Professional Documents

Culture Documents

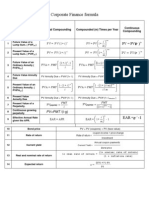

Introduction to Corporate Finance MOOC Module 1 Notes

Uploaded by

Jose Navarro0 ratings0% found this document useful (0 votes)

90 views1 pageOriginal Title

Microsoft Word - Module 1 Cheat Sheet Updated

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

90 views1 pageIntroduction to Corporate Finance MOOC Module 1 Notes

Uploaded by

Jose NavarroCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Introduction

to Corporate Finance MOOC: Module 1 Notes

Valuation Basics Net Present Value

Rate of Return Net Present Value

The gain experienced over a period of time The present value of all the cash flows

expressed in terms of the initial investment. including all the costs.

Future Value (FV) Net Present Value Formula

The value of a given amount of money today at .,

some point in the future. -$" = ./ + ⋯

(1 + *)1

Present Value (PV) PV = Present Value

The amount of money today. ./ = Initial Investment

Ct = Cash Flow at Time t

Future Value (FV) Formula r = rate

!" = $" × (1 + *) T = time

FV = Future Value Perpetuity

PV = Present Value A cash flow stream in which all the cash flows

r = rate

are the same and go on forever.

Compounding Perpetuity Formula

Earning a return on past returns .

General Future Value Formula $" =

*

!" = $" × (1 + *), PV = Present Value

FV = Future Value C = Cash Flow

PV = Present Value r = rate

r = rate Annuity

t = time

A cash flow stream in which all cash flows are

Discounting the same and last for a fixed number of

The process of computing the present value of a periods

future cash flow.

Annuity Formula

Present Value (PV) Formula . 1

!" $" = 21 − 4

$" = * (1 + *)1

(1 + *), PV = Present Value

FV = Future Value C = Cash Flow

PV = Present Value r = rate

r = rate T = time

t = time

Growing Perpetuity

Valuation Cash flows growing at a constant rate and last

Appraising or estimating the worth of something forever.

having economic or monetary value.

Growing Perpetuity Formula

.

$" =

*−5

PV = Present Value

C = Cash Flow

r = rate

g = growth rate of cash flows

You might also like

- Thank You Letter Template for Cash DonationDocument3 pagesThank You Letter Template for Cash Donationbogtik100% (2)

- Corporate Finance FormulasDocument3 pagesCorporate Finance FormulasMustafa Yavuzcan83% (12)

- Formula Sheet Corporate Finance (COF) : Stockholm Business SchoolDocument6 pagesFormula Sheet Corporate Finance (COF) : Stockholm Business SchoolLinus AhlgrenNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- 2020-2021 Mentor Documentation LogDocument4 pages2020-2021 Mentor Documentation Logapi-557107182No ratings yet

- Complete Strategic Financial Management FormulaeDocument39 pagesComplete Strategic Financial Management FormulaePrashanth Yadhav100% (2)

- Time value of money cheat sheetDocument3 pagesTime value of money cheat sheetTechbotix AppsNo ratings yet

- Basic Electrical Plan: ContentsDocument21 pagesBasic Electrical Plan: ContentsJose NavarroNo ratings yet

- DC Circuits GuideDocument37 pagesDC Circuits GuideJose NavarroNo ratings yet

- Design and Detailing of Flat Slab.Document22 pagesDesign and Detailing of Flat Slab.DarsHan MoHanNo ratings yet

- Risk and Rates of ReturnDocument16 pagesRisk and Rates of ReturnSally Goodwill100% (1)

- Income Tax Semifinals ExamDocument5 pagesIncome Tax Semifinals ExamFeelingerang MAYoraNo ratings yet

- Interior Design Student Handbook PDFDocument56 pagesInterior Design Student Handbook PDFJose NavarroNo ratings yet

- fkchegg.comDocument4 pagesfkchegg.commisssunshine112No ratings yet

- History Taking PDFDocument1 pageHistory Taking PDFSanNo ratings yet

- 94 Shortcuts for Managing Windows 10Document2 pages94 Shortcuts for Managing Windows 10Clerenda McgradyNo ratings yet

- 2015 Fastforward Familypractice PressDocument6 pages2015 Fastforward Familypractice PressTania Díez-EderNo ratings yet

- Corporate Finance MOOC Module 1 Valuation BasicsDocument1 pageCorporate Finance MOOC Module 1 Valuation BasicsShivani AgarwalNo ratings yet

- Corporate Finance Certificate NPV FundamentalsDocument1 pageCorporate Finance Certificate NPV FundamentalsNIKHIL SODHINo ratings yet

- Corporate Finance Professional Certificate MOOCDocument1 pageCorporate Finance Professional Certificate MOOCEmmanuel PonceNo ratings yet

- C1M1 QRG PDFDocument1 pageC1M1 QRG PDFRamen ACCANo ratings yet

- Basic Finance FormulasDocument1 pageBasic Finance Formulasmafe moraNo ratings yet

- Corporate Finance Certificate NPV FundamentalsDocument1 pageCorporate Finance Certificate NPV FundamentalsRamen ACCANo ratings yet

- Corporate Finance Professional Certificate MOOCDocument1 pageCorporate Finance Professional Certificate MOOCkolya viktorNo ratings yet

- Module 1 - Basic Finance ConceptsDocument1 pageModule 1 - Basic Finance ConceptsJeniffer FrançaNo ratings yet

- Corporate Finance Professional Certificate MOOC Course 2, The Free Cash Flow Method For Firm Valuation Module 4, Relative ValuationDocument1 pageCorporate Finance Professional Certificate MOOC Course 2, The Free Cash Flow Method For Firm Valuation Module 4, Relative ValuationtotiNo ratings yet

- CA5102 Q1 FORMULA SHEETDocument12 pagesCA5102 Q1 FORMULA SHEETDyra Mae OmegaNo ratings yet

- Async CFin-I Annuities and Perpetuities Friday 5august2022Document35 pagesAsync CFin-I Annuities and Perpetuities Friday 5august2022SSNo ratings yet

- Time Value of MoneyDocument3 pagesTime Value of MoneyVishnupriya PremkumarNo ratings yet

- Quants MMDocument65 pagesQuants MMTu DuongNo ratings yet

- Time Value OF MoneyDocument16 pagesTime Value OF MoneyKomal AgarwalNo ratings yet

- Quantitative Analysis: © EdupristineDocument17 pagesQuantitative Analysis: © EdupristineANASNo ratings yet

- Nataliemoore Time Value of MoneyDocument4 pagesNataliemoore Time Value of MoneyMaurice AgbayaniNo ratings yet

- Formula Sheet For AFB by - Ambitious - BabaDocument11 pagesFormula Sheet For AFB by - Ambitious - BabaKiran PatelNo ratings yet

- Unit 5 Time Value of Money BBS Notes eduNEPAL - Info - PDFDocument3 pagesUnit 5 Time Value of Money BBS Notes eduNEPAL - Info - PDFTorreus AdhikariNo ratings yet

- Financial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementDocument7 pagesFinancial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementAakash TiwariNo ratings yet

- Ch. 5 The Time Value of Money: 5.1. Future Values and Compound InterestDocument2 pagesCh. 5 The Time Value of Money: 5.1. Future Values and Compound InterestShahid NaseemNo ratings yet

- TREASURY MODULE 3 KEY FINANCIAL FORMULASDocument9 pagesTREASURY MODULE 3 KEY FINANCIAL FORMULASmartinNo ratings yet

- Formula Sheet-2nd QuizDocument6 pagesFormula Sheet-2nd QuizEge MelihNo ratings yet

- FM Formula Sheet - Not GivenDocument4 pagesFM Formula Sheet - Not GivenSophie ChopraNo ratings yet

- Finmar FormulaDocument2 pagesFinmar FormulaCPAs AccountNo ratings yet

- FormulasDocument2 pagesFormulasJi ZaragozaNo ratings yet

- Finanical Management Ch4Document60 pagesFinanical Management Ch4Chucky ChungNo ratings yet

- ENECON ReviewerDocument5 pagesENECON ReviewerJomeljames Campaner PanganibanNo ratings yet

- Chapter 5Document3 pagesChapter 5Jayesh DesaiNo ratings yet

- Module 2 Time Value of MoneyDocument7 pagesModule 2 Time Value of MoneyZaid Ismail ShahNo ratings yet

- C2 Revision of Concepts v1Document11 pagesC2 Revision of Concepts v1Umer FarooqNo ratings yet

- Finance 430 Executive SummaryDocument31 pagesFinance 430 Executive SummaryEin LuckyNo ratings yet

- Time Value of Money Concepts ExplainedDocument9 pagesTime Value of Money Concepts ExplainedBenita BijuNo ratings yet

- Tools For Project Evaluation l3prj - Eval - Fina2Document41 pagesTools For Project Evaluation l3prj - Eval - Fina2api-27145250No ratings yet

- Week 4 PostDocument22 pagesWeek 4 Post蔡俊榮No ratings yet

- Financial Market AnalysisDocument21 pagesFinancial Market Analysishareesh008No ratings yet

- Time Value of Money (Module 2)Document17 pagesTime Value of Money (Module 2)Yuvaraj RaoNo ratings yet

- MB - Group Assignent 1Document32 pagesMB - Group Assignent 1Doan BùiNo ratings yet

- FMSM Formula SheetDocument10 pagesFMSM Formula SheetRani LohiaNo ratings yet

- TVM GSNDocument35 pagesTVM GSNM.MONIKANo ratings yet

- Depreciation: Definition of TermsDocument6 pagesDepreciation: Definition of TermsGlyzel DizonNo ratings yet

- Time Value of MoneyDocument2 pagesTime Value of Moneyphia triesNo ratings yet

- Capital Budgeting V2 - Click Read Only To View DocumentDocument40 pagesCapital Budgeting V2 - Click Read Only To View DocumentSamantha Meril PandithaNo ratings yet

- ch1 Notes CfaDocument18 pagesch1 Notes Cfaashutosh JhaNo ratings yet

- Wharton On Coursera: Introduction To Corporate Finance: DiscountingDocument7 pagesWharton On Coursera: Introduction To Corporate Finance: Discountingjhon doeNo ratings yet

- Green Abstract Things Your Need To Analyze InfographicDocument2 pagesGreen Abstract Things Your Need To Analyze InfographicAmira AffendyNo ratings yet

- CFAi Level 1 2010 Book 1 Formulas (Reading 5 Page 181)Document1 pageCFAi Level 1 2010 Book 1 Formulas (Reading 5 Page 181)Jonny DeanNo ratings yet

- MM L1 Formula SheetDocument20 pagesMM L1 Formula SheetMlungisi MalazaNo ratings yet

- CH 2Document6 pagesCH 2Hemant GoyalNo ratings yet

- Microsoft Word - Module 2 Cheat Sheet v3Document1 pageMicrosoft Word - Module 2 Cheat Sheet v3Jose NavarroNo ratings yet

- Capacitance and InductanceDocument23 pagesCapacitance and InductanceJose NavarroNo ratings yet

- Power and Energy: Power - Rate of Doing Work - Rate at Which Energy Is UsedDocument17 pagesPower and Energy: Power - Rate of Doing Work - Rate at Which Energy Is UsedJose NavarroNo ratings yet

- 8 and 9. Simple Elctric Circuit & Ohms LawDocument13 pages8 and 9. Simple Elctric Circuit & Ohms LawJose NavarroNo ratings yet

- Capacitance and InductanceDocument23 pagesCapacitance and InductanceJose NavarroNo ratings yet

- 8 and 9. Simple Elctric Circuit & Ohms LawDocument13 pages8 and 9. Simple Elctric Circuit & Ohms LawJose NavarroNo ratings yet

- Series DC Circuit: From The Circuit Shown AboveDocument37 pagesSeries DC Circuit: From The Circuit Shown AboveJose NavarroNo ratings yet

- Generation Transmission and DistributionDocument18 pagesGeneration Transmission and DistributionJose NavarroNo ratings yet

- 2019 Innovation in Structural Design Competition Southeast Asia, Australia, and New Zealand RegionDocument5 pages2019 Innovation in Structural Design Competition Southeast Asia, Australia, and New Zealand RegionJose NavarroNo ratings yet

- Y - or - Y Conversions StudentDocument16 pagesY - or - Y Conversions StudentJose NavarroNo ratings yet

- Water Line LayoutDocument6 pagesWater Line LayoutJose NavarroNo ratings yet

- COL A Primer Into TADocument45 pagesCOL A Primer Into TAJunar AmaroNo ratings yet

- Basic Electrical Wiring: TermsDocument14 pagesBasic Electrical Wiring: TermsJose NavarroNo ratings yet

- TERMINOLOGY (Compatibility Mode)Document37 pagesTERMINOLOGY (Compatibility Mode)Jose NavarroNo ratings yet

- Three-Phase Ac SystemDocument20 pagesThree-Phase Ac SystemJose NavarroNo ratings yet

- Analysis and Design of Flat Slabs Using Various Codes: M.Anitha B.Q.Rahman JJ .VijayDocument53 pagesAnalysis and Design of Flat Slabs Using Various Codes: M.Anitha B.Q.Rahman JJ .VijayKrishen ChaitanyaNo ratings yet

- Sample Research PaperDocument10 pagesSample Research PaperJose NavarroNo ratings yet

- 5 Story Office Building Construction Project Levels and ProcessesDocument4 pages5 Story Office Building Construction Project Levels and ProcessesJose NavarroNo ratings yet

- C.4 Guaranteed Maximum Price (June 2014)Document10 pagesC.4 Guaranteed Maximum Price (June 2014)Jose NavarroNo ratings yet

- Ce May 2018 PDFDocument14 pagesCe May 2018 PDFJose NavarroNo ratings yet

- 8 and 9. Simple Elctric Circuit & Ohms LawDocument13 pages8 and 9. Simple Elctric Circuit & Ohms LawJose Navarro100% (1)

- Power and EnergyDocument17 pagesPower and EnergyJose NavarroNo ratings yet

- Capacitance and InductanceDocument23 pagesCapacitance and InductanceJose NavarroNo ratings yet

- Vs-Windsor Towers WBSDocument1 pageVs-Windsor Towers WBSJose NavarroNo ratings yet

- Voltage, Current and ResistanceDocument32 pagesVoltage, Current and ResistanceJose NavarroNo ratings yet

- Darby Sporting Goods Inc Has Been Experiencing Growth in The PDFDocument2 pagesDarby Sporting Goods Inc Has Been Experiencing Growth in The PDFAnbu jaromiaNo ratings yet

- Investasi Sementara Pada ObligasiDocument34 pagesInvestasi Sementara Pada ObligasiAli-ImronNo ratings yet

- Zambia: Livingstone City ProfileDocument36 pagesZambia: Livingstone City ProfileUnited Nations Human Settlements Programme (UN-HABITAT)No ratings yet

- A Study On Some Financial Ratios of Bangladeshi Companies by TURINDocument41 pagesA Study On Some Financial Ratios of Bangladeshi Companies by TURINTurin Iqbal100% (1)

- Errata 2020Document3 pagesErrata 2020SamNo ratings yet

- LACTU2170Document389 pagesLACTU2170GemnNo ratings yet

- 4PS Module Answer Sheets ChecklistDocument2 pages4PS Module Answer Sheets Checklistusep manatadNo ratings yet

- Unit 1Document134 pagesUnit 1Laxmi Rajput100% (3)

- Gift of Fire Chapter SummaryDocument5 pagesGift of Fire Chapter SummaryguerotitoNo ratings yet

- Annexure XxxiDocument3 pagesAnnexure XxxiKanaka Raja CNo ratings yet

- Investment Analysis and Portfolio ManagementDocument5 pagesInvestment Analysis and Portfolio ManagementMuhammad QasimNo ratings yet

- Investment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFDocument43 pagesInvestment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFWilliamCartersafg100% (11)

- Sharpe RatiosDocument56 pagesSharpe RatiosbobmezzNo ratings yet

- ICB's Role in Capital MarketsDocument22 pagesICB's Role in Capital MarketsHabibur RahmanNo ratings yet

- Bipard Prashichhan (Gaya) - 87-2023Document8 pagesBipard Prashichhan (Gaya) - 87-2023tinkulal91No ratings yet

- Calculation of Gratuity A) For Employees Covered Under The ActDocument2 pagesCalculation of Gratuity A) For Employees Covered Under The ActdheerajdorlikarNo ratings yet

- Narrations of Account BooksDocument9 pagesNarrations of Account Bookssham sunderNo ratings yet

- Sri Sai Srinivasa Cotton Industries PVT LTDDocument36 pagesSri Sai Srinivasa Cotton Industries PVT LTDManisha NerellaNo ratings yet

- 2207o2314s123d84439e1Document27 pages2207o2314s123d84439e1Ascentech ProductionNo ratings yet

- Comparative Study Between Two BanksDocument26 pagesComparative Study Between Two BanksAnupam SinghNo ratings yet

- Corpo Cases Basic Securities LawDocument40 pagesCorpo Cases Basic Securities LawRonald Z. RayaNo ratings yet

- Bintang Persada Hotel Breakfast CouponDocument4 pagesBintang Persada Hotel Breakfast CouponPutu BudaNo ratings yet

- Conference: 2021 International VirtualDocument5 pagesConference: 2021 International Virtualusama zedanNo ratings yet

- The Importance of Cost ControlDocument36 pagesThe Importance of Cost ControlfajarNo ratings yet

- Task 7: Sreejith E M Jr. Research Analyst Intern 22FMCG30B15Document23 pagesTask 7: Sreejith E M Jr. Research Analyst Intern 22FMCG30B15Sreejitha EmNo ratings yet

- Construction of Bridge Over Andermanik River With Related Works at Payra Port Under Payra Port's First Terminal ProjectDocument2 pagesConstruction of Bridge Over Andermanik River With Related Works at Payra Port Under Payra Port's First Terminal ProjectParvez Syed RafiNo ratings yet