Professional Documents

Culture Documents

Zapanta Et Al V Posadas - PROPERTY

Uploaded by

Laura R. Prado-LopezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zapanta Et Al V Posadas - PROPERTY

Uploaded by

Laura R. Prado-LopezCopyright:

Available Formats

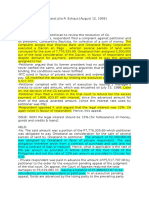

Rufina Zapanta, et. al v Juan Posadas, Jr.

et al

No. 29204-29209, 29 December 1928

FACTS:

(1) Father Braulio Pineda died in Janury 1925 without any descendants or ascendants. He left a

will where he instituted his sister Irene Pineda as his sole heiress.

(2) During his lifetime Father Braulio donated some of his property to the six plaintiffs, all of

whom were his relatives, with the condition that some of them would pay him a certain

amount of rice, and others money every year. An express provision states that failure to fulfill

this condition would revoke the donations. Another clause contained that the donations will

take effect upon acceptance of the donees which the every donee accepted during Father

Braulios lifetime.

(3) Every one of the six plaintiffs filed a separate action against the CIR and his deputy Juan

Posadas, Jr. for the sums each of them paid, under protest, as inheritance tax on the property

donated to them. The CIR in considering the inheritance tax being collected, considered the

donation as a donation mortis causa. The RTC held that the donations were made inter vivos

and should not be subject to inheritance tax and ordered the CIR to return to each plaintiff

the sum paid by the Zapanta et. al.

ISSUE: WON the donation was made inter vivos.

HELD: Yes, judgment affirmed.

RATIO:

(1) The SC held that the said donations were inter vivos as expressly stated in the instruments in

which they appear. The donations were made in consideration of the donors affection and

services that the plaintiffs have rendered to him but he has charged them with an obligation

to pay him a certain amount of rice and money, respectively, for each year during his lifetime,

the donations to become effective upon acceptance.

(2) A donation mortis causa is determined by the donors death in that such death will determine

the acquisition of, or the right to, the property, and that it is revocable at the will of the donor.

(3) A donation inter vivos is produced while the donor is still alive and that the acquisition of, or

right to, the property, is produced while the donor is still alive. In this case, according to the

expressed terms of that the donation were to have its effect upon acceptance, and this took

place during the donors lifetime. Upon acceptance of the donees, during the lifetime of the

donor, the donation had full effect.

You might also like

- Southern Cross Cement Vs Phil Cement MFGDocument13 pagesSouthern Cross Cement Vs Phil Cement MFGMatet Molave-Salcedo100% (1)

- Mortgage GroupDocument2 pagesMortgage Groupcha chaNo ratings yet

- Zoleta Vs SandiganbayanDocument9 pagesZoleta Vs SandiganbayanMc Alaine Ligan100% (1)

- Constantino Found Guilty of MalversationDocument1 pageConstantino Found Guilty of MalversationVerbena Daguinod - BalagatNo ratings yet

- PROPERTY MAKE UP QUIZ Version 2Document7 pagesPROPERTY MAKE UP QUIZ Version 2Francess Mae AlonzoNo ratings yet

- FsadasgfasDocument4 pagesFsadasgfassovxxxNo ratings yet

- Supreme Court rules land formed from creek deposits belongs to adjoining landownerDocument2 pagesSupreme Court rules land formed from creek deposits belongs to adjoining landownerdivina gracia hinloNo ratings yet

- List of Cases in Labor Law ReviewDocument4 pagesList of Cases in Labor Law ReviewRyannDeLeonNo ratings yet

- Gerona vs. DatingalingDocument6 pagesGerona vs. DatingalingRen2No ratings yet

- Cattle Rustling Case: Petitioner Found Guilty as Accessory to the CrimeDocument7 pagesCattle Rustling Case: Petitioner Found Guilty as Accessory to the CrimeDuffy DuffyNo ratings yet

- Credit Week 1 CasesDocument26 pagesCredit Week 1 CasesShantee LasalaNo ratings yet

- XcvxcbnvchjtyhwerrfsafDocument252 pagesXcvxcbnvchjtyhwerrfsafNigel GarciaNo ratings yet

- Zenaida Paz VS Northern Tobacco Redrying CoDocument2 pagesZenaida Paz VS Northern Tobacco Redrying CoraminicoffNo ratings yet

- Aldo Leopold - The Land Ethic Ver. 1Document9 pagesAldo Leopold - The Land Ethic Ver. 1KatarzynaNo ratings yet

- Admin Law Cases Week 3Document18 pagesAdmin Law Cases Week 3bidanNo ratings yet

- Gertrude Consti2 RevDocument8 pagesGertrude Consti2 RevAleezah Gertrude RegadoNo ratings yet

- Election Law CasesDocument315 pagesElection Law CasesPearl Angeli Quisido CanadaNo ratings yet

- Property Case Digests (Atty. Ampil) 15 1. Aldaba V Ca: Inter Vivos, Not Mortis Causa. As Such It Is Valid andDocument1 pageProperty Case Digests (Atty. Ampil) 15 1. Aldaba V Ca: Inter Vivos, Not Mortis Causa. As Such It Is Valid andChristian Lemuel Tangunan TanNo ratings yet

- Pilipinas Bank Vs CADocument2 pagesPilipinas Bank Vs CAHansel Jake B. PampiloNo ratings yet

- Compiled By: SantoallaDocument56 pagesCompiled By: SantoallaJennica Gyrl DelfinNo ratings yet

- Natural Resources NotesDocument13 pagesNatural Resources NotesJANNNo ratings yet

- LBP Vs NatividadDocument12 pagesLBP Vs NatividadLarssen IbarraNo ratings yet

- Chapter 4 Qualifications and DisqualificationsDocument46 pagesChapter 4 Qualifications and DisqualificationsJoulo YabutNo ratings yet

- Gaboya Vs CuiDocument1 pageGaboya Vs CuilawboyNo ratings yet

- Lazatin V HRETDocument1 pageLazatin V HRETDenDen GauranaNo ratings yet

- Teekay Shipping v. Concha To Mawanay v. Phil. Transmarine CaseDocument11 pagesTeekay Shipping v. Concha To Mawanay v. Phil. Transmarine CaseMishal OisinNo ratings yet

- Case Digests April 20 2022Document21 pagesCase Digests April 20 2022Karren Joy CostalesNo ratings yet

- Case Digests in SalesDocument8 pagesCase Digests in SalesVictor SarmientoNo ratings yet

- Agra Social Leg NotesDocument13 pagesAgra Social Leg NotesDael GerongNo ratings yet

- Public International LawDocument18 pagesPublic International LawEra GasperNo ratings yet

- Hartford Steam Boiler Inspection & Ins. Co. v. Harrison, 301 U.S. 459 (1937)Document7 pagesHartford Steam Boiler Inspection & Ins. Co. v. Harrison, 301 U.S. 459 (1937)Scribd Government DocsNo ratings yet

- CequenaDocument4 pagesCequenaPablo EschovalNo ratings yet

- Hall v. Piccio 86 Phil 603 (1950)Document3 pagesHall v. Piccio 86 Phil 603 (1950)gcantiverosNo ratings yet

- Nelly Lim vs Court of Appeals Case Digest on Physician-Patient PrivilegeDocument1 pageNelly Lim vs Court of Appeals Case Digest on Physician-Patient PrivilegeEman EsmerNo ratings yet

- CALO Vs ROLDANDocument2 pagesCALO Vs ROLDANLilibeth Dee GabuteroNo ratings yet

- Civil Law 2 Rev March 2012 DigestDocument12 pagesCivil Law 2 Rev March 2012 DigestMikes FloresNo ratings yet

- People vs. SisonDocument25 pagesPeople vs. SisonClaudine Ann ManaloNo ratings yet

- 04 Pardo vs. Hercules Lumber PDFDocument2 pages04 Pardo vs. Hercules Lumber PDFStacy WheelerNo ratings yet

- LTD List of Common CasesDocument12 pagesLTD List of Common CasesAina ReyesNo ratings yet

- Vertudes v. Buenaflor (478 SCRA 210)Document24 pagesVertudes v. Buenaflor (478 SCRA 210)Yuri SisonNo ratings yet

- Special People Inc Vs Canda Et Al. GR No. 160932 Jan 2013 - FulltextDocument12 pagesSpecial People Inc Vs Canda Et Al. GR No. 160932 Jan 2013 - FulltextNylaNo ratings yet

- Digest 38Document2 pagesDigest 38Paolo TarimanNo ratings yet

- List-Of-cases in Pub CorDocument11 pagesList-Of-cases in Pub CorKay AvilesNo ratings yet

- ELDO J Case DigestDocument1 pageELDO J Case DigestShiela Mae Ancheta100% (1)

- Arbitration Law Midterms JurisprudenceDocument9 pagesArbitration Law Midterms JurisprudenceGanielaNo ratings yet

- COMELEC Powers and FunctionsDocument20 pagesCOMELEC Powers and Functionskero keropiNo ratings yet

- ARBITRATION. Cases On The Jurisdiction of CIACDocument5 pagesARBITRATION. Cases On The Jurisdiction of CIACZenaida AcordaNo ratings yet

- Supreme Court: Eddie Tamondong For Petitioners. Lope Adriano and Emmanuel Pelaez, Jr. For Private RespondentDocument4 pagesSupreme Court: Eddie Tamondong For Petitioners. Lope Adriano and Emmanuel Pelaez, Jr. For Private RespondentJerommel GabrielNo ratings yet

- Yon Mitori - DepositDocument20 pagesYon Mitori - DepositJessica AbadillaNo ratings yet

- Zambales Chromite - Soriano Case DigestsDocument41 pagesZambales Chromite - Soriano Case DigestsJezenEstherB.PatiNo ratings yet

- ProvRem Cases UpdatedDocument10 pagesProvRem Cases UpdatedtimothymaderazoNo ratings yet

- Affidavit of Death Due To Vehicle Accident For Insurance ClaimDocument1 pageAffidavit of Death Due To Vehicle Accident For Insurance ClaimCarlsonn GuillarteNo ratings yet

- GR No. L-2294Document7 pagesGR No. L-2294Jobi BryantNo ratings yet

- Bpi CaseDocument2 pagesBpi Caseinna andresNo ratings yet

- Jurisprudence document classificationDocument4 pagesJurisprudence document classificationDhin CaragNo ratings yet

- ESTATE OF GEORGE LITTON DigestDocument3 pagesESTATE OF GEORGE LITTON DigestPaolo BrillantesNo ratings yet

- Labor Standards ReviewerDocument102 pagesLabor Standards Reviewermelojane abadNo ratings yet

- Balus vs. Balus - GR# 168970 (Digested)Document4 pagesBalus vs. Balus - GR# 168970 (Digested)Athena Garrido0% (1)

- Property 404 Adraincem v. Bullecer Cabusas Jamero NaresDocument31 pagesProperty 404 Adraincem v. Bullecer Cabusas Jamero NaresJhean NaresNo ratings yet

- Tax II IbrahimhazDocument17 pagesTax II IbrahimhazHash IbrahimNo ratings yet

- 06 Pangasinan Transport Inc V The PSCDocument1 page06 Pangasinan Transport Inc V The PSCLaura R. Prado-LopezNo ratings yet

- NPC V CA and CepalcoDocument2 pagesNPC V CA and CepalcoLaura R. Prado-LopezNo ratings yet

- NPC V CA and CepalcoDocument2 pagesNPC V CA and CepalcoLaura R. Prado-LopezNo ratings yet

- DMCI Negligence in Worker's DeathDocument1 pageDMCI Negligence in Worker's DeathLaura R. Prado-LopezNo ratings yet

- City Government of San Pablo V Reyes and MERALCODocument1 pageCity Government of San Pablo V Reyes and MERALCOLaura R. Prado-LopezNo ratings yet

- Iloilo Ice and Cold Storage Company V Public Utility BoardDocument1 pageIloilo Ice and Cold Storage Company V Public Utility BoardLaura R. Prado-Lopez100% (1)

- 18 Rubiso v. RiveraDocument1 page18 Rubiso v. RiveraLaura R. Prado-LopezNo ratings yet

- 18 Rubiso v. RiveraDocument1 page18 Rubiso v. RiveraLaura R. Prado-LopezNo ratings yet

- 17 Trans-Asia Shipping Lines v. CADocument1 page17 Trans-Asia Shipping Lines v. CALaura R. Prado-LopezNo ratings yet

- Spaulding V Grundy - Party WallDocument1 pageSpaulding V Grundy - Party WallLaura R. Prado-LopezNo ratings yet

- Robern Development Corporation v People’s Landless Association Decision on Board AuthorityDocument1 pageRobern Development Corporation v People’s Landless Association Decision on Board AuthorityLaura R. Prado-LopezNo ratings yet

- 06 Far Eastern Surety Vs MisaDocument1 page06 Far Eastern Surety Vs MisaLaura R. Prado-LopezNo ratings yet

- People V Webb GR No. 132577, 17 August 1999 FactsDocument1 pagePeople V Webb GR No. 132577, 17 August 1999 FactsLaura R. Prado-LopezNo ratings yet

- The City of Manila Vs BacayDocument1 pageThe City of Manila Vs BacayLaura R. Prado-LopezNo ratings yet

- Syquia V CA and The Manila Memorial Park CemeteryDocument1 pageSyquia V CA and The Manila Memorial Park CemeteryLaura R. Prado-LopezNo ratings yet

- Aratuc V ComelecDocument1 pageAratuc V ComelecLaura R. Prado-LopezNo ratings yet

- Baksh V CADocument1 pageBaksh V CALaura R. Prado-LopezNo ratings yet

- 32 Martinez V RepublicDocument2 pages32 Martinez V RepublicLaura R. Prado-Lopez100% (1)

- Sitchon Et Al V Aquino - NuisanceDocument2 pagesSitchon Et Al V Aquino - NuisanceLaura R. Prado-LopezNo ratings yet

- Aboitiz Shipping Corporation V New India Assurance Company LTDDocument1 pageAboitiz Shipping Corporation V New India Assurance Company LTDLaura R. Prado-LopezNo ratings yet

- Zapanta Et Al V Posadas - PROPERTYDocument1 pageZapanta Et Al V Posadas - PROPERTYLaura R. Prado-LopezNo ratings yet

- Sitchon Et Al V Aquino - NuisanceDocument2 pagesSitchon Et Al V Aquino - NuisanceLaura R. Prado-LopezNo ratings yet

- 32 Martinez V RepublicDocument2 pages32 Martinez V RepublicLaura R. Prado-Lopez100% (1)

- Sun Insurance Vs Hon AsuncionDocument2 pagesSun Insurance Vs Hon AsuncionLaura R. Prado-LopezNo ratings yet

- FESIC V Vda de HernandezDocument2 pagesFESIC V Vda de HernandezLaura R. Prado-LopezNo ratings yet

- Digest - YASCO V CADocument1 pageDigest - YASCO V CAMaria Anna M LegaspiNo ratings yet

- Lucio Dimayuga v Antonio Dimayuga (GR No. L-6740, 29 April 1955Document1 pageLucio Dimayuga v Antonio Dimayuga (GR No. L-6740, 29 April 1955Laura R. Prado-LopezNo ratings yet

- GONZALES VS CRUZ HEIRS LAND CONTRACT DISPUTEDocument1 pageGONZALES VS CRUZ HEIRS LAND CONTRACT DISPUTELaura R. Prado-Lopez100% (1)

- Arceo Land Ownership DisputeDocument1 pageArceo Land Ownership DisputeLaura R. Prado-Lopez100% (1)

- Charity Value Proposition CanvasDocument1 pageCharity Value Proposition Canvasrasya unoNo ratings yet

- Reduce, Reuse, Recycle, RethinkDocument7 pagesReduce, Reuse, Recycle, RethinkSandeshGiriNo ratings yet

- Campaigning Legal Guide: Politics, Elections and Lobbying.2019Document50 pagesCampaigning Legal Guide: Politics, Elections and Lobbying.2019gerber aladarNo ratings yet

- About The Trevor Project, An LGBTQ Youth Program With Donations From People Such As Daniel Radcliffe, Katy Perry, and Kenneth MehlmanDocument10 pagesAbout The Trevor Project, An LGBTQ Youth Program With Donations From People Such As Daniel Radcliffe, Katy Perry, and Kenneth MehlmanMariah SharpNo ratings yet

- April 24, 2015 Strathmore TimesDocument28 pagesApril 24, 2015 Strathmore TimesStrathmore TimesNo ratings yet

- Model Trust Deed of A Public Charitable TrustDocument4 pagesModel Trust Deed of A Public Charitable TrustRajiv ShahNo ratings yet

- Training Manual - Fundraising For NGO'sDocument28 pagesTraining Manual - Fundraising For NGO'sjohn_eliastam93% (14)

- Backgrounds PilgrimDocument1 pageBackgrounds Pilgrimfishguts4everNo ratings yet

- Merritt Morning Market 2342-Aug 24Document2 pagesMerritt Morning Market 2342-Aug 24Kim LeclairNo ratings yet

- Topic Not For Profit Marketing: Name: Reg. NoDocument28 pagesTopic Not For Profit Marketing: Name: Reg. Nopentagon 5No ratings yet

- By Laws Rcyv 2Document18 pagesBy Laws Rcyv 2James Ramil50% (2)

- VESA Volunteering (Fiji)Document1 pageVESA Volunteering (Fiji)marysunshine111No ratings yet

- Homeless Outreach Program: Larisey's Donate PB&J Sandwiches For HomelessDocument2 pagesHomeless Outreach Program: Larisey's Donate PB&J Sandwiches For Homelessdroman18No ratings yet

- Adulter Paulo CoelhoDocument120 pagesAdulter Paulo CoelhoVăsăliuț Daniela Maria26% (19)

- Biography: Photo Credit: James Quantz JRDocument2 pagesBiography: Photo Credit: James Quantz JRSprinkle NatureNo ratings yet

- YSS Lessons Yogananda English Application FormDocument4 pagesYSS Lessons Yogananda English Application FormSidharth Kapoor33% (3)

- Case PresentationDocument13 pagesCase PresentationSusmita MondalNo ratings yet

- Arpad Busson Speech at The ARK Gala Dinner of 2011: TranscriptionDocument3 pagesArpad Busson Speech at The ARK Gala Dinner of 2011: TranscriptionCazzac111No ratings yet

- Earn Rs.38 Cr lifetime incomeDocument2 pagesEarn Rs.38 Cr lifetime incomeAsgar AliNo ratings yet

- Replace Opposite AdjectivesDocument1 pageReplace Opposite AdjectivesČasovi Engleskog JezikaNo ratings yet

- Success Stories - Annual Report 2013Document16 pagesSuccess Stories - Annual Report 2013NazarethHousingNo ratings yet

- MGB Pahang - ToV Bahasa Inggeris 013 - Pemahaman - Bahagian BDocument10 pagesMGB Pahang - ToV Bahasa Inggeris 013 - Pemahaman - Bahagian BKannan ThiagarajanNo ratings yet

- Property Law FinalsDocument13 pagesProperty Law FinalsTanya Ibañez100% (1)

- Mother Seton Academy Annual Report FY 2017Document16 pagesMother Seton Academy Annual Report FY 2017MotherSetonAcademyNo ratings yet

- Tata Mumbai Marathon Social Media Campaign Focuses on Legacy and TechDocument6 pagesTata Mumbai Marathon Social Media Campaign Focuses on Legacy and TechNishant Nitz AggarwalNo ratings yet

- 2CopyRequirements For The Creation of An Express Private Trust - Law Equity, Trusts Probate IDocument65 pages2CopyRequirements For The Creation of An Express Private Trust - Law Equity, Trusts Probate INadirah Mohamad Sarif100% (2)

- Smithsonian African Art 50th Anniversary GalaDocument14 pagesSmithsonian African Art 50th Anniversary GalaMichael BriggsNo ratings yet

- Tax 670 Milestone 2Document5 pagesTax 670 Milestone 2pthavNo ratings yet

- Bioethics CU 1Document1 pageBioethics CU 1ImongheartNo ratings yet

- Transfer and Business Taxes Midterm Quiz - 02 PROBLEMS: (Write Your Answers On A One Whole Sheet Yellow Pad)Document2 pagesTransfer and Business Taxes Midterm Quiz - 02 PROBLEMS: (Write Your Answers On A One Whole Sheet Yellow Pad)Andrea Tan0% (1)