Professional Documents

Culture Documents

REQUIREMENTS FOR ITR - 2019 Corporation

REQUIREMENTS FOR ITR - 2019 Corporation

Uploaded by

Sally Siaotong0 ratings0% found this document useful (0 votes)

4 views3 pagesOriginal Title

REQUIREMENTS FOR ITR - 2019 corporation.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pagesREQUIREMENTS FOR ITR - 2019 Corporation

REQUIREMENTS FOR ITR - 2019 Corporation

Uploaded by

Sally SiaotongCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

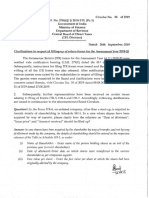

Medez-Galanto & Associates

Certified Public Accountants

M.V. Hechanova, Jaro, Iloilo City Tel. Nos. 503-3234 / 509-1527

REQUIREMENTS FOR ANNUAL INCOME TAX AND

FINANCIAL STATEMENT PREPARATIONS (CORPORATIONS-

VAT)

The following are documents and data needed for the preparation of

financial statements:

BIR FILED RETURNS

1. Previous Year Annual Year 2018

Income Tax Return and

Financial Statement

(1702-RT)

2. Quarterly Income Tax 1st 2nd and 3rd Quarter Year 2019

Returns (1702-Q)

3. Monthly Value Added Tax January, February, April, May,

Returns (2550 –M) July, August, October, November

(Year 2019)

4. Quarterly Value Added 1 2 3 and 4th Quarter Year

st nd rd

Tax Returns (2550-Q) 2019

5. Monthly and Quarterly Year 2019

Withholding Tax -

Expanded (0619 –E &

1601 –EQ)

6. Monthly Withholding Tax Year 2019

Compensation (1601-C)

7. Creditable Withholding Year 2019

Taxes (2307, 2306)

8. Annual Inventory List – As of December 31, 2019

9. 2019 Alphalist for Employees and their corresponding

compensation.

OTHER DOCUMENTS

1. Certificate of Loan Balances as of December 31, 2019 and

Interest Payments for the year 2019

2. Certificate of Purchases from Suppliers (For the year 2019)

3. Schedule of Accounts Payables or List of Payables as of December

31, 2019

4. Schedule of Accounts Receivables or List of Collectibles as of

December 31, 2019

5. List of Assets/Properties/Equipment acquired during the year

2019 and other assets acquired in previous years not declared in

the financial statement. (Please support with invoices or sale

contracts)

6. Summary of Itemized Expenses for the year 2019. (ex. Electricity,

Telephone, Repair and Maintenance, etc.)

7. Official Receipts of Municipal and Local Taxes Paid for the year

2019. (ex. Business Permits, LTO or LTFRB, Real Property Taxes,

etc.)

8. Payroll Records for the whole 2019 year including the summary of

benefits and deductions.

9. Summary of SSS, Philhealth & Pag-Ibig Payments for the whole

2019 year (Employer Share Only)

10. Other financial documents necessary for filing the

company’s Financial Statement and Annual Income Tax Returns

such as but not limited to:

a. General Information Sheet

b. Amended Articles of Incorporation and By Laws (If Any)

c. Others

Please be noted that the deadline for submission of above-mentioned

documents is on February 28, 2020.

Provide 1 white long folder upon submission of documents.

You might also like

- 2 BXooo 006610620000 R 969253 A0 FFC521Document1 page2 BXooo 006610620000 R 969253 A0 FFC521Pily AguilarNo ratings yet

- PPT-on-GST Annual-ReturnDocument33 pagesPPT-on-GST Annual-Returnshrutha p jainNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Transmittal 2019 New FormDocument3 pagesTransmittal 2019 New FormHge Barangay100% (3)

- Barangay Budget Forms 2019Document17 pagesBarangay Budget Forms 2019Arman BentainNo ratings yet

- Promissory Note - SampleDocument4 pagesPromissory Note - SampleSally SiaotongNo ratings yet

- Donation Is SolelyDocument2 pagesDonation Is SolelyAnthony Angel Tejares50% (2)

- Letter of Notification - PCABDocument2 pagesLetter of Notification - PCABSally SiaotongNo ratings yet

- InvoiceDocument1 pageInvoiceBrian Michel RomanNo ratings yet

- Taxation Cup SeriesDocument5 pagesTaxation Cup SeriesGlaiza Atillo Batuto Orgino100% (1)

- 2019 20201 Inter-Agency PayablesDocument4,097 pages2019 20201 Inter-Agency Payablesjerico kier nonoNo ratings yet

- 1 MondayDocument6 pages1 MondayCeline Marie Libatique AntonioNo ratings yet

- Press Release Clarification Regarding Annual Returns and Reconciliation StatementDocument3 pagesPress Release Clarification Regarding Annual Returns and Reconciliation StatementSujata OjhaNo ratings yet

- OdionganDocument7 pagesOdionganJohn Claude TabanNo ratings yet

- Press Release ClarificationDocument3 pagesPress Release ClarificationMukesh ChhadvaNo ratings yet

- Noticeb 1633050029Document8 pagesNoticeb 1633050029Vivek GudeNo ratings yet

- Chapter 8 Tax AdministrationDocument14 pagesChapter 8 Tax AdministrationHazlina Hussein100% (1)

- Letter For AAR - LaurDocument2 pagesLetter For AAR - LaurJonson PalmaresNo ratings yet

- Pages From BCC 2019 20Document1 pagePages From BCC 2019 20Kamran AhmedNo ratings yet

- Compliance Chart FormatDocument2 pagesCompliance Chart FormatSmeet ShahNo ratings yet

- Important GST Dates - Your Calendar For GST 2019Document1 pageImportant GST Dates - Your Calendar For GST 2019Kavitha T SNo ratings yet

- City Executive Summary 2020Document9 pagesCity Executive Summary 2020Shen ʚĩɞNo ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- Handouts SAICA Tax Bill UpdateDocument222 pagesHandouts SAICA Tax Bill UpdateMohola Tebello GriffithNo ratings yet

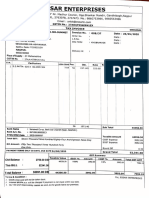

- SAR Audit MemoDocument19 pagesSAR Audit MemoAshish SharmaNo ratings yet

- Tax Collector Correspondence4005106Document2 pagesTax Collector Correspondence4005106Mohammed AbdullahNo ratings yet

- 1st Memo AuditDocument4 pages1st Memo AuditPaul SamuelNo ratings yet

- Circular 26 2019Document4 pagesCircular 26 2019SnehNo ratings yet

- Indian Institute of Management Calcutta: Need Based Financial Assistance (Nbfa) Application Form: Academic Year 2019-20Document16 pagesIndian Institute of Management Calcutta: Need Based Financial Assistance (Nbfa) Application Form: Academic Year 2019-20Ayushi NagarNo ratings yet

- PalawanProv ES2019Document11 pagesPalawanProv ES2019Smile Laugh and Be InspiredNo ratings yet

- Budget Call Circular 2019-2020: Government of Pakistan Finance Division IslamabadDocument46 pagesBudget Call Circular 2019-2020: Government of Pakistan Finance Division IslamabadAshagre MekuriaNo ratings yet

- Form 9C Clarification 3.7.19Document2 pagesForm 9C Clarification 3.7.19ashim1No ratings yet

- Clarification Regarding Annual Returns and Reconciliation StatementDocument4 pagesClarification Regarding Annual Returns and Reconciliation StatementTIRLOK NATH JaggiNo ratings yet

- Qus - Lower TDS DeductionDocument2 pagesQus - Lower TDS Deductionvinus.dhanankarNo ratings yet

- SEC 17Q - IPO & Subs Conso - Q3 2020 - 11112020 - FinalDocument80 pagesSEC 17Q - IPO & Subs Conso - Q3 2020 - 11112020 - Finaldawijawof awofnafawNo ratings yet

- Question Bank For NPODocument17 pagesQuestion Bank For NPOSanyam BohraNo ratings yet

- All About GST Annual ReturnsDocument9 pagesAll About GST Annual ReturnsinfoNo ratings yet

- GTL InfraDocument9 pagesGTL InfraVinay JainNo ratings yet

- KMC Budget English 2019 2020 PDFDocument58 pagesKMC Budget English 2019 2020 PDFAbhishek SatpathyNo ratings yet

- Details of Payment Made Pertaining To The Period: ST STDocument3 pagesDetails of Payment Made Pertaining To The Period: ST STrahulv2No ratings yet

- Tempalte Memo (Thru)Document2 pagesTempalte Memo (Thru)Tinee Felipe - ClementeNo ratings yet

- Public Service Assistant Duties and ResponsibilitesDocument1 pagePublic Service Assistant Duties and ResponsibilitesJomari MontillaNo ratings yet

- Revenue IssuancesDocument3 pagesRevenue IssuancesLucifer MorningstarNo ratings yet

- Explanatory Notes B2011 2Document26 pagesExplanatory Notes B2011 2Zety Mohd NasirNo ratings yet

- (2021 Tax Memo) Year-End Tax Compliance RemindersDocument2 pages(2021 Tax Memo) Year-End Tax Compliance RemindersMary Joy BautistaNo ratings yet

- Flow ChartDocument2 pagesFlow ChartKristal JuditNo ratings yet

- AR 18 19 FINAL 6 5 2020 CompressedDocument68 pagesAR 18 19 FINAL 6 5 2020 CompressednitinrajhirawatNo ratings yet

- Applicable Study Material For November 19 ExamDocument3 pagesApplicable Study Material For November 19 ExamPrabhat Kumar MishraNo ratings yet

- NIFA Report 2018-20Document26 pagesNIFA Report 2018-20zaka khanNo ratings yet

- Week 6 Financial Accoutning Homework HWDocument7 pagesWeek 6 Financial Accoutning Homework HWDoyouknow MENo ratings yet

- BE2015 Guidebook 2Document84 pagesBE2015 Guidebook 2ContenderCNo ratings yet

- Declaration To Hafele Customers 194QDocument2 pagesDeclaration To Hafele Customers 194QBhavesh PatelNo ratings yet

- Bsa 2105 Atty. F. R. Soriano Value-Added TaxDocument2 pagesBsa 2105 Atty. F. R. Soriano Value-Added Taxela kikayNo ratings yet

- 2023 - AST - 7000000066219100 - 87442168 - 2023 - AST - FRPPK9574Q - Order Us 147 - 1063432472 (1) - 27032024Document6 pages2023 - AST - 7000000066219100 - 87442168 - 2023 - AST - FRPPK9574Q - Order Us 147 - 1063432472 (1) - 27032024atishrijiNo ratings yet

- Form12BB R539 Proof Submission Form PDFDocument4 pagesForm12BB R539 Proof Submission Form PDFSiva ThotaNo ratings yet

- ITR1 - Part 2 (Documents Required To File ITR1)Document3 pagesITR1 - Part 2 (Documents Required To File ITR1)gaurav gargNo ratings yet

- 00 - Checklist - My QuerriesDocument2 pages00 - Checklist - My Querriespave.scgroupNo ratings yet

- DonCarlos Bukidnon2019 Audit ReportDocument133 pagesDonCarlos Bukidnon2019 Audit ReportJennifer DabalosNo ratings yet

- AccountingDocument6 pagesAccountingBlue HourNo ratings yet

- Control RegisterDocument7 pagesControl RegisterManoj SharmaNo ratings yet

- United Paragon Mining Corporation SEC 17 Q June302020Document51 pagesUnited Paragon Mining Corporation SEC 17 Q June302020Jon DonNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Additions / Amendments: Item SubjectDocument16 pagesAdditions / Amendments: Item SubjectKen ChiaNo ratings yet

- Sales and Tax Declaration Form 2020Document1 pageSales and Tax Declaration Form 2020k act100% (1)

- Formatted Brgy. FormsDocument21 pagesFormatted Brgy. FormsBarangay CambaroNo ratings yet

- COA Acctg Cir Let 2007-001Document4 pagesCOA Acctg Cir Let 2007-001Misc EllaneousNo ratings yet

- Special Power of AttorneyDocument6 pagesSpecial Power of AttorneySally SiaotongNo ratings yet

- AZUELA, RICHARD (Inhouse 2020)Document8 pagesAZUELA, RICHARD (Inhouse 2020)Sally SiaotongNo ratings yet

- Notes To Financial StatementDocument8 pagesNotes To Financial StatementSally SiaotongNo ratings yet

- Mother of Perpetual Hel Funeral Homes: Notes To Financial StatementDocument9 pagesMother of Perpetual Hel Funeral Homes: Notes To Financial StatementSally SiaotongNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Tax1-BIR Ruling 13-2004 (Headquarters Exempt)Document4 pagesTax1-BIR Ruling 13-2004 (Headquarters Exempt)SuiNo ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Public Finance Management Act (Chapter 22-19)Document54 pagesPublic Finance Management Act (Chapter 22-19)Justice MurapaNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiVishalNo ratings yet

- LIFEBLOOD THEORY - Taxing The People and Their Property Is NECESSITY THEORY - The Power To TaxDocument12 pagesLIFEBLOOD THEORY - Taxing The People and Their Property Is NECESSITY THEORY - The Power To TaxStephen SalemNo ratings yet

- Invoice INV-0038Document1 pageInvoice INV-0038Rabbie LeguizNo ratings yet

- Tax Investment Incentives: Atxb223 Malaysian Taxation Ii 1Document25 pagesTax Investment Incentives: Atxb223 Malaysian Taxation Ii 1arha_86867820100% (1)

- Bonus StatementDocument1 pageBonus StatementSonu Sharma Club fanNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingDocument1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingImran BashaNo ratings yet

- Rajasthan - State FormatDocument9 pagesRajasthan - State FormatvjvksNo ratings yet

- Mepco Online BillDocument2 pagesMepco Online BillArslan ChaudharyNo ratings yet

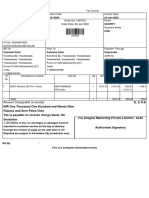

- INR One Thousand One Hundred and Ninety Nine Rupees and Zero Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EDocument1 pageINR One Thousand One Hundred and Ninety Nine Rupees and Zero Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EKamlesh PatelNo ratings yet

- Sec 35 AcDocument14 pagesSec 35 Acshraddha_ghag3760No ratings yet

- Global FinanceDocument11 pagesGlobal Financefiji joseNo ratings yet

- 5 Taxpayer's RemediesDocument5 pages5 Taxpayer's RemediesYarah MNo ratings yet

- Benefits. by of Sales: 2020. SuperannuationDocument1 pageBenefits. by of Sales: 2020. SuperannuationArya RoshanNo ratings yet

- 7198 3Document1 page7198 3aravind029No ratings yet

- BIR RMO No. 6-2021Document5 pagesBIR RMO No. 6-2021Earl PatrickNo ratings yet

- Certificate of Final Tax Withheld at SourceDocument7 pagesCertificate of Final Tax Withheld at Sourcegloryfe almodalNo ratings yet

- Sri Kathyayani Medical & Surgicals: Credit SL 73826Document2 pagesSri Kathyayani Medical & Surgicals: Credit SL 73826Srinivasateja ReddyNo ratings yet

- SS Flat RateDocument1 pageSS Flat RaterohitNo ratings yet

- TDS Return Forms 24Q, 26Q, 27Q, 27EQ: How To Download, Due DatesDocument6 pagesTDS Return Forms 24Q, 26Q, 27Q, 27EQ: How To Download, Due DatesJayesh WaghNo ratings yet

- 02 Chap19 Gruber - Tax IncidenceDocument36 pages02 Chap19 Gruber - Tax IncidenceSagar ChowdhuryNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Lesson 6 TaxationDocument10 pagesLesson 6 TaxationJosiah Samuel EspanaNo ratings yet