Professional Documents

Culture Documents

CBWeeklyReport 13.02

Uploaded by

ran2013Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBWeeklyReport 13.02

Uploaded by

ran2013Copyright:

Available Formats

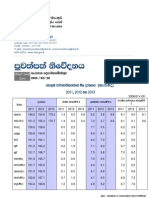

GOVERNMENT SECURITIES MARKET

WEEKLY SUMMARY OF PRIMARY & SECONDARY MARKET TRANSACTIONS

AND WEIGHTED AVERAGE YIELD RATES

Item / Week Ended

Outstanding Stock of Government Securities

Treasury Bills

Outstanding

o/w. amounts held by PDs

o/w. amounts held by Foreign Investors

Treasury Bonds

Outstanding

o/w. amounts held by PDs

o/w. amounts held by Foreign Investors

Primary Issues

Treasury Bills

Amount Offered

Total Bids Received

Total Bids Accepted

Treasury Bonds

Amount Offered

Total Bids Received

Total Bids Accepted

Latest Primary Issues

Treasury Bills

<=91 days

<=182 days

<=364 days

Treasury Bonds

<2 year Last Issue

2 year

Last Issue

3 year

Last Issue

4 year

Last Issue

5 year

Last Issue

6 year

Last Issue

10 year Last Issue

15 year Last Issue

20 year Last Issue

02/08/2012

24/01/2013

02/08/2012

15/02/2013

02/08/2012

02/07/2012

01/02/2013

01/02/2012

Week Ending

Week Ending

Item / Week Ended

Week Ending

13-Feb-2013

06-Feb-2013

Secondary Market

13-Feb-2013

Rs Mn

Rs Mn

785,762

69,955

58,330

758,695

73,953

60,125

2,616,100

24,221

412,814

2,616,100

24,361

412,794

15,000

39,803

24,431

20,000

44,745

20,390

2,000

10,250

4,300

0

0

0

9.1000 %

10.0800 %

11.1000 %

9.2500 %

10.1600 %

11.1100 %

0.0000 %

13.6200 %

10.9800 %

14.1000 %

10.7300 %

14.2500 %

14.7500 %

12.2100 %

11.0000 %

0.0000 %

13.6200 %

10.9800 %

14.1000 %

10.7400 %

14.2500 %

14.7500 %

12.2100 %

11.0000 %

Weighted Average Yield Rates

Treasury Bills

Purchased

<=91 days

<=182 days

<=364 days

Sold

<=91 days

<=182 days

<=364 days

After Tax

Treasury Bonds

Purchased

<=1 year

<=2 year

<=3 year

<=4 year

<=5 year

<=10 year

<=15 year

>15 year

Sold

<=1 year

<=2 year

<=3 year

<=4 year

<=5 year

<=10 year

<=15 year

>15 year

Week Ending

06-Feb-2013

After Tax

9.10%

10.05%

11.10%

9.30%

10.30%

11.10%

9.00%

9.95%

11.03%

9.20%

10.20%

11.00%

0.00%

11.00%

11.00%

10.90%

10.90%

0.00%

0.00%

0.00%

0.00%

10.70%

10.80%

10.85%

10.86%

0.00%

0.00%

0.00%

0.00%

10.70%

10.80%

10.75%

10.86%

0.00%

0.00%

0.00%

0.00%

10.60%

10.70%

10.75%

10.80%

0.00%

0.00%

0.00%

Secondary Market Yield Curves

17.0

16.0

14,036

33,644

28,682

20,042

43,205

18,184

2,000

1,855

18,197

17,822

132,095

11,857

152,335

11,810

12.0

10.0

8.0

7.5

da

ys

<=

18

2

da

ys

<=

1

ye

ar

<=

2

ye

ar

<=

3

ye

ar

<=

4

ye

ar

<=

5

ye

ar

<=

10

ye

ar

<=

15

ye

ar

>1

5

ye

ar

10,049

21,031

<=

91

Yield

14.0

Secondary market Activities

Treasury Bills

Outright Transactions

Purchased

Sold

Repo Transactions

Repurchase

Reverse Repurchase

Treasury Bonds

Outright Transactions

Purchased

Sold

Repo Transactions

Repurchase

Reverse Repurchase

Maturity

ThisWeek

LastWeek

LastMonth

Treasury Bonds

7 Years Last Issue 16/04/2012 12.50%

8 Years Last Issue 01/02/2013 11.44%

9 Years Last Issue 15/09/2011 09.00%

12 Yeras Last Issue 17/10/2011 09.15%

The yield rates of Treasury bills in the primary market auction held on February 13,2013 showed a decrease for all three maturities. The Treasury bill auction was

oversubscribed with Rs.39,803 million of bids received against the offered amount of Rs. 15,000 million. Rs. 24,431 million was accepted.

The total outright transactions reported by primary dealers for the week ending February 13,2013 amounted to Rs. 34,935 million, of which Rs. 3,855 million was reported

for Treasury bonds and Rs . 31,080 million was reported for Treasury bills. The repurchase and reverse repurchase transactions by primary dealers amounted to Rs.192,675

million for the same period.

Source : Primary Dealer Weekly Reporting System, Public Debt Department, CBSL

You might also like

- Daily Trade Journal - 23.05.2013Document7 pagesDaily Trade Journal - 23.05.2013Randora LkNo ratings yet

- Daily Trade Journal - 19.08.2013Document6 pagesDaily Trade Journal - 19.08.2013Randora LkNo ratings yet

- Central Bank of Sri Lanka: Selected Weekly Economic IndicatorsDocument12 pagesCentral Bank of Sri Lanka: Selected Weekly Economic Indicatorsran2013No ratings yet

- Daily Trade Journal - 19.06.2013Document7 pagesDaily Trade Journal - 19.06.2013Randora LkNo ratings yet

- Daily Trade Journal - 17.09.2013Document6 pagesDaily Trade Journal - 17.09.2013ishara-gamage-1523No ratings yet

- Daily Trade Journal - 11.09.2013Document6 pagesDaily Trade Journal - 11.09.2013Randora LkNo ratings yet

- Daily Trade Journal - 17.01.2014Document6 pagesDaily Trade Journal - 17.01.2014Randora LkNo ratings yet

- Daily Trade Journal - 04.10.2013Document6 pagesDaily Trade Journal - 04.10.2013Randora LkNo ratings yet

- Index Spikes Around An Important Technical Level at 5,900..Document6 pagesIndex Spikes Around An Important Technical Level at 5,900..Randora LkNo ratings yet

- Indices Hinges On Positive Territory Amidst Strong TurnoverDocument6 pagesIndices Hinges On Positive Territory Amidst Strong TurnoverRandora LkNo ratings yet

- Daily Trade Journal - 15.07.2013Document6 pagesDaily Trade Journal - 15.07.2013Randora LkNo ratings yet

- Daily Trade Journal - 14.05.2013Document6 pagesDaily Trade Journal - 14.05.2013Randora LkNo ratings yet

- Daily Trade Journal - 11.03.2014Document6 pagesDaily Trade Journal - 11.03.2014Randora LkNo ratings yet

- Daily Trade Journal - 17.06.2013Document7 pagesDaily Trade Journal - 17.06.2013Randora LkNo ratings yet

- Daily Trade Journal - 03.07.2013Document6 pagesDaily Trade Journal - 03.07.2013Randora LkNo ratings yet

- Index Reversed But On A Slow Note : Wednesday, July 10, 2013Document7 pagesIndex Reversed But On A Slow Note : Wednesday, July 10, 2013Randora LkNo ratings yet

- Daily Trade Journal - 09.07.2013Document6 pagesDaily Trade Journal - 09.07.2013Randora LkNo ratings yet

- Daily Trade Journal - 08.08.2013Document6 pagesDaily Trade Journal - 08.08.2013Randora LkNo ratings yet

- Daily Trade Journal - 14.11.2013Document6 pagesDaily Trade Journal - 14.11.2013Randora LkNo ratings yet

- Clothes & Cosmetics-B.planDocument7 pagesClothes & Cosmetics-B.planmgNo ratings yet

- Daily Trade Journal - 26.06.2013Document7 pagesDaily Trade Journal - 26.06.2013Randora LkNo ratings yet

- FSK ProjectDocument16 pagesFSK Projectlaiba khanNo ratings yet

- Daily Trade Journal - 29.07.2013Document6 pagesDaily Trade Journal - 29.07.2013Randora LkNo ratings yet

- Daily Trade Journal - 24.12.2013Document6 pagesDaily Trade Journal - 24.12.2013Randora LkNo ratings yet

- Daily Trade Journal - 30.01.2014Document6 pagesDaily Trade Journal - 30.01.2014Randora LkNo ratings yet

- Daily Trade Journal - 18.06.2013Document7 pagesDaily Trade Journal - 18.06.2013Randora LkNo ratings yet

- Plastics - B. PlanDocument7 pagesPlastics - B. PlanmgNo ratings yet

- Daily Trade Journal - 24.10.2013Document6 pagesDaily Trade Journal - 24.10.2013Randora LkNo ratings yet

- Daily Trade Journal - 13.09.2013Document6 pagesDaily Trade Journal - 13.09.2013Randora LkNo ratings yet

- Daily Trade Journal - 08.10.2013Document6 pagesDaily Trade Journal - 08.10.2013Randora LkNo ratings yet

- Daily Trade Journal - 30.09.2013Document6 pagesDaily Trade Journal - 30.09.2013Randora LkNo ratings yet

- Daily Trade Journal - 07.08.2013Document6 pagesDaily Trade Journal - 07.08.2013Randora LkNo ratings yet

- Daily Trade Journal - 04.09.2013Document6 pagesDaily Trade Journal - 04.09.2013Randora LkNo ratings yet

- BudgetBrief2012 PDFDocument90 pagesBudgetBrief2012 PDFIdara Tehqiqat Imam Ahmad RazaNo ratings yet

- Daily Trade Journal - 30.08.2013Document6 pagesDaily Trade Journal - 30.08.2013Randora LkNo ratings yet

- Daily Trade Journal - 31.10.2013Document6 pagesDaily Trade Journal - 31.10.2013Randora LkNo ratings yet

- 1390-Quarterly Fiscal Bulletin 4Document44 pages1390-Quarterly Fiscal Bulletin 4Macro Fiscal PerformanceNo ratings yet

- Month March 11-2012 CDocument30 pagesMonth March 11-2012 Calinazim55No ratings yet

- JLR bond valuation and refinancing strategyDocument4 pagesJLR bond valuation and refinancing strategyDante Gustilo0% (2)

- Indices Extend Bullish Sentiment YTD Net Foreign Inflow at LKR1.2 BNDocument6 pagesIndices Extend Bullish Sentiment YTD Net Foreign Inflow at LKR1.2 BNRandora LkNo ratings yet

- Business ProjectDocument16 pagesBusiness Projectlaiba khanNo ratings yet

- Daily Trade Journal - 10.01.2014Document6 pagesDaily Trade Journal - 10.01.2014Randora LkNo ratings yet

- Presentation 2Q13Document17 pagesPresentation 2Q13Multiplan RINo ratings yet

- Index Flat Deals in JKH Boost Turnover : Tuesday, July 30, 2013Document6 pagesIndex Flat Deals in JKH Boost Turnover : Tuesday, July 30, 2013Randora LkNo ratings yet

- Daily Trade Journal - 06.12.2013Document6 pagesDaily Trade Journal - 06.12.2013Randora LkNo ratings yet

- Punj Lloyd Result UpdatedDocument11 pagesPunj Lloyd Result UpdatedAngel BrokingNo ratings yet

- Daily Trade Journal - 28.08.2013Document6 pagesDaily Trade Journal - 28.08.2013Randora LkNo ratings yet

- Daily Trade Journal - 20.02.2014Document6 pagesDaily Trade Journal - 20.02.2014Randora LkNo ratings yet

- Carson Cumber BatchDocument166 pagesCarson Cumber Batchmgm2424No ratings yet

- 1392-Quarterly Fiscal Bulletin 2Document45 pages1392-Quarterly Fiscal Bulletin 2Macro Fiscal PerformanceNo ratings yet

- Assignment Solution - Yield Curve and HedgingDocument12 pagesAssignment Solution - Yield Curve and HedgingAkashNo ratings yet

- Wednesday, July 24, 2013: Heavyweights Spearheaded Turnover Amidst Sluggish Indices..Document6 pagesWednesday, July 24, 2013: Heavyweights Spearheaded Turnover Amidst Sluggish Indices..Randora LkNo ratings yet

- Case Assignment 8 - Diamond Energy Resources PDFDocument3 pagesCase Assignment 8 - Diamond Energy Resources PDFAudrey Ang100% (1)

- 4.ratio Analysis Problems FormatDocument5 pages4.ratio Analysis Problems Formatparth38No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Daily Trade Journal - 12.02.2014Document6 pagesDaily Trade Journal - 12.02.2014Randora LkNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Daily Trade Journal - 06.03Document7 pagesDaily Trade Journal - 06.03ran2013No ratings yet

- Current T Bill Press Release 25-03-2013Document1 pageCurrent T Bill Press Release 25-03-2013Randora LkNo ratings yet

- Legal OpinionDocument63 pagesLegal Opinionran2013No ratings yet

- Daily Trade Journal - 28.02Document13 pagesDaily Trade Journal - 28.02ran2013No ratings yet

- Daily Trade Journal - 05.03Document7 pagesDaily Trade Journal - 05.03ran2013No ratings yet

- NBF Sector - February 2013Document27 pagesNBF Sector - February 2013ran2013No ratings yet

- Daily Trade Journal - 04.03Document7 pagesDaily Trade Journal - 04.03ran2013No ratings yet

- Daily Exchange Rates-Commi 28Document1 pageDaily Exchange Rates-Commi 28ran2013No ratings yet

- Daily Exchange Rates-CommiDocument1 pageDaily Exchange Rates-Commiran2013No ratings yet

- Daily Exchange Rates-Commi 28Document1 pageDaily Exchange Rates-Commi 28ran2013No ratings yet

- Daily Exchange Rates-Commi 28Document1 pageDaily Exchange Rates-Commi 28ran2013No ratings yet

- Daily Trade Journal - 01.03Document7 pagesDaily Trade Journal - 01.03ran2013No ratings yet

- Daily Exchange Rates-Commi 28Document1 pageDaily Exchange Rates-Commi 28ran2013No ratings yet

- CCPI Feb 2013Document2 pagesCCPI Feb 2013ran2013No ratings yet

- Daily Exchange Rates-20092011Document1 pageDaily Exchange Rates-20092011LBTodayNo ratings yet

- Daily Trade Journal - 26.02Document13 pagesDaily Trade Journal - 26.02ran2013No ratings yet

- Daily Trade Journal - 22.02Document12 pagesDaily Trade Journal - 22.02ran2013No ratings yet

- Daily Trade Journal - 27.02Document12 pagesDaily Trade Journal - 27.02ran2013No ratings yet

- Daily Trade Journal - 21.02Document12 pagesDaily Trade Journal - 21.02ran2013No ratings yet

- CAL UPI Introduction - 20 Feb 2013Document8 pagesCAL UPI Introduction - 20 Feb 2013ran2013No ratings yet

- Current T Bill Press Release 25-03-2013Document1 pageCurrent T Bill Press Release 25-03-2013Randora LkNo ratings yet

- Daily Exchange Rates-20092011Document1 pageDaily Exchange Rates-20092011LBTodayNo ratings yet

- Plantations Sector 19.02Document3 pagesPlantations Sector 19.02ran2013No ratings yet

- DIAL-Earnings Note 2012-Faster and Cheaper Data-BUYDocument6 pagesDIAL-Earnings Note 2012-Faster and Cheaper Data-BUYran2013No ratings yet

- Daily Exchange Rates-20092011Document1 pageDaily Exchange Rates-20092011LBTodayNo ratings yet

- Daily Exchange Rates-20092011Document1 pageDaily Exchange Rates-20092011LBTodayNo ratings yet

- Daily Trade Journal - 20.02Document12 pagesDaily Trade Journal - 20.02ran2013No ratings yet

- Results Update - Dec 2012 20.02Document15 pagesResults Update - Dec 2012 20.02ran2013No ratings yet

- Results Update - Dec 2012 19.02Document14 pagesResults Update - Dec 2012 19.02ran2013No ratings yet

- Daily Trade Journal - 19.02Document13 pagesDaily Trade Journal - 19.02ran2013No ratings yet

- News Vendor Problem Continuous DemandDocument7 pagesNews Vendor Problem Continuous DemandbuatdownloadajaNo ratings yet

- Curled Metal Inc CalculationDocument3 pagesCurled Metal Inc CalculationOnal Raut50% (2)

- Accounting Solution On Basic Variance AnalysisDocument3 pagesAccounting Solution On Basic Variance AnalysisAssignmentstore100% (2)

- MCQs On Correlation and Regression AnalysisDocument3 pagesMCQs On Correlation and Regression AnalysisMuhammad Imdadullah82% (17)

- Practice QuestionsDocument2 pagesPractice QuestionsferrakimNo ratings yet

- NCFM SeminarDocument20 pagesNCFM Seminarkumar_3233No ratings yet

- Nonlinear ProgrammingDocument2 pagesNonlinear ProgrammingKristen ObrienNo ratings yet

- Systems Concepts in ActionDocument336 pagesSystems Concepts in Actionwillsink100% (1)

- Marketing Interview QuestionsDocument2 pagesMarketing Interview QuestionsVikas TirmaleNo ratings yet

- Research MethodologyDocument8 pagesResearch MethodologySandip DankharaNo ratings yet

- Convertible Note Financing Term SheetDocument2 pagesConvertible Note Financing Term Sheet4natomas100% (1)

- Layout Planning (Operations Management)Document14 pagesLayout Planning (Operations Management)Jean Carla Lim MerinoNo ratings yet

- Recommended KNEC Research Project OutlineDocument10 pagesRecommended KNEC Research Project OutlineAsuntahWaikunu67% (9)

- Title Page Revised ThesisDocument6 pagesTitle Page Revised ThesisJeric Marasigan EnriquezNo ratings yet

- Lesson Plan of International BusinessDocument3 pagesLesson Plan of International BusinessAkshay Anand100% (1)

- BDP Brief FormDocument3 pagesBDP Brief FormPrakashmonNo ratings yet

- Supply Chain Management in E-CommerceDocument9 pagesSupply Chain Management in E-CommerceAbhishek AgarwalNo ratings yet

- Trend LineDocument6 pagesTrend Lineajtt38No ratings yet

- Lectureship Position Sought by Experienced MBADocument3 pagesLectureship Position Sought by Experienced MBAVidya Hegde KavitasphurtiNo ratings yet

- Tarek Zakout - ResumeDocument1 pageTarek Zakout - ResumeTarekzakoutNo ratings yet

- Integrative Studies and Construction Management Courses for Building EngineeringDocument4 pagesIntegrative Studies and Construction Management Courses for Building Engineeringuser2kh_1No ratings yet

- Market Penetration in Bangladesh Bridgestone PDFDocument7 pagesMarket Penetration in Bangladesh Bridgestone PDFnm_nishantNo ratings yet

- Business Plan PresentationDocument17 pagesBusiness Plan Presentationbsmskr0% (1)

- Answer Key For Working CapitalDocument5 pagesAnswer Key For Working CapitallerryroyceNo ratings yet

- Corporate RestructuringDocument8 pagesCorporate RestructuringHarin LydiaNo ratings yet

- MCS 041Document4 pagesMCS 041shivshankar shahNo ratings yet

- Assignment 3 SDKDocument5 pagesAssignment 3 SDKBicycle Thief100% (1)

- Earned Value - One Page SummaryDocument1 pageEarned Value - One Page Summarymy.nafi.pmp5283No ratings yet

- Presentation On PepcoDocument15 pagesPresentation On PepcoJagruti Koli0% (1)

- Managing ChangeDocument12 pagesManaging ChangeCorvitz SamaritaNo ratings yet