Professional Documents

Culture Documents

Indicative Syllabus of Finance & Accounts Financial Reporting

Indicative Syllabus of Finance & Accounts Financial Reporting

Uploaded by

yashOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indicative Syllabus of Finance & Accounts Financial Reporting

Indicative Syllabus of Finance & Accounts Financial Reporting

Uploaded by

yashCopyright:

Available Formats

Indicative Syllabus of Finance & Accounts

Financial Reporting:

1. Indian Accounting Standards (Ind AS) notified by MCA and Guidance Notes

on various accounting aspects issued by the ICAI and advanced problems

based thereon.

2. Corporate financial reporting – issues and problems with special reference

to published financial statements.

3. Accounting Policies

4. Accounting aspects of corporate restructuring.

5. Inventory Accounting

Management Accounting and Financial Management:

1. Project planning and capital budgeting: Techniques for evaluation like

payback method, rate of return, IRR, NPV, etc.; preparation of project

report; financial projections; sensitivity analysis in capital budgeting; Impact

of inflation on capital budgeting decision; capital rationing; risk analysis in

capital budgeting and evaluation of risk investments; social cost-benefit

analysis; simulation and decision tree analysis.

2. Type of financing: project financing; intermediate and long-term financing;

negotiating from loan with banks and financial institutions; appraisal of

term loans in India; lease financing.

3. Special Features of Financial Management in Public Sector Undertakings.

4. Dividend decision: divided policy; its determinants.

5. Tools of Financial Analysis and Planning; Ratio Analysis to evaluate

performance and financial health application of ratio analysis in financial

decision making; Analysis of cash flow and funds flow statements.

6. Management of working capital; Cash and Marketable securities

management; Treasury management; Receivables management; Inventory

management,

Financing of working capital with emphasis on Public Sector Undertakings.

7. Financing decision: Cost of capital; cost of different sources of finance;

Weighted average cost of capital, Marginal cost of capital; Concept of

operating and financial leverage; Capital structure patterns Designing

optimum capital structure; Constraints; Various capital structure theories;

Different sources of finance; Long, medium and short-term finance.

Auditing:

1. Audit strategy, planning and programming.

2. Risk assessment and Internal control including reporting on Internal

Financial Controls.

3. Auditing Standards, Statements and Guidance Notes.

4. Audit of limited companies with emphasis on Public Sector Undertakings.

5. Audit Committees and Corporate Governance.

6. Cost audit.

7. Internal audit, management and operational audit, internal audit of assets

and liabilities.

8. Special aspects of auditing in an automated environment.

9. Audit of payments, purchases, sales , debtors, etc.

10. Special audit procedures, witnessing physical verification of assets.

Cost Management:

1. Cost concepts in decision-making, relevant cost, differential cost,

incremental cost and opportunity cost.

2. Objectives of a costing systems; inventory valuation; creation of a database

for operational control; provision of data for decision-making.

3. General introduction of Cost accounting records and Rule.

4. Marginal Costing; Distinction between Marginal Costing, Activity Based

Costing and Absorption Costing; Break-ever analysis, Cost-Volume-Profit

Analysis. Various decision- making problems.

5. Standard Costing and Variance Analysis.

6. Budgetary Control; Flexible Budgets; Performance Budgets; Zero-

based budgets.

7. Risk Management.

Management Information and Control Systems:

1. Management Information Systems (MIS), Executive Information Systems

(EIS) and Decision support systems.

2. System Evaluation – Hardware and Software.

3. System Maintenance – Hardware and Software including viruses.

4. Information security: Importance and principles of information security, best

approaches to implementing information security.

5. Audit of Information systems.

6. Techniques in data processing – on line, batch mode, real time introduction

to internet and other emerging technologies.

Direct Taxes:

1. The Income Tax Act, 1961 including ICDS and rules there under as amended

from time to time.

Indirect Taxes:

1. The Central Goods and Services Tax Act,2017 (GST) and rules there under

as amended from time to time.

2. Customs Act,1962 and rules there under as amended from time to time.

Corporate Laws:

1. The Companies Act, 2013 and rules there under as amended from time to

time.

*********

You might also like

- 1169 ROSSAYE SITXGLC001 Ass 2 ProjectDocument17 pages1169 ROSSAYE SITXGLC001 Ass 2 Projectmilan shrestha80% (5)

- Apple Case ReportDocument2 pagesApple Case ReportAwa SannoNo ratings yet

- E Book - Aml-Kyc and ComplianceDocument638 pagesE Book - Aml-Kyc and ComplianceGanesh Ramaiyer100% (1)

- Best Buy Citibank StatementDocument8 pagesBest Buy Citibank Statementadrian mayoNo ratings yet

- Audit of Banks Bank AuditDocument34 pagesAudit of Banks Bank AuditRachna Bajaj100% (3)

- Management Advisory ServicesDocument7 pagesManagement Advisory ServicesMarc Al Francis Jacob40% (5)

- 169final New SyllabusDocument17 pages169final New SyllabusBhawanath JhaNo ratings yet

- ICAI Final SyllabusDocument19 pagesICAI Final SyllabusrockwithakmNo ratings yet

- Board of Studies The Institute of Chartered Accountants of IndiaDocument16 pagesBoard of Studies The Institute of Chartered Accountants of IndiaadityaNo ratings yet

- Valuation For Mergers Buyouts and RestructuringDocument17 pagesValuation For Mergers Buyouts and RestructuringCAclubindiaNo ratings yet

- 169final New SyllabusDocument17 pages169final New SyllabusNeethu ThomasNo ratings yet

- 169final New Syllabus PDFDocument15 pages169final New Syllabus PDFNavin Man Singh ShresthaNo ratings yet

- Board of Studies The Institute of Chartered Accountants of IndiaDocument16 pagesBoard of Studies The Institute of Chartered Accountants of IndiaRakeshNo ratings yet

- 01 Task Performance 1 - AuditingDocument6 pages01 Task Performance 1 - AuditingMillania ThanaNo ratings yet

- Merchant Banking and Financial ServicesDocument41 pagesMerchant Banking and Financial ServicesSb KarthickNo ratings yet

- Module A - Indian Financial SystemDocument14 pagesModule A - Indian Financial SystemRavi kumar MishraNo ratings yet

- Risk ManagementDocument31 pagesRisk ManagementAnkit ChawlaNo ratings yet

- 20 Page Commerce & AccountancyDocument20 pages20 Page Commerce & Accountancymikasha977No ratings yet

- Financial Statement Analysis-SampleDocument39 pagesFinancial Statement Analysis-Samplefchemtai4966No ratings yet

- Long Form Audit ReportDocument34 pagesLong Form Audit ReportAshish SaxenaNo ratings yet

- MBA Course OutlinesDocument33 pagesMBA Course OutlinesNafis HasanNo ratings yet

- (Part 2) Conceptual Framework (Doni, Bagas, Papin)Document30 pages(Part 2) Conceptual Framework (Doni, Bagas, Papin)Kazuyano DoniNo ratings yet

- Financial Treasury and Forex ManagementDocument641 pagesFinancial Treasury and Forex Managementcharus289100% (1)

- CPD TestDocument5 pagesCPD Testchandra mohan vermaNo ratings yet

- Assignment - 2 M.Com Sem 4thDocument7 pagesAssignment - 2 M.Com Sem 4thVishwas JaiswalNo ratings yet

- CA PE II SyllabusDocument9 pagesCA PE II SyllabusdeeptimanneyNo ratings yet

- The Pursuit of Conceptual FrameworkDocument24 pagesThe Pursuit of Conceptual FrameworkbananaNo ratings yet

- Guidelines For InspectionDocument132 pagesGuidelines For InspectiondineshmarginalNo ratings yet

- The Institute of Chartered Accountants of India Syllabus For Professional Competence Examination (PCE)Document9 pagesThe Institute of Chartered Accountants of India Syllabus For Professional Competence Examination (PCE)Tanoy DewanjeeNo ratings yet

- Long Form Audit Report of Banks: Presented by:-CA. Santanu GhoshDocument53 pagesLong Form Audit Report of Banks: Presented by:-CA. Santanu GhoshShubham ShindeNo ratings yet

- Financial Management-2Document292 pagesFinancial Management-2benard owinoNo ratings yet

- CAP-II Syllabus PDFDocument19 pagesCAP-II Syllabus PDFashwin0% (1)

- Stage-6 S-601 - Strategic Financial ManagementDocument4 pagesStage-6 S-601 - Strategic Financial ManagementMir Obaid Ullah ShahNo ratings yet

- CAC2110 Accounting and Finacial Analysis 2B Course OutlineDocument2 pagesCAC2110 Accounting and Finacial Analysis 2B Course OutlinereginaldmthabisiNo ratings yet

- CSS Syllabus: Subject: Accountancy & AuditingDocument6 pagesCSS Syllabus: Subject: Accountancy & AuditingHameedNo ratings yet

- IGNOU - Acounting Course PDFDocument22 pagesIGNOU - Acounting Course PDFPulkit SinghNo ratings yet

- 29953bos19569 3 PDFDocument7 pages29953bos19569 3 PDFKALPANA R KHADLOYANo ratings yet

- VSI017 CA Final Subjects (New Course) PDFDocument26 pagesVSI017 CA Final Subjects (New Course) PDFRanajit FouzdarNo ratings yet

- Management Information System: Submitted by Presented byDocument18 pagesManagement Information System: Submitted by Presented byrani222No ratings yet

- Conceptual Framework For Financial ReportingDocument8 pagesConceptual Framework For Financial ReportingQueeny Man-oyaoNo ratings yet

- Audit of Banks AuditDocument34 pagesAudit of Banks Auditlogeshtheking100% (2)

- Syllabus Paper 1: Advanced Accounting: ObjectivesDocument13 pagesSyllabus Paper 1: Advanced Accounting: Objectivesanu_acharya100% (1)

- Corporate ReportingDocument29 pagesCorporate ReportingVignesh BalachandarNo ratings yet

- ASI - Audit of Banks - Part 1Document12 pagesASI - Audit of Banks - Part 1Joshua LisingNo ratings yet

- Accounting in Governance Study NotesDocument33 pagesAccounting in Governance Study NotesAlexander TrovatoNo ratings yet

- SFA Syllabus Wef 01072022Document6 pagesSFA Syllabus Wef 01072022CA Atul SoniNo ratings yet

- Syllabus of Valuation Examination For Asset Class-Securities or Financial Assets With Effect From 1 June 2020Document5 pagesSyllabus of Valuation Examination For Asset Class-Securities or Financial Assets With Effect From 1 June 2020Ramana ReddyNo ratings yet

- Follow Who Know Road: Q1. Define The Following Financial Modeling Terms Business RisksDocument3 pagesFollow Who Know Road: Q1. Define The Following Financial Modeling Terms Business RisksIbrahimm Denis FofanahNo ratings yet

- Increase in Units Due To Additional Materials Standard Costing and Variance AnalysisDocument10 pagesIncrease in Units Due To Additional Materials Standard Costing and Variance AnalysisAlexis SosingNo ratings yet

- CH 01Document6 pagesCH 01Kanbiro OrkaidoNo ratings yet

- Professional Competence Course (PCC) Syllabus Syllabus Group I Paper 1: Advanced AccountingDocument13 pagesProfessional Competence Course (PCC) Syllabus Syllabus Group I Paper 1: Advanced AccountingAnuj GargNo ratings yet

- Document - Acc AssignmentDocument19 pagesDocument - Acc AssignmentNidaNo ratings yet

- FMDocument6 pagesFMshubhamghodke414No ratings yet

- LeasingDocument5 pagesLeasingMarwa Ali EissaNo ratings yet

- Acfm Ch-Two 2022Document46 pagesAcfm Ch-Two 2022mihiretche0No ratings yet

- Audit Fraud MemoDocument16 pagesAudit Fraud MemoManish AggarwalNo ratings yet

- Financial Management NotesDocument202 pagesFinancial Management NotesSandeep KulshresthaNo ratings yet

- 45571bos35676 IntermediateDocument28 pages45571bos35676 IntermediateAnonymous HP68USkhNo ratings yet

- MODULE 1 FINANCIAL REPORTING AND ACCOUNTING STANDARDSsDocument6 pagesMODULE 1 FINANCIAL REPORTING AND ACCOUNTING STANDARDSsVivo V27No ratings yet

- Solutions Manual: Introduction To Management AccountingDocument2 pagesSolutions Manual: Introduction To Management AccountingMagesh RajaNo ratings yet

- Financial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideFrom EverandFinancial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideNo ratings yet

- Financial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsFrom EverandFinancial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsNo ratings yet

- 2016 Vol 1 CH 4 AnswersDocument15 pages2016 Vol 1 CH 4 Answersbebe_cute06XDNo ratings yet

- Schwartz R.a., Byrne J.a., Colaninno A. - A Trading Desk View of Market Quality (2005)Document206 pagesSchwartz R.a., Byrne J.a., Colaninno A. - A Trading Desk View of Market Quality (2005)TimoNo ratings yet

- Telarus Announces The Acquisition of TCGDocument4 pagesTelarus Announces The Acquisition of TCGPR.comNo ratings yet

- Raid Quiz Saidosd RecitDocument4 pagesRaid Quiz Saidosd RecitKristine Lirose BordeosNo ratings yet

- Mercantile Law UST Golden NotesDocument336 pagesMercantile Law UST Golden NotesLeomard SilverJoseph Centron Lim100% (1)

- Flashback Notes, Unit-2, XII ClassDocument24 pagesFlashback Notes, Unit-2, XII Classpraveenathelete007No ratings yet

- Reliability & MSG-3 Processes Theory & Practical - 5 Days: On DemandDocument4 pagesReliability & MSG-3 Processes Theory & Practical - 5 Days: On DemandgabtecNo ratings yet

- AEC 215 MidFinals ExamDocument8 pagesAEC 215 MidFinals ExamHazel Seguerra BicadaNo ratings yet

- Stages of Franshising RelationshipDocument5 pagesStages of Franshising RelationshipDoc Wad Negrete DivinaflorNo ratings yet

- Ims Test (Answers)Document5 pagesIms Test (Answers)mostafa morsyNo ratings yet

- QFD Applied To LibraryDocument15 pagesQFD Applied To LibraryUmesh VishwakarmaNo ratings yet

- OOSR000385740Document2 pagesOOSR000385740AL MAYASINo ratings yet

- Title: A Study On Consumer Buying Behaviours Toward Brand Products"Document9 pagesTitle: A Study On Consumer Buying Behaviours Toward Brand Products"imsong 07No ratings yet

- DRT-2 (PO) Cause ListDocument10 pagesDRT-2 (PO) Cause ListAditi SharmaNo ratings yet

- Ticket Confirmation (Valid For Travel) : Outbound RouteDocument3 pagesTicket Confirmation (Valid For Travel) : Outbound RouteCarmen GomesNo ratings yet

- The Effects of Emotion and Time To Shop On Shopping Behaviour in An International Airport TerminalDocument8 pagesThe Effects of Emotion and Time To Shop On Shopping Behaviour in An International Airport Terminalsmitapatil_88No ratings yet

- Design Thinking WIKIDocument113 pagesDesign Thinking WIKIMarcelo Geraldo Teixeira100% (1)

- Writeshop GuidelinesDocument75 pagesWriteshop GuidelinesErramun De la RosaNo ratings yet

- Sample of Time Frame in ThesisDocument8 pagesSample of Time Frame in Thesiskarawebberoverlandpark100% (2)

- Of What Relevance Is The McKinsey 7s Model of Designing A Business Organization in The Present Dispensation of NigeriaDocument17 pagesOf What Relevance Is The McKinsey 7s Model of Designing A Business Organization in The Present Dispensation of NigeriaSinclairNo ratings yet

- Pre-Model - PME2L - Business Laws - Business Correspondence - Reporting - Answer Key - (30-11-2021)Document20 pagesPre-Model - PME2L - Business Laws - Business Correspondence - Reporting - Answer Key - (30-11-2021)PradeepNo ratings yet

- PPC ProjectDocument11 pagesPPC ProjectKuber PatidarNo ratings yet

- Answers To Assignement 1 Period 3Document16 pagesAnswers To Assignement 1 Period 3trishaNo ratings yet

- Assignment Managing Global WorkforceDocument8 pagesAssignment Managing Global WorkforceMoyooree BiswasNo ratings yet

- Financial Management Theory & Practice-1083-1084Document2 pagesFinancial Management Theory & Practice-1083-1084Syed Farhan AliNo ratings yet

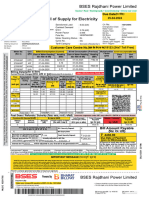

- Bill of Supply For Electricity: Meter Reading StatusDocument2 pagesBill of Supply For Electricity: Meter Reading Statussharmashubham170295No ratings yet

- GE LAW - RA 8560, As AmendedDocument4 pagesGE LAW - RA 8560, As AmendedJULIUS MIRALONo ratings yet