Professional Documents

Culture Documents

Frequently Asked Questions (Faqs) On The Regular Subscription Plan

Uploaded by

Lemuel VillanuevaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Frequently Asked Questions (Faqs) On The Regular Subscription Plan

Uploaded by

Lemuel VillanuevaCopyright:

Available Formats

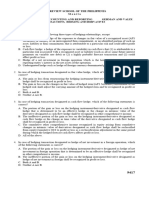

Frequently Asked Questions (FAQs) on the Regular Subscription Plan

A. Overview:

1. What is the Regular Subscription Plan (RSP)?

The Regular Subscription Plan is an investment program that allows you to nominate a regular

contribution amount for the purchase of units for your investment fund account on a periodic basis,

either on a monthly or quarterly basis.

2. What are the benefits of RSP?

Aside from the usual advantages derived from investing in the BPI Investment Funds, RSP offers the

following additional benefits:

a. Higher returns. By enrolling your Investment Fund account into the RSP, a regular contribution

amount is debited from your BPI settlement account on a periodic basis, say on a monthly or

quarterly basis, for the purchase of units based on the prevailing price. This build up strategy allows

you to average your acquisition cost. When prices are low, more units are purchased, while when

prices are high, fewer units are bought, but the overall value of your portfolio likewise increases.

b. No market-timing needed. Because additional investments are automatically programmed

regardless of the movements in the market, there is no longer any need to analyze market

information before deciding when to invest. Gathering the relevant information necessary to time the

market is being done by the Fund Manager for you. Quantitative studies conducted abroad have

proven that while the age-old advice to buy low and sell high is simple and obvious, a clients very

unsystematic behavior leads many to do the opposite. It is advised, therefore, that the best course of

action is to invest regularly and to stay invested.

c. Convenience. You dont need to visit a BPI branch to buy units of participation since contributions

are programmed and electronically processed depending on the schedule that you have identified.

d. Control. You retain control over your investments since you determine the dates of contribution

and the regular contribution amounts for the RSP. Moreover, you may stop and re-start the RSP any

time.

e. Affordability. With low minimum initial and additional contribution amounts, you can now start

building your investment portfolio!

3. What funds will be made available for RSP?

The RSP is available for the following Investment Funds:

BPI Investment Funds Odyssey Funds BPI Index Funds

Peso Denominated Funds

BPI Short Term Fund Odyssey Cash Management

Fund

BPI Phil Equity Index Fund

BPI Premium Bond Fund Odyssey Peso Income Fund ABF Phils Bond Index

Fund

BPI Balanced Fund Odyssey Peso Bond Fund

BPI Equity Value Fund Odyssey Diversified Capital Fund

BPI Philippine High Dividend

Equity Fund

Odyssey Diversified

Balanced Fund

Odyssey Philippine Equity Fund

Odyssey Phil High Conviction

Equity Fund

Global Funds

BPI Global Bond Fund-of-Funds Odyssey Emerging Market

Bond Fund

Phil Dollar Bond Index

Fund

BPI Global Philippine Fund Odyssey Philippine Dollar

Bond Fund

BPI US Equity Index

Feeder Fund

BPI Global Equity Fund-of-

Funds

Odyssey Asia Pacific

High Dividend Equity Fund

BPI European Equity

Index Feeder Fund

4. Can I have different RSP set-ups for one fund?

Yes. You may have different RSP set ups for one fund.

Example: You may have 1 monthly and 1 quarterly RSP set up for one fund running simultaneously.

You may also have 2 monthly RSP set-ups (different dates) running simultaneously.

B. On Activating the RSP:

1. Where can I request for the activation of the RSP for my Investment Funds?

The following channels are available to you if you want to enroll your investment account in the

Regular Subscription Plan.

a. Via the internet through BPI Expressonline (www. bpiexpressonline.com) To avail of the

RSP through this facility you need to be enrolled in BPI Expressonline. If you are already enrolled in

BPI Expressonline, you may register your investment account to avail of the RSP. If you are not yet

enrolled, then you would have to enroll your settlement account/other qualified deposit account with

BPI and your investment account in BPI Express online.

b. Via the Branches- You may visit any BPI branch to request for the activation of the RSP.

2. I have an existing investment account in BPI Expressonline, how do I activate my RSP?

Just follow these easy steps:

Step 1: Log in to BPI Expressonline

Step 2: Go to Investments > Unit Investment Trust Funds >

Subscribe > Regular Subscription Plan (RSP)

Step 3: Select the Investment Account Number that you wish to enroll in RSP

Step 4: Select the investment fund for RSP activation and click the RSP Setup button

Step 5: Provide your RSP details

Step 6: Review and confirm your subscription order

Step 7: A confirmation page of the RSP will appear and an email confirmation of your RSP activation

will be sent to your registered BPI Expressonline email address.

3. Can I nominate another deposit account where the subsequent contribution will be debited?

Your automatic/scheduled contribution will be debited only from the nominated settlement account of

your investment account.

4. Can I immediately enroll in RSP upon account opening?

Yes. You may immediately enroll in RSP upon account opening.

5. What are the minimum investment amounts to avail of the RSP?

a. For new investment accounts or accounts with no existing investments:

To activate the RSP for new accounts or accounts with no existing investments, you are required to

make an initial RSP contribution on the day of the enrollment. Without the minimum initial investment

amount, subsequent subscriptions will not be triggered.

Fund Minimum Initial

Investment Amount

Minimum Transaction

Amount

BPI Investment Funds

All Peso Funds PhP 10,000 PhP 1,000

All Global Funds US$ 500 US$ 200

Odyssey Funds

All Peso Funds PhP 10,000 PhP 5,000

All Global Funds except APHD US$ 1,000 US$ 100

Odyssey Asia Pacific High Dividend Equity

Fund

US$ 5,000 US$ 1,000

BPI Index Funds

All Peso Index Funds PhP 10,000 PhP 1,000

Philippine Dollar Bond Index Fund US$ 500 US$ 200

BPI US Equity Index Feeder Fund US$ 1,000 US$ 500

BPI European Equity Index Feeder Fund US$ 1,000 US$ 500

b. For investment accounts with existing investments:

To activate the RSP for accounts with existing investments, you just need to invest at least the

minimum transaction amount in the minimum initial order amount field.

Fund Minimum Transaction Amount

BPI Investment Funds

All Peso Funds PhP 1,000

All Global Funds US$ 200

Odyssey Funds

All Peso Funds PhP 5,000

All Global Funds except APHD US$ 100

Odyssey Asia Pacific High Dividend Equity

Fund

US$ 1,000

BPI Index Funds

All Peso Index Funds PhP 1,000

Philippine Dollar Bond Index Fund US$ 200

BPI US Equity Index Feeder Fund US$ 500

BPI European Equity Index Feeder Fund US$ 500

C. On the subsequent contribution/regular contribution:

1. What contribution frequencies are available under the RSP?

You may choose from either a monthly or a quarterly contribution schedule.

2. What will happen if my subsequent/scheduled contribution falls on a non-banking day?

If the scheduled contribution falls on a non-banking day, it shall be processed on the next banking

day.

3. What will happen to my subsequent (scheduled) contribution if my settlement account is

unfunded?

The scheduled contribution will not be processed nor will it terminate the RSP. The next subsequent

contribution will proceed as scheduled. No penalty will be imposed against unfunded RSP.

4. Will I be notified of my contribution?

Yes. You will receive a Transaction Advice for each of your processed scheduled contributions.

D. On Amending the RSP and Request for RSP Termination:

1. Where can I request for amendments or termination of enrollment in the RSP facility?

Requests for amendments or termination of enrollment in the RSP facility may be coursed through

your Booking Branch or via the internet through BPI Expressonline. For requests coursed through

your booking branch, a signed Letter of Instruction has to be submitted before the request can be

implemented.

2. Will my RSP enrollment be terminated once I redeem all my units in the Fund?

Yes. Full redemption from the Fund shall result to the termination of my RSP enrollment.

3. What is the default End Date for RSP?

The default End Date is 5 years from the Start Date unless otherwise stated by the client in the RSP

Instruction Sheet.

4. What information can be amended for my RSP?

The following are the information that can be amended:

(a) Subsequent Contribution Amount

(b) Start Date

(c) Subsequent Contribution Frequency

(d) End Date you may extend or shorten the subsequent contribution schedule by requesting for

the amendment of the End Date.

5. When should I make the amendment request or termination request?

Amendments/ requests for termination should be done at least one (1) banking day prior to the date

of contribution, otherwise, the request will be implemented for the next contribution date.

6. How can I re-start an RSP which I have terminated?

You may re-enroll in the RSP facility any time by visiting your nearest BPI branch or re-enrolling

through BPI Expressonline.

You might also like

- RSP FaqDocument3 pagesRSP FaqApple LanuganNo ratings yet

- Kharafi National Retirement ManualDocument17 pagesKharafi National Retirement ManualChristian D. Orbe0% (1)

- Class Evening 23 AprilDocument15 pagesClass Evening 23 AprilbitsthechampNo ratings yet

- NIBL Sahabhagita FundDocument5 pagesNIBL Sahabhagita FundyogendrasthaNo ratings yet

- BCIP Application: Mode of Investment Ocbc Deposit Account Ocbc Online Banking Ocbc SRS AccountDocument6 pagesBCIP Application: Mode of Investment Ocbc Deposit Account Ocbc Online Banking Ocbc SRS Accountmugger123456No ratings yet

- Investing Without a Silver Spoon (Review and Analysis of Fischer's Book)From EverandInvesting Without a Silver Spoon (Review and Analysis of Fischer's Book)No ratings yet

- Kotak Gold Fund SIDDocument30 pagesKotak Gold Fund SIDsabyasachi_paulNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Investor Faqs For Karvy I-Zone + PlanDocument7 pagesInvestor Faqs For Karvy I-Zone + PlanlovelyamitNo ratings yet

- How to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingFrom EverandHow to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingNo ratings yet

- Sip-Of A Mutual FundDocument7 pagesSip-Of A Mutual Fundankit7329No ratings yet

- Nps Note and MCQDocument37 pagesNps Note and MCQRSMENNo ratings yet

- Systematic Investment Plans Mba ProjectDocument69 pagesSystematic Investment Plans Mba ProjectMaheshwari Stephen Pinto87% (150)

- Systematic Investment Plan (Sip) Under 'Nibl Sahabhagita Fund' Frequently Asked Questions (Faqs)Document3 pagesSystematic Investment Plan (Sip) Under 'Nibl Sahabhagita Fund' Frequently Asked Questions (Faqs)MinSc NpilNo ratings yet

- FAQUoS PDFDocument9 pagesFAQUoS PDFmyfoot1991No ratings yet

- How To Open BPI Savings AccountDocument15 pagesHow To Open BPI Savings Accountsamm yuuNo ratings yet

- Profit Plan and Future Plans For InvestmentDocument6 pagesProfit Plan and Future Plans For InvestmentquintanamarfrancisNo ratings yet

- Issuance Process of Commercial Paper CPsDocument3 pagesIssuance Process of Commercial Paper CPsmohakbhutaNo ratings yet

- Unit-2 IPO ProcessDocument4 pagesUnit-2 IPO ProcessPOORNA GOYANKA 2123268No ratings yet

- Executive Summary: Internship Report On The Bank of Punjab Has Almost 80Document6 pagesExecutive Summary: Internship Report On The Bank of Punjab Has Almost 80Arham khanNo ratings yet

- Chapter 09Document8 pagesChapter 09siddhant singhNo ratings yet

- BpiDocument4 pagesBpiElla QuiNo ratings yet

- FAQ On NPSDocument7 pagesFAQ On NPSRaddyNo ratings yet

- 2.introduction To Financial Management - 10818 - FinalDocument67 pages2.introduction To Financial Management - 10818 - FinalJayson Jayjamzkie RepolidoNo ratings yet

- Wealthcon Study NPSDocument27 pagesWealthcon Study NPSYashpal ThakurNo ratings yet

- Infinite Banking Concept: How to invest in Real Estate with Infinite Banking, #1From EverandInfinite Banking Concept: How to invest in Real Estate with Infinite Banking, #1Rating: 2.5 out of 5 stars2.5/5 (2)

- Gic Key Features DocumentDocument22 pagesGic Key Features DocumentRocketNo ratings yet

- Nps For Nris: Eligibility Source of Contributions in NpsDocument12 pagesNps For Nris: Eligibility Source of Contributions in NpsMohammed Shoukat AliNo ratings yet

- NPA (Recovery Policy)Document56 pagesNPA (Recovery Policy)Nithya Ganesh75% (4)

- GSave Account Product Disclosure Sheet - 12072022Document5 pagesGSave Account Product Disclosure Sheet - 12072022Goddee CaboteNo ratings yet

- Intorduction Final 150922Document66 pagesIntorduction Final 150922Shyam SundarNo ratings yet

- Prepare Financial Feasibility Report of A Chosen ProductDocument5 pagesPrepare Financial Feasibility Report of A Chosen ProductRamesh PotbhareNo ratings yet

- Freedom SIP FAQDocument5 pagesFreedom SIP FAQkaushikNo ratings yet

- (ERISA) Issue Statement #5 (Page 14, Point 2) : Commissions Expense Has IncreasedDocument4 pages(ERISA) Issue Statement #5 (Page 14, Point 2) : Commissions Expense Has IncreasedMeg StanNo ratings yet

- Types of Accounts in MCB: Internship Report On Muslim Commercial Bank Page2Document23 pagesTypes of Accounts in MCB: Internship Report On Muslim Commercial Bank Page2nishazaidiNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Financial Institution and MarketsDocument6 pagesFinancial Institution and MarketsHarsh SadavartiaNo ratings yet

- National Pension Scheme FAQsDocument5 pagesNational Pension Scheme FAQsvaierNo ratings yet

- Tutorial Topic 7Document3 pagesTutorial Topic 7Siti AishahNo ratings yet

- PRUInvest Client Activation 2.0 Promo MechanicsDocument3 pagesPRUInvest Client Activation 2.0 Promo MechanicsKarl Jason JosolNo ratings yet

- Pag IBIGDocument32 pagesPag IBIGJessa Borre0% (1)

- Ms Mutual FundDocument25 pagesMs Mutual Fundagrocel_bhv5591No ratings yet

- SIP: Start Early, Save Regularly: DisclaimerDocument2 pagesSIP: Start Early, Save Regularly: DisclaimerWhiteFlintoffNo ratings yet

- FAQs On DBS Wealth Management AccountDocument2 pagesFAQs On DBS Wealth Management AccountkarpeoNo ratings yet

- Morningstar Guide to Mutual Funds: 5-Star Strategies for SuccessFrom EverandMorningstar Guide to Mutual Funds: 5-Star Strategies for SuccessNo ratings yet

- Kickstart Your Corporation: The Incorporated Professional's Financial Planning CoachFrom EverandKickstart Your Corporation: The Incorporated Professional's Financial Planning CoachNo ratings yet

- BMA&Arif Habib Asset Management AnalysisDocument4 pagesBMA&Arif Habib Asset Management AnalysisALI HASSAN SHAIKH(Student)No ratings yet

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- MCB Bank ReportDocument30 pagesMCB Bank ReportdadagfazalNo ratings yet

- 29 March 2021: World Equity Index Feeder Fund - Now Available On The BDO Bills Payment FacilityDocument6 pages29 March 2021: World Equity Index Feeder Fund - Now Available On The BDO Bills Payment FacilityJeuz Llorenz Colendra-ApitaNo ratings yet

- Faqs of Islamic Naya Pakistan Certificates (Inpcs)Document2 pagesFaqs of Islamic Naya Pakistan Certificates (Inpcs)Ahmed NiazNo ratings yet

- Portfolio Management ServicesDocument7 pagesPortfolio Management ServicesSumit DewaniNo ratings yet

- Proposal LetterDocument4 pagesProposal LetterIndranilGhoshNo ratings yet

- Report in Accounting.Document3 pagesReport in Accounting.chelsie santosNo ratings yet

- Book 1: Futuristic Fifteen Man Rugby Union: Academy of Excellence for Coaching Rugby Skills and Fitness DrillsFrom EverandBook 1: Futuristic Fifteen Man Rugby Union: Academy of Excellence for Coaching Rugby Skills and Fitness DrillsNo ratings yet

- FCNRDocument8 pagesFCNRvicky_tiwari1023No ratings yet

- Task 5 RajatDocument16 pagesTask 5 RajatTeja MullapudiNo ratings yet

- 01) Introduction 1Document8 pages01) Introduction 1Lemuel VillanuevaNo ratings yet

- Contributions Payment Form-SSSDocument6 pagesContributions Payment Form-SSSrhev63% (8)

- Personal Data SheetDocument4 pagesPersonal Data SheetLeonil Estaño100% (7)

- Gantt Chart Budget and WasteDocument1 pageGantt Chart Budget and WasteLemuel VillanuevaNo ratings yet

- Biological Molecules Containing Metal Ions: Vitamin B-12Document7 pagesBiological Molecules Containing Metal Ions: Vitamin B-12Lemuel VillanuevaNo ratings yet

- Confidential: Emerging Interdisciplinary Research Grant Capsule Concept Proposal FormDocument19 pagesConfidential: Emerging Interdisciplinary Research Grant Capsule Concept Proposal FormLemuel VillanuevaNo ratings yet

- 19MSFS Cur2Document2 pages19MSFS Cur2Lemuel VillanuevaNo ratings yet

- For Accreditation 2013Document1 pageFor Accreditation 2013Lemuel VillanuevaNo ratings yet

- 09) Introduction 9Document18 pages09) Introduction 9Lemuel VillanuevaNo ratings yet

- Rev Info GraduateDocument8 pagesRev Info GraduateLemuel VillanuevaNo ratings yet

- Observation Day 1 (PHREB-FERCAP Accreditation Survey)Document4 pagesObservation Day 1 (PHREB-FERCAP Accreditation Survey)Lemuel VillanuevaNo ratings yet

- EnglishDocument6 pagesEnglishLemuel VillanuevaNo ratings yet

- Thesis 1st ScreeningDocument4 pagesThesis 1st ScreeningLemuel VillanuevaNo ratings yet

- 19MSFS Req2Document2 pages19MSFS Req2Lemuel VillanuevaNo ratings yet

- Application Form English-2 PDFDocument3 pagesApplication Form English-2 PDFEAYNo ratings yet

- MbaebookDocument12 pagesMbaebookL3ninNo ratings yet

- MBADocument1 pageMBALemuel VillanuevaNo ratings yet

- 1CHE GradDocument3 pages1CHE GradLemuel VillanuevaNo ratings yet

- MBA Course DescriptionsDocument52 pagesMBA Course DescriptionsLemuel VillanuevaNo ratings yet

- MBA Human Resource ManagementDocument1 pageMBA Human Resource ManagementLemuel VillanuevaNo ratings yet

- Dfa - Office of European AffairsDocument11 pagesDfa - Office of European AffairsLemuel VillanuevaNo ratings yet

- Dr. Mario V. Capanzana: "Conduct of 8 NNS Data Organization, Analysis, and Dissemination-Biochemical Phase-GF-LFP."Document1 pageDr. Mario V. Capanzana: "Conduct of 8 NNS Data Organization, Analysis, and Dissemination-Biochemical Phase-GF-LFP."Lemuel VillanuevaNo ratings yet

- Instruction: Choose The Best Order and Sequence of TheDocument2 pagesInstruction: Choose The Best Order and Sequence of TheLemuel Villanueva100% (1)

- MBA Course DescriptionsDocument52 pagesMBA Course DescriptionsLemuel VillanuevaNo ratings yet

- Cover LetterDocument1 pageCover LetterShanina Mae FlorendoNo ratings yet

- Pcs of Egg White Sautéed With Minced Veggies)Document1 pagePcs of Egg White Sautéed With Minced Veggies)Lemuel VillanuevaNo ratings yet

- SluDocument2 pagesSluLemuel VillanuevaNo ratings yet

- Save and Learn Money Market Fund ProspectusDocument43 pagesSave and Learn Money Market Fund ProspectusEunice QueNo ratings yet

- Week 2 Monday Tuesday Wednesday Thursday Friday Breakfast AM Snack Lunch PM SnackDocument1 pageWeek 2 Monday Tuesday Wednesday Thursday Friday Breakfast AM Snack Lunch PM SnackLemuel VillanuevaNo ratings yet

- Save and Learn Balanced Fund Prospectus PDFDocument45 pagesSave and Learn Balanced Fund Prospectus PDFEunice QueNo ratings yet

- End of Month PostingDocument9 pagesEnd of Month Postingabhii10275% (8)

- Data Communication Basics Ch1Document55 pagesData Communication Basics Ch1Ukasha MohammednurNo ratings yet

- BIS Microsoft Dynamics NAV 2009 Vs NAV 2016Document20 pagesBIS Microsoft Dynamics NAV 2009 Vs NAV 2016mohit1990dodwalNo ratings yet

- HSBC Germany Cut Off TimesDocument6 pagesHSBC Germany Cut Off TimesDiana GrajdanNo ratings yet

- Bicycle Motorcycle Car/ Private Type Jeep Pedicab Tricycle Jeepney Multicab & RuscoDocument5 pagesBicycle Motorcycle Car/ Private Type Jeep Pedicab Tricycle Jeepney Multicab & Ruscokim suarezNo ratings yet

- Understanding Zara's Supply ChainDocument7 pagesUnderstanding Zara's Supply ChainDYPUSM WECNo ratings yet

- ReiceivablesDocument27 pagesReiceivablesrivaceline100% (3)

- Po 14281 11092022085718Document41 pagesPo 14281 11092022085718lpagal.epcitNo ratings yet

- Account TitlesDocument28 pagesAccount TitlesEfrelyn Grethel Baraya Alejandro100% (1)

- Sample BPML List For AFSDocument6 pagesSample BPML List For AFSGowtham ReddyNo ratings yet

- Ramsey County District Court Cases Andert Tschida 1943 - 1958Document5 pagesRamsey County District Court Cases Andert Tschida 1943 - 1958api-327987435No ratings yet

- Challan IBDocument1 pageChallan IBJithesh VNo ratings yet

- FadsDocument12 pagesFadsLinky DooNo ratings yet

- Hapter 11: © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/SteinbartDocument86 pagesHapter 11: © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbartarum NastitiNo ratings yet

- Medical Benefits SummaryDocument1 pageMedical Benefits SummaryJanet Zimmerman McNicholNo ratings yet

- Avaya Aura® Communication ManagerDocument4 pagesAvaya Aura® Communication ManagerfarisNo ratings yet

- Sample - Cpcu553 Course GuideDocument100 pagesSample - Cpcu553 Course Guidekalai87100% (1)

- Tesco Digital FibonacciDocument16 pagesTesco Digital Fibonacciadewale abiodunNo ratings yet

- JPMCStatement (1) Chase Credit Caed STMNTDocument4 pagesJPMCStatement (1) Chase Credit Caed STMNTbhawanihpi100% (1)

- Multiple Access Techniques in Wireless CommunicationsDocument48 pagesMultiple Access Techniques in Wireless CommunicationsPritish KamathNo ratings yet

- Terms and Conditions: (Receipt For The Recipient)Document1 pageTerms and Conditions: (Receipt For The Recipient)sagar aroraNo ratings yet

- Consent Form From NRI Customers Other Than in EUDocument2 pagesConsent Form From NRI Customers Other Than in EUNetworkHirukaNo ratings yet

- How To Build Business Credit 060518Document20 pagesHow To Build Business Credit 060518James ClaireNo ratings yet

- Reliance Tax Saver ELSS CAF Full Form ARN 39091Document21 pagesReliance Tax Saver ELSS CAF Full Form ARN 39091tariq1987No ratings yet

- INCOTERMS 2020-Structure, Explanation & LeveragingDocument57 pagesINCOTERMS 2020-Structure, Explanation & Leveragingchanchal maloo100% (1)

- Mobile BankingDocument14 pagesMobile Bankingraghvendrapatel75No ratings yet

- 9417 - Foreign Currency Transactions Hedging and DerivativesDocument7 pages9417 - Foreign Currency Transactions Hedging and Derivativesjsmozol3434qcNo ratings yet

- Https WWW - Cimb.bizchannel - Com.my Corp Front Transactioninquiry - Do Action Doprint PDFDocument1 pageHttps WWW - Cimb.bizchannel - Com.my Corp Front Transactioninquiry - Do Action Doprint PDFSyed HanafieNo ratings yet

- Mobile Money Service Provistion in EthiopiaDocument111 pagesMobile Money Service Provistion in Ethiopiahaymanot kabaNo ratings yet

- Customer Journey1.0Document1 pageCustomer Journey1.0Yash DesaiNo ratings yet