesSPF 5189zdsAparna BhardwajNo ratings yet

- Rfso S A0011749958 1Document3 pagesRfso S A0011749958 1Marian DimaNo ratings yet

- Lancesoft Offer LetterDocument5 pagesLancesoft Offer LetterYogendraNo ratings yet

- Promises During The Elections and InaugurationDocument3 pagesPromises During The Elections and InaugurationJessa QuitolaNo ratings yet

- Allied Banking Corporation V BPIDocument2 pagesAllied Banking Corporation V BPImenforever100% (3)

- Situational Prevention and The Reduction of White Collar Crime by Dr. Neil R. VanceDocument22 pagesSituational Prevention and The Reduction of White Collar Crime by Dr. Neil R. VancePedroNo ratings yet

- Full Download Test Bank For Effective Police Supervision 8th Edition Larry S Miller Harry W More Michael C Braswell 2 PDF Full ChapterDocument36 pagesFull Download Test Bank For Effective Police Supervision 8th Edition Larry S Miller Harry W More Michael C Braswell 2 PDF Full Chapteralterityfane.mah96z100% (12)

- BACK EmfDocument12 pagesBACK Emfarshad_rcciitNo ratings yet

- Beta Theta Pi InformationDocument1 pageBeta Theta Pi Informationzzduble1No ratings yet

- Family Budget': PSP 3301 Household Financial Management Assignment 4Document2 pagesFamily Budget': PSP 3301 Household Financial Management Assignment 4DenzNishhKaizerNo ratings yet