Professional Documents

Culture Documents

Act201 Assignment PDF

Act201 Assignment PDF

Uploaded by

mahmudOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Act201 Assignment PDF

Act201 Assignment PDF

Uploaded by

mahmudCopyright:

Available Formats

ACT 201: Assignment (100)

1. Write short notes on the following accounting principles with proper examples: (9)

a) Consistency

b) Going Concern

c) Periodicity

d) Revenue Recognition Principle

e) Matching Concept

f) Accrual Basis of Accounting

2. Baker Corporation provided the following Statements for 2014-15 –

Balance Sheet 2015 2014

Assets $ $

Cash 40,000 70,000

Accounts Receivable 320,000 350,000

Inventory 460,000 320,000

Total Current Asset 820,000 740,000

Gross Fixed Assets 560,000 520,000

Accumulated Depreciation 180,000 150,000

Net Fixed Asset 380,000 370,000

Total Asset 1,200,000 1,110,000

Liabilities & Stockholders’ Equity

Current Liabilities

Accounts Payable 390,000 320,000

Notes Payable 110,000 90,000

Accrued Expense 20,000 20,000

Total Current Liabilities 520,000 430,000

Long Term Debt 320,000 350,000

Total Liabilities 840,000 780,000

Stockholders’ Equity

Common Stock at par 100,000 100,000

Share Premium Reserve 150,000 150,000

Retained Earnings 110,000 80,000

Total Liabilities & Stockholders’ Equity 1,200,000 1,110,000

Income Statement 2015 2014

$ $

Sales 2,200,000 2,400,000

Cogs 1,420,000 1,700,000

Gross Profit 780,000 700,000

Operating Expenses 600,000 550,000

Operating Income (EBIT) 180,000 150,000

Interest 29,000 40,000

Earnings before Tax (EBT) 151,000 110,000

Tax (30%) 45,000 33,000

Earnings after Tax (Net Income) 106,000 77,000

Additional Information related to 2015:

Purchased equipment paying $40,000 cash.

Annual depreciation expense was $30,000.

Paid cash dividend of $76,000.

No sale of fixed asset.

Required

A) Prepare a Cash Flow Statement for the year 2015. (9)

B) Calculate the following Ratios for the year 2014 and 2015-

Current Ratio

Quick Ratio

Accounts Receivable Turnover

Profit Margin

Asset Turnover

ROA

Return on Common Stockholders’ Equity

Debt to Asset

Times Interest Earned ratio. (5)

C) Analyze the performance of the company over time (2014-15) whether it is improving

or deteriorating based on the above ratios. (10)

3. Philips opened a Motel for business on May 1, 2009. His account has extracted the following trial

balance from his books of account as at May 31 2009.

Trial Balance

Dr. ($) Cr. ($)

Cash 2500

Supplies 1900

Prepaid Insurance 2400

Land 15000

Lodge 70000

Furniture 16800

Accounts payable 5300

Unearned Revenue 3600

Mortgage Loan 35000

Philips, Capital 60000

Rent Revenue 9200

Advertise Expense 500

Salaries Expense 3000

Utilities Expense 1000

Total 113,100 113,100

Notes: The following additional information is to be taken into account.

I. Insurance expires at the rate of $200 per month.

II. Supplies show $900 of unused supplies on May 31.

III. Depreciation $300 on the Lodge and $250 on furniture per month.

IV. Mortgage interest 12% per year. The mortgage was taken on May 1.

V. Unearned rent of $1500 has been earned.

VI. Salaries of $300 are accrued at May 31.

Required:

A. Prepare and complete the whole worksheet. (10)

B. Prepare an Income Statement for the month ended May 31, 2009. (5)

C. Prepare an Owners’ Equity Statement for the month ended May 31, 2009. (5)

D. Prepare a Classified Balance Sheet as at May 31, 2009. (5)

E. Journalize the Closing Entries. (5)

F. Prepare a Post-Closing Trial Balance for the month ended May 31, 2009. (5)

4. You have been assigned as an accountant for comparing the performances of Blackburn

Corporation with Delta Corporation during the year 2019; both are producing textile products.

Both the companies have provided the following information.

Ratio Blackburn Delta

Corporatio

Corporatio n

n

Average Payment Period 76 81

Inventory Turnover 5.1 5.7

P/E Ratio 10.5 10

Average Collection Period 44 51

Debt Ratio 0.37 0.44

Profit Margin 0.082 0.054

Asset Turnover 0.94 0.79

Quick Ratio 1.32 1.46

Current Ratio 2.04 2.08

Times Interest Earned 5.6 3.3

EPS 3.26 1.81

a. In the annual report to the shareholders (owners), the Chief Accountant of Blackburn Corporation

wrote, “2019 was a good year for the firm as we have made higher return compare to our

competitor.” Is the Chief Accountant correct? Explain and use only relevant information in your

analysis. (8)

b. What can you say about both the firms overall efficiency in managing assets, inventories, payables

and receivables? Be as complete as possible given the above information, but do not use any

irrelevant information. (8)

c. You are asked to provide an assessment of both the firms’ liquidity and leverage (debt) position. Be

as complete as possible given the above information, but do not use any irrelevant information. (8)

d. Compare the performance of the company based on shareholders’ (owners’) point of view. (8)

You might also like

- ACCA FA Progress Test PDFDocument21 pagesACCA FA Progress Test PDFNicat IsmayıloffNo ratings yet

- 13-16 - Cash Budget - PQDocument7 pages13-16 - Cash Budget - PQRohaib MumtazNo ratings yet

- Seminar 2-3Document8 pagesSeminar 2-3Nguyen Hien0% (1)

- Reading 21 Financial Analysis Techniques - AnswersDocument72 pagesReading 21 Financial Analysis Techniques - AnswersMohammed GamalNo ratings yet

- Symbol LS2208 Programming - SerialDocument2 pagesSymbol LS2208 Programming - SerialAndrez ZiilvaNo ratings yet

- Church Company Completes These Transactions and Events During MarchDocument56 pagesChurch Company Completes These Transactions and Events During Marchlaale dijaanNo ratings yet

- CH 03Document4 pagesCH 03flrnciairnNo ratings yet

- The Finance Director of Stenigot Is Concerned About The LaxDocument1 pageThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyNo ratings yet

- ADMS 2500 Practice Final Exam SolutionsDocument20 pagesADMS 2500 Practice Final Exam SolutionsAyat TaNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting Assignmentsadif sayeed100% (2)

- Assignment#4 ACT701Document6 pagesAssignment#4 ACT701Sohel Rana0% (1)

- Pebble - Crystal Acquired 60000 of The 100000 Shares in PebbleDocument3 pagesPebble - Crystal Acquired 60000 of The 100000 Shares in PebbleTống Ngọc Gia Thư100% (1)

- The Cash Account in The General Ledger of Ciavarella CorporationDocument2 pagesThe Cash Account in The General Ledger of Ciavarella Corporationamit raajNo ratings yet

- 3int - 2005 - Dec - QUS CAT T3Document10 pages3int - 2005 - Dec - QUS CAT T3asad19No ratings yet

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- 2015 MSE Accounting Sample QuestionsDocument12 pages2015 MSE Accounting Sample QuestionsDharniNo ratings yet

- CH 06Document8 pagesCH 06Tien Thanh DangNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Case 20: The Walt Disney Company: Strategic ManagementDocument31 pagesCase 20: The Walt Disney Company: Strategic ManagementAYU SINAGANo ratings yet

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- Sales Tax QuestionDocument3 pagesSales Tax QuestionKhushi SinghNo ratings yet

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- Session 2Document8 pagesSession 2Muhammad Haris100% (1)

- Chapter-2 Theory - 1-21 - Financial AccountingDocument8 pagesChapter-2 Theory - 1-21 - Financial AccountingOmor FarukNo ratings yet

- 08 - Irrecoverable Debts and Provision For Doubtful Debts Complete Notes-1Document10 pages08 - Irrecoverable Debts and Provision For Doubtful Debts Complete Notes-1Danny FarrukhNo ratings yet

- CAF 1 IA Autumn 2020Document5 pagesCAF 1 IA Autumn 2020Qasim Hafeez KhokharNo ratings yet

- HI5020Document13 pagesHI5020takeshiru000No ratings yet

- F3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Document31 pagesF3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Md Enayetur Rahman100% (1)

- Chapter 1 Exercises 2Document7 pagesChapter 1 Exercises 2thtram03No ratings yet

- 2014 CommentaryDocument46 pages2014 Commentaryduong duongNo ratings yet

- Mark Scheme (Results) Series 2 2014: Pearson LCCI Level 2 Book-Keeping and Accounts (ASE2007)Document13 pagesMark Scheme (Results) Series 2 2014: Pearson LCCI Level 2 Book-Keeping and Accounts (ASE2007)sincere sincereNo ratings yet

- Practice Questions and SolutionsDocument7 pagesPractice Questions and SolutionsLiy TehNo ratings yet

- CH 05Document21 pagesCH 05Muhammad Nur Fazrin50% (2)

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- FIN1161 - Introduction To Finance For Business - Report 2Document6 pagesFIN1161 - Introduction To Finance For Business - Report 2thunlagbd230128No ratings yet

- FA1 General JournalDocument5 pagesFA1 General JournalamirNo ratings yet

- ACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019Document11 pagesACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019nothingNo ratings yet

- FFA Imp Questions-2Document20 pagesFFA Imp Questions-2Abdul Ahad YousafNo ratings yet

- PAPER: Financial Accounting (FA) : Certified College of Accountancy's Mock ExamDocument8 pagesPAPER: Financial Accounting (FA) : Certified College of Accountancy's Mock ExamJack PayneNo ratings yet

- Bca 423-Marginal Vs Absoption Costing.Document8 pagesBca 423-Marginal Vs Absoption Costing.James GathaiyaNo ratings yet

- Financial Accounting Sample Paper 21Document31 pagesFinancial Accounting Sample Paper 21Jayasankar SankarNo ratings yet

- IBF Assign#2Document4 pagesIBF Assign#2Burhan uddin100% (1)

- Ratios - Profitability, Market &Document46 pagesRatios - Profitability, Market &Jess AlexNo ratings yet

- Accounting Irrecoverable Debts. 30/06/2021/ Wednesday Homework. Resource Pack Questions, Question # 1Document4 pagesAccounting Irrecoverable Debts. 30/06/2021/ Wednesday Homework. Resource Pack Questions, Question # 1taiba sajjadNo ratings yet

- Iandfct2exam201504 0Document8 pagesIandfct2exam201504 0Patrick MugoNo ratings yet

- 6int 2006 Dec QDocument9 pages6int 2006 Dec Qrizwan789No ratings yet

- Chap 1 - Inventory Valuation (Questions)Document4 pagesChap 1 - Inventory Valuation (Questions)90 SHAMAZNo ratings yet

- Accounting-2009 Resit ExamDocument18 pagesAccounting-2009 Resit ExammasterURNo ratings yet

- F3 - Mock B - QuestionsDocument15 pagesF3 - Mock B - QuestionsabasNo ratings yet

- Soal P 7.2, 7.3, 7.5Document3 pagesSoal P 7.2, 7.3, 7.5boba milkNo ratings yet

- Accounting January 2016: Recording Adjusting and Closing Entries For A Service BusinessDocument55 pagesAccounting January 2016: Recording Adjusting and Closing Entries For A Service BusinessAlexia MercadoNo ratings yet

- Examples of Trading and Profit and Loss Account and Balance SheetDocument5 pagesExamples of Trading and Profit and Loss Account and Balance SheetSaad Arshad Mughal86% (7)

- ch01 PDFDocument2 pagesch01 PDFDanish BaigNo ratings yet

- Тasks for individual workDocument7 pagesТasks for individual workДарина БережнаяNo ratings yet

- Assignment 8 AnswersDocument6 pagesAssignment 8 AnswersMyaNo ratings yet

- Acca Fa M3 PDFDocument14 pagesAcca Fa M3 PDFtommydunkNo ratings yet

- ACC For Stock IssuesDocument9 pagesACC For Stock IssuesJasonSpringNo ratings yet

- Financial Accounting 4th Edition Chapter 2Document67 pagesFinancial Accounting 4th Edition Chapter 2Joey TrompNo ratings yet

- 3int - 2008 - Jun - Ans CAT T3Document6 pages3int - 2008 - Jun - Ans CAT T3asad19No ratings yet

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- CV of Emrul Hasan 4Document3 pagesCV of Emrul Hasan 4mahmudNo ratings yet

- Email: Phone: Location:: ExperienceDocument2 pagesEmail: Phone: Location:: ExperiencemahmudNo ratings yet

- Trade Map SwapnilaDocument1 pageTrade Map SwapnilamahmudNo ratings yet

- Costing Sheet Signet-26 August 2012Document3 pagesCosting Sheet Signet-26 August 2012mahmudNo ratings yet

- 685 Mid AssignmentDocument32 pages685 Mid AssignmentmahmudNo ratings yet

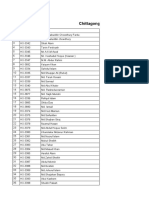

- Ha-Meem Group Employee List Chittagong Division (C&F and MCCL)Document21 pagesHa-Meem Group Employee List Chittagong Division (C&F and MCCL)mahmudNo ratings yet

- Filing (A Merchandisers Master File)Document1 pageFiling (A Merchandisers Master File)mahmudNo ratings yet

- G.E Moore PDFDocument4 pagesG.E Moore PDFmahmudNo ratings yet

- High Commission of India: Visa Application FormDocument2 pagesHigh Commission of India: Visa Application FormmahmudNo ratings yet

- Name: Tanzila Tazin Raka Student ID: 1320577030 Course: Eco134 Section: 01Document1 pageName: Tanzila Tazin Raka Student ID: 1320577030 Course: Eco134 Section: 01mahmudNo ratings yet

- Indvidual Report Market Assesment On Medicine Program: Mba Course: Bus 685Document8 pagesIndvidual Report Market Assesment On Medicine Program: Mba Course: Bus 685mahmudNo ratings yet

- Chapter 3-Disputes and Definitions: in AttitudeDocument9 pagesChapter 3-Disputes and Definitions: in AttitudemahmudNo ratings yet

- Ajax I PDFDocument8 pagesAjax I PDFmahmudNo ratings yet

- Disagreements and DisputesDocument5 pagesDisagreements and DisputesmahmudNo ratings yet

- Ajax III PDFDocument10 pagesAjax III PDFmahmudNo ratings yet

- G.E Moore PDFDocument4 pagesG.E Moore PDFmahmudNo ratings yet

- Pol 101Document4 pagesPol 101mahmudNo ratings yet

- Descartes Locke2Document3 pagesDescartes Locke2mahmudNo ratings yet

- A Critical History of Western PhilosophyDocument7 pagesA Critical History of Western PhilosophymahmudNo ratings yet

- Os Report 2Document89 pagesOs Report 2Sirin ScariaNo ratings yet

- Outcome From The Learning of MockdrillDocument44 pagesOutcome From The Learning of Mockdrill2021mnm009.abhishekNo ratings yet

- Journal of Business Research: Ramendra Thakur, Letty WorkmanDocument8 pagesJournal of Business Research: Ramendra Thakur, Letty WorkmanMovie MovieNo ratings yet

- Diabetes Management ChecklistDocument2 pagesDiabetes Management ChecklistDianne100% (1)

- Adi Sankara Viracita Subramanya Bhujanga StavamDocument5 pagesAdi Sankara Viracita Subramanya Bhujanga StavamRamars AmanchyNo ratings yet

- Quick Audio Mastering With ReaperDocument7 pagesQuick Audio Mastering With ReaperheraNo ratings yet

- Epicor Recognised Best ERP System Provider Asian Manufacturing AwardsDocument2 pagesEpicor Recognised Best ERP System Provider Asian Manufacturing AwardsNoppawan BuangernNo ratings yet

- Notification COIR Board Various VacanciesDocument2 pagesNotification COIR Board Various VacanciesTechnical4uNo ratings yet

- Vodafone Case StudyDocument13 pagesVodafone Case StudySanyam Pandey0% (1)

- Conventions and Codes of An Opening Sequence: MoodboardDocument7 pagesConventions and Codes of An Opening Sequence: Moodboardellieking1994No ratings yet

- 101 ST Charles Avenue Streetcar Line 1835Document8 pages101 ST Charles Avenue Streetcar Line 1835FrankVarrecchioNo ratings yet

- QD81DL96 User Manual (Hardware)Document24 pagesQD81DL96 User Manual (Hardware)Crescendo Solusi TamaNo ratings yet

- People Vs AlvaradoDocument14 pagesPeople Vs AlvaradoShane Fernandez JardinicoNo ratings yet

- Total Rewards Inventory ChecklistDocument1 pageTotal Rewards Inventory ChecklistNhư Cường PhạmNo ratings yet

- Trust and Faith FomartDocument3 pagesTrust and Faith FomartJoshua Friday100% (1)

- Discuss Solutions, Problems, Proposals: Understand The Need To ..Document2 pagesDiscuss Solutions, Problems, Proposals: Understand The Need To ..Freddy De WekkerNo ratings yet

- Ready, Set, Discover! Lesson Plan (SAMPLE)Document8 pagesReady, Set, Discover! Lesson Plan (SAMPLE)blue jadeNo ratings yet

- Business Communication SkillsDocument10 pagesBusiness Communication SkillsKelvin AppadooNo ratings yet

- ConverseDocument6 pagesConverseCedric SantiagoNo ratings yet

- NASA Apollo 11 Mission ReportDocument359 pagesNASA Apollo 11 Mission ReportOrion2015100% (4)

- 02 CT Apfelbaum On HalbwachsDocument17 pages02 CT Apfelbaum On HalbwachsAndrea Cruz HernándezNo ratings yet

- Exploration Pythagorean Theorem: Sam Otten MTH 210A W04Document9 pagesExploration Pythagorean Theorem: Sam Otten MTH 210A W04Nikki AmuraoNo ratings yet

- Health and Food Assignment 13-14Document10 pagesHealth and Food Assignment 13-14Jimmy NguyenNo ratings yet

- To The Tutorial Course: Tutorial Guide Annikki MatthanDocument12 pagesTo The Tutorial Course: Tutorial Guide Annikki MatthanAnnikki Matthan50% (2)

- Akamkpa Quarry Draft ReportDocument260 pagesAkamkpa Quarry Draft ReportGbenga AdewumiNo ratings yet

- BPR HLC DelhiDocument24 pagesBPR HLC Delhisaket kumarNo ratings yet

- Lesson 12 Igon-IgonDocument12 pagesLesson 12 Igon-IgonMarie Carmeli Igon-igon100% (1)

- DR Exam Notes-FinalDocument58 pagesDR Exam Notes-FinalJoanna AbrahamNo ratings yet

- ExamplesDocument5 pagesExamplesRahul RawatNo ratings yet