Professional Documents

Culture Documents

Revised CA Fees PDF

Revised CA Fees PDF

Uploaded by

Lolitambika Neumann0 ratings0% found this document useful (0 votes)

15 views4 pagesOriginal Title

Revised CA Fees.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views4 pagesRevised CA Fees PDF

Revised CA Fees PDF

Uploaded by

Lolitambika NeumannCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

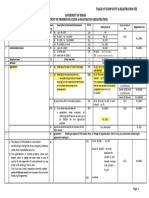

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA (ICAI)

COMMITTEE FOR CAPACITY BUILDING OF MEMBERS IN PRACTICE (CCBMP), ICAI

REVISED MINIMUM RECOMMENDED SCALE OF FEES FOR

THE PROFESSIONAL ASSIGNMENTS DONE BY THE CHARTERED ACCOUNTANTS

The Committee for Capacity Building of Members in Practice (CCBMP) of ICAI as a part of its commitment to strengthen the Small

& Medium Practitioners has initiated the Revised Minimum Recommended Scale of Fees for the professional assignments done by

members of ICAI. The recommendation is about the fee to be charged as per the work performed for various professional assignments.

The fee has been recommended separately for Class A & Class B cities.

Rates

For Class A Cities For Class B Cities

PARTICULARS

Revised Minimum Recommended Revised Minimum Recommended

scale of Fees scale of Fees

I) ADVISING ON DRAFTING OF DEEDS/AGREEMENTS

(a) i) Partnership Deed Rs 15,000/- & Above Rs 10,000/- & Above

ii) Partnership Deed (With consultation & Tax Advisory) Rs 20,000/- & Above Rs 15,000/-& Above

(b) Filing of Forms with Registrar of Firms Rs 7,000/- & Above Per Form Rs 5,000/- & Above Per Form

(c) Supplementary / Modification in Partnership Deed Rs 12,000/- & Above Rs 9,000/- & Above

(d) Joint Development Agreements/ Joint Venture Agreements Rs 12000 & Above (See Note-1) Rs 9000 & Above (See Note-1)

(e) Others Deeds such as Power of Attorney, Will, Gift Deed etc. Rs 5000 & Above Rs 3000 & Above

II) INCOME TAX

A. Filing of Return of Income

I) For Individuals/ HUFs etc.

(a) Filing of Return of Income with Salary/Other Sources/Share of Rs 8,000/- & Above Rs 6,000/- & Above

Profit

(b) Filing of Return of Income with detailed Capital Gain working

i) Less than 10 Transactions (For Shares & Securities) Rs 11,000/- & Above Rs 8,000/- & Above

ii) More than 10 Transactions (For Shares & Securities) Rs 17,000/- & Above Rs 12,000/- & Above

(c) Filing of Return of Income for Capital Gain on Immovable Rs 32,000/- & Above Rs 22,000/- & Above

property

(d) Filing of Return of Income with Preparation of Bank Summary, Rs 12,000/- & Above Rs 9,000/- & Above

Capital A/c & Balance Sheet.

II) (a) Partnership Firms/Sole Proprietor with Advisory Services Rs 15,000/- & Above Rs 11,000/- & Above

(b) Minor's I.T. Statement Rs 8,000/- & Above Rs 8,000/- & Above

(c) Private Ltd. Company :

i) Active Rs 25,000/- & Above Rs 17,000/- & Above

ii) Defunct Rs 12,000/- & Above Rs 9,000/- & Above

(d) Public Ltd. Company

i) Active Rs 65,000/- & Above Rs 45,000/- & Above

ii) Defunct Rs 25,000/- & Above Rs 17,000/- & Above

B. Filing of Forms Etc. (Quarterly Fees) (Quarterly Fees)

(a) Filing of TDS/TCS Return (per Form)

i) With 5 or less Entries Rs 4,000/- & Above Rs 3,000/- & Above

ii) With more than 5 Entries Rs 9,000/- & Above Rs 7,000/- & Above

(b) Filing of Form No. 15-H/G ( per Set) Rs 4,000/- & Above Rs 3,000/- & Above

(c) Form No. 49-A/49-B Rs 4,000/- & Above Rs 3,000/- & Above

(d) Any other Forms filed under the Income Tax Act Rs 4,000/- & Above Rs 3,000/- & Above

C. Certificate

Obtaining Certificate from Income Tax Department Rs 14,000/- & Above Rs 10,000/- & Above

D. Filing of Appeals Etc.

(a) First Appeal Rs 32,000/- & Above Rs 22,000/- & Above

Preparation of Statement of Facts, Grounds of Appeal, Etc.

(b) Second Appeal (Tribunal) Rs 65,000/- & Above Rs 45,000/- & Above

E. Assessments Etc.

(a) Attending Scrutiny Assessment/Appeal

(i) Corporate See Note 1 See Note 1

(ii) Non Corporate Rs 32,000/- & Above Rs 22,000/- & Above

(b) Attending before Authorities Rs 10,000/- & Above Per Visit Rs 7,000/- & Above Per Visit

(c) Attending for Rectifications/Refunds/Appeal effects Etc. Rs 7,000/- & Above Per Visit Rs 5,000/- & Above Per Visit

(d) Income Tax Survey Rs 80,000/- & Above Rs 55,000/- & Above

(e) T.D.S. Survey Rs 50,000/- & Above Rs 35,000/- & Above

(f) Income Tax Search and Seizure See Note 1 See Note 1

(g) Any other Consultancy See Note 1 See Note 1

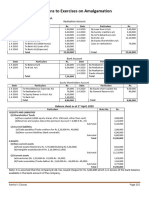

III) CHARITABLE TRUST

(a) (i) Registration Under Local Act Rs 25,000/- & Above Rs 17,000/- & Above

(ii) Societies Registration Act Rs 32,000/- & Above Rs 22,000/- & Above

(b) Registration Under Income Tax Act Rs 25,000/- & Above Rs 18,000/- & Above

(c) Exemption Certificate U/s 80G of Income Tax Act Rs 20,000/- & Above Rs 14,000/- & Above

(d) Filing Objection Memo/other Replies Rs 10,000/- & Above Rs 7,000/- & Above

(e) Filing of Change Report Rs 10,000/- & Above Rs 7,000/- & Above

(f) Filing of Annual Budget Rs 10,000/- & Above Rs 7,000/- & Above

(g) Attending before Charity Commissioner including for Rs 8,000/- & Above Rs 6,000/- & Above

Attending Objections per visit per visit

(h) (i) F.C.R.A. Registration Rs 35,000/- & Above Rs 25,000/- & Above

(ii) F.C.R.A. Certification Rs 8,000/- & Above Rs 6,000/- & Above

IV) COMPANY LAW AND LLP WORK

V) (a) Filing Application for Name Approval Rs 8,000/-& Above Rs 6,000/- & Above

(b) Incorporation of a Private Limited Company/LLP Rs 35,000/- & Above Rs 25,000/- & Above

(c) Incorporation of a Public Limited Company Rs 65,000/- & Above Rs 45,000/- & Above

(d) Advisory or consultation in drafting MOA, AOA Rs 15,000/- & Above Rs 12,000/- & Above

(e) (i) Company's/LLP ROC Work, Preparation of Minutes, See Note 1 See Note 1

Statutory Register & Other Secretarial Work

(ii) Certification (Per Certificate) Rs 15,000/- & Above Rs 10,000/- & Above

(f) Filing Annual Return Etc. Rs 10,000/- & Above per Form Rs 8,000/- & Above per Form

(g) Filing Other Forms Like : F-32, 18, 2 etc. Rs 5,000/- & Above per Form Rs 4,000/- & Above per Form

(h) Increase in Authorised Capital Rs 25,000/- & Above Rs 20,000/- & Above

Filing of F-5, F-23, preparation of Revised Memorandum of

Association/Article of Association/LLP Agreement

(i) DPIN/DIN per Application Rs 4,000/- & Above Rs 3,000/- & Above

(j) Company Law Consultancy including Petition drafting See Note 1 See Note 1

(k) Company Law representation including LLP before RD and NCLT See Note 1 See Note 1

(l) ROC Representation See Note 1 See Note 1

AUDIT AND OTHER ASSIGNMENTS

Rate per day would depend on the complexity of the work and the number of days spent by each person

(i) Principal Rs 18,000/- & Above per day Rs 12,000/- & Above per day

(ii) Qualified Assistants Rs 10,000/- & Above per day Rs 8,000/- & Above per day

(iii) Semi Qualified Assistants Rs 5,000/- & Above per day Rs 4,000/- & Above per day

(iv) Other Assistants Rs 3,000/- & Above per day Rs 2,000/- & Above per day

Subject to minimum indicative Fees as under:

(i) Tax Audit Rs 40,000/- & Above Rs 30,000/- & Above

(ii) Company Audit

(a) Small Pvt. Ltd. Co. (Turnover up to Rs. 2 Crore) Rs 50,000/- & Above Rs 35,000/- & Above

(b) Medium Size Pvt. Ltd. Co./ Public Ltd. Co. Rs 80,000/- & Above Rs 55,000/- & Above

(c) Large Size Pvt. Ltd. Co./ Public Ltd. Co. See Note 1 See Note 1

(iv) Review of TDS Compliance Rs 25,000/- & Above Rs 20,000/- & Above

(v) Transfer Pricing Audit See Note 1 See Note 1

VI) INVESTIGATION, MANAGEMENT SERVICES OR SPECIAL ASSIGNMENTS

Rate per day would depend on the complexity of the work and the number of days spent by each person

(a) Principal Rs 35,000/- & Above + Rs 25,000/- & Above +

per day charge per day charge

(b) Qualified Assistant Rs 18,000/- & Above + Rs 12,000/- & Above +

per day charge per day charge

(c) Semi Qualified Assistant Rs 10,000/- & Above + Rs 7,000/- & Above +

per day charge per day charge

VII) CERIFICATION WORK

(a) Issuing Certificates under the Income Tax Act i.e. U/s 80IA / See Note 1 See Note 1

80IB /10 A/10B & other Certificates

(b) Other Certificates Rs 10,000/- & Above Rs 7,000/- & Above

For LIC/Passport/Credit Card/Etc.

(c) Other Attestation (True Copy) Rs 3,000/- & Above per form Rs 2,000/- & Above per Form

(d) Net worth Certificate for person going abroad Rs 18,000/- & Above Rs 12,000/- & Above

VIII) RERA

(a) Audit of Accounts Rs 10,000/- & Above Rs 7,000/- & Above

(b) Appearance Before Appellate Tribunal or Regulatory Authority or Rs 50,000/- & Above Rs 40,000/- & Above

Adjudicating Authority

(c) Advisory & Consultation See Note 1 See Note 1

(d) Certification for withdrawal of amount See Note 1 See Note 1

IX) CONSULTATION & ARBITRATION

Rate per hour would depend on the complexity of the work and the number of hours spends by each person.

(a) Principal Rs 35,000/- & Above(initial fees) Rs 25,000/- & Above(initial fees)

+ additional fees @ Rs 8,000/- & + additional fees @ Rs 6,000/- &

Above per hour Above per hour

(b) Qualified Assistant Rs 6,000/- & Above per hour Rs 4,000/- & Above per hour

(c) Semi Qualified Assistant Rs 3,000/- & Above per hour Rs 2,000/- & Above per hour

X) NBFC/RBI MATTERS

(a) NBFC Registration with RBI See Note 1 See Note 1

(b) Other Returns Rs 18,000/- & Above Rs 12,000/- & Above

XI) GST

(a) Registration Rs 20,000/- & Above Rs 15,000/- & Above

(b) Registration with Consultation See Note 1 See Note 1

(c) Tax Advisory & Consultation i.e. about value, taxability, See Note 1 See Note 1

classification etc.

(d) Challan/Returns Rs 15,000/- & Above + Rs 10,000/- & Above +

(Rs 4,000/- Per Month) (Rs 3,000/- Per Month)

(e) Adjudication/Show Cause notice reply Rs 30,000/- & Above Rs 20,000/- & Above

(f) Filing of Appeal / Appeals Drafting Rs 30,000/- & Above Rs 20,000/- & Above

(g) Furnish details of inward/outward supply See Note 1 See Note 1

(h) Misc services i.e., refund, cancellation/revocation registration, See Note 1 See Note 1

maintain electronic cash ledger etc.

(i) Audit of accounts and reconciliation Statement Rs 40,000/- & Above Rs 20,000/- & Above

(j) Any Certification Work Rs 10,000/- & Above Rs 5,000/- & Above

XII) FEMA MATTERS

1 Filing Declaration with RBI in relation to transaction by NRIs/ Rs 35,000/- & Above Rs 25,000/- & Above

OCBs

2 Obtaining Prior Permissions from RBI for Transaction with NRIs/ Rs 50,000/- & Above Rs 35,000/- & Above

OCBs

3 Technical Collaboration: See Note 1 See Note 1

Advising, obtaining RBI permission, drafting and preparing

technical collaboration agreement and incidental matters

4 Foreign Collaboration: See Note 1 See Note 1

Advising, obtaining RBI permission, drafting and preparing

technical collaboration agreement and incidental matters (incl.

Shareholders Agreement)

5 Advising on Non Resident Taxation Matters including Double Tax See Note 1 See Note 1

Avoidance Agreements including FEMA

XIII) PROJECT FINANCING

(a) Preparation of CMA Data See Note 1 See Note 1

(b) Services relating to Financial sector See Note 1 See Note 1

Notes:

1) Fees to be charged depending on the complexity and the time spent on the particular assignment.

2) The above recommended minimum scale of fees is as recommended by the Committee for Capacity Building of Members in Practice (CCBMP)

of ICAI.

3) The aforesaid table states recommendatory minimum scale of fees works out by taking into account average time required to complete such

assignments. However, members are free to charge varying rates depending upon the nature and complexity of assignment and time involved in

completing the same.

4) Office time spent in travelling & out-of-pocket expenses would be chargeable. The Committee issues for general information the above recom-

mended scale of fees which it considers reasonable under present conditions. It will be appreciated that the actual fees charged in individual cases

will be matter of agreement between the member and the client.

5) GST should be collected separately wherever applicable.

6) The Committee also recommends that the bill for each service should be raised separately and immediately after the services are rendered.

7) Class A Cities here includes Delhi, Mumbai, Calcutta, Chennai, Pune, Hyderabad, Bangalore and Ahmedabad.

Class B Cities includes all other cities not included in “Class A”.

8) The amount charged will be based on the location of the service provider.

For any Query please contact : Secretary, Committee for Capacity Building of Members in Practice (CCBMP), ICAI, ICAI Bhawan, A-29, First Floor, Administrative Building,

Sector – 62 Noida -201309, UP, India | Ph: 0120-3045994 | E-mail : sambit.mishra@icai.in | Website of ICAI: www.icai.org | Website of CCBMP, ICAI: www.icai.org.in

You might also like

- Bryce Gilmore - Price Action Chronicles Volume 1 PDFDocument209 pagesBryce Gilmore - Price Action Chronicles Volume 1 PDFTDN100% (1)

- ABCDocument15 pagesABCLau Meng YongNo ratings yet

- Mahamerus From Devipuram - Book-Final 06-09-07 Edition IIDocument18 pagesMahamerus From Devipuram - Book-Final 06-09-07 Edition IILolitambika Neumann100% (2)

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Important ContactsDocument32 pagesImportant ContactsVASANTHAIAH P ODEYARNo ratings yet

- Appointment Letter of DirectorsDocument33 pagesAppointment Letter of DirectorsLolitambika NeumannNo ratings yet

- Mock Numerical Questions: Model Test PaperDocument12 pagesMock Numerical Questions: Model Test PaperNaman JainNo ratings yet

- TATA Offer LetterDocument1 pageTATA Offer LetterLolitambika NeumannNo ratings yet

- Hotel Invoice Sample 7Document2 pagesHotel Invoice Sample 7Sandi YudhaNo ratings yet

- Table For Income Tax Summary of RatesDocument1 pageTable For Income Tax Summary of Ratesmike rapistaNo ratings yet

- EconomicsDocument10 pagesEconomicsAbhinav Chauhan50% (2)

- Recommended Rare TextDocument6 pagesRecommended Rare TextShiva MatriNo ratings yet

- Minimum Recommended Scale of Fees For The Professional Assignments Done by The Chartered Accountants For Non Metro CitiesDocument7 pagesMinimum Recommended Scale of Fees For The Professional Assignments Done by The Chartered Accountants For Non Metro CitiesAnonymous L77eD5uoNo ratings yet

- Professional Fees - CA, LegalDocument5 pagesProfessional Fees - CA, LegalAparna BhandariNo ratings yet

- Revised Minimum Recommended Scale of Fees For The Professional Assignments Done by The Chartered AccountantsDocument30 pagesRevised Minimum Recommended Scale of Fees For The Professional Assignments Done by The Chartered AccountantsGAURAV GUPTANo ratings yet

- Schedule of Bank Charges: (Excluding FED)Document63 pagesSchedule of Bank Charges: (Excluding FED)Vc LhrNo ratings yet

- Commerce Bcom Semester 1 2022 November Financial Accounting I 2019 PatternDocument5 pagesCommerce Bcom Semester 1 2022 November Financial Accounting I 2019 PatternOm KapseNo ratings yet

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Document4 pagesPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNo ratings yet

- Commerce - Practice Test 17 - Kautilya 2.0 21st JanDocument10 pagesCommerce - Practice Test 17 - Kautilya 2.0 21st Janitika.chaudharyNo ratings yet

- Department of Prohibition, Excise & Registration (Registration)Document13 pagesDepartment of Prohibition, Excise & Registration (Registration)salini jhaNo ratings yet

- Service ChargesDocument10 pagesService Chargessudarshan1No ratings yet

- Bihar Stamp Duty and Registration Charges BiharDocument1 pageBihar Stamp Duty and Registration Charges BiharAkshansh NegiNo ratings yet

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Document10 pagesReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGNo ratings yet

- Axis BankDocument5 pagesAxis Bankyesh cyberNo ratings yet

- Schedule of Charges Eff From 15.12.2022Document5 pagesSchedule of Charges Eff From 15.12.2022SUMIT PODDARNo ratings yet

- (I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)Document4 pages(I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)dpfsopfopsfhopNo ratings yet

- Foreign Exchange TransactionsDocument6 pagesForeign Exchange TransactionsAshish JaggaNo ratings yet

- MTP May21 ADocument11 pagesMTP May21 Aomkar sawantNo ratings yet

- Q.Prepare A Statement of P & L A/C As Per Revised Schedule III AnsDocument6 pagesQ.Prepare A Statement of P & L A/C As Per Revised Schedule III AnsTejas ChandanshiveNo ratings yet

- 11.solutions Amalgamation 2022 (Page 255-263) PDFDocument9 pages11.solutions Amalgamation 2022 (Page 255-263) PDFrodagab903No ratings yet

- Entrep-Review: Use The Following Information For The Next Two QuestionsDocument3 pagesEntrep-Review: Use The Following Information For The Next Two QuestionsNeil John Santos ParasNo ratings yet

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- HDocument4 pagesHPrashant Sagar GautamNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- Tax Planning and Compliance: RequirementsDocument6 pagesTax Planning and Compliance: RequirementsBizness Zenius HantNo ratings yet

- 11th Accounts Full Test MVPDocument17 pages11th Accounts Full Test MVPnandiniladdha16No ratings yet

- CU Leaked Paper Financial Accounting-IDocument5 pagesCU Leaked Paper Financial Accounting-Idarindainsaan420No ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Accounts Sample Paper 04 0253b13ec1bb2Document48 pagesAccounts Sample Paper 04 0253b13ec1bb2opNo ratings yet

- Instant Paper Commerce Paper - IiDocument3 pagesInstant Paper Commerce Paper - IiM JEEVARATHNAM NAIDUNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- Economics For Engineers Hmts 3201 - 2022Document4 pagesEconomics For Engineers Hmts 3201 - 2022mayur.81926No ratings yet

- Acc q2 SANSDocument11 pagesAcc q2 SANSTanvir AnjumNo ratings yet

- Percentage-Of-Completion and Completed-Contract Methods.: SolutionDocument7 pagesPercentage-Of-Completion and Completed-Contract Methods.: SolutionTracy LeeNo ratings yet

- Ty Bcom PDF Sample QuiestionsDocument49 pagesTy Bcom PDF Sample QuiestionsAniket VyasNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- TP Documentation & Certification - NIRC-07.10Document34 pagesTP Documentation & Certification - NIRC-07.10preetishahNo ratings yet

- M.B.A (2016 Pattern)Document39 pagesM.B.A (2016 Pattern)Radha ChoudhariNo ratings yet

- DEATH OF A PARTNER Intro and Sum-6Document6 pagesDEATH OF A PARTNER Intro and Sum-6gankNo ratings yet

- 12 Accounts Imp ch10 PDFDocument14 pages12 Accounts Imp ch10 PDFmukesh kumarNo ratings yet

- HB2B CHB2BDocument7 pagesHB2B CHB2BAswinBhimaNo ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- Mid Sem 1sem Exam Paper Oct2015Document26 pagesMid Sem 1sem Exam Paper Oct2015angel100% (1)

- Aa RTP M24Document32 pagesAa RTP M24luvkumar3532No ratings yet

- B. Com I All PapersnDocument14 pagesB. Com I All Papersnrahim Abbas aliNo ratings yet

- Forex Annexure VI Final 19112020Document10 pagesForex Annexure VI Final 19112020RahulNo ratings yet

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- Income From Other Sources IllustrationDocument5 pagesIncome From Other Sources IllustrationSarvar PathanNo ratings yet

- Taxation - I: (Please Turn Over)Document3 pagesTaxation - I: (Please Turn Over)Laskar REAZ100% (1)

- Test 8Document3 pagesTest 8lalshahbaz57No ratings yet

- Section "A" Very Short Answer Questions) (Attempt All Questions)Document5 pagesSection "A" Very Short Answer Questions) (Attempt All Questions)Ayusha TimalsinaNo ratings yet

- Jaya College of Arts and Science Department of ManagDocument4 pagesJaya College of Arts and Science Department of ManagMythili KarthikeyanNo ratings yet

- June, 2004 Q.PDocument4 pagesJune, 2004 Q.PM JEEVARATHNAM NAIDUNo ratings yet

- Accounting Finance Specialisation 7 6 22Document9 pagesAccounting Finance Specialisation 7 6 22Gourav kunduNo ratings yet

- Answer Key 3Document8 pagesAnswer Key 3Hari prakarsh NimiNo ratings yet

- Changes Made in Income Tax Act 2058Document10 pagesChanges Made in Income Tax Act 2058shankarNo ratings yet

- Consent For Short Notice PDF 3 210685425Document2 pagesConsent For Short Notice PDF 3 210685425Lolitambika NeumannNo ratings yet

- Letter of Consent To Act As Managing Director Whole Time Director Manager 25042016Document4 pagesLetter of Consent To Act As Managing Director Whole Time Director Manager 25042016Lolitambika NeumannNo ratings yet

- Top 5-ITReFiling Companies IndiaDocument5 pagesTop 5-ITReFiling Companies IndiaLolitambika NeumannNo ratings yet

- Revised CA FeesDocument52 pagesRevised CA FeesLolitambika NeumannNo ratings yet

- Letter Head For CompanyDocument5 pagesLetter Head For CompanyLolitambika NeumannNo ratings yet

- Sample Draft WillDocument2 pagesSample Draft WillLolitambika NeumannNo ratings yet

- Section Q: Extra Territorial Organisations and BodiesDocument3 pagesSection Q: Extra Territorial Organisations and BodiesLolitambika NeumannNo ratings yet

- Solar Systems 14 15Document80 pagesSolar Systems 14 15Lolitambika NeumannNo ratings yet

- List of Approved Institutes in 2015-16Document26 pagesList of Approved Institutes in 2015-16Lolitambika NeumannNo ratings yet

- E Return - Intermediary Registration ServicesDocument38 pagesE Return - Intermediary Registration ServicesLolitambika NeumannNo ratings yet

- GIGW Certificate MCADocument1 pageGIGW Certificate MCALolitambika NeumannNo ratings yet

- Mbamca - 2017-2018Document6 pagesMbamca - 2017-2018Lolitambika NeumannNo ratings yet

- Execution Location in Schedule 1 On The Date Set Forth As The Execution Date in Schedule 1 ("Document3 pagesExecution Location in Schedule 1 On The Date Set Forth As The Execution Date in Schedule 1 ("Lolitambika NeumannNo ratings yet

- K R ChandratreDocument18 pagesK R ChandratreSachin BagmarNo ratings yet

- Saldos A Nivel de Auxiliares Contables Auxiliar Beneficiario/DepositanteDocument3 pagesSaldos A Nivel de Auxiliares Contables Auxiliar Beneficiario/DepositanteNatalia Arias EspinozaNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100Vinodh KumarNo ratings yet

- Vintage LingerieDocument4 pagesVintage Lingeriejulie bennett100% (2)

- SEC Articles - of - Inc. JNA AMENDED 2nd - Purpose JNADocument5 pagesSEC Articles - of - Inc. JNA AMENDED 2nd - Purpose JNAJNA Corp. global tradingNo ratings yet

- Chapter 5 Homework Ethics at WorkDocument2 pagesChapter 5 Homework Ethics at WorkMelanieNo ratings yet

- Tenor Previous Interest Rate P.A. (%) Revised Interest Rate P.A. (%) (W.e.f. 18.12.2012)Document8 pagesTenor Previous Interest Rate P.A. (%) Revised Interest Rate P.A. (%) (W.e.f. 18.12.2012)Holly SmithNo ratings yet

- Colliers Quarterly Manila Q4 2018 OfficeDocument5 pagesColliers Quarterly Manila Q4 2018 OfficeLemuel Bryan Gonzales DenteNo ratings yet

- Nikunj Shah B-24 Hemraj Bijarnia B-3: Presented To Prof. Amit Abhyankar Group Members Atal Singh B-34Document21 pagesNikunj Shah B-24 Hemraj Bijarnia B-3: Presented To Prof. Amit Abhyankar Group Members Atal Singh B-34Vineeta DabbiruNo ratings yet

- Air IndiaDocument52 pagesAir IndiaAashish Gupta100% (1)

- CH 1. Auditing and Internal ControlDocument31 pagesCH 1. Auditing and Internal ControlBio Audi HanantioNo ratings yet

- FinAcc1 Cash and Cash Equivalents and Bank Reconciliation QUIZDocument4 pagesFinAcc1 Cash and Cash Equivalents and Bank Reconciliation QUIZlena cpaNo ratings yet

- Vodafone Group PLCDocument10 pagesVodafone Group PLCNirvana GunboundNo ratings yet

- GMCVB Agreement RenewalDocument231 pagesGMCVB Agreement RenewalDonPeeblesMIANo ratings yet

- SBI STOCK Jaipur TermsDocument1 pageSBI STOCK Jaipur Termsmanish jopatNo ratings yet

- Anderson and Zinder, P.C., CpasDocument3 pagesAnderson and Zinder, P.C., CpasJack BurtonNo ratings yet

- List of Part-66 TYpe Ratings Iaw EDD 2015-020-RDocument519 pagesList of Part-66 TYpe Ratings Iaw EDD 2015-020-RSahan DharmasiriNo ratings yet

- Marketing - Trans StudioDocument16 pagesMarketing - Trans StudioTegar Ditya PragamaNo ratings yet

- Types of Account HolderDocument23 pagesTypes of Account HolderneemNo ratings yet

- Session5 PDocument22 pagesSession5 PAniket BorseNo ratings yet

- P&G and Unilever Case Study-Discussions in Lecture-15Document5 pagesP&G and Unilever Case Study-Discussions in Lecture-15Sambit Mishra50% (2)

- Dry RunDocument5 pagesDry RunMarc MagbalonNo ratings yet

- Chief Financial Officer CfoDocument5 pagesChief Financial Officer Cfoapi-121402956No ratings yet