Professional Documents

Culture Documents

Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: Equity

Uploaded by

Deepanjali0 ratings0% found this document useful (0 votes)

5 views12 pagesOriginal Title

22

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views12 pagesSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: Equity

Uploaded by

DeepanjaliCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 12

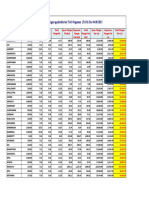

Client Id : N147669

Client Name : SHOURYA MOHAN

Asset Class : equity

Skrip Name Tran Quantity

ALOK INDUS FV1 13,000

AU SMALL FINANCEBANK 230

BANDHAN BANK LIMITED 500

BHARTI INFRATEL LTD 25

BIOCON LTD 580

BIOFIL CHEMICALS 1,681

DCB BANK LIMITED 601

DISH TV INDIA LTD 400

ENGINEERS INDIA FV5 600

EQUITAS SMALL FINBNK 102

FCS SOFTWARE SOL FV1 12,000

FSN E-COMMERCE VENTU 72

FUTURE CONSUMER LTD 01

FUTURE ENTERPRISES 01

FUTURE LIFESTYLE FAS 01

FUTURE RETAIL LIMITE 01

GMM PFAUDLER FV2 12

HAVELLS INDIA FV1 10

HDFC STANDARD LIFE 01

HFCL LIMITED 600

HOUSING DEVLOPMENT 4,501

ICICI PRUDENTIAL LIF 21

INDIAN INFO FV1 10,000

INDUS TOWERS LIMITED 100

L&T FINANCE HOLDINGS 01

LARSEN AND TOUBRO 04

LIFE INSURANCE CORP 48

M&M FIN SERVIC FV2 75

MAHINDRA & MAHI FV5 60

MEDPLUS HEALTH SERVI 18

MIRC ELECTRONICS 300

NALCO LTD F V 5 550

NCL RESEARCH FIN FV1 73,600

NETWORK 18 MEDIA & I 100

NEWGEN SOFTWARE TECH 550

ONE97 COMMUNICATIONS 30

ORIENT GREEN POWER L 10,428

PMC FINCORP LTD FV1 2,400

POWER FINANCE CO LTD 01

RAIL VIKAS NIGAM LTD 75

RBL BANK LIMITED 1,100

RELIANCE COMM LTD 9,000

RELIANCE POWER LTD 1,801

SBI CARDS AND PAYMEN 226

SHYAMKAMAL INV 8,398

SINTEX PLASTICS TECH 01

TATA POWER COMP FV1 350

TATA STEEL LTD FV1 910

TATA TELESERVICES 900

THOMAS COOK FV 1 50

TVS MOTOR COMPANY LT 01

UPL LIMITED 136

URJA GLOBAL FV1 29,000

VIDEOCON INDS 8,500

VODAFONE IDEA LTD 10,501

YES BANK LTD FV2 NEW 5,000

ZEE ENTERTAINMENT 51

0

Open Position Report Aug 22, 2023

Open Positions

Tran Avg Rate Tran Value

31.37 4,07,804.60

203.80 46,874.50

232.94 1,16,467.95

193.48 4,837.00

395.31 2,29,276.92

111.95 1,88,186.49

112.21 67,436.98

17.41 6,962.38

76.95 46,170.65

65.67 6,698.77

4.54 54,442.00

187.50 13,500.00

10.63 10.63

14.94 14.94

78.90 78.90

69.67 69.67

1,628.98 19,547.75

470.27 4,702.70

454.13 454.13

72.82 43,693.97

6.32 28,428.32

535.62 11,248.06

2.77 27,680.00

141.15 14,115.20

59.15 59.15

936.28 3,745.12

949.00 45,552.00

155.39 11,654.06

1,190.34 71,420.11

796.00 14,328.00

17.54 5,263.12

54.30 29,867.18

1.19 87,936.00

43.61 4,361.00

263.40 1,44,870.00

521.03 15,630.98

10.38 1,08,193.26

2.76 6,618.00

81.35 81.35

35.79 2,684.20

139.54 1,53,495.30

3.81 34,318.30

16.64 29,976.14

882.61 1,99,469.42

13.03 1,09,396.74

3.62 3.62

176.56 61,794.48

106.18 96,628.27

172.91 1,55,618.10

68.17 3,408.50

322.81 322.81

743.02 1,01,051.00

14.70 4,26,300.00

5.62 47,749.20

8.91 93,542.72

14.15 70,727.30

179.41 9,149.67

0

Transaction Period

01-APRIL-2022 To 31-MARCH-2023

LTP Market Value

17.15 2,22,950.00

728.75 1,67,612.50

231.90 1,15,950.00

161.75 4,043.75

259.90 1,50,742.00

46.25 77,746.25

115.75 69,565.75

19.05 7,620.00

158.75 95,250.00

86.30 8,802.60

2.45 29,400.00

134.95 9,716.40

0.65 0.65

0.85 0.85

4.85 4.85

3.05 3.05

1,538.95 18,467.40

1,317.25 13,172.50

636.35 636.35

67.90 40,740.00

2.70 12,152.70

547.75 11,502.75

1.87 18,700.00

161.75 16,175.00

123.75 123.75

2,679.75 10,719.00

663.90 31,867.20

288.10 21,607.50

1,548.75 92,925.00

898.50 16,173.00

20.15 6,045.00

88.90 48,895.00

0.70 51,520.00

67.90 6,790.00

968.15 5,32,482.50

856.90 25,707.00

14.75 1,53,813.00

1.70 4,080.00

273.30 273.30

124.75 9,356.25

221.70 2,43,870.00

1.25 11,250.00

17.35 31,247.35

830.40 1,87,670.40

3.42 28,721.16

1.10 1.10

242.95 85,032.50

117.60 1,07,016.00

81.80 73,620.00

115.00 5,750.00

1,353.20 1,353.20

583.95 79,417.20

10.00 2,90,000.00

7.35 62,475.00

7.75 81,382.75

16.95 84,750.00

272.65 13,905.15

Unrealized Gain/Loss

-1,84,854.59

1,20,738.00

-517.95

-793.25

-78,534.92

-1,10,440.24

2,128.77

657.63

49,079.35

2,103.84

-25,042.00

-3,783.60

-9.98

-14.09

-74.05

-66.62

-1,080.35

8,469.80

182.22

-2,953.97

-16,275.62

254.69

-8,980.00

2,059.80

64.60

6,973.88

-13,684.80

9,953.44

21,504.90

1,845.00

781.88

19,027.82

-36,415.96

2,429.00

3,87,612.50

10,076.02

45,619.75

-2,538.00

191.95

6,672.05

90,374.71

-23,068.30

1,271.21

-11,799.02

-80,675.57

-2.52

23,238.03

10,387.74

-81,998.10

2,341.50

1,030.39

-21,633.80

-1,36,300.00

14,725.81

-12,159.97

14,022.70

4,755.48

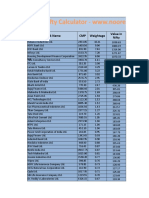

Skrip Name Tran Quantity Tran Avg Rate Tran Value LTP Market Value

ALOK INDUS FV1 13000 31.37 407804.6 17.15 222950

AU SMALL FINANCEBANK 230 203.8 46874.5 728.75 167612.5

BANDHAN BANK LIMITED 500 232.94 116467.95 231.9 115950

BHARTI INFRATEL LTD 25 193.48 4837 161.75 4043.75

BIOCON LTD 580 395.31 229276.92 259.9 150742

BIOFIL CHEMICALS 1681 111.95 188186.49 46.25 77746.25

DCB BANK LIMITED 601 112.21 67436.98 115.75 69565.75

DISH TV INDIA LTD 400 17.41 6962.38 19.05 7620

ENGINEERS INDIA FV5 600 76.95 46170.65 158.75 95250

EQUITAS SMALL FINBNK 102 65.67 6698.77 86.3 8802.6

FCS SOFTWARE SOL FV1 12000 4.54 54442 2.45 29400

FSN E-COMMERCE VENTU 72 187.5 13500 134.95 9716.4

FUTURE CONSUMER LTD 1 10.63 10.63 0.65 0.65

FUTURE ENTERPRISES 1 14.94 14.94 0.85 0.85

FUTURE LIFESTYLE FAS 1 78.9 78.9 4.85 4.85

FUTURE RETAIL LIMITE 1 69.67 69.67 3.05 3.05

GMM PFAUDLER FV2 12 1628.98 19547.75 1538.95 18467.4

HAVELLS INDIA FV1 10 470.27 4702.7 1317.25 13172.5

HDFC STANDARD LIFE 1 454.13 454.13 636.35 636.35

HFCL LIMITED 600 72.82 43693.97 67.9 40740

HOUSING DEVLOPMENT 4501 6.32 28428.32 2.7 12152.7

ICICI PRUDENTIAL LIF 21 535.62 11248.06 547.75 11502.75

INDIAN INFO FV1 10000 2.77 27680 1.87 18700

INDUS TOWERS LIMITED 100 141.15 14115.2 161.75 16175

L&T FINANCE HOLDINGS 1 59.15 59.15 123.75 123.75

LARSEN AND TOUBRO 4 936.28 3745.12 2679.75 10719

LIFE INSURANCE CORP 48 949 45552 663.9 31867.2

M&M FIN SERVIC FV2 75 155.39 11654.06 288.1 21607.5

MAHINDRA & MAHI FV5 60 1190.34 71420.11 1548.75 92925

MEDPLUS HEALTH SERVI 18 796 14328 898.5 16173

MIRC ELECTRONICS 300 17.54 5263.12 20.15 6045

NALCO LTD F V 5 550 54.3 29867.18 88.9 48895

NCL RESEARCH FIN FV1 73600 1.19 87936 0.7 51520

NETWORK 18 MEDIA & I 100 43.61 4361 67.9 6790

NEWGEN SOFTWARE TECH 550 263.4 144870 968.15 532482.5

ONE97 COMMUNICATIONS 30 521.03 15630.98 856.9 25707

ORIENT GREEN POWER L 10428 10.38 108193.26 14.75 153813

PMC FINCORP LTD FV1 2400 2.76 6618 1.7 4080

POWER FINANCE CO LTD 1 81.35 81.35 273.3 273.3

RAIL VIKAS NIGAM LTD 75 35.79 2684.2 124.75 9356.25

RBL BANK LIMITED 1100 139.54 153495.3 221.7 243870

RELIANCE COMM LTD 9000 3.81 34318.3 1.25 11250

RELIANCE POWER LTD 1801 16.64 29976.14 17.35 31247.35

SBI CARDS AND PAYMEN 226 882.61 199469.42 830.4 187670.4

SHYAMKAMAL INV 8398 13.03 109396.74 3.42 28721.16

SINTEX PLASTICS TECH 1 3.62 3.62 1.1 1.1

TATA POWER COMP FV1 350 176.56 61794.48 242.95 85032.5

TATA STEEL LTD FV1 910 106.18 96628.27 117.6 107016

TATA TELESERVICES 900 172.91 155618.1 81.8 73620

THOMAS COOK FV 1 50 68.17 3408.5 115 5750

TVS MOTOR COMPANY LT 1 322.81 322.81 1353.2 1353.2

UPL LIMITED 136 743.02 101051 583.95 79417.2

URJA GLOBAL FV1 29000 14.7 426300 10 290000

VIDEOCON INDS 8500 5.62 47749.2 7.35 62475

VODAFONE IDEA LTD 10501 8.91 93542.72 7.75 81382.75

YES BANK LTD FV2 NEW 5000 14.15 70727.3 16.95 84750

ZEE ENTERTAINMENT 51 179.41 9149.67 272.65 13905.15

209205 13108.53 3483917.61 18751.24 3490794.66

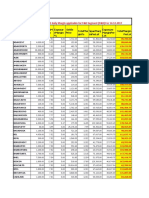

Unrealized Gain/Loss

-184854.59

120738

-517.95

-793.25

-78534.92

-110440.24

2128.77

657.63

49079.35

2103.84

-25042

-3783.6

-9.98

-14.09

-74.05

-66.62

-1080.35

8469.8

182.22

-2953.97

-16275.62

254.69

-8980

2059.8

64.6

6973.88

-13684.8

9953.44

21504.9

1845

781.88

19027.82

-36415.96

2429

387612.5

10076.02

45619.75

-2538

191.95

6672.05

90374.71

-23068.3

1271.21

-11799.02

-80675.57

-2.52

23238.03

10387.74

-81998.1

2341.5

1030.39

-21633.8

-136300

14725.81

-12159.97

14022.7

4755.48

6877.18999999993 0

You might also like

- Term PaperDocument9 pagesTerm Paperkavya surapureddy100% (1)

- New Microsoft Excel WorksheetDocument9 pagesNew Microsoft Excel WorksheetSneha JadhavNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument37 pagesIndex Movement:: National Stock Exchange of India LimitedJayant SharmaNo ratings yet

- Gitanjali Gems Shilpi CableDocument15 pagesGitanjali Gems Shilpi CablestrignentNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument36 pagesIndex Movement:: National Stock Exchange of India Limitedanilkhubchandani9744No ratings yet

- Equity StockDocument4 pagesEquity StockChaitanya EnterprisesNo ratings yet

- Angel SuggestedDocument4 pagesAngel Suggestedmangalraj900No ratings yet

- NSE TOP GAINERSDocument8 pagesNSE TOP GAINERSdewanibipin0% (2)

- Top 50 Indian stocks by market capitalizationDocument18 pagesTop 50 Indian stocks by market capitalizationankur_haldarNo ratings yet

- Top Performing Stocks on NSEDocument33 pagesTop Performing Stocks on NSEAnand ChineyNo ratings yet

- BSE PSU Energy StocksDocument3 pagesBSE PSU Energy StocksYatrikNo ratings yet

- Nifty 100 - Expected Returns (Holding Period of 6-8weeks)Document2 pagesNifty 100 - Expected Returns (Holding Period of 6-8weeks)Sathv100% (1)

- Details of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018Document5 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018mr12323No ratings yet

- Nifty range calculator with expected price changesDocument13 pagesNifty range calculator with expected price changesbrijsingNo ratings yet

- Equity Report 21 Aug To 25 AugDocument6 pagesEquity Report 21 Aug To 25 AugzoidresearchNo ratings yet

- Agustus 2019Document94 pagesAgustus 2019jokoNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument27 pagesIndex Movement:: National Stock Exchange of India LimitedjanuianNo ratings yet

- Mangal Keshav Securities LimitedDocument10 pagesMangal Keshav Securities Limitedsubh2501No ratings yet

- OT Assignment Subham 2Document19 pagesOT Assignment Subham 2S SubhamNo ratings yet

- Top Indian stocks 52-week performanceDocument8 pagesTop Indian stocks 52-week performanceSrikanth MarneniNo ratings yet

- Equity Weekly Report 8 May To 12 MayDocument6 pagesEquity Weekly Report 8 May To 12 MayzoidresearchNo ratings yet

- Growth at Reasonable Price 12 Jun 2023 1218Document1 pageGrowth at Reasonable Price 12 Jun 2023 1218spahujNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument36 pagesIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaNo ratings yet

- Top 100 Stocks 1403Document5 pagesTop 100 Stocks 1403Srikanth MarneniNo ratings yet

- Equity Report 26 June To 30 JuneDocument6 pagesEquity Report 26 June To 30 JunezoidresearchNo ratings yet

- Template Portfolio Analysis2Document145 pagesTemplate Portfolio Analysis2KalpeshNo ratings yet

- Equity Report 10 July To 14 JulyDocument6 pagesEquity Report 10 July To 14 JulyzoidresearchNo ratings yet

- Les Indices BoursierDocument6 pagesLes Indices BoursierkhalifatoNo ratings yet

- MarginDocument5 pagesMarginvenkatesh19701No ratings yet

- ZerodhaDocument89 pagesZerodhaAarti ParmarNo ratings yet

- 01042010Document9 pages01042010Kishore KunduNo ratings yet

- Nifty Calculator Jan 2023Document19 pagesNifty Calculator Jan 2023Shovan GhoshNo ratings yet

- Equity Report 22 May To 26 MayDocument6 pagesEquity Report 22 May To 26 MayzoidresearchNo ratings yet

- Work Stock Market Sheet LatestDocument4 pagesWork Stock Market Sheet Latestanand kumar chaubeyNo ratings yet

- Equity Weekly ReportDocument6 pagesEquity Weekly ReportzoidresearchNo ratings yet

- Nifty 50 sectors show Mild to Super Bearish trendDocument35 pagesNifty 50 sectors show Mild to Super Bearish trendArnab SadhukhanNo ratings yet

- 01062020Document14 pages01062020Kishore KunduNo ratings yet

- 52wkhigh Scripcode LTP Diff Industry Other%Age Foreign%AgeDocument2 pages52wkhigh Scripcode LTP Diff Industry Other%Age Foreign%AgeShahNo ratings yet

- Bank Risk Weighted Capital Ratios in 2005Document6 pagesBank Risk Weighted Capital Ratios in 2005Talha A SiddiquiNo ratings yet

- All Shares Index (08!08!17)Document6 pagesAll Shares Index (08!08!17)Marc AlamoNo ratings yet

- B2Document14 pagesB2marathi techNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 22, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 22, 2012)Manila Standard TodayNo ratings yet

- Financial Ratio Analysis - BMDocument18 pagesFinancial Ratio Analysis - BMKrishnamoorthy VijayalakshmiNo ratings yet

- Sr. No Security Symbol Security NameDocument7 pagesSr. No Security Symbol Security Nameankit1302No ratings yet

- Intraday Traing Strategies Open High Low Top Gainers Top Index Top F&O 52 High Low Day High Low Gap Up 15 Min CandleDocument4 pagesIntraday Traing Strategies Open High Low Top Gainers Top Index Top F&O 52 High Low Day High Low Gap Up 15 Min CandleGeorge Khris DebbarmaNo ratings yet

- Historic Data Nifty50 9THJULYDocument3 pagesHistoric Data Nifty50 9THJULYsriniaithaNo ratings yet

- Bel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeDocument8 pagesBel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeVijayNo ratings yet

- Pricelist 15th DecDocument2 pagesPricelist 15th DecheyzaraNo ratings yet

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeDocument4 pagesSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 27, 2012)Manila Standard TodayNo ratings yet

- Presentation Title and SubtitleDocument24 pagesPresentation Title and Subtitlemoonlight3t31No ratings yet

- Value Research Stock AdvisorDocument5 pagesValue Research Stock AdvisortansnvarmaNo ratings yet

- Change in Open Interest of Nifty stocksDocument24 pagesChange in Open Interest of Nifty stockskselvakumaran9917No ratings yet

- PNL Summary N142943 2021-2022 ReligareDocument6 pagesPNL Summary N142943 2021-2022 ReligareIshika ManwaniNo ratings yet

- Monedas Con Buen PotencialDocument1 pageMonedas Con Buen PotencialDanny Daniel MatosNo ratings yet

- Private LTD CompaniesDocument16 pagesPrivate LTD CompaniesanjankatamNo ratings yet

- Details of Daily Margin Applicable For F&O Segment (F&O) For 14.12.2017Document6 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 14.12.2017Rasmi RanjanNo ratings yet

- Symbol % CHG in OI (Contracts) : 06-Sep 05-SepDocument27 pagesSymbol % CHG in OI (Contracts) : 06-Sep 05-Sepkselvakumaran9917No ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- CAM License Exam Prep PPDocument18 pagesCAM License Exam Prep PPLilliam TorresNo ratings yet

- Philippine Business Course SyllabusDocument11 pagesPhilippine Business Course SyllabusJerrick Ivan YuNo ratings yet

- Econ 204 - Dated Syllabus Fall 2015Document3 pagesEcon 204 - Dated Syllabus Fall 2015Cedric KenneyNo ratings yet

- How To Open A US Bank Account As A Tourist - Non Resident - Backpack MeDocument58 pagesHow To Open A US Bank Account As A Tourist - Non Resident - Backpack MecsanchezptyNo ratings yet

- Capitalization TableDocument10 pagesCapitalization TableDiego OssaNo ratings yet

- Securities Fraud, Stock Price Valuation, and Loss Causation: Toward A Corporate Finance-Based Theory of Loss CausationDocument5 pagesSecurities Fraud, Stock Price Valuation, and Loss Causation: Toward A Corporate Finance-Based Theory of Loss CausationMoin Max ReevesNo ratings yet

- Bid Evaluation ReportDocument4 pagesBid Evaluation ReportSafi Zabihullah SafiNo ratings yet

- Book Keeping: Form Two Midterm Examination March 2020Document5 pagesBook Keeping: Form Two Midterm Examination March 2020Mohamed NgundeNo ratings yet

- Madura GarmentsDocument41 pagesMadura GarmentsAnonymous 7xmMjaJA1No ratings yet

- Internship Bidv BoDocument21 pagesInternship Bidv BoManh Nguyen100% (2)

- Management Basics PDFDocument14 pagesManagement Basics PDFanissaNo ratings yet

- Sennholz - Money and Freedom (1985)Document99 pagesSennholz - Money and Freedom (1985)FiestaNo ratings yet

- Pipe Bender MachineDocument3 pagesPipe Bender MachineNaman PrajapatiNo ratings yet

- Lindberg Phil. vs. City of MakatiDocument15 pagesLindberg Phil. vs. City of Makatixx_stripped52No ratings yet

- Kualitas Pelayanan Keperawatan Di Rumah Sakit Umum Daerah (Rsud) Kota BaubauDocument8 pagesKualitas Pelayanan Keperawatan Di Rumah Sakit Umum Daerah (Rsud) Kota BaubauAmaNo ratings yet

- Chapter 1-3 Apbp Manufacturing CompanyDocument38 pagesChapter 1-3 Apbp Manufacturing CompanySweathzel Cabarrubias GutierrezNo ratings yet

- Globalization processes and impactsDocument16 pagesGlobalization processes and impactsYANAH GRACE LLOVITNo ratings yet

- Full Download Advanced Accounting 9th Edition Hoyle Solutions ManualDocument35 pagesFull Download Advanced Accounting 9th Edition Hoyle Solutions Manualjacksongubmor100% (25)

- Case Study 6 AccentureDocument3 pagesCase Study 6 AccentureYash BansalNo ratings yet

- Research Methodology - FinalpptDocument491 pagesResearch Methodology - FinalpptNithin KumarNo ratings yet

- Contact With The BuyerDocument2 pagesContact With The Buyeraleena raviNo ratings yet

- MPPL-02Project Management PDFDocument21 pagesMPPL-02Project Management PDFbaraNo ratings yet

- AcknowledgementDocument7 pagesAcknowledgementasmshihabNo ratings yet

- Springfield Interchange Improvement ProjectDocument21 pagesSpringfield Interchange Improvement ProjectBobby Boris50% (2)

- How To Find A Million Dollar Amazon ProductDocument78 pagesHow To Find A Million Dollar Amazon ProductSergiuFuiorNo ratings yet

- Corp. AccountingDocument214 pagesCorp. Accountingayxan0013No ratings yet

- Kaizen CostingDocument21 pagesKaizen CostingAustin OliverNo ratings yet

- Tuazon v. Heirs of Bartolome RamosDocument2 pagesTuazon v. Heirs of Bartolome RamosAngelica Abalos100% (1)

- EQ 5D 3L User Guide - Version 6.0 PDFDocument34 pagesEQ 5D 3L User Guide - Version 6.0 PDFAde Yasinta DewiNo ratings yet

- The Polly Peck AffairDocument5 pagesThe Polly Peck AffairAndreea AxenteNo ratings yet