Professional Documents

Culture Documents

3.BOQ-NOTES LC 166

3.BOQ-NOTES LC 166

Uploaded by

Maulik RavalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3.BOQ-NOTES LC 166

3.BOQ-NOTES LC 166

Uploaded by

Maulik RavalCopyright:

Available Formats

BOQ-NOTES :-

(1) All works shall be carried out as per latest MORTH Specification Booklet and other specification of

Division as directed.

(2) All Rates quoted include clearance of site (prior commencement of work and at its close) in all

respects and hold good for work under all conditions, site moisture, weather etc.

(3) The contractor shall exhibit a board as per Government Circular No. Vernacular TNC/ 1090/24/S

dated 05.03.2011 with details specifications and details of works and amount involved at site at his

own cost as directed by Engineer-in-charge.

(4) Testing of material shall be done as per statement attached with specification. The material should be

tested in GERI and or Private laboratory approved by Govt. of Gujarat. Bill for testing charges

should be paid by Executive Engineer and 1% Rs. 38,95,000.00 computed after deducting the cost of

materials to be supplied by the Govt. and shall be recovered from the contractor's running bill as per

Govt., R&B Department No. TNC-1085/(4)/C dtd 20-12-91.

(5) 1.00 % of Construction cost shall be deducted form Bill. Amount of Contract as per the Building and

other Construction worker's welfare cess Act - 1996 (Labour & Employment Department Letter No.

CWA - 2004 - 1831 - M (3). Dt. 9-12-05, Notification of Labour & Employment Department Dtd.

03-01-05 and Labour & Employment Department letter No. CWA / 2004-841-M(3), Dt. 14-12-05).

(6) In all R.C.C. items in rate analysis, standard cement consumption has been taken as per Govt. GR,

SOR-1085-71-H, Dtd. 08/12/1986 as stated in SOR therefore in RCC items where there is a change

as per actual mix design the cost of difference of cement consumption shall be deducted from the

rate of original item at the rate of input rate mentioned in the tender.

(7) The Contractor is solely responsible to bare all applicable taxes i.e. GST etc. & department will not

entertain any contractor representation to reimburse any financial burden due to applicable taxes i.e.

GST etc.

(8) Bidders are advised to visit the site & make himself / themself aware of the scope & specification of

the work to be done & of conditions and other factors bearing on the execution of the work before on

line submission of his / their bids. Once the bid is finalized, under no circumstances arguments for

crust deficiency / additional / altered works will be heard until & unless Engineer in charge deem so.

Engineer in charge shall have right to reject & decision of Engineer in charge shall be final &

binding.

(9) If Found necessary, contractor will be intimated for negotiation. He will be intimated maximum three

times within validity period for negotiation. If contractor does not respond in time, His earnest

money will be forfeited and his tender will be rejected. Paneltative action will be taken on such

contractor.

(10) For Tender cost more than Rs. 2.50 lacs, 2 % (percent) Tax deduction at source shall be made

(which includes 1% (one percent) for GST & 1% (one percent) for CGST as per Govt.of Gujarat,

Finance Deptt.’s Circular No. GST/1017/1097/GST Cell, Dtd. 15/09/2018 & above Circular details

to follows.

You might also like

- Tripura Natural GasDocument123 pagesTripura Natural GasprocesspipingdesignNo ratings yet

- Contractor EOT - Anaylasis Event-WiseDocument27 pagesContractor EOT - Anaylasis Event-WiseArshad Mahmood100% (2)

- Rule 68 - Danao Vs CADocument1 pageRule 68 - Danao Vs CAMiles50% (2)

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of Representativegordon scottNo ratings yet

- Boq NotesDocument1 pageBoq NotesJaimin ShahNo ratings yet

- Building SorDocument224 pagesBuilding SorAshutosh AgrawalNo ratings yet

- Old G.O 65Document22 pagesOld G.O 65Mohammed AzharNo ratings yet

- Roda - BoQDocument32 pagesRoda - BoQjoancaldentey78No ratings yet

- Tender Doc 33Document9 pagesTender Doc 33Mahmudul HasanNo ratings yet

- Inviting Tender SampleDocument5 pagesInviting Tender SampleAagney Alex RobinNo ratings yet

- Gabion Wall Bro TenderDocument28 pagesGabion Wall Bro TenderBIJAY KRISHNA DASNo ratings yet

- CGPWD Road Sor 2015Document92 pagesCGPWD Road Sor 2015Dileep Sharma67% (3)

- (Contractor) Thermax Engg Constrn Co LTD (TECC) : Iso Format No.F-Cmc-9.04Document6 pages(Contractor) Thermax Engg Constrn Co LTD (TECC) : Iso Format No.F-Cmc-9.04JKKNo ratings yet

- EE/NHD/SMG/AE-1/Road Safety Work /NIT-25/2nd Call/ 2021-22/2502 Dated:21-03-2022Document8 pagesEE/NHD/SMG/AE-1/Road Safety Work /NIT-25/2nd Call/ 2021-22/2502 Dated:21-03-2022Praveen Kumar M CNo ratings yet

- Go - Ms.no.227 - 2009 Price AdjustmentsDocument5 pagesGo - Ms.no.227 - 2009 Price AdjustmentsMetro Division 1No ratings yet

- Last SheetDocument51 pagesLast SheetPratik GuptaNo ratings yet

- P.O. MATERIAL - Mamidipally LineDocument30 pagesP.O. MATERIAL - Mamidipally LineBEPL TendersNo ratings yet

- G K P C&W H D D.I. K: Bill of QuantitiesDocument9 pagesG K P C&W H D D.I. K: Bill of QuantitiesNaveed ShaheenNo ratings yet

- Volume-Iii: O/O Chief Engineer (Procurement) MPPTCL, JabalpurDocument128 pagesVolume-Iii: O/O Chief Engineer (Procurement) MPPTCL, JabalpurRamphani NunnaNo ratings yet

- Transmission Corporation of Andhra Pradesh LimitedDocument29 pagesTransmission Corporation of Andhra Pradesh LimitedTender 247No ratings yet

- RFP For IEDocument241 pagesRFP For IEYash GargNo ratings yet

- 2016 02 29 Volme 3 R6Document4 pages2016 02 29 Volme 3 R6sat palNo ratings yet

- Mardanpur NITDocument287 pagesMardanpur NITdeyprasenNo ratings yet

- Volume-3a-Financial BidDocument13 pagesVolume-3a-Financial BidBrijesh RavalNo ratings yet

- Signature of Contractor 7of 121Document5 pagesSignature of Contractor 7of 121kalpana_89128965No ratings yet

- HSR-2023 - Merged NewDocument59 pagesHSR-2023 - Merged NewRasitha NirangaNo ratings yet

- Pune Metro Rail Project Bid Documents FORDocument34 pagesPune Metro Rail Project Bid Documents FORsantanu mukherjeeNo ratings yet

- HSR-Rev 01Document61 pagesHSR-Rev 01Ushan IranthaNo ratings yet

- Report Accompanying The Revised GST & Embedded Tax: Palamoor - Ranga Reddy Lift Irrigation Scheme - Package - 5Document2 pagesReport Accompanying The Revised GST & Embedded Tax: Palamoor - Ranga Reddy Lift Irrigation Scheme - Package - 5Naveenkumar AdirintiNo ratings yet

- SOR Road Works1!4!10Document95 pagesSOR Road Works1!4!10gagajainNo ratings yet

- Vol2 PDFDocument82 pagesVol2 PDFVimal SinghNo ratings yet

- Work OrderDocument4 pagesWork OrderMaitri Auto Electrical East AfricaNo ratings yet

- TenderDocument144 pagesTenderrverma2528No ratings yet

- DanapurBIDDOC 18Document1 pageDanapurBIDDOC 18Prasenjit DeyNo ratings yet

- Dash Fastners Tender DocumentDocument68 pagesDash Fastners Tender DocumentAnonymous 1uGSx8bNo ratings yet

- Price Adjustment GOs & Circulars R&B Department...Document37 pagesPrice Adjustment GOs & Circulars R&B Department...Vizag Roads88% (24)

- Tender Schedult EL 50-36 - 2019-20 - Off Trade MaintenanceDocument14 pagesTender Schedult EL 50-36 - 2019-20 - Off Trade Maintenancekaygupta301102No ratings yet

- JujuDocument46 pagesJujuvarma369vinaNo ratings yet

- 13 Sec 1 General SpecDocument10 pages13 Sec 1 General Specnur fatin farhanaNo ratings yet

- DTCNBurlaDocument199 pagesDTCNBurlasrinivas690% (1)

- PriceAdjustment GOs ampCircularsRabdB DepartmentDocument41 pagesPriceAdjustment GOs ampCircularsRabdB DepartmentV Venkata Narayana50% (4)

- Res Sor 04 01 2019Document192 pagesRes Sor 04 01 2019Sudama ParateNo ratings yet

- QCS-2010 Section 1 Part 01 IntroductionDocument8 pagesQCS-2010 Section 1 Part 01 Introductionbryanpastor106No ratings yet

- Tender For Providing & Fixing of Kota StoneDocument3 pagesTender For Providing & Fixing of Kota StoneSantoshkumar GurmeNo ratings yet

- Nit11 PDFDocument239 pagesNit11 PDFexecutive engineerNo ratings yet

- GO Ms No 57Document2 pagesGO Ms No 57SEPR NlgNo ratings yet

- Tendernotice 1Document6 pagesTendernotice 1Sahil MahajanNo ratings yet

- Technical Specification of Hospital ProjectDocument623 pagesTechnical Specification of Hospital ProjectSalman Shah100% (1)

- Raigad DSR 2015-16 PWD PDFDocument274 pagesRaigad DSR 2015-16 PWD PDFAnonymous YHcvra8Xw689% (9)

- Taxation and Pricing Format For MatarbariDocument3 pagesTaxation and Pricing Format For MatarbariMd. Mozahidul IslamNo ratings yet

- Presentation On Contract ManagementDocument17 pagesPresentation On Contract ManagementPradeep Kumar SharmaNo ratings yet

- Section 1 PDFDocument299 pagesSection 1 PDFIbrahim KhalifaNo ratings yet

- 04 VOL04Tech SpecsDocument534 pages04 VOL04Tech Specssuman prasadNo ratings yet

- PSER:SCT:PAL-I1263:11 13/10/2011: SL. NO. Reference Cl. of Tender Document BHEL's ClarificationDocument18 pagesPSER:SCT:PAL-I1263:11 13/10/2011: SL. NO. Reference Cl. of Tender Document BHEL's ClarificationvinodsomaniNo ratings yet

- Qcs 2010 Part 1.01 IntroductionDocument8 pagesQcs 2010 Part 1.01 IntroductionRotsapNayrbNo ratings yet

- Bro JK NSV & FWDDocument67 pagesBro JK NSV & FWDKailash paliwalNo ratings yet

- Act on Special Measures for the Deregulation of Corporate ActivitiesFrom EverandAct on Special Measures for the Deregulation of Corporate ActivitiesNo ratings yet

- E Tender Notice - New Circuit House RajpiplaDocument4 pagesE Tender Notice - New Circuit House RajpiplaJaimin ShahNo ratings yet

- Use of Plastic Waste in Road ConstructionDocument4 pagesUse of Plastic Waste in Road ConstructionJaimin ShahNo ratings yet

- LetterDocument12 pagesLetterJaimin ShahNo ratings yet

- Special ConditionDocument1 pageSpecial ConditionJaimin ShahNo ratings yet

- Boq NotesDocument1 pageBoq NotesJaimin ShahNo ratings yet

- Specification IndexDocument21 pagesSpecification IndexJaimin ShahNo ratings yet

- Auda - 18 & 20-01-2022 - Sarathya West - ResidentialDocument2 pagesAuda - 18 & 20-01-2022 - Sarathya West - ResidentialJaimin ShahNo ratings yet

- TCS 5Document1 pageTCS 5Jaimin ShahNo ratings yet

- AMC - 04-08-2021 - North West - ResidentialDocument3 pagesAMC - 04-08-2021 - North West - ResidentialJaimin ShahNo ratings yet

- Auda - 18 & 20-01-2022 - Sarathya West - ResidentialDocument2 pagesAuda - 18 & 20-01-2022 - Sarathya West - ResidentialJaimin ShahNo ratings yet

- TCS 4Document1 pageTCS 4Jaimin ShahNo ratings yet

- Bridge RVS Formats With Annexure-1&2 - FINALDocument11 pagesBridge RVS Formats With Annexure-1&2 - FINALJaimin ShahNo ratings yet

- PAE Gambhira Bridge (New Wearing Coat)Document6 pagesPAE Gambhira Bridge (New Wearing Coat)Jaimin ShahNo ratings yet

- CD Work Condition Details and Crash BarrierDocument3 pagesCD Work Condition Details and Crash BarrierJaimin ShahNo ratings yet

- TCS 3Document1 pageTCS 3Jaimin ShahNo ratings yet

- Kerala FlightDocument1 pageKerala FlightJaimin ShahNo ratings yet

- Bridge RVS Formats With Annex-1 02 - FINALDocument11 pagesBridge RVS Formats With Annex-1 02 - FINALJaimin ShahNo ratings yet

- P (CVK N) Mi (H (T (At (T) : (Vbig:-Rijp) Pli (Mi.M.) (Vbig, Rijp) PliDocument1 pageP (CVK N) Mi (H (T (At (T) : (Vbig:-Rijp) Pli (Mi.M.) (Vbig, Rijp) PliJaimin ShahNo ratings yet

- Aato ZZDocument9 pagesAato ZZJaimin ShahNo ratings yet

- P (CVK N) Mi (H (T (At (T) : (Vbig:-Rijp) Pli (Mi.M.) (Vbig, Rijp) PliDocument1 pageP (CVK N) Mi (H (T (At (T) : (Vbig:-Rijp) Pli (Mi.M.) (Vbig, Rijp) PliJaimin ShahNo ratings yet

- Armstrong 2016 Commentary Uk Housing Market Problems and PoliciesDocument5 pagesArmstrong 2016 Commentary Uk Housing Market Problems and PoliciesCandelaNo ratings yet

- Philippine Canadian Inquirer #389Document40 pagesPhilippine Canadian Inquirer #389canadianinquirerNo ratings yet

- How To Interpret A Motor Vehicle Search Result and Search Certificate PDFDocument2 pagesHow To Interpret A Motor Vehicle Search Result and Search Certificate PDFVasif SholaNo ratings yet

- A Mini Project On SapmDocument28 pagesA Mini Project On SapmPraveen KumarNo ratings yet

- Philippine Christian University Course OutlineDocument11 pagesPhilippine Christian University Course OutlineFernan Del Espiritu SantoNo ratings yet

- Operational Risk: Risks Arising From Business ActivityDocument14 pagesOperational Risk: Risks Arising From Business ActivityAmbrose NshekanaboNo ratings yet

- JAPAN Insurance MarketDocument12 pagesJAPAN Insurance MarketGabriela DendeaNo ratings yet

- HVN - Annual Report 2019Document150 pagesHVN - Annual Report 2019Krithik RajNo ratings yet

- 320 33 Powerpoint Slides Chapter 15 Externalities Public GoodsDocument8 pages320 33 Powerpoint Slides Chapter 15 Externalities Public GoodsPrateek KhandelwalNo ratings yet

- Strangeness and The StrangersDocument5 pagesStrangeness and The StrangersabdesssaNo ratings yet

- Summa Kumagai Vs RomagoDocument2 pagesSumma Kumagai Vs RomagoWorstWitch TalaNo ratings yet

- Presentation FormatDocument9 pagesPresentation FormatHassan MohsinNo ratings yet

- Automated Entry-Exit System With SmsDocument8 pagesAutomated Entry-Exit System With SmsenzoNo ratings yet

- Mercantile Law Bar Examination Questions Suggested Answers 1990-2014Document260 pagesMercantile Law Bar Examination Questions Suggested Answers 1990-2014cherry blossomNo ratings yet

- Owner's Manual Dominar 400BSVI PDFDocument60 pagesOwner's Manual Dominar 400BSVI PDFUlagaariyan PremkumarNo ratings yet

- SEC FAQ Authenticity of DocumentsDocument4 pagesSEC FAQ Authenticity of DocumentsRyu UyNo ratings yet

- Understanding Thai Politics PDFDocument19 pagesUnderstanding Thai Politics PDFΑνδρέας ΓεωργιάδηςNo ratings yet

- White Collar CrimeDocument23 pagesWhite Collar Crimesharmasimran0523No ratings yet

- Advanced Fluid Mechanics: Incompressible Flow of Viscous FluidsDocument33 pagesAdvanced Fluid Mechanics: Incompressible Flow of Viscous FluidsTri WidayatnoNo ratings yet

- SPECIAL POWER OF ATTORNEY Angel, Et Al.Document1 pageSPECIAL POWER OF ATTORNEY Angel, Et Al.Janus MariNo ratings yet

- IPL Shangri La Hotel v. CA GR No. 111580Document2 pagesIPL Shangri La Hotel v. CA GR No. 111580Joshua John EspirituNo ratings yet

- Garrett Vent Wastegate Install Guide-1Document12 pagesGarrett Vent Wastegate Install Guide-1Stanislav TsonchevNo ratings yet

- ABC Advance Accounting Inter 1Document4 pagesABC Advance Accounting Inter 1Chirag GadiaNo ratings yet

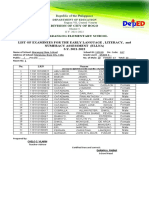

- List of Examinees For The Early Language, Literacy, and Numeracy Assessment (Ellna) S.Y. 2021-2022Document2 pagesList of Examinees For The Early Language, Literacy, and Numeracy Assessment (Ellna) S.Y. 2021-2022April Catadman QuitonNo ratings yet

- Finance Act 2010Document5 pagesFinance Act 2010Tapia MelvinNo ratings yet

- Table A1. JSW Steel Balance Sheet: Source: Dion Global Solutions LimitedDocument12 pagesTable A1. JSW Steel Balance Sheet: Source: Dion Global Solutions Limitedkarunakar vNo ratings yet

- CHAPTER II. CICM in The WorldDocument9 pagesCHAPTER II. CICM in The WorldJocelyn TabudlongNo ratings yet

- Moot Court Tutorial 1Document8 pagesMoot Court Tutorial 1rushi sreedharNo ratings yet