Professional Documents

Culture Documents

Case Digest - Caltex Vs CA, G.R. No. 97753

Uploaded by

J Yasser PascubilloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Digest - Caltex Vs CA, G.R. No. 97753

Uploaded by

J Yasser PascubilloCopyright:

Available Formats

Caltex vs CA Case Digest

Caltex, Inc., petitioner

vs.

Court of Appeals, and Security Bank and Trust Company, respondent.

10 August 1992, G.R. No. 97753

FACTS:

[[[[Certificate of deposit

This is to Certify that BEARER has deposited in this Bank the sum of PESOS: . . . ]]]]

Security bank issued Certificates of Time Deposits to Angel dela Cruz. The same were

given by Dela Cruz to Caltex in connection to his purchase of fuel products of the latter. On a later

date, Dela Cruz approached the bank manager, communicated the loss of the certificates and

requested for a reissuance.

Upon compliance with some formal requirements, he was issued replacements. Thereafter,

he secured a loan from the bank where he assigned the certificates as security. Here comes the

petitioner, averred that the certificates were not actually lost but were given as security for

payment for fuel purchases.

The bank demanded some proof of the agreement but the petitioner failed to comply. The

loan matured and the time deposits were terminated and then applied to the payment of the loan.

Petitioner demands the payment of the certificates but to no avail.

The trail court ruled that the subject certificates of deposit were not negotiable instruments

and that the petitioner did not become their holder in due course.

ISSUES:

Whether or not the certificates of deposit are negotiable instruments.

RULING:

The certifcates of deposit are negotiable instruments.

The requisites for an instrument to become negotiable are;

...

(4) Must be payable to order or to bearer . . .

Here, the documents provide that the amounts deposited shall be repayable to the depositor,

and according to the documents, the depositor is the bearer. The documents do not say that the

depositor is Angel de a Cruz and that the amounts deposited are repayable specifically to him.

Rather, the amounts are to be repayable to the bearer of the documents or, for that matter,

whosoever may be the bearer at the time of presentment. If the bank intended to pay Angel de la

Cruz only, it could have expressed in clear and catergorical terms in the documents, instead of

having the word “Bearer”.

However, the petitioner can still not recover the certificates of time deposit. This is because

that the respondent bank was not informed of the delivery of the certificates of deposit from Angel

dela Cruz to petitioner. A valid negotiation regarding the CTDs for the true purpose an agreement

between petitioner and Dela Cruz requires both delivery and indorsement.

If the CTDS were indeed delivered as payment and not as security, the petitioner’s credit

manager could have easly said so instead of using the words “to guarantee”.

You might also like

- UST Golden Notes - Negotiable InstrumentsDocument30 pagesUST Golden Notes - Negotiable InstrumentsJerik Solas95% (20)

- UST Golden Notes - Negotiable InstrumentsDocument30 pagesUST Golden Notes - Negotiable InstrumentsJerik Solas95% (20)

- UST Golden Notes - Civil Procedure (Remedial Law General Principles Included)Document162 pagesUST Golden Notes - Civil Procedure (Remedial Law General Principles Included)sunem black100% (6)

- Supreme Court Rules in Favor of Petitioner in Check Bouncing CaseDocument3 pagesSupreme Court Rules in Favor of Petitioner in Check Bouncing CaseJunelyn T. Ella100% (1)

- Lesson 8 Installment SalesDocument9 pagesLesson 8 Installment SalesheyheyNo ratings yet

- ILANO VS ESPAÑOL CASE ON FRAUDULENT PROMISSORY NOTESDocument5 pagesILANO VS ESPAÑOL CASE ON FRAUDULENT PROMISSORY NOTESCoreine Valledor-Sarraga100% (1)

- A Technical Guide For Pricing Interest Rate SwaptionDocument11 pagesA Technical Guide For Pricing Interest Rate SwaptionAlan WhiteNo ratings yet

- Everything You Need to Know to Open a Bank AccountDocument9 pagesEverything You Need to Know to Open a Bank AccounttriratnacomNo ratings yet

- PNB Liable for Losses from Unendorsed ChecksDocument2 pagesPNB Liable for Losses from Unendorsed ChecksLara YuloNo ratings yet

- Blueprint of Banking SectorDocument33 pagesBlueprint of Banking SectormayankNo ratings yet

- Usury LawDocument3 pagesUsury LawCarolyn Clarin-Baterna100% (2)

- Usury LawDocument3 pagesUsury LawCarolyn Clarin-Baterna100% (2)

- Firestone Tire & Rubber Co of The Phils v. CADocument1 pageFirestone Tire & Rubber Co of The Phils v. CAJulie Ann Edquila PaduaNo ratings yet

- Great Asian Sales Center Corp. v. BancasiaDocument166 pagesGreat Asian Sales Center Corp. v. Bancasianoirchienne100% (1)

- NutriBullet ManualDocument83 pagesNutriBullet ManualJairo Wilches80% (5)

- NutriBullet ManualDocument83 pagesNutriBullet ManualJairo Wilches80% (5)

- Natividad Gempesaw Vs Court of Appeals Case Digest 2Document3 pagesNatividad Gempesaw Vs Court of Appeals Case Digest 2CuddlyNo ratings yet

- DIGEST Republic Bank V Ebrada PDFDocument1 pageDIGEST Republic Bank V Ebrada PDFAnonymous gy7lIr8No ratings yet

- Salas vs. CA, 181 SCRA 296, Jan. 22, 1990Document2 pagesSalas vs. CA, 181 SCRA 296, Jan. 22, 1990Jaypoll DiazNo ratings yet

- 10 Sps. Evangelista v. Mercator Finance Corp.Document2 pages10 Sps. Evangelista v. Mercator Finance Corp.Janno SangalangNo ratings yet

- Maralit vs Imperial: Indorser Liable for Altered ChecksDocument4 pagesMaralit vs Imperial: Indorser Liable for Altered ChecksCla BANo ratings yet

- Metrobank vs. CA (GR No 88866)Document1 pageMetrobank vs. CA (GR No 88866)Katharina CantaNo ratings yet

- Digest-Sesbreno Vs CADocument2 pagesDigest-Sesbreno Vs CAKennethRobles100% (3)

- Digest-Sesbreno Vs CADocument2 pagesDigest-Sesbreno Vs CAKennethRobles100% (3)

- Cross Selling (With Special Reference To State Bank of India)Document8 pagesCross Selling (With Special Reference To State Bank of India)syed adil razaNo ratings yet

- Philippine Education Co v. Mauricio Soriano, Et Al.Document2 pagesPhilippine Education Co v. Mauricio Soriano, Et Al.Katrina PerezNo ratings yet

- Salas Vs CADocument4 pagesSalas Vs CAHiroshi Carlos100% (1)

- Salas Vs CADocument4 pagesSalas Vs CAHiroshi Carlos100% (1)

- Granada v. PNB (Pamatmat)Document2 pagesGranada v. PNB (Pamatmat)Telle MarieNo ratings yet

- Vicente Go vs. Metrobank., G.R. No. 168842, August 11, 2010Document2 pagesVicente Go vs. Metrobank., G.R. No. 168842, August 11, 2010Lara YuloNo ratings yet

- Development Bank vs. Sima WeiDocument2 pagesDevelopment Bank vs. Sima WeiMichelle Montenegro - Araujo100% (1)

- Blackstone and The Sale of Citigroup's Loan PortfolioDocument10 pagesBlackstone and The Sale of Citigroup's Loan PortfolioRonak Jain0% (1)

- Traders Royal Bank vs. CADocument2 pagesTraders Royal Bank vs. CAMariaFaithFloresFelisarta100% (1)

- ICICI Bank - Restoring Faith in Corporate GovernanceDocument10 pagesICICI Bank - Restoring Faith in Corporate GovernancePriyansh JindalNo ratings yet

- 53 Stelco Vs CADocument6 pages53 Stelco Vs CACharm Divina LascotaNo ratings yet

- NEGO - 30. Far East vs. Gold Palace Jewelry, G.R. No. 168274Document2 pagesNEGO - 30. Far East vs. Gold Palace Jewelry, G.R. No. 168274annedefranco50% (4)

- Development Bank Fails to Collect Unpaid Loan Balance Due to Lack of Check DeliveryDocument2 pagesDevelopment Bank Fails to Collect Unpaid Loan Balance Due to Lack of Check Deliveryhash_tntNo ratings yet

- Ang Tek Lian Vs CADocument2 pagesAng Tek Lian Vs CALee Somar100% (1)

- 02 de Leon v. RodriguezDocument2 pages02 de Leon v. Rodriguezrobby100% (2)

- Security Bank Vs RCBC (Nil Case)Document2 pagesSecurity Bank Vs RCBC (Nil Case)FeBrluadoNo ratings yet

- Republic Planters Bank Vs CA 216 SCRA 738Document3 pagesRepublic Planters Bank Vs CA 216 SCRA 738Chino CabreraNo ratings yet

- De Ocampo V Anita GatchalianDocument2 pagesDe Ocampo V Anita GatchalianjonbelzaNo ratings yet

- DIGEST Traders Royal Bank v. CA Aug182016Document2 pagesDIGEST Traders Royal Bank v. CA Aug182016Anonymous OVr4N9MsNo ratings yet

- FEBTC vs. Querimit ruling on CD paymentDocument1 pageFEBTC vs. Querimit ruling on CD paymentFayda Cariaga100% (3)

- FEBTC vs. Querimit ruling on CD paymentDocument1 pageFEBTC vs. Querimit ruling on CD paymentFayda Cariaga100% (3)

- Sps. Evangelista Vs Mercator Finance CorpDocument2 pagesSps. Evangelista Vs Mercator Finance CorpToni CalsadoNo ratings yet

- Supreme Court Upholds Annulment of Judgment Due to Extrinsic FraudDocument2 pagesSupreme Court Upholds Annulment of Judgment Due to Extrinsic FraudZethMoranaNo ratings yet

- Payslip January 2023Document4 pagesPayslip January 2023Mohit ChahalNo ratings yet

- Mesina v. IAC Case DigestDocument1 pageMesina v. IAC Case DigestKian Fajardo100% (1)

- SC Ruling on Deed of Assignment Extinguishing DebtDocument2 pagesSC Ruling on Deed of Assignment Extinguishing DebtGino Lascano100% (1)

- SC Ruling on Deed of Assignment Extinguishing DebtDocument2 pagesSC Ruling on Deed of Assignment Extinguishing DebtGino Lascano100% (1)

- Digest BANK OF AMERICA NT & SA vs. PHILIPPINE RACING CLUB INCORPORATEDDocument2 pagesDigest BANK OF AMERICA NT & SA vs. PHILIPPINE RACING CLUB INCORPORATEDemolotrabNo ratings yet

- PNB V Manila Oil Refining CoDocument2 pagesPNB V Manila Oil Refining Cosmtm06100% (3)

- Metropol Vs Sambok Case DigestDocument1 pageMetropol Vs Sambok Case DigestRj2100% (1)

- PNB V. Capitol Material Alteration CaseDocument2 pagesPNB V. Capitol Material Alteration CaseGlorious El DomineNo ratings yet

- Dino v. Judal-LootDocument3 pagesDino v. Judal-LootAntonJohnVincentFriasNo ratings yet

- Caltex Vs CA (Digest)Document2 pagesCaltex Vs CA (Digest)Glorious El Domine100% (1)

- M. Samsung Construction Vs Far East BankDocument2 pagesM. Samsung Construction Vs Far East BankPaulitoPunongbayanNo ratings yet

- CASE DIGEST - Metrobank vs. CADocument7 pagesCASE DIGEST - Metrobank vs. CAMaria Anna M Legaspi100% (1)

- 17 - de Ocampo V GatchalianDocument2 pages17 - de Ocampo V Gatchaliansmtm06100% (1)

- Equitable PCI Bank Liable for Manager's CheckDocument2 pagesEquitable PCI Bank Liable for Manager's CheckAntonJohnVincentFrias100% (2)

- Ilusorio Vs CA DigestDocument1 pageIlusorio Vs CA DigestSansa StarkNo ratings yet

- Bank liability of endorser released without notice of dishonorDocument2 pagesBank liability of endorser released without notice of dishonorEileen Kay A. MañiboNo ratings yet

- Consolidated Plywood vs. IFC LeasingDocument3 pagesConsolidated Plywood vs. IFC LeasingNadine Abenoja100% (1)

- Consolidated Plywood Industries VsDocument2 pagesConsolidated Plywood Industries VsDavid Lawrenz Samonte100% (2)

- Associated Bank V CA DigestDocument1 pageAssociated Bank V CA DigestSolomon Malinias BugatanNo ratings yet

- State Investment House, Inc., vs. Court of Appeals and Nora B. Moulic DIGESTDocument1 pageState Investment House, Inc., vs. Court of Appeals and Nora B. Moulic DIGESTMALALA MALALA100% (1)

- Equitable Banking Corporation v. IACDocument2 pagesEquitable Banking Corporation v. IACKaren Ryl Lozada BritoNo ratings yet

- Yang V CA GR No. 138074Document1 pageYang V CA GR No. 138074Rhuejane Gay MaquilingNo ratings yet

- Pal VS CaDocument2 pagesPal VS CaJesa Formaran100% (1)

- Digest - Wong vs. CADocument1 pageDigest - Wong vs. CAPaul Vincent Cunanan100% (1)

- Checks and Negotiable Instruments Case BriefsDocument3 pagesChecks and Negotiable Instruments Case BriefsMaria Anna M Legaspi50% (2)

- PNB vs. Rodriguez G.R. No. 170325 September 26, 2008Document2 pagesPNB vs. Rodriguez G.R. No. 170325 September 26, 2008KF100% (3)

- Supreme Court Rules on Bank Liability for Embezzled Checks Intended for Tax PaymentsDocument2 pagesSupreme Court Rules on Bank Liability for Embezzled Checks Intended for Tax PaymentsKian Fajardo100% (5)

- Citytrust v. IAC DIGESTDocument3 pagesCitytrust v. IAC DIGESTkathrynmaydevezaNo ratings yet

- De Ocampo Vs Gatchalian DigestDocument1 pageDe Ocampo Vs Gatchalian DigestChic PabalanNo ratings yet

- Caltex Philippines Vs CADocument3 pagesCaltex Philippines Vs CAbeth_afanNo ratings yet

- Juanita Salas Vs Court of Appeals (Negotiable Instruments Law)Document1 pageJuanita Salas Vs Court of Appeals (Negotiable Instruments Law)Lance ClementeNo ratings yet

- Ting Ting Pua v. Sps. Lo Bun TiongDocument2 pagesTing Ting Pua v. Sps. Lo Bun TiongRalph Deric EspirituNo ratings yet

- Digested Cases: Negotiable Instruments LawDocument4 pagesDigested Cases: Negotiable Instruments LawSebastian BorcesNo ratings yet

- Ting Ting Pua Vs Spouses Benito Bun Tiong and Caroline Siok Ching TengDocument2 pagesTing Ting Pua Vs Spouses Benito Bun Tiong and Caroline Siok Ching TengLenie Sanchez100% (1)

- Caltex Philippines vs CA Bank CTD RulingDocument1 pageCaltex Philippines vs CA Bank CTD RulingcolleenNo ratings yet

- Dayaming Basa Sa Kamalig Ni BonayDocument4 pagesDayaming Basa Sa Kamalig Ni BonayJ Yasser PascubilloNo ratings yet

- Supreme Court: Arsenio C. Villalon, Jr. For Petitioner. Labaguis, Loyola, Angara & Associates For Private RespondentDocument4 pagesSupreme Court: Arsenio C. Villalon, Jr. For Petitioner. Labaguis, Loyola, Angara & Associates For Private Respondentdejeh ocbaNo ratings yet

- Papa V Au Valencia 13Document2 pagesPapa V Au Valencia 13J Yasser PascubilloNo ratings yet

- Poem 1Document2 pagesPoem 1J Yasser PascubilloNo ratings yet

- English 한글 Word Usage in English Sample Word Usage in HangeulDocument2 pagesEnglish 한글 Word Usage in English Sample Word Usage in HangeulJ Yasser PascubilloNo ratings yet

- Dummy Doc OnlyDocument3 pagesDummy Doc OnlyJ Yasser PascubilloNo ratings yet

- The Basis Is The Doctrine of Representation. The Agent, in So Far As The World IsDocument1 pageThe Basis Is The Doctrine of Representation. The Agent, in So Far As The World IsJ Yasser PascubilloNo ratings yet

- Dummy Document For Download in SCRIBD 1Document1 pageDummy Document For Download in SCRIBD 1J Yasser PascubilloNo ratings yet

- Dummy Doc OnlyDocument3 pagesDummy Doc OnlyJ Yasser PascubilloNo ratings yet

- Dummy Doc For DLDocument2 pagesDummy Doc For DLJ Yasser PascubilloNo ratings yet

- COMM 3 Speech #2Document1 pageCOMM 3 Speech #2J Yasser PascubilloNo ratings yet

- Vocabularies - 500 Most Common Korean VerbsDocument15 pagesVocabularies - 500 Most Common Korean VerbsJ Yasser PascubilloNo ratings yet

- Dummy Doc For DLDocument5 pagesDummy Doc For DLJ Yasser PascubilloNo ratings yet

- Correlation of Alcohol Intake and Student GradesDocument5 pagesCorrelation of Alcohol Intake and Student GradesJ Yasser PascubilloNo ratings yet

- #32Document3 pages#32J Yasser PascubilloNo ratings yet

- #31Document2 pages#31J Yasser PascubilloNo ratings yet

- Project Report On Risk MGT in Life InsuranceDocument77 pagesProject Report On Risk MGT in Life InsuranceAlpatron shit'sNo ratings yet

- FinancialAnalysis - EQUIPOS DEL NORTEDocument6 pagesFinancialAnalysis - EQUIPOS DEL NORTEOscar TrujilloNo ratings yet

- ACC Final Exam S1 2022Document9 pagesACC Final Exam S1 2022Vikash PatelNo ratings yet

- Chapter 3 Analyzing Transactions To Start A BusinessDocument3 pagesChapter 3 Analyzing Transactions To Start A BusinessPaw VerdilloNo ratings yet

- This Study Resource Was: Accounting 201 Name Comprehensive Problem (100 Points) Due: Tuesday, 4/18/2017Document3 pagesThis Study Resource Was: Accounting 201 Name Comprehensive Problem (100 Points) Due: Tuesday, 4/18/2017GraceCaoileNo ratings yet

- Final Solution Sybaf Fa QP Code 22810Document11 pagesFinal Solution Sybaf Fa QP Code 22810praveenk1878No ratings yet

- Kotak Mahindra BankDocument113 pagesKotak Mahindra BankAryan GouthamNo ratings yet

- Outsourcing: - Subcontracting A Certain Business Operation To An Outside Firm, Instead of Doing It "In-House."Document19 pagesOutsourcing: - Subcontracting A Certain Business Operation To An Outside Firm, Instead of Doing It "In-House."Shahroz AliNo ratings yet

- CH 4: Apply Your Knowledge Decision Case 4-1: Accounting 9/e Solutions Manual 392Document15 pagesCH 4: Apply Your Knowledge Decision Case 4-1: Accounting 9/e Solutions Manual 392Loany Martinez100% (1)

- GR 10 Test Posting To Ledger From CashDocument10 pagesGR 10 Test Posting To Ledger From CashStars2323No ratings yet

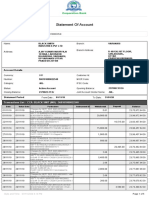

- Statement of AccountDocument5 pagesStatement of AccountAjay MauryaNo ratings yet

- Glen 2001097 KPNK4CDocument3 pagesGlen 2001097 KPNK4CGlen ParadiseNo ratings yet

- Overview of Legal and Regulatory Framework of Islamic FinanceDocument13 pagesOverview of Legal and Regulatory Framework of Islamic FinancenanaNo ratings yet

- Vendor Master FormDocument2 pagesVendor Master Formrekha0% (1)

- Assessing Control Risk and Reporting On Internal ControlsDocument3 pagesAssessing Control Risk and Reporting On Internal Controlsshy meltedNo ratings yet

- Basics of Accounting Notes MBA 2nd SemDocument30 pagesBasics of Accounting Notes MBA 2nd SemVikash ChauhanNo ratings yet

- Gulshan BSDocument8 pagesGulshan BSP2E MIS DDU-GKY Uttar PradeshNo ratings yet

- Borrower (S) Commitment Letter: Revised March 2016Document4 pagesBorrower (S) Commitment Letter: Revised March 2016Noor Azah AdamNo ratings yet

- JP Morgan Guide - To - Mutual - Fund - InvestingDocument12 pagesJP Morgan Guide - To - Mutual - Fund - InvestingAnkit KanojiaNo ratings yet

- U5A3 Answer - XLS? &d2lSessionVal 8JaopjsKRMtwfj245Z158sJvc&Ou 19056036Document3 pagesU5A3 Answer - XLS? &d2lSessionVal 8JaopjsKRMtwfj245Z158sJvc&Ou 19056036Anzal MahmoodNo ratings yet

- POA Group SBA ReportDocument10 pagesPOA Group SBA ReportJamil FranklynNo ratings yet

- PF Transfer From Previous Employer To TechMahindra FAQsDocument3 pagesPF Transfer From Previous Employer To TechMahindra FAQsAbhishek KumarNo ratings yet