Professional Documents

Culture Documents

Inventory Systems: Follow

Uploaded by

Melusi DocOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inventory Systems: Follow

Uploaded by

Melusi DocCopyright:

Available Formats

Search Upload Login Signup

Home Explore Presentation Courses PowerPoint Courses by LinkedIn Learning

4 people clipped this slide Recommended

PowerPoint Tips and Tricks

for Business Presentations

Online Course - LinkedIn Learning

Communication in the 21st

Century Classroom

Online Course - LinkedIn Learning

Teaching Techniques:

Classroom Management

Online Course - LinkedIn Learning

Inventory system

sai prakash

Mrp

Yoshiki Kurata, CIE, AAE

1 of 44 Location analysis

Yoshiki Kurata, CIE, AAE

12,560 views

Inventory systems

Share Like Download ... Forecasting

Yoshiki Kurata, CIE, AAE

Yoshiki Kurata, CIE, AAE, Instructor at Technological Institute of the Philippines

Follow

Assembly planning

Yoshiki Kurata, CIE, AAE

Published on Jun 29, 2013

Published in: Business, Technology

Project planning and control

Yoshiki Kurata, CIE, AAE

12 Comments 9 Likes Statistics Notes

Share your thoughts… Post

Operations Management

Project

Yoshiki Kurata, CIE, AAE

Adam Sheldon

I'd advise you to use this service: ⇒ www.HelpWriting.net ⇐ The price of your order

will depend on the deadline and type of paper (e.g. bachelor, undergraduate etc). The

more time you have before the deadline - the less price of the order you will have.

Thus, this service offers high-quality essays at the optimal price.

6 days ago

Adam Sheldon

I pasted a website that might be helpful to you: ⇒ www.HelpWriting.net ⇐ Good luck!

6 days ago

Adam Sheldon

I like this service ⇒ www.HelpWriting.net ⇐ from Academic Writers. I don't have

enough time write it by myself.

6 days ago

Jolene Lynn

Take the highest paid surveys! ✔✔✔ https://t.cn/A6ybKmr1

1 week ago

Anne Miller , Student

Don't forget another good way of simplifying your writing is using external resources

(such as ⇒ www.HelpWriting.net ⇐ ). This will definitely make your life more easier

3 weeks ago

Show More

Inventory systems

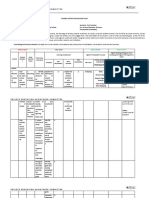

1. Inventory System

2. INVENTORY SYSTEM InventoryInventory is the stock of any item or resource used in an

organization and can include: raw materials, finished products, component parts, supplies, and

work-in-process An inventory systeminventory system is the set of policies and controls that

monitor levels of inventory and determines what levels should be maintained, when stock should

be replenished, and how large orders should be

3. INVENTORY COSTS Holding (or carrying) costs Costs for storage, handling, insurance,

etc Setup (or production change) costs Costs for arranging specific equipment setups, etc

Ordering costs Costs of someone placing an order, etc Shortage costs Costs of canceling

an order, etc

4. E(1 ) Independent vs. Dependent Demand Independent Demand (Demand for the final end-

product or demand not related to other items) Dependent Demand (Derived demand items for

component parts, subassemblies, raw materials, etc) Finished product Component parts

5. Inventory Systems Single-Period Inventory Model One time purchasing decision (Example:

vendor selling t-shirts at a football game) Seeks to balance the costs of inventory overstock

and under stock Multi-Period Inventory Models Fixed-Order Quantity Models Event

Triggered (Example: running out of stock) Fixed-Time Period Models Time triggered

(Example: Monthly sales call by sales representative)

6. Fixed-order quantity model also called economic order quantity (EOQ) an inventory

control model where the amount requisitioned is fixed and the actual ordering is triggered by

inventory dropping to a specified level of inventory

7. Fixed-Order Quantity Model Assumptions Demand for the product is constant and uniform

throughout the period Lead time (time from ordering to receipt) is constant Price per unit of

product is constant

8. Fixed-Order Quantity Model Assumptions Inventory holding cost is based on average

inventory Ordering or setup costs are constant All demands for the product will be satisfied

(No back orders are allowed)

9. Basic Fixed-Order Quantity Model and Reorder Point Behavior R = Reorder point Q =

Economic order quantity L = Lead time L L Q QQ R Time Number of units on hand 1. You

receive an order quantity Q. 2. Your start using them up over time. 3. When you reach down to a

level of inventory of R, you place your next Q sized order. 4. The cycle then repeats.

10. Cost Minimization Goal Ordering Costs Holding Costs Order Quantity (Q) C O S T Annual

Cost of Items (DC) Total Cost QOPT By adding the item, holding, and ordering costs together,

we determine the total cost curve, which in turn is used to find the Qopt inventory order point that

minimizes total costs By adding the item, holding, and ordering costs together, we determine the

total cost curve, which in turn is used to find the Qopt inventory order point that minimizes total

costs

11. Basic Fixed-Order Quantity (EOQ) Model Formula H 2 Q +S Q D +DC=TC Total Annual =

Cost Annual Purchase Cost Annual Ordering Cost Annual Holding Cost + + TC=Total annual cost

D =Demand C =Cost per unit Q =Order quantity S =Cost of placing an order or setup cost R

=Reorder point L =Lead time H=Annual holding and storage cost per unit of inventory TC=Total

annual cost D =Demand C =Cost per unit Q =Order quantity S =Cost of placing an order or

setup cost R =Reorder point L =Lead time H=Annual holding and storage cost per unit of

inventory

12. Deriving the EOQ Using calculus, we take the first derivative of the total cost function with

respect to Q, and set the derivative (slope) equal to zero, solving for the optimized (cost

minimized) value of Qopt Using calculus, we take the first derivative of the total cost function with

respect to Q, and set the derivative (slope) equal to zero, solving for the optimized (cost

minimized) value of Qopt Q = 2DS H = 2(Annual Demand)(Order or Setup Cost) Annual Holding

CostOPT Reorder point, R = d L _ (constant)timeLead=L (constant)demanddailyaverage=d _ We

also need a reorder point to tell us when to place an order We also need a reorder point to tell us

when to place an order

13. EOQ Example (1) Problem Data Annual Demand = 1,000 units Days per year considered in

average daily demand = 365 Cost to place an order = $10 Holding cost per unit per year = $2.50

Lead time = 7 days Cost per unit = $15 Given the information below, what are the EOQ and

reorder point? Given the information below, what are the EOQ and reorder point?

14. EOQ Example (1) Solution Q = 2DS H = 2(1,000 )(10) 2.50 = 89.443 units orOPT 90 units d

= 1,000 units / year 365 days / year = 2.74 units / day Reorder point, R = d L = 2.74units / day

(7days) = 19.18 or _ 20 units In summary, you place an optimal order of 90 units. In the course

of using the units to meet demand, when you only have 20 units left, place the next order of 90

units. In summary, you place an optimal order of 90 units. In the course of using the units to

meet demand, when you only have 20 units left, place the next order of 90 units.

15. EOQ Example (2) Problem Data Annual Demand = 10,000 units Days per year considered in

average daily demand = 365 Cost to place an order = $10 Holding cost per unit per year = 10%

of cost per unit Lead time = 10 days Cost per unit = $15 Determine the economic order quantity

and the reorder point given the following… Determine the economic order quantity and the

reorder point given the following…

16. EOQ Example (2) Solution Q = 2DS H = 2(10,000 )(10) 1.50 = 365.148 units, orOPT 366

units d = 10,000 units / year 365 days / year = 27.397 units / day R = d L = 27.397 units / day (10

days) = 273.97 or _ 274 units Place an order for 366 units. When in the course of using the

inventory you are left with only 274 units, place the next order of 366 units. Place an order for

366 units. When in the course of using the inventory you are left with only 274 units, place the

next order of 366 units.

17. Economic Production Quantity (EPQ) Production done in batches or lots Capacity to

produce a part exceeds the part’s usage or demand rate Assumptions of EPQ are similar to

EOQ except orders are received incrementally during production

18. Assumptions: Only one item involved Annual demand is known The usage rate is

constant Usage occurs continually, but production occurs periodically The production rate is

constant Lead time does not vary There are no quantity discounts

19. Economic Production Quantity Model

20. Formulas: No. of runs per year = D/Q Annual setup cost = (D/Q)S TCmin = Carrying

Cost + Setup Cost = ( )H+(D/Qo)S Qo = ; where p = production or delivery rate u = usage rate

Cycle Time = Run Time = Imax = (p-u) and Iaverage =

21. Example 1 A toy manufacturer uses 48,000 rubber wheels per year for its popular dump truck

series. The firm makes its own wheels, which it can produce at a rate of 800 per day. The toy

trucks are assembled uniformly over the entire year. Carrying cost is $1 per wheel a year. Setup

cost for a production run of wheels is $45. The firm operates 240 days per year.

22. Determine the a.Optimal run size. b.Minimum total annual cost for carrying and setup.

c.Cycle time for the optimal run size. d.Run time.

23. Given: D = 48,000 wheels per year S = $45 H = $1 per wheel per year p = 800 wheels per

day u = 48,000 wheels per 240 days, or 200 wheels per day

24. a. Qo= Qo= = 2,400 wheels b. TCmin = ( )H+(D/Qo)S Thus, you must first compute Imax:

Imax = (p-u) = (800-200) = 1,800 wheels TC = ( )($1) + ( )($45) = $1,800 Solution:

25. c. Cycle Time = = = 12 days Thus, a run of wheels will be made every 12 days. d. Run Time

= = = 3 days Thus, each run will require 3 days to complete.

26. Example 2 The Dine Corporation is both a producer & a user of brass couplings. The firm

operates 220 days a year & uses the couplings at a steady rate of 50 per day. Couplings can be

produced at a rate of 200 per day. Annual storage cost is $2 per coupling, & machine setup cost

is $70 per run. a.Determine the economic run quantity. b.Approximately how many runs per year

will there be? c.Compute the maximum inventory level.

27. Solution a. Qp = = ≈ 1,013 units

28. b. No. of runs = D = 11,000 = 10.86 ≈ 11 per year Q0 1,013 c. Imax = Qp (p - u) = 1,013 (200

- 50) p Imax = 759.75 or 760 units

29. Quantity Discounts • Quantity Discounts, also called Price-Break Models, are price

reductions for large orders offered to costumers to induce them to buy in large quantities. • The

buyer must weigh the potential benefits of reduced purchase price and fewer orders that will

result from buying in large quantities against the increase in carry costs caused by higher

average inventories.

30. Quantity Discounts • The buyer’s goal with quantity discounts is to select the order quantity

that will minimize total cost. • Total cost is the sum of carrying cost, ordering cost and purchasing

cost.

31. Price-Break Model Formula CostHoldingAnnual Cost)SetuporderDemand)(Or2(Annual = iC

2DS =QOPT Based on the same assumptions as the EOQ model, the price-break model has a

similar Qopt formula: i = percentage of unit cost attributed to carrying inventory C = cost per unit

Since “C” changes for each price-break, the formula above will have to be used with each price-

break cost value

32. Total Cost = Carrying Cost + Ordering Cost + Purchasing Cost TC = (Q/2)H + (D/Q)S + PD

Where: Q = Quantity P = Unit Price D = Demand S = Ordering Cost

33. Example1 A company has a chance to reduce their inventory ordering costs by placing larger

quantity orders using the price-break order quantity schedule below. What should their optimal

order quantity be if this company purchases this single inventory item with an e-mail ordering

cost of $4, a carrying cost rate of 2% of the inventory cost of the item, and an annual demand of

10,000 units? A company has a chance to reduce their inventory ordering costs by placing larger

quantity orders using the price-break order quantity schedule below. What should their optimal

order quantity be if this company purchases this single inventory item with an e-mail ordering

cost of $4, a carrying cost rate of 2% of the inventory cost of the item, and an annual demand of

10,000 units? Order Quantity(units) Price/unit($) 0 to 2,499 $1.20 2,500 to 3,999 1.00 4,000 or

more .98

34. Solution units1,826= 0.02(1.20) 4)2(10,000)( = iC 2DS =QOPT Annual Demand (D)= 10,000

units Cost to place an order (S)= $4 First, plug data into formula for each price-break value of

“C” units2,000= 0.02(1.00) 4)2(10,000)( = iC 2DS =QOPT units2,020= 0.02(0.98) 4)2(10,000)( =

iC 2DS =QOPT Carrying cost % of total cost (i)= 2% Cost per unit (C) = $1.20, $1.00, $0.98

Interval from 0 to 2499, the Qopt value is feasible Interval from 2500-3999, the Qopt value is not

feasible Interval from 4000 & more, the Qopt value is not feasible Next, determine if the

computed Qopt values are feasible or not

35. Solution Since the feasible solution occurred in the first price- break, it means that all the

other true Qopt values occur at the beginnings of each price-break interval. Why? Since the

feasible solution occurred in the first price- break, it means that all the other true Qopt values

occur at the beginnings of each price-break interval. Why? 0 1826 2500 4000 Order Quantity

Total annual costs So the candidates for the price- breaks are 1826, 2500, and 4000 units So the

candidates for the price- breaks are 1826, 2500, and 4000 units Because the total annual cost

function is a “u” shaped function Because the total annual cost function is a “u” shaped function

36. Solution iC 2 Q +S Q D +DC=TC Next, we plug the true Qopt values into the total cost

annual cost function to determine the total cost under each price-break Next, we plug the true

Qopt values into the total cost annual cost function to determine the total cost under each price-

break TC(0-2499)=(10000*1.20)+(10000/1826)*4+(1826/2)(0.02*1.20) = $12,043.82 TC(2500-

3999)= $10,041 TC(4000&more)= $9,949.20 TC(0-2499)=(10000*1.20)+(10000/1826)*4+

(1826/2)(0.02*1.20) = $12,043.82 TC(2500-3999)= $10,041 TC(4000&more)= $9,949.20 Finally,

we select the least costly Qopt, which is this problem occurs in the 4000 & more interval. In

summary, our optimal order quantity is 4000 units Finally, we select the least costly Qopt, which

is this problem occurs in the 4000 & more interval. In summary, our optimal order quantity is

4000 units

37. Example2 Consider the following case, where D = 10,000 units (annual demand) i = 20% of

cost (annual carrying cost, storage, interest, obsolescence, etc.) S = $20 to place an order C =

Cost per unit (according to order size; 0-499 units, $5 per unit; 500-999, $4.5 per unit; 1,000 and

up, $3.9 per unit) Consider the following case, where D = 10,000 units (annual demand) i = 20%

of cost (annual carrying cost, storage, interest, obsolescence, etc.) S = $20 to place an order C =

Cost per unit (according to order size; 0-499 units, $5 per unit; 500-999, $4.5 per unit; 1,000 and

up, $3.9 per unit) What quantity should be ordered?What quantity should be ordered?

38. Solution units632.46= 0.2(5) 20)2(10,000)( = iC 2DS =QOPT Annual Demand (D)= 10,000

units Cost to place an order (S)= $20 First, plug data into formula for each price-break value of

“C” units666.67= 0.2(4.50) 20)2(10,000)( = iC 2DS =QOPT units716.11= 0.2(3.90) 20)2(10,000)(

= iC 2DS =QOPT Carrying cost % of total cost (i)= 20% Cost per unit (C) = $5, $4.5, $3.9

Interval from 0 to 499, the Qopt value is feasible Interval from 500-999, the Qopt value is not

feasible Interval from 1000 & more, the Qopt value is not feasible Next, determine if the

computed Qopt values are feasible or not

39. Solution iC 2 Q +S Q D +DC=TC Next, we plug the true Qopt values into the total cost

annual cost function to determine the total cost under each price-break Next, we plug the true

Qopt values into the total cost annual cost function to determine the total cost under each price-

break TC(0-499)=(10000*5)+(10000/634)*20+(634/2)(0.2*5) = $50,632.46 TC(500-999)=

$45,600 TC(1000&more)= $39,558.57 TC(0-499)=(10000*5)+(10000/634)*20+(634/2)(0.2*5) =

$50,632.46 TC(500-999)= $45,600 TC(1000&more)= $39,558.57 Finally, we select the least

costly Qopt, which in this problem occurs in the 1000 & more interval. In summary, our optimal

order quantity is 1000 units Finally, we select the least costly Qopt, which in this problem occurs

in the 1000 & more interval. In summary, our optimal order quantity is 1000 units

40. A-B-C Classification Classifies Inventory items according to some measure of importance,

Usually annual dollar value, and then allocates control efforts accordingly

41. Three Classes of Items A (Very Important Items) Account for 10%-20% of the number of

items in inventory 60%-70% of the dollar inventory of an inventory B (Moderately Important)

Account for 20%-30% of the number of items in inventory 20%-50% of the dollar inventory of

an inventory C (Least Important) Account for 50%-60% of the number of items in inventory

10%-15% of the dollar inventory of an inventory

42. A typical A-B-C breakdown in relative annual dollar value of items and number of items by

category.

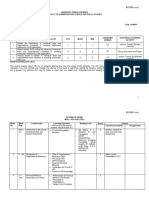

43. Example The annual dollar value of 12 items has been calculated according to annual

demand and unit cost. The annual dollar values were then arrayed from highest to lowest to

simplify classification of items.

44. Item Number Annual Demand Unit Cost Annual Dollar Value Classification 8 $1,000 $4,000

$4,000,000 A 5 $3,900 $700 $2,730,000 A 3 $1,900 $500 $950,000 B 6 $1,000 $915 $915,000 B

1 $2,500 $330 $825,000 B 4 $1,500 $100 $150,000 C 12 $400 $300 $120,000 C 11 $500 $200

$100,000 C 9 $8,000 $10 $80,000 C 2 $1,000 $70 $70,000 C 7 $200 $210 $42,000 C 10 $9,000

$2 $18,000 C

English Español Português Français Deutsch

About Dev & API Blog Terms Privacy Copyright Support

LinkedIn Corporation © 2020

You might also like

- Practical Life Skills - Employment & Volunteering Gr. 9-12+From EverandPractical Life Skills - Employment & Volunteering Gr. 9-12+Rating: 5 out of 5 stars5/5 (1)

- Audit Checklist 1Document2 pagesAudit Checklist 1Jagi NikNo ratings yet

- The Evolution of Corporate LearningDocument12 pagesThe Evolution of Corporate LearningAMAR PRASADNo ratings yet

- Homeopatie: Share Your ThoughtsDocument1 pageHomeopatie: Share Your ThoughtsMircea Eugen Moldovan0% (1)

- Annexure A: Construction Health and Safety Baseline SpecificationDocument60 pagesAnnexure A: Construction Health and Safety Baseline SpecificationGerritNo ratings yet

- Business Logistics/Supply Chain-A Vital SubjectDocument13 pagesBusiness Logistics/Supply Chain-A Vital SubjectAhmed MaherNo ratings yet

- Managerial Accounting PDFDocument108 pagesManagerial Accounting PDFmartinNo ratings yet

- Neinor Homes - MKT Planning and Implementation EMBA BrazilDocument8 pagesNeinor Homes - MKT Planning and Implementation EMBA BrazilIgor SoaresNo ratings yet

- E-Learning and Distance LearningDocument57 pagesE-Learning and Distance Learningnemra160% (5)

- Project About BankingDocument1 pageProject About BankingAbhay YadavNo ratings yet

- C++ Project On Restaurant Billing7Document1 pageC++ Project On Restaurant Billing7AJ SEB MR7No ratings yet

- Online Resrvation SystemDocument1 pageOnline Resrvation SystemKavya sreeNo ratings yet

- Kapasitas Daya Dukung Tiang Pancang Berdasarkan Data SondirDocument1 pageKapasitas Daya Dukung Tiang Pancang Berdasarkan Data SondirIsti HaryantoNo ratings yet

- WWW Slideshare NetDocument5 pagesWWW Slideshare NetOumeyr CheemahNo ratings yet

- ST4SD - Program Schedule - Day 1Document17 pagesST4SD - Program Schedule - Day 1ducbui.giadinhNo ratings yet

- ST4SD - Program Schedule - Day 4Document37 pagesST4SD - Program Schedule - Day 4ducbui.giadinhNo ratings yet

- How To Prepare Table Topics Speech: UploadDocument5 pagesHow To Prepare Table Topics Speech: UploadArvinNo ratings yet

- Rates Analysis For Calculating Material and Labour For Building WorksDocument1 pageRates Analysis For Calculating Material and Labour For Building WorksHscl PulivendulaNo ratings yet

- Topik Toolbox TalkDocument25 pagesTopik Toolbox TalkAnonymous 2JNPJ2aXNo ratings yet

- ST4SD - Program Schedule - Day 2Document36 pagesST4SD - Program Schedule - Day 2ducbui.giadinhNo ratings yet

- ST4SD - Program Schedule - Day 5Document20 pagesST4SD - Program Schedule - Day 5ducbui.giadinhNo ratings yet

- ST4SD - Program Schedule - Day 3Document26 pagesST4SD - Program Schedule - Day 3ducbui.giadinhNo ratings yet

- PGDM Sem 3-Batch 2020-22-TT 29 SepDocument1 pagePGDM Sem 3-Batch 2020-22-TT 29 SepAmit ChakrabortyNo ratings yet

- FIDP TemplateDocument3 pagesFIDP TemplateJovi AbabanNo ratings yet

- Integrated Syllabi Man612 Sir LitoDocument5 pagesIntegrated Syllabi Man612 Sir LitoJohn David JuaveNo ratings yet

- CBSE 8, Math, HOTS Questions Data HandlingDocument1 pageCBSE 8, Math, HOTS Questions Data Handlingdillan sharmaNo ratings yet

- WWW Slideshare NetDocument8 pagesWWW Slideshare NetAnkur VermaNo ratings yet

- Yusuffdm, Department of Management Studies, Indian Institute of Technology RoorkeeDocument5 pagesYusuffdm, Department of Management Studies, Indian Institute of Technology Roorkeeडॉ. सुधांशु जोशीNo ratings yet

- Materi Academic Atmosphere Semester Genap 2022 P1Document18 pagesMateri Academic Atmosphere Semester Genap 2022 P1perencanaan m2uNo ratings yet

- CBSE 8, Math, Sample Questions ExponentsDocument1 pageCBSE 8, Math, Sample Questions Exponentsdillan sharmaNo ratings yet

- Subject: Subject Title:: Info. Tech. Computer Application and Networking VisionDocument5 pagesSubject: Subject Title:: Info. Tech. Computer Application and Networking VisionLizNo ratings yet

- FDY3005 TPA Content Map 2023Document1 pageFDY3005 TPA Content Map 2023sofiapbiasiNo ratings yet

- Fms Ct1 SetaDocument2 pagesFms Ct1 SetaSuresh KNo ratings yet

- Re-Entry Plan (Seaieti)Document2 pagesRe-Entry Plan (Seaieti)Jay R BayarcalNo ratings yet

- AnnualcalendarDocument1 pageAnnualcalendarapi-453647158No ratings yet

- Diagrams NBA EsarDocument12 pagesDiagrams NBA EsarPragya SinghNo ratings yet

- AHLC Catalog Behavioral Event InterviewingDocument20 pagesAHLC Catalog Behavioral Event InterviewingMrChwet AumNo ratings yet

- BLG111E-Introduction To Computer Engineering - Programs: Prof - Dr.Sema F. OKTUĞDocument19 pagesBLG111E-Introduction To Computer Engineering - Programs: Prof - Dr.Sema F. OKTUĞAtakan GolNo ratings yet

- CLP Services MarketingDocument14 pagesCLP Services MarketingRegie Mark Magpayo0% (1)

- SodapdfDocument1 pageSodapdfRockyNo ratings yet

- 4 Seasons" - How To Successfully Deploy E-Learning InitiativeDocument19 pages4 Seasons" - How To Successfully Deploy E-Learning InitiativeMarek HylaNo ratings yet

- Ethics For Success - Course CompletionDocument2 pagesEthics For Success - Course CompletionShravanUdayNo ratings yet

- Re-Entry Plan in LAC SessionDocument3 pagesRe-Entry Plan in LAC SessioneGG p13No ratings yet

- Perkenalan Jurusan - Sistem Informasi - 2021 - R3Document37 pagesPerkenalan Jurusan - Sistem Informasi - 2021 - R3Sylvia SihombingNo ratings yet

- Academic AtmosphereeDocument15 pagesAcademic Atmosphereeellen yanNo ratings yet

- Compare Contrast Essay FinalDocument1 pageCompare Contrast Essay FinalNakı Dilber BüyükdağNo ratings yet

- Session 19 PPDocument26 pagesSession 19 PPArslan TariqNo ratings yet

- SE Curriculum & Syllabus-2021 - FINALDocument3 pagesSE Curriculum & Syllabus-2021 - FINALayushiNo ratings yet

- Unit Plan 1Document3 pagesUnit Plan 1api-489881515100% (1)

- Sow - Adm501 - Mac - Aug22Document13 pagesSow - Adm501 - Mac - Aug22Mohd Azrul AdinNo ratings yet

- Instructional DesignDocument1 pageInstructional DesignmzuaNo ratings yet

- Case Study National Defense University (Strategic Consulting Services)Document12 pagesCase Study National Defense University (Strategic Consulting Services)essahelmehdiNo ratings yet

- WWW - Slideshare - Net - Mobile - Glynpanela - General Mathematics Module 1 Review On Functions PDFDocument7 pagesWWW - Slideshare - Net - Mobile - Glynpanela - General Mathematics Module 1 Review On Functions PDFKenNo ratings yet

- Xa DiscussionvisualDocument1 pageXa Discussionvisualapi-448283923No ratings yet

- View Ikechukwu's Full Profile. It's Free!Document5 pagesView Ikechukwu's Full Profile. It's Free!Lanre OjelabiNo ratings yet

- Georgian Strategy Renewal ProcessDocument1 pageGeorgian Strategy Renewal ProcessgeorgiancollegeNo ratings yet

- Jenna Steele Skills Chart 2Document2 pagesJenna Steele Skills Chart 2api-734017373No ratings yet

- Mcdonald PL Plan Outline - Google SheetsDocument2 pagesMcdonald PL Plan Outline - Google Sheetsapi-727472231No ratings yet

- IdeationDocument1 pageIdeationapi-664608528No ratings yet

- Lkis School Learning Action Cell 2023-2024 - 1Document19 pagesLkis School Learning Action Cell 2023-2024 - 1Jeklenn QuirobinNo ratings yet

- Classroom Management PowerPoint PresentationDocument1 pageClassroom Management PowerPoint PresentationMark Anthony B. Aquino100% (1)

- Obtl-Art AppriciationDocument4 pagesObtl-Art AppriciationJustin SanchoNo ratings yet

- MIE Academy FrameworkDocument15 pagesMIE Academy FrameworkMOHD YUSNIZAM B MOHAMAD Moe100% (1)

- GE-113 - Course SyllabusDocument6 pagesGE-113 - Course SyllabusRico CombinidoNo ratings yet

- Unit Plan Technology and The Global Business EnvironmentDocument7 pagesUnit Plan Technology and The Global Business Environmentapi-513925339No ratings yet

- Lecture Notes On Transportation and Assignment Problem (BBE (H) QTM Paper of Delhi University)Document16 pagesLecture Notes On Transportation and Assignment Problem (BBE (H) QTM Paper of Delhi University)Melusi DocNo ratings yet

- Solved - Farmer Jones Must Determine How Many Acres of Com and W...Document1 pageSolved - Farmer Jones Must Determine How Many Acres of Com and W...Melusi DocNo ratings yet

- LPDocument45 pagesLPAhmad MuzammilNo ratings yet

- Opt 2003-05-28 TLDocument16 pagesOpt 2003-05-28 TLMelusi DocNo ratings yet

- Algebraic Sensitivity Analysis-Objective FunctionDocument1 pageAlgebraic Sensitivity Analysis-Objective FunctionMelusi DocNo ratings yet

- Linear ProgrammingDocument15 pagesLinear Programmingjogindra singh100% (1)

- CasnosDocument40 pagesCasnosKazi ChakibNo ratings yet

- Bus ModDocument2 pagesBus ModdmadhavanurNo ratings yet

- Competitive Retail MarketDocument146 pagesCompetitive Retail Marketahmedh_98No ratings yet

- PAS 24 Related Party Disclosures: Learning ObjectivesDocument4 pagesPAS 24 Related Party Disclosures: Learning ObjectivesFhrince Carl Calaquian100% (1)

- Setting Goals and Managing The Sales Force's PerformanceDocument2 pagesSetting Goals and Managing The Sales Force's PerformanceRohanMohapatraNo ratings yet

- Work Estimate Template in ExcelDocument1 pageWork Estimate Template in Excelking478962No ratings yet

- 5204 Solutions For Problems 2-17, 2-22, 2-26 (12th Ed)Document7 pages5204 Solutions For Problems 2-17, 2-22, 2-26 (12th Ed)assignmentsbysinghNo ratings yet

- Billboard ConstructionDocument4 pagesBillboard ConstructionJohn Anthony MaligaligNo ratings yet

- Hidden Costs of Quality: Measurement & Analysis: Sailaja A, P C Basak and K G ViswanadhanDocument13 pagesHidden Costs of Quality: Measurement & Analysis: Sailaja A, P C Basak and K G ViswanadhanAmit PaulNo ratings yet

- B2B Consultant - Michael PageDocument1 pageB2B Consultant - Michael PageBobo BellaNo ratings yet

- PP-16-Project Board Terms of ReferenceDocument3 pagesPP-16-Project Board Terms of ReferenceSALAH HELLARANo ratings yet

- The COO's Guide To OKRs (Objectives and Key Results)Document13 pagesThe COO's Guide To OKRs (Objectives and Key Results)Jonathan Lewis100% (1)

- S8 Estimation IntroDocument18 pagesS8 Estimation IntroAswajith K BabuNo ratings yet

- Controlling, Delegation and Interdepartment CoordinationDocument18 pagesControlling, Delegation and Interdepartment Coordinationmann chalaNo ratings yet

- 10 Ways Autotask AutomatesDocument15 pages10 Ways Autotask AutomatespriteshjNo ratings yet

- Professional Modern Resume TemplateDocument3 pagesProfessional Modern Resume TemplateSami Ullah NisarNo ratings yet

- Dedication That Drives: WWW - Logagent.rsDocument8 pagesDedication That Drives: WWW - Logagent.rsFilip JovovicNo ratings yet

- Zara PDocument10 pagesZara Papplekung2015No ratings yet

- Internship Repo-WPS OfficeDocument21 pagesInternship Repo-WPS OfficeShraddha ShresthaNo ratings yet

- The Four Pillars of CFO SuccessDocument7 pagesThe Four Pillars of CFO Successanand1kumar-31No ratings yet

- CUBAYDocument11 pagesCUBAYJoebert SencioNo ratings yet

- Material Management 2Document5 pagesMaterial Management 2AadiNo ratings yet

- Business English - Vocabulary BuilderDocument17 pagesBusiness English - Vocabulary BuilderAylin ErdenNo ratings yet

- The Emperor's New ClothesDocument11 pagesThe Emperor's New ClothesSaleh RehmanNo ratings yet

- Implementing Organizational Change Theory Into Practice 3rd Edition Spector Test BankDocument10 pagesImplementing Organizational Change Theory Into Practice 3rd Edition Spector Test BankMarkJoneskjsme100% (9)