Professional Documents

Culture Documents

02

Uploaded by

Rozina TabassumCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02

Uploaded by

Rozina TabassumCopyright:

Available Formats

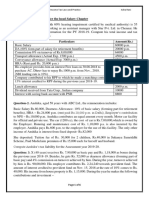

RIPHAH INTERNATIONAL UNIVERSITY

Course: Taxation Academic Year / Session: Spring Dated: 21-03-2020; Submission date: 29-3-2020

2020

Assignment No.: 02 Class: M.Com Total Marks: 07

Q. 1: Mr. Hamid, a citizen of Pakistan, is working with Zee (Pvt.) Limited, a multinational hotel as their head of

marketing for the last 15 years. He has provided you with the following information for the year ended June 30,

2020.

1. Break up of monthly salary is as follows:

Rupees

Basic Salary 500,000

Medical Allowance 75,000

Utility Allowance 50,000

No entitlement for free medical reimbursement is provided by the company. The basic salary received does not

include a onetime amount of Rs. 200,000 given by Zee (Pvt.) limited in cash on behalf of Mr. Hamid, as a

donation to a hospital established by the Government of Punjab.

2. Salary and allowances are deposited into each employee’s bank account on the 5 th working day of the following

month

3. A company maintained car for office and private use is also provided. Hamid pays Rs. 10,000 per month for the

private use of the car. For this purpose a new Mercedes was purchased on 01 January 2016, for Rs. 3,000,000.

Hamid purchased the car from the company at it book value of Rs. 900,000 in 31 October 2019 as per the

company policy. Market value of the company at that time was Rs. 1,500,000

4. On 31 October, 2019, Hamid opted for early retirement. On his retirement, in addition to the monthly

remuneration, he received Rs. 2,000,000 as a golden handshake payment. Hamid’s average rate of tax on his

taxable income for the last three tax years was 5%

5. On 01 April, 2020, Hamid left for Dubai and commenced employment on the same day with Kee (Pvt.) Limited,

an associated company of Zee (Pvt.) Limited. He was paid per month salary of Rs. 300,000. Following his

departure, Hamid returned to Pakistan for the first time on 09 August 2020 for Eid holidays.

6. Hamid was due Rs. 5,000,000 as a gratuity under the gratuity scheme of Zee (Pvt.) Limited. The scheme was not

approved by the FBR. Due to cash constrains, the gratuity though due to Hamid on 31 October 2019 was not

paid to Hamid. On 30 April, 2020, at the request of the Zee (Pvt.) Limited, Kee (Pvt.) Limited transferred the

equivalent of Rs. 5,000,000 in US dollar into Hamid’s US dollar account in UAE in lieu of gratuity due from Zee

(Pvt.) Limited.

7. Hamid was also entitled for a pension of Rs. 50,000 per month from Zee (Pvt.) Limited

8. Hamid paid Rs. 750,000 to Rozee.pk recruitment consultants in Pakistan to help him secure his employment in

Dubai

9. Hamid made a cash payment of Rs. 250,000 on account of Zakat under the Zakat and Ushr Ordinance, 1980

10. Hamid was entitled to lunch at the hotel’s restaurant where the usual charges are Rs. 1,500 per person. He is

entitled to a concessional rate of Rs. 100 per day, which is deducted from his salary. Total number of working

days during his employment with Zee (Pvt.) Ltd were 80 during tax year 2020

11. Hamid received a certificate of deduction of tax on his salary of Rs. 1,500,000

Required:

Give brief reasons for the

Compute Mr. Hamid’s taxable income and tax payable for the tax year 2020.

treatment of any item excluded from taxable income / liability

Page 1

You might also like

- Assignment 1 ABDocument4 pagesAssignment 1 ABWaasfaNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Salaxy Examples (Taxation)Document21 pagesSalaxy Examples (Taxation)PARTH NAIKNo ratings yet

- Tax Mid Term Draft: 15 MarksDocument4 pagesTax Mid Term Draft: 15 MarksWaasfa100% (1)

- TAXATION ASSIGNMENT 1 - 2 QuestionsDocument2 pagesTAXATION ASSIGNMENT 1 - 2 QuestionsFarman AliNo ratings yet

- NullDocument5 pagesNullAshar HammadNo ratings yet

- Assignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsDocument2 pagesAssignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsWaasfaNo ratings yet

- Ed Practice Problems For TaxationDocument6 pagesEd Practice Problems For TaxationKIYYA QAYYUM BALOCH100% (1)

- Income From SalaryDocument10 pagesIncome From SalaryShubham BajajNo ratings yet

- MCQ - Income Under The Head Salary by CA Kishan KumarDocument16 pagesMCQ - Income Under The Head Salary by CA Kishan KumarGoutam ChakrabortyNo ratings yet

- Income Tax Practice QuestionsDocument18 pagesIncome Tax Practice QuestionsNuman Rox0% (2)

- 1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDDocument3 pages1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDadhishree bhattacharyaNo ratings yet

- Salary - Practice QuestionsDocument8 pagesSalary - Practice Questionssyedameerhamza762No ratings yet

- CS 3Document12 pagesCS 3Mallika VermaNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- Questions On Income From SalaryDocument3 pagesQuestions On Income From SalaryAniket AgrawalNo ratings yet

- CFAP 5 AT SupplementDocument28 pagesCFAP 5 AT SupplementHassan NaeemNo ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- Assignment No.01 - Salary IncomeDocument1 pageAssignment No.01 - Salary Incomeabdul.fattaahbakhsh29No ratings yet

- Dac 212 Ass.1Document3 pagesDac 212 Ass.1Nickson AkolaNo ratings yet

- M&MFIN 20072020102948 Recorddate PDFDocument3 pagesM&MFIN 20072020102948 Recorddate PDFChithampararaj GunasekaranNo ratings yet

- Inter Test Paper 4 - SalaryDocument3 pagesInter Test Paper 4 - SalarySrushti Agarwal100% (1)

- Chpter 1, Scope & Levy, Nat & POS, AllDocument14 pagesChpter 1, Scope & Levy, Nat & POS, AllBhavika KhetleNo ratings yet

- Term Test 2Document5 pagesTerm Test 2lalshahbaz57No ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Tax Assignment - 1 2Document1 pageTax Assignment - 1 2mujtabamarchNo ratings yet

- Malaysian Taxation Lecture 2 Employment Income 1Document35 pagesMalaysian Taxation Lecture 2 Employment Income 1Hafizah Mat NawiNo ratings yet

- ICICI Subvention SchemeDocument2 pagesICICI Subvention SchemePrimal SharmaNo ratings yet

- Practicesheet - Input Tax CreditDocument5 pagesPracticesheet - Input Tax CreditHemmu sahuNo ratings yet

- IDBI2019Document1 pageIDBI2019SRINIVASA REDDYNo ratings yet

- Subject: Appointment Letter For The Post of Business Development ExecutiveDocument3 pagesSubject: Appointment Letter For The Post of Business Development ExecutiveMeet ShahNo ratings yet

- Banking & Economy PDF - September 2019 by AffairsCloudDocument77 pagesBanking & Economy PDF - September 2019 by AffairsCloudtoanthoni123No ratings yet

- Assignment No. 2 (Fall 2022)Document3 pagesAssignment No. 2 (Fall 2022)Bluewings Travel &ToursNo ratings yet

- Notice: Asian Paints LimitedDocument17 pagesNotice: Asian Paints LimitedmohitbabuNo ratings yet

- CAF 2 TAX Autumn 2020Document6 pagesCAF 2 TAX Autumn 2020duocarecoNo ratings yet

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- Practical (TSG 2020-21)Document24 pagesPractical (TSG 2020-21)Gaming With AkshatNo ratings yet

- Income From SalaryDocument9 pagesIncome From Salaryvinod nainiwalNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- Compensatio N and Benifit Compensatio N and BenifitDocument20 pagesCompensatio N and Benifit Compensatio N and BenifitBHuwanNo ratings yet

- Taxation Short Questions AnswersDocument4 pagesTaxation Short Questions AnswersSheetal IyerNo ratings yet

- Assignment 3Document2 pagesAssignment 3Haseeb Ahmed ShaikhNo ratings yet

- International Taxation May 23 Suggested AnswersDocument37 pagesInternational Taxation May 23 Suggested AnswersNINTE THANDHANo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument17 pages© The Institute of Chartered Accountants of IndiaFentorNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- CAF 2 - Energizer - Day 1 - March 2023Document14 pagesCAF 2 - Energizer - Day 1 - March 2023Muhammad Ahsan RiazNo ratings yet

- Problems On Income From Other SourcesDocument3 pagesProblems On Income From Other Sourcesgoli pandeyNo ratings yet

- 012-Practice Questions - Income TaxDocument106 pages012-Practice Questions - Income Taxalizaidkhan29% (7)

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Assignment 1 For MBA 2020Document10 pagesAssignment 1 For MBA 2020Sichen UpretyNo ratings yet

- BS 6th Taxation Final Term PaperDocument3 pagesBS 6th Taxation Final Term PaperFarjad AliNo ratings yet

- Cim 8682 Taxation Question Paper (Ahemadabad)Document3 pagesCim 8682 Taxation Question Paper (Ahemadabad)Pomi ShiyaNo ratings yet

- Income From Salary Chapter QuestionsDocument5 pagesIncome From Salary Chapter Questionsanon_595315274100% (1)

- ST ST: © The Institute of Chartered Accountants of IndiaDocument19 pagesST ST: © The Institute of Chartered Accountants of IndiaÑïkêţ BäûðhåNo ratings yet

- Mahindra and Mahindra FinanceDocument1 pageMahindra and Mahindra FinanceNithin VNo ratings yet

- VAT Mock Exam Time 2 Hours Marks 60: Prepared by Snehasish Barua, FCADocument3 pagesVAT Mock Exam Time 2 Hours Marks 60: Prepared by Snehasish Barua, FCAMd MirazNo ratings yet

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNo ratings yet

- Delhi Public School Indirapuram, Ghaziabad Assignment-Fundamental (Partnership)Document2 pagesDelhi Public School Indirapuram, Ghaziabad Assignment-Fundamental (Partnership)Monster QueenNo ratings yet

- Presented by 1) Mayur KhatriDocument14 pagesPresented by 1) Mayur KhatriSoniya Omir VijanNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

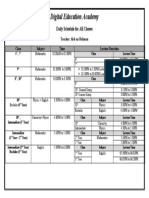

- Digital Education Academy: Daily Schedule For All ClassesDocument1 pageDigital Education Academy: Daily Schedule For All ClassesRozina TabassumNo ratings yet

- Digital Education Academy: Daily Schedule For All ClassesDocument1 pageDigital Education Academy: Daily Schedule For All ClassesRozina TabassumNo ratings yet

- Digital Education Academy: Daily Schedule For All ClassesDocument1 pageDigital Education Academy: Daily Schedule For All ClassesRozina TabassumNo ratings yet

- Iiii Iiiiiii: I Iiii Iiiiii IDocument1 pageIiii Iiiiiii: I Iiii Iiiiii IRozina TabassumNo ratings yet

- Formulas 123Document1 pageFormulas 123Rozina TabassumNo ratings yet

- FormulasDocument1 pageFormulasRozina TabassumNo ratings yet

- Salary-Chp 3Document38 pagesSalary-Chp 3Rozina TabassumNo ratings yet

- Assignment 1Document4 pagesAssignment 1Rozina TabassumNo ratings yet

- A Practical Guide To GST (Chapter 15 - Transition To GST)Document43 pagesA Practical Guide To GST (Chapter 15 - Transition To GST)Sanjay DwivediNo ratings yet

- Acct Statement - XX6782 - 23012024Document5 pagesAcct Statement - XX6782 - 23012024Thejesh tejuNo ratings yet

- Online Merchant Assessment FormDocument4 pagesOnline Merchant Assessment Formbplo mexicoNo ratings yet

- Self Declaration For Tuition FeesDocument1 pageSelf Declaration For Tuition FeesSudha SNo ratings yet

- SIklus IqroDocument7 pagesSIklus IqroorizaNo ratings yet

- 7 Commissioner of Internal Revenue v. John Gotamco & Sons, Inc.Document6 pages7 Commissioner of Internal Revenue v. John Gotamco & Sons, Inc.Vianice BaroroNo ratings yet

- StatementDocument3 pagesStatementStephen SnowdenNo ratings yet

- VAT and OPTDocument10 pagesVAT and OPTSharon CarilloNo ratings yet

- Personal Computer Case Study SolutionDocument3 pagesPersonal Computer Case Study Solutionfaraz ahmad khanNo ratings yet

- Form PDF 870914450231220Document8 pagesForm PDF 870914450231220Sachin KumarNo ratings yet

- IncomeTax MaterialDocument91 pagesIncomeTax MaterialSandeep JaiswalNo ratings yet

- Statement of Axis Account No:914010049504553 For The Period (From: 23-01-2019 To: 02-09-2020)Document4 pagesStatement of Axis Account No:914010049504553 For The Period (From: 23-01-2019 To: 02-09-2020)Chandrani ChatterjeeNo ratings yet

- Tax Receipt Transport Department, Government of West Bengal Registration Authority UTTAR DINAJPUR RTO, West BengalDocument1 pageTax Receipt Transport Department, Government of West Bengal Registration Authority UTTAR DINAJPUR RTO, West BengalSiwam ChoudharyNo ratings yet

- Partnership Digest Obillos Vs CIRDocument2 pagesPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- Name: Edmalyn R. Canton - BSA 1 - BE 302 Morning Subject/course: 892 - Acc 111 Activity 34Document6 pagesName: Edmalyn R. Canton - BSA 1 - BE 302 Morning Subject/course: 892 - Acc 111 Activity 34Adam CuencaNo ratings yet

- Thomas Green of Laramie Wyoming Has Been A Retail SalesclerkDocument2 pagesThomas Green of Laramie Wyoming Has Been A Retail SalesclerkCharlotteNo ratings yet

- Uk PayslipDocument1 pageUk PayslipEsidor PalushiNo ratings yet

- RMO - NO. 9-2018 - DigestDocument5 pagesRMO - NO. 9-2018 - DigestCliff DaquioagNo ratings yet

- Lesson 1: Meaning and Nature of TaxationDocument6 pagesLesson 1: Meaning and Nature of TaxationJun MagallonNo ratings yet

- Mar 2021Document2 pagesMar 2021TanNo ratings yet

- EBS 122 Cum RCD FinanceDocument106 pagesEBS 122 Cum RCD FinanceMd MuzaffarNo ratings yet

- Department of Higher Education, Haryana: (Fee Receipt)Document1 pageDepartment of Higher Education, Haryana: (Fee Receipt)Manisha JangraNo ratings yet

- Deed of Sale - BatadlanDocument3 pagesDeed of Sale - BatadlanMaycee PalenciaNo ratings yet

- Section 3: The Tax System and The Philippines Development ExperienceDocument13 pagesSection 3: The Tax System and The Philippines Development ExperiencePearl ArcamoNo ratings yet

- B3iv19000098 - Ramdani PDFDocument1 pageB3iv19000098 - Ramdani PDFelem usNo ratings yet

- Tax Invoice: Gati Kintetsu Express Private LimitedDocument1 pageTax Invoice: Gati Kintetsu Express Private Limitedsibesh nandiNo ratings yet

- Chapter 2-Statement of Financial Position: Problem 2-1 (AICPA Adapted)Document27 pagesChapter 2-Statement of Financial Position: Problem 2-1 (AICPA Adapted)Asi Cas Jav100% (1)

- CIR Vs PAL Feb 22 2017Document2 pagesCIR Vs PAL Feb 22 2017Jea CoNo ratings yet

- Fiscal Policy - Extra HandoutDocument13 pagesFiscal Policy - Extra HandoutPradeep Kr.No ratings yet

- Certificate of Balance Statement Cheque Copy History Report Request Form (160112) - BlankFormDocument1 pageCertificate of Balance Statement Cheque Copy History Report Request Form (160112) - BlankFormFernando Antúnez GarcíaNo ratings yet