Professional Documents

Culture Documents

Estate Tax PDF

Estate Tax PDF

Uploaded by

Kulet 123Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estate Tax PDF

Estate Tax PDF

Uploaded by

Kulet 123Copyright:

Available Formats

"Annex B-3"

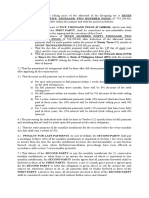

ONETT COMPUTATION SHEET

ESTATE TAX

Revenue Region No. ______ , Revenue District Office No. ______ - _______________________________

NAME OF TAXPAYER: Estate of TIN:

RESIDENCE OF DECEDENT: DATE OF DEATH:

(at the time of Death)

NAME OF EXEC./ADMIN./HEIR: TIN:

ADDRESS: DUE DATE (ET):

COMPUTATION DETAILS

PER AUDIT PER REVIEW

PARTICULARS EXCLUSIVE CONJUGAL TOTAL TOTAL

REAL PROPERTIES (Schedule 1) P P P P

PERSONAL PROPERTIES (Sum of Sched. 2 & 3)

TAXABLE TRANSFERS (Schedule 4)

GROSS ESTATE P P P

LESS: DEDUCTIONS

FUNERAL EXPENSES P P

JUDICIAL EXPENSES

CLAIMS AGAINST THE ESTATE

CLAIMS AGAINST INSOLVENT PERSON

UNPAID MORTGAGES

TRANSFERS FOR PUBLIC USE

PROPERTY PREVIOUSLY TAXED (vanishing deduction)

OTHERS

TOTAL P P

FAMILY HOME

STANDARD DEDUCTION

MEDICAL EXPENSES

OTHERS

TOTAL DEDUCTIONS P P

NET ESTATE P P

Less: Share of Surviving Spouse - (Schedule A)

NET TAXABLE ESTATE P P

ESTATE TAX DUE P P

LESS: Tax Paid per Return, if a return was filed ----------------------------------------------------------------

--------------------------------------------------------------------------------------------------------------

TAX PAYABLE P P

P

Add: 25% Surcharge

Interest ( to )

Compromise Penalty P P

TOTAL AMOUNT PAYABLE ------------------------------------------------------------------------------------------------ P P

SCHEDULE A - COMPUTATION OF SHARE OF SURVIVING SPOUSE

Gross Conjugal Estate P P

Less: Total Conjugal Deductions

Net Conjugal Estate

Share of Surviving Spouse (Net Conjugal Estate / 2) P P

Remarks:

To be accomplished by ONETT Team. Payment Verified by: To be accomplished upon review.

Computed by: Reviewed by:

ONETT Officer ONETT Member/ Collection Section Chief, Assessment Div.

(Signature Over Printed Name) OR No. Tax Type Date of Payment (Signature Over Printed Name)

Approved by: Approved by:

Head, ONETT Team Regional Director

(Signature Over Printed Name) (Signature Over Printed Name)

Reference:

The BIR is not precluded from assessing and collecting any deficiency internal revenue tax(es) that maybe found from the taxpayer after examination or review.

CONFORME:

TAXPAYER/AUTHORIZED REPRESENTATIVE Telephone No. Date

(Signature Over Printed Name)

Instruction: Prepare in duplicate and ascertain that ONETT Computation Sheet is signed by Head ONETT Team before release to taxpayer.

Please attach additional sheet, if necessary.

DETAILS OF PROPERTY:

SCHEDULE 1 - REAL PROPERTIES

OCT/TCT Tax Declaration No. Zonal Value (ZV) Fair Market Value FMV whichever is higher

(TD)

LOCATION CLASS. AREA

CCT No. FMV per BIR (FMV) per TD CONJUGAL EXCLUSIVE

TOTAL P P

PERSONAL PROPERTIES

SCHEDULE 2 - SHARES OF STOCKS

No. of Fair Market FMV whichever is higher

Name of Corp. Stock Cert. No.

Shares Value CONJUGAL EXCLUSIVE

TOTAL P P

SCHEDULE 3 - OTHER PERSONAL PROPERTIES

Fair Market Value

Particulars

Exclusive Conjugal / Communal

TOTAL P P

SCHEDULE 4 - TAXABLE TRANSFERS

Fair Market Value

Particulars

Exclusive Conjugal / Communal

TOTAL P P

You might also like

- BDO Requirements For Claim To Account of Deceased DepositorDocument2 pagesBDO Requirements For Claim To Account of Deceased DepositorANDI CastroNo ratings yet

- Affidavit of Quitclaim 2023Document1 pageAffidavit of Quitclaim 2023Joan Yala SumauangNo ratings yet

- Feasibility Study of A Bank in Canlaon CityDocument136 pagesFeasibility Study of A Bank in Canlaon CityMJ Tan89% (18)

- Omnibus Sworn StatementDocument3 pagesOmnibus Sworn StatementRICHBIANNo ratings yet

- Zonal ValuesDocument65 pagesZonal ValuesAnonymous qsQ33mY0% (2)

- Computation Details: Ali Hassan M. Lucman Jr. Hermeno A. PalamineDocument1 pageComputation Details: Ali Hassan M. Lucman Jr. Hermeno A. PalamineKobi SaibenNo ratings yet

- Write - Off Sample CasesDocument16 pagesWrite - Off Sample CasesLiDdy Cebrero BelenNo ratings yet

- FM-CSVlrd-10 ACCREDITATION AFFIDAVIT OF UNDERTAKING Rev 0 April 30 2018Document1 pageFM-CSVlrd-10 ACCREDITATION AFFIDAVIT OF UNDERTAKING Rev 0 April 30 2018mark jefferson borromeoNo ratings yet

- SMV2017.2 Final Draft-1 PDFDocument72 pagesSMV2017.2 Final Draft-1 PDFJeng GacalNo ratings yet

- P87 Tax Relief For Expenses of EmploymentDocument4 pagesP87 Tax Relief For Expenses of EmploymentKen Smith0% (1)

- Maldives Law of Public Finances 2006 PDFDocument17 pagesMaldives Law of Public Finances 2006 PDFNabil RASHEED100% (1)

- Rmo15 03anxb3Document21 pagesRmo15 03anxb3Maureen PerezNo ratings yet

- Affidavit For Claiming Funeral BenefitDocument4 pagesAffidavit For Claiming Funeral BenefitRobin NicoNo ratings yet

- Affidavit of QuitclaimDocument2 pagesAffidavit of QuitclaimSheila Arenajo ArtilleroNo ratings yet

- RDO No. 52 - Paranaque CityDocument197 pagesRDO No. 52 - Paranaque CityKarla KatigbakNo ratings yet

- APPLICATION FOR LAND TRANSFER CLEARANCE - DAR.Heirs of Atinyao.6.2022Document2 pagesAPPLICATION FOR LAND TRANSFER CLEARANCE - DAR.Heirs of Atinyao.6.2022deth shot0% (1)

- Joint Affidavit-of-Transferor-Transferee-DAR-AO-4-daniel MarzanDocument1 pageJoint Affidavit-of-Transferor-Transferee-DAR-AO-4-daniel MarzanMer Cy100% (1)

- Annex C 0621-EADocument2 pagesAnnex C 0621-EAMELLICENT LIANZA100% (1)

- Easement of Right of WayDocument2 pagesEasement of Right of Wayiris_iris100% (1)

- Aff Transferro-Ree-1Document2 pagesAff Transferro-Ree-1Anonymous kJPBOi0HNo ratings yet

- Affidavit of UndertakingDocument2 pagesAffidavit of UndertakingMA. JEANETTE TOLENTINONo ratings yet

- Deed of Extra-Judicial Settlement and PartitionDocument2 pagesDeed of Extra-Judicial Settlement and Partitionrjpogikaayo100% (1)

- Affidavit of ParaphernalDocument1 pageAffidavit of ParaphernalKyle MondejarNo ratings yet

- Fifth Avenue Property Dev. Corp.: Onett Computation SheetDocument1 pageFifth Avenue Property Dev. Corp.: Onett Computation SheetLaurenNo ratings yet

- Deed of Absolute Sale2Document34 pagesDeed of Absolute Sale2jimmy_andangNo ratings yet

- LRA Circular No 10-2020 - Official List of Documents Required For Registration of Sale of Registerd and Unregistered LandsDocument2 pagesLRA Circular No 10-2020 - Official List of Documents Required For Registration of Sale of Registerd and Unregistered LandsEdwin SegayaNo ratings yet

- Declaration of Heirship With SPA To Sell The Property AdjudicatedDocument2 pagesDeclaration of Heirship With SPA To Sell The Property AdjudicatedJoemar CalunaNo ratings yet

- RDO No. 44 - Taguig-Pateros4850195872301349928Document428 pagesRDO No. 44 - Taguig-Pateros4850195872301349928Karla Katigbak100% (1)

- Eastwest Foreclosed Properties For Sale April 14 2023Document16 pagesEastwest Foreclosed Properties For Sale April 14 2023Coleen Navarro-Rasmussen0% (1)

- Special Power of Attorney (MULTIPLE)Document2 pagesSpecial Power of Attorney (MULTIPLE)Har RizNo ratings yet

- Ibp Surigao Del Sur Chapter Notarial Fees: (Revised Rates)Document1 pageIbp Surigao Del Sur Chapter Notarial Fees: (Revised Rates)DonnaManlangitNo ratings yet

- Revised MOA Paul Andrew Pilapil Lot 1181-BDocument3 pagesRevised MOA Paul Andrew Pilapil Lot 1181-BttunacaoNo ratings yet

- Waiver and Relinquishment of Rights: AffiantDocument2 pagesWaiver and Relinquishment of Rights: AffiantBayani Kamporedondo50% (2)

- Sample SPA - To Sell Real Property (Exclusive)Document3 pagesSample SPA - To Sell Real Property (Exclusive)Chevrolie Maglasang-IsotoNo ratings yet

- RA 7160 Situs of The Tax - IRRDocument71 pagesRA 7160 Situs of The Tax - IRRErnie F. CanjaNo ratings yet

- Contract To Sell - ELENO G. SANCHEZDocument2 pagesContract To Sell - ELENO G. SANCHEZBarn CabsNo ratings yet

- Pantawid Pasada Program Recipients - Partial List PDFDocument201 pagesPantawid Pasada Program Recipients - Partial List PDFTaek WoonNo ratings yet

- RDO-Zarraga, IloiloDocument823 pagesRDO-Zarraga, IloiloDoni June Almio100% (1)

- RDO No. 4 - Calasiao, West Pangasinan 2Document1,416 pagesRDO No. 4 - Calasiao, West Pangasinan 2Jeric Angelo Galon100% (4)

- Omnibus Sworn Statement: AffidavitDocument3 pagesOmnibus Sworn Statement: AffidavitNoah R. LobitanaNo ratings yet

- Affidavit of AdjudicationDocument5 pagesAffidavit of AdjudicationRickyCheryll Bay AmparoNo ratings yet

- Extrajudicial Settlement of The Estate of The Late Angel Ragasa With Consolidation of Titles and Waiver of RightsDocument3 pagesExtrajudicial Settlement of The Estate of The Late Angel Ragasa With Consolidation of Titles and Waiver of Rightstheresa olarveNo ratings yet

- Merville Contract To SellDocument6 pagesMerville Contract To SellKristine DinoNo ratings yet

- Affidavit of Discrepancy - CHONA MARTINO DELADocument1 pageAffidavit of Discrepancy - CHONA MARTINO DELAHadji HrothgarNo ratings yet

- 1701A Annual Income Tax ReturnDocument2 pages1701A Annual Income Tax ReturnJaneth Tamayo NavalesNo ratings yet

- Geodetic Engineer's Report On Relocation SurveyDocument5 pagesGeodetic Engineer's Report On Relocation SurveyMalson GutierrezNo ratings yet

- FS Spa EjsDocument2 pagesFS Spa EjsMarcus GilmoreNo ratings yet

- RDO No. 80 - Mandaue City, CebuDocument798 pagesRDO No. 80 - Mandaue City, CebuCecil GubaNo ratings yet

- CONTRACT TO SELL ExampleDocument3 pagesCONTRACT TO SELL ExampleJanine AranasNo ratings yet

- BIR Ruling No. OT-026-20 (RMO 9-14)Document4 pagesBIR Ruling No. OT-026-20 (RMO 9-14)Hailin QuintosNo ratings yet

- Final Revised Petition Issuance of New OCT Divinagracia Hombrebueno 5Document5 pagesFinal Revised Petition Issuance of New OCT Divinagracia Hombrebueno 5Amelyn Albitos-Ylagan MoteNo ratings yet

- UNDERTAKING MeralcoDocument3 pagesUNDERTAKING MeralcoFaye100% (2)

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Affidavit To SegregateDocument1 pageAffidavit To SegregateKristian Paolo De CastroNo ratings yet

- MOA - Stay in Property-SampleDocument2 pagesMOA - Stay in Property-SampleJean Gorospe100% (1)

- EXTRAJUDICIAL SETTLEMENT With Absolute SaleDocument2 pagesEXTRAJUDICIAL SETTLEMENT With Absolute SaleGlenn Lapitan CarpenaNo ratings yet

- Exibit Aa - Doas-UnilateralDocument2 pagesExibit Aa - Doas-UnilateralMaia Castañeda33% (3)

- Joint Affidavit of Two Disintered PersonDocument2 pagesJoint Affidavit of Two Disintered Personpaolo llegoNo ratings yet

- MemberChangeInformation V06Document2 pagesMemberChangeInformation V06joy barrameda50% (2)

- Rmo15 03anxb1 Onett Computation Sheet CGTDocument3 pagesRmo15 03anxb1 Onett Computation Sheet CGTKenneth SantosNo ratings yet

- ONETT For Sale of Real Property Classified As Ordinary AssetDocument1 pageONETT For Sale of Real Property Classified As Ordinary Assetd-fbuser-49417072No ratings yet

- Rmo15 03anxb PDFDocument1 pageRmo15 03anxb PDFAM CruzNo ratings yet

- Onett Computation SheetDocument1 pageOnett Computation SheetBreahziel ParillaNo ratings yet

- Mgt201 Solved SubjectiveDocument17 pagesMgt201 Solved Subjectivezahidwahla1No ratings yet

- Book Keeping & Accounts/Series-2-2007 (Code2006)Document12 pagesBook Keeping & Accounts/Series-2-2007 (Code2006)Hein Linn Kyaw100% (2)

- Smu Mba 3RD Sem Project ManagementDocument16 pagesSmu Mba 3RD Sem Project ManagementThomDeltaNo ratings yet

- RR No. 03-98Document18 pagesRR No. 03-98fatmaaleahNo ratings yet

- Revision of Published Accounts Format With Selected Mfrs Reference-May2019Document12 pagesRevision of Published Accounts Format With Selected Mfrs Reference-May2019Amin OthmanNo ratings yet

- Accounting Business CaseDocument3 pagesAccounting Business Case當真静花No ratings yet

- Prudential Financial Inc BondDocument2 pagesPrudential Financial Inc BonddroidNo ratings yet

- Government Intervention in The Economy Pros and ConsDocument3 pagesGovernment Intervention in The Economy Pros and ConsJenniferNo ratings yet

- Institutions IN Planning: Rizal Technological UniversityDocument13 pagesInstitutions IN Planning: Rizal Technological Universityjeffrey100% (1)

- Monetary PolicyDocument23 pagesMonetary PolicyManjunath ShettigarNo ratings yet

- Service TaxDocument239 pagesService TaxG Subramaniam100% (1)

- Chapter 05 - AnswerDocument36 pagesChapter 05 - AnswerAgentSkySkyNo ratings yet

- Mortgage Calculator: Karl Jeacle'sDocument2 pagesMortgage Calculator: Karl Jeacle'sScott SweeneyNo ratings yet

- Act 1858 - Real Property Act (Torrens System)Document44 pagesAct 1858 - Real Property Act (Torrens System)Romeo A. Garing Sr.100% (1)

- 125658-1997-China Banking Corp. v. Court of AppealsDocument15 pages125658-1997-China Banking Corp. v. Court of AppealsKristine FayeNo ratings yet

- Subdivision DevelopmentDocument86 pagesSubdivision DevelopmentYen055100% (3)

- Procedure For Private Placement and AllotmentDocument2 pagesProcedure For Private Placement and AllotmentNithya GaneshNo ratings yet

- PagibigDocument16 pagesPagibigDyan Grace CristalNo ratings yet

- Icici Bank: E-Finance For Development - An Indian PerspectiveDocument33 pagesIcici Bank: E-Finance For Development - An Indian Perspectivewasi28No ratings yet

- Dealogic Global Project Finance Rev-2009Document12 pagesDealogic Global Project Finance Rev-2009rorourkeNo ratings yet

- No Akun Nama Akun 1-0000 Aset (Assets)Document2 pagesNo Akun Nama Akun 1-0000 Aset (Assets)nurfaidah khoirunisaNo ratings yet

- Chapter 2 Oblicon ReviewerDocument7 pagesChapter 2 Oblicon ReviewerPetrelle RodrigoNo ratings yet

- How To Approach BanksDocument3 pagesHow To Approach BanksCh M KashifNo ratings yet

- 37 Solving Word QuestionsDocument16 pages37 Solving Word Questionsapi-299265916No ratings yet

- A11 Prohibition of Interest Does It Make SenseDocument28 pagesA11 Prohibition of Interest Does It Make Senseadrhm100% (2)

- Estate and Donor'sDocument20 pagesEstate and Donor'sBar2012No ratings yet

- The Driver Business Plan2Document16 pagesThe Driver Business Plan2AhmedHassanSharkasNo ratings yet