Professional Documents

Culture Documents

Construction Project Payments:: Fundamental Challenges & Solutions

Uploaded by

Vimarshi KasthuriarachchiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Construction Project Payments:: Fundamental Challenges & Solutions

Uploaded by

Vimarshi KasthuriarachchiCopyright:

Available Formats

Copyright © 2015 by the

Construction Financial

Management Association.

All rights reserved. This

article first appeared in

CFMA Building Profits.

Reprinted with permission.

BY THOMAS TETHER, MICHAEL SERAFINO, LAWRENCE DANY & JESSE LINCOLN

CONSTRUCTION PROJECT PAYMENTS:

Fundamental Challenges & Solutions

Typical Contract Provisions

The processes and requirements for a

contractor to obtain payment on any

particular job are typically set forth in

its contract with the owner or upstream

contractor. These provisions generally

provide the prerequisites for the con-

tractor’s right to receive payment, as

well as the methodology for calculating

payment, the paperwork the contractor

is required to submit with its payment

application, the timing for payment,

and the contractor’s rights in the event

payment is not made.

As a matter of negotiated contracts,

these payment provisions can run the

gamut, but here are some of the more

common ones.

Typical Payment Cycle

Contractual payment cycles can vary

from payment being due upon invoice

receipt to payment being due 60 days or

more after invoice receipt. Common pay-

ment cycles are between 15 and 30 days,

which is important for reasons beyond

knowing when the check is in the mail.

Contractors today continue to struggle with a number

of fundamental challenges to receiving payment on It is important to understand the

upstream payment cycle for purposes

construction projects. Was the payment package in of establishing appropriate downstream

processes so that subcontractors and

the correct format? Were all of the detailed contract suppliers understand what type of doc-

requirements related to timing and proper documenta- umentation is required for payment

and when such documentation must be

tion for change orders and claims met? provided to the upstream contractor to

pass through to the owner.

This article outlines some practical steps that project

In addition, some state lien laws include

teams and CFMs can take to minimize these risks. deadlines that are tied to submissions

CFMA Building Profits March/April 2015

of lien waivers (which contractors are typically required to owner.8 Prompt payment acts vary widely among jurisdic-

submit along with a payment application) that may become tions in applicability and scope, including whether parties

important if there is a particularly lengthy payment cycle. can contract around any statutory payment requirements,

and should be reviewed as part of the contract negotiation

For example, Georgia’s lien law mandates the use of a statu- for a given project.

tory form for lien waivers that makes such waivers condi-

tional (i.e., effective only upon the receipt of payment).1 One Supporting Documentation

might think that such a conditional waiver would be effective It is critical to understand what documents contractors are

only if the requested payment was actually made. required to submit in order to receive timely and complete

payment. An owner or upstream contractor may rightfully

However, the Georgia statute also provides that “[s]uch withhold payment until the requesting contractor has sub-

amounts shall conclusively be deemed paid in full” no mitted all required documentation. Documents that may be

later than “[s]ixty days after the date of execution of the required include:

waiver and release, unless prior to the expiration of said

1) an executed payment application, using either a

60 day period the claimant files a claim of lien or files in

form attached to the contract or a standard industry

the county in which the property is located an affidavit of

form such as the AIA G702-1992, Application and

nonpayment.”2 Certificate for Payment,

When a contract contains a 60-day payment cycle and a 2) documentation that substantiates the payment

requirement that lien waivers be submitted with payment requested, which may differ depending on the

applications, statutory provisions like Georgia’s present an contract’s pricing method,

administrative burden on contractors to preserve their lien 3) executed lien waivers and/or claim waivers, and

rights. 4) other documentation evidencing that the requesting

contractor has made, or intends to make, payments to

Other states have different requirements. For example, New all subcontractors and suppliers providing labor, mate-

York’s lien law allows the execution of lien waivers simulta- rials, or equipment for the project. This last item could

neously with or after payment has been made.3 Under Texas include statements of account or affidavits of payment.

law, on the other hand, lien waivers are enforceable only if

they substantially comply with a statutory form4 and only if Contractors seeking payment should know and understand

the claimant has received payment.5 all contractually required documents and include them with

their payment applications. Waiver documents, particularly

Because lien laws and the enforceability of lien waivers vary claim waivers that go beyond simply waiving the contractor’s

from state to state, contractors should have an understand- lien rights to the extent of the payment received, should be

ing of the applicable state law requirements prior to signing carefully reviewed prior to execution. If a contractor has

a contract or starting work on a project. outstanding or potential claims, an unqualified, executed

claim waiver could foreclose any right to pursue those claims

In the absence of a contractual payment cycle (or sometimes in the future. Contractors should accordingly identify and

in lieu of a contractual provision, depending on the appli- reserve any such claims with as much specificity as possible.

cable state law), many jurisdictions have prompt payment

acts that prescribe a time limit for an upstream contracting Documents required for the final payment application typi-

party to make payment to a downstream party. cally include documents necessary for turnover or proj-

ect closeout, such as: 1) as-built drawings, 2) operation

For example, New York’s prompt payment law requires an and maintenance manuals, 3) manufacturers’ warranties or

owner or upstream contractor to approve or disapprove a other warranty documentation, 4) evidence of performance

submitted invoice within 12 days.6 An owner must then pay completion tests, if applicable, and 5) final lien and claim

the invoice no later than 30 days after approval thereof,7 waivers from the contractor and all subcontractors, and con-

and an upstream contractor must pay a subcontractor the sent to final payment from the contractor’s surety. Receipt

funds received from the owner for that subcontractor’s of final payment often acts as a waiver by the contractor of

work within seven days after receipt of the funds from the all claims.

March/April 2015 CFMA Building Profits

Certified Payrolls state level, contain harsh penalties for improper billings sub-

Some construction projects, typically government or public mitted on government projects. These penalties can include

works projects, may require a contractor to submit weekly statutory penalties per each “false claim,” three times the

certified payrolls and statements of compliance in accor- amount of damages to the government, and all costs, includ-

dance with various federal or state prevailing wage laws. ing attorneys’ fees and expenses, incurred by the govern-

Failure to accurately complete these certified payroll reports ment in prosecuting a civil action against a contractor.10

in a timely manner can delay receipt of payment.

Electronic Billing

Contractors should understand any such reporting require- Contracting parties are increasingly turning to electronic bill-

ments prior to starting work and prior to contracting (since ing software to manage the payment application process. This

the requirement may affect the contract price and may software can be useful for managing collection of the various

influence the requirements imposed on subcontractors) and items contractors are required to submit for payment, and

ensure that such provisions are properly flowed down to ensuring that payment is only made after all items are appro-

lower tiers. priately submitted. This eases the administrative burden on

the contracting parties (particularly for the upstream contrac-

Certification Requirements tor that would otherwise have to manually track all submis-

Government projects (and perhaps some private projects, sions), but there are typically subscription costs associated

depending on the contract language, funding sources, or with using the software. These costs should be identified in

payment application forms) also typically require a contrac- advance to allow participating contractors and subcontractors

tor requesting payment to certify certain items with each to accurately price the job and avoid surprises.

payment request. These certifications may include:

In addition, a contractor submitting payment applications

1) that the requested payment is only for work performed through such an electronic system should carefully review

“in accordance with the specifications, terms, and its forms, especially lien and claim waiver documents, to

conditions of the contract,” ensure it has accurately completed the forms and reserved

2) that all payments due to subcontractors and suppliers claims as allowed or necessary.11 If the software does not

from previous payments have been made, allow the forms to be completely filled out, then the parties

should discuss an alternative reporting system.

3) that timely payment to subcontractors and suppliers

will be made from the requested payment, and

Billing Based on Percentage Completed vs.

4) that the payment request does not include amounts Cost-Plus vs. Milestone Achievement

that the contractor intends to withhold or retain from

a subcontractor or supplier. The backup that contractors are required to maintain and

submit to substantiate payment requests differs depending

In addition to the payment request certifications, federal on the contract pricing methodology.

government contracts require a contractor asserting a claim

Billing under lump-sum contracts typically occurs monthly

greater than $100,000 to certify the claim under Federal

and is based on a schedule of values that is prepared by the

Acquisition Regulation (FAR) § 52.233-1(d)(2) as follows:

contractor and approved by the owner or upstream contrac-

I certify that the claim is made in good faith; that tor prior to starting work. The schedule of values should

the supporting data are accurate and complete be assembled to accurately reflect the appropriate propor-

to the best of my knowledge and belief; that the

tion that each item has to the overall lump-sum contract

amount requested accurately reflects the contract

adjustment for which the Contractor believes the price. Otherwise, an imbalance between the work performed

Government is liable; and that I am duly authorized and the payments received could arise during construction.

to certify the claim on behalf of the Contractor.9 Contracts often address this issue by requiring a “balanced”

schedule of values, or a schedule of values that is not “front-

Contractors must carefully evaluate the requirements and end loaded.” (For more information on the risks of front-end

relevant facts needed before making any such certifications loading, read “Taking Risks with Numbers: How Far Can You

because the penalty for false certifications can be significant. Go?” by Susan L. McGreevy and Kathryn I. Landrum in the

False Claims Acts, at the federal level and increasingly at the September/October 2014 issue.)

CFMA Building Profits March/April 2015

project payments

Cha lleng es & Solutions

In any case, the contracting parties should agree on the sched- With cost-plus contracts, the owner or upstream contractor

ule of values in order to facilitate the payment process. often has the right to audit the contractor’s records to verify

the amounts and the propriety of costs charged to the job. It

With each payment application, the contractor reviews its is very important for contractors performing cost-plus work

progress and inserts the percentage of each scheduled value to maintain accurate job-cost records, including backup

that has been completed by the end of the pay period. The (payrolls, invoices, evidence of payment, etc.) for audit pur-

sum of these amounts is the amount due to the contractor poses and in case a dispute arises.

for the pay period – less prior payments, retainage, and any

other amounts the owner or upstream contractor is entitled If a contractor overcharges the owner or upstream contractor,

to withhold. The owner or upstream contractor and/or then it is generally responsible for refunding the overpayment,

other party as the contract may allow (such as a consultant, with interest. The parties’ contract may also require the con-

architect, or the project lender), reviews the contractor’s tractor to reimburse the owner or upstream contractor for the

payment application, compares the asserted percentages costs of the audit in that scenario.

complete with its own observations of the contractor’s prog-

ress, and proposes revisions if necessary. Even with an overall cost-plus contract pricing methodology,

contracting parties can avoid common disputes that arise over

For construction contracts under which the architect per- the propriety of various “overhead” or “general conditions”

forms contract administration, the architect is often required charges by agreeing in advance on a lump-sum amount for

to issue a certificate of payment to the owner containing such costs. In that case, a contractor would typically allocate

the architect’s judgment as to the appropriate percentages the agreed lump sum over the expected duration of the proj-

complete and the amounts due. In such contracts, the timing ect and bill a flat rate with each monthly progress payment

of the owner’s payment obligation is often tied to receipt of application.

the architect’s certificate of payment. Disagreements among

the parties regarding the project’s progress can delay a con- Similarly, parties can agree on daily rates to cover such costs

tractor’s receipt of payment or lead an owner or upstream in the event of change orders that extend the duration of

contractor to withhold disputed amounts, so it is important the project. Typically in this scenario, the agreed lump-sum

to quickly and accurately resolve any such issues. amounts would be exempt from audit.

For cost-plus contracts under which the price is based on Another common contract payment methodology provides

the cost of the work plus a markup for the contractor’s profit for payment based on the achievement of milestones identi-

(regardless if there is a guaranteed maximum price), the fied and agreed upon by the parties. Under this method,

required backup for payment applications may be different. there is typically a lump-sum contract price with certain

percentages of the price allocated to the achievement of

While a contractor may still use a schedule of values to various milestones. The contractor is entitled to payment

track the progress of the job, the contractor typically is also upon achievement of each milestone and should submit the

required to submit appropriate evidence of the costs incurred appropriate backup to substantiate that the milestone has

to perform the work, including: been achieved.

1) payrolls accurately demonstrating labor costs, Claims & Change Orders

2) invoices from subcontractors, suppliers, and/or other Contract requirements for the presentation and resolution

vendors and evidence of payment of the same, and of claims and change orders are important provisions for the

3) other evidence as may be required to reasonably parties to understand, as disputes over entitlement to claims

support the contractor’s costs. and change orders are likely the most common construction

project disputes that lead to arbitration or litigation.

A contractor performing cost-plus work should be familiar

with any definition of the allowable or reimbursable cost Early claim identification is generally desirable for all par-

items contained in its contract. Certain costs a contractor ticipants on a construction project. Contractors benefit from

may internally charge to a project may not be reimbursable promptly bringing such issues to the table and obtaining

under the specific terms of a particular contract. resolution while these issues are fresh in the participants’

March/April 2015 CFMA Building Profits

minds, allowing contractors to receive additional payments In addition, most construction contracts allow the owner

or schedule relief to which they are entitled. or upstream contractor to direct a contractor to perform a

change before or without an agreement on the price of the

For owners and upstream contractors, early claim identifica- change. Such “force account” work is commonly priced on a

tion avoids end-of-job surprises and may provide flexibility cost-plus or time and materials basis.

for mitigating the financial and schedule impacts of an issue.

For all parties, early claim identification may reduce the Therefore, even if the underlying contract is a lump-sum

incidences or costs of formal dispute resolution such as arbi- contract, the contractor should have procedures in place to

tration or litigation. accurately track labor hours and other costs expended on

change order work. Failure to maintain such information can

Construction contracts often require a contractor to submit a prejudice the contractor’s claim for payment.

claim or change order request within a certain number of days

after the occurrence of the event giving rise to the contractor’s After a change order is agreed upon and executed by the

parties, the contractor will typically requisition for payment

claim or request.

of the changed work with its monthly progress payment

For example, the standard AIA general contract conditions request and should include whatever backup is required to

require claims to be initiated “within 21 days after occurrence substantiate the amount requested under the chosen pricing

methodology.

of the event giving rise to such Claim or within 21 days after

the claimant first recognizes the condition giving rise to the

Practical Billing Considerations

Claim, whichever is later.”12

• Consider contracting for lump sum or flat rates

Owners and upstream contractors often insist on shortening where possible

the timeframe, removing the discovery language, and insert- • Consider attaching to the contract agreed-to forms

ing affirmative waiver language such that a contractor failing for payment applications, lien waivers, etc.

to provide timely notice forever waives its claim or entitlement • Understand the documentation available and required

to a change order. These provisions help insulate owners and for payment

upstream contractors from late claims or previously undis- • Understand the timing and documentation required

closed claims being submitted at the end of a project after all for submission of claims and change order requests

or most of the work is complete. • Have the payment packages in the correct and

contractually required format

Contractors can attempt to negotiate greater flexibility to

• Have the required invoicing and supporting payroll

assert claims or change order requests, but no matter what and cost data assembled

the final contract language, a contractor and especially the

• Know the differences between “corporate” reports

project management team must be acutely aware of these

and commonly accepted backup

contract requirements. Failure to follow the contractual pro-

cedures may result in a waiver of the claim. • Have procedures in place for accurately tracking labor

hours and other costs expended on change order

Contractors should also have systems in place for segregat- work even if the base contract is a lump sum contract

ing and maintaining backup documentation for claims and • Try to negotiate payment of undisputed amounts in

change orders. This backup is critical for pricing claims and the event of a dispute

change orders, and contractors are often required to submit

such documentation for the owner or upstream contractor Conclusion

to review before payment. Understanding contractual requirements regarding payment

procedures and ensuring that the project management team

Change orders may be priced using different methodolo- understands those requirements are necessary to minimize

gies than the base contract price. Contracts typically allow the risks of delayed payments or inadvertent waiver or

for change orders to be priced based on: 1) a negotiated reduction of claims. Negotiating contract terms and estab-

lump sum, 2) the application of unit prices to additional lishing procedures to make it easier for the project team to

work, 3) the cost-plus method, 4) time and materials, or 5) comply with the payment requirements can reduce costly

some combination of the different methodologies. disputes and benefit a contractor’s bottom line. n

CFMA Building Profits March/April 2015

project payments

Cha lleng es & Solutions

Endnotes

LAWRENCE DANY is a Partner at Sutherland Asbill &

1. O.C.G.A. §44-14-366(c), (d) (2009). Brennan LLP in New York, NY. He represents clients in

2. Ibid. §44-14-366(f)(2). complex commercial, construction, financial services,

real estate, and litigation and arbitration.

3. N.Y. Lien Law §34 (McKinney 2014).

4. Tex. Property Code Ann. §53.284 (West 2012). As part of the firm’s Construction Industry Practice Group,

5. See ibid. § 53.281(b)(3) (providing that a conditional lien waiver or release he represents construction managers, GCs, specialty con-

is effective only if evidence of payment to the claimant exists); ibid. tractors, and their surety companies in disputes related

§53.283 (stating that “[a] person may not require a claimant or potential to breach of contract, change orders, schedule delays,

claimant to execute an unconditional waiver and release” unless the lost productivity, mechanics’ lien issues, payment and

claimant has received payment). performance bonds, and insurance.

6. N.Y. Gen. Bus. Law §756-a(2)(a)(i), (ii) (McKinney 2009).

Larry’s practice also involves process safety litigation,

7. Ibid. §756-a(3)(a)(ii). occupational health and safety litigation, and industrial

8. Ibid. §756-a(3)(b)(ii). and construction workplace incident response.

9. FAR §52.233-1(d)(2)(iii).

Phone: 212-389-5038

10. See, e.g., 31 U.S.C. §3729 (2012) (providing for civil penalties for false E-Mail: larry.dany@sutherland.com

claims, treble damages, and the payment of costs). Website: www.sutherland.com

11. See, e.g., Laquila Group, Inc. v. Hunt Const. Group, Inc., 997 N.Y.S.2d

99 (N.Y. Sup. Ct. 2014) (subcontractor argued that unqualified payment

application “became simply an acknowledgment by [plaintiff] of its pay- JESSE LINCOLN is an Associate at Sutherland Asbill &

ment receipt” because the software did not allow the subcontractor to list Brennan LLP in its Atlanta, GA office. He focuses his prac-

reserved claims on the “reverse side” of the form, as the form required). tice on the construction industry and commercial litigation

12. AIA Document A201-2007 §15.1.2. and represents construction industry clients at all levels,

including GCs, subcontractors, and owners.

THOMAS TETHER is the Chief Legal Officer and Jesse has handled disputes involving heavy industrial

General Counsel at Lend Lease Americas, Inc. in New facilities, mixed-use commercial developments, and tech-

York, NY, an international property development and nology projects. He also has extensive construction

construction company. He brings more than 24 years of industry transactional experience, representing owners,

experience and legal expertise in real estate, finance, contractors, and subcontractors as well as preparing and

construction, and corporate law. His involvement with negotiating a variety of contracts.

Lend Lease includes Public-Private Partnerships, develop-

ment, investment management, and project management He is a member of the ABA and the Atlanta Bar

and construction. Association.

Phone: 212-592-6700 Phone: 404-853-8211

E-Mail: thomas.tether@lendlease.com E-Mail: jesse.lincoln@sutherland.com

Website: www.lendlease.com Website: www.sutherland.com

MICHAEL SERAFINO is the Vice President & Assistant

General Counsel at Lend Lease Americas, Inc. in New

York, NY. He is responsible for all claims and litigation

at various Lend Lease entities.

Michael provides legal counsel to executive and opera-

tions management on all aspects of construction, employ-

ment, insurance coverage, and corporate law and works

closely with corporate risk managers in identifying and

mitigating commercial risk and compliance issues. He

currently sits on the Executive Board of the Construction

Law Section of the New Jersey Bar Association.

Phone: 212-592-6733

E-Mail: michael.serafino@lendlease.com

Website: www.lendlease.com

March/April 2015 CFMA Building Profits

You might also like

- Subcontractor's Statement PDFDocument2 pagesSubcontractor's Statement PDFAnonymous M4DMq2CZXNo ratings yet

- WF-AID Annual Review 2019/20Document36 pagesWF-AID Annual Review 2019/20worldfedksimcNo ratings yet

- Advance Payment NotesDocument2 pagesAdvance Payment NotesAvinaash VeeramahNo ratings yet

- Appendix to Tender DetailsDocument2 pagesAppendix to Tender DetailsAlexandr Trubca100% (1)

- Research Portals for Construction Project ManagementDocument9 pagesResearch Portals for Construction Project ManagementrajnishatpecNo ratings yet

- Fidic & Qatar Civil CodeDocument1 pageFidic & Qatar Civil CodeerrajeshkumarNo ratings yet

- Sunil Mate CV - Logistcs ManagerDocument3 pagesSunil Mate CV - Logistcs ManagerSunil MateNo ratings yet

- Free Docsketch Account: Delete This Page Before Using This DocumentDocument6 pagesFree Docsketch Account: Delete This Page Before Using This DocumentMaxwellNo ratings yet

- Primavera Engineer To Order (ETO)Document9 pagesPrimavera Engineer To Order (ETO)ShriNo ratings yet

- Time Related Claims GraphicsDocument4 pagesTime Related Claims Graphicsnywd806033No ratings yet

- Pam Northern Chapter: Delay and Disruption in Construction ContractsDocument37 pagesPam Northern Chapter: Delay and Disruption in Construction ContractscfpyNo ratings yet

- Design-Build Teaming Agreements: Written By: Mark C. Friedlander T 312.258.5546Document6 pagesDesign-Build Teaming Agreements: Written By: Mark C. Friedlander T 312.258.5546Ken SuNo ratings yet

- L&T MetroDocument7 pagesL&T MetroSaigyan RanjanNo ratings yet

- Construction Project Claim ResolutionDocument50 pagesConstruction Project Claim ResolutionDAGMAWI ASNAKENo ratings yet

- Riddhi ConsultingDocument6 pagesRiddhi ConsultingRidhi Consulting ServicesNo ratings yet

- Contractor Subcontractor RelationshipDocument11 pagesContractor Subcontractor RelationshipClaire LimNo ratings yet

- Contract AdministrationDocument27 pagesContract AdministrationVVRAONo ratings yet

- Contract Management 2Document13 pagesContract Management 2Ashraf BhaiNo ratings yet

- Dubai SearchDocument2 pagesDubai SearchMisty MannNo ratings yet

- FIDIC Seminar BrochureDocument4 pagesFIDIC Seminar Brochure8790922772No ratings yet

- Assessment of Tender Risks - Red Flag ClausesDocument35 pagesAssessment of Tender Risks - Red Flag ClausesRahulRandyNo ratings yet

- Construction Contracts - A Comparison Between The FIDIC Red Book and The 2010 MDB Conditions PDFDocument3 pagesConstruction Contracts - A Comparison Between The FIDIC Red Book and The 2010 MDB Conditions PDFsenthilNo ratings yet

- Draft - JCO - Contract Agreement - Macopa Cold StorageDocument14 pagesDraft - JCO - Contract Agreement - Macopa Cold StorageMiguel MorenoNo ratings yet

- PPPs Tollway EngDocument28 pagesPPPs Tollway EngASHINo ratings yet

- Nitaqat ExplainedDocument8 pagesNitaqat ExplainednehaNo ratings yet

- Caddell Design Build Contract Redacted Version - April 2022Document198 pagesCaddell Design Build Contract Redacted Version - April 2022WBHM NewsNo ratings yet

- Larsen & Toubro Group of Companies Allowances & Perquisites Applicable To Covenanted Grade M1-B 1. House Rent AllowanceDocument1 pageLarsen & Toubro Group of Companies Allowances & Perquisites Applicable To Covenanted Grade M1-B 1. House Rent AllowanceashokeNo ratings yet

- Construction Claim Form TemplateDocument3 pagesConstruction Claim Form TemplateKevin KevinNo ratings yet

- Ultrasonic Kiosk Works Framework TenderDocument22 pagesUltrasonic Kiosk Works Framework TenderFirasAlnaimiNo ratings yet

- Practice Notes For Quantity Surveyors - Procurement StrategyDocument26 pagesPractice Notes For Quantity Surveyors - Procurement Strategyt chNo ratings yet

- Engineering Project Manager in Knoxville TN Resume Kent MaglebyDocument2 pagesEngineering Project Manager in Knoxville TN Resume Kent MaglebyKentMaglebyNo ratings yet

- FIDIC Presentation PDFDocument6 pagesFIDIC Presentation PDFzhangj5No ratings yet

- Guidelines For Lateral Entry 2009 2010Document35 pagesGuidelines For Lateral Entry 2009 2010Lindsey BrownNo ratings yet

- Ashgal Document PDFDocument182 pagesAshgal Document PDFmamman64No ratings yet

- Extension of Time Under JCT (Illustration)Document1 pageExtension of Time Under JCT (Illustration)LGNo ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Critical Analysis On Cost Management of Commercial Buildings by Using Primavera SoftwareDocument8 pagesCritical Analysis On Cost Management of Commercial Buildings by Using Primavera SoftwareIJRASETPublicationsNo ratings yet

- SOR Road Works 2013Document98 pagesSOR Road Works 2013vineetvceb100% (4)

- Liquidated Damages ResearchDocument3 pagesLiquidated Damages ResearchNatarajan SaravananNo ratings yet

- FIDIC and Qatar Law - SCL CPD EventDocument28 pagesFIDIC and Qatar Law - SCL CPD EventDilan De Silva100% (1)

- FIDIC-An OverviewDocument32 pagesFIDIC-An OverviewBspeedman17564No ratings yet

- Cover Letter For AccountantsDocument7 pagesCover Letter For Accountantssyed Muntazir naqviNo ratings yet

- FIDIC Contract Conditions GuideDocument57 pagesFIDIC Contract Conditions GuidealokNo ratings yet

- Google AdSense - Terms and ConditionsDocument1 pageGoogle AdSense - Terms and Conditionsshaistarasheed9622No ratings yet

- Subcontract Standard Form of Agreement Between: RequestDocument1 pageSubcontract Standard Form of Agreement Between: Requestjherna215No ratings yet

- 5A) SPDP Status Tracking ReportDocument1 page5A) SPDP Status Tracking ReportAswin KurupNo ratings yet

- Types of Construction DelaysDocument35 pagesTypes of Construction DelaysAbdalrhman HamadNo ratings yet

- Comparing Red Book and 1999 Construction Contract ClausesDocument4 pagesComparing Red Book and 1999 Construction Contract ClausesMahmoud Mostafa100% (1)

- Contract Indian Vs FidicDocument12 pagesContract Indian Vs FidicPritam MondalNo ratings yet

- Bechtel Job Description Construction SuperintendentDocument2 pagesBechtel Job Description Construction Superintendentkatoman10100% (1)

- NEOM Minor Works - ITT-19112023Document9 pagesNEOM Minor Works - ITT-1911202301095902062ahmedNo ratings yet

- Interior Construction Scope of WorkDocument101 pagesInterior Construction Scope of WorkTalal ItaniNo ratings yet

- Project Manager Construction in WA Resume James DavenportDocument3 pagesProject Manager Construction in WA Resume James DavenportJamesDavenportNo ratings yet

- Contract Compliance: Contract Administration Schematic (Fidic Clauses)Document2 pagesContract Compliance: Contract Administration Schematic (Fidic Clauses)malcolmpoNo ratings yet

- 001 Training Manual Introduction To The Legal FrameworkDocument17 pages001 Training Manual Introduction To The Legal FrameworkMukesna moya100% (1)

- Pages From Construction Delay ClaimsDocument13 pagesPages From Construction Delay ClaimsPageMasterPublishing50% (2)

- Payments on disputed sums risks minimizedDocument3 pagesPayments on disputed sums risks minimizedmarx0506No ratings yet

- Gtswca Construction Act Brochure June 2020Document26 pagesGtswca Construction Act Brochure June 2020ryfieldsNo ratings yet

- SLQS Qatar CPD No. 101 - Payment Delays in The Construction Industry by Mr. Uditha Tharanga - PresentationDocument31 pagesSLQS Qatar CPD No. 101 - Payment Delays in The Construction Industry by Mr. Uditha Tharanga - Presentationben hurNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- Insurance in Construction ContractsDocument4 pagesInsurance in Construction ContractsRiyas100% (1)

- Key Liability Aspects and LD in Construction Contracts in QatarDocument2 pagesKey Liability Aspects and LD in Construction Contracts in QatarVimarshi KasthuriarachchiNo ratings yet

- The Consequence of Skipping A Mandatory Pre-Arbitral StepDocument2 pagesThe Consequence of Skipping A Mandatory Pre-Arbitral StepVimarshi KasthuriarachchiNo ratings yet

- Good Faith in The Middle East - Construction LawDocument3 pagesGood Faith in The Middle East - Construction LawVimarshi KasthuriarachchiNo ratings yet

- FIDIC Red 1999 - Sub-Clause 20.1Document32 pagesFIDIC Red 1999 - Sub-Clause 20.1Vimarshi KasthuriarachchiNo ratings yet

- 04 6322Document48 pages04 6322Tariq MirNo ratings yet

- Building Permit Application ProcedureDocument10 pagesBuilding Permit Application ProcedureVimarshi KasthuriarachchiNo ratings yet

- Lusail Building Permit Application Procedurees PDFDocument8 pagesLusail Building Permit Application Procedurees PDFVimarshi KasthuriarachchiNo ratings yet

- NRM 2 Guidelines 1st Edition PGguidance 2014Document22 pagesNRM 2 Guidelines 1st Edition PGguidance 2014Vimarshi Kasthuriarachchi100% (1)

- Site Initiation ChecklistDocument3 pagesSite Initiation ChecklistVimarshi KasthuriarachchiNo ratings yet

- 2020 MemphisDocument10 pages2020 MemphisMarv PascNo ratings yet

- IDM-DT GroupAssignment 1 D H IDocument46 pagesIDM-DT GroupAssignment 1 D H IIshikaNo ratings yet

- VAT Explained: A Guide to Value-Added Tax in the PhilippinesDocument28 pagesVAT Explained: A Guide to Value-Added Tax in the PhilippinesJeser JavierNo ratings yet

- Openbravo POS Scripting Tutorial - OpenbravoWikiDocument7 pagesOpenbravo POS Scripting Tutorial - OpenbravoWikiRoussell Rafael Silano HigueraNo ratings yet

- M.COM Elective Course Question Bank on AuditingDocument4 pagesM.COM Elective Course Question Bank on AuditinghareshNo ratings yet

- Vendor Consignment Process - SAP Blogs PDFDocument26 pagesVendor Consignment Process - SAP Blogs PDFrobnunesNo ratings yet

- Ack NSDL000043902Document1 pageAck NSDL000043902JohnsonNo ratings yet

- 10 Impl 13 CustomTools ApprovalProcessesDocument34 pages10 Impl 13 CustomTools ApprovalProcessesMarielle GonzalvoNo ratings yet

- Corporate Governance ControlsDocument50 pagesCorporate Governance ControlsKathleenNo ratings yet

- Kasaragod Municipality: Transaction DetailsDocument2 pagesKasaragod Municipality: Transaction DetailsmodsumNo ratings yet

- SAP ESM: Understanding External Service ManagementDocument10 pagesSAP ESM: Understanding External Service ManagementMurali100% (1)

- Electronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaDocument94 pagesElectronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaMa Jessica Maramag BaroroNo ratings yet

- TAX PAYER GUIDE: BIR Compliance for BusinessesDocument7 pagesTAX PAYER GUIDE: BIR Compliance for BusinessesLevi Lazareno EugenioNo ratings yet

- Motorcycle Insurance ReceiptDocument1 pageMotorcycle Insurance ReceiptWan RidhwanNo ratings yet

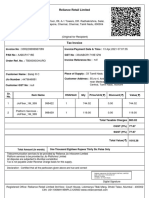

- Reliance Retail Limited: Total Amount (In Words) One Thousand Eighteen Rupees Thirty Six Paisa OnlyDocument3 pagesReliance Retail Limited: Total Amount (In Words) One Thousand Eighteen Rupees Thirty Six Paisa OnlyBalaNo ratings yet

- Sap Book For Beginners and LearnersDocument8 pagesSap Book For Beginners and Learnersdeborahkong9900No ratings yet

- Sap Real Time IssuesDocument4 pagesSap Real Time IssuessowmyanavalNo ratings yet

- Calculating Output VAT on Sales of Goods and PropertiesDocument118 pagesCalculating Output VAT on Sales of Goods and PropertiesRenz Francis LimNo ratings yet

- Mobile Milk Tea ShopDocument4 pagesMobile Milk Tea ShopTeddy PedrajasNo ratings yet

- Latest SAP MM Interview Questions and Answers 2013: Aranganathan ChandranDocument6 pagesLatest SAP MM Interview Questions and Answers 2013: Aranganathan ChandrannidhiNo ratings yet

- Zomato Food Order: Summary and Receipt: Item Quantity Unit Price Total PriceDocument1 pageZomato Food Order: Summary and Receipt: Item Quantity Unit Price Total PriceRaju SNo ratings yet

- e-SAP RlinkDocument30 pagese-SAP RlinkFemiNo ratings yet

- Financial Management Documentary On Mang InasalDocument208 pagesFinancial Management Documentary On Mang InasalJust MeNo ratings yet

- Housing Development Regulations Amendment 2015Document66 pagesHousing Development Regulations Amendment 2015Ezumi HarzaniNo ratings yet

- VAHAN 4.0 (Citizen Services) Onlineapp01 135 8001Document1 pageVAHAN 4.0 (Citizen Services) Onlineapp01 135 8001bk5441951No ratings yet

- Sai BabuDocument2 pagesSai Babushivani negiNo ratings yet

- LT E-BillDocument2 pagesLT E-BillShahbaz ShaikhNo ratings yet

- ABM FABM1 AIRs LM Q3 W7) M7.1Document9 pagesABM FABM1 AIRs LM Q3 W7) M7.1MEDILEN O. BORRESNo ratings yet

- ALL-FSD Functional Specification Document - FI ChequesDocument15 pagesALL-FSD Functional Specification Document - FI ChequesMarcelo Del Canto RodriguezNo ratings yet

- End of Lesson AssessmentDocument2 pagesEnd of Lesson AssessmentJoanna Carla LlorenteNo ratings yet