Professional Documents

Culture Documents

FT - Oil and Gas 1 PDF

Uploaded by

Yash GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FT - Oil and Gas 1 PDF

Uploaded by

Yash GuptaCopyright:

Available Formats

FINANCIAL TIMES

Oll&Gllsln<lu<try

Oilindusrry reels fromhistork

crash

Foor<Mrtssllilll' ligh! onooc:e -mlghlvsecr01

riowur'Mler<ieq,

0 0 0 1111

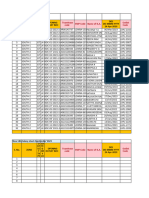

The firstholf of2020 hasheen brutol

fortheoilindustry:globaldemand

droppedalmostalhirdatone sta.ge.a

marketsharewarbrough1an

onslaughtofSaudicrudeandUSprices

collapsedbelowzeroforthe ftrsttime

OilprDducers"recentsecond-quartu

earningsreflectthisdamage.withboth

globalsupermajorsand U5

independentswritingdownassetsand

posting huge losses

Asrhechartsbelowshow,deep

~ ~~:~ec1~

1

"J:::;~;:a~:~:; balance

sheets.sac rificingoutputgrowthtodo

from upstream exploration and

prDductiontodownstream refining,the

coronav·ruspandem·c,p ·c ,and

unprc.:edentedvolatilityhascaused

ha,·oc.Despiteitsrecent recovery.

crudeisstilltradingataboutathird

belowlasiyear'saverageprice

A mighty industry has shrunk Where

onc eenergyba1tledfo rsupremacyin

rheS&P500"smarke1capita lisation.i1S

sliarehasnowdwindledto lessthan3

"Nerlncome

Across thewo rld, producers'bottom

lineswere hit hard in thesecond

quarter.Thecol lapseinprlcecoupled

withthel!Vaporntionindemandmeant

companiesswungfromhealthyprofirs

in 201 9todeep losses in2020,inmany

caseswiprecedemed in cheir

magnitude

Improvedpricesinthe thirdquar1er

willallowmany tot umaprofitagain

But for sorneitwill betoolate,asthe

des!ructiona lreadywrought leaves

thern strugglingwidergrowingdebt

pl lesa ndv,ithless money topay

shareholdersand res1oreinvest ors'

faith

Cl)

Capital expenditure

Companies haveresponded bycutling

costswherevertheycan.Planstodrill

morewellsandincreaseproduction

havelargelyheenaban donedas

prDducersfocuson tighteningtheir

beltsat theexpenseoffuture

expansion. The nurnber of rigs

operatinglntheUSisdownthree•

quarterscomparedwithlast;,ear

DriUingfewerwells tDdayme ans

prDducing lessoil tomorrow.

Companies"capacityforgrowthhas

beendiminished. txecmiveshave

acknowledgedthattheera of rampent

expansion intheUSshalepatch.which

ha s driven Americatobecome the

world's largest oilproducer,maybe

Refining

Thedownstreampart ofthe majon·

businesses-whererawcrude is

relinedintopetrol, dieseljetfuel and

otherproducrn-hasalsorome under

significant pressure.

Demandfortheruelrheyproducewas

slashedaspeoplestopped drivinga nd

flying. Andnow.as th e priceofcrude

recovers.ithnsdonesoatamuch

quickerpacethandemand and prices

forreftnedproducts.That hassqueezed

margins- especially in Europe's

ageingplams.which sellfuel intoa

stagnating market

Writedown s

Theeffectsof thepandemicwillbe

long-lasting,bringingthe peakinglobal

oil demandcloser(some analysts think

ithasalreadypass..d).Thishasforced

com panlestogra pplewith thefact that

manyof!heirassets may nowbe worrh

alotlessthantheywereayearago

l'ricess1aying\ower forlonge r will

mean muchoftheiroil willnormakeil

out ofthe ground

Thathas madeimpairmentsa them eof

recentmomhs, withcompanieswriting

downtensofbillionsofdollars'worth

ofassetsastheyprepareforalessoily

futu re.

S&Pequityshare

Energycompanies.once amongthe

world 's mostvaluable,havesuffered a

rapidfall fromgrac,,_Foryears.

F.xxonMobilboastedthernamleof

biggestpublidytradedcompanyinthe

world.butltisnowdwarfedby

technologygroupssucha sAmazon,

Apple and Google

Thesector hasshrunkrapidly inrecenr

years.ln2008. energy stocksmade up

about16percemofthevalueof

companiesontheS&l'500.Theynow

accountfor just 2.6percem

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Answer Key PDFDocument27 pagesAnswer Key PDFYash GuptaNo ratings yet

- Answer Key PDFDocument27 pagesAnswer Key PDFYash GuptaNo ratings yet

- 5 6087175265069301925Document3 pages5 6087175265069301925Yash GuptaNo ratings yet

- IPTC 2021 Call For Papers Brochure PDFDocument14 pagesIPTC 2021 Call For Papers Brochure PDFYash Gupta100% (1)

- Gupta 2020Document6 pagesGupta 2020Ricky SimanjuntakNo ratings yet

- Gyu LrtterDocument1 pageGyu LrtterYash GuptaNo ratings yet

- Norrman 2016Document7 pagesNorrman 2016Yash GuptaNo ratings yet

- Assignment 5Document8 pagesAssignment 5Yash GuptaNo ratings yet

- Sennheiser-Warranty. CB1198675309 PDFDocument1 pageSennheiser-Warranty. CB1198675309 PDFNIKHILNo ratings yet

- Unit 2 Petrology (Metamorphic Rocks)Document47 pagesUnit 2 Petrology (Metamorphic Rocks)Yash GuptaNo ratings yet

- Yao 2018Document12 pagesYao 2018Yash GuptaNo ratings yet

- Syllabus CPCDocument1 pageSyllabus CPCYash GuptaNo ratings yet

- Nano-Composite PPD for Waxy Crude OilDocument32 pagesNano-Composite PPD for Waxy Crude OilYash GuptaNo ratings yet

- 10.0000@www - Onepetro.org@conference paper@ISOPE I 19 365Document8 pages10.0000@www - Onepetro.org@conference paper@ISOPE I 19 365Yash GuptaNo ratings yet

- Setting Operating Conditions: Gas ChromatographyDocument1 pageSetting Operating Conditions: Gas ChromatographyYash GuptaNo ratings yet

- Gyanendra Sharma's Resume for Oil & Gas PositionsDocument2 pagesGyanendra Sharma's Resume for Oil & Gas PositionsYash GuptaNo ratings yet

- Suggestions ModifedDocument3 pagesSuggestions ModifedYash GuptaNo ratings yet

- Minor ReportDocument27 pagesMinor ReportYash GuptaNo ratings yet

- Projections of PlanesDocument16 pagesProjections of PlanesYash GuptaNo ratings yet

- Draw Prism and Pyramid Projections GuideDocument15 pagesDraw Prism and Pyramid Projections GuideYash GuptaNo ratings yet

- Nano-Composite PPD for Waxy Crude OilDocument32 pagesNano-Composite PPD for Waxy Crude OilYash GuptaNo ratings yet

- Minor ReportDocument27 pagesMinor ReportYash GuptaNo ratings yet

- Breakfast Lunch Snacks Dinner Monday: For Any Queries Contact: Swapnil Gupta (Room No. 105)Document1 pageBreakfast Lunch Snacks Dinner Monday: For Any Queries Contact: Swapnil Gupta (Room No. 105)Yash GuptaNo ratings yet

- Setting Operating Conditions: Gas ChromatographyDocument1 pageSetting Operating Conditions: Gas ChromatographyYash GuptaNo ratings yet

- Drilling McqsDocument7 pagesDrilling Mcqsfaisalnoorafridi71% (7)

- Gupta Y M06 Assignment PaperDocument2 pagesGupta Y M06 Assignment PaperYash GuptaNo ratings yet

- Folds & FaultsDocument118 pagesFolds & FaultsYash GuptaNo ratings yet

- Gupta Y M02 Assignment01Document3 pagesGupta Y M02 Assignment01Yash GuptaNo ratings yet

- Liquid-Liquid Extraction ExamplesDocument31 pagesLiquid-Liquid Extraction ExamplesJeffersonPalaciosNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Contract Costing Sem IVDocument17 pagesContract Costing Sem IVHarshit DaveNo ratings yet

- Calculating product costs using activity-based costing vs traditional methodsDocument4 pagesCalculating product costs using activity-based costing vs traditional methodsKamran ArifNo ratings yet

- Synopsis: "A Study On Inventory Management at Andhra Pradesh Southern Power Distribution Company LTD, TirupathiDocument5 pagesSynopsis: "A Study On Inventory Management at Andhra Pradesh Southern Power Distribution Company LTD, Tirupathisree anugraphicsNo ratings yet

- Cost Sheet Direct CostgDocument19 pagesCost Sheet Direct CostgLOKESH KUMARNo ratings yet

- Grade 8 Profit-Loss and Discounts: Answer The QuestionsDocument10 pagesGrade 8 Profit-Loss and Discounts: Answer The QuestionssnehaNo ratings yet

- Cañon EodDocument58 pagesCañon EodJonatan AlmeidaNo ratings yet

- Cevas Theorem Written by Sir Abdul BasitDocument3 pagesCevas Theorem Written by Sir Abdul BasitSHK-NiaziNo ratings yet

- Synchro-Cog HT: Synchronous Drive BeltDocument32 pagesSynchro-Cog HT: Synchronous Drive BeltDavid BaylissNo ratings yet

- Course Syllabus-International Economics IDocument6 pagesCourse Syllabus-International Economics IbashatigabuNo ratings yet

- Trading The News Five ThingsDocument39 pagesTrading The News Five ThingsRuiNo ratings yet

- This Study Resource WasDocument3 pagesThis Study Resource WasCHAU Nguyen Ngoc BaoNo ratings yet

- Form MGT 7 01032021 SignedDocument14 pagesForm MGT 7 01032021 SignedMohak GuptaNo ratings yet

- Different Types of LoomDocument19 pagesDifferent Types of LoomAhmad Rasheed100% (1)

- Ground Floor Plan Second Floor Plan: Scale 1: 100 METERS Scale 1: 100 METERSDocument5 pagesGround Floor Plan Second Floor Plan: Scale 1: 100 METERS Scale 1: 100 METERSBon HarperNo ratings yet

- SAE Flat Washer Dimensions & Specifications - AFT FastenersDocument1 pageSAE Flat Washer Dimensions & Specifications - AFT FastenersKai LinNo ratings yet

- Solution Manual For Introduction To Finance 17th Edition Ronald W MelicherDocument24 pagesSolution Manual For Introduction To Finance 17th Edition Ronald W MelicherCrystalPhamfcgz95% (41)

- 4 Iw 6GN1 3Document1 page4 Iw 6GN1 3lebanese.intlNo ratings yet

- NEGOTIN FINAL EXAM QuestionDocument1 pageNEGOTIN FINAL EXAM Questionjan bert0% (1)

- Managerial decisions in various market structuresDocument2 pagesManagerial decisions in various market structuresdeeznutsNo ratings yet

- DVC Company ProfileDocument10 pagesDVC Company ProfileDv AccountingNo ratings yet

- Ecotrics (PR) Panel Data ReferenceDocument22 pagesEcotrics (PR) Panel Data ReferenceArka DasNo ratings yet

- Database Calon PegawaiDocument12 pagesDatabase Calon PegawainadyaNo ratings yet

- W5 Case Study Cross-Cultural Conflicts in The Corning-Vitro Joint Venture PDFDocument4 pagesW5 Case Study Cross-Cultural Conflicts in The Corning-Vitro Joint Venture PDFsyafiq basrah0% (1)

- LT101A MP Series1 ManualDocument2 pagesLT101A MP Series1 ManualДмитро СелютінNo ratings yet

- Formula Sheet: FV (Continuous Compounding) PVDocument5 pagesFormula Sheet: FV (Continuous Compounding) PVTanzim HudaNo ratings yet

- InflationDocument40 pagesInflationmaanyaagrawal65No ratings yet

- Form Po-001Document2 pagesForm Po-001Marnhy SNo ratings yet

- Pre-Export Certificate Program for Middle East and African MarketsDocument35 pagesPre-Export Certificate Program for Middle East and African MarketsKANINTA YUDHANo ratings yet

- ARCHITECTURAL DESIGN SITE PLANNINGDocument5 pagesARCHITECTURAL DESIGN SITE PLANNINGMarnie Shane GamezNo ratings yet

- LBA Salary Sheet September'2023 SouthDocument28 pagesLBA Salary Sheet September'2023 SouthManojNo ratings yet