Professional Documents

Culture Documents

Assets : Does Assets Liabilities + Equity? Yes The Balance Sheet Balances. Yes The Balance Sheet Balances

Uploaded by

lemagnus123Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assets : Does Assets Liabilities + Equity? Yes The Balance Sheet Balances. Yes The Balance Sheet Balances

Uploaded by

lemagnus123Copyright:

Available Formats

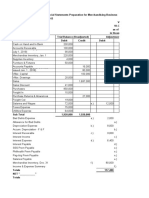

BALANCE SHEET

$ Change from % Change from

12/31/2014 12/31/2015 2014 to 2015 2014 to 2015

ASSETS:

Current Assets:

Cash and cash equivalents $ 400,000 $ 601,000 $ 201,000 50%

Short-term investments $ 900,000 $ 899,000 $ (1,000) 0%

Accounts receivable $ 180,000 $ 230,000 $ 50,000 28%

Assets

Inventory

Total Current Assets

$

$

20,000

1,500,000

$

$

45,000

1,775,000

$

$

25,000

275,000

125%

18%

=

Long Term Assets:

depreciation

Land

$

$

100,000

15,000

$

$

95,000

25,000

$

$

(5,000)

10,000

-5%

67%

Machine $ - $ 50,000 $ 50,000 N/A

Total Long Term Assets $ 115,000 $ 170,000 $ 55,000 48%

Total Assets $ 1,615,000 $ 1,945,000 $ 330,000 20%

LIABILITIES & EQUITY:

Current Liabilities:

Accounts payable $ 30,000 $ 35,000 $ 5,000 17%

Liabilities

Short-term debt

Total Current Liabilities

$

$

100,000

130,000

$

$

90,000

125,000

$

$

(10,000)

(5,000)

-10%

-4%

+Long Term Liabilities:

Long-term debt $ 1,000,000 $ 900,000 $ (100,000) -10%

Equity

Total Liabilities

Equity:

$ 1,130,000 $ 1,025,000 $ (105,000) -9%

Retained Earnings $ 470,000 $ 845,000 $ 375,000 80%

Common Shares $ 15,000 $ 75,000 $ 60,000 400%

Total Equity $ 485,000 $ 920,000 $ 435,000 90%

Total Liabilities and Equity $ 1,615,000 $ 1,945,000 $ 330,000 20%

Does Assets = Liabilities + Equity? Yes the Yes the balance

balance sheet sheet balances.

balances.

Cash Flow Statement Exercise

In the white boxes below are cash flow statement items for 2015

Step 1: Copy and paste all items in the white boxes below into the correct white boxes on the next tab in

columns B and D (the 'Questions' tab).

Step 2: Make sure that the Total Change in Cash Flow must = the 2015 Balance Sheet cash balance (which is $201,000 from

Step 3: In column F, please state what the source of the line item is. Please chose one of the following:

Balance Sheet (Current Assets)

Balance Sheet (Current Liabilities)

Balance Sheet (Equity)

Balance Sheet (Long Term Assets)

Balance Sheet (Long Term Liabilities)

Income Statement

Step 4: Check to see if your answers are correct on the "Answers" tab.

Cash Flow Statement Items (sorted alphabetically 12/31/2016

Depreciation & Amortization $ 5,000

Increase in Accounts Payable $ 15,000

Increase in Accounts Receivable $ (170,000)

Increase in Common Shares $ 10,000

Increase in Inventory $ (647,125)

Increase in Long Term Debt $ 300,000

Increase in Short Term Debt $ 30,750

Land $ -

Machine $ -

Net Income $ 157,875

CASH FLOW STATEMENT

12/31/2016

CASH FLOW FROM OPERATIONS

Total Cash Flow from Operations $ -

CASH FLOW FROM INVESTING

Total Cash Flow from Investing $ -

CASH FLOW FROM FINANCING

Total Cash Flow from Financing $ -

Total Change in Cash Flow $ -

Please Note: the Total Change

in Cash Flow must = the 2016

Balance Sheet cash balance -

the 2015 Balance Sheet cash

balance (which equals -

CASH FLOW STATEMENT

12/31/2016

CASH FLOW FROM OPERATIONS

Net Income $ 157,875

Depreciation & Amortization $ 5,000

Increase in Accounts Receivable $ (170,000)

Increase in Inventory $ (647,125)

Increase in Accounts Payable $ 15,000 Balance Sheet (Current Liabilities)

Total Cash Flow from Operations $ (639,250)

CASH FLOW FROM INVESTING

Land $ - Balance Sheet (Long Term Assets)

Machine $ - Balance Sheet (Long Term Assets)

Total Cash Flow from Investing $ -

CASH FLOW FROM FINANCING

Increase in Short Term Debt $ 30,750 Balance Sheet (Current Liabilities)

Increase in Long Term Debt $ 300,000 Balance Sheet (Long Term Liabilities)

Increase in Common Shares $ 10,000

Total Cash Flow from Financing $ 340,750

Total Change in Cash Flow $ (298,500)

Please Note: the Total

Change in Cash Flow must =

the 2016 Balance Sheet cash

balance - the 2015 Balance

Sheet cash balance (which

You might also like

- Assets : Does Assets Liabilities + Equity? Yes The Balance Sheet Balances. Yes The Balance Sheet BalancesDocument3 pagesAssets : Does Assets Liabilities + Equity? Yes The Balance Sheet Balances. Yes The Balance Sheet BalancesmeralinNo ratings yet

- Assets : Does Assets Liabilities + Equity? Yes The Balance Sheet Balances. Yes The Balance Sheet BalancesDocument3 pagesAssets : Does Assets Liabilities + Equity? Yes The Balance Sheet Balances. Yes The Balance Sheet BalancessafhkNo ratings yet

- 3.1 Balance Sheet ExampleDocument3 pages3.1 Balance Sheet ExampleMi TvNo ratings yet

- Cost Structures and Flexibility - CompleteDocument2 pagesCost Structures and Flexibility - CompleteRemmy MuneneNo ratings yet

- Contoh Soal AkuntansiDocument4 pagesContoh Soal AkuntansiRicky ChenNo ratings yet

- Waddell Company Had The Following BalancesDocument6 pagesWaddell Company Had The Following Balanceslaale dijaanNo ratings yet

- Cost Structures and Flexibility - BlankDocument2 pagesCost Structures and Flexibility - BlankJYNo ratings yet

- 01 Steop enDocument28 pages01 Steop enMutesa ChrisNo ratings yet

- Case 1 Excel Data Ebtm 350Document5 pagesCase 1 Excel Data Ebtm 350api-530290270No ratings yet

- Dashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Document1 pageDashboard Template: Business Unit Revenue ($000) Profit Margin ($000)GolamMostafaNo ratings yet

- Model Oventa Multi Nive LDocument5 pagesModel Oventa Multi Nive LMayte SánchezNo ratings yet

- Series A Preferred Share AnalysisDocument12 pagesSeries A Preferred Share AnalysisLalit mohan PradhanNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument4 pagesCapital Investment Model - NPV IRR Payback: Strictly Confidentialsh munnaNo ratings yet

- Finansijski Pregled - LiteDocument1 pageFinansijski Pregled - LiteDimitrije MladenovicNo ratings yet

- Pam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationDocument3 pagesPam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationJalaj GuptaNo ratings yet

- 1 $20,000 2 56000 3 - 2500 4 48000 - 48000 5 10000 6 - 2000 7 8 9 10 11 12 13 14 15 Totals $63,500 $8,000 $0 $0 $0 $0 $0 $10,000 $0Document2 pages1 $20,000 2 56000 3 - 2500 4 48000 - 48000 5 10000 6 - 2000 7 8 9 10 11 12 13 14 15 Totals $63,500 $8,000 $0 $0 $0 $0 $0 $10,000 $0Nick AltmanNo ratings yet

- Exercise 2-3Document2 pagesExercise 2-3Nick AltmanNo ratings yet

- Ejercio de ExelDocument18 pagesEjercio de ExelDaysi RoseroNo ratings yet

- Investment Planner (5 Yrs) : Expense-Savings BifurcationDocument24 pagesInvestment Planner (5 Yrs) : Expense-Savings BifurcationRavi DubeyNo ratings yet

- BP Security ServicesDocument6 pagesBP Security ServicesAnithaNo ratings yet

- Wassim Zhani Corporate Taxation Reconcialiation of Income Per BooksDocument7 pagesWassim Zhani Corporate Taxation Reconcialiation of Income Per BookswassimzhaniNo ratings yet

- pc102 - Final ProjectW13 - Ramon GutierrezDocument10 pagespc102 - Final ProjectW13 - Ramon GutierrezEJ LacdaoNo ratings yet

- Advance2 HW - P6-9Document4 pagesAdvance2 HW - P6-9Fernando HermawanNo ratings yet

- Quadrant ChartDocument2 pagesQuadrant ChartNyoman YudhanaNo ratings yet

- BACS Weekly Monetary Report 25-07-18Document7 pagesBACS Weekly Monetary Report 25-07-18Gian MarcosNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument3 pagesCapital Investment Model - NPV IRR Payback: Strictly ConfidentialKrishna YagnamurthyNo ratings yet

- AccountsDocument5 pagesAccountsHarshani DanpaulNo ratings yet

- Part - 2 As Planned S CurvesDocument15 pagesPart - 2 As Planned S CurvesSekson LapcharoensinNo ratings yet

- Assets, Liabilities and Equity of ARA Galleries Pty LTD As at 30 June 2017Document4 pagesAssets, Liabilities and Equity of ARA Galleries Pty LTD As at 30 June 2017BáchHợpNo ratings yet

- DB6 - Worksheet & FS Prep For Merchandising BusinessDocument4 pagesDB6 - Worksheet & FS Prep For Merchandising BusinessArrianeNo ratings yet

- Sales Pipeline TemplateDocument6 pagesSales Pipeline TemplateArifin MasruriNo ratings yet

- Loss Prevention Bulletin Vol.38 Light 3Document41 pagesLoss Prevention Bulletin Vol.38 Light 3Chetan LikhiteNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Risk Table P I Diagram ExampleDocument1 pageRisk Table P I Diagram ExamplesociatteNo ratings yet

- Personal BudgetDocument1 pagePersonal Budgetأبورؤس عبدالكاشفNo ratings yet

- Solutions Balancing Process Capacity Simulation Challenge 1 and Challange 2Document29 pagesSolutions Balancing Process Capacity Simulation Challenge 1 and Challange 2Mariam AlraeesiNo ratings yet

- Present Value ToolDocument3 pagesPresent Value ToolNazmi PllanaNo ratings yet

- Evaluating Business and Engineering Assets - Part II: Professor C. S. ParkDocument8 pagesEvaluating Business and Engineering Assets - Part II: Professor C. S. ParkAlishaNo ratings yet

- Contoh Family BudgetDocument3 pagesContoh Family BudgetReno VehardianNo ratings yet

- Dashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Document1 pageDashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Tony PhạmNo ratings yet

- Break-Even Occurs Between The Production Volume Interval of 20,000 To 30,000Document6 pagesBreak-Even Occurs Between The Production Volume Interval of 20,000 To 30,000kripsNo ratings yet

- Raportoverbudget PDFDocument1 pageRaportoverbudget PDFAlexandru BaciuNo ratings yet

- PA Biweekly5 G1Document3 pagesPA Biweekly5 G1Quang NguyenNo ratings yet

- Raportoverbudget PDFDocument1 pageRaportoverbudget PDFAlexandru BaciuNo ratings yet

- Cost Overruns: Task Cost Variance Resource Cost VarianceDocument1 pageCost Overruns: Task Cost Variance Resource Cost VarianceAlexandru BaciuNo ratings yet

- H.W ch4q7 Acc418Document4 pagesH.W ch4q7 Acc418SARA ALKHODAIRNo ratings yet

- WBS T C S Description Budget StartDocument14 pagesWBS T C S Description Budget StartJohn NoriegaNo ratings yet

- Real Estate - Proposal - TemplateDocument58 pagesReal Estate - Proposal - Templatepalanisamy744100% (1)

- Account Debit CreditDocument4 pagesAccount Debit CreditMcKenzie WNo ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentAtka chNo ratings yet

- Project Cost Setup and Budgeting Preparation To PPS and Germany Gar 6300 - 6500Document1 pageProject Cost Setup and Budgeting Preparation To PPS and Germany Gar 6300 - 6500Kami Plant InternasionalNo ratings yet

- BCSRevenue Discrimation ChartDocument1 pageBCSRevenue Discrimation ChartZach VaughnNo ratings yet

- SBR1 Dummy With Cash FlowDocument15 pagesSBR1 Dummy With Cash Flowakansha.associate.workNo ratings yet

- ACC10007-timed WorksheetDocument7 pagesACC10007-timed WorksheetsummerNo ratings yet

- 2021 11 05 Midterms DEPTALSDocument3 pages2021 11 05 Midterms DEPTALSeveNo ratings yet

- LE3 - Finance ModuleDocument5 pagesLE3 - Finance ModuleSafraz BacchusNo ratings yet

- Breakevenanalysis - 2Document2 pagesBreakevenanalysis - 2moqmerNo ratings yet

- Financial Ratio Analysis TemplateDocument6 pagesFinancial Ratio Analysis Template✬ SHANZA MALIK ✬No ratings yet

- Week 12 - Acct - Performance Measure - Practice and CaseDocument76 pagesWeek 12 - Acct - Performance Measure - Practice and CaseAlenne FelizardoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Indian Financial SystemsDocument116 pagesIndian Financial Systemsshiva karthickNo ratings yet

- Elements of Financial ServicesDocument554 pagesElements of Financial ServicesUJJAL SAHU100% (1)

- Total GadhaDocument14 pagesTotal GadhaAkhil Dayalu100% (2)

- M A I N T e N A N C eDocument3 pagesM A I N T e N A N C elemagnus123No ratings yet

- Advanced Vocabulary Development For TOEFL Word List 02Document5 pagesAdvanced Vocabulary Development For TOEFL Word List 02Farlin Paulino SanzNo ratings yet

- SAT / ACT / PSAT Word List - 01Document5 pagesSAT / ACT / PSAT Word List - 01aehsgo2collegeNo ratings yet

- Capital Structure DecisionsDocument35 pagesCapital Structure DecisionskiruthekaNo ratings yet

- Module B Dec 2018answerDocument8 pagesModule B Dec 2018answerConnieChoiNo ratings yet

- Basel 3 PDFDocument6 pagesBasel 3 PDFNischal PatelNo ratings yet

- Case Study: Exchange Rate Policy at The Monetary Authority of SingaporeDocument16 pagesCase Study: Exchange Rate Policy at The Monetary Authority of SingaporeDexpistol33% (3)

- Questions: Answers Answer To Q 14.1 Parts (A) and (B) Are Provided in The Excel File Titled "Q 14.1 Excel Solutions - XLS"Document1 pageQuestions: Answers Answer To Q 14.1 Parts (A) and (B) Are Provided in The Excel File Titled "Q 14.1 Excel Solutions - XLS"Nga BuiNo ratings yet

- JPM CDS PrimerDocument11 pagesJPM CDS PrimerJorge AraujoNo ratings yet

- Fabm2 - Q2 - M2Document17 pagesFabm2 - Q2 - M2Christopher AbundoNo ratings yet

- Growth & Changing Structure of Non-Banking Financial InstitutionsDocument12 pagesGrowth & Changing Structure of Non-Banking Financial InstitutionspremdeepsinghNo ratings yet

- 6359476Document30 pages6359476marianaNo ratings yet

- The Nature Conservancy - 2023 Endowment Impact Report (40p)Document40 pagesThe Nature Conservancy - 2023 Endowment Impact Report (40p)Aza O'Leary - SEE The Change ProductionsNo ratings yet

- Financial Accounting Assignment 1Document3 pagesFinancial Accounting Assignment 1Mr Chaitanya Valiveti IPENo ratings yet

- Turkish Airlines Financial Statements Exel (Hamada SH)Document89 pagesTurkish Airlines Financial Statements Exel (Hamada SH)hamada1992No ratings yet

- BCG Global Asset Management 2020 May 2020 R - tcm9 247209 PDFDocument27 pagesBCG Global Asset Management 2020 May 2020 R - tcm9 247209 PDFLawrence HNo ratings yet

- Business Studies Project On Credit CardsDocument10 pagesBusiness Studies Project On Credit CardsPiyush Setia0% (1)

- OpTransactionHistoryTpr03 01 2023Document21 pagesOpTransactionHistoryTpr03 01 2023rajesh lankaNo ratings yet

- Financial Eduation and Investment Awareness-22Document6 pagesFinancial Eduation and Investment Awareness-22Vinay Gowda D M100% (1)

- 04 Accounts Receivable - (PS)Document2 pages04 Accounts Receivable - (PS)kyle mandaresioNo ratings yet

- Term V: Private Equity and Venture CapitalDocument4 pagesTerm V: Private Equity and Venture CapitalJitesh ThakurNo ratings yet

- An Analysis of Interest Rate Spread in Nepalese Commercial BankDocument12 pagesAn Analysis of Interest Rate Spread in Nepalese Commercial BankUday Sharma33% (9)

- Aftab Automobiles Limited and Its SubsidiariesDocument4 pagesAftab Automobiles Limited and Its SubsidiariesNur Md Al HossainNo ratings yet

- Principles of Microeconomics-57375Document15 pagesPrinciples of Microeconomics-57375msfaziah.hartanahNo ratings yet

- Chapter 16: Equity Portfolio Management StrategiesDocument29 pagesChapter 16: Equity Portfolio Management StrategiesMohamed HammadNo ratings yet

- Assignment 2.2Document6 pagesAssignment 2.2GLEN JORDAN ANTONIONo ratings yet

- Zenith Bank Statement Ronald Morris For Dec 20TH To 22ND 2023Document2 pagesZenith Bank Statement Ronald Morris For Dec 20TH To 22ND 2023Emeka AmaliriNo ratings yet

- Using Financial Accounting Information The Alternative To Debits and Credits 10th Edition Porter Solutions ManualDocument19 pagesUsing Financial Accounting Information The Alternative To Debits and Credits 10th Edition Porter Solutions Manualleonardedanah7lkhe100% (27)

- FI Def Elements QBDocument13 pagesFI Def Elements QBheisenbergNo ratings yet

- RenewalPremium 35616458Document1 pageRenewalPremium 35616458Raghavendra ChinnuNo ratings yet

- 4.1 Time Value of Money PDFDocument13 pages4.1 Time Value of Money PDFPractice AddaNo ratings yet

- Markit Itraxx Europe Series 18 RulebookDocument10 pagesMarkit Itraxx Europe Series 18 RulebookPeter FraserNo ratings yet

- HDFC - Company Analysis - SAMNIDHY INSTAGRAM - 4 PDFDocument10 pagesHDFC - Company Analysis - SAMNIDHY INSTAGRAM - 4 PDFAsanga KumarNo ratings yet