Professional Documents

Culture Documents

GRN Preparation

Uploaded by

mansi0 ratings0% found this document useful (0 votes)

96 views1 pagegrn

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgrn

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

96 views1 pageGRN Preparation

Uploaded by

mansigrn

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

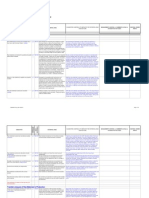

GRN preparation-

The documents sent are checked at the gate

PO is verified, if everything is OK the vehicle is given entry. The bill is stamped with the

gate inward entry stamp and local body tax stamp.

The material is to be sent to warehouse. The types of warehouses are-

o Main Raw Material

o Finished Goods(FG)

o Forging & Fittings

o Shop attachment and consumables.

On the basis of the type of material the material will be sent to the respective warehouse.

If there is no code on the document challan, then the store person would punch the item

code on the challan

Test certificate received along with the material, given to receipt QC for internal given

code number.

If the material is unloaded outside the factory warehouse, RMGP (raw material gate pass)

is made to move raw material from factory to unloading point.

There the vehicle is unloaded and quantity is verified.

Item Code and Test certificate is written on the materials and location on challan. The

document is sent back to the factory for to make GRN.

Store person makes the GRN and the document is handed over to excise for CENVAT

reversal.

The excise person gets CENVAT and returns the original document to stores.

The stores confirm the GRN through system.

One copy of the GRN along with the supporting documents is sent to QC for GRN

clearance. The supporting documents include-

o TC

o Inspection Report(IR)

o Packing slip(if required)

Once everything is checked as per PO terms and conditions the QC person clears the

GRN through system and informs the store

The store does inbound through the system and the material is ready for use.

The store people will send the documents to finance

You might also like

- S Ox Inventory Management Risks and ControlsDocument19 pagesS Ox Inventory Management Risks and ControlsMudit Kothari50% (2)

- SOP of Receiving Raw MaterialDocument4 pagesSOP of Receiving Raw MaterialYousif100% (6)

- S Ox Inventory Management Risks and ControlsDocument21 pagesS Ox Inventory Management Risks and ControlsAdnan Avdukić100% (1)

- Bangladesh Exporter GuidelinesDocument27 pagesBangladesh Exporter GuidelinesBaki HakimNo ratings yet

- Materials Receivig Work Instruction in A Manufacturing UnitDocument2 pagesMaterials Receivig Work Instruction in A Manufacturing Unitdeiveeganv411591% (11)

- Custom ClearanceDocument24 pagesCustom ClearanceManasi BundeNo ratings yet

- PVoC Inspection ProcedureDocument8 pagesPVoC Inspection Procedurefelixarim7299No ratings yet

- Pepping Up The MenuDocument3 pagesPepping Up The MenumansiNo ratings yet

- SOP For Material Inward - Inspection - AccountingDocument2 pagesSOP For Material Inward - Inspection - AccountingSuleman KhanNo ratings yet

- Stores ProcessDocument2 pagesStores Processabhishek agarwalNo ratings yet

- FG FlowchartDocument19 pagesFG FlowchartJesse Vance100% (1)

- SOP-Incoming MaterialsDocument4 pagesSOP-Incoming MaterialsShubham GuptaNo ratings yet

- Supply ChainDocument1 pageSupply ChainKashif IqbalNo ratings yet

- Different Modes of ReceiptDocument7 pagesDifferent Modes of ReceiptSK RAFI AHMEDNo ratings yet

- Inbound Supply Chain Process of Central Ware House, Jamshedpur ProcurementDocument3 pagesInbound Supply Chain Process of Central Ware House, Jamshedpur ProcurementAditya Raj GehlotNo ratings yet

- WPPDC-QMD-001-Material Control and Werehousing ProcedureDocument4 pagesWPPDC-QMD-001-Material Control and Werehousing ProcedureSimbu ArasanNo ratings yet

- Receiving Process Training ModuleDocument7 pagesReceiving Process Training Modulebijaypathak02No ratings yet

- Collection of Items: 1) by RoadDocument9 pagesCollection of Items: 1) by RoadCarbin VinojiNo ratings yet

- SOP IniventoryDocument12 pagesSOP IniventorychayalocNo ratings yet

- Warehousing & ControlsDocument15 pagesWarehousing & ControlsjmlafortezaNo ratings yet

- Material Control and WarehousingDocument25 pagesMaterial Control and WarehousingDeepak Rajan100% (1)

- BN-CO-107 Standard Procedure For Material Control and WarehousingDocument20 pagesBN-CO-107 Standard Procedure For Material Control and WarehousingAli HajirassoulihaNo ratings yet

- Cost RecordingDocument5 pagesCost RecordingGyanu KhatriNo ratings yet

- Procurement of Stores (Non-Stock) Procedure by Harjeet MeenaDocument19 pagesProcurement of Stores (Non-Stock) Procedure by Harjeet Meenaharjeet100% (3)

- Manage Inventory Operations in Dry Goods WarehouseDocument26 pagesManage Inventory Operations in Dry Goods WarehouseRonald San Juan LamataNo ratings yet

- Supply Chain of Big BazaarDocument13 pagesSupply Chain of Big Bazaarkhushbooseth0% (1)

- Autocars: Primary Transport Acknowledgement Check Points (Incoming Vehicles)Document17 pagesAutocars: Primary Transport Acknowledgement Check Points (Incoming Vehicles)yogeshpatil987No ratings yet

- WPPDC-QMD-001-Material Control and Werehousing ProcedureDocument5 pagesWPPDC-QMD-001-Material Control and Werehousing ProcedureSimbu ArasanNo ratings yet

- Standard Operating Procedure (SOP) For Store: (Procurement of Material)Document9 pagesStandard Operating Procedure (SOP) For Store: (Procurement of Material)TASHIDINGNo ratings yet

- PURCHASE ORDER TITLEDocument3 pagesPURCHASE ORDER TITLEVenkat GudipatiNo ratings yet

- New Lesotho garment factory work instructionsDocument5 pagesNew Lesotho garment factory work instructionsJahaziNo ratings yet

- Fabric Stores ProceduresDocument3 pagesFabric Stores ProceduresLM MuhammadNo ratings yet

- Warehouse Operations and Activities Receiving and Issuing of SuppliesDocument13 pagesWarehouse Operations and Activities Receiving and Issuing of SuppliesJasmine KariukiNo ratings yet

- SOP 9 IDENTIFICATION AND TRACEABILITYDocument3 pagesSOP 9 IDENTIFICATION AND TRACEABILITYvaishnavi100% (5)

- Import PurchaseDocument20 pagesImport PurchaseKAMALJEET SINGHNo ratings yet

- PTCL Internship - Materials and Logistics Business ProcessDocument3 pagesPTCL Internship - Materials and Logistics Business ProcessZeshan Ali SyedNo ratings yet

- Custom Clearance ProcessDocument5 pagesCustom Clearance ProcessAsif KhanNo ratings yet

- Customs Clearance in IndiaDocument16 pagesCustoms Clearance in IndiaAdNo ratings yet

- 8' Infinity Policies and GuidelinesDocument8 pages8' Infinity Policies and GuidelinesRicardo DelacruzNo ratings yet

- SOP Corporate StoresDocument3 pagesSOP Corporate StoresVikram MishraNo ratings yet

- Strategic Commodities Control HK 31052012Document2 pagesStrategic Commodities Control HK 31052012Steven LeeNo ratings yet

- QuestionsDocument8 pagesQuestionsValsa HarikaNo ratings yet

- Store SopDocument6 pagesStore SopRAJESH KUMAR100% (1)

- 10 Naw To Be Material AccountingDocument24 pages10 Naw To Be Material AccountingsivasivasapNo ratings yet

- Custom Clearance Procedures For Imported and Exported GoodsDocument54 pagesCustom Clearance Procedures For Imported and Exported GoodsntamakheNo ratings yet

- Export ProcedureDocument13 pagesExport Procedurejayparekh280% (1)

- Report of Orientation: Date TaskDocument6 pagesReport of Orientation: Date TaskAfzaalChNo ratings yet

- AB Hi-Fi Expenditure CycleDocument3 pagesAB Hi-Fi Expenditure CycleDella Charista0% (1)

- Procurement Process Flow ChartDocument2 pagesProcurement Process Flow Chartzaini29No ratings yet

- Formats & Procedures for STP/EHTP UnitsDocument16 pagesFormats & Procedures for STP/EHTP Unitsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Procedure For Clearance of Imported and Export Goods.: Roduct - Development - Process - International - Marketing&b 37&c 41Document23 pagesProcedure For Clearance of Imported and Export Goods.: Roduct - Development - Process - International - Marketing&b 37&c 41niharaNo ratings yet

- Mamta BhushanDocument26 pagesMamta BhushanDinesh HegdeNo ratings yet

- Purchase Order: Vendor DetailsDocument2 pagesPurchase Order: Vendor DetailsdevendrasinghsapNo ratings yet

- Import Procedure Sea FreightDocument2 pagesImport Procedure Sea FreightDeepak JhaNo ratings yet

- Receipt Process NotificationDocument1 pageReceipt Process NotificationVivek AnandNo ratings yet

- Process CycleDocument2 pagesProcess CycleRahul Kumar VaishNo ratings yet

- S.No. Topic: 1 Business Process 2 Purchase Department 3 Purchase Team 4 Type of PurchaseDocument5 pagesS.No. Topic: 1 Business Process 2 Purchase Department 3 Purchase Team 4 Type of PurchaseVeera ManiNo ratings yet

- Inventory ValuationDocument1 pageInventory ValuationmansiNo ratings yet

- Thermax LTD 35th Annual Report 2015 16 PDFDocument184 pagesThermax LTD 35th Annual Report 2015 16 PDFmansiNo ratings yet

- Distribution ManagementDocument104 pagesDistribution ManagementmansiNo ratings yet

- Strategic Initiative BPRDocument5 pagesStrategic Initiative BPRmansiNo ratings yet

- Advance PaymentsDocument5 pagesAdvance PaymentsmansiNo ratings yet

- FinancialsDocument49 pagesFinancialsmansiNo ratings yet

- Gold Plus Case StudyDocument11 pagesGold Plus Case StudymansiNo ratings yet

- Infor LN Invoicing User Guide For Sales InvoicingDocument54 pagesInfor LN Invoicing User Guide For Sales InvoicingmansiNo ratings yet

- Tata GoldplusDocument4 pagesTata GoldplusmansiNo ratings yet

- Who Is Competent?Document17 pagesWho Is Competent?mansiNo ratings yet

- SIP TitleDocument3 pagesSIP TitlemansiNo ratings yet

- Carrier's Legal LiabilityDocument5 pagesCarrier's Legal LiabilitymansiNo ratings yet

- Virtual Team at Nanavati AssociatesDocument3 pagesVirtual Team at Nanavati AssociatesmansiNo ratings yet

- Icici Bank InnovationsDocument2 pagesIcici Bank InnovationsmansiNo ratings yet

- DistributionDocument3 pagesDistributionmansiNo ratings yet

- Case in Conversation WithmyselfDocument5 pagesCase in Conversation WithmyselfmansiNo ratings yet

- Negotiable Instruments Act, 1881: Key ConceptsDocument26 pagesNegotiable Instruments Act, 1881: Key ConceptsmansiNo ratings yet

- Expert Insights to Craft Your MBA ApplicationDocument7 pagesExpert Insights to Craft Your MBA Applicationmansi100% (1)

- Emotional Intelligence Case StudyDocument7 pagesEmotional Intelligence Case StudymansiNo ratings yet

- LogisticsDocument7 pagesLogisticsmansiNo ratings yet

- BrexitDocument19 pagesBrexitmansiNo ratings yet

- FERA, FEMA Customs PDFDocument5 pagesFERA, FEMA Customs PDFmansiNo ratings yet

- Interview Questions-Field WorkDocument1 pageInterview Questions-Field WorkmansiNo ratings yet

- CaseDocument9 pagesCasemansiNo ratings yet

- Understanding Sociological Theories Through Functionalism, Conflict, and InteractionismDocument24 pagesUnderstanding Sociological Theories Through Functionalism, Conflict, and InteractionismmansiNo ratings yet

- Group meeting minutes for case study assignment discussionDocument1 pageGroup meeting minutes for case study assignment discussionmansiNo ratings yet

- Universal Food Products Company: Cases in Management ProcessDocument6 pagesUniversal Food Products Company: Cases in Management ProcessmansiNo ratings yet

- AddictionDocument18 pagesAddictionmansiNo ratings yet