Professional Documents

Culture Documents

Operation Ending As at 31 December 2019

Uploaded by

Shazni Ahamed0 ratings0% found this document useful (0 votes)

22 views2 pagesOriginal Title

accounting1-3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views2 pagesOperation Ending As at 31 December 2019

Uploaded by

Shazni AhamedCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

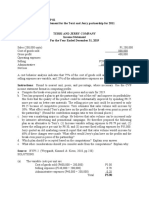

2) Details pertaining to the business named “Yapa family & co”, for the year of

operation ending as at 31st December 2019

(Rs:)

Sales 1,800,000

Cost of sales:

Opening stocks 50,000

Purchases 400,000

Carriage inwards 30,000

480,000

Returns (Less) (10,000)

Values presented for sales 470,000

Closing stocks(Less) 160,000

Cost of sales(Less) 310,000 (310,000)

1) Gross profit 1,490,000

Other incomes 600,000

Expenses (Less) 870,000

1,220,000

2) Operating Profit 1,220,000

Interest expenses(Less) 90,000

Profit before taxation 1,130,000

Taxation(Less) 70,000

3) Profit After Taxation(PAT/Net Profit) 1,060, 000

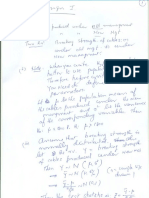

1) Gross Profit Ratio = Gross profit

Sales

= 1,490,000 ×100%

1,800,000

= 82.78%

Here we see that GPR is likely high, we know that GPR the measure of

company efficiency, so the company is in good a position

2) Operating Profit Ratio = Operating Profit

Sales

= 1,490,000 ×100%

1,800,000

= 67.78%

Here you see, the OPR is greater than 50% so its likely we got the profit

greater than half of our investment. So its good for the organisation.

3) Net Profit Ratio = PAT

Sales

= 1,060,000 ×100%

1,800,000

= 58.89%

You might also like

- W14 - As8 Maranan, A2aDocument3 pagesW14 - As8 Maranan, A2aJere Mae MarananNo ratings yet

- Case 3 FS AnalysisDocument1 pageCase 3 FS AnalysisCABAHM San Sebastian CaviteNo ratings yet

- Sem Output Probs and AnswersDocument16 pagesSem Output Probs and AnswersMargie KeiNo ratings yet

- SBA03 FSAnalysisPart32of3Document5 pagesSBA03 FSAnalysisPart32of3Jr PedidaNo ratings yet

- Assignment 1 - Taxation On Individuals-SolutionsDocument5 pagesAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- M3 Activity 1Document6 pagesM3 Activity 1Ruffa May GonzalesNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Managerial Accounting - Final Project - Yahya Patanwala.12028Document4 pagesManagerial Accounting - Final Project - Yahya Patanwala.12028Yahya SaifuddinNo ratings yet

- 2 Ratio Analysis Problems and SolutionsDocument30 pages2 Ratio Analysis Problems and SolutionsAayush Agrawal100% (3)

- End-Term Paper Financial Management - 2 Set - A: SolutionDocument7 pagesEnd-Term Paper Financial Management - 2 Set - A: SolutionLakshmi NairNo ratings yet

- Afar by Dr. FerrerDocument4 pagesAfar by Dr. FerrerFrans HechanovaNo ratings yet

- Afar by Dr. Ferrer First Preboard Review 85Document4 pagesAfar by Dr. Ferrer First Preboard Review 85Julie Neay AfableNo ratings yet

- AfarDocument4 pagesAfaroxennnnNo ratings yet

- HW - AFM - E7-25, E7-28, P7-42 - Kelompok 8Document7 pagesHW - AFM - E7-25, E7-28, P7-42 - Kelompok 8swear to the skyNo ratings yet

- Afar by Dr. FerrerDocument4 pagesAfar by Dr. FerrerJade GomezNo ratings yet

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- 3.3 Exercise - Improperly Accumulated Earnings TaxDocument2 pages3.3 Exercise - Improperly Accumulated Earnings TaxRenzo KarununganNo ratings yet

- MODULE 3 CVP ANALYSIS - GROUP 2 AE6 Strategic Business AnalysisDocument5 pagesMODULE 3 CVP ANALYSIS - GROUP 2 AE6 Strategic Business AnalysisJaime PalizardoNo ratings yet

- Cost Volume Profit Analysis (With Leverage)Document5 pagesCost Volume Profit Analysis (With Leverage)jhariz1201.vhNo ratings yet

- Chapter 13 - Gross Profit MethodDocument2 pagesChapter 13 - Gross Profit MethodBena CubillasNo ratings yet

- Group Quiz InstructionsDocument9 pagesGroup Quiz InstructionsRaidenhile mae VicenteNo ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- The Profit of A Business During An Accounting Period Is Equal ToDocument4 pagesThe Profit of A Business During An Accounting Period Is Equal Toabdirahman YonisNo ratings yet

- Solutions To Formative Assignments On Chapter 6Document4 pagesSolutions To Formative Assignments On Chapter 6FaidraLourdiNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- Question 1-1-1Document14 pagesQuestion 1-1-1Aqsa AnumNo ratings yet

- Business Math Qtr1 Week 6Document2 pagesBusiness Math Qtr1 Week 6Joan BalmesNo ratings yet

- Ea 14Document4 pagesEa 14Nicole BatoyNo ratings yet

- Course Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Document4 pagesCourse Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Wild GhostNo ratings yet

- Income Statement-Mcq ProblemsDocument3 pagesIncome Statement-Mcq Problemschey dabestNo ratings yet

- A. Trend Percentages: RequiredDocument5 pagesA. Trend Percentages: RequiredAngel NuevoNo ratings yet

- Lesson 3 Profit or LossDocument28 pagesLesson 3 Profit or Lossgatdula.hannahlulu.burgosNo ratings yet

- Manual Solution 6-14Document5 pagesManual Solution 6-14Sohmono HendraiosNo ratings yet

- Profit and LossDocument17 pagesProfit and Lossalexis albarilloNo ratings yet

- Acc AssignmentDocument8 pagesAcc AssignmentKashémNo ratings yet

- Unit - 3 - Exercise - Taton, Querubine MaeDocument3 pagesUnit - 3 - Exercise - Taton, Querubine MaeMichelle Taton HoranNo ratings yet

- Fernandez - SIM Activity - HyperinflationDocument5 pagesFernandez - SIM Activity - HyperinflationJeric TorionNo ratings yet

- AccSoc ACCT102-23S1 Pre-Test 2 TutorialDocument38 pagesAccSoc ACCT102-23S1 Pre-Test 2 TutorialowmferrierNo ratings yet

- Transfer Pricing Tax ManagementDocument5 pagesTransfer Pricing Tax ManagementJuanNo ratings yet

- Cases 3 - Berlin Novanolo G (29123112)Document4 pagesCases 3 - Berlin Novanolo G (29123112)catatankotakkuningNo ratings yet

- Financial Statement ExercisesDocument2 pagesFinancial Statement ExercisesMai Nguyễn ThanhNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument3 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- Income Statement - MerchandisingDocument1 pageIncome Statement - MerchandisingSharrah San MiguelNo ratings yet

- Midway Greasy 2002 2003 2002 2003Document6 pagesMidway Greasy 2002 2003 2002 2003Pang SiulienNo ratings yet

- AFAR ST - Consignment and Franchise Op ExercisesDocument4 pagesAFAR ST - Consignment and Franchise Op ExercisesCayden BrookeNo ratings yet

- 202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Document11 pages202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Sayhan Hosen Arif100% (1)

- Quizzes - Chapter 2 - Statement of Comprehensive IncomeDocument6 pagesQuizzes - Chapter 2 - Statement of Comprehensive IncomeAmie Jane Miranda100% (1)

- Capital BudgetingDocument22 pagesCapital BudgetingSirshajit SanfuiNo ratings yet

- FY11 Employee Bonus PlanDocument2 pagesFY11 Employee Bonus PlanDaniel LaneNo ratings yet

- Ratio Analysis: Profitability RatiosDocument10 pagesRatio Analysis: Profitability RatiosREHANRAJNo ratings yet

- Requirement 1 Total Per Unit: Banitog, Brigitte C. BSA 211 Exercise 1 (Contribution Format Income Statement)Document4 pagesRequirement 1 Total Per Unit: Banitog, Brigitte C. BSA 211 Exercise 1 (Contribution Format Income Statement)MyunimintNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- Excel File of Financial Projection and FundingDocument21 pagesExcel File of Financial Projection and FundingDave John LavariasNo ratings yet

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Installment SalesDocument6 pagesInstallment SalesJeramae M. artNo ratings yet

- FM Chapter 8 PDFDocument6 pagesFM Chapter 8 PDFSuzanne AcostaNo ratings yet

- FBF Final Project Report (Financial Plan)Document6 pagesFBF Final Project Report (Financial Plan)Afaq BhuttaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Tutorial - 2 Tubular Reactors: 3 3 in Out 6 - 2 - 1Document2 pagesTutorial - 2 Tubular Reactors: 3 3 in Out 6 - 2 - 1Shazni AhamedNo ratings yet

- Tutorial - Steam BasicsDocument2 pagesTutorial - Steam BasicsShazni AhamedNo ratings yet

- Tutorial - Steam Generation 18-5-2020Document2 pagesTutorial - Steam Generation 18-5-2020Shazni AhamedNo ratings yet

- References: Control For Chemical Batch Reactors Applied To A Polymerization ProcessDocument1 pageReferences: Control For Chemical Batch Reactors Applied To A Polymerization ProcessShazni AhamedNo ratings yet

- 2018 Applied Stat AnswersDocument5 pages2018 Applied Stat AnswersShazni AhamedNo ratings yet

- AppliedStat - 2017 - June - 20190515014903Document4 pagesAppliedStat - 2017 - June - 20190515014903Shazni AhamedNo ratings yet

- Tutorial 1Document3 pagesTutorial 1Shazni AhamedNo ratings yet

- EN1802 Tutorial 2 PDFDocument4 pagesEN1802 Tutorial 2 PDFHashan ErandaNo ratings yet

- Arabic DaysDocument3 pagesArabic DaysShazni AhamedNo ratings yet

- EN1802 - Basic Electronics: S6 - Integrated Circuits and AmplifiersDocument4 pagesEN1802 - Basic Electronics: S6 - Integrated Circuits and AmplifiersShazni AhamedNo ratings yet

- EN1802 - Basic Electronics: S3 - Diodes, Diode Circuits and ApplicationsDocument27 pagesEN1802 - Basic Electronics: S3 - Diodes, Diode Circuits and ApplicationsShazni AhamedNo ratings yet

- EN1802 - Basic Electronics: S4 - Bipolar Junction Transistors and CircuitsDocument14 pagesEN1802 - Basic Electronics: S4 - Bipolar Junction Transistors and CircuitsShazni AhamedNo ratings yet

- Answers For The Assignment 1Document6 pagesAnswers For The Assignment 1Shazni AhamedNo ratings yet

- EN1802 Tut3Document2 pagesEN1802 Tut3Shazni AhamedNo ratings yet

- EN1802 Tut2Document2 pagesEN1802 Tut2Shazni AhamedNo ratings yet

- University of Moratuwa University of MoratuwaDocument4 pagesUniversity of Moratuwa University of MoratuwaNithesh NitheshbNo ratings yet

- Basic Electronics: Tutorial 3Document2 pagesBasic Electronics: Tutorial 3Shazni AhamedNo ratings yet

- Math MidDocument9 pagesMath MidShazni AhamedNo ratings yet

- PDF 2020 02 09Document6 pagesPDF 2020 02 09Shazni AhamedNo ratings yet

- Useful Arabic Words and PhrasesDocument2 pagesUseful Arabic Words and PhrasesARRM87MURUGANNo ratings yet

- J.Shazni Ahamed: Course CertificateDocument1 pageJ.Shazni Ahamed: Course CertificateShazni AhamedNo ratings yet

- MID-math TMJKDocument6 pagesMID-math TMJKShazni AhamedNo ratings yet

- Input Output Examples KnowmoreDocument76 pagesInput Output Examples KnowmoreSylvinceterNo ratings yet

- Thank You For Your Passion of Learning. and For Enrolling in My Arabic Language Class. - Mohammed ZaidDocument1 pageThank You For Your Passion of Learning. and For Enrolling in My Arabic Language Class. - Mohammed ZaidShazni AhamedNo ratings yet

- Timeline Stress The Key Aspects To Consider Going Forward: SeptemberDocument1 pageTimeline Stress The Key Aspects To Consider Going Forward: SeptemberEllen PorterNo ratings yet

- The Growing Use of Polymers As Biomaterials: Assignment 02-Combinig Sources (Citing & Referencing)Document1 pageThe Growing Use of Polymers As Biomaterials: Assignment 02-Combinig Sources (Citing & Referencing)Shazni AhamedNo ratings yet

- Waterglass Vs AlkoxideDocument6 pagesWaterglass Vs AlkoxideShazni AhamedNo ratings yet

- Preparation of Silica Aerogel Form Rice Husk (Interim - Report - 1)Document1 pagePreparation of Silica Aerogel Form Rice Husk (Interim - Report - 1)Shazni AhamedNo ratings yet

- Module Descriptor Batch 2017 CH4214 FinalDocument2 pagesModule Descriptor Batch 2017 CH4214 FinalShazni AhamedNo ratings yet

- Arabic DaysDocument3 pagesArabic DaysShazni AhamedNo ratings yet