Professional Documents

Culture Documents

Technical Support and Resistance - 050719

Uploaded by

Prasanna ManaviOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Support and Resistance - 050719

Uploaded by

Prasanna ManaviCopyright:

Available Formats

Technical Support & Resistance

Support & Resistance

July 5, 2019

April 2,

Support: The support level is the lowest price a security trades at, over a period of time. The price stops dropping

because buyers start to outnumber sellers. The longer the price stays at a particular level, the stronger the support at

that level. Many traders believe that the stronger the support at a given level, the less likely it will break below,

however it is recommended to exit the position if support breaks.

Resistance: The resistance level is the highest price a security trades at over a period of time. The price stops rising

because sellers begin to outnumber buyers. The more often the price reaches a particular level of resistance and fails

to break through, the stronger the resistance at that level. For this reason, many traders believe that the stronger the

resistance, the less likely the price will break through that level, however it is recommended to enter the position

once the resistance break

Note: This is recommended to use "Limit" and "SLTP" for disciplined trading.

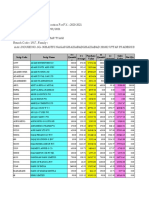

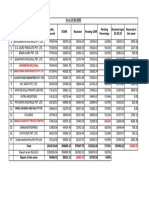

Scrip Name Close S1 S2 S3 R1 R2 R3 Trend

NIFTY 50 11946.75 11925 11901 11879 11970 11993 12016 Positive

S&P BSE SENSEX INDEX 39908.06 39851 39794 39730 39972 40036 40092 Positive

NIFTY BANK 31471.85 31398 31323 31217 31578 31683 31758 Positive

NIFTY 50 FUTURES 11979.65 11949 11918 11893 12005 12030 12062 Positive

NIFTY BANK FUTURES 31548.2 31468 31389 31279 31658 31769 31848 Positive

ACC LTD 1576.75 1564 1551 1538 1590 1603 1616 Positive

AMBUJA CEMENTS 216.1 215 213 212 218 219 221 Positive

ADANI POWER LTD 65.35 65 64 63 67 68 70 Positive

ADANI ENTERPRISE 156.1 152 150 145 160 165 167 Positive

ADANI PORTS AND 414.9 413 411 409 417 419 421 Negative

AJANTA PHARMA 946.3 921 895 868 974 1001 1027 Neutral

ASHOK LEYLAND 89.95 89 88 88 91 92 93 Neutral

ALLAHABAD BANK 50.65 49 48 46 51 52 53 Positive

AMARA RAJA BATT 648.2 638 627 619 656 664 675 Positive

ANDHRA BANK 23.9 24 23 23 25 25 25 Positive

APOLLO HOSPITALS 1325.45 1314 1305 1287 1342 1359 1369 Negative

ASIAN PAINTS LTD 1359.7 1352 1344 1336 1367 1374 1382 Neutral

APOLLO TYRES LTD 199.4 198 197 196 201 203 204 Neutral

AUROBINDO PHARMA 605.1 596 587 581 611 617 626 Neutral

ARVIND LTD 68.85 68 66 65 71 72 74 Neutral

AXIS BANK LTD 808.85 805 800 796 814 818 823 Positive

BAJAJ FINANCE LT 3732.5 3708 3684 3663 3753 3774 3798 Positive

BATA INDIA LTD 1457.25 1450 1444 1435 1465 1474 1480 Positive

BEML LTD 916.4 912 906 899 924 930 936 Positive

BHARAT FINANCIAL 898 - - - - - 0 Positive

BHARTI AIRTEL 362.75 355 348 343 367 372 379 Positive

BHARAT ELECTRON 113.6 112 111 109 114 115 116 Positive

BHARAT HEAVY ELE 73.1 72 72 71 74 74 75 Neutral

BHARAT FORGE CO 475.95 464 453 445 484 493 503 Positive

BHARTI INFRATEL 263.1 262 259 257 266 269 271 Neutral

BALKRISHNA INDS 751.55 745 740 734 757 762 768 Positive

BIOCON LTD 248.95 247 245 243 251 253 255 Negative

BAJAJ AUTO LTD 2894.8 2879 2862 2847 2911 2926 2943 Neutral

BAJAJ FINSERV LT 8537.55 8454 8369 8318 8590 8641 8726 Positive

BANK OF BARODA 129.4 127 124 122 132 134 137 Positive

BANK OF INDIA 94.5 94 93 92 97 97 99 Positive

BOSCH LTD 16882.3 16673 16464 16306 17041 17199 17408 Positive

BHARAT PETROL 380 378 375 372 384 387 389 Negative

BALRAMPUR CHINI 147.9 143 138 136 151 154 158 Positive

BERGER PAINTS 320.45 318 316 314 322 324 325 Neutral

BRITANNIA INDS 2841.35 2804 2766 2743 2865 2888 2926 Positive

ICICI Securities Ltd. | Retail Equity Research

Technical Support & Resistance

Support & Resistance

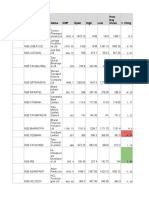

CAN FIN HOMES 357.95 355 352 348 362 366 369 Positive

CANARA BANK 287.15 283 279 274 292 297 301 Positive

April 2,

CONTAINER CORP 573 568 564 558 579 585 589 Negative

CADILA HEALTHCAR 236.75 235 234 232 239 240 242 Positive

CEAT LTD 936 923 911 897 949 963 974 Positive

CENTURY TEXTILE 972.4 962 951 935 989 1005 1015 Neutral

CESC LTD 780.3 774 768 758 790 800 806 Neutral

CG POWER AND IND 26.25 25 25 24 26 27 27 Negative

CHOLAMANDALAM IN 291.7 290 286 283 296 298 302 Neutral

CIPLA LTD 551.55 550 548 545 555 558 560 Neutral

COLGATE PALMOLIV 1151.5 1144 1136 1126 1161 1172 1179 Positive

COAL INDIA LTD 251.1 249 248 246 253 254 256 Negative

CASTROL INDIA 132 131 130 129 134 135 136 Negative

DABUR INDIA LTD 402.95 400 397 394 407 411 414 Negative

DCB BANK LTD 231.9 230 227 225 236 239 242 Positive

DEWAN HOUSING 83.2 81 79 76 86 89 92 Positive

DISH TV INDIA 31.55 30 29 28 33 35 36 Positive

DIVI LABS LTD 1619.8 1609 1597 1582 1636 1651 1663 Neutral

DLF LTD 194.6 193 191 189 198 199 202 Positive

DR REDDY'S LABS 2602.4 2590 2578 2563 2617 2632 2644 Neutral

EICHER MOTORS 19825.4 19609 19393 19150 20068 20311 20527 Neutral

ENGINEERS INDIA 120 119 117 115 122 125 126 Negative

EQUITAS HOLDINGS 121.45 120 119 118 122 123 124 Positive

ESCORTS LTD 570.9 564 558 549 579 588 594 Positive

EXIDE INDUS LTD 206.5 203 201 198 208 211 214 Negative

FED BANK LTD 108.85 108 107 106 110 111 111 Neutral

FORTIS HEALTHCAR 133.8 133 132 132 135 136 137 Positive

GAIL INDIA LTD 307.8 305 302 300 310 312 315 Negative

GODREJ CONSUMER 674.7 665 656 649 680 688 696 Negative

GODREJ INDUSTRIE 482.55 479 475 470 488 493 497 Negative

GMR INFRASTRUCTU 15.1 15 15 15 15 15 15 Positive

GLENMARK PHARMA 440.2 438 436 432 444 448 451 Neutral

GODFREY PHILLIPS 832.85 821 808 795 847 860 873 Positive

GRANULES INDIA 100.25 98 96 94 102 104 105 Positive

GRASIM INDS LTD 941.6 930 918 910 950 958 971 Positive

GUJARAT STATE F 93.25 92 92 91 93 94 94 Neutral

HAVELLS INDIA 783.8 780 775 768 792 799 805 Negative

HINDUSTAN CONST 11.7 12 12 12 12 12 13 Negative

HCL TECH LTD 1040.75 1033 1025 1015 1050 1059 1068 Negative

HOUSING DEV FIN 2280.25 2268 2256 2247 2289 2298 2310 Neutral

HDFC BANK LTD 2483.8 2472 2459 2446 2498 2511 2524 Negative

HOUSING DEVELOPM 15.95 16 16 15 16 16 17 Negative

HEXAWARE TECHNOL 372.85 368 364 357 379 386 390 Negative

HERO MOTOCORP LT 2606.15 2588 2570 2555 2621 2636 2654 Positive

HINDALCO INDS 206.9 207 205 203 210 211 213 Neutral

HINDUSTAN PETRO 288.65 286 285 283 289 291 292 Neutral

HINDUSTAN UNILEV 1793.6 1783 1773 1765 1801 1809 1820 Positive

HINDUSTAN ZINC 239.85 236 234 231 241 244 246 Negative

INDIABULLS REAL 118.3 116 114 111 120 122 124 Positive

INDIA CEMENTS 104.5 105 104 103 106 106 107 Positive

INDO COUNT INDS 32.65 33 32 32 34 34 35 Negative

IDBI BANK LTD 37.65 36 36 35 37 38 38 Positive

IDEA CELLULAR 12.35 11 11 10 12 13 14 Positive

IDFC LTD 37.65 36 36 35 38 39 39 Positive

IDFC BANK LTD 45 44 44 43 45 46 46 Positive

IFCI LTD 9.15 9 9 8 9 9 9 Neutral

INDRAPRASTHA GAS 302.5 302 299 297 306 309 311 Neutral

INDIABULLS HOUSI 703.85 687 671 650 724 745 761 Positive

ICICI Securities Ltd. | Retail Equity Research

Technical Support & Resistance

Support & Resistance

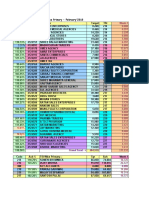

INDUSIND BANK 1493.1 1469 1444 1421 1516 1538 1563 Positive

INDIAN BANK 260.15 258 256 252 263 266 268 Positive

April 2,

INTERGLOBE AVIAT 1635.75 1591 1546 1518 1664 1692 1738 Positive

INFIBEAM INCORPO 44.45 45 44 45 46 46 46 Positive

INFOSYS LTD 733.8 730 725 722 737 741 745 Negative

INDIAN OIL CORP 156.55 155 154 153 157 158 159 Neutral

ICICI PRUDENTIAL 393.9 390 384 380 399 402 408 Positive

IRB INFRASTRUCTU 95.9 95 95 94 96 97 98 Positive

ITC LTD 277.65 276 274 273 279 280 282 Positive

JET AIRWAYS IND 65.5 65 64 62 69 70 72 Negative

JAIN IRRIGATION 27.25 26 25 24 28 29 30 Positive

JAIPRAKASH ASSOC 3 3 3 3 3 3 3 Positive

JINDAL STEEL & P 142.1 140 138 134 145 148 150 Positive

JSW STEEL LTD 275.05 274 272 270 278 280 282 Neutral

JSW ENERGY LTD 71.95 71 70 69 72 74 74 Positive

JUBILANT FOODWOR 1259.05 1252 1245 1236 1268 1277 1284 Positive

JUST DIAL LTD 779.8 770 762 749 792 804 813 Positive

KARNATAKA BANK 105.2 104 103 102 106 107 108 Positive

KAJARIA CERAMICS 584.35 579 572 568 590 594 600 Neutral

CUMMINS INDIA 760.3 750 740 732 769 777 787 Negative

KOTAK MAHINDRA 1497.8 1481 1463 1451 1511 1523 1541 Positive

KAVERI SEED 475.2 470 466 461 479 484 488 Positive

LIC HOUSING FIN 568.75 565 563 559 572 575 578 Positive

LUPIN LTD 754.35 748 742 737 760 766 771 Neutral

LARSEN & TOUBRO 1571.7 1563 1555 1541 1586 1599 1608 Positive

L&T FINANCE HOLD 120.05 118 117 116 121 123 123 Positive

MAHANAGAR GAS LT 828.3 818 808 799 837 846 856 Positive

MAX FINANCIAL SE 415.25 412 407 402 422 427 431 Positive

MCX INDIA LTD 864.8 859 853 846 871 879 884 Positive

MANAPPURAM FINAN 136.25 136 135 133 138 140 141 Positive

MAHINDRA & MAHIN 672.15 668 662 659 677 680 686 Neutral

M&M FIN SERVICES 395.5 394 390 387 400 404 407 Positive

MARICO LTD 374.2 373 370 368 377 378 381 Negative

MRF LTD 56539.45 56228 55915 55529 56927 57313 57626 Negative

CHENNAI PETROLEU 206.9 206 205 204 208 209 210 Neutral

MANGALORE REFINE 60.25 59 59 59 60 61 61 Neutral

MARUTI SUZUKI IN 6544.45 6508 6470 6430 6586 6626 6664 Negative

MOTHERSON SUMI 126.85 125 123 122 127 129 130 Positive

MINDTREE LTD 899.05 891 882 873 910 919 928 Negative

MUTHOOT FINANCE 624.65 618 612 601 636 646 653 Negative

NATIONAL ALUMIN 50.55 51 50 49 52 52 53 Positive

NBCC INDIA LTD 61.3 60 59 58 62 63 63 Positive

NESTLE INDIA LTD 11884.45 11800 11715 11630 11970 12055 12140 Neutral

NHPC LTD 24.6 25 25 25 25 25 26 Negative

NIIT TECH LTD 1338.15 1325 1312 1300 1350 1362 1376 Neutral

NCC LTD 97.3 95 94 92 98 100 101 Neutral

NMDC LTD 116.5 116 115 114 118 119 120 Neutral

NTPC LTD 143.45 142 141 139 144 145 146 Neutral

ORIENTAL BANK OF 94.95 94 93 92 96 97 98 Positive

ORACLE FINANCIAL 3235.95 3207 3179 3148 3266 3297 3325 Neutral

OIL INDIA LTD 177.7 177 176 175 179 180 181 Positive

OIL & NATURAL GA 167.1 165 164 162 168 170 171 Positive

PAGE INDUSTRIES 20876.9 20767 20658 20579 20955 21034 21143 Neutral

PC JEWELLER LTD 42.35 42 41 39 44 45 46 Negative

PIDILITE INDS 1226.85 1218 1208 1196 1240 1252 1262 Positive

PIRAMAL ENTERPRI 1949 1881 1813 1703 2059 2169 2236 Neutral

PETRONET LNG LTD 252.65 251 247 246 256 257 261 Positive

PUNJAB NATL BANK 82.05 81 80 79 83 84 84 Positive

ICICI Securities Ltd. | Retail Equity Research

Technical Support & Resistance

Support & Resistance

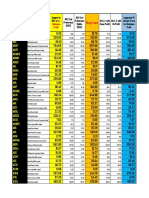

POWER FINANCE 133.05 131 130 128 134 136 137 Positive

PTC INDIA LTD 67.05 66 66 65 67 68 68 Neutral

April 2,

PVR LTD 1691.85 1680 1669 1656 1704 1717 1729 Positive

POWER GRID CORP 210.2 209 207 206 212 213 215 Positive

RBL BANK LTD 654.15 649 644 637 661 668 673 Positive

RELIANCE CAPITAL 64.35 64 62 61 66 68 69 Neutral

RELIANCE COMMUNI 1.5 3 2 3 3 2 3 Positive

REC LIMITED 167.4 166 165 163 170 172 173 Positive

RELIANCE INFRAST 54.65 53 52 50 56 58 59 Negative

REPCO HOME FINAN 373.05 371 368 366 377 380 383 Neutral

RELIANCE INDS 1284 1279 1274 1268 1290 1296 1301 Positive

RELIANCE POWER 4.3 4 4 3 4 4 4 Negative

RAYMOND LTD 760.15 754 747 737 771 781 788 Positive

STEEL AUTHORITY 51.9 52 51 51 53 53 54 Neutral

STATE BANK IND 367.4 365 363 360 370 373 375 Positive

SHRIRAM TRANSPRT 1062.85 1050 1038 1017 1082 1102 1114 Neutral

SOUTH INDIAN BK 13 13 13 13 13 13 13 Positive

SIEMENS LTD 1357.65 1336 1315 1302 1370 1383 1405 Positive

SYNDICATE BANK 41.2 40 40 39 42 43 43 Positive

SHREE CEMENT 21605.25 21380 21153 20956 21803 21999 22226 Positive

SREI INFRASTRUCT 18.25 18 17 17 18 19 19 Positive

SRF LTD 3047.7 3030 3011 2991 3068 3087 3106 Neutral

STRIDES SHASUN L 393.4 389 386 381 397 402 405 Negative

SUZLON ENERGY 5.05 5 5 4 5 5 6 Positive

SUN PHARMA INDU 392.1 390 387 383 397 401 404 Negative

SUN TV NETWORK 510.9 508 505 500 516 521 525 Positive

TATA STEEL LTD 495.3 491 488 482 500 506 509 Negative

TATA COMMUNICATI 463.05 456 449 439 473 483 490 Neutral

TATA CONSULTANCY 2242.65 2232 2220 2210 2254 2264 2276 Negative

TECH MAHINDRA LT 700.6 695 691 686 705 711 715 Negative

TATA ELXSI LTD 914.35 906 896 888 924 932 942 Negative

TATA GLOBAL BEVE 269.65 267 266 263 271 274 276 Negative

TORRENT POWER LT 303.7 299 295 288 310 317 321 Positive

TATA POWER CO 72.15 72 71 70 74 75 76 Neutral

RAMCO CEMENT/THE 787.55 779 773 762 797 807 814 Neutral

TORRENT PHARMA 1545.15 1535 1524 1514 1557 1568 1579 Neutral

TITAN CO LTD 1290.35 1276 1263 1240 1312 1335 1348 Negative

TATA CHEMICALS 617.95 615 613 609 621 625 628 Neutral

TATA MOTORS LTD 165.2 162 159 157 168 171 174 Positive

TV18 BROADCAST L 24.1 24 24 23 24 24 24 Negative

TVS MOTOR CO LTD 432.35 428 425 419 438 444 447 Positive

UNITED BREWERIES 1367.85 1355 1341 1319 1390 1411 1425 Positive

UJJIVAN FINANCIA 295.9 293 290 285 301 306 310 Positive

UNION BANK INDIA 84.85 83 83 81 86 88 88 Positive

UNITED SPIRITS 575 573 569 565 581 585 589 Negative

UPL LTD 698.35 666 633 613 719 739 772 Positive

ULTRATECH CEMENT 4645.35 4588 4530 4492 4684 4722 4781 Positive

VEDANTA LTD 171.05 170 168 166 174 176 178 Neutral

V-GUARD IND LTD 246.95 242 238 235 250 254 258 Positive

VOLTAS LTD 634.95 632 629 624 640 645 649 Negative

WOCKHARDT LTD 372.45 369 366 362 376 380 383 Positive

WIPRO LTD 283.85 283 281 280 286 287 289 Negative

YES BANK LTD 96.25 94 91 87 101 105 108 Negative

ZEE ENTERTAINMENT 356.45 353 349 342 365 371 376 Positive

ICICI Securities Ltd. | Retail Equity Research

Technical Support & Resistance

Support & Resistance

April 2,

ICICI Direct Technical Desk

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East), Mumbai – 400 093

research@icicidirect.com

ICICI Securities Ltd. | Retail Equity Research

Technical Support & Resistance

Support & Resistance

April 2,

Disclaimer

ANALYST CERTIFICATION

We /I, Dharmesh Shah, Nitin Kunte, Ninad Tamhanekar, Pabitro Mukherjee, Vinayak Parmar Research Analysts, authors and the names subscribed to this report,

hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part

of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and

distribution of financial products. ICICI Securities Limited is a SEBI registered Research Analyst with SEBI Registration Number – INH000000990. ICICI Securities

Limited SEBI Registration is INZ000183631 for stock broker. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank

and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management,

etc. (“associates”), the details in respect of which are available on www.icicibank.com

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our

associates might have investment banking and other business relationship with a significant percentage of companies cove red by our Investment Research

Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or

derivatives of any companies that the analysts cover.

The information and opinions in this section have been prepared by ICICI Securities and are subject to change without any notice. The report and information

contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part

or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update

the information herein on reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be reg ulatory,

compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended

temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be

acting in an advisory capacity to this company, or in certain other circumstances.

The research recommendations are based on information obtained from public sources and sources believed to be reliable, but n o independent verification has

been made nor is its accuracy or completeness guaranteed. These research recommendations and information herein is solely for informational purpose and shall

not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. ICICI Securities will

not treat recipients as customers by virtue of their receiving these recommendations. Nothing in this section constitutes investment, legal, accounting and tax

advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions

expressed herein may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial

positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should

independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any

other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of these recommendations. Past

performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before

investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may

be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the

subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned herein during the period prece ding twelve months from

the date of these recommendations for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant

banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage

services from the companies mentioned herein in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of re search report. ICICI Securities or its

associates or its Analysts did not receive any compensation or other benefits from the companies mentioned in the report or t hird party in connection with

preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of interest at the time of

publication of this reports.

It is confirmed that Dharmesh Shah, Nitin Kunte, Ninad Tamhanekar, Pabitro Mukherjee and Vinayak Parmar, Research Analysts gi ving these recommendations

have not received any compensation from the companies mentioned herein in the preceding twelve months.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the company/companies

mentioned herein as of the last day of the month preceding the publication of these research recommendations.

Since Associates (ICICI group companies) of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial

ownership in various companies including the subject company/companies mentioned herein.

It is confirmed that Research Analysts do not serve as an officer, director or employee or advisory board member of the companies mentioned herein.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented herein.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned herein.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report or recommendations are not directed or intended for distribution to, or use by, any person or entity who is a cit izen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject

ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for

sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are require d to inform themselves of and to

observe such restriction

ICICI Securities Ltd. | Retail Equity Research

You might also like

- CIR vs. Primetown Property GroupDocument2 pagesCIR vs. Primetown Property GroupElaine Belle OgayonNo ratings yet

- BSE Sensex Status: World IndicesDocument28 pagesBSE Sensex Status: World IndicesHirendra PatilNo ratings yet

- Client Hunting HandbookDocument105 pagesClient Hunting Handbookc__brown_3No ratings yet

- StockTracker Rev2 OrigDocument149 pagesStockTracker Rev2 OrigPuneet100% (2)

- BigTrade ListDocument12 pagesBigTrade ListDharmesh MistryNo ratings yet

- Zomer Development Company, Inc Vs Special 20th Division of CADocument20 pagesZomer Development Company, Inc Vs Special 20th Division of CACJNo ratings yet

- CPE655 Solid Waste ManagementDocument108 pagesCPE655 Solid Waste ManagementAmirah SufianNo ratings yet

- Osamu Dazai: Genius, But No Saint - The Japan TimesDocument3 pagesOsamu Dazai: Genius, But No Saint - The Japan TimesBenito TenebrosusNo ratings yet

- OBE-Syllabus Photography 2015Document8 pagesOBE-Syllabus Photography 2015Frederick Eboña100% (1)

- Technical Support & Resistance Level AnalysisDocument8 pagesTechnical Support & Resistance Level AnalysisKit MandalNo ratings yet

- Indian Company Net Profits 2012-2014Document46 pagesIndian Company Net Profits 2012-2014Raj Kumar JhaNo ratings yet

- CSR Spending Data Sheet Big 500 Year 2014-15Document42 pagesCSR Spending Data Sheet Big 500 Year 2014-15Parminder SinghNo ratings yet

- Pricetiming - Alpha ListDocument1 pagePricetiming - Alpha Listdodda1981No ratings yet

- Index: AlphabeticalDocument6 pagesIndex: AlphabeticalSiddharth BhattacharyaNo ratings yet

- TrackingDocument6 pagesTrackingpsukhija2No ratings yet

- Cash DataDocument14 pagesCash DataNupur TyagiNo ratings yet

- Alphabet Index Final 9xDocument6 pagesAlphabet Index Final 9xHariharran Addithya Ramakrishnan100% (1)

- Bse EsgDocument32 pagesBse Esgpoojaguptainida1No ratings yet

- MSCI India Index Closing at 1987.98Document16 pagesMSCI India Index Closing at 1987.98bhusanNo ratings yet

- Book 6Document3 pagesBook 6salvi_2079No ratings yet

- Equity Portfolio Performance Overview: 1st JUL - 5th JUL, 2019Document2 pagesEquity Portfolio Performance Overview: 1st JUL - 5th JUL, 20194D EngineeringNo ratings yet

- Avg 22082020Document52 pagesAvg 22082020api-523630792No ratings yet

- Se Name Budget TM Op STK TM MTD Primary TM % Ach Budget MTD Secondary % Ach BudgetDocument58 pagesSe Name Budget TM Op STK TM MTD Primary TM % Ach Budget MTD Secondary % Ach BudgetA MNo ratings yet

- Template Portfolio Analysis2Document145 pagesTemplate Portfolio Analysis2KalpeshNo ratings yet

- Claim Experience 2009 2010 LicDocument3 pagesClaim Experience 2009 2010 LicakchatNo ratings yet

- How to avail 0% installment plan for appliances and electronicsDocument59 pagesHow to avail 0% installment plan for appliances and electronicsJunydAhmedNo ratings yet

- StocksDocument5 pagesStockstemp raoNo ratings yet

- NSE stock market updatesDocument270 pagesNSE stock market updatesராபர்ட் ஆன்றோ ரெனிNo ratings yet

- BSE-Continuous Upper CircuitDocument6 pagesBSE-Continuous Upper CircuitARJUN BANSALNo ratings yet

- CapitalGainLossSummary pcpw055Document6 pagesCapitalGainLossSummary pcpw055Prachi PatwariNo ratings yet

- MARKET CORRECTIONDocument5 pagesMARKET CORRECTIONThiyaga RajanNo ratings yet

- Fundamental Analysis and Stock Picks of Top Auto Ancillary CompaniesDocument10 pagesFundamental Analysis and Stock Picks of Top Auto Ancillary CompaniesHarsh parasher (PGDM 17-19)No ratings yet

- Name of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Document15 pagesName of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Adarsh JainNo ratings yet

- SMA Break Out StocksDocument12 pagesSMA Break Out StocksktanveersapNo ratings yet

- PNL Summary N142943 2021-2022 ReligareDocument6 pagesPNL Summary N142943 2021-2022 ReligareIshika ManwaniNo ratings yet

- CFA Daily Report Feb'10Document187 pagesCFA Daily Report Feb'101nafis1No ratings yet

- Portfolio-1 with February 2022 CE writting opportunityDocument5 pagesPortfolio-1 with February 2022 CE writting opportunityPravin SinghNo ratings yet

- Mentor Level Volunteer Farmer Data ReportDocument2 pagesMentor Level Volunteer Farmer Data ReportVeterinary HospitalTuniNo ratings yet

- 51 Acp-March2015Document3 pages51 Acp-March2015Projects ScholarsDenNo ratings yet

- Awesome BSEXL - V0.1Document225 pagesAwesome BSEXL - V0.1naamhsNo ratings yet

- Stock MarketDocument11 pagesStock MarketMufaddal DaginawalaNo ratings yet

- Share Watch.0Document5 pagesShare Watch.0Shrestha HemNo ratings yet

- 30.04.2023 को जीवन बीमाकर्ताओं का प्रथम वर्ष का प्रीमियम First year premium of Life Insurers as at 30.04.2023Document36 pages30.04.2023 को जीवन बीमाकर्ताओं का प्रथम वर्ष का प्रीमियम First year premium of Life Insurers as at 30.04.2023Ashutosh KumarNo ratings yet

- Indexing - FMCGDocument23 pagesIndexing - FMCGRUTVIKA DHANESHKUMARKUNDAGOLNo ratings yet

- Tara Genset Sundry Debtors ReportDocument6 pagesTara Genset Sundry Debtors ReportABHISHEK JHANo ratings yet

- 003 Formula If Nif and orDocument17 pages003 Formula If Nif and orNitin ChauhanNo ratings yet

- List of Stocks Down More Than 20Document4 pagesList of Stocks Down More Than 20Keshav KhetanNo ratings yet

- Aban Offshore: ABB ACCDocument19 pagesAban Offshore: ABB ACCswamikambliNo ratings yet

- Abm Fibonacci Monday by RobuDocument8 pagesAbm Fibonacci Monday by RobuSiva Gnanam KNo ratings yet

- 07 Findings and ConclusionDocument7 pages07 Findings and ConclusionAmish SoniNo ratings yet

- Project 1 DataDocument236 pagesProject 1 Data825SURYA PRAKASH UMMADISHETTYNo ratings yet

- Swing TradingDocument10 pagesSwing Tradingضیاء المصطفیٰ شکیلNo ratings yet

- 192.168.9.12 Techexcel Railo Tomcat Webapps ROOT Reports History PDF 84 001088 24072023 11485151584670 114955Document1 page192.168.9.12 Techexcel Railo Tomcat Webapps ROOT Reports History PDF 84 001088 24072023 11485151584670 114955Arjun LoharNo ratings yet

- Consolidated Data On Commission and Expenses Paid To Distributors During FY 2020-21 and Additional DisclosuresDocument16 pagesConsolidated Data On Commission and Expenses Paid To Distributors During FY 2020-21 and Additional DisclosuresChandra PrakashNo ratings yet

- Rising Net Cash Flow and Cash From Operating Activity Aug 10Document3 pagesRising Net Cash Flow and Cash From Operating Activity Aug 10KabirNo ratings yet

- Stop Loss 1-Day Equity Close Price Below or 50% of Premium (Buy) Price Comments Lot Size LTPDocument2 pagesStop Loss 1-Day Equity Close Price Below or 50% of Premium (Buy) Price Comments Lot Size LTPSathva SeelanNo ratings yet

- Final Ohlc April EbookDocument24 pagesFinal Ohlc April EbookMakarandNo ratings yet

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDocument12 pagesSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliNo ratings yet

- Bse Stock ListDocument938 pagesBse Stock Listshivaji gungiNo ratings yet

- Book 1Document64 pagesBook 1poojaguptainida1No ratings yet

- Pending CMR 05.02Document1 pagePending CMR 05.02SATISH GOENKANo ratings yet

- Fundamental Analysis of StocksDocument12 pagesFundamental Analysis of Stocksverma vikasNo ratings yet

- 6th Sep 2017 Share DetailsDocument148 pages6th Sep 2017 Share DetailsMadhana Gopal PNo ratings yet

- Bank group-wise gross NPAs, advances and ratiosDocument6 pagesBank group-wise gross NPAs, advances and ratiosPrasad KhandekarNo ratings yet

- Dade Girls SoccerDocument1 pageDade Girls SoccerMiami HeraldNo ratings yet

- Scheme Samsung NT p29Document71 pagesScheme Samsung NT p29Ricardo Avidano100% (1)

- CV - Diego Allendes - Civil EngineerDocument1 pageCV - Diego Allendes - Civil EngineerPari D. ShitPostingNo ratings yet

- IAII FINAL EXAM Maual SET BDocument9 pagesIAII FINAL EXAM Maual SET BClara MacallingNo ratings yet

- ?PMA 138,39,40,41LC Past Initials-1Document53 pages?PMA 138,39,40,41LC Past Initials-1Saqlain Ali Shah100% (1)

- P17P01 Ca019 17 An 101 1260 in DWG 191 - Tus Ins 233 FS 0194 - 0 PDFDocument7 pagesP17P01 Ca019 17 An 101 1260 in DWG 191 - Tus Ins 233 FS 0194 - 0 PDFrenzomcuevaNo ratings yet

- Senguntha KshatriyaDocument34 pagesSenguntha Kshatriyabogar marabuNo ratings yet

- Scaffold Inspection Checklist FINALDocument2 pagesScaffold Inspection Checklist FINALRhannie GarciaNo ratings yet

- Review On Birth Asphyxia by TibinDocument22 pagesReview On Birth Asphyxia by Tibintibinj67No ratings yet

- Flava Works vs. MyVidster, Leaseweb, Voxel - Net, Et All - 4th Amended ComplaintDocument340 pagesFlava Works vs. MyVidster, Leaseweb, Voxel - Net, Et All - 4th Amended ComplaintPhillip BleicherNo ratings yet

- Semi Anual SM Semana 15Document64 pagesSemi Anual SM Semana 15Leslie Caysahuana de la cruzNo ratings yet

- Oblicon Chap 1 5Document15 pagesOblicon Chap 1 5Efrean BianesNo ratings yet

- 9 English Eng 2023 24Document4 pages9 English Eng 2023 24Vikas SinghNo ratings yet

- Assigment 2Document3 pagesAssigment 2Aitor AguadoNo ratings yet

- User's Manual: & Technical DocumentationDocument20 pagesUser's Manual: & Technical DocumentationPODOSALUD HUANCAYONo ratings yet

- UST Medicine I Schedule 2016-2017Document6 pagesUST Medicine I Schedule 2016-2017ina17_eaglerNo ratings yet

- Parallel Worlds ChessDocument2 pagesParallel Worlds ChessRobert BonisoloNo ratings yet

- National Scholars Program 2005 Annual Report: A Growing Tradition of ExcellenceDocument24 pagesNational Scholars Program 2005 Annual Report: A Growing Tradition of ExcellencejamwilljamwillNo ratings yet

- Asma G.SDocument5 pagesAsma G.SAfia FaheemNo ratings yet

- Corporate LendingDocument2 pagesCorporate LendingrubaNo ratings yet

- Notes of Meetings MergedDocument8 pagesNotes of Meetings MergedKreeshnee OreeNo ratings yet

- Lincoln Brewster - MajesticDocument1 pageLincoln Brewster - MajesticdenverintranslationNo ratings yet

- FF6GABAYDocument520 pagesFF6GABAYaringkinkingNo ratings yet

- NajeebRehman 1505 14145 1/AFN ExamplesDocument47 pagesNajeebRehman 1505 14145 1/AFN ExamplesQazi JunaidNo ratings yet