Professional Documents

Culture Documents

Bautista, Ivern S Bsa & 4Th Year PWC Philippines Tax Department Activites/Tasks

Uploaded by

Aybern Bawtista0 ratings0% found this document useful (0 votes)

7 views1 pageThe document is a weekly work journal from the 1st week of April for a student named Ivern S. Bautista interning at PwC Philippines in the Tax Department. Over the course of the week, the student participated in orientation, training on interpersonal skills, department tours, team introduction, learning about tax assessment laws and processes, and validating documents. The student reflected on learning how to interact professionally, gaining knowledge about taxes and their impact, and adjusting to the new environment while developing skills.

Original Description:

Journal Format

Original Title

1. Weekly Work Journal

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is a weekly work journal from the 1st week of April for a student named Ivern S. Bautista interning at PwC Philippines in the Tax Department. Over the course of the week, the student participated in orientation, training on interpersonal skills, department tours, team introduction, learning about tax assessment laws and processes, and validating documents. The student reflected on learning how to interact professionally, gaining knowledge about taxes and their impact, and adjusting to the new environment while developing skills.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageBautista, Ivern S Bsa & 4Th Year PWC Philippines Tax Department Activites/Tasks

Uploaded by

Aybern BawtistaThe document is a weekly work journal from the 1st week of April for a student named Ivern S. Bautista interning at PwC Philippines in the Tax Department. Over the course of the week, the student participated in orientation, training on interpersonal skills, department tours, team introduction, learning about tax assessment laws and processes, and validating documents. The student reflected on learning how to interact professionally, gaining knowledge about taxes and their impact, and adjusting to the new environment while developing skills.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

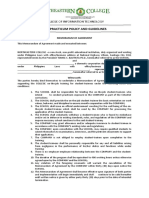

Weekly Work Journal

1st Week April Month

Bautista, Ivern S BSA & 4th year

PwC Philippines Tax Department

Activites/Tasks:

1. Orientation about the PwC, its Vision, Purpose and Values. Understanding the

difference and advantage of PwC compared to other Accounting Firms.

2. Training our interpersonal skill together with the newly hired staffs and interns.

3. Getting to know one another through activities during the seminar and building

relationships and gaining new friends.

4. Departmental Tour and observation of PwC environment.

5. Deployment to respective environment and introduction to the team.

6. Adjustment to the environment and interaction with seniors and co-interns.

7. Introduction to nature of service the department and team do.

8. Introduction to the processes of Tax Assessment laws and processes.

9. Creating Schedules of account items under tax assessment of the BIR.

10. Vouching of supporting and validating source documents.

Lessons Learned/Reflections:

I learned how to interact and communicate well, in a mannered way, with other people. I

gained new knowledge about taxes and its processes. I was able to see in real life how

tax affects businesses and organizations. I am happy that I am learning a lot and gaining

new experiences together with new friends. It is a bit hard to adjust and be flexible with the

environment constraint but I am able to cope up. I am confident that I have develeped and

improved my interpersonal and intellectual skills. I am excited to share this knowledge and

to help others using the same.

Prepared by: Validated by:

____________________________ _______________________________

Student’s Signature over Printed Name/Date Site Supervisor’s Signature over Printed Name/Date

Received and Reviewed by:

_____________________________________

Internship Adviser’s Signature over Printed Name/Date

You might also like

- BSA Internship CapstoneDocument25 pagesBSA Internship Capstonemarie paz fernandezNo ratings yet

- Syllabus - Advanced Accounting IDocument4 pagesSyllabus - Advanced Accounting IJade TanNo ratings yet

- Updated Shs Work Immersion PortfolioDocument47 pagesUpdated Shs Work Immersion PortfolioAica Rose Dela Cruz100% (1)

- Philippine Christian UniversityDocument27 pagesPhilippine Christian UniversityVher DucayNo ratings yet

- Work Immersion OrientationDocument32 pagesWork Immersion OrientationRodj Eli Mikael Viernes-IncognitoNo ratings yet

- Work Immersion Portfolio For Face To Face Class 1Document34 pagesWork Immersion Portfolio For Face To Face Class 1Edwin GervacioNo ratings yet

- Career GuidanceDocument11 pagesCareer Guidanceana1maria2No ratings yet

- Jose Maria College: Student Practicum JournalDocument39 pagesJose Maria College: Student Practicum JournalPorferia PugosaNo ratings yet

- Reflective EssayDocument13 pagesReflective Essaylufemos OlufemiNo ratings yet

- Application For Building Permit (For Building Permit)Document2 pagesApplication For Building Permit (For Building Permit)Nica Panelo100% (1)

- Work Immersion Red DesignDocument49 pagesWork Immersion Red DesignChristine GilbuelaNo ratings yet

- GENERIC PORTFOLIO JajaDocument45 pagesGENERIC PORTFOLIO JajaSalvacion N. Barot100% (1)

- Assessment 2Document15 pagesAssessment 2Gurpreet KaurNo ratings yet

- Summer PortfolioDocument14 pagesSummer Portfolioapi-398187383No ratings yet

- Practicum Report!! - IIDocument39 pagesPracticum Report!! - IIEldionJagorinNo ratings yet

- Intern ReportDocument42 pagesIntern ReportVictor Kamugisha73% (11)

- Authorization Letter: Batangas CityDocument8 pagesAuthorization Letter: Batangas CityHoward UntalanNo ratings yet

- KathDocument34 pagesKathFaye NamzugNo ratings yet

- On - The - Job Training 2: Southern Luzon State University Tiaong CampusDocument9 pagesOn - The - Job Training 2: Southern Luzon State University Tiaong CampusJp Isles MagcawasNo ratings yet

- Kevin Cureg PortfolioDocument33 pagesKevin Cureg PortfolioFaye NamzugNo ratings yet

- Carljef 8Document36 pagesCarljef 8Faye NamzugNo ratings yet

- IphitechDocument8 pagesIphitechJohn ValenciaNo ratings yet

- Nabatanzi Heather KS18B05-503 Internship ReportDocument12 pagesNabatanzi Heather KS18B05-503 Internship ReportNabatanzi HeatherNo ratings yet

- JMJ Marist Brothers Notre Dame of Kidapawan College Kidapawan CityDocument9 pagesJMJ Marist Brothers Notre Dame of Kidapawan College Kidapawan Citychat100% (1)

- OushaDocument13 pagesOushaCutee ManoNo ratings yet

- Internship SyllabusDocument7 pagesInternship Syllabusapi-525560067No ratings yet

- Training Contract 2015 - FINALDocument5 pagesTraining Contract 2015 - FINALClark QuayNo ratings yet

- Entrepreneurship Field Studies Course SyllabusDocument8 pagesEntrepreneurship Field Studies Course SyllabusKam WillNo ratings yet

- Internship ReportDocument31 pagesInternship ReportNovita SariNo ratings yet

- CHC50113 Cluster 4 Third Party Report v2.0Document8 pagesCHC50113 Cluster 4 Third Party Report v2.0Juan MedinaNo ratings yet

- Mba 007 Cardiff MBBT23904Document31 pagesMba 007 Cardiff MBBT23904JeyaThees JeyNo ratings yet

- Alvarez, Hazel C. (Semis Auditing)Document2 pagesAlvarez, Hazel C. (Semis Auditing)hazel alvarezNo ratings yet

- PrathapReddy (3 3)Document3 pagesPrathapReddy (3 3)francisNo ratings yet

- New Microsoft Word DocumentDocument10 pagesNew Microsoft Word DocumentFasola TawaNo ratings yet

- PRE IMMERSION PROPER PortfolioDocument22 pagesPRE IMMERSION PROPER PortfoliobauyanmariaNo ratings yet

- NEW OJT SBA Policy and Guidelines BSBADocument14 pagesNEW OJT SBA Policy and Guidelines BSBAGessilleNo ratings yet

- Iec 2 Corp IntDocument14 pagesIec 2 Corp Intpavananjanadri89No ratings yet

- Research and EvaluationDocument26 pagesResearch and EvaluationHazel JoanNo ratings yet

- PortfolioDocument44 pagesPortfolioRizzy CerdanNo ratings yet

- My Internship DiaryDocument11 pagesMy Internship Diarymichellecapiral0% (1)

- Files 4eaDocument1 pageFiles 4eaapi-277585712No ratings yet

- 2014-2015 Internship Agreement FormDocument6 pages2014-2015 Internship Agreement Formapi-300841408No ratings yet

- Work Immersion Portfolio: (Based On Deped Order No. 30 S. 2017)Document19 pagesWork Immersion Portfolio: (Based On Deped Order No. 30 S. 2017)Michael YumizuriNo ratings yet

- AcknowledgementDocument39 pagesAcknowledgementSanjay KhaDkaNo ratings yet

- Pdf-To-Word EditedDocument48 pagesPdf-To-Word EditedJames Genesis Ignacio LolaNo ratings yet

- Prefinal Exams 1stsem SY2018-2019 MCDocument3 pagesPrefinal Exams 1stsem SY2018-2019 MCAbraham Jr. ManansalaNo ratings yet

- Mountain View College School of Business and Accountancy Bsba Department Practicum Policy and GuidelinesDocument9 pagesMountain View College School of Business and Accountancy Bsba Department Practicum Policy and GuidelinesGessilleNo ratings yet

- Vaish ReportDocument81 pagesVaish ReportEsha GowdaNo ratings yet

- Company Evaluation Form For PracticumDocument1 pageCompany Evaluation Form For Practicumjohnmarkgalangsaclao29No ratings yet

- Employee Performance Appraisal ReportDocument6 pagesEmployee Performance Appraisal ReportOla AmerNo ratings yet

- Shashank Singh Parihar Final ReportDocument19 pagesShashank Singh Parihar Final ReportkingyassinghNo ratings yet

- Teaching Internship ContractDocument4 pagesTeaching Internship ContractrencylaneeNo ratings yet

- Management Chapter 1 To Chapter 5Document51 pagesManagement Chapter 1 To Chapter 5affenpinscherNo ratings yet

- BSBINN601 Case Study AssessmentDocument14 pagesBSBINN601 Case Study AssessmentSummi ShresthaNo ratings yet

- Work Immesion Portfolio - 2024Document25 pagesWork Immesion Portfolio - 2024Ela KimNo ratings yet

- Full & Final R R ON INTERNSHIPDocument4 pagesFull & Final R R ON INTERNSHIPSahnaz Gohor JahanNo ratings yet

- Narrative ReportDocument2 pagesNarrative ReportJeann Razen Orian MendozaNo ratings yet

- Presentation FindexDocument5 pagesPresentation FindexClement LiuNo ratings yet

- Answer Booklet & Marking Guide: BSBMGT616 Develop and Implement Strategic PlansDocument6 pagesAnswer Booklet & Marking Guide: BSBMGT616 Develop and Implement Strategic PlansSamir BhandariNo ratings yet

- Portfolio ImmersionDocument34 pagesPortfolio Immersionbautistajelo1No ratings yet

- Clerk (Income Maintenance): Passbooks Study GuideFrom EverandClerk (Income Maintenance): Passbooks Study GuideNo ratings yet

- DDocument1 pageDAybern BawtistaNo ratings yet

- PH 2018 PWC Illustrative Financial StatementDocument236 pagesPH 2018 PWC Illustrative Financial StatementAybern BawtistaNo ratings yet

- 2016 Unaudited Financial StatementDocument29 pages2016 Unaudited Financial StatementAybern BawtistaNo ratings yet

- Orca Share Media1520856036149Document19 pagesOrca Share Media1520856036149Aybern BawtistaNo ratings yet

- SEC. 98. Imposition of TaxDocument15 pagesSEC. 98. Imposition of TaxAybern BawtistaNo ratings yet

- BLT Business Income OnwardsDocument16 pagesBLT Business Income OnwardsAybern BawtistaNo ratings yet

- Intern: Bautista, Ivern S. Department: Tax Department: Checked ByDocument1 pageIntern: Bautista, Ivern S. Department: Tax Department: Checked ByAybern BawtistaNo ratings yet

- CVP Analysis No AnswerDocument9 pagesCVP Analysis No AnswerAybern BawtistaNo ratings yet