Professional Documents

Culture Documents

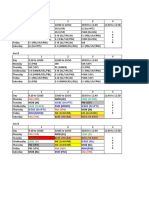

Provident Fund Contribution Calculator (A) (B) (C) (D)

Uploaded by

sri_yan0 ratings0% found this document useful (0 votes)

22 views1 pageThis document is a calculator for provident fund contributions in India. It shows employee contributions of 12% of basic salary in column B. Employer contributions are shown in column C at the same rate, and pension fund contributions by the employer at 8.33% of basic salary are in column D. The total annual contribution deposited into the employee's account is the sum of columns B, C and D before interest is applied. Basic salary figures for each month should be entered to calculate the accurate contributions.

Original Description:

PF Calculator

Original Title

PF Calculator

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a calculator for provident fund contributions in India. It shows employee contributions of 12% of basic salary in column B. Employer contributions are shown in column C at the same rate, and pension fund contributions by the employer at 8.33% of basic salary are in column D. The total annual contribution deposited into the employee's account is the sum of columns B, C and D before interest is applied. Basic salary figures for each month should be entered to calculate the accurate contributions.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views1 pageProvident Fund Contribution Calculator (A) (B) (C) (D)

Uploaded by

sri_yanThis document is a calculator for provident fund contributions in India. It shows employee contributions of 12% of basic salary in column B. Employer contributions are shown in column C at the same rate, and pension fund contributions by the employer at 8.33% of basic salary are in column D. The total annual contribution deposited into the employee's account is the sum of columns B, C and D before interest is applied. Basic salary figures for each month should be entered to calculate the accurate contributions.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

Provident Fund Contribution Calculator

(A)

(B)

(C )

(D)

Employee Contribution Employer Contribution

12 % @ of Basic Salary ( B - D )

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Pension Fund

@ 8.33

% of Basic

Salary from

Employer's

Contribution

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Total Contribution for the Year

0.00

Total Contribution for the year Deposited to Your RPFC

Account is (B) + ( C) + (D) before Interest*

0.00

0.00

Month

March

April

May

June

July

August

September

October

November

December

January

February

Please enter your actual Basic Salary

recived under head " BASIC" in your

Payslip

0.00

0.00

Basic Salary may reduce / increase due to attendance or any other factor

* Calculated Before Interest on PF & Pension which is declared by the Government of India

Pension Fund is calculated @ 8.33 % of the Basic Salary or Rs. 541/- per month whichever is less

You might also like

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Provident Fund Contribution Calculator (A) (B) (C) (D)Document1 pageProvident Fund Contribution Calculator (A) (B) (C) (D)Shilpa ShivannaNo ratings yet

- IT Calculator FY2009-10Document7 pagesIT Calculator FY2009-10RanjaniNo ratings yet

- Management Control SystemDocument11 pagesManagement Control SystemomkarsawantNo ratings yet

- Tax Implications On Income From EmploymentDocument6 pagesTax Implications On Income From Employmentkoiralan529No ratings yet

- SalaryDocument1 pageSalaryPrince AntonyNo ratings yet

- Patanjali Case StudyDocument6 pagesPatanjali Case StudysukhvindertaakNo ratings yet

- B Com Sem - VI Tally Third Class 2023Document2 pagesB Com Sem - VI Tally Third Class 2023Ayesha HignisNo ratings yet

- Ac557 W3 HW HBDocument2 pagesAc557 W3 HW HBHasan Barakat100% (2)

- Week3 Homework AC557Document2 pagesWeek3 Homework AC557seniorr001100% (1)

- Week 4 Practice Questions 1Document17 pagesWeek 4 Practice Questions 1Gabriel Abdillah100% (1)

- Key Assumptions: Investment DetailsDocument3 pagesKey Assumptions: Investment DetailsZulqarnainNo ratings yet

- Acct 557Document5 pagesAcct 557kihumbae100% (4)

- 401 (K) Savings Calculator: 401 (K) Plan Assumptions Summary of ResultsDocument3 pages401 (K) Savings Calculator: 401 (K) Plan Assumptions Summary of ResultsjhgkjhghjggjgjkjgkjNo ratings yet

- Inter Acct. Ch20Document20 pagesInter Acct. Ch20Angela ZhangNo ratings yet

- Lec. 11 & 12Document31 pagesLec. 11 & 12hafezmahmod86No ratings yet

- Cash Flow Forecast: SALES (See Notes) ReceiptsDocument4 pagesCash Flow Forecast: SALES (See Notes) ReceiptsGiurgi IoanNo ratings yet

- (Input Company Name) Income Statement Projection: RevenueDocument1 page(Input Company Name) Income Statement Projection: RevenueAshimNo ratings yet

- PAS 19 (Revised) Employee BenefitsDocument35 pagesPAS 19 (Revised) Employee BenefitsReynaldNo ratings yet

- Category - 2 PayrollDocument6 pagesCategory - 2 PayrollShipraNo ratings yet

- Preliminary Stuff and InputsDocument17 pagesPreliminary Stuff and InputsMehmet IsbilenNo ratings yet

- Section 401 (K) Calculator - ProblemDocument6 pagesSection 401 (K) Calculator - ProblemRaphael NanoNo ratings yet

- Section 401 (K) Calculator - ProblemDocument6 pagesSection 401 (K) Calculator - ProblemRaphael NanoNo ratings yet

- Salary Structure For 2008-2009Document28 pagesSalary Structure For 2008-2009anon-289280No ratings yet

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- Financial Forecasting: SIFE Lakehead 2009Document7 pagesFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNo ratings yet

- Salary Slip (32114282 October, 2019) PDFDocument1 pageSalary Slip (32114282 October, 2019) PDFSafa Saleem ButtNo ratings yet

- PDF Document E64dfec87bb0 1Document75 pagesPDF Document E64dfec87bb0 120BRM051 Sukant SNo ratings yet

- Income StatementDocument20 pagesIncome StatementkasoziNo ratings yet

- Information Technology SBA 2020 - 2021Document9 pagesInformation Technology SBA 2020 - 2021Michaela PowellNo ratings yet

- Vlookup, PMT FunctionswDocument1 pageVlookup, PMT Functionswapi-281337231No ratings yet

- Net Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!Document7 pagesNet Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!abhi1648665No ratings yet

- Problem Set #1 Solution: Part 1 (Cost of Capital)Document4 pagesProblem Set #1 Solution: Part 1 (Cost of Capital)Shirley YeungNo ratings yet

- Foreign Tax Credit - Worked Example From IRASDocument1 pageForeign Tax Credit - Worked Example From IRASItorin DigitalNo ratings yet

- Leveraged Buyout Analysis For Company XYZ: Select Operating and Financial DataDocument12 pagesLeveraged Buyout Analysis For Company XYZ: Select Operating and Financial DataVijendranArumugamNo ratings yet

- Case 3 SalaryDocument3 pagesCase 3 SalaryKritika ChoudharyNo ratings yet

- Noreen5e Appendix07C TB AnswerKeyDocument214 pagesNoreen5e Appendix07C TB AnswerKeyLeighNo ratings yet

- BFF2140 - Practice Questions For Final Exam - With - SolutionsDocument15 pagesBFF2140 - Practice Questions For Final Exam - With - SolutionsFarah PatelNo ratings yet

- Hrconnect Total CompDocument2 pagesHrconnect Total CompFatima SaeedNo ratings yet

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Een Field Real EstateDocument4 pagesEen Field Real Estatehemant sugandhNo ratings yet

- Current Year ($) Forecasted For Next Year ($) Book Value of Debt 50 50 Market Value of Debt 62Document9 pagesCurrent Year ($) Forecasted For Next Year ($) Book Value of Debt 50 50 Market Value of Debt 62Joel Christian MascariñaNo ratings yet

- Info SysDocument5 pagesInfo SysAtit SukheNo ratings yet

- Questions AccDocument3 pagesQuestions AccrajguptaNo ratings yet

- Section 401 (K) Calculator - ProblemDocument7 pagesSection 401 (K) Calculator - ProblemRaphael NanoNo ratings yet

- Provident FundDocument9 pagesProvident Fundmohammed umairNo ratings yet

- St-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsDocument13 pagesSt-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsGianfranco SpatolaNo ratings yet

- State Pension FundDocument4 pagesState Pension FundJunaid AkhtarNo ratings yet

- Residual Income Valuation - UrpDocument18 pagesResidual Income Valuation - Urparmando.chappell1005100% (1)

- OfferLetter Riya GuptaDocument2 pagesOfferLetter Riya Guptavermatanishq1610No ratings yet

- Salary Slip (31753687 November, 2019)Document1 pageSalary Slip (31753687 November, 2019)naheedNo ratings yet

- Income Analysis WorksheetDocument11 pagesIncome Analysis WorksheetRajasekhar Reddy AnekalluNo ratings yet

- 4801-Article Text-19217-1-10-20110701Document8 pages4801-Article Text-19217-1-10-20110701David BriggsNo ratings yet

- Computation of IncomeDocument4 pagesComputation of IncomeNATIONAL FARMERS PRODUCER COMPANYNo ratings yet

- Financial Projecti TemplatesDocument27 pagesFinancial Projecti Templatesbarakkat72No ratings yet

- Quiz 8Document1 pageQuiz 8Panda ErarNo ratings yet

- Dominica BEL Assignment-2Document23 pagesDominica BEL Assignment-2Victor MirandaNo ratings yet

- CapstruDocument30 pagesCapstruPro ResourcesNo ratings yet

- Incometax CalcualtorDocument4 pagesIncometax Calcualtorprakash_pkNo ratings yet

- PRMO 2020 CH 3 PolynomialsDocument18 pagesPRMO 2020 CH 3 Polynomialssri_yanNo ratings yet

- JP Mysore Exp Third Ac (3A) : Electronic Reserva On Slip (ERS)Document2 pagesJP Mysore Exp Third Ac (3A) : Electronic Reserva On Slip (ERS)sri_yanNo ratings yet

- Chapter Contents: Sets and Their RepresentationDocument10 pagesChapter Contents: Sets and Their Representationsri_yanNo ratings yet

- PRMO-2020 - Ch-2 - Number TheoryDocument28 pagesPRMO-2020 - Ch-2 - Number Theorysri_yanNo ratings yet

- Chapter Contents: Sets and Their RepresentationDocument10 pagesChapter Contents: Sets and Their Representationsri_yanNo ratings yet

- Certificate: Ms. Sreepavani VantedduDocument1 pageCertificate: Ms. Sreepavani Vanteddusri_yanNo ratings yet

- Faa (VPK) : Mob (JK) Mob (JK) Mob (JK)Document4 pagesFaa (VPK) : Mob (JK) Mob (JK) Mob (JK)sri_yanNo ratings yet

- Clubs Intro: Fudan UniversityDocument55 pagesClubs Intro: Fudan Universitysri_yanNo ratings yet

- Log EngagehubDocument1,137 pagesLog Engagehubsri_yanNo ratings yet

- Hindi Movie DatabaseDocument801 pagesHindi Movie DatabaseSyed Imran Shah94% (49)