CAPA Format

Uploaded by

Sanjeev KumarRelated knowledge pages

- What is the best way to start investing in stocks?

Investing in stocks is a common way for individuals to build long-term wealth, but it requires careful planning and understanding of how markets work.

- How does technical analysis work for trading stocks and other markets?

Technical analysis is an approach to evaluating financial securities and markets by examining past trading data, primarily price and trade volume, in an effort to forecast future price movements. Instead of assessing a company’s fundamental value (such as earnings or dividends), technical analysts focus on charts and statistical indicators derived from market data. This methodology assumes that all relevant information (including fundamental and news factors) is reflected in the market price, so studying price action alone can provide trading signals. Technical analysis is commonly used by traders in stocks, commodities, currencies, cryptocurrencies, and other assets that have sufficient historical price data. Its goal is to identify patterns, trends, and statistical signals in market data that may indicate future market direction. Technical traders often use these signals to time entries and exits, manage risk, and guide trading decisions, typically over various time frames.

- What factors cause currency exchange rates to go up or down?

Currency exchange rates, which define the value of one country’s currency in terms of another, fluctuate constantly on global markets.

CAPA Format

Uploaded by

Sanjeev KumarRelated knowledge pages

- What is the best way to start investing in stocks?

Investing in stocks is a common way for individuals to build long-term wealth, but it requires careful planning and understanding of how markets work.

- How does technical analysis work for trading stocks and other markets?

Technical analysis is an approach to evaluating financial securities and markets by examining past trading data, primarily price and trade volume, in an effort to forecast future price movements. Instead of assessing a company’s fundamental value (such as earnings or dividends), technical analysts focus on charts and statistical indicators derived from market data. This methodology assumes that all relevant information (including fundamental and news factors) is reflected in the market price, so studying price action alone can provide trading signals. Technical analysis is commonly used by traders in stocks, commodities, currencies, cryptocurrencies, and other assets that have sufficient historical price data. Its goal is to identify patterns, trends, and statistical signals in market data that may indicate future market direction. Technical traders often use these signals to time entries and exits, manage risk, and guide trading decisions, typically over various time frames.

- What factors cause currency exchange rates to go up or down?

Currency exchange rates, which define the value of one country’s currency in terms of another, fluctuate constantly on global markets.

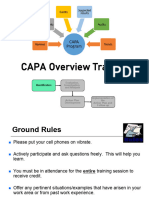

- CAPA Template Form: This form is used for identifying problems and detailing corrective and preventive actions, including root cause analysis and action implementation.

Related knowledge pages

- What is the best way to start investing in stocks?

Investing in stocks is a common way for individuals to build long-term wealth, but it requires careful planning and understanding of how markets work.

- How does technical analysis work for trading stocks and other markets?

Technical analysis is an approach to evaluating financial securities and markets by examining past trading data, primarily price and trade volume, in an effort to forecast future price movements. Instead of assessing a company’s fundamental value (such as earnings or dividends), technical analysts focus on charts and statistical indicators derived from market data. This methodology assumes that all relevant information (including fundamental and news factors) is reflected in the market price, so studying price action alone can provide trading signals. Technical analysis is commonly used by traders in stocks, commodities, currencies, cryptocurrencies, and other assets that have sufficient historical price data. Its goal is to identify patterns, trends, and statistical signals in market data that may indicate future market direction. Technical traders often use these signals to time entries and exits, manage risk, and guide trading decisions, typically over various time frames.

- What factors cause currency exchange rates to go up or down?

Currency exchange rates, which define the value of one country’s currency in terms of another, fluctuate constantly on global markets.