Professional Documents

Culture Documents

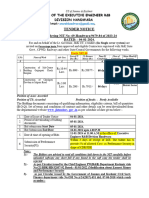

Taxation and Pricing Format For Matarbari

Uploaded by

Md. Mozahidul IslamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation and Pricing Format For Matarbari

Uploaded by

Md. Mozahidul IslamCopyright:

Available Formats

Government of the People’s Republic of Bangladesh

Office of the Chief Engineer

Roads and Highways Department

Sarak Bhaban, Tejgaon, Dhaka

Phone: +8802-8879299 Fax :+8802-8879199

E-mail : ce@rhd.gov.bd

Memo No. Date:

Subject: Request for Confirmation of Taxation and Pricing Format for Matarbari Port Development

Project (RHD Component).

Ref.: Project Director (ACE), RHD, Matarbari Port Development Project (RHD Component)’s Memo No.

PD/MPDP/322 dated 01-09-2021.

With reference to the letter mentioned above, the comments of this office are given below:

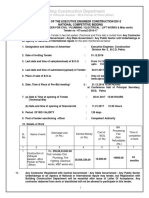

Comment on Serial No. 1, 2 & 4 :

The proposed provisions are accepted which may be incorporated in the bidding document.

Comment on Serial No. 3:

The foreign staff and workers of the Contractor shall be liable to pay Personal Income Tax irrespective of their

incomes such as salaries, wages etc. in the Employer’s Country according to the prevailing Tax Rules. However,

any exemption of Personal Income Tax for foreign staff and workers according to the loan agreement shall be

subject to approval of National Board of Revenue (NBR), Bangladesh on case by case basis.

Comment on Serial No. 5:

It has been mentioned in the referenced letter that JICA loans will not cover the amount of Custom Duties and

taxes applicable for importation of plant and materials under this project. To comply with this condition of JICA

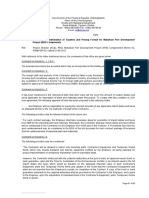

loan agreement, the following segment of texts has been proposed in the referened letter:

“…….. the Employer will be responsible for paying the relevant amounts of any applicable import duties and taxes

so assessed directly to the Tax Authority of behalf of the Contractor…….”

The following provision may be followed instead of the above text:

“ For each contract package, the Employer shall take necessary steps for exemption of import duties and taxes

from NBR for the imported plant and materials. Alternately, the Contractor shall pay import duties and taxes which

will be reimbursed to the Contractor by the Employer from GOB part of the Contract. A Provisional Sum item for

such reimbursement may be considered in the BOQ of the bid document for each contract package (Provisional

Sum for reimbursement of imported plant and materials).

Comment on Serial No. 6:

The following provision may be considered

“The Contractor will be allowed to import only bona-fide plant, Contractor's Equipment and Temporary Works

items, which may include transport and delivery equipment certified by the Employer as being essential for

project implementation on temporary importation-cum-re-exportable basis.

However, the Contractor shall post with the customs authorities at the port of entry an approved export bond or

bank guarantee, valid until the Time for Completion of the Works plus six months, in an amount equal to the full

import duties and taxes which would be payable on the assessed imported value of such Contractor's

Equipment, plant and Temporary Works items and callable in the event that the Contractor's Equipment and

plant are not exported from the Employer's country on completion of the Contract. A copy of the bond or bank

guarantee endorsed by the customs authorities shall be provided by the Contractor to the Employer, and copied

to the Engineer, upon the importation of individual items of the Contractor's Equipment, plant, Temporary Works

items or goods.

Page-01 of 02

Letter-Chief Engineer-2021 (English)-Seyam 1

To obtain exemption of Duties and Taxes on bona-fide plant, Contractor's Equipment and Temporary Works

items, the Contractor shall submit a Master List, certified by the Employer, to the National Board of Revenue for

their information and final approval.

The Master List will be based on the list of equipment submitted by the Contractor in the Bid. The list of

equipment submitted by the bidder will be reviewed and modified, if necessary, at the time of finalization of the

Contract Agreement in consultation with the National Board of Revenue.”

Comment on Serial No. 7:

The proposed provisions are accepted which may be incorporated in the bidding document.

Comment on Serial No. 8:

The Unit rate of each item shall include IT and VAT which will be deducted at source on payments from the

Employer to the Contractor. In case of any change in VAT and IT rates, the corresponding effect shall be reflected

in the Contract price according to the provision of conditions of Contract.

Therefore, he is requested to take necessary action in light of the above-mentioned comments.

(Md. Abdus Sabur)

Chief Engineer

Project Director (ACE, RHD)

Matarbari Port Development Project (RHD Part)

RHD Foreign Aided Projects Office Building (1st Floor)

Road-27, Block-A, Banani, Dhaka-1213

Copy:

Additional Chief Engineer, RHD, Planning and Maintenance Wing, Sarak Bhaban, Tejgaon, Dhaka.

Page-02 of 02

Letter-Chief Engineer-2021 (English)-Seyam 2

Letter-Chief Engineer-2021 (English)-Seyam 3

You might also like

- The New 3D Layout for Oil & Gas Offshore Projects: How to ensure successFrom EverandThe New 3D Layout for Oil & Gas Offshore Projects: How to ensure successRating: 4.5 out of 5 stars4.5/5 (3)

- TenderDocument144 pagesTenderrverma2528No ratings yet

- Government of Karnataka: National HighwayDocument30 pagesGovernment of Karnataka: National Highwayakshatjain3001No ratings yet

- 81067tenderpages PDFDocument70 pages81067tenderpages PDFsantosh nageshwarNo ratings yet

- Textbook of Urgent Care Management: Chapter 4, Building Out Your Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 4, Building Out Your Urgent Care CenterNo ratings yet

- Section2 - Tender Data SheetDocument5 pagesSection2 - Tender Data SheetParvez Syed RafiNo ratings yet

- Part 1 BRBCL P2aDocument147 pagesPart 1 BRBCL P2aKunal SinghNo ratings yet

- Upto For In: CircularDocument2 pagesUpto For In: CircularmanishjonwNo ratings yet

- Tender PagesDocument400 pagesTender PagesSiddhesh JamsandekarNo ratings yet

- TENDER - BRO Himachal Pradesh Rs.87 CR PDFDocument168 pagesTENDER - BRO Himachal Pradesh Rs.87 CR PDFVishal ChaudharyNo ratings yet

- Nit 69 RNB HandwaraDocument8 pagesNit 69 RNB HandwaraLone MusaibNo ratings yet

- Tender 2 PDFDocument243 pagesTender 2 PDFabid4845No ratings yet

- Office of The Superintending Engineer Gonda Circle, PWD, GondaDocument4 pagesOffice of The Superintending Engineer Gonda Circle, PWD, GondaDescon Infrastructures Pvt. Ltd.No ratings yet

- Sample Tender For Construction WorkDocument131 pagesSample Tender For Construction WorkSanjay M. ParkarNo ratings yet

- Section 2 (Bid Data Sheet) DS-2Document7 pagesSection 2 (Bid Data Sheet) DS-2Advut TonmoyNo ratings yet

- Section2 - Tender Data SheetDocument7 pagesSection2 - Tender Data SheetTahia CorporationNo ratings yet

- Section2 - Tender Data SheetDocument2 pagesSection2 - Tender Data Sheetmahmudul hasanNo ratings yet

- 1.attachment 1 LETTER INVITING BIDDocument5 pages1.attachment 1 LETTER INVITING BIDstegenNo ratings yet

- 82105TENDERPAGESDocument76 pages82105TENDERPAGESChandrapal ChandrapalNo ratings yet

- BCPL LOA BTSS2 Po1459Document46 pagesBCPL LOA BTSS2 Po1459Chandan KumarNo ratings yet

- Transgenic Glass HouseDocument64 pagesTransgenic Glass Housesreddy.ncert.indiaNo ratings yet

- Section 8 - Special Conditions of ContractDocument8 pagesSection 8 - Special Conditions of ContractShuhan Mohammad Ariful HoqueNo ratings yet

- Selling Tender Document (Principal) - Selling Tender Document (Others) - Receiving Tender DocumentDocument1 pageSelling Tender Document (Principal) - Selling Tender Document (Others) - Receiving Tender Documentsharif uddinNo ratings yet

- Section2 - Tender Data SheetDocument6 pagesSection2 - Tender Data Sheetmohammed nusrot hossanNo ratings yet

- 8347 Tender DocumentDocument40 pages8347 Tender Documentmvs srikarNo ratings yet

- VDC AgreementDocument5 pagesVDC AgreementSudeep ChNo ratings yet

- NIT50TDocument224 pagesNIT50TsalfmarcomrNo ratings yet

- Kurung KumeyDocument5 pagesKurung Kumeyjai karanNo ratings yet

- Tendernotice 1-1Document165 pagesTendernotice 1-1Bittudubey officialNo ratings yet

- Supply of Local Construction Material: Royal Government of Bhutan Ministry of Works and Human SettlementDocument31 pagesSupply of Local Construction Material: Royal Government of Bhutan Ministry of Works and Human SettlementRinchen DorjiNo ratings yet

- Tendernotice 2Document47 pagesTendernotice 2Descon Infrastructures Pvt. Ltd.No ratings yet

- Tendernotice 1Document6 pagesTendernotice 1Sahil MahajanNo ratings yet

- Thrie Beam UttarakhandDocument36 pagesThrie Beam UttarakhandAkepati Sunil Kumar ReddyNo ratings yet

- 21L00020 - Bidding DocumentsDocument31 pages21L00020 - Bidding DocumentsRoger DinopolNo ratings yet

- E Tender Crane Shed BuildingDocument112 pagesE Tender Crane Shed Buildingkamit.qcengineerNo ratings yet

- Tendernotice 1Document5 pagesTendernotice 1Sham SuriNo ratings yet

- DTCN Gudari fvc-SINGLE COVERDocument88 pagesDTCN Gudari fvc-SINGLE COVERIsha BeheraNo ratings yet

- Schedule of Rates 2012-13 WRD KarnatakaDocument173 pagesSchedule of Rates 2012-13 WRD KarnatakaRiazahemad B Jagadal100% (1)

- NA 28.11.2020 Up To 13:00 Hrs 14.12.2020 Up To 13:00 Hrs 15.12.2020 Up To 13:00 HrsDocument3 pagesNA 28.11.2020 Up To 13:00 Hrs 14.12.2020 Up To 13:00 Hrs 15.12.2020 Up To 13:00 Hrshare ramNo ratings yet

- Encl.: As Above. Copy For Kind Perusal To:: SMEC International Pty. LTDDocument8 pagesEncl.: As Above. Copy For Kind Perusal To:: SMEC International Pty. LTDMohd UmarNo ratings yet

- 8262 Tender DocsDocument52 pages8262 Tender DocsAkash NitoneNo ratings yet

- E Bid1Document74 pagesE Bid1Praween mandappatiNo ratings yet

- GO Ms No 57Document2 pagesGO Ms No 57SEPR NlgNo ratings yet

- Tender Document (Tender For Consultancy Serivices)Document21 pagesTender Document (Tender For Consultancy Serivices)SoniyaSinghNo ratings yet

- The Reference Time For All The Above Activities Is 11.30 HoursDocument12 pagesThe Reference Time For All The Above Activities Is 11.30 HoursBbbNo ratings yet

- JujuDocument46 pagesJujuvarma369vinaNo ratings yet

- Section2 - Tender Data SheetDocument5 pagesSection2 - Tender Data Sheetsarder nafiNo ratings yet

- Pre Qualification DocumentDocument40 pagesPre Qualification DocumentshamandeepsinghNo ratings yet

- 23-02-2021 - Upto 3.00 P.M. and Will Be Opened at 3.30 PM in The Office of The ExecutiveDocument3 pages23-02-2021 - Upto 3.00 P.M. and Will Be Opened at 3.30 PM in The Office of The ExecutiveusmanaliNo ratings yet

- PaniaDocument5 pagesPaniajai karanNo ratings yet

- EC 7,80,35,047 Construction of Office Building For Assam and Nagaland-CPWD PDFDocument129 pagesEC 7,80,35,047 Construction of Office Building For Assam and Nagaland-CPWD PDFSachin MoryaNo ratings yet

- Composite Dtcn-Single CoverDocument88 pagesComposite Dtcn-Single CoverIsha BeheraNo ratings yet

- Building Construction Department: Construction of Vidhayak Awasan - MLA Parisar at Patna (Bihar)Document3 pagesBuilding Construction Department: Construction of Vidhayak Awasan - MLA Parisar at Patna (Bihar)PERVEZ AHMAD KHANNo ratings yet

- Composite Dtcn-Se OfficeDocument94 pagesComposite Dtcn-Se OfficeIsha BeheraNo ratings yet

- Notice Inviting Tender: Office of The Executive Engineer PWD (R&B) Division KathuaDocument8 pagesNotice Inviting Tender: Office of The Executive Engineer PWD (R&B) Division KathuaMonish MNo ratings yet

- Civil Aviation Authority, Bangladesh: Office of The Superintendent Engineer Elm Circle-Project. Kurmitola. Dhaka-1229Document2 pagesCivil Aviation Authority, Bangladesh: Office of The Superintendent Engineer Elm Circle-Project. Kurmitola. Dhaka-1229S.M BadruzzamanNo ratings yet

- Tendernotice AnantnagDocument67 pagesTendernotice AnantnagMutasim QureshiNo ratings yet

- Security Fencing With Allied Infrastructure at Cod Under Ge (E) JabalpurDocument78 pagesSecurity Fencing With Allied Infrastructure at Cod Under Ge (E) JabalpurManoj Kumar SagarNo ratings yet

- Leave Application AGDocument2 pagesLeave Application AGMd. Mozahidul IslamNo ratings yet

- Quran Tafseer in BanglaDocument186 pagesQuran Tafseer in BanglaMd. Mozahidul IslamNo ratings yet

- 'Document116 pages'Md. Mozahidul IslamNo ratings yet

- H - VH - KZ ©C I Gva G: Cöavb Cö KŠKJXDocument3 pagesH - VH - KZ ©C I Gva G: Cöavb Cö KŠKJXMd. Mozahidul IslamNo ratings yet

- CV of RajibDocument2 pagesCV of RajibMd. Mozahidul IslamNo ratings yet

- CV of Shaharia IslamDocument3 pagesCV of Shaharia IslamMd. Mozahidul IslamNo ratings yet

- DATE CalculationDocument7 pagesDATE CalculationMd. Mozahidul IslamNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentMd. Mozahidul IslamNo ratings yet

- DATE CalculationDocument7 pagesDATE CalculationMd. Mozahidul IslamNo ratings yet

- Taxation and Pricing Format For MatarbariDocument3 pagesTaxation and Pricing Format For MatarbariMd. Mozahidul IslamNo ratings yet

- Class 10th IMO 5 Years EbookDocument71 pagesClass 10th IMO 5 Years EbookAdarsh Agrawal100% (1)

- Business Plan: Malaysian NGV SDN BHDDocument81 pagesBusiness Plan: Malaysian NGV SDN BHDMurtaza ShaikhNo ratings yet

- RRB Alp Tech. CBT 2 Master Question Paper Electrician Trade Date 22 1 2019 Shift 1Document58 pagesRRB Alp Tech. CBT 2 Master Question Paper Electrician Trade Date 22 1 2019 Shift 1arpitrockNo ratings yet

- Ordinary Differential Equations Multiple Choice Questions and Answers - SanfoundryDocument7 pagesOrdinary Differential Equations Multiple Choice Questions and Answers - SanfoundrySaiman PervaizNo ratings yet

- List of Ambulance Services in Rajahmundry - PythondealsDocument5 pagesList of Ambulance Services in Rajahmundry - PythondealsSRINIVASARAO JONNALANo ratings yet

- List of Circulating Currencies by CountryDocument8 pagesList of Circulating Currencies by CountryVivek SinghNo ratings yet

- Child Has Does: The Adultery, Child Be and Entitled His Own, The Child's That His DueDocument1 pageChild Has Does: The Adultery, Child Be and Entitled His Own, The Child's That His DuerickmortyNo ratings yet

- Lecture 02 Running EnergyPlusDocument29 pagesLecture 02 Running EnergyPlusJoanne SiaNo ratings yet

- Subgrade Preparation in Earth CutDocument3 pagesSubgrade Preparation in Earth Cutusama buttNo ratings yet

- Grundfosliterature 3081153Document120 pagesGrundfosliterature 3081153Cristian RinconNo ratings yet

- GTA Liberty City Stories CheatsDocument6 pagesGTA Liberty City Stories CheatsHubbak KhanNo ratings yet

- Motion For Forensic Examination - Cyber CasedocxDocument5 pagesMotion For Forensic Examination - Cyber CasedocxJazz Tracey100% (1)

- IO - 20190107 - ABB MV Switchgear 36kV - Installation and Operating Instructions - V20 - ENDocument24 pagesIO - 20190107 - ABB MV Switchgear 36kV - Installation and Operating Instructions - V20 - ENFranco MolinaNo ratings yet

- Fundamental of HDD Technology (3) : OutlineDocument8 pagesFundamental of HDD Technology (3) : OutlineJoseMNo ratings yet

- List of Medical Institutions Available For Foreign Language(s)Document24 pagesList of Medical Institutions Available For Foreign Language(s)leithNo ratings yet

- Novtang (Int'l Wed)Document3 pagesNovtang (Int'l Wed)raymondsuwsNo ratings yet

- LECTURE 11-Microalgal Biotechnology-Biofuels N BioproductsDocument16 pagesLECTURE 11-Microalgal Biotechnology-Biofuels N BioproductsIntan Lestari DewiNo ratings yet

- Design of Earth Air Tunnel To Conserve Energy - FinalDocument19 pagesDesign of Earth Air Tunnel To Conserve Energy - FinalApurva AnandNo ratings yet

- Volkswagen Passat R Line Price ListDocument2 pagesVolkswagen Passat R Line Price ListDr Uvarani Sp Care Rawang TinNo ratings yet

- Door LockDocument102 pagesDoor LockNicolás BozzoNo ratings yet

- Easa Ad 2022-0026 1Document12 pagesEasa Ad 2022-0026 1Syed BellaryNo ratings yet

- Tracer Survey Manual - Final 2Document36 pagesTracer Survey Manual - Final 2nesrusam100% (1)

- 5c X-Tend FG Filter InstallationDocument1 page5c X-Tend FG Filter Installationfmk342112100% (1)

- CFP The 17th International Computer Science and Engineering Conference (ICSEC 2013)Document1 pageCFP The 17th International Computer Science and Engineering Conference (ICSEC 2013)Davy SornNo ratings yet

- Cenomar Request PSA Form-NewDocument1 pageCenomar Request PSA Form-NewUpuang KahoyNo ratings yet

- Trench Infill Catalog Sheet Euro Version PDFDocument3 pagesTrench Infill Catalog Sheet Euro Version PDFricbxavierNo ratings yet

- LT32567 PDFDocument4 pagesLT32567 PDFNikolayNo ratings yet

- Unit 2 Travel EnquiryDocument10 pagesUnit 2 Travel EnquiryQuân Soon Lê ChuNo ratings yet

- Fisher Separation TheoremDocument31 pagesFisher Separation TheoremArdi Gunardi0% (3)

- 08147-416H - LEGEND - Wahl - Fact Sheets - 5StarSeries - GBDocument1 page08147-416H - LEGEND - Wahl - Fact Sheets - 5StarSeries - GBChristian ParedesNo ratings yet

- To Engineer Is Human: The Role of Failure in Successful DesignFrom EverandTo Engineer Is Human: The Role of Failure in Successful DesignRating: 4 out of 5 stars4/5 (137)

- The Things We Make: The Unknown History of Invention from Cathedrals to Soda CansFrom EverandThe Things We Make: The Unknown History of Invention from Cathedrals to Soda CansRating: 4.5 out of 5 stars4.5/5 (21)

- Cable Supported Bridges: Concept and DesignFrom EverandCable Supported Bridges: Concept and DesignRating: 5 out of 5 stars5/5 (1)

- Summary of Neil Postman's Amusing Ourselves to DeathFrom EverandSummary of Neil Postman's Amusing Ourselves to DeathRating: 4 out of 5 stars4/5 (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Crossings: How Road Ecology Is Shaping the Future of Our PlanetFrom EverandCrossings: How Road Ecology Is Shaping the Future of Our PlanetRating: 4.5 out of 5 stars4.5/5 (10)

- The Things We Make: The Unknown History of Invention from Cathedrals to Soda CansFrom EverandThe Things We Make: The Unknown History of Invention from Cathedrals to Soda CansNo ratings yet

- Piping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationFrom EverandPiping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationRating: 4 out of 5 stars4/5 (18)

- The Finite Element Method: Linear Static and Dynamic Finite Element AnalysisFrom EverandThe Finite Element Method: Linear Static and Dynamic Finite Element AnalysisRating: 5 out of 5 stars5/5 (3)

- The Great Bridge: The Epic Story of the Building of the Brooklyn BridgeFrom EverandThe Great Bridge: The Epic Story of the Building of the Brooklyn BridgeRating: 4.5 out of 5 stars4.5/5 (59)

- Troubleshooting and Repair of Diesel EnginesFrom EverandTroubleshooting and Repair of Diesel EnginesRating: 1.5 out of 5 stars1.5/5 (2)

- Construction Innovation and Process ImprovementFrom EverandConstruction Innovation and Process ImprovementAkintola AkintoyeNo ratings yet

- Structural Cross Sections: Analysis and DesignFrom EverandStructural Cross Sections: Analysis and DesignRating: 4.5 out of 5 stars4.5/5 (19)

- Pile Design and Construction Rules of ThumbFrom EverandPile Design and Construction Rules of ThumbRating: 4.5 out of 5 stars4.5/5 (15)

- Engineering Rock Mass Classification: Tunnelling, Foundations and LandslidesFrom EverandEngineering Rock Mass Classification: Tunnelling, Foundations and LandslidesRating: 4 out of 5 stars4/5 (5)

- Skyway: The True Story of Tampa Bay's Signature Bridge and the Man Who Brought It DownFrom EverandSkyway: The True Story of Tampa Bay's Signature Bridge and the Man Who Brought It DownNo ratings yet

- Bridge Engineering: Classifications, Design Loading, and Analysis MethodsFrom EverandBridge Engineering: Classifications, Design Loading, and Analysis MethodsRating: 4 out of 5 stars4/5 (16)

- Transportation Decision Making: Principles of Project Evaluation and ProgrammingFrom EverandTransportation Decision Making: Principles of Project Evaluation and ProgrammingNo ratings yet