Professional Documents

Culture Documents

Property Due Diligence Report Documents Under Consideration

Uploaded by

Adrian SantosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Due Diligence Report Documents Under Consideration

Uploaded by

Adrian SantosCopyright:

Available Formats

PROPERTY DUE DILIGENCE REPORT

Documents under consideration:

1. Transfer Certificate of Title No. ____________ (TCT No. ____________);

2. Petition for Cancellation of Encumbrance in the TCT No. ____________;

3. Tax Clearance for Building with OR No. ____________ (TC-B)

4. Tax Clearance for Lot ____________ with OR No. ____________ (TC-L)

5. “Napakahalang Babasahin” for Lot ____________;

6. Tax Declaration of Real Property No. ____________ (TD-L) and,

7. City of Toledo Notice of Assessment.

Findings:

1. The subject property covered by TCT No. ____________ is particularly

described as Lot No. ____________ Plan No. ____________, Portion of

____________, ____________ located at City of Toledo, Province of Cebu,

Island of Cebu.

2. TC-B is for a property with A. R. P. No. ____________. While TC-L covers a

property described as Lot No. ____________.

3. TD-L covers a property described as Lot No. ____________.

4. TCT No. ____________ has an annotation for liabilities. However, the same

was already cancelled.

Comments:

TCT No. ____________ covers Lot No. ____________ and NOT Lot No.

____________.

TC-L covers a property described as Lot No. ____________. Therefore, it is not

the Tax Clearance for TCT No. ____________.

TC-B is for a property with A. R. P. No. ____________. Unfortunately, there

are no other documents, like its Tax Declaration, to reckon with to determine if it

is the Tax Clearance for the improvements situated in TCT No. ____________.

TD-L covers a property described as Lot No. ____________. The property

described in TCT No. ____________. Since there is no Tax Clearance

presented covering Lot No. ____________, as what is attached is for Lot No.

1081-E, there can be no proof if the real property taxes for the said property were

paid or not.

The names appearing on the aforementioned documents are different. As well as

the name of the requesting party in the receipts and acknowledgement forms.

Recommendations:

1. Ask for the correct Tax Clearances involving the land covered by TCT No.

____________ and its improvement.

2. In its absence, the purchase of the subject property will be very risky and

expensive since if the real property taxes were not actually paid, assessments can

go as high as 5-10 years’ worth of back taxes.

3. Ask for the Tax Declaration covering the improvement situated in the subject

property.

4. The risk respecting the annotation for liabilities can be disregarded since the

same was already cancelled.

5. Inquire comprehensively with the personality of the person you are dealing with.

The difference in the names appearing in the documents for consideration is

highly suspicious.

You might also like

- Authorization Letter for Property Tax MapDocument1 pageAuthorization Letter for Property Tax MapJason YangaNo ratings yet

- Chattel Mortgage Registration ProceduresDocument2 pagesChattel Mortgage Registration ProceduresJan Roots100% (1)

- Acknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Document1 pageAcknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Christina Pic-it BaguiwanNo ratings yet

- Branch Office Expression of Interest For Amnesty of Fines and Penalties at SECDocument2 pagesBranch Office Expression of Interest For Amnesty of Fines and Penalties at SECcsb1683100% (1)

- Letter For Delisting BIRDocument2 pagesLetter For Delisting BIRFreann Sharisse AustriaNo ratings yet

- SEC Affidavit of Confirmation of CorrectionDocument1 pageSEC Affidavit of Confirmation of CorrectionJfm A Dazlac0% (1)

- @properties Exclusive Marketing AgreementDocument2 pages@properties Exclusive Marketing AgreementPeter AngeloNo ratings yet

- ANNEX B Undertaking - Corp.Document1 pageANNEX B Undertaking - Corp.cynthia r. monjardin100% (1)

- Affidavit of No RentalDocument2 pagesAffidavit of No RentalFeisty LionessNo ratings yet

- SEC Opinion Re Change of Principal AddressDocument5 pagesSEC Opinion Re Change of Principal AddressLRMNo ratings yet

- Affidavit of UndertakingDocument1 pageAffidavit of UndertakingMaria OzawiNo ratings yet

- BOARD RESOLUTION - Sale of StocksDocument1 pageBOARD RESOLUTION - Sale of StocksGeraldine S CarpioNo ratings yet

- Neighbors Approve Cell Tower ConstructionDocument1 pageNeighbors Approve Cell Tower ConstructionEgg EggNo ratings yet

- Sample SMRDocument1 pageSample SMRearl0917No ratings yet

- Ethical StandardsDocument4 pagesEthical StandardsLeitz Camyll Ang-AwNo ratings yet

- Affidavit of Adjoining OwnersDocument1 pageAffidavit of Adjoining OwnersRamil Carreon100% (1)

- BOND APPLICATION INDIVIDUAL. Heirs BondDocument5 pagesBOND APPLICATION INDIVIDUAL. Heirs BondAnonymous 4nbk4yr100% (1)

- DOLE Form On Establishment Termination ReportDocument1 pageDOLE Form On Establishment Termination ReportNasir AhmedNo ratings yet

- PRC Request Form for Dislodging SalespersonsDocument1 pagePRC Request Form for Dislodging SalespersonsNASSER DUGASANNo ratings yet

- Afffidavit of Non-Filing of Double Claim and Agreeement To Testify in CourtDocument1 pageAfffidavit of Non-Filing of Double Claim and Agreeement To Testify in CourtBryan VeneracionNo ratings yet

- Sample Board ResolutionDocument2 pagesSample Board ResolutionJen GamilNo ratings yet

- GFFS General Form Rev 20061Document14 pagesGFFS General Form Rev 20061Genesis Manalili100% (1)

- Zonal Values Notice for RDO 57 - Biñan CityDocument298 pagesZonal Values Notice for RDO 57 - Biñan CitySu San100% (1)

- Broker Accreditation ContractDocument2 pagesBroker Accreditation ContractMiriam RamirezNo ratings yet

- Revenue Code of Las Pinas City PDFDocument105 pagesRevenue Code of Las Pinas City PDFKriszan ManiponNo ratings yet

- 6-2 Affidavit of Mailing Notice - Shareholders Annual MeetingDocument1 page6-2 Affidavit of Mailing Notice - Shareholders Annual MeetingDanielNo ratings yet

- Sublease AgreementDocument5 pagesSublease AgreementImee OrtizoNo ratings yet

- Stirling HomexDocument3 pagesStirling HomexAnne cutieNo ratings yet

- SEC SMR Format 2yrs - 2018 - 10 CopiesDocument1 pageSEC SMR Format 2yrs - 2018 - 10 CopiesMarvin CeledioNo ratings yet

- Hoa Invitation Letter 12-20-14Document2 pagesHoa Invitation Letter 12-20-14api-275599579No ratings yet

- BIR Ruling No. 253-16Document4 pagesBIR Ruling No. 253-16john allen MarillaNo ratings yet

- Authority To SellDocument3 pagesAuthority To SellAlbert Caisip SampangNo ratings yet

- Affidavit of Adjoining OwnersDocument2 pagesAffidavit of Adjoining Ownersmarjorie gadorNo ratings yet

- Sample of Loan Agreement PhilippinesDocument2 pagesSample of Loan Agreement PhilippinesLea May Dela cruzNo ratings yet

- Certification of Company Car AssignmentDocument1 pageCertification of Company Car AssignmentCasandra KayeNo ratings yet

- Supply Purchase Agreement (Spa) CementDocument4 pagesSupply Purchase Agreement (Spa) CementRonald Allan caballes100% (1)

- Special power attorney removalDocument1 pageSpecial power attorney removalmarivic buenaflorNo ratings yet

- Procedure For Land AcquisitionDocument25 pagesProcedure For Land AcquisitionRob ClosasNo ratings yet

- Notice of Non-Renewal of Lease With Notice To VacateDocument1 pageNotice of Non-Renewal of Lease With Notice To VacateJimbo HotdogNo ratings yet

- Deed of Extra-Judicial Settlement - Cash Deposits of YyyyyyyyyyyyyyDocument3 pagesDeed of Extra-Judicial Settlement - Cash Deposits of YyyyyyyyyyyyyyGian Lozada BorataNo ratings yet

- Sample MOADocument8 pagesSample MOAAndre CruzNo ratings yet

- Sublease FormatDocument6 pagesSublease FormatNan MallNo ratings yet

- Affidavit of Full RetirementDocument2 pagesAffidavit of Full RetirementMitzi WamarNo ratings yet

- TIN Verification SlipDocument21 pagesTIN Verification SlipKate Hazzle Janda100% (1)

- Affidavit of Loss OrcrDocument2 pagesAffidavit of Loss OrcrJ CNo ratings yet

- License To SellDocument24 pagesLicense To SellMay YellowNo ratings yet

- Bir RR 16-2011Document4 pagesBir RR 16-2011ATTY. R.A.L.C.100% (1)

- 1 - PCAB - Application LetterDocument1 page1 - PCAB - Application LetterMardeOpamenNo ratings yet

- Affidavit of GuaranteeDocument1 pageAffidavit of Guaranteeprince762No ratings yet

- Philippine Promissory Note DetailsDocument1 pagePhilippine Promissory Note Detailsbhem silverio0% (1)

- Affidavit of ConsolidationDocument4 pagesAffidavit of ConsolidationrichardgomezNo ratings yet

- Logistics Primary PurposeDocument2 pagesLogistics Primary PurposeDonna de BelenNo ratings yet

- Joint Affidavit of Undertaking To Change Name - CorpoDocument1 pageJoint Affidavit of Undertaking To Change Name - Corposummer1sibiNo ratings yet

- QuitClaim SampleDocument1 pageQuitClaim SampleMarcus M. GambonNo ratings yet

- Philippines Debt AcknowledgmentDocument1 pagePhilippines Debt AcknowledgmentBagnet_KarahayNo ratings yet

- Evidence Pronove Lecture PDFDocument31 pagesEvidence Pronove Lecture PDFEllen DebutonNo ratings yet

- 02 Draft Director's Certificate - Ez Aug 2017Document2 pages02 Draft Director's Certificate - Ez Aug 2017Archie MuyrongNo ratings yet

- Bir Waiver of Defense of PrescriptionDocument3 pagesBir Waiver of Defense of PrescriptionCha Ancheta Cabigas0% (1)

- Due Diligence ReportDocument2 pagesDue Diligence ReportKen GabrielNo ratings yet

- Petition For Issuance of New Owner's Duplicate Copy of Title - SampleDocument3 pagesPetition For Issuance of New Owner's Duplicate Copy of Title - SampleVanessa Mallari75% (8)

- LinkedIn Content Calendar Excel TemplateDocument31 pagesLinkedIn Content Calendar Excel TemplateSandeep SinghNo ratings yet

- Math 1050 ProjectDocument5 pagesMath 1050 Projectapi-267005931No ratings yet

- Part II Extended Purchase Specification Based On Contactless Low-Value Payment ApplicationDocument67 pagesPart II Extended Purchase Specification Based On Contactless Low-Value Payment ApplicationMai Nam ThangNo ratings yet

- TD Beyond Checking: Account SummaryDocument4 pagesTD Beyond Checking: Account SummaryJohn BeanNo ratings yet

- Saral Jeevan Bima Brochure-BRDocument10 pagesSaral Jeevan Bima Brochure-BRprabuNo ratings yet

- Birla Sun Life Tax Relief 96 Fund Application FormDocument3 pagesBirla Sun Life Tax Relief 96 Fund Application FormDrashti Investments100% (2)

- RMC 28-2003 Clarification On Imposition of VAT On Banks, Etc PDFDocument10 pagesRMC 28-2003 Clarification On Imposition of VAT On Banks, Etc PDFMarc Myer De AsisNo ratings yet

- Atty. Cabaniero Tax QuestionsDocument26 pagesAtty. Cabaniero Tax QuestionsBon ChuNo ratings yet

- Compound InterestDocument5 pagesCompound Interestआई सी एस इंस्टीट्यूटNo ratings yet

- First Bank September 1st To January 23Document16 pagesFirst Bank September 1st To January 23Samuel OshinnugaNo ratings yet

- E-TdsDocument58 pagesE-TdsRohan JainNo ratings yet

- Master CardDocument22 pagesMaster CardAsef KhademiNo ratings yet

- Report 01Document94 pagesReport 01Waseem AnsariNo ratings yet

- Cash Handling Policy HourlyDocument1 pageCash Handling Policy HourlyJosh SchmidtNo ratings yet

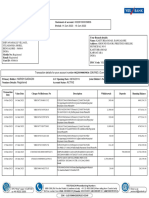

- Account Statement 14 Jun 2023-19 Jun 2023Document4 pagesAccount Statement 14 Jun 2023-19 Jun 2023propvisor real estateNo ratings yet

- Skrill Quick Checkout GuideDocument110 pagesSkrill Quick Checkout GuidesubcribedNo ratings yet

- Essential reading list and instructions for live UPSC classDocument12 pagesEssential reading list and instructions for live UPSC classJana KvNo ratings yet

- Public Finance - Final PracticeDocument7 pagesPublic Finance - Final PracticeozdolNo ratings yet

- Stamp Act and ImpoundingDocument2 pagesStamp Act and ImpoundingAnkit TewariNo ratings yet

- Cir v. SekisuiDocument1 pageCir v. SekisuiFrancis Xavier SinonNo ratings yet

- TAX INVOICEDocument1 pageTAX INVOICEdhyan patel100% (1)

- Account Statement From 1 Feb 2021 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 1 Feb 2021 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSurjeet kumarNo ratings yet

- Tax EqualizationDocument5 pagesTax EqualizationTaxpert Professionals Private Limited100% (1)

- Sahara NidhiDocument4 pagesSahara NidhiAyush DubeyNo ratings yet

- Taxation of Special Entities and Introduction to MCITDocument11 pagesTaxation of Special Entities and Introduction to MCITIvy ObligadoNo ratings yet

- Bill of Exchange (Credit Instruments)Document12 pagesBill of Exchange (Credit Instruments)Aziz ShaikhNo ratings yet

- Apply for Commercial Unit at Paras SquareDocument14 pagesApply for Commercial Unit at Paras SquareSehgal EstatesNo ratings yet

- OIEP00608369000000985748 : Electricity BillDocument1 pageOIEP00608369000000985748 : Electricity BillMohamed AarifNo ratings yet

- SfsfgegDocument1 pageSfsfgegvishalNo ratings yet

- Emergency Recovery Payment Grant A199480158Document2 pagesEmergency Recovery Payment Grant A199480158HenhamNo ratings yet