Professional Documents

Culture Documents

Assignment Add 1 PDF

Assignment Add 1 PDF

Uploaded by

haraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Add 1 PDF

Assignment Add 1 PDF

Uploaded by

haraCopyright:

Available Formats

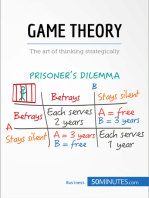

Introduction to Game Theory

What is Game Theory?

Game theory is a branch of applied mathematics and economics that studies

strategic situations where there are several stakeholders, each with different goals,

whose actions can affect one another.

Although it has been applied to complex business issues and military strategy,

game theory reveals its card-game origins through its name and terminology. For

example, a game is any situation where multiple players can affect the outcome, a

player is a stakeholder, a move or option is an action a player can take and, at the

end of the game, the payoff for each player is the outcome.

In general, the value of game theory lies in understanding the interactions and

likely outcomes when the end result is dependent on the actions of others who have

potentially conflicting motives. Game theory’s value to business lies in allowing

structured analysis of complex multi-player issues including the identification of a

business’ best attainable outcome, threats and promises available to different

players and the prediction of the likely actions and reactions of other players.

History of Game Theory

Game theory is a well developed field of study that has attracted some of the

world’s greatest mathematicians, won two Nobel Prizes and is even credited with

winning the Cold War.

The origins of game theory go far back in time. Recent work suggests that the

division of an inheritance described in the Talmud (in the early years of the first

millennium) predicts the modern theory of cooperative games and, in 1713, James

Waldegrave wrote out a strategy for a card game that provided the first known

solution to a two player game.

History of Game Theory Timeline

Second Nobel

Marketplace Acceptance

Prize Awarded

First Nobel

Prize Awarded

Business

Talmud Applications

anticipates Prisoner’s

Game Theory Dilemma

Cold War

John von Neumann

First Minimax Oskar Morgenstern

mixed strategy 2 x 2 games

solution created

0 1713 1940 1950 1960 1970 1980 1990 2000 2005

©2007 Open Options Corporation – Page 1/4

Despite these early efforts, the book The Theory of Games and Economic Behavior

by John von Neumann and Oskar Morgenstern (published in 1944) is usually

credited as the origin of the formal study of game theory. This pioneering work

focused on finding unique strategies that allowed players to minimize their

maximum losses (minimax solution) by considering, for every possible strategy of

their own, all the possible responses of other players. Building upon von

Neumann’s earlier work on two player games where the winnings of one player are

equal and contrary to the losses of his opponent (zero-sum) and where each player

knows the strategies available to all players and their consequences (perfect

information), von Neumann and Morgenstern extended the minimax theorem to

include games involving imperfect information and games with more than two

players.

The golden age of game theory occurred in the 1950s and 1960s when researchers

focused on finding sets of strategies, known as equilibria, to “solve” a game if all

players behaved rationally. The most famous of these is the Nash equilibrium

proposed by John Nash, later made famous in the film “A Beautiful Mind” starring

Russell Crowe. A Nash equilibrium exists if no player can unilaterally move to

improve their own outcome. In other words, they have no incentive to change,

since their strategy is the best they can do given the actions of the other players.

Nash also made significant contributions to bargaining theory and examined

cooperative games where threats and promises are fully binding and enforceable.

In 1965, Reinhard Selten introduced the concept of subgame perfect equilibria,

which describes strategies that deliver Nash equilibrium across every sequential

subgame of the original game. Such subgame perfect equilibria may be found by

first determining optimal action of the player who makes the last move of the

game. Then, the optimal action of the next to last moving player is determined

assuming the last player's action as given. The process, known as backward

induction, continues until all players’ actions have been determined.

In 1967, John Harsanyi formalized Nash’s work and developed incomplete

information games. He, along with John Nash and Reinhard Selten, won the Nobel

Prize for Economics in 1994.

Another important contribution to game theory during the 1950s and 1960s was

Luce and Raiffa's book, Games and Decisions. The Prisoner's Dilemma, introduced

by the RAND Corporation and very familiar to any MBA student, is also a product of

this period.

Further adding to the acclaim of game theory, another Nobel Prize was awarded to

game theorists, Robert Aumann and Thomas Schelling, in 2005. Schelling used

game theory in his 1960 book The Strategy of Conflict to explain why credible

threats of nuclear annihilation from the U.S. and the former Soviet Union were

counterbalancing through mutually assured destruction and therefore were not

©2007 Open Options Corporation – Page 2/4

likely to be used. He also argued that the ability to retaliate was more useful that

the ability to withstand an attack.

Aumann's work was mathematical and focused on whether co-operation increases if

games are continually repeated rather than played out in a single encounter. He

showed that co-operation is less likely when there are many participants, when

interactions are infrequent, when the time horizon is short or when others' actions

cannot be clearly observed.

Throughout the years, game theory has been applied to many different fields of

study including auction of underused radio spectra, artificial intelligence,

bargaining, evolutionary biology, political science and real world business decisions.

Application of Game Theory in Business

Game theory with its focus on the interactions of multiple players, each trying to

maximize their own rewards, is a natural fit for many types of business issues.

From labor negotiations to competitive pricing, game theory provides a structured

way to analyze the set of possible strategies and recommend an optimal strategy

for each player.

However, real business decisions have significant complications that are often

ignored by abstract, academic game theory. First, real business decisions almost

always have many players, a challenge for classical game theory. Second, there can

be complex relationships among the players. For example, business issues are

usually mixed-motive games in which the players have some common interests and

some competing ones. Third, business outcomes are often not easy to reduce to a

common measure for value such as dollars or expected utility. Rather, strategic

interests, long term relationships and the personal goals of the CEO or founder can

be critically influential.

In the 1980s, Niall Fraser (founder of Open Options) studied how threats can

constrain other players and create stable outcomes in multiple player games.

Building upon the academic work of Dr. Fraser, and verified over a decade of real

world cases across a wide range of industries, Open Options has developed a

unique modeling method and proprietary software tools to analyze complex, multi-

player business issues.

In game theory terminology, Open Options uses n-player, non-cooperative,

nonzero-sum, non-simultaneous, asymmetric, ordinal game theory. This allows the

modeling of very complex issues involving many players with distinct goals and

multiple distinct options. Each business issue is modeled as a single encounter over

the time frame specified, rather than many repeated games, but does not assume

players act simultaneously or without the knowledge of other players’ actions.

Furthermore, rather than estimating the expected utility of each outcome for each

player as usually required in game theory, Open Options asks the client to rank

each possible action of all players from most important to least important from each

©2007 Open Options Corporation – Page 3/4

player’s perspective. By the principle of lexicography, this permits the calculation of

the rank ordering of all outcomes for each player, even where millions of outcomes

are possible. Consequently, many of the classical difficulties associated with

developing utility functions are eliminated, and credible preference information can

be gathered for a large number of outcomes in a practical manner.

Building upon a solid theoretical foundation, the Open Options Process has dealt

with real world business problems for many Fortune 500 companies and has helped

achieve favorable outcomes worth billions of dollars by allowing management teams

to better understand the implications of the preferences and actions of other

players.

Further Reading

Books

Fraser, N.M. and K.W. Hipel (1984). Conflict Analysis: Models and Resolutions. New

York: North-Holland.

Harsanyi, J.C. (1977). Rational Behavior and Bargaining Equilibrium in Games and

Social Situations. Cambridge: Cambridge University Press.

Luce, R.D. and H. Raiffa (1957). Games and Decisions: Introduction and Critical

Survey. New York: John Wiley & Sons.

Raiffa, H. (1982). The Art and Science of Negotiation: How to Resolve Conflicts and

Get the Best Out of Bargaining. Cambridge, Massachusetts: Harvard University

Press.

Synder, G.H. and P. Diesing (1977). Conflict among Nations: Bargaining, Decision

Making and System Structure in International Crises. Princeton, New Jersey:

Princeton University Press.

von Neumann, J. and O. Morgenstern (1944). Theory of Games and Economic

Behavior, Princeton, New Jersey: Princeton University Press.

Journals

Games and Economic Behavior

International Game Theory Review

International Journal of Game Theory

©2007 Open Options Corporation – Page 4/4

You might also like

- COT 1 Lesson Plan Practical Research IIDocument7 pagesCOT 1 Lesson Plan Practical Research IIRomy Sales Grande Jr.No ratings yet

- ECE321 Lab3Document9 pagesECE321 Lab3Ha Tran KhiemNo ratings yet

- Game Theory - PresentationDocument17 pagesGame Theory - Presentationsaachi anandNo ratings yet

- Game Theory ReportDocument49 pagesGame Theory ReportSoumya BilwarNo ratings yet

- An Analysis of Conflict A111Document35 pagesAn Analysis of Conflict A111accelwNo ratings yet

- Theory of Games Von NeumannDocument12 pagesTheory of Games Von NeumannyoppiNo ratings yet

- Introduction To MathematicsDocument10 pagesIntroduction To MathematicsMohammed Abid AbrarNo ratings yet

- Method For Numerical Investigation Game TheoryDocument3 pagesMethod For Numerical Investigation Game Theoryyorany físicoNo ratings yet

- Research Paper Topic - Game Theory: Table of ContactsDocument9 pagesResearch Paper Topic - Game Theory: Table of ContactsPriyanshi SoniNo ratings yet

- Economics and Algorithmic Game Theory (January 2017)Document6 pagesEconomics and Algorithmic Game Theory (January 2017)TACN-2C-19ACN Nguyen Tien DucNo ratings yet

- Game TheoryDocument28 pagesGame Theoryshreya5319100% (1)

- Theoretical fra-WPS OfficeDocument1 pageTheoretical fra-WPS OfficeJamaica MendozaNo ratings yet

- Paper 06 Nagel (1995)Document15 pagesPaper 06 Nagel (1995)jacoboNo ratings yet

- Beauty ContestsDocument15 pagesBeauty ContestsTeoo MayayooNo ratings yet

- Operations Research A Report Submitted For External Assessment OnDocument29 pagesOperations Research A Report Submitted For External Assessment OnishmeetkohliNo ratings yet

- Draft On Game TheoryDocument4 pagesDraft On Game TheoryPranay SomaniNo ratings yet

- Game Theory: Made By: B - M - Ahaduzzaman & Sujit Kumar JithDocument8 pagesGame Theory: Made By: B - M - Ahaduzzaman & Sujit Kumar JithFaisal AhamedNo ratings yet

- Game Theory Strategies For Decision Making - A Case Study: N. Santosh RanganathDocument5 pagesGame Theory Strategies For Decision Making - A Case Study: N. Santosh RanganathSofia LivelyNo ratings yet

- Nash Equilibrium' Was Provided by John Nash Where He Developed A Definition of AnDocument2 pagesNash Equilibrium' Was Provided by John Nash Where He Developed A Definition of AnKhairah A KarimNo ratings yet

- A Review On Game Theory As A Tool in Operation ResearchDocument22 pagesA Review On Game Theory As A Tool in Operation ResearchRaphael OnuohaNo ratings yet

- Game Theory - SOLDocument66 pagesGame Theory - SOLJordan StarNo ratings yet

- Game TheoryDocument10 pagesGame TheoryTapas BhadraNo ratings yet

- The History of Game TheoryDocument23 pagesThe History of Game TheoryHafsa JahanNo ratings yet

- Introduction To Game Theory: Yale Braunstein Spring 2007Document39 pagesIntroduction To Game Theory: Yale Braunstein Spring 2007Gábor Mátyási100% (1)

- Game TheoryDocument8 pagesGame TheoryZaharatul Munir SarahNo ratings yet

- Theory of Games - An Introduction Author Omar Raoof and Hamed Al-RaweshidyDocument13 pagesTheory of Games - An Introduction Author Omar Raoof and Hamed Al-RaweshidyraduNo ratings yet

- Lectura 1 PDFDocument21 pagesLectura 1 PDFValentina Rojas GomezNo ratings yet

- Game Theory IntroductionDocument5 pagesGame Theory IntroductionPriya RawatNo ratings yet

- Game Theory - 1st PartDocument22 pagesGame Theory - 1st PartDoğukanNo ratings yet

- Practical Applicability of Game Theory in Economic in Recent TimesDocument8 pagesPractical Applicability of Game Theory in Economic in Recent TimesSHAMBHAVI VATSANo ratings yet

- Game Theory, Second Edition, 2014 Thomas S. FergusonDocument304 pagesGame Theory, Second Edition, 2014 Thomas S. FergusonMuchen DongNo ratings yet

- A Short Introduction To Game TheoryDocument22 pagesA Short Introduction To Game TheoryDeepansh TyagiNo ratings yet

- GAME Theory by (M.A.K. Pathan)Document12 pagesGAME Theory by (M.A.K. Pathan)M.A.K. S. PathanNo ratings yet

- What Is Game Theory?Document5 pagesWhat Is Game Theory?Akriti SinghNo ratings yet

- Cooperative Games and Cooperatives OrganizationsDocument13 pagesCooperative Games and Cooperatives OrganizationsSandru RaresNo ratings yet

- MathIlluminated 09 TXTDocument39 pagesMathIlluminated 09 TXTS.L.L.C100% (1)

- Application of Game Theory in Business Decisions - 1Document25 pagesApplication of Game Theory in Business Decisions - 1Rita RemeikieneNo ratings yet

- Game TheoryDocument5 pagesGame TheoryEduardus (Eduard)No ratings yet

- Game TheoryDocument3 pagesGame TheoryReign Helaena PardilloNo ratings yet

- Game Theory Project Oct '08Document16 pagesGame Theory Project Oct '08Ruhi SonalNo ratings yet

- Congestion Games and Potentials ReconsideredDocument19 pagesCongestion Games and Potentials Reconsideredsjdjd ddjdjfNo ratings yet

- Unit - IvDocument4 pagesUnit - IvRyan MorrisNo ratings yet

- Game TheoryDocument186 pagesGame TheoryMarco Antonio Martinez AndradeNo ratings yet

- Game Theory: Class Notes For Math 167, Fall 2000 Thomas S. FergusonDocument7 pagesGame Theory: Class Notes For Math 167, Fall 2000 Thomas S. Fergusonccasas80No ratings yet

- Game Theory CompiledDocument29 pagesGame Theory CompiledMuhammad NadeemNo ratings yet

- Extension of Game Theory: Jerome Lloyd A. IgayaDocument3 pagesExtension of Game Theory: Jerome Lloyd A. IgayaJessaNo ratings yet

- An Introductory Review On Quantum Game Theory: Wenjie Liu1, Jingfa Liu, Mengmeng Cui Ming HeDocument4 pagesAn Introductory Review On Quantum Game Theory: Wenjie Liu1, Jingfa Liu, Mengmeng Cui Ming HegeekmastaNo ratings yet

- Pareja, Nelvie Mae C. - Assignment No. 3Document8 pagesPareja, Nelvie Mae C. - Assignment No. 3Nelvie Mae ParejaNo ratings yet

- The Study of Game Theory in Wireless Sensor NetworksDocument8 pagesThe Study of Game Theory in Wireless Sensor NetworksInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- CRS LessonsDocument9 pagesCRS LessonsIvan NguyenNo ratings yet

- Rohini College of Engineering and Technology Department of Management StudiesDocument12 pagesRohini College of Engineering and Technology Department of Management StudiesakilanNo ratings yet

- Coursera ReadingDocument11 pagesCoursera Readinghyun P.No ratings yet

- DCC 5240 Microeconomics 2: Lecture 1: Introduction To Game TheoryDocument8 pagesDCC 5240 Microeconomics 2: Lecture 1: Introduction To Game TheoryTaufiq Us Samad TonmoyNo ratings yet

- Two-Person Zero-Sum Games With Saddle PointDocument12 pagesTwo-Person Zero-Sum Games With Saddle Pointharish ChNo ratings yet

- Submitted By:: Game TheoryDocument8 pagesSubmitted By:: Game TheoryFaisal AhamedNo ratings yet

- Game PlayingDocument36 pagesGame PlayingShariq Parwez100% (1)

- Game Theory: A Beginner's Guide to Strategy and Decision-MakingFrom EverandGame Theory: A Beginner's Guide to Strategy and Decision-MakingNo ratings yet

- Elementary Game TheoryDocument1 pageElementary Game TheoryBernardo GonzalezNo ratings yet

- Professionals Play MinimaxDocument22 pagesProfessionals Play MinimaxManish GoyalNo ratings yet

- Game Theory PDFDocument57 pagesGame Theory PDFmanisha sonawane100% (1)

- Baronchelli - The Emergence of Consensus A PrimerDocument13 pagesBaronchelli - The Emergence of Consensus A PrimermannycarNo ratings yet

- El Tao y El UniversoDocument4 pagesEl Tao y El UniversomannycarNo ratings yet

- Can Math Explain Ideological ConflictDocument4 pagesCan Math Explain Ideological ConflictmannycarNo ratings yet

- Complex-Network Modelling and InferenceDocument26 pagesComplex-Network Modelling and InferencemannycarNo ratings yet

- Violencia Escolar ClavesDocument5 pagesViolencia Escolar ClavesmannycarNo ratings yet

- Condorcet Y La EducacionDocument3 pagesCondorcet Y La EducacionmannycarNo ratings yet

- The Hidden Traps in Decision MakingDocument1 pageThe Hidden Traps in Decision MakingmannycarNo ratings yet

- Adobe Pagemaker 6.5 Tutorial ManualsDocument490 pagesAdobe Pagemaker 6.5 Tutorial ManualsmannycarNo ratings yet

- (International Centre For Mechanical Sciences 275) H. P. Rossmanith (Eds.) - Rock Fracture Mechanics-Springer-Verlag Wien (1983) PDFDocument491 pages(International Centre For Mechanical Sciences 275) H. P. Rossmanith (Eds.) - Rock Fracture Mechanics-Springer-Verlag Wien (1983) PDFikhsan febriyan100% (1)

- Mid Term3 Review 15Document32 pagesMid Term3 Review 15Jeremy SchneiderNo ratings yet

- ManualDocument21 pagesManualVeljko LapčevićNo ratings yet

- Bhati SirDocument71 pagesBhati SirRakesh BhatiNo ratings yet

- What Is Encapsulation in Java and OOPS With ExampleDocument14 pagesWhat Is Encapsulation in Java and OOPS With ExampleAbdul GafurNo ratings yet

- Demand Forecasting: Evidence-Based Methods: Armstrong@wharton - Upenn.eduDocument23 pagesDemand Forecasting: Evidence-Based Methods: Armstrong@wharton - Upenn.eduChuka ChumaNo ratings yet

- Problem SolvingDocument4 pagesProblem SolvingNin OngNo ratings yet

- Compiler DesignDocument40 pagesCompiler DesignMohd ShahidNo ratings yet

- Self Concepttt PDFDocument167 pagesSelf Concepttt PDFAlberto Peña Chavarino100% (2)

- Randon Number GenerationDocument12 pagesRandon Number Generationatul211988No ratings yet

- 2023 ME Question Paper Format For CAT-1Document3 pages2023 ME Question Paper Format For CAT-1vkamarajNo ratings yet

- Lesson 2-6 Ratios and Proportions - DemoDocument45 pagesLesson 2-6 Ratios and Proportions - DemoCARLOS BANTULONo ratings yet

- AllenDocument56 pagesAllenRavi Kiran KoduriNo ratings yet

- Gee - SW Pe Calculation (Old)Document16 pagesGee - SW Pe Calculation (Old)azwan100% (1)

- Session 4-6Document69 pagesSession 4-6Ranjit Roy GhatakNo ratings yet

- Single Phase Ac Circuits - JDocument74 pagesSingle Phase Ac Circuits - JRyan PaulNo ratings yet

- Kael LA2Document7 pagesKael LA2Mark John Paul Cabling0% (1)

- High Performance Computing in CST Studio Suite: Felix WolfheimerDocument18 pagesHigh Performance Computing in CST Studio Suite: Felix WolfheimerPragash SangaranNo ratings yet

- PowerMILL 2016 - Whats New enDocument45 pagesPowerMILL 2016 - Whats New enHappy DaysNo ratings yet

- An Experimental Study On Scale Effects in Rock Mass Joint StrengthDocument14 pagesAn Experimental Study On Scale Effects in Rock Mass Joint StrengthTen FreireNo ratings yet

- Bitwise OperatorsDocument4 pagesBitwise OperatorsslspaNo ratings yet

- NCSC TG 009Document122 pagesNCSC TG 009bromlantNo ratings yet

- Problems and SolutionsDocument12 pagesProblems and SolutionsNaresh Joseph ChristyNo ratings yet

- Solucionario Parte 3 Matemáticas Avanzadas para Ingeniería - 2da Edición - Glyn JamesDocument32 pagesSolucionario Parte 3 Matemáticas Avanzadas para Ingeniería - 2da Edición - Glyn JamesKimberly Clark100% (5)

- Module 2 Hebb NetDocument12 pagesModule 2 Hebb NetVighnesh MNo ratings yet

- Textbook A Brief Survey of Quantitative Eeg 1St Edition Kaushik Majumdar Ebook All Chapter PDFDocument40 pagesTextbook A Brief Survey of Quantitative Eeg 1St Edition Kaushik Majumdar Ebook All Chapter PDFphillip.lee501100% (17)

- Kalman FilterDocument21 pagesKalman Filterabenezer zegeyeNo ratings yet

- 4.11 Collection and Presentation of DataDocument11 pages4.11 Collection and Presentation of DataiamamayNo ratings yet