Professional Documents

Culture Documents

Lesson 7 - Audit Evidence PDF

Uploaded by

Allaina Uy Berbano0 ratings0% found this document useful (0 votes)

65 views7 pagesOriginal Title

Lesson 7 - Audit Evidence.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

65 views7 pagesLesson 7 - Audit Evidence PDF

Uploaded by

Allaina Uy BerbanoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

2.

More material à More evidence

Audit Evidence, Procedures, and 3. Greater audit risk à More evidence

4. Prior years’ experience with client

Working Papers

COMPETENCE OF AUDIT EVIDENCE

CLIENT ASSERTIONS • quality or reliability of evidence to support opinion

• representations by mgmt. that are embodied in the on FS

FS, presented in the FS • Guidelines:

• Auditor must verify the validity of these assertions, 1. Obtained outside > Obtained within

must obtain and evaluate audit evidence that will 2. Good IC > Weak IC

prove or refute mgmt. representations 3. Obtained directly > Obtained indirectly

4. Written > Oral

Existence or occurrence

- assets and liab presented actually exist as of the DESIRABLE CHARACTERISTICS OF AN EVIDENCE

balance sheet date Relevance

- transactions were recorded in the appropriate - evidence must support or refute acct info

accounting period Freedom from Bias

Completeness - evidence should not tend to unduly support one

- all transactions that occurred during the period decision to the disadvantage of another possible

under audit were recorded decision

Rights and Obligation Objectivity

- assets are rights of the company while the - capability of an evidence to enable diff authors to

recorded liab are actual obli of the company as of a arrive at similar decision based upon the same set

given date of evidence

Valuation or Allocation Persuasiveness

- amounts are in the FS at appropriate amounts - sufficient & appropriate to form opinion

Presentation and Disclosure - can be evaluated only after considering the

- accounts and info in the FS are properly classified, combination of appropriateness & sufficiency

described and discussed - applies to the judgment

- Guidelines:

AUDIT EVIDENCE 1. Satisfaction of auditor

a. Depreciation expense

NATURE OF AUDIT EVIDENCE b. Bad debts, doubtful accounts

• Evidence – data or info assembled by an auditor c. Estimated liability for product warranty

that corroborates or refutes an item under audit 2. Within cost limits, obtained at a reasonable

– any info used by the auditor to determine cost and within reasonable time.

whether the info being audited is in accordance w § auditor’s goal: obtain a sufficient amt of

the established criteria (PFRS) appropriate evidence at lowest total cost

– used to help draw conclu about a subject matter 3. Continue gathering evidence to remove

under study substantial doubt on material items on FS

• Evidence may consist of: 4. Not examine based on 100%, only a selective

1. Underlying accounting data test (Sampling)

a. Books of original entries (journals)

b. Ledgers TYPES OF AUDIT EVIDENCE

c. Worksheets w computations, ie. cost 1. Physical Evidence

allocation, reconciliation, etc - inspection/count of a tangible asset

2. Corroborating information (Confirm) - satisfies existence but not valuation and rights

a. Checks & obli

b. invoices - requires:

c. confirmation replies o examination of assets

d. minutes of meetings o observation of client’s procedures

e. Contracts on file - normally for cash, inventories, equipment,

f. Data obtained by the auditor from inquiries, investments, bldgs., etc.

observation, physical examination, - provides assurance as to existence and should

recomputations, etc. be supplemented by other evidence to

• No evidence = No audit determine ownership, valuation and quality of

condition

SUFFICIENCY OF AUDIT EVIDENCE - Existence: verifies that an asset actually exists

• quantity of evidence auditor should obtain to Completeness: determine whether the assets

support their opinion on FS physically examined are actually recorded on

• Guidelines in deciding: the books

1. More competent à Less evidence 2. Mathematical Recomputations

- recheck the accuracy of computations by client à the client using the confirmation form

- except those needing other experts template prepared by the auditor

- Ex: extending sales invoices and inventory, Who sends the confirmation request?

adding journals and subsidiary records and à the auditor

checking calculations of Dep Exp To whom should the third party reply?

3. Documentation à Directly to the auditor.

- examination of supporting docus of recorded - Positive or Negative Confirmation

transactions and info appearing in FS 5. Representation by Client Personnel

- matching recorded transactions w - statements in answer to queries posed by

corresponding documents auditors

- Classifications: - obtaining of written or oral info from the client in

a. From outside client company and used by response to questions from the auditor

client (vendor’s invoices, insurance - has very limited reliability value, not usually

policies) regarded as conclusive evidence, must

b. From inside client company and used by corroborated w other types of procedures to

outside org (checks, sales invoices, debit obtain sufficient appropriate evidence

and credit memos) 6. Data Interrelationship from Analytical Review

c. From inside client company and used by Procedures

client (journals, vouchers, payroll record) - examination and comparison of relationships

- Internal Documents among data

§ prepared and used w/in the client’s org and - understand the client’s industry and business

are retained wo ever going to an outside - assess the entity’s ability to continue as a going

party concern

§ Ex: duplicate sales invoices, official - Indicate the presence of possible

receipts, employees’ time reports, and misstatements in the financial statements

receiving reports - Reduce detailed audit tests

- External Documents 7. Internal Control

§ handled by someone outside the client's - adequate and operating IC policies &

org who is a party to the transac being procedures enhance the reliability

documented but w/c are either currently - adequate IC = strong evidence of validity

held by the client or readily accessible - Caution:

§ Ex: vendors’ invoices, insurance policies, 1) Not rely completely on IC structure to

board resolutions under the custody of a gather evidence, but to merely restrict the

third party legal counsel appointed as application of audit procedures

corporate secretary 2) To restrict audit procedures = not to

§ more reliable than internal eliminate entire audit procedures

4. Representation by Third Parties or Confirmations 8. Subsequent Events

- from outside client company and sent directly to - events or transactions occurring subsequent to

auditor the BS date but before the issuance of audited

- More reliable than documentation FS and auditor’s opinion

- Examples: Release of

a. Bank confirmation Bal Sheet Subsequent

Date Events Audited FS &

b. AR confirmation Opinion

c. AP confirmation

d. Bond trustees Adjusting Non-Adjusting

- Success depends on ff factors: Events Events

1) parties requested to confirm are

knowledgeable Adjusting Events Non-Adjusting Events

2) auditor had a free hand in selecting parties provide addt’l evidence w provide evidence w

or samples respect to conditions respect to conditions not

3) auditors personally and directly mailed the existed on the BS date existing on the BS date

confirmation requests and affect the estimates but occur subsequent to

4) replies or returned requests are received inherent in the process of that date

directly by auditor wo interception by client prep of FS

5) exceptions expressed by third parties are Contingent Liab Addt’l issues of stocks

verifies by the auditor and discussed w after BS date

client

- Requirements: 9. Reperformance

a) Auditor must confirm AR - auditor’s independent tests of client acct

b) Auditors control mailing & receipt of replies procedures or controls that were originally done

c) Electronic confirmations are permitted 10. Observation

- Who prepares the confirmation request? - Use one’s senses to assess client activities.

- Tour plant to obtain a general impression of and does not provide reasonable assurance

client’s facilities. that the balances are accurate

- Observation is rarely sufficient by itself. - Negative Confirmation

- Often need to corroborate w another kind of o third party is requested to respond directly

evidence only if the auditor disagrees w the info in

- rarely sufficient because of the risk of client request

personnel changing their behavior because of o high risk of arriving at incorrect conclu

the auditor’s presence o used when: amount to be confirmed is small

or when IC structure is effective and provides

a reasonable assurance that balances are

accurate

3. Vouching

- examination of supporting documents of

transactions

- from the books of accounts to source docus

- “tracing back”

- from accounting records to supporting docu

- existence

4. Tracing

- tracing of docus to acct records w/c follows

reverse rule of vouching

- from sources docus to records

- from supporting docu to the accounting records

- completeness

5. Reperformance

- reviewing the work done by client staff to check

its accuracy

6. Observation

- witnessing the activities of client’s staff

7. Reconciliation

- determining agreement between sets of records

- independently maintained but related records

8. Inquiry

- asking questions to facilitate performance of

subsequent audit steps

9. Inspection

AUDIT OBJECTIVES - critical examination of forms and docus to

• developed by auditor to ensure only relevant determine proper treatment in acct records &

evidence will be obtained FS

• Ex: Inventory balance 10. Analytical Review Procedures

- study of relationships, rations and trends

AUDIT TECHNIQUES AND PROCEDURES 11. Scan

• Audit Techniques: to achieve audit objectives 12. Read

• Audit Procedures: 13. Foot

o to verify mgmt. assertions 14. Compare

o to obtain sufficient competent evidence that

will prove the truth or falsity of the assertions AUDIT PROCEDURES ACCORDING TO PURPOSE

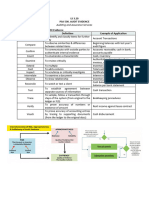

in the FS Test of Controls Substantive Tests

o Examples: (Compliance Test)

1. Physical Examination To determine To verify assertions of

- to gather physical evidence effectiveness of design & mgmt. re. FS components

- Ex: cash & securities counts ope of IC structure

2. Confirmation

- involves requesting a third party to affirm EXAMPLES OF AUDIT PROCEDURES

accuracy of items per records maintained by the Existence or Occurrence

client 1. Inv existence: inventory observations, test counts

- Positive Confirmation 2. AR existence: confirmation

o third party is requested to respond directly to 3. Cash existence: cash counts, bank recon

the auditor regardless of whether former 4. Sales/Exp: examine relevant docus, analytical

agrees or disagrees w info in request review procedures

o used when: amount to be confirmed is Completeness

material or when IC structure is inadequate 1. Cash count

2. Bank recon and cut-off bank statements examination was made in accordance w

3. Year-end accrual for payroll GAAS/PSA

4. Unrecorded liab by examining payments in next year

Rights and Obligations Actions to be taken where the auditor suspects errors or

1. Passbooks and bank statements irregularities

2. Loan agreements w creditors Material:

3. Evidence proving ownership of properties and equip 1. Discuss w mgmt. or w BOD + addt’l investigation

4. Cost of capitalized lease and lease contract 2. Obtain further evidence to know if fraud or

Valuation or Allocation irregularities exist

1. Conversion rate for foreign currency 3. Consult client’s counsel involving law

2. Recalculate prepaid expenses 4. Make necessary corrections

3. Allowance for doubtful accounts 5. Qualify opinion, disclaim or withdraw

4. Inventory pricing 6. If withdraw, consult their own counsel

Presentation & Disclosure

1. Significant assets pledged as collaterals for liab, and Immaterial:

if so, properly disclose in the notes to FS 1. Discuss w mgmt. (at least one rank higher those

2. Restriction by creditors involved)

3. Propriety of accounts classified into CA, 2. Pursue a conclu

Investments, PPE, etc. 3. Consider possibility of errors or irregularities in

4. Naming of accounts (RE vs. Earned Surplus) other control procedures

TYPES OF SUBSTANTIVE TESTS WORKING PAPERS

Analytical Review Test of Details • documents accumulated showing procedures

Procedures performed, audit testing applied, info obtained, &

Study of relationships Examination of items or conclusions

among financial & non- details in acct balance or • connecting link among client’s acct records, FS, &

financial data transaction class. audit report

Provides evidence on Obtain evidence that will • only tangible evidence of compliance w generally

reasonableness of acct either substantiate or accepted auditing standards after the audit

balance identify misstatements

A. Test of Balances PURPOSES OF WORKING PAPER PREPARATION

- tests that make up the Primary

acct balance 1. To aid auditor in conduct & supervision

B. Test of Transactions 2. To provide proof of compliance w the standards of

- test to support entries in field work, i.e., planning, supervision, IC structure.

the acct 3. Principal support for auditor’s opinion

- debit or credit side Secondary

1. To aid in planning & conducting future audits

ERRORS & IRREGULARITIES 2. To provide info useful in MAS

3. To provide info needed for income tax return

Error Irregularities 4. To provide defense in case of litigation for

Unintentional mistakes Intentional manipulation malpractice

of records or FS for the

benefit of the entity under DESIRABLE QUALITITES OF AUDIT WP

audit, mgmt., employees, 1) Adequate planning & supervision of audit

third parties engagement

Fraudulent financial 2) Study & eval of IC structure and its NTE of audit

reporting (Mgmt.) procedures applied

Misappropriation of 3) Sufficiency & competence of evidence gathered to

assets (employees) support auditor’s opinion

• Auditors has to plan examination to search for

errors and irregularities that materially distort FS. CLASSIFICATIONS OF AUDIT WORKING PAPERS

A. Permanent File

Expectation Gap - info of continuing significance to auditor in

Auditors conduct examination: performing recurring & current audits

1. Based on selective tests (sampling) - mostly accumulated during initial audit

2. Subject to inherent risks - reference source for new staff members in

3. To express opinion on the fairness of FS, not to knowing client and for more experienced auditor

discover errors/irregularities in planning current year’s audit

4. Subject to inherent limitations of IC structure - intended to contain data of a historical or

• undetected material errors/irregularities do not continuing nature pertinent to the current audit

mean negligence of auditor as long as the - usual contents:

1. Articles of incorporation and by-laws bb. Detailed analysis & compu of Prep Exp

2. Copies of significant contracts (loan agreements, bond L. Investments & related dividend & Int Income:

indenture, pension plans, etc.) aa. Analysis of ledger accounts

3. Summary indicating: bb. Analysis showing composition properly reconciled

A. Audit report requirements cc. Securities count sheet

aa. To the BOD or stockholders dd. Confirmation replies

bb. To banks M. AP & Accrued Expense:

cc. To gov’t regulatory agencies aa. Analysis of ledger accounts

B. Description of company and its ope bb. Schedule of creditors’ balances

C. Company ownership cc. Summary of confirmation results

D. Company mgmt. dd. Confirmation replies

4. Org chart N. NP & related Int Exp:

5. Chart of accounts aa. Analysis of ledger accounts

6. Copy of company acct procedures and control manual (IC) bb. Schedule of notes & related int reconciled

7. Continuing analyses of: cc. Confirmation replies

A. PPE related to AccDep O. Analysis of significant Inc Statement Accts

B. Long-term liab 4. Tax folder

C. SH’s equity accounts A. Letter to and from the BIR

8. Results of analytical procedures from previous years’ audits B. Pending tax assessments, if any

C. Draft of audit report to accompany ITR

B. Current File D. Draft of ITR

E. Peculiar accounts form inc tax computations

- evidence gathered & conclu reached relevant to aa. Non-taxable items

the audit of particular year bb. Non-deductible items

- audit program, general info, working trial cc. Credible income tax withheld

balance, adjusting and reclassification entries, dd. New BIR pronouncements or regulations

5. Supporting Schedules

supporting schedules

A. Analysis

- usual contents: B. Trial Balance or List

1. Administrative folder: C. Reconciliation of amounts

A. Engagement letter D. Tests of reasonableness

B. Audit memorandum, including: E. Summary of procedures

aa. Special audit risk F. Examination of supporting documents

bb. Accts/areas requiring special emphasis G. Informational

cc. Expected client’s assistance H. Outside documentation

dd. Use of internal auditor’s work

ee. Anticipated reliance on IC

ff. ICQ & flowcharts relative to study & eval of IC SOME BASIC CONCEPTS ON AUDIT WP

gg. Audit program Ownership & Custody

hh. Special disclosures required in the notes to FS • property of auditor

2. Correspondence folder:

A. Copies of letters to and from mgmt. • may be useful to client but not theirs

B. Management letter

C. Lawyer’s letter Client-Prepared Working Papers

D. Management representation letter • client & auditor agree that some schedules,

3. Ledger accounts folder

A. Draft of audit report analyses, reconciliations and computations are to

B. Draft of FS be prepared by client’s staff for submission to the

C. Working trial bal auditor

D. Adjustments

E. Reclassification entries

• Advantages:

F. Cash account: 1. Auditors relieved of unimportant tasks and are

aa. Lead schedule for cash able to devote more time to significant work

bb. Cash count sheets 2. Audit fees reduced

cc. Bank recon

dd. Bank confirmation replies

G. AR: Lead Schedule

aa. Analysis of ledger acct • to combine similar accounts for a summarized

bb. Schedule of customers’ balances forwarding to the working trial balance

cc. Summary of confirmation results

dd. Confirmation replies

ee. Analysis of ADA Tick marks

H. NR & related interest: • symbols to indicate audit procedures performed

aa. Analysis of ledger accounts

bb. Schedule of NR & related interest account - footings checked

cc. Summary of confirmation results - traced from general ledger

dd. Confirmation replies - confirmation

I. Advances to officers and employees and other rec.

aa. Analysis of ledger accounts - reconciled

bb. Schedules of receivables reconciled w controlling

cc. Confirmation replies Sign Off

J. Inventories:

aa. Summary showing quantity, cost, market & final • signatures or initials of preparer/reviewer affixed &

valuation dated on the working papers

bb. Copy of inventory summary submitted w the BIR

cc. Confirmation replies Filing and Indexing

K. Prepayments

aa. Analysis of ledger accounts • Filing

o sequence of working papers in arrangement through inquiries or exam of supporting

• Indexing & Cross-Indexing schedules or docu prepared by the client

o by using numbers, alphabet or both 4. Qualification of indiv providing info

o facilitates control, assembly and review of WP o the evidence will not be reliable unless the

individual providing it is qualified to do so

GUIDELINES IN PREPARATION OF WP o For ex, info about the computation of an entity’s

pension liability should come from an actuary

Senior, Semi-Senior and Junior Auditors that possesses qualifications, skills and

à accumulating working papers experience

Senior Auditor 5. Degree of objectivity

à overall responsibility for completeness o Objective evidence > evidence that requires

Manager considerable judgment to determine whether it

à review of all wp is correct

Partner-in-Charge 6. Timeliness

à may review on a selective basis before report is signed o when it is accumulated or to the period covered

by the audit

Contains: o For ex, evidence is more reliable for balance

a. Client’s name sheet accounts when it is obtained as close as

b. Ledger account title the balance sheet date as possible. For income

c. Balance sheet date for real accounts and year statement accounts, evidence is more reliable

covered for operating accounts if there is a sample that will cover the trans that

d. Dates and initials of preparers and reviewers happened during the year such as selecting

e. Audit procedure applied by tick marks & legend sample of sales transac for each mon in a year.

f. Identification of docus examined or source of info

g. Appropriate cross referencing to other WP AUDIT EVIDENCE AND PERSUASIVENESS

Audit Evidence Qualities Affecting Persuasiveness

AUDIT EVIDENCE DECISIONS Decisions of Evidence

1. Which audit procedures to use Audit Appropriateness

o audit procedure – detailed instruction that procedures & - Relevance

explains the audit evidence to be obtained timing - Reliability

2. What sample size to select for a given procedure > Independence of provider

o Once a procedure is selected, auditors can > Effectiveness of IC

vary the sample size from one to all the items > Auditor's direct knowledge

in the population being tested > Qualifications of provider

3. Which items to select from the population > Objectivity of evidence

o auditor can select (a) sales transactions within - Timeliness

a particular week or month or (b) examine the > When procedures are performed

first 50 checks or (c) select 50 checks with the > Portion of period being audited

largest amounts, or (d) select the checks Sample size & Sufficiency

randomly or (e) select those checks that the items to select Adequate sample size

auditor thinks are most likely to be in error. The Selection of proper popu items

procedures for the selection of samples will be

discussed further in Audit Sampling AUDIT DOCUMENTATION

4. When to perform the procedures (timing) • principal record of auditing procedures applied,

o interim phase or year-end evidence obtained, and conclusions reached by the

auditor in the engagement

AUDIT PROGRAM • to aid the auditor in providing reasonable assurance

• action guide for auditors in performing the FS audit that an adequate audit was conducted in

• lists the detailed procedures to be performed for a accordance with auditing standards

particular FS account (e.g. cash, receivables, PPE) • WORKING PAPER (See page 4)

or a transaction cycle (e.g. revenue cycle,

expenditure cycle) I. Purpose of Audit Documentation

• As a basis for planning the audit

CHARACTERISTICS OF RELIABLE EVIDENCE • As a tool to summarize and record the evidence

1. Independence of provider accumulated and conclusion reached therein

o outside source > within during the conduct of the audit.

2. Effectiveness of client’s IC • As a basis for quality control procedures.

o effective IC > weak IC • As a basis to comply with the auditor’s

3. Auditor’s direct knowledge professional responsibilities

o directly through physical exam, observation, II. Ownership of Audit Files

recalculation, and inspection > indirectly

• Auditor’s

III. Confidentiality of Audit Files

• An auditor shall not disclose any confidential info

obtained in the course of a professional

engagement except w the consent of the client, or

if there is legal need to do so.

SARBANES-OXLEY ACT

• requires auditors of public companies to prepare &

maintain audit working papers for a period of no less

than seven years

• SEC rules require the auditor to maintain copies of

memos, correspondence, communications, other

documents and records, including electronic

records, related to the audit or review

PREPARATION OF AUDIT DOCUMENTATION

• Each audit file should be properly identified

• Documentation should be indexed and cross-

referenced

• Completed documentation must clearly indicate the

audit work performed

• It should include sufficient information

• It should plainly state the conclusions reached

EFFECT OF TECHNOLOGY

• Audit evidence is increasingly in electronic form

• Auditors must evaluate how electronic info affects

their ability to gather evidence

• Auditors use computers to read and examine

evidence

• Software programs are typically Windows-based

You might also like

- Chapter 4 - Evidential Matter and Its DocumentationDocument14 pagesChapter 4 - Evidential Matter and Its DocumentationKristine WaliNo ratings yet

- CISA EXAM-Testing Concept-Knowledge of Compliance & Substantive Testing AspectsFrom EverandCISA EXAM-Testing Concept-Knowledge of Compliance & Substantive Testing AspectsRating: 3 out of 5 stars3/5 (4)

- CPA Review Notes 2019 - Audit (AUD)From EverandCPA Review Notes 2019 - Audit (AUD)Rating: 3.5 out of 5 stars3.5/5 (10)

- Cyber Security 2017Document8 pagesCyber Security 2017Anonymous i1ClcyNo ratings yet

- (PDF) Biochemistry and Molecular Biology of Plants: Book DetailsDocument1 page(PDF) Biochemistry and Molecular Biology of Plants: Book DetailsArchana PatraNo ratings yet

- Lesson 7 - Audit EvidenceDocument7 pagesLesson 7 - Audit EvidenceAllaina Uy BerbanoNo ratings yet

- CH 15 - Audit EvidenceDocument7 pagesCH 15 - Audit EvidenceJwyneth Royce DenolanNo ratings yet

- Audit Planning and Analytical ProceduresDocument25 pagesAudit Planning and Analytical ProceduresImran MobinNo ratings yet

- Audit Planning and Analytical ProceduresDocument24 pagesAudit Planning and Analytical ProceduresMouna MoonyNo ratings yet

- Gathering and Evaluating Audit EvidencesDocument21 pagesGathering and Evaluating Audit EvidencesJov E. AlcanseNo ratings yet

- Acctg 163 Review 4Document9 pagesAcctg 163 Review 4Tressa Salarza PendangNo ratings yet

- Audit EvidenceDocument5 pagesAudit Evidencecvgp1298No ratings yet

- Substantive Test VsDocument2 pagesSubstantive Test VsPrincess TolentinoNo ratings yet

- Audit EvidenceDocument16 pagesAudit EvidenceDymphna Ann CalumpianoNo ratings yet

- Audit PrelimsDocument10 pagesAudit PrelimsMane NessyNo ratings yet

- Audit I CH IVDocument7 pagesAudit I CH IVAhmedNo ratings yet

- Audit EvidenceDocument39 pagesAudit EvidencetasleemfcaNo ratings yet

- Module 8 - Substantive Test of Details of AccountsDocument12 pagesModule 8 - Substantive Test of Details of AccountsMark Angelo BustosNo ratings yet

- Chapter 12 AnsDocument6 pagesChapter 12 AnsDave Manalo100% (1)

- Understanding Audit Standards and TypesDocument3 pagesUnderstanding Audit Standards and TypesKendall JennerNo ratings yet

- TEST OF CONTROLS: ACQUISITIONS TRANSACTIONSDocument7 pagesTEST OF CONTROLS: ACQUISITIONS TRANSACTIONSVan Jasper VienesNo ratings yet

- Audit Process - Performing Substantive TestDocument49 pagesAudit Process - Performing Substantive TestBooks and Stuffs100% (1)

- Lesson 7 Audit EvidenceDocument13 pagesLesson 7 Audit Evidencewambualucas74No ratings yet

- LS 3.20 - PSA 500 Audit EvidenceDocument3 pagesLS 3.20 - PSA 500 Audit EvidenceSkye LeeNo ratings yet

- Audit Evidence Standards ISA 500-599Document9 pagesAudit Evidence Standards ISA 500-599Imtiaz ChowdhuryNo ratings yet

- AUD 1.4 Audit Objectives, Procedures, Evidence and Documentation - 2022Document11 pagesAUD 1.4 Audit Objectives, Procedures, Evidence and Documentation - 2022Aimee CuteNo ratings yet

- Audit Evidence and Documentation HandoutsDocument16 pagesAudit Evidence and Documentation Handoutsumar shahzadNo ratings yet

- Auditing CHAPTER THREEDocument9 pagesAuditing CHAPTER THREEGetachew JoriyeNo ratings yet

- Audit Evidence and Audit ProceduresDocument17 pagesAudit Evidence and Audit ProceduresVindhaya vasiniNo ratings yet

- Obtained by The Auditor in Arriving at The Conclusions On Which The Audit Opinion Is BaseDocument2 pagesObtained by The Auditor in Arriving at The Conclusions On Which The Audit Opinion Is BaseTech for lifeNo ratings yet

- Aas 5 Audit EvidenceDocument4 pagesAas 5 Audit EvidenceRishabh GuptaNo ratings yet

- Chapter_5_Audit_Evidence_and_DocumentatiDocument54 pagesChapter_5_Audit_Evidence_and_Documentatipadma adrianaNo ratings yet

- 12 Audit EvidenceDocument11 pages12 Audit EvidenceMoffat MakambaNo ratings yet

- Auditing 10Document10 pagesAuditing 10Rose Mae RubioNo ratings yet

- B3 - Audit EvidenceDocument8 pagesB3 - Audit EvidenceFrank AlexanderNo ratings yet

- Solution Manual Audit Arens Edisi 12 Chapter7 DikonversiDocument23 pagesSolution Manual Audit Arens Edisi 12 Chapter7 DikonversiAndrian ArifansaNo ratings yet

- Auditing and Assurance Services 15th Edition Arens Solutions Manual 1Document24 pagesAuditing and Assurance Services 15th Edition Arens Solutions Manual 1irene100% (31)

- Auditing and Assurance Services 15th Edition Arens Solutions Manual 1Document36 pagesAuditing and Assurance Services 15th Edition Arens Solutions Manual 1alexandriabrowningmzpcqjtkid100% (25)

- Ireneo Chapter 10 Ver 2020Document82 pagesIreneo Chapter 10 Ver 2020shanNo ratings yet

- Audit Evidence: Concept Checks P. 167Document32 pagesAudit Evidence: Concept Checks P. 167hsingting yuNo ratings yet

- Chapter Five: Audit Evidence and Edp AuditDocument52 pagesChapter Five: Audit Evidence and Edp AuditFackallofyouNo ratings yet

- Audit CH 5pptDocument19 pagesAudit CH 5pptsolomon adamuNo ratings yet

- Unit 5: Audit EvidenceDocument10 pagesUnit 5: Audit EvidenceNigussie BerhanuNo ratings yet

- AUDIT EVIDENCE FOR TANZANIA INSTITUTE OF ACCOUNTANCYDocument12 pagesAUDIT EVIDENCE FOR TANZANIA INSTITUTE OF ACCOUNTANCYCostancia rwehaburaNo ratings yet

- Audit Evidence, Procedures and DocumentationDocument35 pagesAudit Evidence, Procedures and DocumentationLANGITBIRUNo ratings yet

- Notes PSA 500Document5 pagesNotes PSA 500Aang GrandeNo ratings yet

- AT 08 PSA Audit EvidenceDocument7 pagesAT 08 PSA Audit EvidencePrincess Mary Joy LadagaNo ratings yet

- Accounts Payable Testing and ProceduresDocument29 pagesAccounts Payable Testing and ProceduresDiane RoallosNo ratings yet

- Accounts Payable Testing TechniquesDocument29 pagesAccounts Payable Testing TechniquesDiane RoallosNo ratings yet

- Sa 501,505,510Document17 pagesSa 501,505,510Krrish KelwaniNo ratings yet

- Chapter 3.auditing Concepts and ToolsDocument18 pagesChapter 3.auditing Concepts and ToolsHussen AbdulkadirNo ratings yet

- Aud EvidenceDocument14 pagesAud EvidenceJadeNo ratings yet

- Chapter 4.2022.englishDocument44 pagesChapter 4.2022.english26 Đỗ Kim NgọcNo ratings yet

- Implementing Risk Response Audit EvidenceDocument8 pagesImplementing Risk Response Audit EvidenceJoyce Anne GarduqueNo ratings yet

- Pertemuan 11 Evidence HDocument17 pagesPertemuan 11 Evidence HAmin NasutionNo ratings yet

- Topic # 2: Introdu Ction To Auditin GDocument31 pagesTopic # 2: Introdu Ction To Auditin GRizza OmalinNo ratings yet

- Auditing and Assurance Services 15Th Edition Arens Solutions Manual Full Chapter PDFDocument44 pagesAuditing and Assurance Services 15Th Edition Arens Solutions Manual Full Chapter PDFstephenthanh1huo100% (11)

- Auditing and Assurance Services 15th Edition Arens Solutions ManualDocument23 pagesAuditing and Assurance Services 15th Edition Arens Solutions Manualfidelmaalexandranbj100% (32)

- Procedure How Used (Examples) Assertion(s) Tested: Some Examples of How Students Should Answer Qualitative QuestionsDocument6 pagesProcedure How Used (Examples) Assertion(s) Tested: Some Examples of How Students Should Answer Qualitative QuestionsKhairiNo ratings yet

- Audit Evidence Review for Ntokozo CoDocument3 pagesAudit Evidence Review for Ntokozo CoDitebogoNo ratings yet

- Audit Evidence Chapter Key ConceptsDocument39 pagesAudit Evidence Chapter Key ConceptsCẩm Tú NguyễnNo ratings yet

- AA-Audit EvidenceDocument15 pagesAA-Audit EvidenceRafsan JazzNo ratings yet

- Marriage Laws Legal & Canonical Requirements of MarriageDocument5 pagesMarriage Laws Legal & Canonical Requirements of MarriageAllaina Uy BerbanoNo ratings yet

- The Domestic Church: Home FamDocument7 pagesThe Domestic Church: Home FamAllaina Uy BerbanoNo ratings yet

- Lesson 7 - Audit Evidence PDFDocument7 pagesLesson 7 - Audit Evidence PDFAllaina Uy BerbanoNo ratings yet

- Different Callings in Life: Hristian Vision of Marriage & FamilyDocument3 pagesDifferent Callings in Life: Hristian Vision of Marriage & FamilyAllaina Uy BerbanoNo ratings yet

- Lesson 7 - Audit Evidence PDFDocument7 pagesLesson 7 - Audit Evidence PDFAllaina Uy BerbanoNo ratings yet

- Possible Mgmt Manipulation Internal ControlsDocument5 pagesPossible Mgmt Manipulation Internal ControlsAllaina Uy BerbanoNo ratings yet

- Lesson 6 - Internal ControlsDocument5 pagesLesson 6 - Internal ControlsAllaina Uy BerbanoNo ratings yet

- Corporate Social Responsibility: Milton FriedmanDocument3 pagesCorporate Social Responsibility: Milton FriedmanAllaina Uy BerbanoNo ratings yet

- Lesson 5 - Audit PlanningDocument4 pagesLesson 5 - Audit PlanningAllaina Uy BerbanoNo ratings yet

- Intro To Business Ethics: A. B. C. D. E. FDocument2 pagesIntro To Business Ethics: A. B. C. D. E. FAllaina Uy BerbanoNo ratings yet

- Product Safety & Pricing: Other Parties Adversely AffectedDocument4 pagesProduct Safety & Pricing: Other Parties Adversely AffectedAllaina Uy BerbanoNo ratings yet

- Audit Planning Factors and Key ConsiderationsDocument4 pagesAudit Planning Factors and Key ConsiderationsAllaina Uy BerbanoNo ratings yet

- Lesson 7 - Audit Evidence PDFDocument7 pagesLesson 7 - Audit Evidence PDFAllaina Uy BerbanoNo ratings yet

- Possible Mgmt Manipulation Internal ControlsDocument5 pagesPossible Mgmt Manipulation Internal ControlsAllaina Uy BerbanoNo ratings yet

- Possible Mgmt Manipulation Internal ControlsDocument5 pagesPossible Mgmt Manipulation Internal ControlsAllaina Uy BerbanoNo ratings yet

- Audit Planning Factors and Key ConsiderationsDocument4 pagesAudit Planning Factors and Key ConsiderationsAllaina Uy BerbanoNo ratings yet

- Audit Planning Factors and Key ConsiderationsDocument4 pagesAudit Planning Factors and Key ConsiderationsAllaina Uy BerbanoNo ratings yet

- I Button Proper TDocument4 pagesI Button Proper TmariammariaNo ratings yet

- J Ipm 2019 102121Document17 pagesJ Ipm 2019 102121bilalNo ratings yet

- L Williams ResumeDocument2 pagesL Williams Resumeapi-555629186No ratings yet

- 19 Unpriced BOM, Project & Manpower Plan, CompliancesDocument324 pages19 Unpriced BOM, Project & Manpower Plan, CompliancesAbhay MishraNo ratings yet

- ElectricalDocument30 pagesElectricalketerNo ratings yet

- Week 4 Gen EconDocument10 pagesWeek 4 Gen EconGenner RazNo ratings yet

- PiXL Knowledge Test ANSWERS - AQA B1 CORE Science - Legacy (2016 and 2017)Document12 pagesPiXL Knowledge Test ANSWERS - AQA B1 CORE Science - Legacy (2016 and 2017)Mrs S BakerNo ratings yet

- Scientology Abridged Dictionary 1973Document21 pagesScientology Abridged Dictionary 1973Cristiano Manzzini100% (2)

- History and Development of the Foodservice IndustryDocument23 pagesHistory and Development of the Foodservice IndustryMaria Athenna MallariNo ratings yet

- Virtio-Fs - A Shared File System For Virtual MachinesDocument21 pagesVirtio-Fs - A Shared File System For Virtual MachinesLeseldelaterreNo ratings yet

- Chirag STDocument18 pagesChirag STchiragNo ratings yet

- LogDocument119 pagesLogcild MonintjaNo ratings yet

- Body Shaming Among School Going AdolesceDocument5 pagesBody Shaming Among School Going AdolesceClara Widya Mulya MNo ratings yet

- SMEs, Trade Finance and New TechnologyDocument34 pagesSMEs, Trade Finance and New TechnologyADBI EventsNo ratings yet

- A ULTIMA ReleaseNotesAxiomV PDFDocument38 pagesA ULTIMA ReleaseNotesAxiomV PDFIVANALTAMARNo ratings yet

- Week 1 Gec 106Document16 pagesWeek 1 Gec 106Junjie FuentesNo ratings yet

- Organizational Behaviour Group Assignment-2Document4 pagesOrganizational Behaviour Group Assignment-2Prateek KurupNo ratings yet

- MATHEMATICAL ECONOMICSDocument54 pagesMATHEMATICAL ECONOMICSCities Normah0% (1)

- Steel Glossary RBC Capital GoodDocument10 pagesSteel Glossary RBC Capital Goodrajesh pal100% (1)

- InteliLite AMF20-25Document2 pagesInteliLite AMF20-25albertooliveira100% (2)

- A Summer Internship Project ON " To Study The Supply Chain Management On Amul Fresh Products" AT GCMMF, AmulDocument19 pagesA Summer Internship Project ON " To Study The Supply Chain Management On Amul Fresh Products" AT GCMMF, AmulweetrydhNo ratings yet

- Friction, Gravity and Energy TransformationsDocument12 pagesFriction, Gravity and Energy TransformationsDaiserie LlanezaNo ratings yet

- Environmental Threats Differentiated Reading Comprehension Ver 1Document20 pagesEnvironmental Threats Differentiated Reading Comprehension Ver 1Camila DiasNo ratings yet

- Ktu Students: Principles of ManagementDocument22 pagesKtu Students: Principles of ManagementNidaNo ratings yet

- Ek Pardesi Mera Dil Le Gaya Lyrics English Translation - Lyrics GemDocument1 pageEk Pardesi Mera Dil Le Gaya Lyrics English Translation - Lyrics Gemmahsa.molaiepanahNo ratings yet

- Catalogo Head FixDocument8 pagesCatalogo Head FixANDREA RAMOSNo ratings yet

- Administracion Una Perspectiva Global Y Empresarial Resumen Por CapitulosDocument7 pagesAdministracion Una Perspectiva Global Y Empresarial Resumen Por Capitulosafmqqaepfaqbah100% (1)

- 1 PBDocument11 pages1 PBAnggita Wulan RezkyanaNo ratings yet