Professional Documents

Culture Documents

Shari'Ah Issues in Islamic Banking Pakistan

Uploaded by

Ahmed YousufzaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shari'Ah Issues in Islamic Banking Pakistan

Uploaded by

Ahmed YousufzaiCopyright:

Available Formats

QUALITATIVE RESEARCH TECHNIQUE SECOND ASSIGNMENT

TITLE OF ASSIGNED ARTICLE:

SHARIAH ISSUES IN ISLAMIC BANKING : A QUALITATIVE SURVEY IN MALAYSIA

AUTHORS NAME:

AbdelghaniEchchabi

Department of Business Administration, International Islamic University Malaysia,

Kuala Lumpur, Malaysia, and

HassanuddeenAbd. Aziz

Department of Finance, International Islamic University Malaysia, Kuala Lumpur,

Malaysia

JOURNAL:

Qualitative Research in Financial Markets

NUMBER OF WORDS:

492

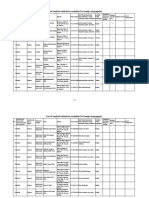

GROUP MEMBERS:

MUHAMMAD RAMAZAN KALHORO

BISHARAT HUSSAIN

DANISH KHAN

FARIS MAHAR

SHARIAH ISSUES IN ISLAMIC BANKING

A QUALITATIVE SURVEY IN MALAYSIA

1- Reasons for the selection of this article:

i.

This article fulfills all the criteria set by our teacher for the selection of our

article such as it is related to business discipline, it is based on the empirical

study, it is qualitative in nature, it is published within last five years and

finally phenomenology approach is used in it.

ii.

This article is published in impact factor journal (Qualitative Research in

Financial Markets) so its findings can be relied and trusted.

2- Purpose for which the article is selected: Phenomenological approach is usually

helpful when a researcher needs a description of common meaning for several

individuals of their lived experiences of a concept or phenomenon (Creswell 2013

page# 76). Moreover, the purpose of this selected article is to examine the customers

perception regarding the current shariah issues of Islamic banks in Malaysia

(Echchabi et al. 2014, p# 02), which shows a common experience that customers

share regarding the sharia issues existing in banking. Therefore a phenomenological

approach is appropriate for the purpose of this article.

3- Empirical Context of the Study: As far as an empirical context of the study is

concerned, the author tried to study the real experience of customers regarding

Islamic sharia banking issues using semi structured interviews from 10 regular

customers. (See articles p# 02) which helped them collect primary data for getting

the empirical evidence in the context of study?

4- Methodology

i.

Technique used: Techniques used by these authors were also appropriate. In

line with the objectives of the study, they used the qualitative technique with

the help of an in-depth interview in order to generate comprehensive

information to determine the perception of the customers about the shariah

compliance of their Islamic banks. Quantitative method would not have been

useful in this case.

ii.

Sampling Method: Sample selected was appropriate for the given approach.

According to Creswell 2013 (page# 81), in phenomenological approach, data

is collected from individuals who have experienced the phenomenon. In this

case the interviewees selected were the regular customers of Islamic banking

(page # 08 Paragraph # 01) and they had all experienced the Shariah issues in

their respective banks.

iii.

Analysis: Analysis section of this article seems appropriate. The authors

reviewed the 10 interviews several times to achieve the holistic understanding

of the meaning of the participants experiences about a common phenomenon

(Page# 08, Data analysis section). In addition the researchersalso highlighted

the significant statements/ sentences, which is required in phenomenological

approach, told by the participants (see results section for example p#8-11).

5- Tracing the researcher invisible or visible: Study shows that researchers had not

experienced the phenomenon and got information after collecting data through in

depth interviews. Moreover the researcher was not much involved in research just like

researchers do in ethnography. Therefore it can be said that researcher was invisible in

research as he was studying the context but not a part of the context.

6- Characteristics of phenomenological approach: The research satisfies almost all the

characteristics of phenomenological approach (Used in our selected article) of

qualitative research: the authors studied the lived phenomena of regular customers of

Islamic banking through in-depth interviews and analyzed transcribed data to describe

the sense of experience of customers.

You might also like

- CHP For AjmerDocument343 pagesCHP For AjmerHarsh Shah33% (3)

- Performance Appraisal at KMBDocument66 pagesPerformance Appraisal at KMBKrishna ChodasaniNo ratings yet

- Mba - Synopsis - Format - For - Comperative Study Axis Bank and SbiDocument8 pagesMba - Synopsis - Format - For - Comperative Study Axis Bank and SbisunnyNo ratings yet

- An Introduction To Secondary Data Analysis With IBM SPSS Statistics - John MacInnesDocument504 pagesAn Introduction To Secondary Data Analysis With IBM SPSS Statistics - John MacInnesAhmed Yousufzai100% (1)

- Motion For Forensic Examination - Cyber CasedocxDocument5 pagesMotion For Forensic Examination - Cyber CasedocxJazz Tracey100% (1)

- Skott Marsi Art Basel Sponsorship DeckDocument11 pagesSkott Marsi Art Basel Sponsorship DeckANTHONY JACQUETTENo ratings yet

- Final SynopsisDocument10 pagesFinal SynopsisArun AcharyaNo ratings yet

- Fahad Ashraf SynopsisDocument8 pagesFahad Ashraf SynopsisNageshwar SinghNo ratings yet

- Customer Services in ICICI&SBI-SynopsisDocument4 pagesCustomer Services in ICICI&SBI-SynopsisNageshwar SinghNo ratings yet

- Measuring Customers Attitudes Towards BaDocument16 pagesMeasuring Customers Attitudes Towards Bafikru terfaNo ratings yet

- Factor Analysis On Purchasing Decision of Islamic Insurance: Purpose of The StudyDocument5 pagesFactor Analysis On Purchasing Decision of Islamic Insurance: Purpose of The StudyTAZWARUL ISLAMNo ratings yet

- OB Group AssignmentDocument10 pagesOB Group AssignmentmubeyinyenuriyeNo ratings yet

- Assignment No. 1: Mr. Ahmed AsifDocument4 pagesAssignment No. 1: Mr. Ahmed AsifejazrdNo ratings yet

- Research Methodology Full ReportDocument22 pagesResearch Methodology Full ReportRAJUKACHHAD09No ratings yet

- Performance Appraisal in Banking Sector by Ekta BhatiaDocument102 pagesPerformance Appraisal in Banking Sector by Ekta BhatiaManjuNo ratings yet

- Performance Appraisal in Banking Sector by Ekta BhatiaDocument102 pagesPerformance Appraisal in Banking Sector by Ekta BhatiaSalman QureshiNo ratings yet

- Final Exam of Arm Mba Taha AnwarDocument4 pagesFinal Exam of Arm Mba Taha Anwartaha anwarNo ratings yet

- Article Review Group AssignmentDocument11 pagesArticle Review Group AssignmentmkdiNo ratings yet

- Final Synopsis of VikasDocument13 pagesFinal Synopsis of VikasRakesh YadavNo ratings yet

- Credit Risk MGHT Article ReviewDocument8 pagesCredit Risk MGHT Article ReviewAbdi Mucee TubeNo ratings yet

- Chapter 6Document17 pagesChapter 6shibanath guruNo ratings yet

- Project Report On Marketing Strategies of VodafoneDocument73 pagesProject Report On Marketing Strategies of VodafonePankaj GandhiNo ratings yet

- Research Design SERVQUAL Model ICICI BankDocument6 pagesResearch Design SERVQUAL Model ICICI BankPULKIT KAURA 2127621100% (1)

- A Study of Consumer Behavior With Respect To Financial News Paper at Business StandardDocument42 pagesA Study of Consumer Behavior With Respect To Financial News Paper at Business Standardsai thesisNo ratings yet

- PraveenDocument13 pagesPraveenNageshwar SinghNo ratings yet

- Reasearch Proposal On Mutual FundDocument8 pagesReasearch Proposal On Mutual FundpalashmkhNo ratings yet

- Scope of StudyDocument2 pagesScope of StudyAthirah DasukiNo ratings yet

- Mid-Term RMDocument15 pagesMid-Term RMMartinnico Octatrino SiraitNo ratings yet

- RMDocument38 pagesRMDDZNo ratings yet

- A Comparative Fundamental Analysis of Bank Nifty StocksDocument5 pagesA Comparative Fundamental Analysis of Bank Nifty StocksnidhinambuNo ratings yet

- Competitive Stock Market Trading" 7. Problem Statement: Each Research Study Has Its Own Specific Purpose. ItDocument4 pagesCompetitive Stock Market Trading" 7. Problem Statement: Each Research Study Has Its Own Specific Purpose. ItapshapadaliyaNo ratings yet

- Lit Rview Credit AppraisalDocument4 pagesLit Rview Credit AppraisalHari KrishnanNo ratings yet

- Merchant Bank DataDocument7 pagesMerchant Bank DataHarsh KbddhsjNo ratings yet

- Project OutlineDocument7 pagesProject OutlineهشامعبدالعزيزNo ratings yet

- A Study On Customer Satisfaction Towards Organised and Unorganised RetailingDocument5 pagesA Study On Customer Satisfaction Towards Organised and Unorganised RetailingMohammed WaseemNo ratings yet

- Review of LiteratureDocument11 pagesReview of Literaturesneha s kumarNo ratings yet

- AB BankingDocument100 pagesAB Bankingextra fileNo ratings yet

- Literature Review 2Document9 pagesLiterature Review 2Hari Priya0% (1)

- Portfolio Investment Analysis Of: Nepal Stock MarketDocument11 pagesPortfolio Investment Analysis Of: Nepal Stock MarketDipenNo ratings yet

- Raghav Chaithly - Major ProjectDocument49 pagesRaghav Chaithly - Major ProjectDheeraj PrajapatiNo ratings yet

- The Relationship Between Customer Behavior Modeling and Banking SustainabilityDocument19 pagesThe Relationship Between Customer Behavior Modeling and Banking Sustainabilityثقتي بك ياربNo ratings yet

- Final 14-04-2022Document80 pagesFinal 14-04-2022Priyanka SadaphuleNo ratings yet

- YARDSTIK INTERNATIONAL COLLEGE Articl Group Assign MentDocument9 pagesYARDSTIK INTERNATIONAL COLLEGE Articl Group Assign MentmkdiNo ratings yet

- Workshop Sheet 5B (Drafting The Methodology)Document5 pagesWorkshop Sheet 5B (Drafting The Methodology)Jastine EmpenidaNo ratings yet

- Research Papers On Investment BehaviorDocument9 pagesResearch Papers On Investment Behaviorafnhicafcspyjh100% (1)

- Literature ReviewDocument28 pagesLiterature ReviewajayNo ratings yet

- Dissertation Synopsis On "Document5 pagesDissertation Synopsis On "rohanNo ratings yet

- A Study On Various Banking Service Factors Influencing To HNI/Premium Customers BehavioursDocument6 pagesA Study On Various Banking Service Factors Influencing To HNI/Premium Customers BehavioursAshutosh KumarNo ratings yet

- Amit Dey SynopDocument7 pagesAmit Dey Synopnageshwar singhNo ratings yet

- Customer Services in ICICI&SBIDocument14 pagesCustomer Services in ICICI&SBINageshwar SinghNo ratings yet

- Proposal Project Paper 1 - AITABDocument11 pagesProposal Project Paper 1 - AITABwaja2607No ratings yet

- 09jjcma048 SandeepDocument4 pages09jjcma048 SandeepPrinceKunjumonNo ratings yet

- HRM Assignment 1Document17 pagesHRM Assignment 1chocolateNo ratings yet

- Mutualfunds - Its Influence and Impact On Bangalore Market SegmentDocument4 pagesMutualfunds - Its Influence and Impact On Bangalore Market SegmentKshatriy'as ThigalaNo ratings yet

- Research Methodology and Review of Literature: Statistical TechniquesDocument27 pagesResearch Methodology and Review of Literature: Statistical TechniquesBhavin GhoniyaNo ratings yet

- A Comparative Study of Customer Satisfaction Towards Hospitality Services in AmravatiDocument9 pagesA Comparative Study of Customer Satisfaction Towards Hospitality Services in AmravatiPushpak MahakalkarNo ratings yet

- Project F of RelianceDocument62 pagesProject F of RelianceVinod Kumar Saroj100% (1)

- Customer Satisfaction Towards Financial Products and Services of HDFC BankDocument9 pagesCustomer Satisfaction Towards Financial Products and Services of HDFC BankUtsav JaiswalNo ratings yet

- Manmul Profile MbaDocument20 pagesManmul Profile MbaVishwa NNo ratings yet

- Axis BankDocument79 pagesAxis BankAnnu Kesharwani AKNo ratings yet

- Bank Dissertation PDFDocument8 pagesBank Dissertation PDFPaperHelpWritingCanada100% (1)

- Qualitative Research for Beginners: From Theory to PracticeFrom EverandQualitative Research for Beginners: From Theory to PracticeRating: 3 out of 5 stars3/5 (2)

- Participatory Action Research for Evidence-driven Community DevelopmentFrom EverandParticipatory Action Research for Evidence-driven Community DevelopmentNo ratings yet

- Hatch 2001Document29 pagesHatch 2001Ahmed YousufzaiNo ratings yet

- 615 Public Policy Profits and PopulismDocument8 pages615 Public Policy Profits and PopulismAhmed YousufzaiNo ratings yet

- Stock Market, Economic Performance, and Presidential ElectionsDocument12 pagesStock Market, Economic Performance, and Presidential ElectionsAhmed YousufzaiNo ratings yet

- The Price of Political Uncertainty: Evidence From The 2016 U.S. Presidential Election and The U.S. Stock MarketsDocument27 pagesThe Price of Political Uncertainty: Evidence From The 2016 U.S. Presidential Election and The U.S. Stock MarketsAhmed YousufzaiNo ratings yet

- Are Policy Platforms Capitalized Into Equity Prices? Evidence From The Bush/Gore 2000 Presidential ElectionDocument21 pagesAre Policy Platforms Capitalized Into Equity Prices? Evidence From The Bush/Gore 2000 Presidential ElectionAhmed YousufzaiNo ratings yet

- APA Style Format Daftar Pustaka PDFDocument4 pagesAPA Style Format Daftar Pustaka PDFfilantropiNo ratings yet

- Who Writes The News? Corporate Press Releases During Merger NegotiationsDocument51 pagesWho Writes The News? Corporate Press Releases During Merger NegotiationsAhmed YousufzaiNo ratings yet

- Political Elections and Uncertainty Are BRICS Markets Equally Exposed To Trump's Agenda?Document27 pagesPolitical Elections and Uncertainty Are BRICS Markets Equally Exposed To Trump's Agenda?Ahmed YousufzaiNo ratings yet

- Presidents Blinder Watson Nov2013Document57 pagesPresidents Blinder Watson Nov2013Ahmed YousufzaiNo ratings yet

- DPTX 0 0 11230 Jdip01 18655 0 74572Document79 pagesDPTX 0 0 11230 Jdip01 18655 0 74572Ahmed YousufzaiNo ratings yet

- W 23152Document31 pagesW 23152Ahmed YousufzaiNo ratings yet

- Buchanan 2016Document57 pagesBuchanan 2016Ahmed YousufzaiNo ratings yet

- Engelberg ParsonsDocument44 pagesEngelberg ParsonsAhmed YousufzaiNo ratings yet

- Soros Game ChangerDocument3 pagesSoros Game ChangerAhmed YousufzaiNo ratings yet

- Occupy and TEA Party's Attention Support Current Relevance of Smith, Hamilton, and Keynes Economic Views President Obama's Economic InfluencesDocument9 pagesOccupy and TEA Party's Attention Support Current Relevance of Smith, Hamilton, and Keynes Economic Views President Obama's Economic InfluencesAhmed YousufzaiNo ratings yet

- U.S. Private Capital Accumulation and Trump's Economic ProgramDocument17 pagesU.S. Private Capital Accumulation and Trump's Economic ProgramAhmed YousufzaiNo ratings yet

- GMMDocument33 pagesGMMShuchi GoelNo ratings yet

- SSRN Id2845385Document25 pagesSSRN Id2845385Ahmed YousufzaiNo ratings yet

- W 22740Document13 pagesW 22740Ahmed YousufzaiNo ratings yet

- SSRN Id2845385Document25 pagesSSRN Id2845385Ahmed YousufzaiNo ratings yet

- Article For FRDocument41 pagesArticle For FRAhmed YousufzaiNo ratings yet

- W 23184Document43 pagesW 23184Ahmed YousufzaiNo ratings yet

- Economic Modelling: Kun Fan, Yang Shen, Tak Kuen Siu, Rongming WangDocument10 pagesEconomic Modelling: Kun Fan, Yang Shen, Tak Kuen Siu, Rongming WangAhmed YousufzaiNo ratings yet

- Nonlinear Analysis: Real World Applications: R.H. LiuDocument13 pagesNonlinear Analysis: Real World Applications: R.H. LiuAhmed YousufzaiNo ratings yet

- Goodell 2015Document44 pagesGoodell 2015Ahmed YousufzaiNo ratings yet

- Wooldridge Session 4Document64 pagesWooldridge Session 4Henry KaweesaNo ratings yet

- EconometricsDocument4 pagesEconometricsarsalan1984No ratings yet

- Economic Modelling: Kun Fan, Yang Shen, Tak Kuen Siu, Rongming WangDocument10 pagesEconomic Modelling: Kun Fan, Yang Shen, Tak Kuen Siu, Rongming WangAhmed YousufzaiNo ratings yet

- Finance Research Letters: Yann BraouezecDocument8 pagesFinance Research Letters: Yann BraouezecAhmed YousufzaiNo ratings yet

- Barangay San Pascual - Judicial Affidavit of PB Armando DeteraDocument9 pagesBarangay San Pascual - Judicial Affidavit of PB Armando DeteraRosemarie JanoNo ratings yet

- LT32567 PDFDocument4 pagesLT32567 PDFNikolayNo ratings yet

- Security+ Guide To Network Security Fundamentals, Fifth EditionDocument52 pagesSecurity+ Guide To Network Security Fundamentals, Fifth EditionVitæ ÆgisNo ratings yet

- Microsoft Power Platform Adoption PlanningDocument84 pagesMicrosoft Power Platform Adoption PlanningcursurilemeleNo ratings yet

- Automotive Workshop Practice 1 Report - AlignmentDocument8 pagesAutomotive Workshop Practice 1 Report - AlignmentIhsan Yusoff Ihsan0% (1)

- LGC CasesDocument97 pagesLGC CasesJeshe BalsomoNo ratings yet

- BBA - Study On Gold As A Safer Investment CommodityDocument94 pagesBBA - Study On Gold As A Safer Investment CommoditySANJU GNo ratings yet

- Jungle Safari Booking Management System: Mini Project ReportDocument19 pagesJungle Safari Booking Management System: Mini Project ReportNIRAV SHAH100% (1)

- LSD - Job Description - LogisticsDocument2 pagesLSD - Job Description - LogisticsIjas AslamNo ratings yet

- Assessment Task 2 2Document10 pagesAssessment Task 2 2Pratistha GautamNo ratings yet

- Assessment E - Contract - LaundryDocument5 pagesAssessment E - Contract - LaundrySiddhartha BhusalNo ratings yet

- PEL 20161201 Dec 2016Document76 pagesPEL 20161201 Dec 2016RémiNo ratings yet

- How The CBO Works: Jonathan Lewis WWW - Jlcomp.demon - Co.ukDocument37 pagesHow The CBO Works: Jonathan Lewis WWW - Jlcomp.demon - Co.ukomeratisNo ratings yet

- The Object-Z Specification Language: Software Verification Research Centre University of QueenslandDocument155 pagesThe Object-Z Specification Language: Software Verification Research Centre University of QueenslandJulian Garcia TalanconNo ratings yet

- List of Medical Institutions Available For Foreign Language(s)Document24 pagesList of Medical Institutions Available For Foreign Language(s)leithNo ratings yet

- A Study On Flywheel Energy Recovery From Aircraft BrakesDocument5 pagesA Study On Flywheel Energy Recovery From Aircraft BrakesRaniero FalzonNo ratings yet

- Microwave Engineering MCC121, 7.5hec, 2014: Passive DevicesDocument47 pagesMicrowave Engineering MCC121, 7.5hec, 2014: Passive DevicesBruno AlvimNo ratings yet

- Case Study-Hain Celestial: Student Name Institution Affiliation DateDocument5 pagesCase Study-Hain Celestial: Student Name Institution Affiliation DategeofreyNo ratings yet

- Information For Producers of Emergency Fittings Acc. To Iec 60598 2 22Document10 pagesInformation For Producers of Emergency Fittings Acc. To Iec 60598 2 22mohammed imran pashaNo ratings yet

- Algebra 1 Vocab CardsDocument15 pagesAlgebra 1 Vocab Cardsjoero51No ratings yet

- 27 20130913 Kebijakan Inovasi Teknologi Untuk Pengelolaan Lahan Suboptimal Berkelanjutan-With-Cover-Page-V2Document12 pages27 20130913 Kebijakan Inovasi Teknologi Untuk Pengelolaan Lahan Suboptimal Berkelanjutan-With-Cover-Page-V2MeigimaesaNo ratings yet

- CorpDocument14 pagesCorpIELTSNo ratings yet

- Evolution of Human Resource ManagementDocument13 pagesEvolution of Human Resource Managementmsk_1407No ratings yet

- Lect 04Document22 pagesLect 04Beam MoonNo ratings yet

- Thesis HealthDocument5 pagesThesis Healthcreasimovel1987100% (1)

- Warm Mix Asphalt: "National Perspective"Document46 pagesWarm Mix Asphalt: "National Perspective"Royhan RizkyNo ratings yet

- Hiring and Selection Process: A Harvard Business School: Case StudyDocument26 pagesHiring and Selection Process: A Harvard Business School: Case StudylonlinnessNo ratings yet