Professional Documents

Culture Documents

Fii Stats 08-Sep-2017

Fii Stats 08-Sep-2017

Uploaded by

Saquib Rahaman0 ratings0% found this document useful (0 votes)

9 views1 pagefii stats

Original Title

fii_stats_08-Sep-2017 (1)

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfii stats

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageFii Stats 08-Sep-2017

Fii Stats 08-Sep-2017

Uploaded by

Saquib Rahamanfii stats

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

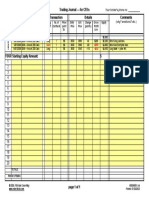

FII DERIVATIVES STATISTICS FOR 08-Sep-2017

OPEN INTEREST AT

THE END OF THE

BUY SELL DAY

No. of Amt in No. of Amt in No. of Amt in

contracts Crores contracts Crores contracts Crores

INDEX FUTURES 15328 1267.99 14020 1148.73 201272 15236.80

INDEX OPTIONS 385964 31974.72 383430 31491.84 926076 71410.79

STOCK FUTURES 78811 5771.46 78991 5832.93 780857 54810.90

STOCK OPTIONS 65755 5176.71 66449 5220.85 64941 4765.38

Notes:

Both buy and sell positions have been considered

Options Value (Buy/Sell) = Strike price * Qty

Futures Value (Buy/Sell) = Traded Price * Qty

Value & Open Interest at the end of day:

Options Value (End of day) = Underlying Close Price * Qty

Futures Value (End of day) = Closing Futures Price * Qty (closing price is the daily settlement price of futures contracts)

You might also like

- SERIES 7 EXAM STUDY GUIDE + TEST BANKFrom EverandSERIES 7 EXAM STUDY GUIDE + TEST BANKRating: 2.5 out of 5 stars2.5/5 (3)

- Fii Stats 30 Jun 2010Document1 pageFii Stats 30 Jun 2010intraday_trader_nse5528No ratings yet

- Fii StatsDocument1 pageFii StatsksvelusamyNo ratings yet

- Fii Stats 04 May 2011Document1 pageFii Stats 04 May 2011Prashant SinghNo ratings yet

- Fii Stats 17 Feb 2017Document1 pageFii Stats 17 Feb 2017Dalu ChockiNo ratings yet

- Fii Stats 12 Oct 2015Document1 pageFii Stats 12 Oct 2015Uma ArunachalamNo ratings yet

- Fii Stats 27 Jan 2014Document1 pageFii Stats 27 Jan 2014Sanjeev PaliseryNo ratings yet

- Fii Stats 12 Dec 2012Document1 pageFii Stats 12 Dec 2012Arvind Sanu MisraNo ratings yet

- Fii Stats 21 Nov 2012Document1 pageFii Stats 21 Nov 2012Arvind Sanu MisraNo ratings yet

- Fii Stats 27 Jan 2016Document1 pageFii Stats 27 Jan 2016ShanKar PadmanaBhanNo ratings yet

- FP 1Document3 pagesFP 1Sandip PatelNo ratings yet

- Explanation of Net Change in Open InterestDocument8 pagesExplanation of Net Change in Open Interestaniljain16No ratings yet

- Fii Stats 22 Nov 2012Document1 pageFii Stats 22 Nov 2012Arvind Sanu MisraNo ratings yet

- Fii Stats 16 Nov 2016Document1 pageFii Stats 16 Nov 2016pawanNo ratings yet

- 03.12.2019latest (Daily Trends in FPI - FII Investments)Document1 page03.12.2019latest (Daily Trends in FPI - FII Investments)xxNo ratings yet

- Swing Trading With Technical AnalysisDocument39 pagesSwing Trading With Technical AnalysisSteve SheldonNo ratings yet

- Market - Outlook - 09 - 09 - 2015 1Document14 pagesMarket - Outlook - 09 - 09 - 2015 1PrashantKumarNo ratings yet

- Rev MarketLot DerivativeContracts GlobalIndicesDocument1 pageRev MarketLot DerivativeContracts GlobalIndicesRajesh Kumar SubramaniNo ratings yet

- Daily Derivative Report 19.09.13Document3 pagesDaily Derivative Report 19.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- Daily Derivative Report 11.09.13Document3 pagesDaily Derivative Report 11.09.13Mansukh Investment & Trading SolutionsNo ratings yet

- Intermediate Guide To E-Mini Futures Contracts - Rollover Dates and Expiration - InvestopediaDocument5 pagesIntermediate Guide To E-Mini Futures Contracts - Rollover Dates and Expiration - Investopediarsumant1No ratings yet

- Baer Essentials BJB Cayman Seurities PortfolioDocument12 pagesBaer Essentials BJB Cayman Seurities PortfolionsadnanNo ratings yet

- Kotak Nifty ETF PDFDocument4 pagesKotak Nifty ETF PDFkayNo ratings yet

- Derivative Report 10 July 2014Document8 pagesDerivative Report 10 July 2014Stock Tips provider in IndiaNo ratings yet

- Derivative Report 19 August 2014Document8 pagesDerivative Report 19 August 2014Stock Tips provider in IndiaNo ratings yet

- CDDocument2 pagesCDGautam PraveenNo ratings yet

- Trading Journal Template 04Document1 pageTrading Journal Template 04Mustakim HossainNo ratings yet

- Address: 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai - 400093Document17 pagesAddress: 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai - 400093sidegigengineer1995No ratings yet

- Instrument Qty. Price LTP Sl. Target Tr. Sl. Type Prod. ValDocument2 pagesInstrument Qty. Price LTP Sl. Target Tr. Sl. Type Prod. ValTestNo ratings yet

- National Stock Exchange of India Limited Department: Futures & OptionsDocument56 pagesNational Stock Exchange of India Limited Department: Futures & OptionsPrince GardenNo ratings yet

- Day Trading - Bill HiderDocument18 pagesDay Trading - Bill HideryfatihNo ratings yet

- Orascom Development HLDG: Key Figures (EUR) Buying and Selling (In MLN EUR) PriceDocument4 pagesOrascom Development HLDG: Key Figures (EUR) Buying and Selling (In MLN EUR) Priceruven_oberlaenderNo ratings yet

- Derivative Report 01 July 2014Document8 pagesDerivative Report 01 July 2014PalakMisharaNo ratings yet

- SEC Form 17Q - September 30, 2019 - 09-30-2019Document36 pagesSEC Form 17Q - September 30, 2019 - 09-30-2019kaki33261No ratings yet

- 27 JUN JUNE2014: Stock Stock AnalysisDocument8 pages27 JUN JUNE2014: Stock Stock Analysisapi-234732356No ratings yet

- Financial Derivatives PresentationDocument27 pagesFinancial Derivatives PresentationCompliance CRGNo ratings yet

- Date Name Qty Buying Selling ValueDocument4 pagesDate Name Qty Buying Selling Valuesahil singhNo ratings yet

- Div Opps 50: Corporate BondsDocument1 pageDiv Opps 50: Corporate BondsMatt AndersonNo ratings yet

- Turnover in Foreign Exchange Market #: BulletinDocument1 pageTurnover in Foreign Exchange Market #: BulletinSanjiva KumarNo ratings yet

- HDFC - Aug 18 2010Document3 pagesHDFC - Aug 18 2010y2india_007No ratings yet

- Derivative Report 28 MAY 2014Document8 pagesDerivative Report 28 MAY 2014PalakMisharaNo ratings yet

- Group Members: Kinjal Pranav Manoj Srikant MaheshDocument58 pagesGroup Members: Kinjal Pranav Manoj Srikant MaheshhardikvibhakarNo ratings yet

- Taxpnl MS7553 2023 - 2024 Q1 Q4Document32 pagesTaxpnl MS7553 2023 - 2024 Q1 Q4Aditya ChawardolNo ratings yet

- Derivative Report 16 July 2014Document8 pagesDerivative Report 16 July 2014Stock Tips provider in IndiaNo ratings yet

- Chap7 LMS DMDocument11 pagesChap7 LMS DMredmiabc61No ratings yet

- Derivative Report 27 June 2014Document8 pagesDerivative Report 27 June 2014PalakMisharaNo ratings yet

- Mini Case 4Document8 pagesMini Case 4ying huiNo ratings yet

- Derivative Report 09 July 2014Document8 pagesDerivative Report 09 July 2014Stock Tips provider in IndiaNo ratings yet

- First Quarter 2010 Industrial ReportDocument6 pagesFirst Quarter 2010 Industrial Reportdhutchins6116No ratings yet

- InvoiceDocument1 pageInvoiceBruts KennyNo ratings yet

- Premarket Technical&Derivative Angel 24.11.16Document5 pagesPremarket Technical&Derivative Angel 24.11.16Rajasekhar Reddy AnekalluNo ratings yet

- 02d713ac-60d6-44a8-b3b5-aa8a8d96d47bDocument39 pages02d713ac-60d6-44a8-b3b5-aa8a8d96d47bajajkhan22659No ratings yet

- Sesa Sterlite LimitedDocument1 pageSesa Sterlite Limitedsun1986No ratings yet

- Laporan Order Event Panimbang 2019Document32 pagesLaporan Order Event Panimbang 2019afniNo ratings yet

- Bloomberg - Investment Banking CheatsheetDocument2 pagesBloomberg - Investment Banking CheatsheetjujonetNo ratings yet

- PDF FileDocument7 pagesPDF FileSaroj KhadangaNo ratings yet

- Taxpnl BRR016 2023 - 2024 Q1 Q4Document34 pagesTaxpnl BRR016 2023 - 2024 Q1 Q4IntelloristNo ratings yet

- Announcement of Result of Tender Offer For Shares in FUJITSU FRONTECH LIMITED (Securities Code 6945)Document5 pagesAnnouncement of Result of Tender Offer For Shares in FUJITSU FRONTECH LIMITED (Securities Code 6945)vivektripathi11619No ratings yet

- 18 Shopify-Q3-2015Document36 pages18 Shopify-Q3-2015GDoingThings YTNo ratings yet

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKNo ratings yet

- 5 DynamicsDocument67 pages5 DynamicsMurugan.SubramaniNo ratings yet

- Application of Redox ChemistryDocument30 pagesApplication of Redox ChemistryMurugan.Subramani100% (1)

- Elasticity BoardworksDocument27 pagesElasticity BoardworksMurugan.SubramaniNo ratings yet

- Space (Part 1)Document33 pagesSpace (Part 1)Murugan.SubramaniNo ratings yet

- OscillationsDocument39 pagesOscillationsMurugan.SubramaniNo ratings yet

- Szanto FrankDocument6 pagesSzanto FrankMurugan.Subramani100% (1)

- Iso 19659-1-2017 - enDocument29 pagesIso 19659-1-2017 - enMurugan.Subramani100% (1)

- Quality Inspectors - Job DescriptionDocument3 pagesQuality Inspectors - Job DescriptionMurugan.SubramaniNo ratings yet

- Date Instrument Underlying Expiry Datemtm Settlement PriceDocument5 pagesDate Instrument Underlying Expiry Datemtm Settlement PriceMurugan.SubramaniNo ratings yet

- Manual Export CATIADocument14 pagesManual Export CATIAMurugan.SubramaniNo ratings yet

- BOM CompareDocument1 pageBOM CompareMurugan.SubramaniNo ratings yet