Professional Documents

Culture Documents

Wave 4 Should Not Overlap Wave 1

Uploaded by

James RoniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wave 4 Should Not Overlap Wave 1

Uploaded by

James RoniCopyright:

Available Formats

Elliott Wave Rules and Guidelines -- Wave 4 Should Not Overlap Wave 1

page 1

Elliott Wave Rules and Guidelines

WAVE 4 SHOULD NOT OVERLAP WAVE 1

(By Marc Rinehart)

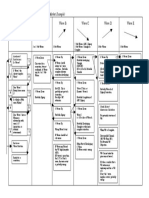

Elliott Wave Theory in its simplest form defines a series of impulse and corrective price patterns

as a wave sequence consisting of five general waves trending in either an up or down direction.

Within a general five-wave sequence there are guidelines designed to help you better wave

count, calculate or predict wave relationships. One guideline is referred to as the Wave 4, Wave

1 Overlap Rule. This rule states for a valid five-wave sequence to occur Wave 1 cannot overlap

any Wave 4 profit-taking pullback.

This means the end of Wave 4 should not trade through the peak or depression of the Wave 1

end. If an overlap occurs, the sequence becomes a three-wave (A-B-C) corrective pattern.

Elliott Wave Rules and Guidelines -- Wave 4 Should Not Overlap Wave 1

page 2

A more generous interpretation states a five-wave sequence still can be valid if you allow no

more than 10 to 15% overlapping of Wave 1 and Wave 4 to occur. During the early stages of

researching the Advanced GET Elliott Wave logic, it was concluded allowing for the 10-15% overlap

exception statistically is a valid Elliott Wave approach for improving Wave 4 trading opportunity.

The significance of the Wave 4, Wave 1 Overlap rule, allowing for 10-15% overlap, is an

important distinction when using Elliott Wave theory. Knowledge of this rule is useful in better

defining and using wave counts to establish more realistic risk-verses-reward trading parameters.

Say you wish to establish a Type 1 Buy opportunity on a Wave 4 pullback. Why not include the

overlap area in your positioning strategy if it is nearby and relevant to the trade setup. A slight

adjustment in your stop loss placement, for example, could keep you from prematurely stopping

out of what later turns into a winning position. The Wave 4, Wave 1 Overlap area can provide a

respectable risk-reward ratio for aggressive traders in what is the last hope wave count option.

Elliott Wave Rules and Guidelines -- Wave 4 Should Not Overlap Wave 1

page 3

To summarize AGET interpretation when using the Wave 4, Wave 1 Overlap rule: overlap

violation cannot be allowed in cash markets; in futures and stock markets, research confirms a 10

to 15% Wave 4 and Wave 1 overlapping is allowed. While rare, there are instances where a fivewave sequence still can evolve after a minor overlap. Again, remember the use of the overlap

count in trading should be recognized only as a last resort option on any buy or sell Type 1 setup.

An Wave 4, Wave 1 Overlap example is seen in the NY March 03 High Grade Copper Daily

futures contract. This contract was posted 10 December, 2002, first in Advanced GET Traders

Outlook. A Wave 4 pullback was suggested, monitoring for a possible Type 1 Buy setup was

advised at that time. (See HGH3 Chart #1)

Near the end of December a Type 1 Buy opportunity grew complicated. A quality Type 1 Buy

trade setup was no longer possible using primary AGET Type 1 setup tools.

Specifically, in this example: the Wave 4 Channels didnt hold, suggesting a breakdown. The

PTI became less than 35, suggesting normal profit-taking was no longer evident. The 5/35 Elliott

Oscillator did not hold 1.40, Ellipses minor MOB shown previous did not stop retracement.

Under this picture there really was no reason to buy HG Copper. However, what happens if you

are a more aggressive risk-taker and you still want to really buy this copper contract? Knowing the

Wave 4, Wave 1 Overlap rule provides aggressive traders an objective last chance option.

(See HGH3 Chart #2)

Elliott Wave Rules and Guidelines -- Wave 4 Should Not Overlap Wave 1

page 4

In the final analysis the overlap held. If a trade was taken, using the Regression Trend Channel

or 6/4 DMA Channeling technique, combining with an aggressive Ellipse study application could

have been utilized as a part of a trailing stop strategy to help protect profits. (See HGH3 Chart #3)

You might also like

- GuideToElliottWaveAnalysisAug2012 PDFDocument5 pagesGuideToElliottWaveAnalysisAug2012 PDFvhugeat50% (2)

- Elliott WAVe SimpleDocument22 pagesElliott WAVe Simplel3ohit100% (1)

- Elliott Wave 2Document29 pagesElliott Wave 2francisblesson100% (1)

- Esignal Manual Ch6Document10 pagesEsignal Manual Ch6dee138100% (1)

- Putting It All Together. Welcome To Module 4Document52 pagesPutting It All Together. Welcome To Module 4Raul Domingues Porto Junior100% (3)

- Elliott Wave TheoryDocument13 pagesElliott Wave Theorymark adamNo ratings yet

- Elliot WaveDocument8 pagesElliot WaveGateshNdegwahNo ratings yet

- Practical Elliott Wave Trading StrategiesDocument0 pagesPractical Elliott Wave Trading StrategiesGeorge Akrivos100% (2)

- Elliott Wave Theory BasicsDocument7 pagesElliott Wave Theory BasicsSarat KumarNo ratings yet

- EW Fibonacci ManualDocument198 pagesEW Fibonacci Manualstephane83% (6)

- Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave StructureFrom EverandHarmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave StructureRating: 3 out of 5 stars3/5 (1)

- The Profitable Art and Science of Vibratrading: Non-Directional Vibrational Trading Methodologies for Consistent ProfitsFrom EverandThe Profitable Art and Science of Vibratrading: Non-Directional Vibrational Trading Methodologies for Consistent ProfitsNo ratings yet

- Mastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice ExercisesFrom EverandMastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice ExercisesRating: 4 out of 5 stars4/5 (3)

- The Nature of Trends: Strategies and Concepts for Successful Investing and TradingFrom EverandThe Nature of Trends: Strategies and Concepts for Successful Investing and TradingNo ratings yet

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthFrom EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNo ratings yet

- Summary of John Bollinger's Bollinger on Bollinger BandsFrom EverandSummary of John Bollinger's Bollinger on Bollinger BandsRating: 3 out of 5 stars3/5 (1)

- 24.progress Labels in ZigzagsDocument16 pages24.progress Labels in ZigzagsSATISHNo ratings yet

- Advanced Level Elliott Wave Analysis GuideDocument64 pagesAdvanced Level Elliott Wave Analysis GuideMohd Harraz Abbasy100% (2)

- 26.missing Waves and EmulationsDocument11 pages26.missing Waves and EmulationsSATISHNo ratings yet

- 28 Elliot Wave PDFDocument14 pages28 Elliot Wave PDFRavikumar GandlaNo ratings yet

- Elliott Wave Rules, Guidelines and Basic StructuresDocument22 pagesElliott Wave Rules, Guidelines and Basic Structuresalok100% (1)

- NeorulesDocument1 pageNeorulesGurjar rgNo ratings yet

- Overview of Fibonacci and Elliott Wave RelationshipsDocument11 pagesOverview of Fibonacci and Elliott Wave RelationshipsNishuNish100% (1)

- Elliott Wave Crib SheetDocument5 pagesElliott Wave Crib SheetezrawongNo ratings yet

- Elliot Wave: by Noname Intermediate Elliot Wave Advanced Elliot WaveDocument30 pagesElliot Wave: by Noname Intermediate Elliot Wave Advanced Elliot WaveGlobal Evangelical Church Sogakope BuyingLeads100% (1)

- The Amazing Elliott's Wave3 PDFDocument99 pagesThe Amazing Elliott's Wave3 PDFFlukii Polo100% (1)

- Elliott Wave Rules and GuidelinesDocument4 pagesElliott Wave Rules and Guidelineskacraj100% (1)

- 3 Step Guide To Identify Confirm and Place A Low Risk Position Using Elliott Wave TheoryDocument13 pages3 Step Guide To Identify Confirm and Place A Low Risk Position Using Elliott Wave Theoryomi221No ratings yet

- Fibonacci and Elliottwave Relationships.Document11 pagesFibonacci and Elliottwave Relationships.Fazlan SallehNo ratings yet

- Fib Calculations in Elliott Wave Theory AnalysisDocument6 pagesFib Calculations in Elliott Wave Theory Analysishaseeb100% (1)

- Elliot Wave Cheat Sheet FinalDocument16 pagesElliot Wave Cheat Sheet Finalbjm778No ratings yet

- Wave Theory - ComDocument26 pagesWave Theory - ComKevin Sula100% (2)

- EWT Lecture Notes by Soros1Document131 pagesEWT Lecture Notes by Soros1Shah Aia Takaful Planner100% (1)

- Guideline 1: How To Draw Elliott Wave On ChartDocument6 pagesGuideline 1: How To Draw Elliott Wave On ChartAtul Mestry100% (2)

- New Elliottwave Short VersionDocument58 pagesNew Elliottwave Short VersionPeter Nguyen100% (1)

- Elliot Wave by Jayforexhouse 4.0Document19 pagesElliot Wave by Jayforexhouse 4.0Aivar VilloutaNo ratings yet

- 1001 Discovering EWPDocument11 pages1001 Discovering EWPJustin Yeo0% (1)

- Eliot Waves E Book Part1 PDFDocument13 pagesEliot Waves E Book Part1 PDFByron Arroba0% (1)

- Elliott Wave Patterns & Fibonacci Relationships Core Reference GuideDocument33 pagesElliott Wave Patterns & Fibonacci Relationships Core Reference GuideStephen MungaiNo ratings yet

- 3 Step Guide To Low Risk Trading Using. Elliott Wave.: Enda GlynnDocument13 pages3 Step Guide To Low Risk Trading Using. Elliott Wave.: Enda GlynnSATISHNo ratings yet

- Elliott Wave Basics Impulse PatternsDocument12 pagesElliott Wave Basics Impulse Patternsjagadeesh44No ratings yet

- ESignal - Manual - ch23 Elliot Wave TriggerDocument2 pagesESignal - Manual - ch23 Elliot Wave Triggerlaxmicc100% (1)

- Elliott Wave and Fibonacci - Learn About Patterns and Core ReferencesDocument33 pagesElliott Wave and Fibonacci - Learn About Patterns and Core ReferencesDuca George100% (1)

- Elliott Wave Structures Guide - Page 1Document2 pagesElliott Wave Structures Guide - Page 1Access LimitedNo ratings yet

- Harmonic CourseDocument66 pagesHarmonic CourseartzpirationNo ratings yet

- The Wavy Tunnel: Trading Live Jody SamuelsDocument42 pagesThe Wavy Tunnel: Trading Live Jody SamuelsPeter Nguyen100% (1)

- Elliott & FibboDocument17 pagesElliott & FibboSATISH100% (2)

- New Elliottwave Execution and Correlation Final Aug 13 14552100Document95 pagesNew Elliottwave Execution and Correlation Final Aug 13 14552100Peter Nguyen100% (3)

- Cheatsheets - Elliot WavesDocument3 pagesCheatsheets - Elliot WavesPaul Mears100% (1)

- Elliot WavesDocument6 pagesElliot WavesJorge IvanNo ratings yet

- Easy Way To Spot Elliott Waves With Just One Secret Tip PDFDocument4 pagesEasy Way To Spot Elliott Waves With Just One Secret Tip PDFJack XuanNo ratings yet

- Transcript Glenn Neely InterviewDocument15 pagesTranscript Glenn Neely Interviewasdfghjkjgfdxz100% (1)

- The Magic and Logic ofDocument72 pagesThe Magic and Logic ofKane Oo100% (2)

- Corrective WaveDocument1 pageCorrective WaveMoses ArgNo ratings yet

- Elliott GuideDocument42 pagesElliott GuideemreNo ratings yet

- Neely Glenn NeowavesDocument12 pagesNeely Glenn NeowavesDinesh Choudhary100% (1)

- Wavy Tunnel Module 62012Document32 pagesWavy Tunnel Module 62012Minh Trần100% (2)

- Elliott Wave Simple DescriptionDocument23 pagesElliott Wave Simple DescriptionGeorge Akrivos100% (3)

- Lesson 3 Fibonacci and Moving AveragesDocument12 pagesLesson 3 Fibonacci and Moving AveragesJames RoniNo ratings yet

- The Super Scalper StrategyDocument10 pagesThe Super Scalper StrategyJames Roni0% (1)

- PC 400 LC 8Document8 pagesPC 400 LC 8James RoniNo ratings yet

- HINO Spec ZS4141 (700 Series)Document4 pagesHINO Spec ZS4141 (700 Series)James RoniNo ratings yet

- Trading by Reading Market 2008Document16 pagesTrading by Reading Market 2008James RoniNo ratings yet

- Franchise LitigationDocument60 pagesFranchise LitigationJay R MVNo ratings yet

- Đề Cương Ôn Ngữ Dụng HọcDocument30 pagesĐề Cương Ôn Ngữ Dụng HọcCherry Trang100% (1)

- Bata India LTD V Am Turaz PDFDocument66 pagesBata India LTD V Am Turaz PDFsowjanya.sNo ratings yet

- Planview Enterprise AgileDocument2 pagesPlanview Enterprise AgileLarryv2uNo ratings yet

- Indigenous MethodlogiesDocument16 pagesIndigenous MethodlogiesMaria Paula MenesesNo ratings yet

- Get Ready For The TOEFL Primary - Grade 5 - For StudentsDocument110 pagesGet Ready For The TOEFL Primary - Grade 5 - For StudentsAnh NguyễnNo ratings yet

- Managing Tumor Lysis Syndrome.2Document4 pagesManaging Tumor Lysis Syndrome.2Caballero X CaballeroNo ratings yet

- Cellular Organiztationpf The CellDocument2 pagesCellular Organiztationpf The CellKathleen NocheNo ratings yet

- Secondary Lesson PlanDocument2 pagesSecondary Lesson Planwilliamsk31No ratings yet

- Hypomagnesemia A Clinical Approach in Chronically Ill Patients With Multiple ComorbiditiesDocument14 pagesHypomagnesemia A Clinical Approach in Chronically Ill Patients With Multiple ComorbiditiesAthenaeum Scientific PublishersNo ratings yet

- Addis Ababa University: Department of Law Individual Assignment 1Document3 pagesAddis Ababa University: Department of Law Individual Assignment 1Amir sabirNo ratings yet

- Business & ComputerDocument8 pagesBusiness & Computerandrewarun1987No ratings yet

- Competitive Structure of IndustriesDocument28 pagesCompetitive Structure of IndustriesRavi Sharma100% (1)

- A Research Proposal: EntitledDocument11 pagesA Research Proposal: EntitledJOBBELE SAGCALNo ratings yet

- Activity 1: Let'S Ponder!Document3 pagesActivity 1: Let'S Ponder!Kim YeontanNo ratings yet

- IPE Beams Dimensions and PropertiesDocument2 pagesIPE Beams Dimensions and PropertiesGalih Santana0% (1)

- APA Style GuideDocument56 pagesAPA Style GuidejeenaNo ratings yet

- Human Right Mahatma Gandhi University BBA CBCS 5-1Document19 pagesHuman Right Mahatma Gandhi University BBA CBCS 5-1Rajesh MgNo ratings yet

- Fecha Estrategia: #Cedula Apellidos Y NombresDocument14 pagesFecha Estrategia: #Cedula Apellidos Y NombresYenny AcostaNo ratings yet

- IctfpdDocument2 pagesIctfpdapi-409798698No ratings yet

- Spec Alloy Steel WireDocument6 pagesSpec Alloy Steel WireNour Saad EdweekNo ratings yet

- Bhrigu-Bindu - The Mysterious System of 'Nadi Jyotisha'Document3 pagesBhrigu-Bindu - The Mysterious System of 'Nadi Jyotisha'Vd Vivek SharmaNo ratings yet

- Lecture Notes On Mathematical Olympiad Courses: For Junior Section Vol. 2Document12 pagesLecture Notes On Mathematical Olympiad Courses: For Junior Section Vol. 2cheintNo ratings yet

- Module 1Document11 pagesModule 1Rhembea Gardose FerasolNo ratings yet

- Impact of Indian Cinema On Adolescents - A Sociological Study of Jaipur-Rajasthan, India 2013Document14 pagesImpact of Indian Cinema On Adolescents - A Sociological Study of Jaipur-Rajasthan, India 2013Sanchita GhoshNo ratings yet

- How To Make A Research TitleDocument1 pageHow To Make A Research TitleHanzell Faith Bayawa DaculaNo ratings yet

- Resolving Communal Conflicts in Ghana Seminar ReportDocument18 pagesResolving Communal Conflicts in Ghana Seminar ReportwacsiNo ratings yet

- Soal Ramedial Bahasa Inggris Kelas XIDocument3 pagesSoal Ramedial Bahasa Inggris Kelas XIKusnadi DahariNo ratings yet

- Qasidas of Al Husain Ibn Mansur Al HallajDocument6 pagesQasidas of Al Husain Ibn Mansur Al HallajJelenka Gasic OrsagNo ratings yet

- Research Paper Title TagalogDocument7 pagesResearch Paper Title Tagalogoppfaztlg100% (1)