Professional Documents

Culture Documents

PT Indosat TBK: 1H20: Splendid Operating Profit

Uploaded by

Sugeng YuliantoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PT Indosat TBK: 1H20: Splendid Operating Profit

Uploaded by

Sugeng YuliantoCopyright:

Available Formats

PT Indosat Tbk (ISAT) 12 August 2020

1H20: Splendid Operating Profit

INDONESIA | TELECOMMUNICATION | COMPANY UPDATE BUY

MARKET PRICE IDR 2,350

1H20 Financial Results TARGET PRICE IDR 3,300

ISAT reported revenues of IDR 13,45 tn, up 9.4% YoY, 6.2% QoQ, largely in line with our POTENTIAL UPSIDE +40.4%

forecast. Net Loss came at IDR341.1 bn, slightly bigger than a net loss of IDR331.9 bn in 1H19.

COMPANY DATA

O/S SHARES (BN) : 5.43

Revenues from the cellular segment jumped 11.8% YoY, as an increase in Data revenue

MARKET CAP (IDR TN) : 12.99

(+27.8% YoY), offset the vanishing revenues in voice and SMS (-35.2% YoY). MIDI revenues MARKET CAP (USD BN) : 0.88

crept up 2.4% YoY as a result of the revenue increase in overall services. Fixed telecom 52 - WK HI/LO (IDR) : 3,950/1,190

revenues plummeted 19.8% YoY due to a decline in incoming traffic. 3M AVG. VOLUME (MN SHARES): 8.54

PAR VALUE (IDR) : 100

Costs were tightly kept in check with operating expenses (Opex) inched up only 7.6% YoY. as

MAJOR SHAREHOLDERS, %

a spike in Personnel Expense (+43.1% YoY) was canceled out by a 36.6% YoY drop in General OOREDO ASIA PTE LTD 65.00%

and Administration (G&A) expense. REPUBLIC OF INDONESIA 14.29%

NORGES BANK 0.66%

Operating Profit skyrocketed 36.5% YoY and 354.1% QoQ. EBITDA reached IDR 5.4 tn, a INVESCO LTD 0.33%

22.5% improvement YoY, leading to EBITDA Margin of 40.4%, an improvement by 4.3 ppt DIMENSIONAL FUND ADVISORS LP 0.31%

ALLIANZ SE 0.20%

from last year.

PRICE VS. JCI

ISAT continues to have a strong and healthy balance sheet with net debt to EBITDA improved

to 1.35x vs 2.81x in 1H19.

Solid Operational Performance

Cellular subscribers in 1H20 stood at 57.2 million (+0.9% YoY). Throughout 2Q20, subscribers

increased by 1.8% (QoQ) thanks to better product offerings combined with the improved

network quality.

Blended Average Revenue per User (ARPU) increased to IDR31.400, from previously

IDR27.900 in 1H 2019. Data traffic also surged 60.8% YoY to 2,216 petabytes. Average Source: PSI Research, Bloomberg

Minutes of Usage (MOU) per customer shrank to 29.5 minutes (-16.8% YoY), in line with the

negative industry trend of traditional voice services. KEY FINANCIALS

IDR Bn FY18 FY19 FY20F FY21F FY22F

Capital Expenditure (Capex) was down 22.4% YoY due to a slower rollout at the start of this Revenue 23,140 26,118 28,211 30,229 32,414

year. ISAT accelerated its network rollout in 2Q20 by quadrupling its Capex to IDR2.63 tn EBITDA 7,784 9,856 11,161 11,622 12,670

from IDR634 bn in 1Q20, indicating its commitment to meet the FY2020 Capex guidance (2,404) 1,569 (1,243) (1,130)

between IDR 8.5 tn to IDR 9.5 tn. (442) 289 (229) (208) (194)

(3.8) 10.2 (10.3) (11.3) (12.1)

As of June 2020, ISAT operated 124,944 BTS (+44.7% YoY) fewer than the number of BTS P/BV, x

(133,186) it operated in 1Q20 as the company shifted its focus on 4G expansion by adjusting

ROE, % (19.8) 11.4 (9.9) (9.7)

frequency allocation and adding more BTS. In 1H20, ISAT increased the number of 4G BTS to

ROA, %

52,776 while at the same time reducing, the number of 3G BTS (-11% QOQ), and 2G BTS (- 0

10.76% QoQ).

Source: Phillip Sekuritas Indonesia Research

Valuation

We reaffirm our Buy recommendation on ISAT but raise our target price to IDR 3,300 (from Valuation Method: Discounted Cash Flow (DCF)

IDR 3,150 previously) to reflect ISAT strong growth momentum in 2020-22F and its healthier

balance sheet. Our new target price offers 40.4% upside to the current price and implies Stefanus Adrian Chandra (+62 57900800)

FY20F EV/EBITDA of 4.16x which slightly above ISAT 5 year historical average of 4.0x. The risk stefchandra@phillip.co.id

to our call is slower revenue growth, tighter industry competition, and higher cost from

network expansion.

Page | 1 | PHILLIP SEKURITAS INDONESIA

PT INDOSAT TBK COMPANY UPDATES

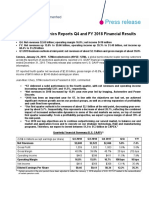

Figure 1 – ISAT 6M20 Earning Reviews

(IDR Bn) 6M19 6M20 %YOY 1Q20 2Q20 %QOQ %FY20F

Revenue 12,292 13,451 9.4% 6,523 6,928 6.2% 48%

Operating Profit 797 1,088 36.5% 196 892 355% 83%

EBITDA 4,433 5,430 22.5% 2,380 3,050 28.2% 49%

Net Income (332) (341) (2.8%) (606) 265 N/A

Revenue Breakdown

Data 7,308 9,342 27.8% 4,397 4,945 12.5%

Voice & SMS 1,866 1,208 (35.2%) 641 567 (11.5%)

Others 2,392 1,647 (31,1%) 840 807 (3.9%)

MIDI 1,988 2,036 2.4% 1,008 1,028 2.0%

Fixed Telecommunication 342 274 (19.8%) 144 130 (9.5%)

Margins

Operating Margin 6.5% 8.1% 3.0% 12.9%

EBITDA Margin 36.1% 40.4% 36.5% 44.0%

Net Margin (2.7%) (2.5%) (9.3%) 3.8%

Source: Company, Phillip Sekuritas Indonesia Research

Figure 2 – ISAT Quarterly EBITDA (Bn) and EBITDA Margin Figure 3 – ISAT Net Debt to EBITDA

*Net debt excludes obligation under financial lease

Source: Company, Phillip Sekuritas Indonesia Research

Figure 4 – ISAT EV/EBITDA BAND

Source: Company, Phillip Sekuritas Indonesia Research

Page | 2 | PHILLIP SEKURITAS INDONESIA

PT INDOSAT TBK COMPANY UPDATES

Financials

FYE 2018A 2019A 2020F 2021F 2022F

Income Statement (IDR Bn)

Revenue 23,140 26,118 28,211 30,229 32,414

COGS (Ex D&A) 12,043 12,343 13,123 14,097 15,086

SG & A and Others (Ex D&A) 4,596 3,919 4,117 4,510 4,658

D&A 8,249 9,570 9,661 10,081 10,873

Operating profit / EBIT (465) 286 1,310 1,541 1,798

EBITDA 7,784 9,856 11,161 11,622 12,670

Interest expense 2,125 2,761 2,779 2,846 2,988

Non-Operating Income (74) 120 0 0 0

EBT 39,128 43,110 48,308 54,433 60,109

Tax expenses (578) (43) (367) (326) (297)

Minority Interest 319 61 141 151 162

Net Income (2,404) 1,569 (1,243) (1,130) (1,054)

Revenue Breakdown (IDR Bn)

Data 12,519 15,376 17,643 19,928 22,001

SMS & Voice 6,073 3,416 2,187 1,571 1,272

Others 4,658 4,747 4,664 4,695 4,743

MIDI 4,383 4,781 5,033 5,245 5,474

Fixed Telecommunication 729 662 643 623 605

Balance Sheet (IDR Bn)

Cash and equivalents 1,045 5,881 3,028 1,723 1,848

Account Receivable 2,963 3,043 3,287 3,522 3,777

Inventories 48 29 31 34 36

PPE - net 36,899 42,753 45,807 47,836 49,296

Other assets 12,184 11,106 11,272 11,481 11,502

Total assets 53,140 62,813 63,426 64,595 66,459

Account Payable 7,779 8,962 9,528 10,236 10,954

Accrued Expenses 3,322 4,187 4,398 4,819 4,977

Short Term Debt 550 0 0 4,978 4,588

Current Maturities 5,428 5,675 7,846 4,650 7,941

Long Term Debt 15,075 15,932 14,085 13,435 12,494

Other Liability 8,850 14,350 14,962 14,850 14,771

Total liabilities 41,003 49,106 50,820 52,968 55,724

Total Equity 12,136 13,707 12,606 11,627 10,734

Source: PSI Research

Page | 3 | PHILLIP SEKURITAS INDONESIA

PT INDOSAT TBK COMPANY UPDATES

FYE 2018A 2019A 2020F 2021F 2022F

Cash Flow Statement (IDR Bn)

Net income (2,404) 1,569 (1,243) (1,130) (1,054)

Depreciation & Amortization 8,249 9,570 9,661 10,081 10,873

Changes in WC 4,036 3,479 346 520 479

Other 433 28 753 74 108

Cash Flow from Operations 9,434 14,786 9,517 9,655 10,483

Capex (8,534) (9,567) (12,695) (12,092) (12,317)

Other (3,182) 0 0 0 0

Cash Flow from Investing (11,716) (10,406) (12,695) (12,092) (12,317)

Change in Debt 1,864 554 325 1,132 1,959

Dividend (397) 0 0 0 0

Dividend to Minority Interest (80) 0 0 0 0

Other 265 0 0 0 0

Cash Flow from Financing 1,653 457 325 1,132 1,959

Net change in cash (630) 4,836 (2,853) (1,305) 125

Cash Ending 1,045 5,881 3,028 1,723 1,848

Valuation Ratios

P/E (X) (3.8) 10.2 (10.3) (11.3) (12.1)

P/B (X) 0.8 1.2 1.0 1.1 1.2

EV/EBITDA (X) 4.3 4.2 3.7 3.8 3.6

Dividend Yield 0.0 0.0 0.0 0.0 0.0

Growth & Margins

Growth

Revenue (22.7%) 12.9% 8.0% 7.2% 7.2%

Operating profit (111.5%) N/A 357.7% 17.6% 16.7%

EBITDA (39.6%) 26.6% 13.2% 4.1% 9.0%

Net Income (311.6%) 165.3% 179.2% 9.1% 6.7%

Margins

Operating Margin (2.0%) 1.1% 4.6% 5.1% 5.5%

EBITDA Margin 33.6% 37.7% 39.6% 38.4% 39.1%

Net Profit Margin (10.4%) 6.0% (4.4%) (3.7%) (3.3%)

Key ratios

ROA (4.5%) 2.5% (2.0%) (1.7%) (1.6%)

ROE (19.8%) 11.4% (9.9%) (9.7%) (9.8%)

Net Gearing 173.5% 157.6% 174.0% 198.4% 233.1%

Per share data (IDR)

EPS (442) 289 (229) (208) (194)

DPS 73 0 0 0 0

BVPS 2,233 2,523 2,320 2,140 1,975

Source: Phillip Sekuritas Indonesia Research

Page | 4 | PHILLIP SEKURITAS INDONESIA

PT INDOSAT TBK COMPANY UPDATES

Important Information

Rating for Sectors:

Overweight : We expect the industry to perform better than the primary market index (JCI) over the next 12

months.

Neutral : We expect the industry to perform in line with the primary market index (JCI) over the next 12

months.

Underweight : We expect the industry to under-perform the primary market index (JCI) over the next 12 months.

Rating for Stocks:

Buy : The stock is expected to give total return (price appreciation + dividend yield) of > +10% over the next.

12 months.

Hold : The stock is expected to give total return of > 0% to ≤ +10% over the next 12 months.

Sell : The stock is expected to give total return of < 0% over the next 12 months.

Outperform : The stock is expected to do slightly better than the market return. Equal to “moderate buy”

Underperform : The stock is expected to do slightly worse than the market return. Equal to “moderate sell”

Analyst Certification

The research analyst(s) primarily responsible for the preparation of this research report hereby certify that all of the views expressed

in this research report accurately reflect their personal views about any and all of the subject securities or issuers. The research

analyst(s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific

recommendations or views expressed in this research report.

Disclaimers

This document has been prepared for general circulation based on information obtained from sources believed to be reliable. But

we do not make any representations as to its accuracy or completeness. Phillip Sekuritas Indonesia (PSI) accept no liability

whatsoever for any direct or consequential loss arising from any use of this document or any solicitations of an offer to buy or sell

any securities. PSI and its directors, officials and/or employees may have positions in, and may affect transactions in securities

mentioned herein from time to time in the open market or otherwise, and may receive brokerage fees or act as principal or agent

in dealing with respect to these companies. PSI may also seek investment banking business with companies covered in its research

reports. As a result investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this

report. Investors should consider this report as only a single factor in making their investment decision.

Disclosure

Phillip Sekuritas Indonesia, or persons associated with or connected to Phillip Sekuritas Indonesia, including but not limited to its

officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large

number of corporations in Indonesia and worldwide, including but not limited to commercial / investment banking activities

(including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Sekuritas

Indonesia, or persons associated with or connected to Phillip Sekuritas Indonesia, including but not limited to its officers, directors,

employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s)

of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally,

Phillip Sekuritas Indonesia, or persons associated with or connected to Phillip Sekuritas Indonesia, including but not limited to its

officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to

such companies and investments or related investments, as may be mentioned in this report.

Investment Banking and Advisory activities: In the preceding 12 months, Phillip Sekuritas Indonesia and/or an affiliate is not

involved in any investment banking activities with PT. Indosat Tbk.

Market Maker and Liquidity Provider: Phillip Sekuritas Indonesia and/or an affiliate is not a market maker / liquidity provider in

securities issued by PT. Indosat Tbk.

Other Financial Interests: Phillip Sekuritas Indonesia owns 0 shares in PT. Indosat Tbk.

Analyst’s Disclosure:

Share Ownership: The analyst who wrote and published this report owns 0 shares in PT. Indosat Tbk.

Affiliation: The analyst who wrote and published this report is not affiliated with PT. Indosat and any of the affiliates of PT. Indosat

Tbk.

Page | 5 | PHILLIP SEKURITAS INDONESIA

PT INDOSAT TBK COMPANY UPDATES

Management

Jasa Adhimulya +62 21 57 900 800 Muhammad Syahrizannas +62 21 57 900 800

(Head, Research - Equities) jamulya@phillip.co.id (Research Administrator) Ichan@phillip.co.id

Macro | Strategy | Banks Cement| Precast Telecommunication

Jasa Adhimulya +62 21 57 900 800 Anugerah Zamzami Nasr +62 21 57 900 800 Stefanus A. Chandra +62 21 57 900 800

jamulya@phillip.co.id anugerah.zamzami@phillip.co.id stefchandra@phillip.co.id

Technical Analyst Plantation

Muhammad Syahrizannas Michael Filbery +62 21 57 900 800

ichan@phillip.co.id michael.filbery@phillip.co.id

AUSTRALIA CAMBODIA CHINA

PhillipCapital Limited Phillip Bank PLC Phillip Financial Advisory (Shanghai) Co Ltd

Level 10, 330 Collins Street #27DEF, Preah Monivong Blvd - Sangkat No. 436 Heng Feng Road - Greentech Tower Unit

Melbourne VIC 3000 SrahChork, Khan Daun Penh 604

Australia Phnom Penh, Cambodia Shanghai, China

Tel (61) 3 8633 9800 Tel (855) 23 862 777 Tel (86-21) 5169 9400

Fax (61) 3 9629 8882 Fax (855) 23 862 727 Fax (86-21) 6353 2643

Website: www.phillipcapital.com.au Website: www.phillipbank.com.kh Website: www.phillip.com.cn

FRANCE HONG KONG INDIA

King &Shaxson Capital Limited Phillip Securities (HK) Ltd PhillipCapital (India) Private Limited

3rd Floor, 35 Rue de la Bienfaisance 75008 11/F United Centre 95 Queensway No.1, 18th Floor, Urmi Estate

Paris France Hong Kong 95, Ganpatrao Kadam Marg, Lower Parel

Tel (33-1 45633100) Tel (852) 2277 6600 WestMumbai 400-013 - Maharashtra, India

Fax (33-1) 45636017 Fax (852) 2868 5307 Tel 1 (91) 22 2483 1919

Website: www.kingandshaxson.com Websites: www.phillip.com.hk Tel 2 (91) 22 2300 2999

Toll Free No. 1800 22 1331

Fax (91) 22 2300 2969

Website: www.phillipcapital.in

INDONESIA JAPAN UNITED KINGDOM

PT Phillip Sekuritas Indonesia Phillip Securities Japan, Ltd. King &Shaxson Capital Limited

ANZ Tower Level 23B, 4-2 NihonbashiKabuto-cho Chuo-ku, 6th Floor, Candlewick House,

JlJendSudirmanKav. 33A Tokyo 103-0026 120 Cannon Street,

Jakarta 10220 – Indonesia Tel (81-3) 3666 2101 London, EC4N 6AS

Tel (62-21) 5790 0800 Fax (81-3) 36678806 Tel (44-20) 7426 5950

Fax (62-21) 5790 0809 Website: www.phillip.co.jp Fax (44-20) 7626 1757

Website:www.phillip.co.id Website: www.kingandshaxson.com

MALAYSIA SINGAPORE SRI LANKA

Phillip Capital Management SdnBhd Phillip Securities Pte Ltd Asha Phillip Securities Ltd

B-3-6 Block B Level 3 Megan Avenue II, 250 North Bridge Road, #06-00 Raffles City Tower 2nd Floor, Lakshmans Building, No. 321

No. 12, Jalan Yap Kwan Seng, 50450 Singapore 179 101 Galle Road, Colombo 03

Kuala Lumpur Tel (65) 6533 6001 (General) Sri Lanka

Tel (603) 2162 8841 Fax (65) 6535 3834 Tel (94) 11 2429 100

Fax +603 2166 5099 Website: www.phillip.com.sg Fax (94) 11 2429 199

Website: www.poems.com.my Website: www.ashaphillip.net

THAILAND TURKEY UNITED ARAB EMIRATES

Phillip Securities (Thailand) Public Co. Ltd Phillip Capital MenkulDegerler Phillip Futures DMCC

15th Floor, Vorawat Building, 849 Silom Road, Silom, Dr. CemilBengu Cad. Hak Is Merkezi Member of the Dubai Gold and Commodities

Bangrak No. 2 kat 6A. Caglayan Exchange (DGCX)

Bangkok 10500 Thailand 34403 Istanbul, Turkey 1202, Jumeirah Lake Towers (JLT)

Tel (66-2) 635 1700 / 268 0999 Tel (0212) 296 8484 P.O Box 212291, Dubai, UAE

Fax (66-2) 268 0921 Fax (0212) 233 6969 Tel (971) 433 25052

Website: www.phillip.co.th Website: www.phillip.com.tr Fax (971) 433 28895

Website: www.phillip.in

UNITED STATES

Phillip Capital Inc

141 W Jackson Blvd Ste 3050

Chicago Board of Trade Building

Chicago, IL 60604 USA

Tel 1 (312) 356 9000

Fax 1 (312) 356 9005

Website: www.phillipcapital.com

Page | 6 | PHILLIP SEKURITAS INDONESIA

PT INDOSAT TBK COMPANY UPDATES

ANZ Tower Level 23B, Jl. Jendral Sudirman Kav 33A, Jakarta, 10220 - Indonesia

Telp. (62-21) 57 900 800, Fax. (62-21) 57 900 809, Email: customercare@phillip.co.id Website: www.phillip.co.id | www.poems.co.id | www.poems.web.id

Komp. Ruko Mega Grosir Cempaka Mas Mangga Dua

Jl. Let. Jend. Soeprapto Ruko Bahan Bangunan Mangga Dua Blok F1/8

Blok D No. 7 Jakarta, 10640 Jl. Mangga Dua Selatan Jakarta 10730

Telp. (021) 4288 5051 / 50; Fax. (62-21) 4288 5050 Telp. (021) 6220 3589; Fax. (021) 6220 3602

E-Mail: franky@phillip.co.id E-Mail: yosen.tjong@phillip.co.id

Puri Roxy

Metro Park Residence Tower Milan LG 16 Pusat Niaga Roxy Mas Blok B2/2

Jl. Pilar Mas Raya Kav. 28 – Jakarta Barat, 11520 Jl. KH. Hasyim Ashari - Jakarta Barat

Telp. (021) 2258 1073 Telp. (021) 6386 8308; Fax. (021) 6333 420

E-Mail: hendra.k@phillip.co.id E-Mail: dicky@phillip.co.id

Pantai Indah Kapuk Taman Palem

Jl. Pantai Indah Barat Rukan Ekslusif BGM Blok B-6 Citypark Business District, Blok B2 No. 12, Cengkareng, Jakbar 11730

Telp. (021) 5694 5791/92/93; Fax. (021) 56945790 Telp. (021) 22522147/48

E-Mail: pik.admin@phillip.co.id E-Mail: adminpalem@phillip.co.id

Tanah Abang Kelapa Gading

Pusat Grosir Metro Tanah Abang (PGMTA) Zona 3 Lt. 5, No. 001 Jl. K.H Hasyim, Tanah Abang Jl. Boulevard Raya Blok WB2/27 Kelapa Gading Jakarta Utara

- Jakarta Pusat 10250 Telp. (62-21) 7070 0050/4587/9264; Fax. (62-21) 453 2939;

Telp : (021) 5010 1638; Fax : (021) 3003 6748 E-Mail: tjandrabuana@phillip.co.id

E-Mail: tarjo.kapita@yahoo.com

Citra Garden 2 Alam Sutera

Komp. Citra – Blok A/12, Kalideres, JakBar, 11830 Ruko Prominence Blok 38 - G No. 18

Telp. (021) 5437 4635 Jl. Sutra Barat Boulevard Alam Sutra 15143, Tangerang

E-Mail: dtandy08@yahoo.com No. Telp : (021) 50314300

E-Mail: adminserpong@phillip.co.id

Purwokerto Yogyakarta

Jln. Perintis Kemerdekaan No. 38 Kantor Perwakilan (KP) BEI Yogyakarta

Purwokerto - Jawa Tengah, 53110 Jl. Mangkubumi No. 111 Yogyakarta

Telp. (0281) 626 899 Telp. (0274) 557367

E-Mail: haddy1812@gmail.com E-mail: sugiyanto@phillip.co.id

Semarang Tegal

Jl. Karang Wulan Timur No. 2 - 4 Semarang Kompleks Nirmala Square Blok C no.7

Indonesia Jl. YosSudarso - Tegal 52121

Telp. (024) 3555959; Fax. (024) 3513194 Telp. (0283) 340774

E-Mail: adminsmg@phillip.co.id E-mail: ary@phillip.co.id

Bandung Batam

Komp. Paskal Hypersquare Blok D-40 Kompleks Mahkota Raya

Telp. (022) 8606 0765; Fax : (022) 860 61 120 Blok A no. 10 Batam Centre, Kota Batam 29456, Kepri

E-Mail: adminbandung@phillip.co.id; felix@phillip.co.id Telp. (62-778) 748 3337/3030/3131; Fax. (62-778) 7483117

E-Mail: phillip_batam2@yahoo.com

Surabaya Pontianak

Jln. Flores No. 11 Surabaya, 60281 Kantor Perwakilan (KP) BEI Pontianak - Komplek Perkantoran Central Perdana Blok A2-A3

Telp. (031) 5015777; Fax. (031) 5010567 Jalan Perdana – Pontianak, 78124

E-Mail: kadim.phillip@gmail.com Telp. (0561) 8102257

E-Mail: andi.abdi@phillip.co.id

Jambi Denpasar

Jln. GR. Djamin Datuk Bagindo No. 56A Kantor Perwakilan (KP) BEI Denpasar

Jambi, 36142 Jl. P.B. Sudirman 10 X Kav. 2

Telp. (0741) 7555 699 Denpasar - Bali

E-Mail: mimi.phillip@yahoo.com Telp. (0361) 255 900

E-Mail: phillipdps@gmail.com

Bandar Lampung Palembang

Jl. Pangeran Diponegoro 36A - Bandar Lampung, 35214 Kantor Perwakilan (KP) BEI Palembang

Telp. (0721) 474 234; Fax. (0721) 474 108 Jalan Angkatan 45 No.13 - 14 – Palembang, 30137

E-Mail: kk_lampung@yahoo.com Telp. (0711) 564 092 60

E-Mail: peni@phillip.co.id

Manado Yogyakarta

Kantor Perwakilan (KP) BEI Manado – Ruko Mega Style, Blok 1C No. 9, Kompleks Mega Mas, Kantor Perwakilan (KP) BEI Yogyakarta

Jalan Pierre Tendean Boulevard – Manado, 95000 Jalan Mangkubumi No. 111, Yogyakarta – Jawa Tengah

Telp. (0431) 882 0390 Telp. (0274) 557 367

E-Mail: chlief@phillip.co.id E-Mail: sugiyanto@phillip.co.id

Page | 7 | PHILLIP SEKURITAS INDONESIA

PT INDOSAT TBK COMPANY UPDATES

Jayapura Banjarmasin

Kantor Perwakilan (KP) BEI Jayapura - Komp. Ruko Pasifik Permai Blok. H-19, Jayapura Jl. A. Yani Km. 5,5 No. 2A

99112, Papua Banjarmasin 70249

Telp. (0967) 532 414 Telp. (0511) 6744 204

E-Mail: fitria.novita@phillip.co.id E-Mail: yunisasmita@phillip.co.id

Ambon Medan

Kantor Perwakilan (KP)- BEI Ambon Kompleks Multatuli Indah

Jln. Philip Latumahina, No. 16, Ruko C. Jl. Multatuli Blok CC No. 5 & 6

Kel. Honipopu, Kec. Sirimau, Ambon 97115 Medan 20151

Telp. (0911) 382 3336 Telp. (061) 457 4033, 457 4055

E-Mail: rahma@phillip.co.id E-Mail: adminmedan@phillip.co.id

Page | 8 | PHILLIP SEKURITAS INDONESIA

You might also like

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Phillip Capital ISAT - Growth Momentum ContinuesDocument8 pagesPhillip Capital ISAT - Growth Momentum Continuesgo joNo ratings yet

- PT XL Axiata TBK: Digital FocusDocument8 pagesPT XL Axiata TBK: Digital FocusTeguh PerdanaNo ratings yet

- Telkom Indonesia showing strength across segmentsDocument6 pagesTelkom Indonesia showing strength across segmentsMochamad IrvanNo ratings yet

- PT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsDocument9 pagesPT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsSugeng YuliantoNo ratings yet

- Investor Digest Pusat 28 Februari 2023Document10 pagesInvestor Digest Pusat 28 Februari 2023ALAMSYAH FormalNo ratings yet

- Ki Isat 20240213Document8 pagesKi Isat 20240213muh.asad.amNo ratings yet

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocument7 pagesLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahNo ratings yet

- Annual Report of Info Edge by Icici SecurityDocument12 pagesAnnual Report of Info Edge by Icici SecurityGobind yNo ratings yet

- Teamlease Services (Team In) : Q4Fy19 Result UpdateDocument8 pagesTeamlease Services (Team In) : Q4Fy19 Result Updatesaran21No ratings yet

- Telekomunikasi Indonesia (TLKM) : Target Price: RP 75.000Document6 pagesTelekomunikasi Indonesia (TLKM) : Target Price: RP 75.000Hamba AllahNo ratings yet

- Wipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityDocument14 pagesWipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityPramod KulkarniNo ratings yet

- Telekomunikasi Indonesia: 1Q18 Review: Weak But Within ExpectationsDocument4 pagesTelekomunikasi Indonesia: 1Q18 Review: Weak But Within ExpectationsAhmad RafifNo ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- Equity Research: Result UpdateDocument8 pagesEquity Research: Result UpdateyolandaNo ratings yet

- Accumulate: Growth Momentum Continues!Document7 pagesAccumulate: Growth Momentum Continues!sj singhNo ratings yet

- Cipla: Performance HighlightsDocument8 pagesCipla: Performance HighlightsKapil AthwaniNo ratings yet

- Bank Central Asia: Update On BUY (From BUY)Document4 pagesBank Central Asia: Update On BUY (From BUY)Valentinus AdelioNo ratings yet

- 141342112021251larsen Toubro Limited - 20210129Document5 pages141342112021251larsen Toubro Limited - 20210129Michelle CastelinoNo ratings yet

- Indofood Sukses Makmur: Equity ResearchDocument4 pagesIndofood Sukses Makmur: Equity ResearchAbimanyu LearingNo ratings yet

- Anand Rural Electrification Corp Buy 25oct10Document2 pagesAnand Rural Electrification Corp Buy 25oct10bhunkus1327No ratings yet

- Astra Agro Lestari TBK: Soaring Financial Performance in 3Q20Document6 pagesAstra Agro Lestari TBK: Soaring Financial Performance in 3Q20Hamba AllahNo ratings yet

- Indofood CBP Sukses Makmur: Equity ResearchDocument5 pagesIndofood CBP Sukses Makmur: Equity ResearchAbimanyu LearingNo ratings yet

- Dolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Document6 pagesDolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Bhaveek OstwalNo ratings yet

- Vinati Organics: AccumulateDocument7 pagesVinati Organics: AccumulateBhaveek OstwalNo ratings yet

- PT Semen Indonesia, TBK: 1H 2015 Update - Weak MarginDocument7 pagesPT Semen Indonesia, TBK: 1H 2015 Update - Weak MarginRendy SentosaNo ratings yet

- ZEE Q4FY20 RESULT UPDATEDocument5 pagesZEE Q4FY20 RESULT UPDATEArpit JhanwarNo ratings yet

- Kino Indonesia: Equity ResearchDocument5 pagesKino Indonesia: Equity ResearchHot AsiNo ratings yet

- IVRCL Infrastructure: Performance HighlightsDocument7 pagesIVRCL Infrastructure: Performance Highlightsanudeep05No ratings yet

- BNIS Short Notes: Proxy To Indonesia's DigitalizationDocument5 pagesBNIS Short Notes: Proxy To Indonesia's DigitalizationAgus SuwarnoNo ratings yet

- Bharti Airtel Company Update - 270810Document6 pagesBharti Airtel Company Update - 270810Robin BhimaiahNo ratings yet

- Bharti Airtel: CMP: INR271 TP: INR265 NeutralDocument10 pagesBharti Airtel: CMP: INR271 TP: INR265 Neutralপ্রিয়াঙ্কুর ধরNo ratings yet

- Infosys - 1QFY20 Results Review - HDFC Sec-201907132137072766041Document15 pagesInfosys - 1QFY20 Results Review - HDFC Sec-201907132137072766041Yash SoparkarNo ratings yet

- Resource Sharing For An Intelligent Future: Interim Report 2021Document50 pagesResource Sharing For An Intelligent Future: Interim Report 2021mailimailiNo ratings yet

- Bharti Airtel Result UpdatedDocument13 pagesBharti Airtel Result UpdatedAngel BrokingNo ratings yet

- 08f55b3bf6604d12beb3c608f7e80abe-25012024Document6 pages08f55b3bf6604d12beb3c608f7e80abe-25012024investfortestNo ratings yet

- BhartiAirtel-1QFY2013RU 10th AugDocument13 pagesBhartiAirtel-1QFY2013RU 10th AugAngel BrokingNo ratings yet

- Bharti Airtel: Performance HighlightsDocument13 pagesBharti Airtel: Performance HighlightsAngel BrokingNo ratings yet

- IDBI Diwali Stock Picks 2019Document12 pagesIDBI Diwali Stock Picks 2019Akt ChariNo ratings yet

- INFY - NoDocument12 pagesINFY - NoSrNo ratings yet

- Bharti Airtel Result UpdatedDocument13 pagesBharti Airtel Result UpdatedAngel BrokingNo ratings yet

- JSW Energy's strong 3QFY19 on higher merchant ratesDocument8 pagesJSW Energy's strong 3QFY19 on higher merchant ratesOrlieus GonsalvesNo ratings yet

- Blue Star: Performance HighlightsDocument8 pagesBlue Star: Performance HighlightskasimimudassarNo ratings yet

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- Further Resource Sharing: Interim Report 2020Document50 pagesFurther Resource Sharing: Interim Report 2020mailimailiNo ratings yet

- Polycab India's Q1FY23 revenue up 48%, margins expandDocument10 pagesPolycab India's Q1FY23 revenue up 48%, margins expandResearch ReportsNo ratings yet

- Cyient 2QFY19 Earnings Update: Revenue Beats Estimates; Margins Expand 152bpsDocument6 pagesCyient 2QFY19 Earnings Update: Revenue Beats Estimates; Margins Expand 152bpsADNo ratings yet

- XL Axiata TBK: (EXCL)Document4 pagesXL Axiata TBK: (EXCL)Hamba AllahNo ratings yet

- Muthoot Finance: CMP: INR650Document12 pagesMuthoot Finance: CMP: INR650vatsal shahNo ratings yet

- DAGRI Growth AheadDocument7 pagesDAGRI Growth AheadanjugaduNo ratings yet

- Indofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsDocument6 pagesIndofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsPutu Chantika Putri DhammayantiNo ratings yet

- RIL 4QFY20 Results Update | Sector: Oil & GasDocument34 pagesRIL 4QFY20 Results Update | Sector: Oil & GasQUALITY12No ratings yet

- Ipca RRDocument9 pagesIpca RRRicha P SinghalNo ratings yet

- NH Korindo CTRA - Focus On Existing ProjectsDocument6 pagesNH Korindo CTRA - Focus On Existing ProjectsHamba AllahNo ratings yet

- Stmicro - Q4-Fy2018 PR - FinalDocument12 pagesStmicro - Q4-Fy2018 PR - Finalakshay kumarNo ratings yet

- Overweight: Going Through Steep PathsDocument6 pagesOverweight: Going Through Steep PathsPutu Chantika Putri DhammayantiNo ratings yet

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadDocument13 pagesIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaNo ratings yet

- Sonata Software (SSOF IN) : Q2FY19 Result UpdateDocument9 pagesSonata Software (SSOF IN) : Q2FY19 Result UpdateADNo ratings yet

- 637957201521149984_Godrej Consumer Products Result Update - Q1FY23Document4 pages637957201521149984_Godrej Consumer Products Result Update - Q1FY23Prity KumariNo ratings yet

- Airtel AnalysisDocument15 pagesAirtel AnalysisPriyanshi JainNo ratings yet

- Paper - Projectile - Ball Trajectory Planning in Serving TaskDocument10 pagesPaper - Projectile - Ball Trajectory Planning in Serving TaskSugeng YuliantoNo ratings yet

- Nitrate DOC316.53.01067 PDFDocument8 pagesNitrate DOC316.53.01067 PDFkrishna karuturiNo ratings yet

- Nessler Ammonia HACHDocument6 pagesNessler Ammonia HACHMesut GenişoğluNo ratings yet

- Method NitrateDocument8 pagesMethod NitrateSugeng YuliantoNo ratings yet

- COD MetodDocument6 pagesCOD MetodSugeng YuliantoNo ratings yet

- Water PDFDocument250 pagesWater PDFkelvinNo ratings yet

- 2593 - Hach Food Bro PDFDocument20 pages2593 - Hach Food Bro PDFAkhiruddin AbasNo ratings yet

- Manual Dqo 8000Document8 pagesManual Dqo 8000Styp Zuñiga GuillenNo ratings yet

- SP 510 Hardness Monitor: Maximize Your Softener Cycle Time and Minimize Your Regeneration CostDocument4 pagesSP 510 Hardness Monitor: Maximize Your Softener Cycle Time and Minimize Your Regeneration CostSugeng YuliantoNo ratings yet

- Semen Indonesia (Persero) : Enabling Future GrowthDocument10 pagesSemen Indonesia (Persero) : Enabling Future GrowthSugeng YuliantoNo ratings yet

- WIJAYA KARYA BETON (WTON IJ) SLOW START BUT IMPROVEMENT SEENDocument10 pagesWIJAYA KARYA BETON (WTON IJ) SLOW START BUT IMPROVEMENT SEENSugeng YuliantoNo ratings yet

- Msds Pocl3Document6 pagesMsds Pocl3Arya Bima Aji KusumaNo ratings yet

- AsasDocument2 pagesAsasbuntu2003No ratings yet

- SP510 Hardness Analyzer (1 MG/L Trip Point) : Maximize Your Softener Cycle Time and Minimize Your Regeneration CostDocument2 pagesSP510 Hardness Analyzer (1 MG/L Trip Point) : Maximize Your Softener Cycle Time and Minimize Your Regeneration CostSugeng YuliantoNo ratings yet

- Brian Windsor Troubleshooting1Document35 pagesBrian Windsor Troubleshooting1brandlabBDNo ratings yet

- Personal Service Report Swro Pt. Ip Pelabuhan Ratu '28des15Document5 pagesPersonal Service Report Swro Pt. Ip Pelabuhan Ratu '28des15Sugeng YuliantoNo ratings yet

- Ta Percobaan %konsentraasi Awal (G/L) : '.K' '-R' 'TL, Detik' 'ZL, CM' 'Percobaan' 'Perhitungan' 'Location' 'Best'Document3 pagesTa Percobaan %konsentraasi Awal (G/L) : '.K' '-R' 'TL, Detik' 'ZL, CM' 'Percobaan' 'Perhitungan' 'Location' 'Best'Sugeng YuliantoNo ratings yet

- Fairfield Institute of Management & Technology E-Commerce: Lab/Practical File Subject Code: 112Document24 pagesFairfield Institute of Management & Technology E-Commerce: Lab/Practical File Subject Code: 112AYUSHNo ratings yet

- What Is Mean?: Extrapolation InterpolationDocument2 pagesWhat Is Mean?: Extrapolation InterpolationVinod SharmaNo ratings yet

- Top Answers to Mahout Interview QuestionsDocument6 pagesTop Answers to Mahout Interview QuestionsPappu KhanNo ratings yet

- Vocabulary Practice 1Document3 pagesVocabulary Practice 1Phuong AnhNo ratings yet

- Assessment Cover Sheet: BSB52415 Diploma of Marketing and Communication Student NameDocument11 pagesAssessment Cover Sheet: BSB52415 Diploma of Marketing and Communication Student NameChun Jiang0% (1)

- Integrated Marketing Communication PlanDocument5 pagesIntegrated Marketing Communication Planprojectwork185No ratings yet

- Petol Ps 460-5G: Technical SheetDocument2 pagesPetol Ps 460-5G: Technical SheetA MahmoodNo ratings yet

- Chapter 11 RespirationDocument2 pagesChapter 11 Respirationlock_jaw30No ratings yet

- Bee WareDocument49 pagesBee WareJayNo ratings yet

- Fee Structure 2023-2024Document10 pagesFee Structure 2023-2024Emmanuel NjogellahNo ratings yet

- Families of Carbon Compounds: Functional Groups, Intermolecular Forces, & Infrared (IR) SpectrosDocument79 pagesFamilies of Carbon Compounds: Functional Groups, Intermolecular Forces, & Infrared (IR) SpectrosRuryKharismaMuzaqieNo ratings yet

- THC124 - Lesson 1. The Impacts of TourismDocument50 pagesTHC124 - Lesson 1. The Impacts of TourismAnne Letrondo Bajarias100% (1)

- Coaching, Mentoring & OnboardingDocument43 pagesCoaching, Mentoring & OnboardingosvehNo ratings yet

- ORPHEUS by GRS Mead - Electronic Text EditionDocument199 pagesORPHEUS by GRS Mead - Electronic Text EditionMartin EuserNo ratings yet

- Bharathidasan University UG/PG Exam ApplicationDocument2 pagesBharathidasan University UG/PG Exam ApplicationOppili yappanNo ratings yet

- Assignments - 2017 09 15 182103 - PDFDocument49 pagesAssignments - 2017 09 15 182103 - PDFMena AlzahawyNo ratings yet

- Sop For FatDocument6 pagesSop For Fatahmed ismailNo ratings yet

- Multicolor Fluorochrome Laser Chart PDFDocument1 pageMulticolor Fluorochrome Laser Chart PDFSathish KumarNo ratings yet

- NYC Chocolate Chip Cookies! - Jane's PatisserieDocument2 pagesNYC Chocolate Chip Cookies! - Jane's PatisserieCharmaine IlaoNo ratings yet

- B.O Blog 6 (Benefits and Hacks of Using Turmeric)Document6 pagesB.O Blog 6 (Benefits and Hacks of Using Turmeric)sanaNo ratings yet

- "A Study Consumer Satisfaction Towards Royal Enfield BikesDocument72 pages"A Study Consumer Satisfaction Towards Royal Enfield BikesKotresh Kp100% (1)

- 2nd Chapter Notes Mechanical Engineering DiplomaDocument7 pages2nd Chapter Notes Mechanical Engineering DiplomaUsmanNo ratings yet

- PW 160-Taliban Fragmentation Fact Fiction and Future-PwDocument28 pagesPW 160-Taliban Fragmentation Fact Fiction and Future-Pwrickyricardo1922No ratings yet

- Remote Control Panel (RCP) User'S GuideDocument13 pagesRemote Control Panel (RCP) User'S GuideAdrian PuscasNo ratings yet

- Christopher Westra - Laws of Attraction PDFDocument3 pagesChristopher Westra - Laws of Attraction PDFZachary LeeNo ratings yet

- Examining The Structural Relationships of Destination Image, Tourist Satisfaction PDFDocument13 pagesExamining The Structural Relationships of Destination Image, Tourist Satisfaction PDFAndreea JecuNo ratings yet

- New Translation and Deciphering of ChineDocument14 pagesNew Translation and Deciphering of ChineRémyNo ratings yet

- Kütahya between the Lines: Uncovering Historical Insights from Post-Medieval CeramicsDocument24 pagesKütahya between the Lines: Uncovering Historical Insights from Post-Medieval Ceramicslatinist1No ratings yet

- Powerful and Durable JCB JS200 Tracked ExcavatorDocument6 pagesPowerful and Durable JCB JS200 Tracked ExcavatorMB Viorel100% (1)

- Group ActDocument3 pagesGroup ActRey Visitacion MolinaNo ratings yet