Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsPENALTIES - Expired ATP

PENALTIES - Expired ATP

Uploaded by

kmoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Bir Ruling - Exemption of Donation From DSTDocument10 pagesBir Ruling - Exemption of Donation From DSTDenise Capacio LirioNo ratings yet

- Bir Ruling Da 086 08Document5 pagesBir Ruling Da 086 08Orlando O. CalundanNo ratings yet

- BOI Citizen's CharterDocument32 pagesBOI Citizen's CharterPam MarceloNo ratings yet

- SECTION 2. Objectives: Application Form), Tax Residency Certificate (TRC) Duly Issued by The ForeignDocument13 pagesSECTION 2. Objectives: Application Form), Tax Residency Certificate (TRC) Duly Issued by The ForeignCarloAysonNo ratings yet

- RMC No. 3-2022Document2 pagesRMC No. 3-2022Shiela Marie MaraonNo ratings yet

- My Own ABC's To Success by Madeleine Macutay, CpaDocument3 pagesMy Own ABC's To Success by Madeleine Macutay, Cpaeine10100% (1)

- Affidavit of LegitimationDocument2 pagesAffidavit of LegitimationChen C AbreaNo ratings yet

- Guidelines and Conduct of TCVD RMO09-2006Document45 pagesGuidelines and Conduct of TCVD RMO09-2006Kris CalabiaNo ratings yet

- 14-2001 - Requirements For Tax ExemptionDocument7 pages14-2001 - Requirements For Tax ExemptionArjam B. BonsucanNo ratings yet

- Affidavit of Loss Format TinDocument1 pageAffidavit of Loss Format TinRached Piamonte RondinaNo ratings yet

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutDocument4 pagesBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiNo ratings yet

- Common-Taxes - Income-Tax VAT OPT WT v2Document52 pagesCommon-Taxes - Income-Tax VAT OPT WT v2kayelineNo ratings yet

- Revenue Memorandum Order No. 37-94: March 25, 1994Document8 pagesRevenue Memorandum Order No. 37-94: March 25, 1994Rufino Gerard Moreno IIINo ratings yet

- Extrajudicial Settlement of EstateDocument4 pagesExtrajudicial Settlement of EstateStewart Paul TorreNo ratings yet

- Motion To Release Motor Vehicle-GumpalDocument5 pagesMotion To Release Motor Vehicle-Gumpalmagiting mabayogNo ratings yet

- Refund of CWT and VAT Upon Dissolution of Company - ICN 9.11.14Document3 pagesRefund of CWT and VAT Upon Dissolution of Company - ICN 9.11.14JianSadakoNo ratings yet

- Petition For Corporate Rehabilitation, Planholders, CreditorsDocument23 pagesPetition For Corporate Rehabilitation, Planholders, CreditorsMelvin PernezNo ratings yet

- Republic of The Philippines Quezon City: Court AppealsDocument38 pagesRepublic of The Philippines Quezon City: Court AppealsHerzl Hali V. HermosaNo ratings yet

- 1905 (Encs) 2000Document4 pages1905 (Encs) 2000Loss Pokla100% (1)

- Decision: Second DivisionDocument13 pagesDecision: Second DivisionGilbert John LacorteNo ratings yet

- Tax Refund LetterDocument1 pageTax Refund LetterClaire MeredithNo ratings yet

- Receipts InvoicesDocument9 pagesReceipts InvoicesDu Baladad Andrew Michael100% (1)

- BOI Form 501 Energy-RevisedDocument7 pagesBOI Form 501 Energy-RevisedNegros Solar PHNo ratings yet

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- Prescription, Waiver and Closure - Jamie Lyn HernandezDocument23 pagesPrescription, Waiver and Closure - Jamie Lyn HernandezJamie LynNo ratings yet

- RR No. 13-98Document16 pagesRR No. 13-98Ana DocallosNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- Bir Ruling No. 108-93Document2 pagesBir Ruling No. 108-93saintkarriNo ratings yet

- Powerpoint-09.14.22-Smmc Vat Zero Rating PDFDocument92 pagesPowerpoint-09.14.22-Smmc Vat Zero Rating PDFGirlie BacaocoNo ratings yet

- Secretary Certificate - Intra-Corporate - JELMACT REALTY CORP 2021Document1 pageSecretary Certificate - Intra-Corporate - JELMACT REALTY CORP 2021ACYATAN & CO., CPAs 2020No ratings yet

- BIR RMC No. 62-2005Document15 pagesBIR RMC No. 62-2005dencave1No ratings yet

- Cta 2D CV 09224 M 2019feb12 AssDocument17 pagesCta 2D CV 09224 M 2019feb12 AssMelan YapNo ratings yet

- Sworn Statement - Annex A With POS-BOS DetailsDocument1 pageSworn Statement - Annex A With POS-BOS Detailspetroncalamba40No ratings yet

- Cta Eb CV 01054 D 2015jan13 AssDocument18 pagesCta Eb CV 01054 D 2015jan13 AssMarcy BaklushNo ratings yet

- Suico JOINTDocument41 pagesSuico JOINTAlvin PateresNo ratings yet

- Cancellation of Business RegistrationDocument2 pagesCancellation of Business Registrationallen pinlacNo ratings yet

- Secretary Certificate For Sec Gis 1-13-2021Document2 pagesSecretary Certificate For Sec Gis 1-13-2021gabriella shintaine dominique dilayNo ratings yet

- CPA Certificate - CorporationDocument8 pagesCPA Certificate - CorporationHaRry PeregrinoNo ratings yet

- The Philippines: Tax Assessment, Appeal and Dispute ResolutionDocument29 pagesThe Philippines: Tax Assessment, Appeal and Dispute ResolutionJBNo ratings yet

- Invalidating Tax Assessment January 2024 2Document68 pagesInvalidating Tax Assessment January 2024 2arnulfojr hicoNo ratings yet

- 2005 BIR - Ruling - DA 139 05 - 20210505 12 PWRFVVDocument2 pages2005 BIR - Ruling - DA 139 05 - 20210505 12 PWRFVVAnya ForgerNo ratings yet

- Application For VAT Zero RatingDocument9 pagesApplication For VAT Zero RatingHanabishi RekkaNo ratings yet

- 2015 BIR Withholding Tax TableDocument1 page2015 BIR Withholding Tax TableJonasAblangNo ratings yet

- Dof Department Order No. 023-01Document2 pagesDof Department Order No. 023-01Ralph Ronald CatipayNo ratings yet

- Borres Realty & Development Corporation Borres Realty & Development CorporationDocument12 pagesBorres Realty & Development Corporation Borres Realty & Development Corporation09303313316No ratings yet

- Motion For Reconsideration Allow Payment of Filing Fee - Maria Cecilia P. LambatinDocument1 pageMotion For Reconsideration Allow Payment of Filing Fee - Maria Cecilia P. LambatinTere TongsonNo ratings yet

- Bir Ruling 332-12Document3 pagesBir Ruling 332-12Neil MayorNo ratings yet

- Pagong BagalDocument1 pagePagong Bagaljuliet_emelinotmaestroNo ratings yet

- 1 Requirements For Petition To LiftDocument1 page1 Requirements For Petition To LiftMarbe Rica PaladinNo ratings yet

- BIR Abatement FormDocument1 pageBIR Abatement FormJecky Delos ReyesNo ratings yet

- Republic of The Philippines Application For: National Water Resources Board Renewal ofDocument2 pagesRepublic of The Philippines Application For: National Water Resources Board Renewal ofMark PesiganNo ratings yet

- VALUE ADDED TAX Notes From BIRDocument30 pagesVALUE ADDED TAX Notes From BIREmil BautistaNo ratings yet

- A. Assessment B. Collection: Remedies of The GovernmentDocument10 pagesA. Assessment B. Collection: Remedies of The GovernmentGianna CantoriaNo ratings yet

- 4 - Rizal Provincial Government v. BIRDocument17 pages4 - Rizal Provincial Government v. BIRCarlota VillaromanNo ratings yet

- Promissory Note Ver 1.2 2021 With VersionDocument2 pagesPromissory Note Ver 1.2 2021 With Versionlilibeth padernaNo ratings yet

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDocument29 pages209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaNo ratings yet

- Notes On Application For Authority To Print ReceiptsDocument3 pagesNotes On Application For Authority To Print ReceiptsDenzel Edward CariagaNo ratings yet

- Application For Authority To Print Receipts & Invoices - Bureau of Internal RevenueDocument6 pagesApplication For Authority To Print Receipts & Invoices - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- 2 Tips & Tricks For MSMEs Tax Compliance Handouts PDFDocument79 pages2 Tips & Tricks For MSMEs Tax Compliance Handouts PDFGetty Reagan DyNo ratings yet

- 19473-2000-Amendment of The Revised Schedule ofDocument4 pages19473-2000-Amendment of The Revised Schedule ofPhilAeonNo ratings yet

- International Academy v. LittonDocument5 pagesInternational Academy v. LittonCherry ChaoNo ratings yet

- Gamboa v. TevesDocument17 pagesGamboa v. TevesCherry ChaoNo ratings yet

- International Express Travel v. CADocument3 pagesInternational Express Travel v. CACherry ChaoNo ratings yet

- Coastal Pacific Trading Inc. v. Southern Rolling Mills Inc.Document8 pagesCoastal Pacific Trading Inc. v. Southern Rolling Mills Inc.Cherry ChaoNo ratings yet

- California Manufacturing v. Advanced Technology System Inc.Document4 pagesCalifornia Manufacturing v. Advanced Technology System Inc.Cherry ChaoNo ratings yet

- RDO No. 43 - Pasig CityDocument374 pagesRDO No. 43 - Pasig CityCherry Chao100% (2)

- Estate Tax Amnesty ReturnDocument2 pagesEstate Tax Amnesty ReturnCherry Chao0% (1)

- Case Digest Sulo Sa Nayon Inc.Document3 pagesCase Digest Sulo Sa Nayon Inc.Cherry ChaoNo ratings yet

- Diamond Farms Inc Vs Diamond Farm Workers Multi-Purpose CooperativeDocument2 pagesDiamond Farms Inc Vs Diamond Farm Workers Multi-Purpose CooperativeCherry ChaoNo ratings yet

- FASAP v. PALDocument1 pageFASAP v. PALCherry ChaoNo ratings yet

PENALTIES - Expired ATP

PENALTIES - Expired ATP

Uploaded by

kmo0 ratings0% found this document useful (0 votes)

11 views1 pageOriginal Title

PENALTIES - Expired ATP.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pagePENALTIES - Expired ATP

PENALTIES - Expired ATP

Uploaded by

kmoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

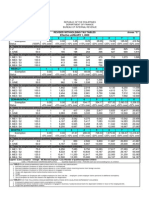

PENALTIES

AMOUNT OF COMPROMISE PENALTY

For failure to issue receipts or sales or First Offense Second Offense

commercial invoices P10,000 P20,000

For refusal to issue receipts or sales or

25,000 50,000

commercial invoices

For issuance of receipts that do not truly

reflect and/or contain all the information 1,000 2,500

required to be shown therein

If the information missing is the correct

2,000 5,000

amount of the transaction

If the duplicate copy of the invoices is

blank but the original copy thereof is 10,000 20,000

detached from the booklet

For possession or use of unregistered

10,000 20,000

receipts or invoices

For use of unregistered cash register

25,000 50,000

machines in lieu of invoices or receipts

For possession or use of multiple or

Not subject to Compromise

double receipts or invoices

For printing or causing, aiding or abetting the printing of:

a) Receipts or invoices without authority

10,000 20,000

from the BIR

b) Double or multiple sets of receipts or

Not subject to Compromise

invoices

c) Receipts or invoices not bearing any of 5,000 10,000

the following:

Consecutive numbers

·Name of Taxpayer

· Business Style

· Business address of the person or entity

to use the same

· Taxpayer Account No.

· Name, address, date, authority no. of

the printer and inclusive serial numbers

of the batch or receipts printed

· VAT No., if taxpayer is VAT-registered

For failure of the printer to submit the

required quarterly report under Sec. 238 1,000 3,000

of the Tax Code as amended

Source: https://www.bir.gov.ph/index.php/registration-requirements/secondary-registration/application-

for-authority-to-print-receipts-invoices.html#procedures

You might also like

- Bir Ruling - Exemption of Donation From DSTDocument10 pagesBir Ruling - Exemption of Donation From DSTDenise Capacio LirioNo ratings yet

- Bir Ruling Da 086 08Document5 pagesBir Ruling Da 086 08Orlando O. CalundanNo ratings yet

- BOI Citizen's CharterDocument32 pagesBOI Citizen's CharterPam MarceloNo ratings yet

- SECTION 2. Objectives: Application Form), Tax Residency Certificate (TRC) Duly Issued by The ForeignDocument13 pagesSECTION 2. Objectives: Application Form), Tax Residency Certificate (TRC) Duly Issued by The ForeignCarloAysonNo ratings yet

- RMC No. 3-2022Document2 pagesRMC No. 3-2022Shiela Marie MaraonNo ratings yet

- My Own ABC's To Success by Madeleine Macutay, CpaDocument3 pagesMy Own ABC's To Success by Madeleine Macutay, Cpaeine10100% (1)

- Affidavit of LegitimationDocument2 pagesAffidavit of LegitimationChen C AbreaNo ratings yet

- Guidelines and Conduct of TCVD RMO09-2006Document45 pagesGuidelines and Conduct of TCVD RMO09-2006Kris CalabiaNo ratings yet

- 14-2001 - Requirements For Tax ExemptionDocument7 pages14-2001 - Requirements For Tax ExemptionArjam B. BonsucanNo ratings yet

- Affidavit of Loss Format TinDocument1 pageAffidavit of Loss Format TinRached Piamonte RondinaNo ratings yet

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutDocument4 pagesBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiNo ratings yet

- Common-Taxes - Income-Tax VAT OPT WT v2Document52 pagesCommon-Taxes - Income-Tax VAT OPT WT v2kayelineNo ratings yet

- Revenue Memorandum Order No. 37-94: March 25, 1994Document8 pagesRevenue Memorandum Order No. 37-94: March 25, 1994Rufino Gerard Moreno IIINo ratings yet

- Extrajudicial Settlement of EstateDocument4 pagesExtrajudicial Settlement of EstateStewart Paul TorreNo ratings yet

- Motion To Release Motor Vehicle-GumpalDocument5 pagesMotion To Release Motor Vehicle-Gumpalmagiting mabayogNo ratings yet

- Refund of CWT and VAT Upon Dissolution of Company - ICN 9.11.14Document3 pagesRefund of CWT and VAT Upon Dissolution of Company - ICN 9.11.14JianSadakoNo ratings yet

- Petition For Corporate Rehabilitation, Planholders, CreditorsDocument23 pagesPetition For Corporate Rehabilitation, Planholders, CreditorsMelvin PernezNo ratings yet

- Republic of The Philippines Quezon City: Court AppealsDocument38 pagesRepublic of The Philippines Quezon City: Court AppealsHerzl Hali V. HermosaNo ratings yet

- 1905 (Encs) 2000Document4 pages1905 (Encs) 2000Loss Pokla100% (1)

- Decision: Second DivisionDocument13 pagesDecision: Second DivisionGilbert John LacorteNo ratings yet

- Tax Refund LetterDocument1 pageTax Refund LetterClaire MeredithNo ratings yet

- Receipts InvoicesDocument9 pagesReceipts InvoicesDu Baladad Andrew Michael100% (1)

- BOI Form 501 Energy-RevisedDocument7 pagesBOI Form 501 Energy-RevisedNegros Solar PHNo ratings yet

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- Prescription, Waiver and Closure - Jamie Lyn HernandezDocument23 pagesPrescription, Waiver and Closure - Jamie Lyn HernandezJamie LynNo ratings yet

- RR No. 13-98Document16 pagesRR No. 13-98Ana DocallosNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- Bir Ruling No. 108-93Document2 pagesBir Ruling No. 108-93saintkarriNo ratings yet

- Powerpoint-09.14.22-Smmc Vat Zero Rating PDFDocument92 pagesPowerpoint-09.14.22-Smmc Vat Zero Rating PDFGirlie BacaocoNo ratings yet

- Secretary Certificate - Intra-Corporate - JELMACT REALTY CORP 2021Document1 pageSecretary Certificate - Intra-Corporate - JELMACT REALTY CORP 2021ACYATAN & CO., CPAs 2020No ratings yet

- BIR RMC No. 62-2005Document15 pagesBIR RMC No. 62-2005dencave1No ratings yet

- Cta 2D CV 09224 M 2019feb12 AssDocument17 pagesCta 2D CV 09224 M 2019feb12 AssMelan YapNo ratings yet

- Sworn Statement - Annex A With POS-BOS DetailsDocument1 pageSworn Statement - Annex A With POS-BOS Detailspetroncalamba40No ratings yet

- Cta Eb CV 01054 D 2015jan13 AssDocument18 pagesCta Eb CV 01054 D 2015jan13 AssMarcy BaklushNo ratings yet

- Suico JOINTDocument41 pagesSuico JOINTAlvin PateresNo ratings yet

- Cancellation of Business RegistrationDocument2 pagesCancellation of Business Registrationallen pinlacNo ratings yet

- Secretary Certificate For Sec Gis 1-13-2021Document2 pagesSecretary Certificate For Sec Gis 1-13-2021gabriella shintaine dominique dilayNo ratings yet

- CPA Certificate - CorporationDocument8 pagesCPA Certificate - CorporationHaRry PeregrinoNo ratings yet

- The Philippines: Tax Assessment, Appeal and Dispute ResolutionDocument29 pagesThe Philippines: Tax Assessment, Appeal and Dispute ResolutionJBNo ratings yet

- Invalidating Tax Assessment January 2024 2Document68 pagesInvalidating Tax Assessment January 2024 2arnulfojr hicoNo ratings yet

- 2005 BIR - Ruling - DA 139 05 - 20210505 12 PWRFVVDocument2 pages2005 BIR - Ruling - DA 139 05 - 20210505 12 PWRFVVAnya ForgerNo ratings yet

- Application For VAT Zero RatingDocument9 pagesApplication For VAT Zero RatingHanabishi RekkaNo ratings yet

- 2015 BIR Withholding Tax TableDocument1 page2015 BIR Withholding Tax TableJonasAblangNo ratings yet

- Dof Department Order No. 023-01Document2 pagesDof Department Order No. 023-01Ralph Ronald CatipayNo ratings yet

- Borres Realty & Development Corporation Borres Realty & Development CorporationDocument12 pagesBorres Realty & Development Corporation Borres Realty & Development Corporation09303313316No ratings yet

- Motion For Reconsideration Allow Payment of Filing Fee - Maria Cecilia P. LambatinDocument1 pageMotion For Reconsideration Allow Payment of Filing Fee - Maria Cecilia P. LambatinTere TongsonNo ratings yet

- Bir Ruling 332-12Document3 pagesBir Ruling 332-12Neil MayorNo ratings yet

- Pagong BagalDocument1 pagePagong Bagaljuliet_emelinotmaestroNo ratings yet

- 1 Requirements For Petition To LiftDocument1 page1 Requirements For Petition To LiftMarbe Rica PaladinNo ratings yet

- BIR Abatement FormDocument1 pageBIR Abatement FormJecky Delos ReyesNo ratings yet

- Republic of The Philippines Application For: National Water Resources Board Renewal ofDocument2 pagesRepublic of The Philippines Application For: National Water Resources Board Renewal ofMark PesiganNo ratings yet

- VALUE ADDED TAX Notes From BIRDocument30 pagesVALUE ADDED TAX Notes From BIREmil BautistaNo ratings yet

- A. Assessment B. Collection: Remedies of The GovernmentDocument10 pagesA. Assessment B. Collection: Remedies of The GovernmentGianna CantoriaNo ratings yet

- 4 - Rizal Provincial Government v. BIRDocument17 pages4 - Rizal Provincial Government v. BIRCarlota VillaromanNo ratings yet

- Promissory Note Ver 1.2 2021 With VersionDocument2 pagesPromissory Note Ver 1.2 2021 With Versionlilibeth padernaNo ratings yet

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDocument29 pages209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaNo ratings yet

- Notes On Application For Authority To Print ReceiptsDocument3 pagesNotes On Application For Authority To Print ReceiptsDenzel Edward CariagaNo ratings yet

- Application For Authority To Print Receipts & Invoices - Bureau of Internal RevenueDocument6 pagesApplication For Authority To Print Receipts & Invoices - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- 2 Tips & Tricks For MSMEs Tax Compliance Handouts PDFDocument79 pages2 Tips & Tricks For MSMEs Tax Compliance Handouts PDFGetty Reagan DyNo ratings yet

- 19473-2000-Amendment of The Revised Schedule ofDocument4 pages19473-2000-Amendment of The Revised Schedule ofPhilAeonNo ratings yet

- International Academy v. LittonDocument5 pagesInternational Academy v. LittonCherry ChaoNo ratings yet

- Gamboa v. TevesDocument17 pagesGamboa v. TevesCherry ChaoNo ratings yet

- International Express Travel v. CADocument3 pagesInternational Express Travel v. CACherry ChaoNo ratings yet

- Coastal Pacific Trading Inc. v. Southern Rolling Mills Inc.Document8 pagesCoastal Pacific Trading Inc. v. Southern Rolling Mills Inc.Cherry ChaoNo ratings yet

- California Manufacturing v. Advanced Technology System Inc.Document4 pagesCalifornia Manufacturing v. Advanced Technology System Inc.Cherry ChaoNo ratings yet

- RDO No. 43 - Pasig CityDocument374 pagesRDO No. 43 - Pasig CityCherry Chao100% (2)

- Estate Tax Amnesty ReturnDocument2 pagesEstate Tax Amnesty ReturnCherry Chao0% (1)

- Case Digest Sulo Sa Nayon Inc.Document3 pagesCase Digest Sulo Sa Nayon Inc.Cherry ChaoNo ratings yet

- Diamond Farms Inc Vs Diamond Farm Workers Multi-Purpose CooperativeDocument2 pagesDiamond Farms Inc Vs Diamond Farm Workers Multi-Purpose CooperativeCherry ChaoNo ratings yet

- FASAP v. PALDocument1 pageFASAP v. PALCherry ChaoNo ratings yet