Professional Documents

Culture Documents

12 Month Cash Flow statement1AZX

12 Month Cash Flow statement1AZX

Uploaded by

Mukhlish AkhatarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Month Cash Flow statement1AZX

12 Month Cash Flow statement1AZX

Uploaded by

Mukhlish AkhatarCopyright:

Available Formats

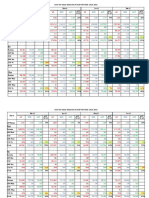

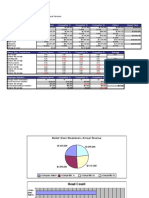

Twelve-month profit and loss projection Enter your Company Name here Fiscal Year Begins Jan-04

Notes on Preparation

LY

.%

4

-04

4

4

-04

4

4

4

04

B/A

y-0

g-0

AR

v-0

c-0

b-0

r-0

n-0

r -0

t-0

Note: You may want to print this information to use as reference later. To delete these

IND

p

n

l-

%

%

%

Ma

Ma

Au

YE

Oc

Ap

No

De

Se

Fe

Ju

Ju

Ja

%

instructions, click the border of this text box and then press the DELETE key.

Revenue (Sales)

Category 1 - - You should change

- "category 1, category

- 2", etc. labels

- to the actual names

- of your sales- - - - - - -

categories. Enter sales for each category for each month. The spreadsheet will add up total

Category 2 - - annual sales. In- the "%" columns,-the spreadsheet will

- show the % of total

- -

sales contributed - - - - - -

Category 3 - - by each category.

- - - - - - - - - - -

Category 4 - - - - - - - - - - - - -

COST OF GOODS SOLD (also called Cost of Sales or COGS): COGS are those expenses

Category 5 - - directly related to

- producing or buying

- your products- or services. For example,

- purchases

- of - - - - - -

Category 6 - - inventory or raw- materials, as well- as the wages (and

- payroll taxes) of-employees directly

- - - - - - -

involved in producing your products/services, are included in COGS. These expenses usually

Category 7 - - go up and down- along with the volume

- of production- or sales. Study your

- records to - - - - - - -

Total Revenue (Sales) 0 0.0 0 0.0 determine

0 COGS

0.0 for each 0

sales0.0

category. Control

0 of COGS is the

0.0 0 key

0.0to profitability

0 for most

0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0

businesses, so approach this part of your forecast with great care. For each category of

Cost of Sales product/service, analyze the elements of COGS: how much for labor, for materials, for

packing, for shipping, for sales commissions, etc.? Compare the Cost of Goods Sold and

Category 1 - - -

Gross Profit of your various sales -categories. Which- are most profitable,

- and which are least

- - - - - - - -

Category 2 - - and why? Underestimating

- COGS- can lead to under- pricing, which can- destroy your ability

- to - - - - - -

earn a profit. Research carefully and be realistic. Enter the COGS for each category of sales

Category 3 - - for each month.- In the "%" columns,- the spreadsheet - will show the COGS- -

as a % of sales - - - - - -

Category 4 - - dollars for that category.

- - - - - - - - - - -

Category 5 - - - - - - - - - - - - -

GROSS PROFIT: Gross Profit is Total Sales minus Total COGS. In the "%" columns, the

Category 6 - - spreadsheet will- show Gross Profit

- as a % of Total Sales.

- - - - - - - - -

Category 7 - - - - - - - - - - - - -

OPERATING EXPENSES (also called Overhead): These are necessary expenses which,

Total Cost of Sales 0 - 0 - however,0are not

- directly related

0 to- making or0buying- your products/services.

0 - 0 utilities,

Rent, - 0 - 0 - 0 - 0 - 0 - 0 -

telephone, interest, and the salaries (and payroll taxes) of office and management employees

Gross Profit 0 - 0 - 0

are examples. -

Change the 0names- of the Expense

0 -

categories to0suit your

- type of business

0 - and 0 - 0 - 0 - 0 - 0 - 0 -

your accounting system. You may need to combine some categories, however, to stay within

Expenses the 20 line limit of the spreadsheet. Most operating expenses remain reasonably fixed

Salary expenses - -

regardless of changes

-

in sales volume.

-

Some, like sales

-

commissions,- may vary with sales. - - - - - - -

Some, like utilities, may vary with the time of year. Your projections should reflect these

Payroll expenses - - fluctuations. The - only rule is that the

- projections should

- -

simulate your financial reality as - - - - - - -

Outside services - - nearly as possible.

- In the "%" columns,

- the spreadsheet

- will show Operating

- Expenses as - a% - - - - - -

of Total Sales.

Supplies (office and

- - - - - - - - - - - - -

operating)

NET PROFIT: The spreadsheet will subtract Total Operating Expenses from Gross Profit to

Repairs and maintenance - - calculate Net Profit.

- In the "%" columns,

- it will show -Net Profit as a % of

- Total Sales. - - - - - - -

Advertising - - INDUSTRY AVERAGES:

- The first-column, labeled "IND.

- %" is for posting

- average cost factors

- - - - - - -

Car, delivery and travel - - for firms of your- size in your industry.

- Industry average

- data is commonly

- available from- - - - - - -

industry associations, major manufacturers who are suppliers to your industry, and local

Accounting and legal - - colleges, Chambers

- - and public libraries.

of Commerce, - -

One common source is the book- - - - - - -

Rent - - Statement Studies

- published annually

- by Robert Morris

- Associates. It can

- be found in major

- - - - - - -

libraries, and your banker almost surely has a copy. It is unlikely that your expenses will be

Telephone - - exactly in line with

- industry averages,

- - helpful in areas -in which expenses- may

but they can be - - - - - -

Utilities - - be out of line. - - - - - - - - - - -

Insurance - - - - - - - - - - - - -

Taxes (real estate, etc.) - - - - - - - - - - - - -

Interest - - - - - - - - - - - - -

Depreciation - - - - - - - - - - - - -

Other expenses (specify) - - - - - - - - - - - - -

Other expenses (specify) - - - - - - - - - - - - -

Other expenses (specify) - - - - - - - - - - - - -

Misc. (unspecified) - - - - - - - - - - - - -

Total Expenses 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 -

Net Profit 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 -

You might also like

- Technical Analysis of StockDocument77 pagesTechnical Analysis of StockBhavesh RogheliyaNo ratings yet

- Rent ReceiptDocument1 pageRent Receiptbathyal28% (43)

- P&L AccountDocument13 pagesP&L AccountRajneesh SehgalNo ratings yet

- Family Office Vs Private BanksDocument59 pagesFamily Office Vs Private Banksdsrkim100% (2)

- Profit and Loss Statement Template (Excel)Document1 pageProfit and Loss Statement Template (Excel)MicrosoftTemplates100% (7)

- Cash Flow Forecast TemplateDocument2 pagesCash Flow Forecast TemplatewresfrNo ratings yet

- Projected Balance Sheet FormatDocument2 pagesProjected Balance Sheet FormatkumaranprasadNo ratings yet

- Labor Cost Code PDFDocument5 pagesLabor Cost Code PDFkarthikaswiNo ratings yet

- General Journal: Doc. Post. Date NO. RefDocument32 pagesGeneral Journal: Doc. Post. Date NO. RefChristine Elaine LamanNo ratings yet

- Detailed Sales ForecastDocument3 pagesDetailed Sales Forecastapi-3809857100% (2)

- Oursuite:Daily Activity Report/Time Record: Hourly RegularDocument2 pagesOursuite:Daily Activity Report/Time Record: Hourly RegularSandipan BasuNo ratings yet

- How To Write A Business Proposal That Drives Action - GrammarlyDocument12 pagesHow To Write A Business Proposal That Drives Action - GrammarlyIbitoye IdowuNo ratings yet

- Revenue Worksheet: Food and Beverage Sample WorksheetDocument10 pagesRevenue Worksheet: Food and Beverage Sample WorksheetJose BarajasNo ratings yet

- Critical Path Pre Opening HotelDocument25 pagesCritical Path Pre Opening HotelFelix Rusli MagnificentnineNo ratings yet

- Rolling Forecast TemplateDocument4 pagesRolling Forecast TemplatebenaikodonNo ratings yet

- #13 Biological AssetsDocument3 pages#13 Biological AssetsZaaavnn VannnnnNo ratings yet

- Internal Rate of Return - IRR - CalculatorDocument3 pagesInternal Rate of Return - IRR - Calculatorapi-3809857No ratings yet

- Profit and Loss Projection, 1yrDocument1 pageProfit and Loss Projection, 1yrhowieg43100% (2)

- Time Sheet For Daily Work at MCS-TB1 2016Document5 pagesTime Sheet For Daily Work at MCS-TB1 2016Roland NicolasNo ratings yet

- FC & VCDocument25 pagesFC & VCAdanbungaran PangribNo ratings yet

- Front Desk - Early Shift - Receptionist - Check ListDocument2 pagesFront Desk - Early Shift - Receptionist - Check ListAbrahamNo ratings yet

- From Requisition To Purchase OrderDocument56 pagesFrom Requisition To Purchase OrderBelajar MONo ratings yet

- 5 Year Financial PlanDocument26 pages5 Year Financial PlanNaimul KaderNo ratings yet

- Job Title: Department: Reporting ToDocument3 pagesJob Title: Department: Reporting ToThành Nguyễn100% (1)

- General Manager'S Comments On Monthly Overview Property: MonthDocument9 pagesGeneral Manager'S Comments On Monthly Overview Property: Monthhathaichanok_tNo ratings yet

- Flow Chart (Accounts Payable Clerk)Document2 pagesFlow Chart (Accounts Payable Clerk)cristynvilNo ratings yet

- Personlig BudgetDocument6 pagesPersonlig BudgetAnn SundkvistNo ratings yet

- Financial Report of HotelDocument28 pagesFinancial Report of HotelShandya MaharaniNo ratings yet

- Hotel Development Cash FlowDocument23 pagesHotel Development Cash FlowMohammed Abubakar HusainNo ratings yet

- Marketing Budget TemplateDocument4 pagesMarketing Budget Templatelindsy_liat.lashay2608No ratings yet

- ROI AnalysisDocument2 pagesROI Analysisapi-3809857100% (2)

- Capital Budget For RestaurantDocument4 pagesCapital Budget For RestaurantSartaj_S_Bedi_83320% (1)

- Purchasing or Buyer or Procurement or Supply Chain or Sales or BDocument4 pagesPurchasing or Buyer or Procurement or Supply Chain or Sales or Bapi-77263021No ratings yet

- Statement of Cash Flow by KiesoDocument85 pagesStatement of Cash Flow by KiesoSiblu HasanNo ratings yet

- UST Final CaseDocument4 pagesUST Final Casestrongchong0050% (2)

- Hospitality Preventive Maintenance ChecklistDocument12 pagesHospitality Preventive Maintenance ChecklistsachinNo ratings yet

- Manual Book No.012 - CHRI MANAGER ON DUTY MANUAL - Ver.001-2011Document26 pagesManual Book No.012 - CHRI MANAGER ON DUTY MANUAL - Ver.001-2011willyNo ratings yet

- Breakfast Checklist Week 1 2 3 4 5 YesDocument2 pagesBreakfast Checklist Week 1 2 3 4 5 YesSoo Ke XinNo ratings yet

- Purchasing Manager: Position: Purchasing Department: Reporting To: Chief Supervision: SummaryDocument2 pagesPurchasing Manager: Position: Purchasing Department: Reporting To: Chief Supervision: SummarySoehermanto DodyNo ratings yet

- ANALYSISTABS Project Appraisal Template ExcelDocument11 pagesANALYSISTABS Project Appraisal Template ExcelTo AliceNo ratings yet

- North Country AutoDocument9 pagesNorth Country AutoSamu BorgesNo ratings yet

- Sample Plan For The Plan: Project Initiation ActivitiesDocument2 pagesSample Plan For The Plan: Project Initiation ActivitiesAnia SalcedoNo ratings yet

- Job Description Restaurant Manager PDFDocument1 pageJob Description Restaurant Manager PDFClarensia TantriNo ratings yet

- Hospitality Industry Chart of Accounts PDFDocument12 pagesHospitality Industry Chart of Accounts PDFAmeliaPrisiliaNo ratings yet

- MHK 2016 - Flowchart of Food & BeveragesDocument16 pagesMHK 2016 - Flowchart of Food & BeveragesAreej FatimaNo ratings yet

- IC Business Plan TemplateDocument8 pagesIC Business Plan TemplateNasruddin TesanNo ratings yet

- Principal Duties and ResponsibilitiesDocument2 pagesPrincipal Duties and ResponsibilitiesAhmadreza KhosraviNo ratings yet

- Overhead Analysis: - Understand How To Analyse Overheads - How To Reduce Overhead ExpensesDocument21 pagesOverhead Analysis: - Understand How To Analyse Overheads - How To Reduce Overhead Expensesmohamed.mahrous1397No ratings yet

- Comprehensive Topics With AnsDocument28 pagesComprehensive Topics With AnsHaru Lee60% (5)

- 2012 The Supply Chain and Manufacturing Survey Position SummariesDocument54 pages2012 The Supply Chain and Manufacturing Survey Position SummariesLowell HarperNo ratings yet

- KAMA-Employee Self Assessment & Management Evaluation FormDocument3 pagesKAMA-Employee Self Assessment & Management Evaluation FormDanny Rose GavalesNo ratings yet

- Template P&L (Profit-and-Loss) ExcelDocument3 pagesTemplate P&L (Profit-and-Loss) ExcelIsaac Foster100% (1)

- Hotel InventoryDocument10 pagesHotel InventoryATA PLANNERSNo ratings yet

- Balance-Sheet US GAAPDocument1 pageBalance-Sheet US GAAPvishnuNo ratings yet

- 04.floor Captain JDDocument5 pages04.floor Captain JDmexanjNo ratings yet

- Operating Expense BudgetDocument10 pagesOperating Expense Budgetapi-3809857No ratings yet

- TUNE HOTEL - Sample ProjectDocument13 pagesTUNE HOTEL - Sample ProjectJulius Fernan Vega100% (1)

- Cost of Sales Analysis in SCR For Year 2014-2015: BUD BUD BUD BUDDocument3 pagesCost of Sales Analysis in SCR For Year 2014-2015: BUD BUD BUD BUDNorbert CouvreurNo ratings yet

- 12 Month Cash Flow Statement1AZXDocument1 page12 Month Cash Flow Statement1AZXSayed Abo ElkhairNo ratings yet

- Krezly Azelle Cyrizze P. Guillaron Hm303 Front Office ManagerDocument3 pagesKrezly Azelle Cyrizze P. Guillaron Hm303 Front Office ManagerJoanna Marie Panganiban Macalinao100% (1)

- Robert Dunn PresentationDocument11 pagesRobert Dunn PresentationBarry SwaynNo ratings yet

- Daily LogDocument1 pageDaily LogTarun MaudgalyaNo ratings yet

- DHR Co Fi Sop 007 Vat SalesDocument3 pagesDHR Co Fi Sop 007 Vat SalesDeo Patria HerdriantoNo ratings yet

- SOP BackOfficeDocument28 pagesSOP BackOfficeVita Dudul Virania100% (1)

- Dashboard Excel HotelDocument26 pagesDashboard Excel Hoteljem170No ratings yet

- PCR# Project: MDC CatarmanDocument54 pagesPCR# Project: MDC CatarmanA.J. ArellanoNo ratings yet

- Record Keeping ChecklistDocument1 pageRecord Keeping ChecklistalexandriasbdcNo ratings yet

- IC WBS Tree Diagram Template 8721Document3 pagesIC WBS Tree Diagram Template 8721Ivana RamayantiNo ratings yet

- Jamuna Enterprises (Stationery) Private Limited: New Delhi Profit and Loss Account For The Year Ended 31St March, 2009Document1 pageJamuna Enterprises (Stationery) Private Limited: New Delhi Profit and Loss Account For The Year Ended 31St March, 2009Joshua McdowellNo ratings yet

- Administration & Logistic ManagerDocument2 pagesAdministration & Logistic ManagerFahad KhanNo ratings yet

- 4.7 Artifacts Applied Across PerformanceDocument4 pages4.7 Artifacts Applied Across PerformanceAmmar Yasir100% (1)

- Cost Estimate: Project Name: Date: Month 1 2 3 4 5 6 WBS CategoriesDocument2 pagesCost Estimate: Project Name: Date: Month 1 2 3 4 5 6 WBS CategoriesRanda S JowaNo ratings yet

- Standard Operating Procedures For FS EquipmentsDocument24 pagesStandard Operating Procedures For FS EquipmentsAnonymous LFgO4WbIDNo ratings yet

- Project Plan TemplateDocument6 pagesProject Plan TemplateiunitedNo ratings yet

- Gantt ChartDocument5 pagesGantt ChartRana AtifNo ratings yet

- 12 Month Cash Flow Statement1AZXDocument1 page12 Month Cash Flow Statement1AZXahmed HOSNYNo ratings yet

- Website Budgeting ToolDocument4 pagesWebsite Budgeting Toolapi-3809857No ratings yet

- Streamlined Expense EstimatesDocument6 pagesStreamlined Expense Estimatesapi-3809857No ratings yet

- Cash Flow Projections - TemplateDocument3 pagesCash Flow Projections - TemplateAdrianna LenaNo ratings yet

- Value Analysis Calculator For Product - ServiceDocument1 pageValue Analysis Calculator For Product - Serviceapi-3809857No ratings yet

- Net Present Value CalculatorDocument2 pagesNet Present Value Calculatormehul2011No ratings yet

- Streamlined Sales Forecast1Document2 pagesStreamlined Sales Forecast1api-3809857No ratings yet

- Special Order PricingDocument1 pageSpecial Order Pricingapi-3809857No ratings yet

- One Month Balance SheetDocument1 pageOne Month Balance Sheetapi-3809857No ratings yet

- Steps Costs GraphDocument1 pageSteps Costs Graphapi-3809857100% (1)

- Product Profitability AnalysisDocument2 pagesProduct Profitability AnalysisAvinash KumarNo ratings yet

- Opening Day Balance SheetDocument2 pagesOpening Day Balance Sheetapi-3809857No ratings yet

- Equity Reconciliation ReportDocument3 pagesEquity Reconciliation Reportapi-3809857No ratings yet

- Financial PerformanceDocument8 pagesFinancial Performanceapi-3809857No ratings yet

- Key Performance Indicator Plan: (Company Name)Document6 pagesKey Performance Indicator Plan: (Company Name)api-3809857100% (2)

- Twelve Month Sales ForecastDocument1 pageTwelve Month Sales ForecastUbuntu LinuxNo ratings yet

- Competitive Market Benchmark Analysis For Financial ServicesDocument2 pagesCompetitive Market Benchmark Analysis For Financial Servicesapi-3809857No ratings yet

- Balance Sheet With InstructionsDocument4 pagesBalance Sheet With Instructionsapi-3809857100% (1)

- Balance Sheet With Financial Ratios1Document1 pageBalance Sheet With Financial Ratios1Indah SusiloNo ratings yet

- Budget Scenario AnalysisDocument3 pagesBudget Scenario Analysisapi-3809857100% (1)

- Five Year Projection WorksheetDocument1 pageFive Year Projection WorksheetUbuntu LinuxNo ratings yet

- CIR v. Next Mobile, G.R. No. 212825, December 7, 2015.odfDocument7 pagesCIR v. Next Mobile, G.R. No. 212825, December 7, 2015.odfHenry LNo ratings yet

- Final DissertationDocument9 pagesFinal DissertationNaina BakshiNo ratings yet

- Sales Average InventoryDocument7 pagesSales Average InventorysikderaminulNo ratings yet

- Ottey Corporation Issued 4 Million of 10 Year 7 Callable Convertible PDFDocument1 pageOttey Corporation Issued 4 Million of 10 Year 7 Callable Convertible PDFFreelance WorkerNo ratings yet

- Vrdolyak Soso Superseding IndictmentDocument19 pagesVrdolyak Soso Superseding IndictmentCrains Chicago BusinessNo ratings yet

- IATA Economic Briefing Airline Cost Performance UpdateDocument7 pagesIATA Economic Briefing Airline Cost Performance UpdateIza YulizaNo ratings yet

- Yutivo Sons Hardware Co. vs. CTA: Nature of The CaseDocument3 pagesYutivo Sons Hardware Co. vs. CTA: Nature of The CaseNorma BayonetaNo ratings yet

- Divtek S Variety Store Is Completing The Accounting Process For TheDocument1 pageDivtek S Variety Store Is Completing The Accounting Process For Thehassan taimourNo ratings yet

- Earnings Management Are View of LiteratureDocument13 pagesEarnings Management Are View of LiteratureLujin MukdadNo ratings yet

- TDS Rate DetailsDocument10 pagesTDS Rate DetailsAsif Assistant ManagerNo ratings yet

- Advanced Financial Accounting and ReportingDocument10 pagesAdvanced Financial Accounting and ReportingMary Rose RamosNo ratings yet

- Latihan Balance SheetDocument10 pagesLatihan Balance SheetULAN BATAWENNo ratings yet

- Report On Financial Analysis of ICI Pakistan Limited 2008Document9 pagesReport On Financial Analysis of ICI Pakistan Limited 2008helperforeuNo ratings yet

- Tax Doesnt Have To Be Taxing London's Onshore FinanceDocument19 pagesTax Doesnt Have To Be Taxing London's Onshore FinanceMAKAB BNo ratings yet

- Profit & LossDocument19 pagesProfit & LossDurvesh GhosalkarNo ratings yet

- Day 12 Chap 7 Rev. FI5 Ex PRDocument11 pagesDay 12 Chap 7 Rev. FI5 Ex PRkhollaNo ratings yet

- Grade 7 Term 2 Social ScienceDocument101 pagesGrade 7 Term 2 Social ScienceVarshLokNo ratings yet

- CHAPTER 13 B - Special Allowable Itemized Deductions and NOLCODocument2 pagesCHAPTER 13 B - Special Allowable Itemized Deductions and NOLCODeviane CalabriaNo ratings yet

- Ata Khan & Co. Chartered Accountants Auditors' Report To The Shareholders of H.R. Textile Mills LimitedDocument19 pagesAta Khan & Co. Chartered Accountants Auditors' Report To The Shareholders of H.R. Textile Mills Limitedkhurshid topuNo ratings yet

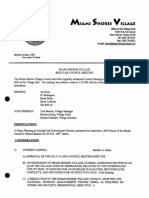

- Miami Shores VillageDocument3 pagesMiami Shores Villageal_crespoNo ratings yet

- DIVIDENDS ON PREFERENCE AND ORDINARY SHARES - Del RosarioDocument17 pagesDIVIDENDS ON PREFERENCE AND ORDINARY SHARES - Del RosarioPamela Ledesma SusonNo ratings yet