Professional Documents

Culture Documents

CENVAT Credit Rules, 2002: Reasoning

Uploaded by

Harsha AmmineniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CENVAT Credit Rules, 2002: Reasoning

Uploaded by

Harsha AmmineniCopyright:

Available Formats

REASONING:

The contention of the Revenue is that as per Rule 3(4) of the CENVAT Credit Rules,

2002 when inputs or capital goods on which CENVAT credit was taken, are removed as such

from the factory, the manufacturer of the final products shall pay an amount equal to the

credit availed in respect of such inputs or capital goods and such removal shall be made under

the cover of an invoice referred to in Rule 7. Therefore, it is contended that the Tribunal

erroneously held that there was no provision for payment of interest, especially, when there is

a specific provision contained in Section 11AB of the Act.

Rule 3 of the CENVAT Credit Rules, 2002 deals with the circumstances under which

the manufacturer or producer of final products shall be allowed to take credit. Sub Rule (3) of

Rule 3 of the CENVAT Credit Rules, 2002 states that Cenvat Credit may be utilized for

payment of any duty of excise on any final products or for payment of duty on inputs or

capital goods themselves if such inputs are removed as such or after being partially

processed, or such capital goods are removed as such.

As noticed above, the case relates to clearances effected by the assessee during the

period April 2003 to March 2004. Sub Rule (4) to Rule 3 of the CENVAT Credit Rules,

2002 was substituted by Notification No.13/2003 dated 01.03.2003. The substituted rule

reads as follows:

"(4) When inputs or capital goods, on which CENVAT credit has been taken, are

removed as such from the factory, the manufacturer of the final products shall pay an amount

equal to the credit availed in respect of such inputs or capital goods and such removal shall

be made under the cover of an invoice referred to in Rule 7."

CONCLUSION:

The court Held that it was not in dispute that assessee had paid duty at end of month,

much prior to 5th day of following month or in case where removal had taken place in March

before 31st March of relevant year, in such circumstances, it could not be said that there has

been delay in payment of duty so as to invoke s. 11AB of Act, even though Tribunal had

proceeded on basis that deposit was made prior to issuance of show cause notice, on facts,

Court found, such a contention was not tenable .It was evidently clear that assessee had

deposited amount before issuance of show cause notice, yet Court did not think, that it need

to enter into question since essentially assessee's case fell within scope of r. 3(4) r/w r. 8 of

Rules . Revenue appeal was rejected .Appeal dismissed.

You might also like

- Deed of Earthly Birth-Right PDFDocument15 pagesDeed of Earthly Birth-Right PDFPatrick Mabry100% (4)

- Fidic Summary of Contract Procedures and ClausesDocument13 pagesFidic Summary of Contract Procedures and ClausesALDEN100% (2)

- Preweek Pointers For Civpro and Crimpro 2022Document42 pagesPreweek Pointers For Civpro and Crimpro 2022Harry PotterNo ratings yet

- Affidavit of Parental Advice To MarriageDocument2 pagesAffidavit of Parental Advice To MarriageWilma Pereña75% (12)

- FIDIC FAQs and ResourcesDocument6 pagesFIDIC FAQs and ResourcesGerard BoyleNo ratings yet

- Customary Land LawDocument41 pagesCustomary Land LawDelenzy Cino79% (14)

- Cir V AcostaDocument2 pagesCir V AcostaMemey C.No ratings yet

- Grounds of AppealDocument12 pagesGrounds of AppealIRTribunalNo ratings yet

- Asiatrust Dev V Concepts TradingDocument4 pagesAsiatrust Dev V Concepts Tradingdino de guzman0% (1)

- p2010 Fenwick - Claims N Notices N Time BarDocument17 pagesp2010 Fenwick - Claims N Notices N Time BarPameswaraNo ratings yet

- Eligibility Criteria and Requirements For Enrolment As An Advocate (As Per Section 24 of The Advocates Act)Document2 pagesEligibility Criteria and Requirements For Enrolment As An Advocate (As Per Section 24 of The Advocates Act)Harsha AmmineniNo ratings yet

- Claims Under FIDIC 2016 HoganDocument4 pagesClaims Under FIDIC 2016 HogangimasaviNo ratings yet

- EO Kasambahay DeskDocument2 pagesEO Kasambahay DeskBarangay San Ramon100% (2)

- Requirements For Reduction of Appeal BondDocument5 pagesRequirements For Reduction of Appeal BondLourd Bonilla TandayagNo ratings yet

- Payment and Milestone SchedulesDocument71 pagesPayment and Milestone SchedulesCu Ti100% (1)

- Buena VistaDocument2 pagesBuena VistaAdie EstrelladoNo ratings yet

- JMM Promotions and Management, Inc. vs. National Labor Relations Commission and Ulpiano L. Delos Santos and Radiola Toshiba Philippines, Inc. vs. The Intermediate Appellate CouDocument4 pagesJMM Promotions and Management, Inc. vs. National Labor Relations Commission and Ulpiano L. Delos Santos and Radiola Toshiba Philippines, Inc. vs. The Intermediate Appellate CouJacinth DelosSantos DelaCernaNo ratings yet

- CS Form No. 32 Oath of OfficeDocument1 pageCS Form No. 32 Oath of OfficeJanine Erika Julom Brillantes100% (1)

- Balite Vs Ss VenturesDocument4 pagesBalite Vs Ss VenturesHarold EstacioNo ratings yet

- The Law of Trusts NotesDocument5 pagesThe Law of Trusts NotesRANDAN SADIQNo ratings yet

- ProblemDocument3 pagesProblemIsha MishraNo ratings yet

- Vol 3 Secaidtccp 9Document7 pagesVol 3 Secaidtccp 9timirkantaNo ratings yet

- JMM Promotions v. NLRCDocument2 pagesJMM Promotions v. NLRCMia Dee-AbdNo ratings yet

- Ios 6Document4 pagesIos 6Harsha AmmineniNo ratings yet

- KlebeDocument13 pagesKlebepvtNo ratings yet

- Efore Shok Umar Orah Ember UdicialDocument8 pagesEfore Shok Umar Orah Ember UdicialSaloni KumarNo ratings yet

- 2023 PTD 541 161BDocument8 pages2023 PTD 541 161BYour AdvocateNo ratings yet

- MTP 3 15 Answers 1680935509Document8 pagesMTP 3 15 Answers 1680935509Umar MalikNo ratings yet

- Moot IbcDocument9 pagesMoot IbcJai VermaNo ratings yet

- Loan AgreementDocument10 pagesLoan AgreementMukesh VNo ratings yet

- US Internal Revenue Service: rp-06-40Document7 pagesUS Internal Revenue Service: rp-06-40IRSNo ratings yet

- Company LawDocument8 pagesCompany LawCHIMONo ratings yet

- J 2017 SCC OnLine NCLAT 63 Shreya14 Nluassamacin 20230215 130923 1 4Document4 pagesJ 2017 SCC OnLine NCLAT 63 Shreya14 Nluassamacin 20230215 130923 1 4Shreya KumarNo ratings yet

- Return of The Dragon (By S.Jaikumar and G.Natarajan, Advocates, Swamy Associates, Chennai)Document3 pagesReturn of The Dragon (By S.Jaikumar and G.Natarajan, Advocates, Swamy Associates, Chennai)Sameer HusainNo ratings yet

- J 2020 SCC OnLine Blog OpEd 75 Cabhishekllb18 Lawallianceeduin 20220815 190433 1 5Document5 pagesJ 2020 SCC OnLine Blog OpEd 75 Cabhishekllb18 Lawallianceeduin 20220815 190433 1 5Abhishek CharanNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaKartik GuptaNo ratings yet

- 7/april/2020 Insolvency Code ContinuesDocument11 pages7/april/2020 Insolvency Code ContinuesMishika PanditaNo ratings yet

- Decoding Recent Judgements of Supreme Court in Taxes - Part 2Document3 pagesDecoding Recent Judgements of Supreme Court in Taxes - Part 2prithish mNo ratings yet

- Instruction 1914Document3 pagesInstruction 1914ExcelNo ratings yet

- Article PF Contributions On AllowancesDocument4 pagesArticle PF Contributions On Allowancestarlochan singhNo ratings yet

- General Terms and Conditions For Debt Collection Services: Preamble Vienna, 3.4.2017Document3 pagesGeneral Terms and Conditions For Debt Collection Services: Preamble Vienna, 3.4.2017Ernest AbiertasNo ratings yet

- Sub-Clause 20.1 - The FIDIC Time Bar Under Common and Civil LawDocument15 pagesSub-Clause 20.1 - The FIDIC Time Bar Under Common and Civil LawMilan UljarevicNo ratings yet

- CIR vs. Medical CenterDocument5 pagesCIR vs. Medical CenterJenica Anne DalaodaoNo ratings yet

- 001-FIDIC Conditions DABDocument6 pages001-FIDIC Conditions DABmullanaNo ratings yet

- Indian Bank Association v. Union of IndiaDocument19 pagesIndian Bank Association v. Union of IndiaBar & BenchNo ratings yet

- Central Excise Rules 2002Document14 pagesCentral Excise Rules 2002Amitabha Sankar BhaduriNo ratings yet

- VAT ApppealDocument7 pagesVAT ApppealhhhhhhhuuuuuyyuyyyyyNo ratings yet

- Clause-20 Fidic 1999 - Complete NarrativeDocument55 pagesClause-20 Fidic 1999 - Complete NarrativeUsmanNo ratings yet

- Credai - Reply - FinalDocument8 pagesCredai - Reply - Finalsiddhapura.zianNo ratings yet

- Revised Standard Operating ProcedureDocument6 pagesRevised Standard Operating ProcedureManmatha SahooNo ratings yet

- Atlantic Department Stores, Inc. v. United States, 557 F.2d 957, 2d Cir. (1977)Document8 pagesAtlantic Department Stores, Inc. v. United States, 557 F.2d 957, 2d Cir. (1977)Scribd Government DocsNo ratings yet

- Agreement On Bank TransactionsDocument16 pagesAgreement On Bank TransactionsYa LiNo ratings yet

- Brand Realty Services Ltd. v. Sir John Bakeries India (P) LTD., 2022 SCC OnLine NCLAT 290Document5 pagesBrand Realty Services Ltd. v. Sir John Bakeries India (P) LTD., 2022 SCC OnLine NCLAT 290aadityaNo ratings yet

- Harry M. Stevens, Inc. v. James W. Johnson, Former Collector of Internal Revenue For The Third District of New York, 238 F.2d 436, 2d Cir. (1956)Document5 pagesHarry M. Stevens, Inc. v. James W. Johnson, Former Collector of Internal Revenue For The Third District of New York, 238 F.2d 436, 2d Cir. (1956)Scribd Government DocsNo ratings yet

- Pam Northern Chapter: Delay and Disruption in Construction ContractsDocument37 pagesPam Northern Chapter: Delay and Disruption in Construction ContractscfpyNo ratings yet

- SLQS Qatar CPD No. 101 - Payment Delays in The Construction Industry by Mr. Uditha Tharanga - PresentationDocument31 pagesSLQS Qatar CPD No. 101 - Payment Delays in The Construction Industry by Mr. Uditha Tharanga - Presentationben hurNo ratings yet

- Cu Unjieng e HijosDocument2 pagesCu Unjieng e HijosIna VillaricaNo ratings yet

- A3 SP473 MAK DAEP LET 0905 Payment Certificate No. 54 - Application of Delay PenaltyDocument6 pagesA3 SP473 MAK DAEP LET 0905 Payment Certificate No. 54 - Application of Delay PenaltyEhab IbrahimNo ratings yet

- Citation (SCL) : (2021) 164 SCL 455 (SC)Document10 pagesCitation (SCL) : (2021) 164 SCL 455 (SC)Aryan AnandNo ratings yet

- UntitledDocument5 pagesUntitledharsh hgNo ratings yet

- High Court Reduces GST Penalty From Rs. 56,00,952 To Rs. 10000 - Taxguru - inDocument5 pagesHigh Court Reduces GST Penalty From Rs. 56,00,952 To Rs. 10000 - Taxguru - inVineet AgrawalNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument16 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Credit 2nd Meeting Copy LangDocument7 pagesCredit 2nd Meeting Copy LangJuan Carlo CastanedaNo ratings yet

- Full Title: Dario Nacar Vs - Gallery Frames And/Or Felipe Bordey, JR., STATEMENT OF FACTS Petitioner Dario Nacar Filed A Complaint BeforeDocument3 pagesFull Title: Dario Nacar Vs - Gallery Frames And/Or Felipe Bordey, JR., STATEMENT OF FACTS Petitioner Dario Nacar Filed A Complaint BeforeJuan Carlo CastanedaNo ratings yet

- Proposed Rules Governing Regulation CrowdfundingFrom EverandProposed Rules Governing Regulation CrowdfundingNo ratings yet

- Enrollment of Advocates in India Who Is An Advocate?Document1 pageEnrollment of Advocates in India Who Is An Advocate?Harsha AmmineniNo ratings yet

- The Foreign Lawyers Are Required To Pay Some Amount of Fee For Registration in India So Under The Rule of 6 (D) of Bar Council of IndiaDocument2 pagesThe Foreign Lawyers Are Required To Pay Some Amount of Fee For Registration in India So Under The Rule of 6 (D) of Bar Council of IndiaHarsha AmmineniNo ratings yet

- Types of Alternate Dispute ResolutionDocument2 pagesTypes of Alternate Dispute ResolutionHarsha AmmineniNo ratings yet

- Consideration Oflaw Degree Obtained in University'S Situated in ForeignDocument2 pagesConsideration Oflaw Degree Obtained in University'S Situated in ForeignHarsha AmmineniNo ratings yet

- Alternate Dispute ResolutionDocument2 pagesAlternate Dispute ResolutionHarsha AmmineniNo ratings yet

- Sahara Industries, Patrampur Road, Jaspur and Others V State Bank of India Main Branch, Kashipur FactsDocument1 pageSahara Industries, Patrampur Road, Jaspur and Others V State Bank of India Main Branch, Kashipur FactsHarsha AmmineniNo ratings yet

- Dispute ResloutionDocument2 pagesDispute ResloutionHarsha AmmineniNo ratings yet

- Mandatory ArbitrationDocument3 pagesMandatory ArbitrationHarsha AmmineniNo ratings yet

- V.M. Kurian vs. State of Kerala and Ors. Facts:: MANU/SC/0205/2001Document2 pagesV.M. Kurian vs. State of Kerala and Ors. Facts:: MANU/SC/0205/2001Harsha AmmineniNo ratings yet

- IssuseDocument1 pageIssuseHarsha AmmineniNo ratings yet

- ReasoningDocument1 pageReasoningHarsha AmmineniNo ratings yet

- Jayan V Hong Kong and Shanghai Banking Corporation Limited: 2009 Indlaw KER 587Document2 pagesJayan V Hong Kong and Shanghai Banking Corporation Limited: 2009 Indlaw KER 587Harsha AmmineniNo ratings yet

- Collector of Stamps vs. Se Investment Limited and Others FactsDocument1 pageCollector of Stamps vs. Se Investment Limited and Others FactsHarsha AmmineniNo ratings yet

- Commissioner of Central Excise Chennai IV Commissionerate, Chennai V Customs Excise and Service Tax Appellate Tribunal South Zonal Bench, Chennai and Another FactsDocument1 pageCommissioner of Central Excise Chennai IV Commissionerate, Chennai V Customs Excise and Service Tax Appellate Tribunal South Zonal Bench, Chennai and Another FactsHarsha AmmineniNo ratings yet

- Reasoning:: ConstitutionDocument1 pageReasoning:: ConstitutionHarsha AmmineniNo ratings yet

- ReasoningDocument2 pagesReasoningHarsha AmmineniNo ratings yet

- Pawan Kumar Garg and Others V Chairman & Managing Director, Bharat Sanchar Nigam Limited, New Delhi and Others FactsDocument1 pagePawan Kumar Garg and Others V Chairman & Managing Director, Bharat Sanchar Nigam Limited, New Delhi and Others FactsHarsha AmmineniNo ratings yet

- DRT Act 2006 Indlaw SC 900 DRT Act: ReasoningDocument2 pagesDRT Act 2006 Indlaw SC 900 DRT Act: ReasoningHarsha AmmineniNo ratings yet

- In Re: Bharath Beedi Works Limited FactsDocument1 pageIn Re: Bharath Beedi Works Limited FactsHarsha AmmineniNo ratings yet

- ConclusionDocument1 pageConclusionHarsha AmmineniNo ratings yet

- Reasoning:: 2003 Indlaw SC 789Document2 pagesReasoning:: 2003 Indlaw SC 789Harsha AmmineniNo ratings yet

- ConclusionDocument1 pageConclusionHarsha AmmineniNo ratings yet

- ConclusionDocument1 pageConclusionHarsha AmmineniNo ratings yet

- Issue:: 1985 Indlaw CAL 141Document1 pageIssue:: 1985 Indlaw CAL 141Harsha AmmineniNo ratings yet

- State of Kerala vs. Kuriyan Varghese and Ors. Facts: MANU/KE/0805/2001Document1 pageState of Kerala vs. Kuriyan Varghese and Ors. Facts: MANU/KE/0805/2001Harsha AmmineniNo ratings yet

- Ravindra Kumar Parashar and Others V State Bar Council of Chhattisgarh and Another FactsDocument1 pageRavindra Kumar Parashar and Others V State Bar Council of Chhattisgarh and Another FactsHarsha AmmineniNo ratings yet

- ReasoningDocument1 pageReasoningHarsha AmmineniNo ratings yet

- Brij Mohan Prasad and Others vs. State of U.P. and Others FactsDocument1 pageBrij Mohan Prasad and Others vs. State of U.P. and Others FactsHarsha AmmineniNo ratings yet

- Ravindra Kumar Parashar and Others V State Bar Council of Chhattisgarh and Another FactsDocument1 pageRavindra Kumar Parashar and Others V State Bar Council of Chhattisgarh and Another FactsHarsha AmmineniNo ratings yet

- Churchill Mining v. Indonesia (ANALYSIS)Document25 pagesChurchill Mining v. Indonesia (ANALYSIS)Wirando GirsangNo ratings yet

- In Re Texas, No. 03-20-00447-CV (Tex. App. Dec. 2, 2020)Document14 pagesIn Re Texas, No. 03-20-00447-CV (Tex. App. Dec. 2, 2020)RHTNo ratings yet

- FOIA Lawsuit Filed Against ASPDocument18 pagesFOIA Lawsuit Filed Against ASPMarine GlisovicNo ratings yet

- Starkville Dispatch Eedition 3-5-21Document16 pagesStarkville Dispatch Eedition 3-5-21The DispatchNo ratings yet

- BotchweyDocument18 pagesBotchweydennis greenNo ratings yet

- First Principles Cheat Sheet - DisputandumDocument8 pagesFirst Principles Cheat Sheet - Disputandumchandra halim mNo ratings yet

- Commercial and Industrial Law PPT 2Document18 pagesCommercial and Industrial Law PPT 2GayathriSrinivasanNo ratings yet

- State CA9 OppDocument59 pagesState CA9 OppPersonInTheUSANo ratings yet

- E.M.S Namboodiripad v. T. Narayanan Nambiyar AIR 1970 SC 2015Document11 pagesE.M.S Namboodiripad v. T. Narayanan Nambiyar AIR 1970 SC 2015Shagun HoodaNo ratings yet

- Estate Tax CasesDocument17 pagesEstate Tax CasesWarly PabloNo ratings yet

- Shankari Prasad v. Union of India (1951)Document5 pagesShankari Prasad v. Union of India (1951)Nitish GuptaNo ratings yet

- Lease Deed - Commercial - TemplateDocument11 pagesLease Deed - Commercial - TemplateKhushboo SharmaNo ratings yet

- Pol1090 Law and EqualityDocument5 pagesPol1090 Law and Equalityapi-542961198No ratings yet

- Guardianship and Custody: Under Hindu LawDocument12 pagesGuardianship and Custody: Under Hindu LawShanskriti SwainNo ratings yet

- Dr. Hernando B. Perez: (Person Not Related by Consanguinity or Affinity To Applicant /appointee)Document1 pageDr. Hernando B. Perez: (Person Not Related by Consanguinity or Affinity To Applicant /appointee)Meynard MagsinoNo ratings yet

- Early Voting Locations in Erie CountyDocument1 pageEarly Voting Locations in Erie CountyWGRZ-TVNo ratings yet

- Family Law 2 Index - nLZbkuQDocument5 pagesFamily Law 2 Index - nLZbkuQVishwaNo ratings yet

- Masidlak Eagles Form 2Document2 pagesMasidlak Eagles Form 2Rubie Anne SaducosNo ratings yet

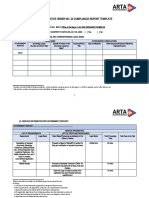

- Citizens Charter Bplo Arta MC 2020-04 Editable TemplateDocument3 pagesCitizens Charter Bplo Arta MC 2020-04 Editable Templateapi-541795421No ratings yet

- Landscape and LandschaftDocument1 pageLandscape and LandschaftThiagoNo ratings yet

- HTTP WWW - Icj Cij - Org Docket Files 95 7495Document87 pagesHTTP WWW - Icj Cij - Org Docket Files 95 7495Victor Waller SadallaNo ratings yet

- This Study Resource Was: Chaos at Uber: The New Ceos Challenge (2018) Final Case AssignmentDocument5 pagesThis Study Resource Was: Chaos at Uber: The New Ceos Challenge (2018) Final Case Assignmentlingly justNo ratings yet