Professional Documents

Culture Documents

Lankbank Environmental PDF

Uploaded by

wmorreOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lankbank Environmental PDF

Uploaded by

wmorreCopyright:

Available Formats

Environmental

Protection and Management

Fostering a Greener, Healthier Environment

Sps. Aileen and Jonathan Suy

JOMARAY Pulp Packaging Industries

2010 SME Maka-kalikasan Awardee

The recognition from LANDBANK for protecting the environment and

promoting environmental programs through the course of our business

operations came as a surprise to us. JOMARAY have been around to serve

our patrons and clients while significantly conserving and safeguarding

the environment. Our gratitude to LANDBANK for the financial support to

our recycling plant.

LANDBANK is committed to support and actively

promote environmental protection and sustainable

development. Its Corporate Environmental Policy conveyed

the Banks advocacy to take part in the protection of the

environment and promotion of sustainable development

through integration of effective environmental management

practices into its operations, services and decisions.

The creation of an Environmental Unit which was later

on upgraded to Environmental Program and Management

Department designated an organic unit within the Bank to

pursue this commitment.

Environmental Management System

The Environmental Management System (EMS) provided

LANDBANK a framework for handling its environmental

issues. It brings together the Banks business processes,

as well as the environmental aspects and impacts of its

activities, products and services.

To support the implementation and continual

improvement of LANDBANKs EMS, various in-house

environmental programs and initiatives are being

implemented such as electricity, water, paper and fuel

conservation programs.

LANDBANK EMS Milestones

January 2003

The Banks Corporate Environmental Policy was

established.

June 2005

LANDBANK Head Offices EMS was certified

to be compliant with ISO 14001 international

standards.

April 2008

Implementation of EMS Good Practices

nationwide took effect through LANDBANK

Executive Order No. 20, Series of 2008.

August 2008

ISO 14001:2004 certificate was expanded to

include 10 pilot branches in NCR.

August 2010

Additional eight provincial branches in Luzon,

Visayas and Mindanao were issued with ISO

14001:2004 certificate.

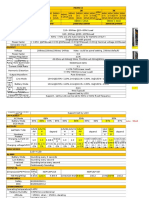

Results of EMS Implementation

at the Head Office

Electricity Consumption (in kwh)

Fuel Consumption (in liters)

160,000

11,000,000

10,500,000

140,000

10,000,000

120,000

9,500,000

100,000

9,000,000

2010

10,728,407

9,791,205

2009

10,867,500

10,076,500

baseline

actual

A4 Bond Paper Consumption

(in reams)

40,000

2010

154,967

143,768

2009

131,586

130,900

Water Consumption per

Capita (in cubic meters)

2009

27,508

18,191

20

18

20,000

2010

27,508

18,647

baseline

actual

16

0

baseline

actual

2010

19.71

17.41

2009

19.71

19.29

baseline

actual

In

Units

In

Million

1,728,202

kwh

13.50

Reduced 789.79

metric tons of CO2

Water

7,278

m3

0.62

Conserved fresh /

potable water

A4 Bond Paper

18,178

reams

2.25

Saved 742 trees

Fuel

(Diesel and

Gasoline)

11,885

liters

0.62

Reduced 25.03 metric

tons of CO2

Total Savings

from 2009-2010

Electricity

Benefit to

Environment

Notes:

Baseline data for 2010 electricity consumption was

adjusted to exclude consumption at the 10th and 12th

floors of the LANDBANK Plaza.

Baseline data for 2010 fuel consumption was adjusted to

reflect additional vehicles acquired by the Bank.

Minimal increase in paper consumption is within the target

set by the Bank.

27

Environmental Protection and Management

LANDBANK voluntarily implements the Greenhouse Gas

(GHG) Accounting and Reporting Program. The program

aims to determine the carbon footprint of LANDBANK or

the total GHG emission of its operations. LANDBANKs GHG

Accounting and Reporting Program was implemented in

2010. The Bank initially computed the direct (Scope 1) and

indirect (Scope 2) GHG emissions of its Head Office and

branches particularly from the use of service vehicles and

consumption of purchased electricity, respectively.

By knowing the major sources of LANDBANKs carbon

footprint, the Bank was able to determine and continuously

identify programs and projects to reduce or offset its GHG

emissions.

To further enhance its GHG inventory, LANDBANK is

currently in the process of covering all units nationwide

for its Scope 1 and Scope 2 emissions and is studying the

inclusion of other indirect GHG emissions (Scope 3) from

business travels and employees commuting to work.

Equivalent GHG Emission

(in metric tons CO2)

Source of

Emission

Fuel

(Scope 1)

Electricity

(Scope 2)

Total Per Source

374.59

4,539.38

4,913.97

LANDBANK Branches *

* covers 324 reporting branches/field

offices

1,776.58

6,221.24

7,997.82

Total per Scope

2,151.17

10,760.62

LANDBANK Plaza/Head Office

Total Carbon Footprint of LANDBANK

12,911.79

LANDBANKs Carbon Footprint

83%

electricity

17%

fuel

28

Implementing Environmental Due

Diligence in Credit Delivery

The Credit Policy Issuance (CPI) 2009-02 aims to ensure

that all projects financed by LANDBANK and all collaterals

being offered as securities are environmentally sound and

compliant with environmental laws and regulations.

The Banks environmental due diligence (EDD) is

embedded in its credit delivery starting from loan packaging

until its full payment.

While all financed projects are covered by the EDD,

detailed environmental assessment includes only the

projects that fall within the environmental impact

groupings per Department of Environment and Natural

Resources (DENR) Administrative Order No. 2003-30 or the

Implementing Guidelines of the Philippine Environmental

Impact Statement (EIS) System.

Projects Assessed Per EIS Grouping

(from January to December 2010)

The EDD system helps LANDBANK clients mitigate risks

associated with possible imposition of fines and penalties

or closure due to environment-related violations. At the

same time, the Banks role as a funder that promotes

environmental stewardship and socially responsible

development is reinforced as the policy guarantees

that project proponents are compliant with Philippine

environmental laws and standards.

To recognize the clients efforts in environmental

protection and responsible operations, LANDBANK included

environmental criteria in the annual search for outstanding

clients and gave special awards for best environmental

practices:

1. Best in Environmental Protection Award under the

Gawad sa Pinakatanging Kooperatiba or Gawad

PITAK;

2. SME Maka-kalikasan Award under the Gawad

Entrepreneur; and

3. Most Environment-Friendly Project under the

Countryside Loan Fund (CLF) Award.

85%

Group II

13%

Group III

2%

Group I

Projects

GROUP I

Environmentally Critical Projects

2010

2009

12

GROUP II

Projects located in Environmentally Critical

Areas (ECAs)

299

268

GROUP III

Non-environmentally critical project in

non-environmentally critical area

45

61

352

344

GROUP IV

Co-located project under one or more

proponents/locators which are located in a

contiguous area

TOTAL

Of the projects requiring detailed environmental

assessment for 2010, 224 projects or 64 percent are fully

compliant with environmental laws and regulations while

128 projects or 36 percent are being assisted and guided

by LANDBANK to comply with the different environmental

requirements and standards.

Financing and Managing Climate

Change and Environmental Projects

In 2009 and 2010 LANDBANK extended 4.7 billion

loans to environment-related projects to promote cleaner

production and environment friendly business practices.

LANDBANK accesses long-term development funds from

international partners namely the World Bank (WB), Asian

Development Bank (ADB), Japan International Cooperation

Agency (JICA) and Kreditanstalt fr Wiederaufbau (KfW)

of Germany, among others. These funds were on-lent to its

mandated clients to finance services and manufacturing that

generates employment and address problems on water, solid

waste management, sanitation and sewerage facilities, and

renewable energy, among others.

Ongoing foreign-funded projects are given on the

next page.

29

Environmental Protection and Management

Foreign Funds for the Environment

Project

Features

Status / Impact as of end-2010

WB-Support for

Strategic Local

Development and

Investment Project

JPY 11.7 billion loan fund to improve 2.3 billion funded 64 projects for drainage/sanitation,

public service provision and

water system, shoreline protection, construction of

management intended for LGUs

slaughterhouse, public market, among others

implementing strategic infrastructure 60.0 million approved for 1MW mini-hydro power plant

investments

project and 293 million for landfill project

WB-Manila Third

Sewerage Project

US$64 million loan to Manila Water

Company, Inc. to increase coverage

and effectiveness of sewerage service

delivery, as well as, to establish

financial and technical viability of new

approaches for sewage management

in Metro Manila

68,910 water connections with sewage treatment

completed

3.79 million meters3 of sewage treated prior to disposal

333,157 septic tanks de-sludged; 731,188 meters3 septage

treated prior to disposal

306.84 tons of Biochemcial Oxygen Demand removed in

2010

KfW-Community Based

Forest & Mangrove

Protection Program

EUR 2.4 million loan fund for

relending to eligible Panay and

Negros LGUs for infrastructure /

livelihood activities supportive of

Natural Resource Management

39.6 million initially disbursed for construction of fish

market, inland resort and purchase of heavy equipment

KfW-Credit Line for

Energy Efficiency and

Climate Protection

EUR 2.0 million loan to reduce direct

consumption of primary energy/

direct greenhouse gas (GHG)

emissions for clients environmental

projects

120 LBP personnel participated in four briefings aimed

at enhancing capacity for evaluating renewable energy

projects

Ozone Depleting

Substance (ODS)

Phaseout Investment

Project

$10.58 million grant from Multilateral

Fund of Montreal Protocol,

co-implemented with DENR

2,563 ODP tons of CFC phased out under the project

benefiting 17 enterprises from the manufacturing sector

and 2,294 refrigeration and mobile air conditioning service

shops

Aimed to phase out

chlorofluorocarbon (CFC)

consumption according to the

Montreal Protocol phase-out schedule

Project Preparation

Fund (PPF) for

Renewable Energy

Supported project preparation of three mini-hydro

US$ 321,300 Global Environment

projects with projected power capacity of 16MW and

Facility from United Nations

equivalent GHG to be reduced of 76,382tCO2e

Development Programme (UNDP)

implemented by Department of

Energy under the Capacity Building to

Remove Barriers towards Renewable

Energy Development (CBRED), with

LANDBANK as Program and Fund

Manager

Aimed to finance project preparation

activities such as market assessment,

technical data gathering, feasibility

study preparation, etc. for renewable

energy projects

30

Renewable Energy for Wiser and

Accelerated Resources Development

(REWARD)

The REWARD Program is the Banks financing assistance

in response to the governments call to promote the

development of renewable energy and biofuels projects in

the country. It aims to lessen dependence on imported fuels

and enhance the quality of the environment, as well as

employment in the community.

Type of Project

No. of

Projects

Total Project

Size/Capacity

Biofuel

125,000 liters

per day of fuel

grade ethanol

Hydro Power

764.6 MW

Biomass

17.195 MW

TOTAL

16

At present, it has two PoAs:

Methane Recovery and Combustion with Renewable

Energy Generation from Anaerobic Animal Manure

Management Systems (Animal Waste-to-Energy);

and

Landfill Gas Recovery and Combustion with

Renewable Energy Generation from Sanitary Landfill

Sites (Landfill Gas-to-Energy).

Emission Reduction Purchase Agreement with the

World Bank / International Bank for Reconstruction and

Development was signed in January 2010 for the sale and

purchase of carbon emission reduction (CERs) from the

above PoAs. The CERs will be generated from the 41 pig

farms and two sanitary landfills that have signified their

interest to join the CFSF program.

Carbon Finance Support Facility (CFSF)

Clean Development Mechanism (CDM) is a program

of the United Nations Framework Convention on Climate

Change which allows developing countries like the

Philippines to sell their carbon credits or certified emission

reduction (CER) from CDM projects to developed countries

in order to meet their GHG emission reduction targets as

agreed in the Kyoto Protocol. CFSF aims to assist clients in

every step of the CDM project cycle including financing with

the end-view of generating and monetizing carbon credits to

serve as an additional revenue stream.

LANDBANK is the first financial institution in the

Philippines to engage as a Coordinating and Managing

Entity (C/ME) for two CDM Programme of Activities (PoAs).

As a C/ME, LANDBANK prepares the CDM Project Activity

Design Documents, provides assistance and facilitates CDM

project application, validation, monitoring and verification,

as well as financing.

Biotech Farms in Koronadal,

South Cotabato

Marcela Farms in Bohol

Assistance to Indigenous Peoples (IPs)

for Environment Protection and EcoBiodiversity

This LCDFI program focuses on organizing and providing

alternative livelihood to indigenous peoples communities to

prevent encroachment and degradation of forest resources.

Eight institutional partners participated in this program,

benefiting 1,600 IPs.

31

You might also like

- Finance - United UtilitiesDocument4 pagesFinance - United UtilitiesRohit DhoundiyalNo ratings yet

- Country Paper: Philippines: Part 2Document6 pagesCountry Paper: Philippines: Part 2ADBI EventsNo ratings yet

- Green Finance For Green GrowthDocument24 pagesGreen Finance For Green GrowthSreejith BhattathiriNo ratings yet

- San Fran Strategic PlanDocument36 pagesSan Fran Strategic PlanNeilNo ratings yet

- Greeen Banking of IBBLDocument4 pagesGreeen Banking of IBBLVubon MinuNo ratings yet

- Water Wastewater Impact Reporting Final 8 June 2017 130617Document9 pagesWater Wastewater Impact Reporting Final 8 June 2017 130617Renny DesianaNo ratings yet

- IncinerationDocument35 pagesIncinerationFrancisco RenteriaNo ratings yet

- CIRCLECON Study ICSRPA GeorgiaDocument33 pagesCIRCLECON Study ICSRPA GeorgiaElene ChkheidzeNo ratings yet

- A User's Guide To The CDM: (Clean Development Mechanism)Document89 pagesA User's Guide To The CDM: (Clean Development Mechanism)Mohan KrishnaNo ratings yet

- PT SMI Green Bond Dan Green Sukuk FrameworkDocument7 pagesPT SMI Green Bond Dan Green Sukuk FrameworkMohammad NurzamanNo ratings yet

- LLDADocument23 pagesLLDAimanolkioNo ratings yet

- At A Glance The Green Seafood Business Programme Project DescriptionDocument2 pagesAt A Glance The Green Seafood Business Programme Project Descriptionapi-286562658No ratings yet

- Annual Environment: National Capital CommissionDocument36 pagesAnnual Environment: National Capital CommissionpriyankaNo ratings yet

- STS-STANDDocument4 pagesSTS-STANDMichael Lalim Jr.No ratings yet

- Scho1209brnz e e PDFDocument76 pagesScho1209brnz e e PDFmunawarNo ratings yet

- BECC Accomplishments - November 19, 2014 ENGDocument62 pagesBECC Accomplishments - November 19, 2014 ENGManuel F. Rubio GallegoNo ratings yet

- Tor National Consultant For Nama Document On Street Efficient Lighting 1Document5 pagesTor National Consultant For Nama Document On Street Efficient Lighting 1api-304173542No ratings yet

- Canada Wide Action Plan EPRDocument50 pagesCanada Wide Action Plan EPRJesus Chucho BruzualNo ratings yet

- BNP Paribas Commitments For The Environment Oct 2017Document4 pagesBNP Paribas Commitments For The Environment Oct 2017TadilakshmikiranNo ratings yet

- 3M Virtual Tour (Draft)Document9 pages3M Virtual Tour (Draft)Dipak PatilNo ratings yet

- Waste ManagementDocument100 pagesWaste ManagementumzzNo ratings yet

- Karoun 4 Hydropower: Summary BoxDocument5 pagesKaroun 4 Hydropower: Summary BoxShankar JhaNo ratings yet

- Auckland Waste Management and Minimisation PlanDocument88 pagesAuckland Waste Management and Minimisation PlanGeorge WoodNo ratings yet

- Team D Class 5 Unit 6: Submitted By: Karan Malik Shivani Pal Shreya Khastagir Smit ShahDocument22 pagesTeam D Class 5 Unit 6: Submitted By: Karan Malik Shivani Pal Shreya Khastagir Smit ShahSmit ShahNo ratings yet

- UWS Carbon Management Plan 2010Document44 pagesUWS Carbon Management Plan 2010Chris FindlayNo ratings yet

- CER and VERDocument7 pagesCER and VERramuraghavan264No ratings yet

- IEMA Special Report WEBDocument102 pagesIEMA Special Report WEBluminita_mataNo ratings yet

- Bangladesh Partnership For Cleaner TextileDocument17 pagesBangladesh Partnership For Cleaner TextileDyeing DyeingNo ratings yet

- City Profile: Parañaque City (Philippines)Document2 pagesCity Profile: Parañaque City (Philippines)Lloyd KangNo ratings yet

- ToR Blue Economy TC Ver 22.04.2022Document10 pagesToR Blue Economy TC Ver 22.04.2022Nour-Eddine GaaloulNo ratings yet

- Final ToR For PCB MGT Project - ESIA Study.Document17 pagesFinal ToR For PCB MGT Project - ESIA Study.melkamuNo ratings yet

- Competition Law: Banking & Financial Institutions & Environmental SafeguardsDocument15 pagesCompetition Law: Banking & Financial Institutions & Environmental SafeguardsAshish SinghNo ratings yet

- Tor National Consultant For Nama Document On General Efficient LightingDocument5 pagesTor National Consultant For Nama Document On General Efficient Lightingapi-304173542No ratings yet

- 2006 IEC Philippines Country PaperDocument23 pages2006 IEC Philippines Country PaperMichael AlvarezNo ratings yet

- Kingspan EPDs Paper ALCAS 2013Document11 pagesKingspan EPDs Paper ALCAS 2013Ingeniero Mac DonnellNo ratings yet

- Derichebourg - Green Bond Framework VFDocument11 pagesDerichebourg - Green Bond Framework VFAleks Mk-kewlNo ratings yet

- DBLGreen Banking PolicyDocument4 pagesDBLGreen Banking PolicyRahman Mahin MizanNo ratings yet

- Quezon Province BiogasDocument34 pagesQuezon Province BiogascspolaNo ratings yet

- DBP Accomplishment ReportDocument23 pagesDBP Accomplishment ReportRaquelSaenzNo ratings yet

- Lceabc LceaDocument20 pagesLceabc LceaMiaNo ratings yet

- Aug112013gbcrd04e PDFDocument11 pagesAug112013gbcrd04e PDFMd. Monowar HossainNo ratings yet

- Clean Development Mechanism ThesisDocument8 pagesClean Development Mechanism Thesisfjebwgr4100% (1)

- cgpp4 9 Cit - SummaryDocument2 pagescgpp4 9 Cit - Summaryapi-286562658No ratings yet

- Best Practice in Microfinance - Green Finance Products - Cooperative Bank of KarditsaDocument1 pageBest Practice in Microfinance - Green Finance Products - Cooperative Bank of KarditsaHendra PutraNo ratings yet

- Korindo Biomass v02 2 - CompaDocument43 pagesKorindo Biomass v02 2 - CompajokanovNo ratings yet

- GH G ConversionDocument146 pagesGH G ConversionjorgeNo ratings yet

- Vietnam NCSP 2006 VerifiedDocument41 pagesVietnam NCSP 2006 VerifiedDuong Tranvan0% (1)

- Green Building User GuideDocument22 pagesGreen Building User Guidetpqnhat50% (2)

- Water Service Investment Programme 2010-2012Document68 pagesWater Service Investment Programme 2010-2012valeriobrlNo ratings yet

- Tao Wang - World Bank Experience On Carbon Finance Operations in BiogasDocument20 pagesTao Wang - World Bank Experience On Carbon Finance Operations in BiogasEnergy for AllNo ratings yet

- Dicky Edwin Hindarto - Lessons From Indonesia Carbon MarketDocument13 pagesDicky Edwin Hindarto - Lessons From Indonesia Carbon MarketAsia Clean Energy ForumNo ratings yet

- Guidebook On Waste Minimisation For IndustriesDocument27 pagesGuidebook On Waste Minimisation For Industriesnarasimhamurthy414No ratings yet

- Materilas and ConstructionDocument20 pagesMaterilas and ConstructionSajjad HassanNo ratings yet

- Env Management Sysem-FinalDocument44 pagesEnv Management Sysem-FinalShalini JhaNo ratings yet

- Environmental IssuesDocument6 pagesEnvironmental IssuesmwangangisimoNo ratings yet

- Solid Waste Management Sector in Pakistan: A Reform Road Map for Policy MakersFrom EverandSolid Waste Management Sector in Pakistan: A Reform Road Map for Policy MakersNo ratings yet

- Environmental Accounting and Reporting in India: A Study of Selected CompaniesDocument6 pagesEnvironmental Accounting and Reporting in India: A Study of Selected Companiesdevraj537853No ratings yet

- Unlocking the hydrogen economy — stimulating investment across the hydrogen value chain: Investor perspectives on risks, challenges and the role of the public sectorFrom EverandUnlocking the hydrogen economy — stimulating investment across the hydrogen value chain: Investor perspectives on risks, challenges and the role of the public sectorNo ratings yet

- PEG NursingDocument1 pagePEG NursingNikki M. ArapolNo ratings yet

- St. CamillusDocument26 pagesSt. CamillusNikki M. ArapolNo ratings yet

- Family Nursing Care Management Final Output For RealDocument46 pagesFamily Nursing Care Management Final Output For RealNikki M. ArapolNo ratings yet

- BioethicsDocument7 pagesBioethicsNikki M. ArapolNo ratings yet

- Case Study - Chronic BronchitisDocument5 pagesCase Study - Chronic BronchitisNikki M. ArapolNo ratings yet

- William Gilbert (1544-1603) Hypothesized That The Earth Is A Giant MagnetDocument10 pagesWilliam Gilbert (1544-1603) Hypothesized That The Earth Is A Giant MagnetNikki M. ArapolNo ratings yet

- Or NCP (Knowledge Deficit)Document1 pageOr NCP (Knowledge Deficit)Nikki M. ArapolNo ratings yet

- Or Drug StudyDocument7 pagesOr Drug StudyNikki M. ArapolNo ratings yet

- Or NCP (Risk For Infection)Document1 pageOr NCP (Risk For Infection)Nikki M. Arapol100% (1)

- Or NCP (Impaired Elimination)Document1 pageOr NCP (Impaired Elimination)Nikki M. ArapolNo ratings yet

- Or NCP (Risk For Bleeding)Document1 pageOr NCP (Risk For Bleeding)Nikki M. Arapol100% (1)

- Or NCP (Activity Intolerance)Document1 pageOr NCP (Activity Intolerance)Nikki M. Arapol100% (1)

- Or NCP (Risk For Injury)Document1 pageOr NCP (Risk For Injury)Nikki M. ArapolNo ratings yet

- CTL Development in ChinaDocument19 pagesCTL Development in ChinaZagdsuren AsNo ratings yet

- Soc BookDocument19 pagesSoc BookmuraliNo ratings yet

- 6-GFM G - 100ah Gel Battery Specification: Sunbright Power Co.,LTD. Sunbright Power Co.,LTDDocument2 pages6-GFM G - 100ah Gel Battery Specification: Sunbright Power Co.,LTD. Sunbright Power Co.,LTDtalibanindonesiaNo ratings yet

- 1-3K Memo IIDocument15 pages1-3K Memo IIDiegoNo ratings yet

- 2019 Formula List 5105 PDFDocument5 pages2019 Formula List 5105 PDFErwinNo ratings yet

- A High-Performance ChargerDocument11 pagesA High-Performance ChargerCR AthiraNo ratings yet

- Lecture 3 Phase TransformersDocument28 pagesLecture 3 Phase TransformersDaniel_Gar_Wah_HoNo ratings yet

- (EPAS) History of TransformerDocument33 pages(EPAS) History of TransformerMarcus Abracosa CaraigNo ratings yet

- Technical Particular and GuaranteeDocument2 pagesTechnical Particular and Guaranteeemailsepamku gorgom100% (2)

- 6305ele S1Document23 pages6305ele S1Jianguo WangNo ratings yet

- Memo On AEPS ReportDocument1 pageMemo On AEPS ReportNathan BenefieldNo ratings yet

- Cruise Ship UpgradeDocument2 pagesCruise Ship Upgrademr.sanyNo ratings yet

- Power Charts D2876.: at Fu LL Loa DDocument4 pagesPower Charts D2876.: at Fu LL Loa DBoyan BalanovNo ratings yet

- Nature Power 110 Watt Solar Panel KitDocument10 pagesNature Power 110 Watt Solar Panel KitBenjamin DoverNo ratings yet

- Clel083e138 MVSWG Exe WDG 601Document40 pagesClel083e138 MVSWG Exe WDG 601arielaparicioNo ratings yet

- 7PG21 Solkor RF Technical Manual Chapter 6 Commissioning PDFDocument21 pages7PG21 Solkor RF Technical Manual Chapter 6 Commissioning PDFmarkgaloNo ratings yet

- Why Is Ammonia Chiller More EfficientDocument2 pagesWhy Is Ammonia Chiller More Efficientsugandaraj522No ratings yet

- RCD0477270 K128 Circuit Diagram HDocument125 pagesRCD0477270 K128 Circuit Diagram HDinh SangNo ratings yet

- SPM D11Document82 pagesSPM D11Jaweria SiddiquiNo ratings yet

- Quotation: Wan SP EnterpriseDocument4 pagesQuotation: Wan SP EnterprisectaznimNo ratings yet

- Lab 5: Conservation of Energy: Physics NYA Section-460 Presented To Mr.W.ChayaDocument2 pagesLab 5: Conservation of Energy: Physics NYA Section-460 Presented To Mr.W.ChayaChristopher MorganNo ratings yet

- Power Plant P&IDDocument1 pagePower Plant P&IDRebaz Jamal Ahmed0% (1)

- Details of Solar Power Project, 31-3-2019 NDocument1 pageDetails of Solar Power Project, 31-3-2019 NPranav. ThubeNo ratings yet

- Chemistry InvestigatoryDocument16 pagesChemistry InvestigatoryVedant LadheNo ratings yet

- Part Iii - Electric SupplyDocument21 pagesPart Iii - Electric SupplymariyaNo ratings yet

- Ave - PF Report: Elnet Ver 5.0 Elmeasure India PVT LTDDocument3 pagesAve - PF Report: Elnet Ver 5.0 Elmeasure India PVT LTDMadan TiwariNo ratings yet

- Alfanar Co.: Site Test Report Ng-Sa Name of Substation: Dammam Housing 115/13.8KV Substation # 3Document2 pagesAlfanar Co.: Site Test Report Ng-Sa Name of Substation: Dammam Housing 115/13.8KV Substation # 3jayabalNo ratings yet

- 1ST Year CH# 11 T-12Document3 pages1ST Year CH# 11 T-12Amir HabibNo ratings yet

- 1b Technical Description - JMS 320C47 11barDocument11 pages1b Technical Description - JMS 320C47 11barRyan Meta PratamaNo ratings yet

- 34.5 KV Rms 34.5 KV RMS: 0 % THD 0 % THDDocument33 pages34.5 KV Rms 34.5 KV RMS: 0 % THD 0 % THDGlenn GregorioNo ratings yet