Professional Documents

Culture Documents

Comp Acctg Brochure PDF

Uploaded by

Danielle Watson0 ratings0% found this document useful (0 votes)

53 views2 pagesThis document provides course information for Computerised Accounting with MYOB, including the aims, content, materials, study options, timetable, fees, and enrolment details. The course aims to teach students how to set up and operate a business accounting system using MYOB software to assist with financial management. Students will learn to set up accounts, enter transactions, reconcile accounts, and generate financial reports. The course can be taken through scheduled classes or self-paced external study. Fees vary for local students, those with a concession card, and international students.

Original Description:

Original Title

comp-acctg-brochure-.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides course information for Computerised Accounting with MYOB, including the aims, content, materials, study options, timetable, fees, and enrolment details. The course aims to teach students how to set up and operate a business accounting system using MYOB software to assist with financial management. Students will learn to set up accounts, enter transactions, reconcile accounts, and generate financial reports. The course can be taken through scheduled classes or self-paced external study. Fees vary for local students, those with a concession card, and international students.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views2 pagesComp Acctg Brochure PDF

Uploaded by

Danielle WatsonThis document provides course information for Computerised Accounting with MYOB, including the aims, content, materials, study options, timetable, fees, and enrolment details. The course aims to teach students how to set up and operate a business accounting system using MYOB software to assist with financial management. Students will learn to set up accounts, enter transactions, reconcile accounts, and generate financial reports. The course can be taken through scheduled classes or self-paced external study. Fees vary for local students, those with a concession card, and international students.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

COURSE INFORMATION

COMPUTERISED ACCOUNTING

WITH MYOB

(National Code: FNSACC406A)

AIM OF COURSE COURSE MATERIALS

Save time and money by using MYOB to assist in the Students are required to purchase their own

financial management of your small business. materials for both class and external studies. Go to

TAFEshop http://shop.tafesa.edu.au

At the completion of this unit you should be able

to work with your accountant to set up and You will have a comprehensive self-paced workbook

operate a business accounting system using that will enable you to work through practical case

MYOB. studies based on real businesses. A test drive CD of

MYOB with installation instructions is also included.

COURSE CONTENT Purchase of MYOB software is therefore not required

Learn how to: to complete this course. However you will need to

Set up MYOB for a business provide your own USB drive.

Create and maintain an Accounts List

Set up and maintain customer and supplier STUDY OPTIONS

records You can choose between two flexible study

Set up and maintain inventory records options:

Enter opening balances Classes – you can work at your own speed, in a small

Process receipts and payments class, with individual attention from an experienced

Create invoices tutor. You would be required to attend class three hours

Complete a bank reconciliation per week for 8 weeks. Refer to the course dates and

Process petty cash and credit card transactions

times listed below. In addition you will need to allow

Produce a variety of financial reports, including

approximately 3 hours per week outside of class time

GST reports

to practise skills learned in class and for completion of

Complete a Business Activity Statement

an assignment.

Backup and restore information

Note – Payroll is NOT included in this Unit External Study – you will be using a comprehensive

self-paced workbook that will enable you to work

ENTRY REQUIREMENTS through practical case studies based on real

This unit assumes you have completed the unit businesses. An experienced tutor will support you

‘Maintain Financial Records’ or other accounting through a telephone, email or drop in tutorial service.

studies and have knowledge of double entry This is an ideal option for those who live too far away,

accounting. or who cannot commit to scheduled classes.

Do you know the five account groups?

Can you analyse a transaction into debit and

credit components?

Can you complete a bank reconciliation? Class Timetable – 2012

Are you familiar with GST?

If you answered ‘no’ to any of the above, you should

complete the unit ‘Maintain Financial Records’ prior Computerised Accounting with MYOB – Semester 1

to enrolling in ‘Computerised Accounting’. (TAFE Code – AABLP) (Curriculum Hours 80)

8 x 3 hour session per week

You must also be able to operate a computer

competently using Windows software. That is you

need to have some understanding of file Mondays 6.00pm – 9.00pm 6 Feb to 2 Apr

management and directories and you should be Wednesdays 9.00am – 12n 15 Feb to 4 Apr

able to copy files. If you do not have these skills Mondays 9.00am – 12n 30 April to 25 June

you should complete an introductory computing Wednesdays 6.00pm – 9.00pm 9 May to 27 July

course prior to enrolling in ‘Computerised

Accounting’.

S:\man\adl\ADMIN\2012\Master Brochures\SB\Comp Acctg Brochure 2012.rtf

FEES

MINIMAL COMPUTER REQUIREMENTS

Pentium 1 GHz, Windows 7, XP or Vista, 1 GB RAM, TAFE FEES Concession International *

Hard Drive with at least 2 GB of free space and a CD

Tuition 276.00 112.00 400.00

drive.

Text/Workbook

48.00 48.00 48.00

(inc GST)

SMALL BUSINESS QUALIFICATIONS

This unit is an elective in the Certificate IV in Total Fee $324.00 168.00 $448.00

Small Business Management. Successful

completion of the assessment will grant you one Note: No refund of fees available for

unit to count towards this award. International Students

RECOGNITION OF PRIOR LEARNING Concessions are available to holders of a health care

If you already have competence in small business card or pension card. A copy of the concession card is

management, you can ask to have those skills required. The fee includes all learning materials. There

recognised. This is done through an assessment of is no need to buy additional texts. If you are in

your prior formal or informal study, work business, the fees may be tax deductible for yourself

experience, training and life experience. and for your employees.

Documentary evidence must be provided. An Refund Policy

application form can be obtained from the Small

Refund of fees is available under certain

Business Training Centre. A fee applies for this circumstances. Check with the Enrolment Officer at

service. the Small Business Training Centre for further

information.

ADDITIONAL SERVICES

The following support services are provided: Student ID Card – $5.50

Learning Resource Centre (LRC)

FURTHER INFORMATION

Counselling

TAFE SA

Childcare

Employment Service

Adelaide City Campus

Learning Support (support for students

Small Business Training Centre

experiencing difficulties within their program of Management, Small Business and Retail Programs

study) Level 1, East Wing

Disability or Special Needs Support 120 Currie Street

Cafeteria (GPO Box 1872)

Car Parking (independent car parking is Adelaide 5000

available underneath the Adelaide City campus) Tel: (08) 8207 8373 or (08) 8207 8328

Fax: (08) 8410 0633

For additional information contact Client Services TTY Tel: (08) 8207 8206

on (08) 8207 8201. sbtc@tafesa.edu.au

ENROLMENT INFORMATION www.tafesa.edu.au/sbtc

To enrol complete a Registration Form and Unit ABN 57 500 809 958

Selection form from our office and return via email

NOTE

to sbtc@tafesa.edu.au or post to:

The fees listed are subject to change at any time and do not

TAFE SA commit the Institute to charging the fees indicated.

Adelaide City Campus The information was accurate at the time of printing and the

The Small Business Training Centre Institute reserves the right to make any changes necessary.

GPO Box 1872 Adelaide SA 5001

Conditions of enrolment including Policies and Procedures, the Code

of Practice and details of the services provided are available on the

TAFE SA website – www.tafe.sa.edu.au

Payment process.

Once your registration has been processed our office TAFE SA strives to provide an environment that fosters fairness,

will issue an invoice to be paid online or via your equity and respect for social and cultural diversity and that is free

local post office. Course fees may be tax deductible from unlawful discrimination and harassment. You can obtain up-to-

date information on equity policies, programs and services at the

depending on your circumstances. website or Client Services.

S:\man\adl\ADMIN\2012\Master Brochures\SB\Comp Acctg Brochure 2012.rtf

You might also like

- Accounting Study Material - UnlockedDocument925 pagesAccounting Study Material - UnlockedCan I Get 1000 Subscribers100% (1)

- Audit Module 1Document427 pagesAudit Module 1Ripper100% (1)

- CompTIA A+ Certification All-in-One Exam Guide: How to pass the exam without over studying!From EverandCompTIA A+ Certification All-in-One Exam Guide: How to pass the exam without over studying!Rating: 1 out of 5 stars1/5 (3)

- Taxation IIDocument467 pagesTaxation IItoufiqNo ratings yet

- Reptilian Astral WarsDocument4 pagesReptilian Astral WarsAlienraces1No ratings yet

- Business Strategy Study Guide 2015Document38 pagesBusiness Strategy Study Guide 2015hopeaccaNo ratings yet

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

- p5 Module 1Document308 pagesp5 Module 1Md Mahamoodali100% (1)

- Workday Knowledge Management Training Catalog 1 PDFDocument35 pagesWorkday Knowledge Management Training Catalog 1 PDFPavan Kumar75% (4)

- Audit & Assurance Study Guide 2015Document26 pagesAudit & Assurance Study Guide 2015Maddie Green100% (1)

- U2 AssessmentDocument11 pagesU2 Assessmentsadfgdfg0% (11)

- SMPS FundamentalsDocument53 pagesSMPS FundamentalsRahul Gupta100% (2)

- ABE Level 4 - Introduction To AccountingDocument410 pagesABE Level 4 - Introduction To AccountingIamThe Boss67% (3)

- ABE Level 4 - Introduction To AccountingDocument410 pagesABE Level 4 - Introduction To AccountingIamThe Boss67% (3)

- AtmakarakaDocument3 pagesAtmakarakaswamyvk100% (1)

- Cost Center Acc. (CO-CCA) Case Study - Lecturer Notes: Product MotivationDocument19 pagesCost Center Acc. (CO-CCA) Case Study - Lecturer Notes: Product MotivationNugraheniSusantiNo ratings yet

- Enterprise Asset Management (EAM) Case Study - Lecturer NotesDocument15 pagesEnterprise Asset Management (EAM) Case Study - Lecturer NotesmeddebyounesNo ratings yet

- Basics On Piping LayoutDocument11 pagesBasics On Piping Layoutpuru55980No ratings yet

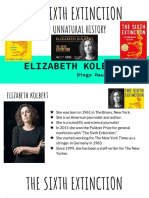

- The Sixth Extinction An Unnatural HistoryDocument20 pagesThe Sixth Extinction An Unnatural HistoryEDISON ALARCON100% (1)

- Myob Ace Payroll: Accounting &Document2 pagesMyob Ace Payroll: Accounting &Muhammad RamadhanNo ratings yet

- ACCT 1116 - Syllabus Sec A05 Rupani (W2020)Document7 pagesACCT 1116 - Syllabus Sec A05 Rupani (W2020)mikewithers41No ratings yet

- Lesson Plan Accounting For A Service Proprietorship Stage 2 - 1Document5 pagesLesson Plan Accounting For A Service Proprietorship Stage 2 - 1adhikari.2861No ratings yet

- Proposal For Training ProgramDocument6 pagesProposal For Training ProgramsainipreetpalNo ratings yet

- P2 P Training Guide v2.0.3Document6 pagesP2 P Training Guide v2.0.3Timothy MunhengaNo ratings yet

- BSAIS 1st Year FAR - Prelim ModuleDocument30 pagesBSAIS 1st Year FAR - Prelim ModuleRalphFlorence MancillaNo ratings yet

- BCTT-K18-Nguyen Huu Phuoc - FullDocument81 pagesBCTT-K18-Nguyen Huu Phuoc - FullPhước NguyễnNo ratings yet

- Diploma of Payroll Services BrochureDocument8 pagesDiploma of Payroll Services BrochureFareed KhanNo ratings yet

- ACTG 360 Syllabus (Winter 2020) Michael Schuster Portland State University Management AccountingDocument10 pagesACTG 360 Syllabus (Winter 2020) Michael Schuster Portland State University Management AccountingHardlyNo ratings yet

- ACCT610-999 SPRING2015 Managerial Accounting Course Syllabus - Revised ScheduleDocument16 pagesACCT610-999 SPRING2015 Managerial Accounting Course Syllabus - Revised SchedulebabydreaNo ratings yet

- 1.1 How-To-Use-This-Competency-Based-Learning-MaterialDocument2 pages1.1 How-To-Use-This-Competency-Based-Learning-MaterialJessa Mae RoneNo ratings yet

- BSBFIM501 ASS2 NiranDocument11 pagesBSBFIM501 ASS2 NiranMaykiza NiranpakornNo ratings yet

- M1 Initial PageDocument14 pagesM1 Initial PageRaj DasNo ratings yet

- ACG3341 Gaukel 2013fallDocument9 pagesACG3341 Gaukel 2013fallalnahary1No ratings yet

- End User Training Curriculum: Sage Evolution Premium Administrator Course (Learning Unit 3)Document5 pagesEnd User Training Curriculum: Sage Evolution Premium Administrator Course (Learning Unit 3)Deluxê HoveNo ratings yet

- ISATraining CatalogDocument56 pagesISATraining CatalogmirkofedorNo ratings yet

- Accounting Cycle Assignment HelpDocument6 pagesAccounting Cycle Assignment Helpfpxmfxvlf100% (1)

- Aat Course WorkDocument8 pagesAat Course Workxmufyevcf100% (2)

- BUA ACCTG Flexible OBTL A4Document12 pagesBUA ACCTG Flexible OBTL A4Alexandra De LimaNo ratings yet

- Coursework of AccountingDocument7 pagesCoursework of Accountingzys0vemap0m3100% (2)

- Navision Attain EssentialsDocument351 pagesNavision Attain EssentialskirutitNo ratings yet

- Studentcompanion FLAU4bDocument12 pagesStudentcompanion FLAU4bNidhiNo ratings yet

- APM - SM - 2023 - 2024 As at 19 May 2023 TCDocument425 pagesAPM - SM - 2023 - 2024 As at 19 May 2023 TC3bbas Al-3bbasNo ratings yet

- FY20 QBO Clients Course 5 Expanding UsabilityDocument47 pagesFY20 QBO Clients Course 5 Expanding UsabilityWinnieNo ratings yet

- Cube Academy Training SchemeDocument6 pagesCube Academy Training SchemesassNo ratings yet

- TallyDocument64 pagesTallyEbin josephNo ratings yet

- Taxmann-Academy BrochureDocument12 pagesTaxmann-Academy Brochurepankajmandhani007No ratings yet

- Payroll System Thesis DocumentationDocument8 pagesPayroll System Thesis Documentationafktlrreerdihj100% (2)

- Solved Manaual of Fundamentals of FinanceDocument14 pagesSolved Manaual of Fundamentals of Financemansoor mahmoodNo ratings yet

- 2223 Obtl Bus AcctgDocument12 pages2223 Obtl Bus AcctgRYUJIりゅじNo ratings yet

- SyllabusDocument6 pagesSyllabusee1993No ratings yet

- Aat Course With Work PlacementDocument5 pagesAat Course With Work Placementbatesybataj3100% (2)

- Aat Course With Work ExperienceDocument5 pagesAat Course With Work Experiencen1b1bys1fus2100% (2)

- Training Plac AccountantDocument4 pagesTraining Plac AccountantAhmed NaguibNo ratings yet

- 1.1 What Is Financial Accounting and How Does It Fit Within The Professional Stage?Document20 pages1.1 What Is Financial Accounting and How Does It Fit Within The Professional Stage?nitu mdNo ratings yet

- Aat Level 2 CourseworkDocument5 pagesAat Level 2 Courseworkqtcdctzid100% (2)

- Dimension® Systems Customer Training: Facilitator GuideDocument17 pagesDimension® Systems Customer Training: Facilitator GuideОлександрNo ratings yet

- Preparing For Year-End Statutory AuditDocument12 pagesPreparing For Year-End Statutory AuditAbdulhameed BabalolaNo ratings yet

- UT Dallas Syllabus For Aim6338.0g1.11s Taught by Mary Beth Goodrich (Goodrich)Document15 pagesUT Dallas Syllabus For Aim6338.0g1.11s Taught by Mary Beth Goodrich (Goodrich)UT Dallas Provost's Technology GroupNo ratings yet

- PowerPoint PresentationDocument4 pagesPowerPoint Presentationgbolahan oluyemiNo ratings yet

- Icai Group 1 As Study MatDocument236 pagesIcai Group 1 As Study Matahtesham8130No ratings yet

- Audit Only CourseworkDocument8 pagesAudit Only Courseworkafazakemb100% (2)

- Course Booking Form - QMS-VILT - CR - 06-2022Document3 pagesCourse Booking Form - QMS-VILT - CR - 06-2022Laltu DuttaNo ratings yet

- Assessment Case StudyDocument6 pagesAssessment Case StudyDevendra SuryavanshiNo ratings yet

- 75122bos60681 Init m1Document19 pages75122bos60681 Init m1kanyadarivivekanandaNo ratings yet

- 75122bos60681 Init m1 - UnlockedDocument19 pages75122bos60681 Init m1 - Unlockedhrudaya boysNo ratings yet

- Elga and Graduate Outcomes Program Outcomes: College of BusinessDocument7 pagesElga and Graduate Outcomes Program Outcomes: College of BusinessJasmine LimNo ratings yet

- Ab Institute Accounting PH Certificate IV Accounting BookkeepingDocument10 pagesAb Institute Accounting PH Certificate IV Accounting BookkeepingLauren RamosNo ratings yet

- Factorising Year 8 June 8 2017Document15 pagesFactorising Year 8 June 8 2017Danielle WatsonNo ratings yet

- Accounting Chapter 1Document5 pagesAccounting Chapter 1Danielle WatsonNo ratings yet

- Adjusting Entries ExplanationDocument18 pagesAdjusting Entries ExplanationDanielle WatsonNo ratings yet

- VCE Accounting 2019 - 2023: Advice For TeachersDocument3 pagesVCE Accounting 2019 - 2023: Advice For TeachersDanielle WatsonNo ratings yet

- SSAccExams ErrataPages2019 PDFDocument11 pagesSSAccExams ErrataPages2019 PDFDanielle WatsonNo ratings yet

- Lesson 1 - Introduction To Algebra 5A PDFDocument23 pagesLesson 1 - Introduction To Algebra 5A PDFDanielle WatsonNo ratings yet

- 3column Cash PDFDocument1 page3column Cash PDFDanielle WatsonNo ratings yet

- Computerised Accounting With MYOB PDFDocument82 pagesComputerised Accounting With MYOB PDFDanielle WatsonNo ratings yet

- Acc 3 Revision Questions 18Document6 pagesAcc 3 Revision Questions 18Danielle WatsonNo ratings yet

- Acc 3 Revison Question 15 PDFDocument6 pagesAcc 3 Revison Question 15 PDFDanielle WatsonNo ratings yet

- Cambridge 1&2 Solutions PDFDocument642 pagesCambridge 1&2 Solutions PDFDanielle WatsonNo ratings yet

- 03 Cash Flow Balance SheetsDocument13 pages03 Cash Flow Balance SheetsDanielle WatsonNo ratings yet

- Acc 3 Unit 3 Revision Questions 13Document12 pagesAcc 3 Unit 3 Revision Questions 13Danielle WatsonNo ratings yet

- Lecture - Notes On PayrollDocument20 pagesLecture - Notes On Payrollkemmys100% (1)

- Acc Study Guide Miniexam SolutionsDocument29 pagesAcc Study Guide Miniexam SolutionsDanielle WatsonNo ratings yet

- Sentencing: Quick GuideDocument54 pagesSentencing: Quick GuideDanielle WatsonNo ratings yet

- 05 Solutions Chapter 5Document26 pages05 Solutions Chapter 5Danielle WatsonNo ratings yet

- 03 Cash Flow Balance SheetsDocument13 pages03 Cash Flow Balance SheetsDanielle WatsonNo ratings yet

- 06 Solutions Chapter 6 PDFDocument42 pages06 Solutions Chapter 6 PDFCindy ReyesNo ratings yet

- 03 Cash Flow Balance SheetsDocument13 pages03 Cash Flow Balance SheetsDanielle WatsonNo ratings yet

- BEE MCQ Unit IVDocument16 pagesBEE MCQ Unit IVUmesh PatilNo ratings yet

- PPA Application - 2700 Sloat BLVD (283 Units)Document8 pagesPPA Application - 2700 Sloat BLVD (283 Units)Sasha PerigoNo ratings yet

- Computing Test StatisticDocument8 pagesComputing Test StatisticFranklin BenitezNo ratings yet

- 2020 Book ThePalgraveHandbookOfGlobalSocDocument1,039 pages2020 Book ThePalgraveHandbookOfGlobalSocYoussef AmzilNo ratings yet

- IHS Markit - The Global Ultrasound MarketDocument2 pagesIHS Markit - The Global Ultrasound MarketwwtqfgtpNo ratings yet

- Impact On OrganizationsDocument14 pagesImpact On OrganizationsogakhanNo ratings yet

- Leybold Didactic EquipmentsDocument4 pagesLeybold Didactic EquipmentsAffo AlexNo ratings yet

- MindmapDocument2 pagesMindmapapi-545246569No ratings yet

- Schlosser Distillation SSCHI 2011 256Document14 pagesSchlosser Distillation SSCHI 2011 256Brandon LizardoNo ratings yet

- FINAL REPORT OF TRAINING RRRRDocument26 pagesFINAL REPORT OF TRAINING RRRR52-Suraj RaskarNo ratings yet

- Ok - Las-Q2 Oral - Com W1Document5 pagesOk - Las-Q2 Oral - Com W1Ruben Rosendal De AsisNo ratings yet

- Shiksha Sopan April 09Document4 pagesShiksha Sopan April 09Amrendra NarayanNo ratings yet

- Proforma - Attendance PercentageDocument6 pagesProforma - Attendance Percentageraja93satNo ratings yet

- Table of SpecificationDocument5 pagesTable of SpecificationEvangeline Delos Santos50% (2)

- Shaker SK L180 SDocument1 pageShaker SK L180 SUPT LABKESDA KAB PADANG PARIAMANNo ratings yet

- Er9000en 21204 1.00Document106 pagesEr9000en 21204 1.00Alexandru AnghelNo ratings yet

- Phy12l E301Document5 pagesPhy12l E301Arvn Christian Santicruz FloresNo ratings yet

- Basic Measurement PiezoeletricDocument6 pagesBasic Measurement PiezoeletricALEX_INSPETORNo ratings yet

- List of ROs Under VODocument74 pagesList of ROs Under VOvivek mishraNo ratings yet

- Performance Evaluation of TDL Channels For Downlink 5G MIMO SystemsDocument4 pagesPerformance Evaluation of TDL Channels For Downlink 5G MIMO SystemspruxmanNo ratings yet

- Geometry of Middle SurfaceDocument29 pagesGeometry of Middle SurfaceParth ShahNo ratings yet

- Centroid + MOI (Students)Document39 pagesCentroid + MOI (Students)Usman HafeezNo ratings yet

- tf00001054 WacDocument22 pagestf00001054 WacHritik RawatNo ratings yet

- Manual Hydraulic Power UnitsDocument20 pagesManual Hydraulic Power UnitsabdiNo ratings yet

- Revised Research Request Form Undergrad and Masteral Back FrontDocument4 pagesRevised Research Request Form Undergrad and Masteral Back Frontmichael tampusNo ratings yet