Professional Documents

Culture Documents

Pms Performance 30 JUNE 2019: Large Cap Oriented

Uploaded by

maheshtech76Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pms Performance 30 JUNE 2019: Large Cap Oriented

Uploaded by

maheshtech76Copyright:

Available Formats

DON’T JUST INVEST, MAKE AN INFORMED DECISION

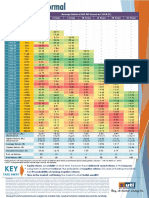

PMS PERFORMANCE 30TH JUNE 2019

(ARRANGED IN THE ORDER OF LARGECAP, MIDCAP AND MULTICAP)

LARGE CAP ORIENTED

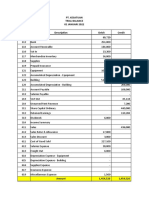

STRATEGY NAME AUM (approx in cr) 1M 3M 6M 1Y 2Y 3Y 5Y SI

Accuracap Alpha 10 534 -1.52% 0.56% 4.91% 4.67% 8.86% 12.42% 13.52% 14.81%

Ambit Coffee CAN 314 -1.10% -1.60% -0.10% 4.10% 15.40% - - 18.10%

Centrum Hedged Portfolio - - -0.80% 2.20% -1.30% 3.90% - - 5.70%

ICICI Prudential Largecap Portfolio 169 0.75% 4.23% 10.36% 14.38% 12.67% 13.41% 12.27% 18.16%

Invesco India Large Cap Core - -1.61% -0.84% 5.61% 5.68% 11.17% 15.72% 12.77% -

Marcellus Consistent Compunders 264 0.20% 0.30% 3.40% - - - - 5.30%

Motilal Oswal Value 2210 -0.77% 4.43% 9.08% 5.73% 6.59% 9.17% 11.43% 22.45%

Pelican PE Fund 51 0.01% 0.97% 2.01% 4.35% - - - 4.60%

Reliance Absolute Freedom - -0.21% 4.87% 11.49% 11.76% 7.84% 13.21% 11.30% 15.25%

Reliance High Conviction - -0.62% 4.71% 13.19% 12.18% 5.17% 12.75% 11.73% 18.08%

TATA Capital Blue Chip Plus Strategy - 0.53% 3.99% 8.86% 8.89% 9.76% 9.70% 8.05% 10.22%

TATA Capital Blue Chip Strategy - 0.34% 4.60% 9.42% 9.71% 11.40% 12.45% 10.50% 9.35%

TATA Capital Consumption Strategy - 0.72% 0.98% 0.56% 3.06% 10.36% 16.15% 16.89% 17.04%

Nifty50 - -1.12% 1.42% 8.53% 10.03% 11.27% 12.46% 9.14% -

MID & SMALL CAP ORIENTED

STRATEGYNAME AUM (approx in cr) 1M 3M 6M 1Y 2Y 3Y 5Y SI

Accuracap Dynamo 5 -6.48% -10.00% -23.60% -26.66% -6.51% - - 13.09%

Accuracap Pico Power 355 -3.79% -4.63% -4.28% -14.42% -6.90% 7.27% 12.98% 20.51%

Ambit Emerging Giants 62 -1.70% -3.90% -4.90% -3.30% - - - -4.30%

Ambit Good and Clean 115 -1.10% 3.50% 11.60% 21.80% 13.70% 16.10% - 12.90%

Care PMS Growth Plus Value 250 -6.10% -6.54% -11.95% -21.79% -11.69% -2.02% 11.01% 19.40%

Centrum Deep Value - - 0.80% 2.70% 2.60% 4.50% 9.70% - 10.50%

Centrum Micro - - -1.40% -3.30% -8.10% 0.50% - - 6.70%

Centrum Multibagger - - -1.40% 3.00% 0.30% 1.60% 7.10% 13.50% 17.70%

Edelweiss Hexagon 269 -3.60% -3.70% -1.50% -13.10% -10.40% 1.70% - 5.40%

IndiaNivesh Sprout PMS 108 -6.90% -8.70% -11.40% -13.00% -0.50% 3.80% - 4.70%

Invesco India Caterpillar 48 -3.36% -6.16% -3.44% -6.12% 0.54% 9.64% 15.80% 17.20%

Motilal Oswal India Opportunities (IOP) Sr 1 3406 -4.78% -3.06% 0.65% -6.17% -9.97% 9.97% 12.79% 12.03%

Motilal Oswal India Opportunities (IOP) Sr 2 565 -4.41% -6.46% -3.79% -10.85% - - - -9.13%

Nine Rivers Capital Aurum Small Cap - -1.70% -1.50% 2.10% -6.40% -4.40% 4.50% 16.20% 29.90%

Opportunities

Prabhudas Liladhar Fortune Strategy 22 -1.78% -6.18% -8.31% -20.01% - - - -9.25%

Reliance Emerging India - -0.90% 0.13% 5.57% -0.62% -0.51% - - 7.45%

Renaissance Midcap - 0.20% - 14.40% 10.90% - - - 3.60%

Sundaram Midcap - -2.50% -0.50% 4.40% 7.50% 4.00% 10.50% 12.90% 16.40%

Systematix Dynamic Investement Portfolio - -0.35% 3.82% 9.60% 4.25% - - - 4.41%

Tamohara TILES 36 -1.31% -3.59% -2.26% -1.84% 5.66% 12.56% - 11.97%

TATA Capital Emerging Opportunities - 0.47% 1.48% 3.66% 5.13% 8.13% 13.84% 14.14% 10.91%

Strategy

Nifty Midcap 100 - -1.70% -3.31% -1.24% -2.90% -0.21% 8.52% 9.73% -

DON’T JUST INVEST, MAKE AN INFORMED DECISION

PMS PERFORMANCE 30TH JUNE 2019

(ARRANGED IN THE ORDER OF LARGECAP, MIDCAP AND MULTICAP)

MULTI CAP ORIENTED

STRATEGY NAME AUM (approx in cr) 1M 3M 6M 1Y 2Y 3Y 5Y SI

2Point2 Capital Long Term Value Fund 212 -0.50% 4.01% 10.50% 14.60% 14.30% - - 21.10%

Accuracap Alphagen 129 -3.24% -3.61% -1.34% -6.22% -0.68% 10.28% - 9.06%

Aditya Birla Select Sector Portfolio 569 -2.10% -6.10% -1.40% -13.30% -6.70% 3.90% 11.90% 14.90%

Aditya Birla Core Equity Portfolio 927 -0.20% 1.60% 7.30% 0.20% -2.60% 4.60% 13.30% 16.80%

Alchemy High Growth 2751 0.10% 2.30% 3.50% 0.60% 6.70% 13.80% 14.60% 23.60%

Alchemy Select Stock 3185 -0.10% 2.80% 5.00% 3.10% 10.90% 16.50% 18.60% 22.50%

ALFAccurate Advisors AAA PMS 576 -1.80% -2.00% 1.90% -4.60% 4.20% 10.80% 15.50% 18.80%

ASK India Entrepreneur Portfolio 8620 -1.90% 0.20% 4.20% 3.40% 9.80% 12.80% 17.10% 18.60%

ASK Growth Strategy 2576 -1.70% 1.70% 3.30% 1.70% 5.80% 13.20% 17.00% 20.00%

ASK India Select Portfolio 2974 -1.00% 1.50% 5.00% 2.80% 5.10% 10.50% 16.70% 16.60%

Axis Brand Equity 940 0.00% 2.20% 4.80% 4.20% 10.00% - - 11.90%

Buoyant Capital Opportunities Multi-Cap - -2.40% -2.40% 3.30% -0.10% 12.80% 21.40% - 22.80%

Centrum Wealth Creator - - 2.00% 7.40% 4.40% 1.70% 5.10% 13.70% 15.50%

Choice Ideal Valuation Startegy - -1.82% -1.43% 0.05% 1.19% - - - -2.68%

Choice New India Startegy - -0.61% 2.48% 5.48% -1.76% - - - -2.98%

Edelweiss Rubik 57 -3.60% -4.10% -1.00% -7.20% - - - -7.10%

Emkay Lead PMS - -1.90% 1.10% 6.70% - - - - 17.40%

ICICI Prudential Contra PMS 78 -0.63% 1.40% 11.39% - - - - 18.08%

ICICI Prudential Flexicap Portfolio 915 -0.72% 3.64% 7.71% 5.91% 8.98% 12.53% 12.44% 19.35%

ICICI Prudential Value Portfolio 151 -1.38% 0.51% 7.30% 6.74% 7.59% 10.30% 12.93% 16.42%

IDFC NEO - -0.33% 0.90% -3.71% -11.31% - - - 2.04%

IIFL Multicap - -0.19% 4.86% 16.34% 18.79% 14.57% 17.80% - 19.08%

IIFL Multicap Advantage - -0.23% 4.13% 13.34% 15.66% - - - 10.11%

Invesco India DAWN 540 -1.35% -1.05% 5.85% 9.34% - - - 5.40%

Invesco India R.I.S.E 717 -1.52% -5.10% -4.27% -9.43% 5.60% 14.07% - 15.20%

Invesco Sector Opportunities - -2.61% -7.93% -6.89% -11.36% -0.19% 6.80% 10.28% 12.55%

Kotak Special Situations Value Sr 1 2643 -3.30% -5.10% 1.90% -9.60% -6.70% 5.20% 15.70% 18.80%

Kotak Special Situations Value Sr 2 1076 -3.90% -3.60% 2.10% -7.80% - - - -8.30%

Marathon Trends Mega Trends 134 -0.43% 2.57% 6.39% 6.17% - - - 3.98%

Motilal Oswal Business Opportunities (BOP) 270 -0.06% 2.61% 6.74% 4.94% - - - 2.39%

Motilal Oswal Next Trillion Dollar Oppor- 9020 -1.36% -1.64% -0.36% -1.03% 3.92% 11.96% 19.59% 16.19%

tunities (NTDOP)

Narnolia India 3T 178 0.20% 1.90% 6.20% 3.10% 7.70% 15.00% 17.20% 20.90%

O3 Capital PMS 46 -1.26% - - - - - - 3.48%

Phillip Capital Signature India Portfolio 76 -1.02% 1.96% 9.57% 7.85% 8.85% 12.31% - 13.37%

Prabhudas Liladhar Equigrow Strategy 14 -1.00% -3.70% -0.10% -7.80% 5.70% 11.60% 13.50% 19.60%

Prabhudas Liladhar Multi Strategy 100 -1.20% -2.50% -1.90% -10.60% 10.10% 16.50% 16.30% 22.10%

Purnartha Research and Advisory* 5000 -0.24% 1.84% 12.89% 6.35% 16.46% 21.42% 25.06% 41.11%

Renaissance India Opportunities - -0.10% - 12.40% 12.40% - - - 7.60%

Satco Growth & Momentum 18 -2.70% -0.40% 4.00% -5.30% 2.30% 13.90% 23.20% 29.69%

DON’T JUST INVEST, MAKE AN INFORMED DECISION

PMS PERFORMANCE 30TH JUNE 2019

(ARRANGED IN THE ORDER OF LARGECAP, MIDCAP AND MULTICAP)

SBI Growth with Values - -0.09% 6.92% 9.67% 4.86% 9.57% - - 9.67%

Sundaram PACE - -1.40% 2.10% 8.30% 3.90% 4.50% 10.50% 12.70% 19.30%

Sundaram SISOP - 0.50% 3.50% 8.10% 1.90% 8.00% 9.60% 15.10% 22.90%

Tamohara TIOS 37 0.25% -1.22% 3.31% 2.64% 7.43% 11.52% - 13.95%

TATA Capital ACT - -0.07% 1.95% - - - - - 4.22%

Nifty 500 - -1.50% -0.06% 5.32% 5.41% 7.67% 11.43% 9.36% -

*Purnartha Research & Advisory is a SEBI Registered Investment Advisory Service

VA L U A T I O N S

Index PE - 3 Year High PE - Current (as on 30th June 2019) PE - 3 Year Low

Nifty 50 29.9 28.98 21.18

Nifty 500 34.65 30.96 24.37

Nifty Midcap 100 62.07 30.96 29.76

Criteria for the one highlighted in each category is as follows :

We do 4 P analysis of all product ( Philosophy, Portfolio, Performance, Price ). We have highlighted in each category respective

products that we find best ones as per our 4 P analysis. We like the ones which rank high on performance consistency, portfolio

PE is lower, portfolio is diversified, follow variable fee model, and operate in boutique style of management with more than 2

years of track record.

Where portfolio is highly concentrated, we give weightage to performance consistency and % of mid cap. In this case, we like

the ones whose consistency of performance is very high and % of mid-small cap is not high.

For the ones that are highly concentrated as well as high on mid and small cap allocation, we have given higher weightage to

other factors i.e. Low Portfolio PE, Boutique style of management, Variable fee option.

OBJECTIVE TOP PERFORMERS :

TIME PERIOD 1ST 2ND 3RD

Last 1 M ICICI Prudential Largecap Portfolio TATA Capital Consumption Strategy TATA Capital Blue Chip Plus Strategy

Last 3 M SBI Growth with Values Reliance Absolute Freedom IIFL Multicap

Last 6M IIFL Multicap Renaissance Midcap IIFL Multicap Advantage

Last 1 Y Ambit Good and Clean IIFL Multicap IIFL Multicap Advantage

Last 3 Y Purnartha Research and Advisory Buoyant Capital Opportunities Multi-Cap IIFL Multicap

Last 5 Y Purnartha Research and Advisory Satco Growth & Momentum Motilal Oswal NTDOP

“DISCLAIMER: - The performance data has been captured from the latest factsheets procured from respective product

manufactured. The data is as of 30th June 2019.

Performance upto 1 Year is absolute and above 1 Year is Annualised.

PMS-AIF.com has taken due care in collating the data from respective providers. It has been done on best effort basis and the

accuracy of the data cannot be guarranteed. PMS-AIF.com should not be held responsible for any errors for the results arising

from use of this data whatsoever.

Investments are subject to market related risks. Past Performance may or may not be sustained in future and should not be used

as a basis for comparison with other investments. Please read the disclosure documnets carefully before investing. Portfolio

Management Services are market linked and donot offer any guaranteed/assured returns”

You might also like

- Monthly Performance Report: MonthDocument16 pagesMonthly Performance Report: Monthkumarprasoon99No ratings yet

- Zubair Ahmed MazariDocument3 pagesZubair Ahmed Mazarizee khan100% (1)

- Investment Strategy & Model Portfolio: April'23Document28 pagesInvestment Strategy & Model Portfolio: April'23Ravichandra BNo ratings yet

- Field Instrument Presentation (Rev.2)Document94 pagesField Instrument Presentation (Rev.2)Duong NguyenNo ratings yet

- Profibus DP PDF 1Document79 pagesProfibus DP PDF 1Eyitayo Simon AyeniNo ratings yet

- Abt PRS013 TSL EsDocument546 pagesAbt PRS013 TSL EsIsaac MendibleNo ratings yet

- 3 - S5 Load Sharing Rev0Document19 pages3 - S5 Load Sharing Rev0Amirouche BenlakehalNo ratings yet

- 2600T Basic Transmitter Theory (TI - 266-En - B-09 - 2013)Document32 pages2600T Basic Transmitter Theory (TI - 266-En - B-09 - 2013)JGlobexNo ratings yet

- Intelligent Advisory PortfoliosDocument5 pagesIntelligent Advisory PortfoliosRaghu Mk0% (1)

- BASIC PRINCIPLES OF EXPLOSIVE PROTECTION IEC 60079Document18 pagesBASIC PRINCIPLES OF EXPLOSIVE PROTECTION IEC 60079Duong NguyenNo ratings yet

- Pos 020 Sok7263341 06 Cause Effect DiagramDocument54 pagesPos 020 Sok7263341 06 Cause Effect DiagramKhasem AlgusbiNo ratings yet

- P6022MAB.000.51S.046 - Personal Protective EquipmentDocument13 pagesP6022MAB.000.51S.046 - Personal Protective EquipmentbabjihanumanthuNo ratings yet

- Wealthdesk IIFL PresentationDocument13 pagesWealthdesk IIFL PresentationNagesh ShettyNo ratings yet

- R2B-P2-205-03-H-NC-47424 - Rev.C - Code ADocument17 pagesR2B-P2-205-03-H-NC-47424 - Rev.C - Code Adaniel contrerasNo ratings yet

- ASEM IA Product Guide enDocument77 pagesASEM IA Product Guide enNguyễn Văn ViệtNo ratings yet

- P5504mew SWK 10 SS V PPR 001 - ADocument14 pagesP5504mew SWK 10 SS V PPR 001 - Avignesh558855No ratings yet

- Station Designer Software: User GuideDocument382 pagesStation Designer Software: User GuideIbrahimNo ratings yet

- BPCL Rasayani LPG PlantDocument6 pagesBPCL Rasayani LPG PlantGokul KoreNo ratings yet

- FS 3202 - FS-Flow Transmitter (Electronic)Document9 pagesFS 3202 - FS-Flow Transmitter (Electronic)Binu ManiNo ratings yet

- Controller System For Industrial AutomatDocument27 pagesController System For Industrial AutomatALI SABIRNo ratings yet

- Rahul Jain, AMIE: (Mech), CFPSDocument5 pagesRahul Jain, AMIE: (Mech), CFPSSafety PriorityNo ratings yet

- Sipart Ps100: Siemens - Tld/keyword Unrestricted © Siemens AG 2019Document46 pagesSipart Ps100: Siemens - Tld/keyword Unrestricted © Siemens AG 2019fredyNo ratings yet

- IPS-MBD21907-In-529 - Datasheet of PH Transmitter - ADocument3 pagesIPS-MBD21907-In-529 - Datasheet of PH Transmitter - ANikhil KarkeraNo ratings yet

- White Paper Alarm Rationalization Deltav en 56654Document13 pagesWhite Paper Alarm Rationalization Deltav en 56654Ans MediaNo ratings yet

- FS 3213 - FS-Electro Magnetic Flow MeterDocument6 pagesFS 3213 - FS-Electro Magnetic Flow MeterBinu ManiNo ratings yet

- H-10207 99cka 00-002f Fe-Cscs Hydroprocess Application Description - BDocument43 pagesH-10207 99cka 00-002f Fe-Cscs Hydroprocess Application Description - Bnguyen rinNo ratings yet

- Chemical Industry ApplicationsDocument74 pagesChemical Industry ApplicationslimberapazaNo ratings yet

- (New) Price List Hikvision Uniview-V9.3.1Document58 pages(New) Price List Hikvision Uniview-V9.3.1Rizky MaulidyNo ratings yet

- Trend Function - TBDocument35 pagesTrend Function - TBbmw316100% (1)

- 3adw000078r0301 Dcs5 Software Descr e CDocument228 pages3adw000078r0301 Dcs5 Software Descr e Caninda_dNo ratings yet

- I NST R Ument at I Onpr Ocess& Cont R Ol. - Quest I On&Answer! ! By:Zahi DkhanDocument80 pagesI NST R Ument at I Onpr Ocess& Cont R Ol. - Quest I On&Answer! ! By:Zahi DkhanLimoel HierrasNo ratings yet

- UPS power supply bus wiring diagramDocument257 pagesUPS power supply bus wiring diagramRakesh Kumar Singh (Phase 1B)100% (1)

- Wel - Come TO: Distributed Control System (DCS)Document49 pagesWel - Come TO: Distributed Control System (DCS)duc tranNo ratings yet

- M1. Multi Axis Servo System Using Step Motors and Motion Control PDFDocument37 pagesM1. Multi Axis Servo System Using Step Motors and Motion Control PDFTrân HồNo ratings yet

- Intouch Tse DG 10Document139 pagesIntouch Tse DG 10dNichiNo ratings yet

- IMCC Check ListDocument9 pagesIMCC Check ListZulfequar R. Ali KhanNo ratings yet

- Sachin IoclDocument22 pagesSachin IoclAbhishek GuptaNo ratings yet

- R2B-P2-205-03-H-CE-47233 - Rev.E - Code ADocument2 pagesR2B-P2-205-03-H-CE-47233 - Rev.E - Code Adaniel contrerasNo ratings yet

- Aravind VJJDocument300 pagesAravind VJJ54 Pe AravindswamyNo ratings yet

- National Oil Corporation: Rev Date Description Checked ApprovedDocument34 pagesNational Oil Corporation: Rev Date Description Checked ApprovedYousab JacobNo ratings yet

- Fast Tools Bu50a01a00-01en - 002Document7 pagesFast Tools Bu50a01a00-01en - 002Juan Jorge Pablo ValdiviaNo ratings yet

- Custody transfer metering systems for crude oil pipelinesDocument23 pagesCustody transfer metering systems for crude oil pipelinesMOSES EDWINNo ratings yet

- Model 1700 Training Activity TwoDocument12 pagesModel 1700 Training Activity Twoyao nestorNo ratings yet

- B0750as RDocument474 pagesB0750as RCamiloNo ratings yet

- System Overview: Training Services Center - SVD Prepared By: Muhammad ArwinDocument58 pagesSystem Overview: Training Services Center - SVD Prepared By: Muhammad ArwinchoirulNo ratings yet

- Emf KrohneDocument69 pagesEmf KrohneMaria Fernanda FS100% (1)

- Ethane Filter (Et1 000 20)Document12 pagesEthane Filter (Et1 000 20)Mohammad TV'sNo ratings yet

- F&G Cause and Effect Matrix for Salalah Methanol ProjectDocument6 pagesF&G Cause and Effect Matrix for Salalah Methanol ProjectpavanNo ratings yet

- ds5555 11Document376 pagesds5555 11huichuan wangNo ratings yet

- Im32p01c60 01enDocument109 pagesIm32p01c60 01enserg elisNo ratings yet

- General Arrangement Panel Painting Booth Control Panel 1Document5 pagesGeneral Arrangement Panel Painting Booth Control Panel 1Media RaharjaNo ratings yet

- Prometer 100 precision metering series with IEC 61850 supportDocument4 pagesPrometer 100 precision metering series with IEC 61850 supportPontasNo ratings yet

- 112-EP4-PE-IsS-0402 - Datasheet For Analyzer With ShelterDocument108 pages112-EP4-PE-IsS-0402 - Datasheet For Analyzer With Sheltercre1982100% (1)

- S06H1021Document90 pagesS06H1021salaNo ratings yet

- Second Place - Joydeep SarkarDocument22 pagesSecond Place - Joydeep SarkarGaurav ManiyarNo ratings yet

- GSM BSS Network KPI (Paging Success Rate) Optimization ManualDocument27 pagesGSM BSS Network KPI (Paging Success Rate) Optimization ManualRey B.SalvoNo ratings yet

- By Mr. Yongyuth Lokloung Instrument Department: Instrument Control Concept and Block DiagramDocument39 pagesBy Mr. Yongyuth Lokloung Instrument Department: Instrument Control Concept and Block DiagramDuong NguyenNo ratings yet

- Chemical Dosing Unit (Cdu) : Rabigh II Project Interconnecting Package (UO1)Document19 pagesChemical Dosing Unit (Cdu) : Rabigh II Project Interconnecting Package (UO1)dodonggNo ratings yet

- Hytera SmartDispatch-Net Installation Guide V4.0Document79 pagesHytera SmartDispatch-Net Installation Guide V4.0tanajm60No ratings yet

- Nov PMS PerformanceDocument3 pagesNov PMS PerformanceYASHNo ratings yet

- Power FinanceDocument132 pagesPower Financemaheshtech76No ratings yet

- Digging Deep Into Debt: High Debt Doesn't Always Mean TroubleDocument1 pageDigging Deep Into Debt: High Debt Doesn't Always Mean Troublemaheshtech76No ratings yet

- The Story of A Stock InvestorDocument3 pagesThe Story of A Stock Investormaheshtech76No ratings yet

- Warren Buffett's Latest Annual Letter 2018Document4 pagesWarren Buffett's Latest Annual Letter 2018maheshtech760% (1)

- The Watch List: Being Near-Monopolies, These Companies Have High Chances of Delivering Consistent ReturnsDocument2 pagesThe Watch List: Being Near-Monopolies, These Companies Have High Chances of Delivering Consistent Returnsmaheshtech76No ratings yet

- The Rise of Money ManagersDocument2 pagesThe Rise of Money Managersmaheshtech76No ratings yet

- RSI signals possible rebound for Russell 2000, S&P 500, Dow Jones and Nifty 50Document4 pagesRSI signals possible rebound for Russell 2000, S&P 500, Dow Jones and Nifty 50maheshtech76No ratings yet

- Volatility Reduces Over TimeDocument1 pageVolatility Reduces Over Timemaheshtech76No ratings yet

- Quackery Begets Quackery: JakartaDocument15 pagesQuackery Begets Quackery: Jakartaamisha2562585No ratings yet

- March-PMS-Performance-Newsletter (PMS AIF World)Document5 pagesMarch-PMS-Performance-Newsletter (PMS AIF World)maheshtech76No ratings yet

- High Earnings Growth Portfolio StocksDocument21 pagesHigh Earnings Growth Portfolio StocksVIREN GOHILNo ratings yet

- PMS FaqDocument4 pagesPMS Faqmaheshtech76No ratings yet

- Why Mid & Small Caps NowDocument13 pagesWhy Mid & Small Caps NowVikash MantryNo ratings yet

- High Earnings Growth Portfolio StocksDocument21 pagesHigh Earnings Growth Portfolio StocksVIREN GOHILNo ratings yet

- High Earnings Growth Portfolio StocksDocument21 pagesHigh Earnings Growth Portfolio StocksVIREN GOHILNo ratings yet

- 2020 Top Picks PDFDocument38 pages2020 Top Picks PDFmaheshtech76No ratings yet

- AkzoNobel AR 2018-19 PDFDocument202 pagesAkzoNobel AR 2018-19 PDFmaheshtech76No ratings yet

- Investing in 2020 & Beyond: Global Strategy PaperDocument28 pagesInvesting in 2020 & Beyond: Global Strategy Papermaheshtech76100% (1)

- Economy: A Turnaround' Appears DistantDocument18 pagesEconomy: A Turnaround' Appears Distantmaheshtech76No ratings yet

- Dividend Payout HistoryDocument1 pageDividend Payout Historymaheshtech76No ratings yet

- PresentationDocument2 pagesPresentationKishan kumarNo ratings yet

- AkzoNobel AR 2018-19 PDFDocument202 pagesAkzoNobel AR 2018-19 PDFmaheshtech76No ratings yet

- AksharChem Care Rating Oct 19Document5 pagesAksharChem Care Rating Oct 19maheshtech76No ratings yet

- University of Madras (With Effect From The Academic Year 2016-2017) Annexure-Ii Revised Scheme of Examination: Semester IDocument41 pagesUniversity of Madras (With Effect From The Academic Year 2016-2017) Annexure-Ii Revised Scheme of Examination: Semester ISam PeterNo ratings yet

- Women's Changing Roles in the U.S. MilitaryDocument9 pagesWomen's Changing Roles in the U.S. Militaryamandeep raiNo ratings yet

- 17.04.1295 DPDocument4 pages17.04.1295 DPUt SamNo ratings yet

- ST - Joseph's Degree & PG College Business Law Unit1Document14 pagesST - Joseph's Degree & PG College Business Law Unit1Saud Waheed KhanNo ratings yet

- Proforma Balance Sheet with Financing OptionsDocument6 pagesProforma Balance Sheet with Financing OptionsJohn Richard Bonilla100% (4)

- 061B Jsa Land Clearing 0+00Document10 pages061B Jsa Land Clearing 0+00sas13No ratings yet

- Mba-Mk4 2023Document6 pagesMba-Mk4 2023Lalit SinghNo ratings yet

- SECRETS OF SELLING SUCCESSDocument30 pagesSECRETS OF SELLING SUCCESSventvmNo ratings yet

- 12 M's To Successful EntrepreneurshipDocument3 pages12 M's To Successful EntrepreneurshipQueen Valle100% (4)

- Customs Valuation SystemDocument3 pagesCustoms Valuation SystemJehiel CastilloNo ratings yet

- Product Roadmap Guide by ProductPlanDocument68 pagesProduct Roadmap Guide by ProductPlananikbiswasNo ratings yet

- M02 CILO14 WK07to12 Partnership LiquidationDocument15 pagesM02 CILO14 WK07to12 Partnership LiquidationHoney Faith Dela CruzNo ratings yet

- HSG THPT Mock Exam 01Document17 pagesHSG THPT Mock Exam 01nhưNo ratings yet

- ENT300 - Case StudyDocument29 pagesENT300 - Case StudySITI NUR WARDINA WAFI ROMLINo ratings yet

- Clow IAPMC9 PPT 13Document46 pagesClow IAPMC9 PPT 13rana 123No ratings yet

- WA 6 NPV, IRR and PaybackDocument7 pagesWA 6 NPV, IRR and PaybackUbong AkpekongNo ratings yet

- Corporate Liability in Bankruptcy and the Principle of ProportionalityDocument7 pagesCorporate Liability in Bankruptcy and the Principle of ProportionalityZikri MohamadNo ratings yet

- Consumer Behavior For Milk and Dairy Products As DDocument7 pagesConsumer Behavior For Milk and Dairy Products As DRushikesh patelNo ratings yet

- Antoine Resume 52020Document2 pagesAntoine Resume 52020api-512211605No ratings yet

- Bactol - Chapter 1 4 Revision 1Document51 pagesBactol - Chapter 1 4 Revision 1Christina22418No ratings yet

- Assignment PA 324Document18 pagesAssignment PA 324Mohammad Al-AminNo ratings yet

- BSNS201 L2 Intergenerational Business - 2023Document23 pagesBSNS201 L2 Intergenerational Business - 2023isabel bruceNo ratings yet

- Walt Disney Case Analysis PDFDocument10 pagesWalt Disney Case Analysis PDFDominic LeeNo ratings yet

- (Assignment) Finc 331 Project 1Document6 pages(Assignment) Finc 331 Project 1Nashon ChachaNo ratings yet

- Ensto Sustainability Report 2022Document35 pagesEnsto Sustainability Report 2022Dilip79No ratings yet

- Marketing Management Assignment - 1 - AttemptDocument17 pagesMarketing Management Assignment - 1 - AttemptBalakrishna ChintalaNo ratings yet

- Jaipur - Rajasthan India - Business Industrial Directory Database List of Companies Small & Medium Enterprises - SME & Industries (.XLSX Excel Format) 7th EditionDocument3 pagesJaipur - Rajasthan India - Business Industrial Directory Database List of Companies Small & Medium Enterprises - SME & Industries (.XLSX Excel Format) 7th EditionRohit BalaniNo ratings yet

- Kunci Jawaban Uts - Pengantar Akuntansi - s1 AkuntansiDocument18 pagesKunci Jawaban Uts - Pengantar Akuntansi - s1 AkuntansiAll AboutNo ratings yet

- Accounting Cycle: Service BusinessDocument16 pagesAccounting Cycle: Service BusinessMavie PhotographyNo ratings yet

- FSA - Ch06 - Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument46 pagesFSA - Ch06 - Liquidity of Short-Term Assets Related Debt-Paying AbilityAmine AbdesmadNo ratings yet