Professional Documents

Culture Documents

Tyndall Furniture Company (A)

Uploaded by

Procusto LOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tyndall Furniture Company (A)

Uploaded by

Procusto LCopyright:

Available Formats

case

20 Tyndall Furniture

Company (A)

Greg Procter, vice-president of marketing for the Tyndall Furniture Company, knew

that the single most important marketing decision a company made was the selec-

tion of products and markets to serve. He was acutely aware of the need to focus his

firm’s resources because sales growth in the most recent period had slowed signifi-

cantly. Profits were also below the industry average. Further complicating the task

he faced were the dramatic changes going on in the industry. He was most

concerned about the increasing competition at the retail level. A major problem was

the recent popularity of galleries in the retail store. He had to decide just where he

would marshall his energies, both on products and on markets.

Company Background

Established in 1898 by Henry H. Tyndall, the company remained a family-owned

business until 1963 when it was bought out by Berkron Industries Inc., a large

conglomerate with interests in textiles, chemicals, food, clothing, retailing and,

more recently, financial services. Although predominantly based in North America,

Berkron also has interests in Australasia and Europe.

Although the company had in the past been an above-average profit earner within

the furniture industry as a whole, in recent years its performance had declined

(Exhibit 1), a fact that led to the appointment of Matt Culley as chief executive

officer two years before. As with most markets, the furniture industry was

becoming increasingly more competitive and witnessing significant changes in both

products and market outlets (Exhibit 2).

Sales of the company had shown significant growth in recent years but slowed

dramatically in the most recently completed year (Exhibit 2). Productivity increases

and judicious cost cutting, combined with some advantageous product mix changes,

kept net profits growing. Unfortunately, profitability as measured by net profit

percentage and return on total assets was still below the industry average. It was felt

This case was prepared by Professors W. L. Berry (Ohio State University), T. J. Hill (University of Oxford), J. E. Klomp-

maker (University of North Carolina) and W. G. Morrissey (North Carolina State University) as a basis for class discussion

rather than to illustrate either effective of ineffective handling of an administrative situation. © Professor W. L. Berry,

Professor J. E. Klompmaker, Professor W. G. Morrissey or AMD Publishing (UK). Enquiries in the USA to Zip Publishing,

1634 N. High Street, Columbus, Ohio 43201.

531

T. Hill, Manufacturing Strategy

© Terry Hill 2000

532 M A N U FA C T U R I N G S T R AT E G Y : T E X T A N D C A S E S

that the increasingly competitive nature of the industry was largely responsible for

this below-average performance.

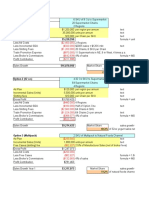

Exhibit 1 Furniture industry comparisons (per cent)

Current year minus

Companies Current

4 3 2 1 year

Tyndall

Sales 100.0 100.0 100.0 100.0 100.0

Cost of goods sold 79.1 78.3 78.3 79.2 78.1

Net profit before tax 4.8 3.7 4.4 3.5 4.2

Return on total assets 5.4 5.1 6.5 6.0 7.1

Return on investment – 8.6 9.0 9.4 10.5

Sales growth – 10.1 13.7 13.3 4.1

Average all case goods companies

Sales 100.0% 100.0% 100.0% – –

Cost of goods sold 75.9 75.2 76.7 n.a. n.a.

Net profit before tax 7.7 7.4 7.3 n.a. n.a.

Return on total assets n.a. n.a. 7.0 n.a. n.a.

Average all furniture companies

Sales 100.0% 100.0% 100.0% – –

Cost of goods sold 75.6 74.6 75.1 n.a. n.a.

Net profit before tax 7.6 8.3 8.4 n.a. n.a.

Return on total assets 8.2 8.7 8.9 n.a. n.a.

Note

n.a. signifies that the particular industry information is not available.

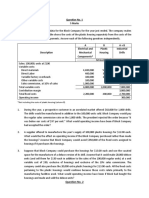

Exhibit 2 Tyndall sales analysis

Current year minus Current

Market types

2 1 year

Small chains

Sales ($) 1 188 189 1 468 848 1 389 077

Number of outlets 14 14 14

Small independents

Sales ($) 19 417 109 20 005 636 18 162 589

Number of outlets 577 594 601

Large independents

Sales ($) 1 504 000 1 841 000 1 742 000

Number of outlets 5 5 5

Galleries

Sales ($) 7 655 279 8 534 630 10 307 532

Number of outlets 48 50 50

Mom and pop stores

Sales ($) 6 813 000 4 288 000 4 921 200

Number of outlets 1 365 1 126 883

Mass merchandiser

Sales ($) 5 576 000 5 285 000 6 242 400

Number of outlets 1 1 1

Total sales ($) 42 153 577 41 423 114 42 764 798

Total outlets 2 010 1 790 1 554

You might also like

- Economic Analysis - MM2Document4 pagesEconomic Analysis - MM2Akanksha TiwariNo ratings yet

- G. VINOD - 12134 Samir Parandkar - 12159 K Gomathi Shankar - 12022 Abhishek Nair - 12063 Aditya Todi - 12123 MOHD. KHATIB - 12032Document16 pagesG. VINOD - 12134 Samir Parandkar - 12159 K Gomathi Shankar - 12022 Abhishek Nair - 12063 Aditya Todi - 12123 MOHD. KHATIB - 12032moekhatibNo ratings yet

- Case Study of American Box CompanyDocument11 pagesCase Study of American Box CompanyChirag PugaliyaNo ratings yet

- ROI measures and profitability ratiosDocument6 pagesROI measures and profitability ratiosawaischeemaNo ratings yet

- Fischer Price ToysDocument11 pagesFischer Price ToysAvijit BanerjeeNo ratings yet

- Absorption and Marginal CostingDocument25 pagesAbsorption and Marginal CostingMehwish ziadNo ratings yet

- NextRetail Caseclubucl@Document12 pagesNextRetail Caseclubucl@grace.fengNo ratings yet

- Question 1-1-1Document14 pagesQuestion 1-1-1Aqsa AnumNo ratings yet

- CFM Case PDFDocument12 pagesCFM Case PDFnitesh sharmaNo ratings yet

- WalmartcaseDocument30 pagesWalmartcaseBarret RobisonNo ratings yet

- Tonka Corporation: Name Student IdDocument17 pagesTonka Corporation: Name Student IdMd. Mustakim Uddin MishuNo ratings yet

- Gross Profit Variation Analysis: AbstractDocument5 pagesGross Profit Variation Analysis: AbstractHarrah Mitzi Cortes LarinoNo ratings yet

- Analyzing Financial Statements and Key Profitability RatiosDocument15 pagesAnalyzing Financial Statements and Key Profitability RatiosMohammad Al AkoumNo ratings yet

- Dominos Pizza Group PLC Preliminary Results HighlightsDocument46 pagesDominos Pizza Group PLC Preliminary Results Highlights11pintu11No ratings yet

- GINO SA: Optimising Distribution Channels in ChinaDocument44 pagesGINO SA: Optimising Distribution Channels in ChinaRohit MahadevNo ratings yet

- VALUE For All Seasons: Annual ReportDocument52 pagesVALUE For All Seasons: Annual Reportbillroberts981No ratings yet

- Unit Four: Measuring Mix and Yield VariancesDocument6 pagesUnit Four: Measuring Mix and Yield VariancesTammy 27100% (1)

- Accounting for Managers: Calculating Break-Even PointsDocument123 pagesAccounting for Managers: Calculating Break-Even PointsAmanuel GirmaNo ratings yet

- Basics of Financial AnalysisDocument29 pagesBasics of Financial AnalysisOman Sher100% (1)

- CMKT 300 2021 Module 4 Brand MetricsDocument28 pagesCMKT 300 2021 Module 4 Brand MetricsHồng KhanhNo ratings yet

- ACC 203 Ch06 SolutionDocument12 pagesACC 203 Ch06 Solutionomaritani2005No ratings yet

- Piedmont Fasteners Break Even AnalysisDocument9 pagesPiedmont Fasteners Break Even AnalysisAi Lyn100% (1)

- BUS Tutorial 4 - Financial Statement 19Document4 pagesBUS Tutorial 4 - Financial Statement 19Setsuna TeruNo ratings yet

- The Home Depot IncDocument12 pagesThe Home Depot IncKhushbooNo ratings yet

- Nyse Aan 2008Document48 pagesNyse Aan 2008gaja babaNo ratings yet

- Marginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5Document5 pagesMarginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5신두No ratings yet

- ACCT2511 Topic 2 Tutorial Solutions STUDENTDocument8 pagesACCT2511 Topic 2 Tutorial Solutions STUDENTKJSAdNo ratings yet

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- International Trade NotesDocument10 pagesInternational Trade NotesMthobisi CeleNo ratings yet

- July 2021 Retail Sales IndexDocument4 pagesJuly 2021 Retail Sales IndexBernewsAdminNo ratings yet

- Strategic Management BookletDocument29 pagesStrategic Management Bookletmismail306No ratings yet

- Ss 3Document32 pagesSs 3Trần Nguyễn Quỳnh GiaoNo ratings yet

- Business Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONDocument20 pagesBusiness Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONJhudiel Dela ConcepcionNo ratings yet

- Cost-Volume-Profit Relationships: Mcgraw-Hill /irwinDocument15 pagesCost-Volume-Profit Relationships: Mcgraw-Hill /irwinHibaaq AxmedNo ratings yet

- Managerial Accounting: Prepared by Diane Tanner University of North FloridaDocument10 pagesManagerial Accounting: Prepared by Diane Tanner University of North Floridaharshnvicky123No ratings yet

- DAC 5013-Week 03Document60 pagesDAC 5013-Week 03Dilshan J. NiranjanNo ratings yet

- CVPDocument8 pagesCVPJessica EntacNo ratings yet

- Profitability ControlDocument30 pagesProfitability Controlhasmukh19840% (1)

- US shaving market data 2005-2010 and consumer segmentation analysisDocument19 pagesUS shaving market data 2005-2010 and consumer segmentation analysisPriyanka BindumadhavanNo ratings yet

- Assignment C - Calculating Components of Operating Statements 8Document2 pagesAssignment C - Calculating Components of Operating Statements 8api-513411115No ratings yet

- Analysis of Clean Edge Razor: Splitting Hairs in Product PositioningDocument4 pagesAnalysis of Clean Edge Razor: Splitting Hairs in Product PositioningSumit Kumar ThakurNo ratings yet

- Absorption and Variable CostingDocument2 pagesAbsorption and Variable CostingWafah HadjisalicNo ratings yet

- AW_2021_2023Document3 pagesAW_2021_2023abdul.elgoharyNo ratings yet

- Dake Corporation's manufacturing costs analysisDocument9 pagesDake Corporation's manufacturing costs analysisWarda Tariq0% (1)

- Case 7B FRC M. Gerry Naufal 29123123Document7 pagesCase 7B FRC M. Gerry Naufal 29123123m.gerryNo ratings yet

- Examples FMA - 5Document10 pagesExamples FMA - 5DaddyNo ratings yet

- Sweat GaloreDocument17 pagesSweat GaloreMuhdAfiq50% (2)

- Master Budget Formulas Module 6 Management AccountingDocument14 pagesMaster Budget Formulas Module 6 Management AccountingcykablyatNo ratings yet

- Malcolm Mcdonald International 10 Principles of World Class Strategic Marketing PDFDocument118 pagesMalcolm Mcdonald International 10 Principles of World Class Strategic Marketing PDFsew ireneNo ratings yet

- Nasdaq Aaon 2011Document72 pagesNasdaq Aaon 2011gaja babaNo ratings yet

- Nyse Cas 2011Document118 pagesNyse Cas 2011gaja babaNo ratings yet

- Tutorial 1Document5 pagesTutorial 1FEI FEINo ratings yet

- Natureview Farm Case AnalysisDocument8 pagesNatureview Farm Case Analysiskks4h100% (2)

- GP Variance AnalysisDocument2 pagesGP Variance AnalysisRodison de GuiaNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingTaha JavaidNo ratings yet

- Sale ManagementDocument14 pagesSale ManagementWaqas AwanNo ratings yet

- 1Q19 Caterpillar Inc. ResultsDocument19 pages1Q19 Caterpillar Inc. ResultsValter SilveiraNo ratings yet

- F5 CKT QnsDocument6 pagesF5 CKT QnsAmeera KhalidNo ratings yet

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Tyndall Furniture Company (C)Document2 pagesTyndall Furniture Company (C)Procusto LNo ratings yet

- Manufacturing StrategyDocument2 pagesManufacturing StrategyProcusto LNo ratings yet

- US retail sales and e-commerce estimatesDocument2 pagesUS retail sales and e-commerce estimatesProcusto LNo ratings yet

- Iknow LLC Discusses Building Leadership Support and Maximizing The Value of A KM ProgramDocument6 pagesIknow LLC Discusses Building Leadership Support and Maximizing The Value of A KM ProgramProcusto LNo ratings yet

- Tyndall Furniture Company (B) EnglishDocument2 pagesTyndall Furniture Company (B) EnglishProcusto LNo ratings yet

- Answers Hang Out! Workbook 2: Welcome UnitDocument16 pagesAnswers Hang Out! Workbook 2: Welcome UnitProcusto L0% (1)

- CNT 0011190 01Document7 pagesCNT 0011190 01Edward RojasNo ratings yet

- Request Taxpayer ID and Certification FormDocument6 pagesRequest Taxpayer ID and Certification FormMuhammad Husnain Ijaz0% (1)

- K09527 10 Best Practices KM CommunicationsDocument1 pageK09527 10 Best Practices KM CommunicationsProcusto LNo ratings yet

- Canon C-Park Photography TipsDocument0 pagesCanon C-Park Photography TipsJose Ribamar do NascimentoNo ratings yet

- PDF Test File PDFDocument1 pagePDF Test File PDFProcusto LNo ratings yet

- Request Taxpayer ID and Certification FormDocument6 pagesRequest Taxpayer ID and Certification FormMuhammad Husnain Ijaz0% (1)

- K08140 - Compensation BMK Resource Listv2Document6 pagesK08140 - Compensation BMK Resource Listv2Procusto LNo ratings yet

- Request Taxpayer ID and Certification FormDocument6 pagesRequest Taxpayer ID and Certification FormMuhammad Husnain Ijaz0% (1)

- Fire-Station e A4Document7 pagesFire-Station e A4Procusto LNo ratings yet

- House assembly instructionsDocument1 pageHouse assembly instructionsClaudiaStelianPaunNo ratings yet

- Fire Station (Assembly Instructions) : Glue. GlueDocument1 pageFire Station (Assembly Instructions) : Glue. Gluelev76No ratings yet

- K08140 - Compensation BMK Resource Listv2Document6 pagesK08140 - Compensation BMK Resource Listv2Procusto LNo ratings yet

- K08042 - Social Networking and Online CollaborationDocument6 pagesK08042 - Social Networking and Online CollaborationProcusto LNo ratings yet

- K08052 - Example Lessons Learned Submission FormsDocument6 pagesK08052 - Example Lessons Learned Submission FormsProcusto LNo ratings yet

- Basic IconsDocument3 pagesBasic IconsProcusto LNo ratings yet

- OSB Measure List - 205 - Reward and Retain EmployeesDocument6 pagesOSB Measure List - 205 - Reward and Retain EmployeesProcusto LNo ratings yet

- MAN CentrumTransportDocument1 pageMAN CentrumTransportProcusto LNo ratings yet

- K07391 - Quantifying The Benefits of Quality-Part Four - Industry WeekDocument5 pagesK07391 - Quantifying The Benefits of Quality-Part Four - Industry WeekProcusto LNo ratings yet

- K08810 HCM Unilever Global RewardsDocument8 pagesK08810 HCM Unilever Global RewardsProcusto LNo ratings yet

- K08141 - Employee Benefits BMK Resource List V2Document6 pagesK08141 - Employee Benefits BMK Resource List V2Procusto LNo ratings yet

- K07301 - Labor Cost Planning Can Be TrickyDocument4 pagesK07301 - Labor Cost Planning Can Be TrickyProcusto LNo ratings yet

- K07943 HCM People Challenges PRDocument2 pagesK07943 HCM People Challenges PRProcusto LNo ratings yet

- K07588 - Designing Offices Employees Want To Work inDocument5 pagesK07588 - Designing Offices Employees Want To Work inProcusto LNo ratings yet

- Zouq Report For Supply Chain ManagementDocument20 pagesZouq Report For Supply Chain ManagementMuhammadSaad100% (1)

- HM Report Assignment MGT Mix MarketingDocument5 pagesHM Report Assignment MGT Mix MarketingrabiatulNo ratings yet

- Streamlining Supply Chain Management With E-BusinessDocument7 pagesStreamlining Supply Chain Management With E-BusinessLeo CarvalhoNo ratings yet

- Crazy EddieDocument20 pagesCrazy EddieblablaNo ratings yet

- Sapna Project File PDFDocument57 pagesSapna Project File PDFPreet PreetNo ratings yet

- Chapter 11Document35 pagesChapter 11anon_210832836No ratings yet

- Bricks or Clicks?Document36 pagesBricks or Clicks?Chase DanNo ratings yet

- 1 Suraj AgrawaI - Rayna Ours and TravelsDocument37 pages1 Suraj AgrawaI - Rayna Ours and Travelssasank1804No ratings yet

- PWC Webinar Importing Retailing JapanDocument35 pagesPWC Webinar Importing Retailing JapanAnkitNo ratings yet

- Quick Commerce Will The Disruption of The Food RetailDocument28 pagesQuick Commerce Will The Disruption of The Food RetailPrateek Gupta IPM 2021-26 BatchNo ratings yet

- Name: Misbah Shahid Khan Reg# 45363Document4 pagesName: Misbah Shahid Khan Reg# 45363misbah khanNo ratings yet

- CBSE Class 11 Business Studies Important Questions Internal TradeDocument4 pagesCBSE Class 11 Business Studies Important Questions Internal TradeAryan Dev SinghNo ratings yet

- Mis 1 PDFDocument24 pagesMis 1 PDFGanapati KattigeNo ratings yet

- Store Desgin and Visual MerchandisingDocument121 pagesStore Desgin and Visual MerchandisingIshan Sheth100% (1)

- Marketing Case SolutionDocument5 pagesMarketing Case SolutionNelly Odeh100% (1)

- Raising Productivity and Reducing Risk for Ugandan HouseholdsDocument60 pagesRaising Productivity and Reducing Risk for Ugandan HouseholdsAmos BakeineNo ratings yet

- Internal Audit ChecklistDocument80 pagesInternal Audit ChecklistdinuindiaNo ratings yet

- Assigment Relationship Marketing Bbmr4103Document17 pagesAssigment Relationship Marketing Bbmr4103Loyai BaimNo ratings yet

- Differences Between Forward and Reverse Logistics in A Retail EnvironmentDocument4 pagesDifferences Between Forward and Reverse Logistics in A Retail EnvironmentsawlaninNo ratings yet

- CRC-ACE REVIEW SCHOOL AUDITING PROBLEMSDocument8 pagesCRC-ACE REVIEW SCHOOL AUDITING PROBLEMSLuzviminda Maruzzo100% (2)

- Supply Chain Game ChangersDocument60 pagesSupply Chain Game ChangersYen Nguyen0% (1)

- Luminaire Program Outdoor: Light Is OSRAMDocument605 pagesLuminaire Program Outdoor: Light Is OSRAMPatricia Vargas VillegasNo ratings yet

- Walmart Storewars CaseDocument16 pagesWalmart Storewars CaseJITESHNo ratings yet

- Research Chapter 1-3 PR2Document21 pagesResearch Chapter 1-3 PR2LoeynahcNo ratings yet

- Walmert Brand PositioningDocument11 pagesWalmert Brand PositioningMaryam KhalidNo ratings yet

- IMT 76 Industrial Marketing M2Document4 pagesIMT 76 Industrial Marketing M2solvedcareNo ratings yet

- Eco7 Launching A New Motor Oil SpreadsheetDocument12 pagesEco7 Launching A New Motor Oil SpreadsheetHarsh Vivek0% (3)

- 554-Article Text-866-1-10-20200430Document9 pages554-Article Text-866-1-10-20200430এ.বি.এস. আশিকNo ratings yet

- Impact of Brexit On Exports and Import On UK BusinessDocument13 pagesImpact of Brexit On Exports and Import On UK BusinessAsfa SaadNo ratings yet

- Customer Relationship Management in Business-To-Bu PDFDocument10 pagesCustomer Relationship Management in Business-To-Bu PDFSmoky RubbishNo ratings yet